Paper Pigments Market by Type (Calcium Carbonate and Kaolin), Application (Coated Paper and Uncoated Paper), and Region (APAC, North America, Europe, and RoW (Middle East & Africa and South America)) - Global Forecast to 2023

[104 Pages Report] The paper pigments market was valued at USD 12.88 billion in 2017 and is projected to reach USD 17.72 billion by 2023, at a CAGR of 5.6% during the forecast period. Increasing demand for paper from the packaging industry is one of the major drivers for the paper pigments market. The high growth of the packaging industry coupled with increasing regulations related to renewable packaging materials are leading to the increasing use of paper over plastic. This has propelled the consumption of paper in packaging, which in turn, is projected to drive the paper pigments market.

Market Dynamics

Drivers

- Increasing demand for paper in the packaging industry

- High demand in developing countries

- Sustained demand for uncoated paper

Restraints

- Enviornmental concerns related to the recycling of paper

- Growing digitalization affecting the paper industry

Opportunities

- Growing need for superior quality coated paper

Challenges

- Inefficiency in the recycling of paper

Increasing demand for paper in the packaging industry

The packaging industry is witnessing high growth due to the growing urbanization, demographic changes, rapid growth in emerging economies and technological advancements. The growing environmental concerns have also encouraged the use of paper in the packaging industry. Approximately 30.0% of the packaging industry is currently accounted for by paper. Hence, paper packaging plays a significant role in the packaging industry. The value of the paper packaging industry was approximately USD 65 billion in 2017. This implies that paper pigments are witnessing an increase in demand in the paper packaging industry.

The importance of eco-friendly products is increasing in the packaging industry which has led to the use of sustainable and recyclable packaging materials. This has also resulted in a rise in recycling activities in the paper industry, thereby increasing the use of paper in the packaging industry. Moreover, recycling paper saves landfill space, reduces paper waste disposal issues, and helps cater to several environmental concerns. This high growth in the paper packaging industry is driving the demand for paper pigments.

Objectives of the Study

- To analyze and forecast the market size for paper pigments, in terms of value and volume

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To define, describe, and forecast the paper pigments market on the basis of type, application, and region

- To forecast the paper pigments market size with respect to 4 main regions, namely, North America, Europe, Asia Pacific, and Rest of the World

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze competitive developments, such as agreements, partnerships & joint ventures, mergers & acquisitions, and investments & expansions in the paper pigments market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

Years considered for this report

- 2017 Base Year

- 2018 Estimated Year

- 2023 Projected Year

Research Methodology

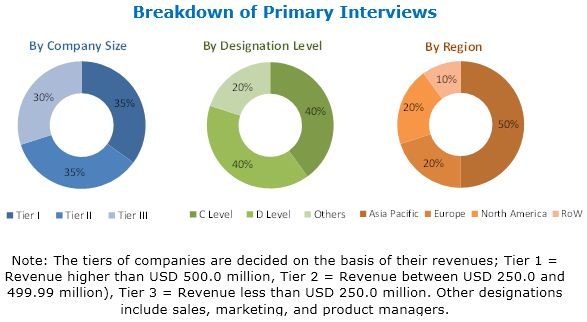

This study estimates the size of the paper pigments market for 2018 and projects its growth till 2023. It provides a detailed qualitative and quantitative analysis of the paper pigments market. Secondary sources, such as D&B Hoovers, Bloomberg Business Week, and Factiva, among others, were used to identify and collect information useful for this extensive, commercial study of the paper pigments market. Primary sources, such as experts from related industries and suppliers of paper pigments were interviewed to obtain and verify critical information and assess prospects of the paper pigments market.

To know about the assumptions considered for the study, download the pdf brochure

Key players profiled in the report include Omya (Switzerland), Imerys (France), Minerals Technologies (US), BASF (Germany), Ashapura Group (India), Huber (US), Kemira Oyj (Finland), Chemours (US), Thiele Kaolin Company (US), and KaMin/CADAM (US).

Target Audience:

- Manufacturers of Paper Pigments

- Chemical Suppliers

- Traders, Distributors, and Suppliers of Paper Pigments

- Raw Material Suppliers

- Government and Research Organizations

- Industry Associations

This study answers several questions for stakeholders, primarily, which market segments they should focus upon during the next 2 to 5 years to prioritize their efforts and investments. It also provides a competitive landscape of the paper pigments market.

