Surface Protection Tapes Market by Type (Polyethylene, Polypropylene, Polyvinyl chloride), Surface Material (Polished metals, Glass, Plastic) End-use (Electronics & appliances, Building & construction, Automotive), and Region - Global Forecast to 2024

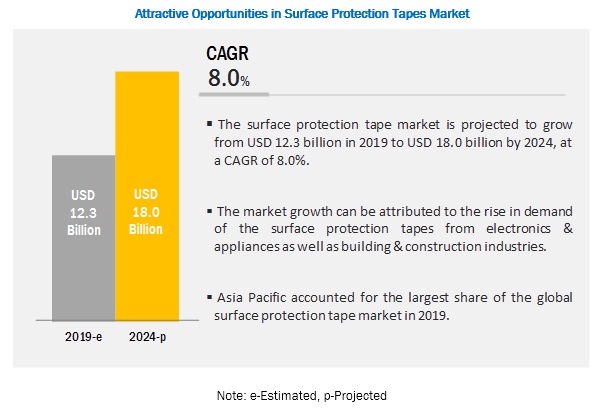

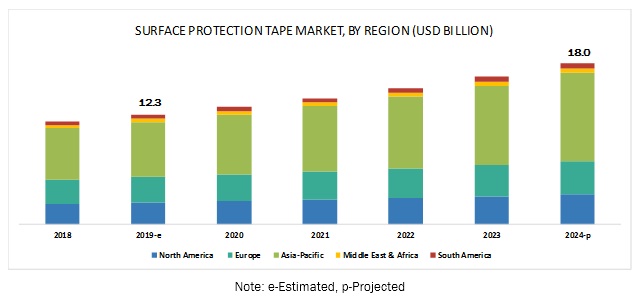

[161 Pages Report] The surface protection tapes market is projected to grow from USD 12.3 billion in 2019, to reach USD 18.0 billion by 2024, recording a CAGR of 8.0% from 2019 to 2024. The demand for surface protection tapes is driven by the growing use of these tapes due to their durability, ease of application, and ease of removal properties. In addition, advancement in the adhesive tapes technology is projected to offer opportunities for the growth of this market.

In terms of value and value, the polypropylene segment is projected to be the fastest-growing segment in the surface protection tapes market from 2019 to 2024.

Based on the type, the polypropylene segment in the surface protection tapes market is projected to grow at the highest CAGR during the forecast period, in terms of both value and volume. These surface protection tapes are used for applications, where resistance to high temperatures is required. Therefore, these films are majorly used in industries such as transportation and electronics, where manufacturing operations are carried out at high temperatures. These tapes offer better clarity, higher impact strength, and better barrier properties. They are more expensive than the polyethylene surface protection tapes due to their inbuilt elasticity.

The polished metal segment to dominate the surface protection tapes market, in terms of both value and volume, during the forecast period.

Based on the surface material, the polished metal segment is projected to dominate the surface protection tapes market from 2019 to 2024, in terms of both value and volume. Metals are widely used in various end-use industries such as building & construction (for curtain walls, building panels, and coil coatings), and automotive (for the vehicle components). These metal surfaces need to be safeguarded using a surface protection tape during the process of manufacturing, assembling, transportation, and storage, and hence, drive the need for the surface protection tapes.

The Asia Pacific surface protection tapes market is projected to witness rapid growth during the forecast period.

The increase in demand for surface protection tapes is largely attributed to the growth in the infrastructure and building & construction industries. High economic growth, intensive construction activities, and increasing standards of living are the main factors driving the market for surface protection tapes in the region. Rapid urbanization has led to an increase in the infrastructural development in the region, which is further driving the demand for surface protection tapes.

Key Market Players

Toray Industries, Inc. (Japan), Intertape Polymer Group (Canada), Tesa SE (Germany), DowDuPont (US), Chevron Phillips Chemical Company (US), Nitto Denko Corporation (Japan), 3M (US), Berry Global Inc. (US), Avery Dennison (US), and Compagnie de Saint-Gobain S.A. (France) are the key players operating in the surface protection tapes market.