Scope of the Report:

The paper pigments market has been segmented as follows:

Paper Pigments Market, by Type:

- Calcium Carbonate

- Kaolin

- Others

Paper Pigments Market, by Application:

- Uncoated paper

- Coated paper

Paper Pigments Market, by Region:

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Rest of APAC

- Europe

- Germany

- Finland

- France

- Italy

- Sweden

- Rest of Europe North America

- US

- Canada

- Mexico

- Rest of the World

- Middle East & African countries

- South America

- Brazil

- Argentina

- Others

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for this report:

Product Analysis

- A product matrix that provides a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Asia Pacific paper pigments market

The paper pigments market is estimated to be USD 13.52 billion in 2018 and is projected to reach USD 17.72 billion by 2023, at a CAGR of 5.6% from 2018 to 2023.

The high demand for paper in emerging countries is leading to the increasing consumption of paper. Despite the increasing use of electronic devices and e-publishing, both, the demand for coated as well as uncoated paper is projected to drive the paper pigments market.

Based on type, the paper pigments market has been segmented into calcium carbonate, kaolin, and others. Calcium carbonate is projected to be the largest and the fastest-growing type of paper pigment during the forecast period. The increasing demand for bright and bulk paper is leading to the increasing preference for the use of calcium carbonate over kaolin. Ground Calcium Carbonate (GCC) is the largest type of calcium carbonate paper pigment. It accounted for a share of 70.0% in the global calcium carbonate paper pigments market, in terms of volume, in 2017. The low cost and easy production process of GCC makes it the most widely used type. Precipitated Calcium Carbonate (PCC) is the fastest-growing market as it imparts very high brightness to the paper. Increasing demand for coated paper in future is expected to lead to the increasing penetration of PCC, leading to its high growth rate during the forecast period.

Based on application, the paper pigments market has been segmented into coated and uncoated paper. Coated paper is projected to be the largest application of paper pigments during the forecast period. The need for superior quality paper is increasing, offering significant growth potential for coated papers. Moreover, the loading percentage of paper pigments in coating applications is increasing. The use of coated paper is also increasing due to growth of the packaging industry, and hence, is expected to register a higher growth rate. Uncoated paper is also a significant application of paper pigments owing to the high demand for paper pigments for newsprint, writing, and printing paper. Uncoated paper is also expected to witness significant demand in APAC owing to its low cost.

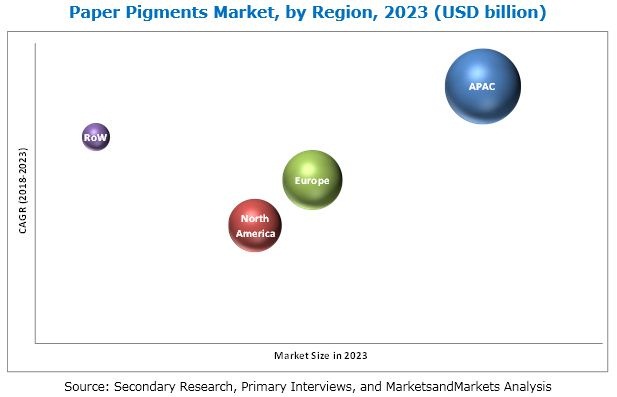

The paper pigments market has been studied for Asia Pacific (APAC), North America, Europe, and the Rest of the World. APAC is projected to be the largest and the fastest-growing paper pigments market. The APAC paper pigments industry is experiencing high growth and increasing investments to meet the demand from the paper industry. APAC accounts for half the global demand for paper (48.0% in 2016), driving the demand for paper pigments. Growing industrialization, increasing businesses, and educational institutions in this region are expected to contribute to high demand for paper and in turn, are expected to drive the demand for paper pigments during the forecast period.

Coated Paper

Paper pigments provide a coating layer on paper which gives uniformity to the paper surface, makes paper whiter, improves opacity, provides the desired finish, imparts printing properties, and improves the shade of the coating. Coated paper has a matte or glossy finish with smoothness and shine. The coating allows the ink to get absorbed into the paper. This creates a cleaner and smoother printing surface, thereby improving the quality of photos and blends.

Modern coatings are composed of pigments, binders, additives, and fluid. The papers are subjected to sizing, coating, and calendering to impart adequate smoothness, brightness, gloss, opacity, ink, and receptivity. Coated paper exhibits resistance to dirt and moisture. It also requires less printing ink as it does not absorb the ink. Coated papers are much heavier than uncoated papers.

Uncoated Paper

Uncoated paper is more widely used than coated paper. It is less smooth than coated paper and absorbs more ink while printing an image. Uncoated paper is also less expensive than coated paper. It is mainly used for applications such as letterheads, envelopes, and forms used for writing and printing.

Paper pigments are used as fillers in the uncoated paper. Fillers are essential in printing papers to increase opacity and brightness, as well as enhance printing properties. The major types of fillers include talc, hydrous kaolin, precipitated silicas and silicates (PSS), and titanium dioxide. The fillers refract and backscatter light through the surface of the paper. The filler paper pigments need to be dispersed evenly through the sheet to increase the optical efficiency. Filler pigments require properties such as a high degree of whiteness, a high index of refraction, small particle size, low solubility in water, low impurities, and low specific gravity. The filler pigments must also be chemically inert to avoid reactions with other chemicals in the paper. Depending on the surface of the paper, uncoated papers are classified as woven, linen, and laid.

The key factors restraining growth of the paper pigments market are, environmental concerns related to recycling paper and growing digitalization affecting the paper industry.

Companies such as Omya (Switzerland), Imerys (France), Minerals Technologies (US), BASF (Germany), Ashapura Group (India), Huber (US), Kemira Oyj (Finland), Chemours (US), Thiele Kaolin Company (US), and KaMin/CADAM (US), have adopted various developmental strategies, such as mergers & acquisitions, agreements, partnerships & joint ventures, and investments & expansions to enhance their footholds in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Significant Opportunities in the Paper Pigments Market

4.2 APAC Paper Pigments Market, By Application and Country

4.3 Paper Pigments Market, By Type

4.4 Paper Pigments Market, By Application

4.5 Paper Pigments Market, By Region

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Paper in the Packaging Industry

5.2.1.2 High Demand in Developing Countries

5.2.1.3 Sustained Demand for Uncoated Paper

5.2.2 Restraints

5.2.2.1 Environmental Concerns Related to the Recycling of Paper

5.2.2.2 Growing Digitalization Affecting the Paper Industry

5.2.3 Opportunities

5.2.3.1 Growing Need for Superior Quality Coated Paper

5.2.4 Challenges

5.2.4.1 Inefficiency in the Recycling of Paper

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Buyers

5.3.4 Bargaining Power of Suppliers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicators

5.4.1 GDP Growth Rate Forecast of Major Economies

5.4.2 Paper Industry

6 Expert Interview (Page No. - 37)

7 Paper Pigments Market, By Type (Page No. - 39)

7.1 Introduction

7.2 Calcium Carbonate

7.2.1 GCC

7.2.2 PCC

7.3 Kaolin

7.3.1 Hydrous Kaolin

7.3.2 Calcined Kaolin

7.4 Others

7.4.1 Talc

7.4.2 Titanium Dioxide

7.4.3 Gypsum

8 Paper Pigments Market, By Application (Page No. - 44)

8.1 Introduction

8.2 Coated Paper

8.2.1 By Coating Type

8.2.1.1 Satin-Coated Paper

8.2.1.2 Gloss-Coated Paper

8.2.1.3 Dull-Coated Paper

8.2.1.4 Matte-Coated Paper

8.2.1.5 Cast-Coated Paper

8.3 Uncoated Paper

8.3.1 By Surface Type

8.3.1.1 Woven Or Smooth Uncoated Paper

8.3.1.2 Laid Uncoated Paper

8.3.1.3 Linen Uncoated Paper

9 Paper Pigments Market, By Region (Page No. - 49)

9.1 Introduction

9.2 APAC

9.2.1 China

9.2.2 India

9.2.3 Japan

9.2.4 South Korea

9.2.5 Indonesia

9.2.6 Rest of APAC

9.3 North America

9.3.1 US

9.3.2 Canada

9.3.3 Mexico

9.4 Europe

9.4.1 Germany

9.4.2 Finland

9.4.3 France

9.4.4 Sweden

9.4.5 Italy

9.4.6 Rest of Europe

9.5 RoW

9.5.1 Middle East & African Countries

9.5.2 South American Countries

9.5.2.1 Brazil

9.5.2.2 Argentina

9.5.2.3 Rest of South America

10 Competitive Landscape (Page No. - 76)

10.1 Overview

10.2 Market Ranking

10.3 Competitive Scenario

10.3.1 Investment & Expansion

10.3.2 Merger & Acquisition

10.3.3 Agreement, Partnership & Joint Venture

11 Company Profile (Page No. - 80)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Imerys

11.2 Omya

11.3 Minerals Technologies (MTI)

11.4 BASF

11.5 Ashapura Group

11.6 J.M. Huber Corporation

11.7 Kemira

11.8 Chemours

11.9 Thiele Kaolin Company

11.10 Kamin/Cadam

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11.11 Other Key Players

11.11.1 FP Pigments

11.11.2 Mississippi Lime

11.11.3 Nordkalk

11.11.4 Sibelco

11.11.5 Quarzwerke

12 Appendix (Page No. - 99)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (80 Tables)

Table 1 Trends and Forecast of GDP, 20172022 (USD Billion)