DowDuPont (US) is one of the leading chemical companies. It is an active player in offering surface protection films to a range of end-use industries. For instance, it provides polyvinyl fluoride (PVF) films for industrial applications. The company owns 13,000 US patents as well as 42,700 foreign patents, as of December 2018. Further, it has a strong foothold across the globe with a presence across Africa, the Asia Pacific, Europe, the Middle East, South America, and North America. Its strong global presence and diverse product portfolio contribute to its leading market position. It has adopted a merger as its growth strategy to accelerate its market growth. In September 2017, DuPont (US) and Dow Chemicals (US) agreed to merge, to form DowDuPont, with a motive to increase their market growth, and would perform as a holding company after this merger. The company aims to attain sustainable growth through the expansion of its product portfolio and strengthen its R&D capabilities through this merger.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Value (USD) and Volume (Million Square Feet) |

|

Segments covered |

Type, Surface Material, End Use, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, South America, and the Middle East & Africa |

|

Companies covered |

DowDuPont (US), Compagnie de Saint-Gobain S.A. (France), 3M (US), Toray Industries, Inc. (Japan), Chevron Phillips Chemical Company (US), Berry Global Inc. (US), Nitto Denko Corporation (Japan), Avery Dennison (US), Tesa SE (Germany), and Intertape Polymer Group (Canada) |

This research report categorizes the surface protection tapes market based on type, surface material, end use, and region.

On the basis of type, the surface protection tapes market has been categorized as follows:

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl chloride (PVC)

On the basis of surface material, the surface protection tapes market has been categorized as follows:

- Polished metals

- Glass

- Plastics

On the basis of end-use, the surface protection tapes market has been categorized as follows:

- Electronics & appliances

- Building & construction

- Automotive

On the basis of region, the surface protection tapes market has been categorized as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In March 2019, Tesa (Germany) invested more than USD 34 million (30 million euros) to expand its Suzhou site (China). This new unit will be involved in the manufacturing of precision adhesive tapes and is projected to expand the manufacturing capabilities of these precision adhesive tapes for applications in the automotive and electronics industries.

- In October 2018, Avery Dennison introduced SPF-XI Supreme Protection Film. This film will help in the protection of the vehicles appearance from the UV, temperature, or any other damages.

- In May 2018, North America Tesa acquired Functional Coatings, Inc. (US), and is now a wholly-owned affiliate of the Tesa Tape Inc.-North America. This strategic initiative is projected to expand the existing product portfolio of Tesa along with strengthening its market position in various industries.

Key Questions Addressed by the Report:

- What are the global trends that are increasing the demand for surface protection tapes? Would the market witness an increase or decline in demand in the coming years?

- What is the estimated demand for different types of surface protection tapes?

- Where will the strategic developments take the industry in the mid to long-term?

- What are the upcoming industry applications and trends for surface protection tapes?

Frequently Asked Questions (FAQ):

What are the factors contributing to the final price of surface protection tapes?

Major factors contributing to the final price of surface protection tapes are type of raw materials, volume of the product required, manufacturing techniques, labor cost, energy cost, and role of supply chain.

What are the different types of surface protection tapes?

The different types of surface protection tapes includes polyethylene, polypropylene, polyvinyl chloride, and others.Others include polystyrene, polyethylene terephthalate, and polyvinyl fluoride.

What are the different types of surface materials for the application of surface protection tapes?

The different type of surface material for the surface protection tapes includes polished metals, glass, plastic, and others. Others include decorative laminate, stone, carpet, and coated surface.

What are the different end-use industries for surface protection tapes?

The end-use industries for surface protection tapes include electronics & appliances, building & construction, automotive, and others. Others include aerospace, healthcare, and military.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Regional Scope

1.3.2 Periodization Considered for the Study

1.4 Currency Considered

1.5 Units Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 31)

3.1 Introduction

3.2 Surface Protection Tapes Market

4 Premium Insights (Page No. - 35)

4.1 Attractive Opportunities in the Surface Protection Tapes Market

4.2 Asia Pacific: Surface Protection Tapes Market, By Type & Country

4.3 Surface Protection Tapes Market, By Type

4.4 Surface Protection Tapes Market, By Surface Material

4.5 Surface Protection Tapes Market, By End-Use Industry

4.6 Surface Protection Tapes Market, By Country

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Wide Acceptance Due to Reduced Weight, Ease of Application, and Ease of Removal

5.2.1.2 Growing Use of Surface Protection Tapes in Diversified Industries

5.2.2 Restraints

5.2.2.1 Volatility in Raw Material Prices

5.2.2.2 Difficulty in Recycling Polymer Plastics

5.2.3 Opportunities

5.2.3.1 Advancement in Adhesive Tapes Technology

5.2.3.2 Rise in Building & Construction Activities

5.2.3.3 Developing the Transportation Sector Around the World

5.2.4 Challenges

5.2.4.1 Implementation of Stringent Regulatory Policies

5.2.4.2 Uncertainty About Bond Permanency

6 Surface Protection Tape Market, By Type (Page No. - 43)

6.1 Introduction

6.2 Polyethylene (PE)

6.2.1 The Polyethylene (PE) Segment Dominated the Surface Protection Tape Market in 2018

6.3 Polypropylene (PP)

6.3.1 The Polypropylene (PP) to Be the Fastest Growing Type of Surface Protection Tapes

6.4 Polyvinyl Chloride (PVC)

6.4.1 The Polyvinyl Chloride (PVC) to Be the Largest Segment in 2018, in Terms of Volume

6.5 Others

6.5.1 The Others Segment is Projected to Record A High Growth Rate During the Forecast Period

7 Surface Protection Tapes Market, By Surface Material (Page No. - 48)

7.1 Introduction

7.2 Polished Metals

7.2.1 The Polished Metals Segment to Lead the Surface Protection Tapes Market During the Forecast Period

7.3 Glass

7.3.1 The Glass Segment to Be the Second-Largest Segment of the Surface Protection Tapes Market

7.4 Plastic

7.4.1 The Versatility & Durability of Plastic Surfaces is Expected to Drive Its Demand, and Hence the Demand for Surface Protection Tapes

7.5 Others

7.5.1 The Others Segment is Projected to Record A Moderate Growth Rate During the Forecast Period

8 Surface Protection Market, By End-Use Industry (Page No. - 52)

8.1 Introduction

8.2 Electronics & Appliances

8.2.1 The Electronics & Appliances Segment to Lead the Surface Protection Tapes Market, in Terms of Both Value & Volume

8.3 Building & Construction

8.3.1 Rising Demand for Construction Activities to Drive the Demand for Surface Protection Tapes

8.4 Automotive

8.4.1 The Automotive Segment to Be the Second-Largest Segment in the Surface Protection Tapes Market

8.5 Others

8.5.1 The Others Segment is Projected to Record A Moderate Growth Rate During The Forecast Period

9 Surface Protection Tapes Market, By Region (Page No. - 57)

9.1 Introduction

9.2 Asia Pacific

9.2.1 China

9.2.1.1 China is Projected to Be The Largest & Fastest Growing Country in The Global Surface Protection Tapes Market

9.2.2 Japan

9.2.2.1 The Polyethylene Segment is Projected to Be the Largest Segment in the Japanese Surface Protection Tapes Market

9.2.3 India

9.2.3.1 India is Projected to Be the Second Fastest-Growing Country-Level Market for Surface Protection Tapes in the Asia Pacific Market