Table 2 Paper Production, By Type, 20122015 (Thousand Metric Ton)

Table 3 Paperboard and Pulp Consumption, By Region, 2015 (Kiloton)

Table 4 Paper Industry Statistics, 2015

Table 5 Properties of Paper Pigments

Table 6 Paper Pigments By Market Size, By Type, 20162023 (Kiloton)

Table 7 Paper Pigments By Market Size, By Type, 20162023 (USD Million)

Table 8 Calcium Carbonate Paper Pigments By Market Size, By Type, 20162023 (Kiloton)

Table 9 Calcium Carbonate Paper Pigments By Market Size, By Type, 20162023 (USD Million)

Table 10 Types of Paper

Table 11 By Market Size, By Application, 20162023 (Kiloton)

Table 12 By Market Size, By Application, 20162023 (USD Million)

Table 13 Pulp & Paper Production, By Country, 2015 (Million Metric Ton)

Table 14 By Market Size, By Region, 20162023 (Kiloton)

Table 15 By Market Size, By Region, 20162023 (USD Million)

Table 16 APAC: By Market Size, By Country, 20162023 (Kiloton)

Table 17 APAC: By Market Size, By Country, 20162023 (USD Million)

Table 18 APAC: By Market Size, By Application, 20162023 (Kiloton)

Table 19 APAC: By Market Size, By Application, 20162023 (USD Million)

Table 20 China: By Market Size, By Application, 20162023 (Kiloton)

Table 21 China: By Market Size, By Application, 20162023 (USD Million)

Table 22 India: By Market Size, By Application, 20162023 (Kiloton)

Table 23 India: By Market Size, By Application, 20162023 (USD Million)

Table 24 Japan: By Market Size, By Application, 20162023 (Kiloton)

Table 25 Japan: By Market Size, By Application, 20162023 (USD Million)

Table 26 South Korea: By Market Size, By Application, 20162023 (Kiloton)

Table 27 South Korea: By Market Size, By Application, 20162023 (USD Million)

Table 28 Indonesia: Paper Pigments Market Size, By Application, 20162023 (Kiloton)

Table 29 Indonesia: By Market Size, By Application, 20162023 (USD Million)

Table 30 Rest of APAC: Pulp & Paper Production, 2015 (Million Metric Ton)

Table 31 Rest of APAC: By Market Size, By Application, 20162023 (Kiloton)

Table 32 Rest of APAC: By Market Size, By Application, 20162023 (USD Million)

Table 33 North America: By Market Size, By Country, 20162023 (Kiloton)

Table 34 North America: By Market Size, By Country, 20162023 (USD Million)

Table 35 North America: By Market Size, By Application, 20162023 (Kiloton)

Table 36 North America: By Market Size, By Application, 20162023 (USD Million)

Table 37 US: By Market Size, By Application, 20162023 (Kiloton)

Table 38 US: By Market Size, By Application, 20162023 (USD Million)

Table 39 Canada: Paper Pigments Market Size, By Application, 20162023 (Kiloton)

Table 40 Canada: By Market Size, By Application, 20162023 (USD Million)

Table 41 Mexico: By Market Size, By Application, 20162023 (Kiloton)

Table 42 Mexico: By Market Size, By Application, 20162023 (USD Million)

Table 43 Europe: By Market Size, By Country, 20162023 (Kiloton)

Table 44 Europe: By Market Size, By Country, 20162023 (USD Million)

Table 45 Europe: By Market Size, By Application, 20162023 (Kiloton)

Table 46 Europe: By Market Size, By Application, 20162023 (USD Million)

Table 47 Germany: By Market Size, By Application, 20162023 (Kiloton)

Table 48 Germany: By Market Size, By Application, 20162023 (USD Million)

Table 49 Finland: By Market Size, By Application, 20162023 (Kiloton)

Table 50 Finland: By Market Size, By Application, 20162023 (USD Million)

Table 51 France: By Market Size, By Application, 20162023 (Kiloton)

Table 52 France: By Market Size, By Application, 20162023 (USD Million)