9.2.4 South Korea

9.2.4.1 The Rise in Electronics Industry is Projected to Drive the Demand for Surface Protection Tapes in South Korea

9.2.5 Rest of Asia Pacific

9.2.5.1 The Rise in Demand for Construction & Transportation Activities is Projected to Drive the Surface Protection Tapes Market in Rest

of Asia Pacific 69

9.3 Europe

9.3.1 Germany

9.3.1.1 Germany to Lead the European Surface Protection Tapes Market

9.3.2 UK

9.3.2.1 UK to Be the Third-Largest Market for the Surface Protection Tapes Market, in Terms of Value

9.3.3 Italy

9.3.3.1 The Polyethylene Segment to Lead the Surface Protection Tapes Market in Italy

9.3.4 France

9.3.4.1 Rise in Automotive Industry to Support the Growth of the Surface Protection Tapes Market in France

9.3.5 Russia

9.3.5.1 The Polypropylene Surface Protection Tapes to Be the Fastest Growing Segment in Russia

9.3.6 Rest of Europe

9.3.6.1 Increaseing Investment From the Government for Development Projects to Drive the Demand for Surface Protection Tapes in Rest of

Europe

9.4 North America

9.4.1 US

9.4.1.1 The US is the Largest Country-Level Market for Surface Protection Tapes in North America

9.4.2 Mexico

9.4.2.1 The Growing Public and Private Construction Activities is Projected to Drive the Surface Protection Tapes Market in Mexico

9.4.3 Canada

9.4.3.1 Rise in Automotive Industry is Projected to Drive the Canadian Surface Protection Tapes Market

9.5 Middle East & Africa (MEA)

9.5.1 Turkey

9.5.1.1 The Turkey to Grow at the Highest CAGR in the Middle East & Africa Surface Protection Tapes Market, in Terms of Volume

9.5.2 UAE

9.5.2.1 The UAE to Be the Second-Lastest Surface Protection Tapes Market in the Middle East & Africa

9.5.3 Saudi Arabia

9.5.3.1 Polyethylene Segment to Lead the Surface Protection Tapes Market in Saudi Arabia

9.5.4 South Africa

9.5.4.1 Rising Industrialization to Drive the Surface Protection Tapes Market in South Africa

9.5.5 Rest of Middle East & Africa

9.5.5.1 Rest of the Middle East & Africa to Grow at A Stagnant Rate During the Forecast Period

9.6 South America

9.6.1 Brazil

9.6.1.1 Brazil to Account for the Largest Share in the South American Surface Protection Tapes Market

9.6.2 Argentina

9.6.2.1 Polyethylene to Be the Leading Segment of Surface Protection Tapes Market in Argentina

9.6.3 Rest of South America

9.6.3.1 Growth in the Building & Construction Industry to Drive the Surface Protection Tapes Market in Rest of South America

10 Competitive Landscape (Page No. - 112)

10.1 Overview

10.2 Market Ranking

10.3 Competitive Leadership Mapping

10.3.1 Visionary Leaders

10.3.2 Innovators

10.3.3 Dynamic Differentiators

10.3.4 Emerging Companies

10.4 Competitive Scenario

10.4.1 Expansions, Investments, and Divestitures

10.4.2 Mergers and Acquisitions

10.4.3 New Product Developments

11 Company Profiles (Page No. - 120)

11.1 DowDuPont

11.1.1 Business Overview

11.1.2 Products Offered

11.1.3 Recent Developments

11.1.4 SWOT Analysis

11.1.5 MnM View

11.2 Compagnie De Saint-Gobain S.A.

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Recent Developments

11.2.4 SWOT Analysis

11.2.5 MnM View

11.3 3M

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Recent Developments

11.3.4 SWOT Analysis

11.3.5 MnM View

11.4 Toray Industries, Inc.

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 SWOT Analysis

11.4.4 MnM View

11.5 Chevron Phillips Chemical Company

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 SWOT Analysis

11.5.4 MnM View

11.6 Berry Global Inc.

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 Recent Developments

11.6.4 MnM View

11.7 Nitto Denko Corporation

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Recent Developments

11.7.4 MnM View

11.8 Avery Dennison

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 Recent Developments

11.8.4 MnM View

11.9 Tesa SE

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 Recent Developments

11.9.4 MnM View

11.10 Intertape Polymer Group Inc.

11.10.1 Business Overview

11.10.2 Products Offered

11.10.3 Recent Developments

11.10.4 MnM View

11.11 Other Players

11.11.1 Chargeurs

11.11.2 Scapa Group

11.11.3 American Biltrite Inc.

11.11.4 Delphon

11.11.5 Tuftape Fzco

11.11.6 Polifilm Group

11.11.7 Rhira Industries LLC

11.11.8 Fixon

11.11.9 Integument Technologies, Inc.

11.11.10 Mitsui Chemicals Tohcello, Inc.

11.11.11 Pregis LLC

11.11.12 Ajit Industries Private Limited

11.11.13 Mexim Adhesive Tapes Pvt. Ltd.

11.11.14 Covertec SRL

11.11.15 Aurotapes

12 Appendix (Page No. - 153)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (96 Tables)

Table 1 USD Conversion Rates, 20162018

Table 2 Surface Protection Tape Market Size, By Type, 20172024 (USD Million)

Table 3 Surface Protection Tape Market Size, By Type, 20172024 (Million Square Feet)

Table 4 Surface Protection Tapes Market Size, By Surface Material, 20172024 (USD Million)

Table 5 Surface Protection Tapes Market Size, By Surface Material, 20172024 (Million Square Feet)

Table 6 Surface Protection Tapes Market Size, By End-Use Industry, 20172024 (USD Million)

Table 7 Surface Protection Tapes Market Size, By End-Use Industry, 20172024 (Million Square Feet)

Table 8 Surface Protection Tapes Market Size, By Region, 20172024 (USD Million)

Table 9 Surface Protection Tapes Market Size, By Region, 20172024 (Million Square Feet)

Table 10 Asia Pacific: Surface Protection Tapes Market Size, By Country, 20172024 (USD Million)

Table 11 Asia Pacific Surface Protection Tapes Market Size, By Country, 20172024 (Million Square Feet)

Table 12 Asia Pacific: Surface Protection Tapes Market Size, By Type, 20172024 (USD Million)

Table 13 Asia Pacific: Surface Protection Tapes Market Size, By Type, 20172024 (Million Square Feet)

Table 14 Asia Pacific: Surface Protection Tapes Market Size, By Surface Material, 20172024 (USD Million)

Table 15 Asia Pacific: Surface Protection Tapes Market Size, By Surface Material, 20172024 (Million Square Feet)

Table 16 Asia Pacific: Surface Protection Tapes Market Size, By End Use Industry, 20172024 (USD Million)

Table 17 Asia Pacific: Surface Protection Tapes Market Size, By End Use Industry, 20172024 (Million Square Feet)

Table 18 China: Surface Protection Tapes Market Size, By Type, 20172024 (USD Million)

Table 19 China: Surface Protection Tapes Market Size, By Type, 20172024 (Million Square Feet)

Table 20 Japan: Surface Protection Tapes Market Size, By Type, 20172024 (USD Million)

Table 21 Japan: Surface Protection Tapes Market Size, By Type, 20172024 (Million Square Feet)

Table 22 India: Surface Protection Tapes Market Size, By Type, 20172024 (USD Million)

Table 23 India: Surface Protection Tapes Market Size, By Type, 20172024 (Million Square Feet)

Table 24 South Korea: Surface Protection Tapes Market Size, By Type, 20172024 (USD Million)

Table 25 South Korea: Surface Protection Tapes Market Size, By Type, 20172024 (Million Square Feet)

Table 26 Rest of Asia Pacific: Surface Protection Tapes Market Size, By Type, 20172024 (USD Million)

Table 27 Rest of Asia Pacific: Surface Protection Tapes Market Size, By Type, 20172024 (Million Square Feet)

Table 28 Europe: Surface Protection Tapes Market Size, By Country, 20172024 (USD Million)

Table 29 Europe: Surface Protection Tapes Market Size, By Country, 20172024 (Million Square Feet)

Table 30 Europe: Surface Protection Tapes Market Size, By Type, 20172024 (USD Million)

Table 31 Europe: Surface Protection Tapes Market Size, By Type, 20172024 (Million Square Feet)