Table 53 Sweden: By Market Size, By Application, 20162023 (Kiloton)

Table 54 Sweden: By Market Size, By Application, 20162023 (USD Million)

Table 55 Italy: By Market Size, By Application, 20162023 (Kiloton)

Table 56 Italy: By Market Size, By Application, 20162023 (USD Million)

Table 57 Rest of Europe: Pulp & Paper Production, 2015 (Million Metric Ton)

Table 58 Rest of Europe: By Market Size, By Application, 20162023 (Kiloton)

Table 59 Rest of Europe: By Market Size, By Application, 20162023 (USD Million)

Table 60 RoW: By Market Size, By Country, 20162023 (Kiloton)

Table 61 RoW: By Market Size, By Country, 20162023 (USD Million)

Table 62 RoW: By Market Size, By Application, 20162023 (Kiloton)

Table 63 RoW: By Market Size, By Application, 20162023 (USD Million)

Table 64 Middle East & African Countries: Pulp & Paper Production, 2015 (Million Metric Ton)

Table 65 Middle East & African Countries: By Market Size, By Application, 20162023 (Kiloton)

Table 66 Middle East & African Countries: By Market Size, By Application, 20162023 (USD Million)

Table 67 South America: By Market Size, By Country, 20162023 (Kiloton)

Table 68 South America: By Market Size, By Country, 20162023 (USD Million)

Table 69 South America: By Market Size, By Application, 20162023 (Kiloton)

Table 70 South America: By Market Size, By Application, 20162023 (USD Million)

Table 71 Brazil: By Market Size, By Application, 20162023 (Kiloton)

Table 72 Brazil: By Market Size, By Application, 20162023 (USD Million)

Table 73 Argentina: By Market Size, By Application, 20162023 (Kiloton)

Table 74 Argentina: By Market Size, By Application, 20162023 (USD Million)

Table 75 Rest of South America: Pulp & Paper Production, 2015 (Million Metric Ton)

Table 76 Rest of South America: By Market Size, By Application, 20162023 (Kiloton)

Table 77 Rest of South America: By Market Size, By Application, 20162023 (USD Million)

Table 78 Investment & Expansion, 20142018

Table 79 Merger & Acquisition, 20142018

Table 80 Agreement, Partnership & Joint Venture, 20142018

List of Figures (36 Figures)

Figure 1 Paper Pigments Market Segmentation

Figure 2 Paper Pigments Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Paper Pigments Market: Data Triangulation

Figure 6 Paper Pigments Market Size, By Volume & Value, 20162023

Figure 7 Calcium Carbonate to Dominate the Paper Pigments Market

Figure 8 GCC to Be the Largest Type of Calcium Carbonate Paper Pigments

Figure 9 Coated Paper Application to Dominate the Paper Pigments Market

Figure 10 China to Be the Largest Paper Pigments Market

Figure 11 APAC Dominated the Paper Pigments Market in 2017

Figure 12 High GRowth Potential in Paper Industry to Drive the Market

Figure 13 Coated Paper Segment Dominated the Market in APAC

Figure 14 Calcium Carbonate to Be the Fastest-Growing Type of Paper Pigments

Figure 15 Coated Paper Segment to Register the Highest Cagr

Figure 16 APAC Led the Paper Pigments Market in 2017

Figure 17 Overview of Factors Governing the Paper Pigments Market

Figure 18 Paper Pigments Market: Porters Five Forces Analysis

Figure 19 Calcium Carbonate to Dominate the Paper Pigments Market

Figure 20 Coated Paper Application to Drive the Paper Pigments Market

Figure 21 China to Register the Highest Cagr in the Paper Pigments Market

Figure 22 APAC: Paper Pigments Market Snapshot

Figure 23 North America: Paper Pigments Market Snapshot

Figure 24 Europe: Paper Pigments Market Snapshot

Figure 25 Companies Adopted Investment & Expansion as the Key Growth Strategy Between 2014 and 2018

Figure 26 Ranking of Key Market Players, 2017

Figure 27 Imerys: Company Snapshot

Figure 28 Imerys: SWOT Analysis

Figure 29 Omya: SWOT Analysis

Figure 30 MTI: Company Snapshot

Figure 31 MTI: SWOT Analysis

Figure 32 BASF: Company Snapshot

Figure 33 BASF: SWOT Analysis

Figure 34 Ashapura Group: Company Snapshot

Figure 35 Kemira: Company Snapshot

Figure 36 Chemours: Company Snapshot

Growth opportunities and latent adjacency in Paper Pigments Market