Table 32 Europe: Surface Protection Tapes Market Size, By Surface Material, 20172024 (USD Million)

Table 33 Europe: Surface Protection Tapes Market Size, By Surface Material, 20172024 (Million Square Feet)

Table 34 Europe: Surface Protection Tapes Market Size, By End Use Industry, 20172024 (USD Million)

Table 35 Europe: Surface Protection Tapes Market Size, By End Use Industry, 20172024 (Million Square Feet)

Table 36 Germany: Surface Protection Tapes Market Size, By Type, 20172024 (USD Million)

Table 37 Germany: Surface Protection Tapes Market Size, By Type, 20172024 (Million Square Feet)

Table 38 UK: Surface Protection Tapes Market Size, By Type, 20172024 (USD Million)

Table 39 UK: Surface Protection Tapes Market Size, By Type, 20172024 (Million Square Feet)

Table 40 Italy: Surface Protection Tapes Market Size, By Type, 20172024 (USD Million)

Table 41 Italy: Surface Protection Tapes Market Size, By Type, 20172024 (Million Square Feet)

Table 42 France: Surface Protection Tapes Market Size, By Type, 20172024 (USD Million)

Table 43 France: Surface Protection Tapes Market Size, By Type, 20172024 (Million Square Feet)

Table 44 Russia: Surface Protection Tapes Market Size, By Type, 20172024 (USD Million)

Table 45 Russia: Surface Protection Tapes Market Size, By Type, 20172024 (Million Square Feet)

Table 46 Rest of Europe: Surface Protection Tapes Market Size, By Type, 20172024 (USD Million)

Table 47 Rest of Europe: Surface Protection Tapes Market Size, By Type, 20172024 (Million Square Feet)

Table 48 North America: Surface Protection Tapes Market Size, By Country, 2017-2024 (USD Million)

Table 49 North America: Surface Protection Tapes Market Size, By Country, 2017-2024 (Million Square Feet)

Table 50 North America: Surface Protection Tapes Market Size, By Type, 2017-2024 (USD Million)

Table 51 North America: Surface Protection Tapes Market Size, By Type, 2017-2024 (Million Square Feet)

Table 52 North America: Surface Protection Tapes Market Size, By Surface Material, 2017-2024 (USD Million)

Table 53 North America: Surface Protection Tapes Market Size, By Surface Material, 2017-2024 (Million Square Feet)

Table 54 North America: Surface Protection Tapes Market Size, By End Use Industry, 2017-2024 (USD Million)

Table 55 North America: Surface Protection Tapes Market Size, By End Use Industry, 2017-2024 (Million Square Feet)

Table 56 US: Surface Protection Tapes Market Size, By Type, 2017-2024 (USD Million)

Table 57 US: Surface Protection Tapes Market Size, By Type, 2017-2024 (Million Square Feet)

Table 58 Mexico: Surface Protection Tapes Market Size, By Type , 2017-2024 (USD Million)

Table 59 Mexico: Surface Protection Tapes Market Size, By Type , 2017-2024 (Million Square Feet)

Table 60 Canada: Surface Protection Tapes Market Size, By Type , 2017-2024 (USD Million)

Table 61 Canada: Surface Protection Tapes Market Size, By Type , 2017-2024 (Million Square Feet)

Table 62 Middle East & Africa: Surface Protection Tapes Market Size, By Country, 20172024 (USD Million)

Table 63 Middle East & Africa: Surface Protection Tapes Market Size, By Country, 20172024 (Million Square Feet )

Table 64 Middle East & Africa: Surface Protection Tapes Market Size, By Type, 20172024 (USD Million)

Table 65 Middle East & Africa: Surface Protection Tapes Market Size, By Type, 20172024 (Million Square Feet)

Table 66 Middle East & Africa: Surface Protection Tapes Market Size, By Surface Material, 20172024 (USD Million)

Table 67 Middle East & Africa: Surface Protection Tapes Market Size, By Surface Material, 20172024 (Million Square Feet)

Table 68 Middle East & Africa: Surface Protection Tapes Market Size, By End Use Industry, 20172024 (USD Million)

Table 69 Middle East & Africa: Surface Protection Tapes Market Size, By End Use Industry, 20172024 (Million Square Feet)

Table 70 Turkey: Surface Protection Tapes Market Size, By Type, 20172024 (USD Million)

Table 71 Turkey: Surface Protection Tapes Market Size, By Type, 20172024 (Million Square Feet)

Table 72 UAE: Surface Protection Tapes Market Size, By Type, 20172024 (USD Million)

Table 73 UAE: Surface Protection Tapes Market Size, By Type, 20172024 (Million Square Feet)

Table 74 Saudi Arabia: Surface Protection Tapes Market Size, By Type, 20172024 (USD Million)

Table 75 Saudi Arabia: Surface Protection Tapes Market Size, By Type, 20172024 (Million Square Feet )

Table 76 South Africa: Surface Protection Tapes Market Size, By Type, 20172024 (USD Million)

Table 77 South Africa: Surface Protection Tapes Market Size, By Type, 20172024 (Million Square Feet )

Table 78 Rest of Middle East & Africa: Surface Protection Tapes Market Size, By Type, 20172024 (USD Million)

Table 79 Rest of Middle East & Africa: Surface Protection Tapes Market Size, By Type, 20172024 (Million Square Feet )

Table 80 South America: Surface Protection Tapes Market Size, By Country, 20172024 (USD Million)

Table 81 South America: Surface Protection Tapes Market Size, By Country, 20172024 (Million Square Feet)

Table 82 South America: Surface Protection Tapes Market Size, By Type, 20172024 (USD Million)

Table 83 South America: Surface Protection Tapes Market Size, By Type, 20172024 (Million Square Feet)

Table 84 South America: Surface Protection Tapes Market Size, By Surface Material, 20172024 (USD Million)

Table 85 South America: Surface Protection Tapes Market Size, By Surface Material, 20172024 (Million Square Feet)

Table 86 South America: Surface Protection Tapes Market Size, By End Use Industry, 20172024 (USD Million)

Table 87 South America: Surface Protection Tapes Market Size, By End Use Industry, 20172024 (Million Square Feet)

Table 88 Brazil: Surface Protection Tapes Market Size, By Type, 20172024 (USD Million)

Table 89 Brazil: Surface Protection Tapes Market Size, By Type, 20172024 (Million Square Feet)

Table 90 Argentina: Surface Protection Tapes Market Size, By Type, 20172024 (USD Million)

Table 91 Argentina: Surface Protection Tapes Market Size, By Type, 20172024 (Million Square Feet)

Table 92 Rest of South America: Surface Protection Tapes Market Size, By Type, 20172024 (USD Million)

Table 93 Rest of South America: Surface Protection Tapes Market Size, By Type, 20172024 (Million Square Feet)

Table 94 Expansions, Investments, and Divestitures, 2015-2019

Table 95 Mergers, and Acquisitions, 2015-2018

Table 96 New Product Developments, 2015-2018

List of Figures (40 Figures)

Figure 1 Surface Protection Tapes Market Segmentation

Figure 2 Surface Protection Tapes Market, By Region

Figure 3 Surface Protection Tapes Market: Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Surface Protection Tapes: Data Triangulation

Figure 7 The Polyethylene Segment is Projected to Lead the Surface Protection Tapes Market During the Forecast Period, By Type

Figure 8 The Polished Metals Segment is Projected to Lead the Surface Protection Tapes Market During the Forecast Period, By Surface Material

Figure 9 The Electronics & Appliances Segment is Projected to Lead the Surface Protection Tapes Market During the Forecast Period, By End-Use Industry

Figure 10 Asia Pacific Led the Surface Protection Tapes Market in 2018

Figure 11 Rise in Demand From End-Use Industries is Projected to Drive Surface Protection Tapes Market

Figure 12 China Was the Largest Market for Surface Protection Tapes in Asia Pacific in 2018

Figure 13 Polyethylene is Projected to Lead the Surface Protection Tapes Market During the Forecast Period

Figure 14 Polished Metals to Lead the Surface Protection Tapes Market, in Terms of Surface Material

Figure 15 Electronics & Appliances is Projected to Be the Fastest-Growing Application in the Surface Protection Tapes Market

Figure 16 The Surface Protection Tapes Market in China is Projected to Grow at the Highest CAGR From 2019 to 2024

Figure 17 Surface Protection Tapes Market Dynamics

Figure 18 Surface Protection Tape Market Size, By Type, 2019 vs. 2024 (USD Million)

Figure 19 Surface Protection Tapes Market Size, By Surface Material, 2019 vs. 2024 (USD Million)

Figure 20 Surface Protection Tapes Market Share, By End-Use Industry, 2019 vs. 2024 (USD Million)

Figure 21 Geographical Snapshot: Surface Protection Tapes Market Growth Rate, By Country, 2019-2024

Figure 22 Asia Pacific: Market Snapshot

Figure 23 Companies Adopted Various Growth Strategies From 2016 to 2018

Figure 24 Market Ranking of Key Players, 2018

Figure 25 Surface Protection Tapes Market: Competitive Leadership Mapping, 2017

Figure 26 DowDuPont: Company Snapshot

Figure 27 DowDuPont: SWOT Analysis

Figure 28 Compagnie De Saint-Gobain S.A.: Company Snapshot

Figure 29 Compagnie De Saint-Gobain S.A.: SWOT Analysis

Figure 30 3M: Company Snapshot

Figure 31 3M: SWOT Analysis

Figure 32 Toray Industries, Inc.: Company Snapshot

Figure 33 Toray Industries, Inc.: SWOT Analysis

Figure 34 Chevron Phillips Chemical Company: Company Snapshot

Figure 35 Chevron Phillips Chemical Company: SWOT Analysis

Figure 36 Berry Global Inc.: Company Snapshot

Figure 37 Nitto Denko Corporation: Company Snapshot

Figure 38 Avery Dennison: Company Snapshot

Figure 39 Tesa SE : Company Snapshot

Figure 40 Intertape Polymer Group Inc.: Company Snapshot

The study involved four major activities for estimating the current global size of the surface protection tapes market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of surface protection tapes through primary research. Both top-down and bottom-up approaches were employed to estimate the overall size of the surface protection tapes market. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for the study on the surface protection tapes market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

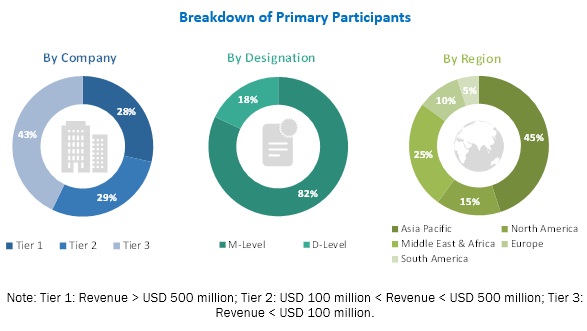

Primary Research

Various primary sources from both supply- and demand-side of the market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various key companies and organizations operating in the surface protection tapes market. The primary sources from the demand-side included key executives from the surface protection tapes & films companies. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the global size of the surface protection tapes market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the surface protection tapes market. The data was triangulated by studying various factors and trends from both demand- and supply-side.

Research Objectives

- To define, analyze, and project the size of the surface protection tapes market, in terms of value and volume, based on type, surface material, end use, and region

- To project the size of the market and its segments, in terms of value and volume, with respect to the five main regions, namely, North America, Europe, the Asia Pacific, the Middle East & Africa, and South America

- To provide detailed information about the key factors such as drivers, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets, with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments such as acquisitions, expansions, investments, new product developments, partnerships, and agreements in the surface protection tapes market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the surface protection tapes report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the surface protection tapes market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Surface Protection Tapes Market