Sealing & Strapping Packaging Tapes Market by Material (PP, Paper, PVC), type of adhesive (Acrylic, Rubber-based, and Silicone), Applications (Carton sealing and Strapping & bundling), and Region - Global Forecast to 2023

[126 Pages Report] Sealing & strapping packaging tapes are continuous flexible strips of paper, plastic, cloth, metal, or foam that are coated on a single or both sides with an adhesive. Sealing tapes can adhere to a variety of substrates by applying light pressure at room temperature. On the other hand, strapping does not require any adhesive and is majorly used in bundling and pelletizing. The primary raw materials used to manufacture these packaging tapes are acrylic, rubber, silicone, and other resins such as polyurethanes, poly-iso-butanes hybrid, nitriles, and hydrophilic adhesive along with substrates such as PVC, paper, PP, fabric, metal, and foam.

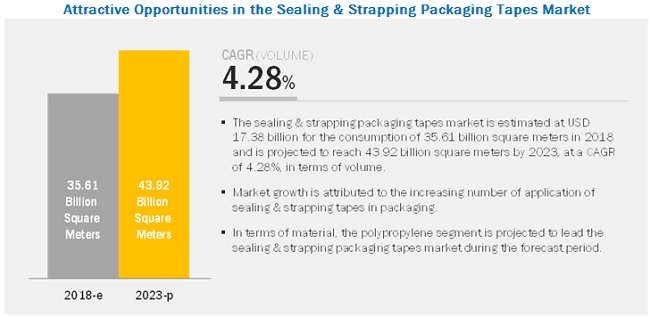

The market size was estimated at USD 17.37 billion in 2018 and is projected to reach USD 22.07 billion by 2023 at a CAGR of 4.89%. Furthermore, the market is estimated at USD 17.38 billion for the consumption of 35.61 billion square meters in 2018 and is projected to reach 43.92 billion square meters by 2023 at a CAGR of 4.28%, in terms of volume.

The increasing use of these packaging adhesive-based tapes for various applications in all end-use industries and the high demand for these tapes in the Asia Pacific region are some of the factors driving the market. Increasing adoption of low-cost, flexible packaging and fast curing time of sealing & strapping tapes are the major factors driving the sealing & strapping packaging tapes market growth. However, the rise in raw material prices is a significant restraint for the growth of the market.

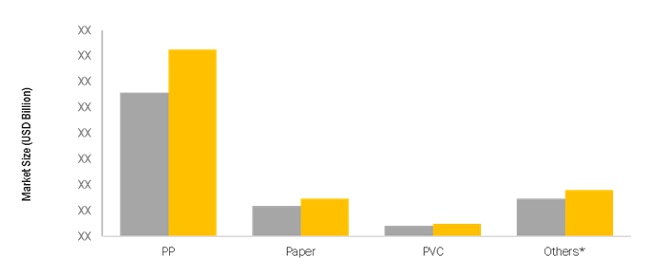

By material, the polypropylene segment is expected to lead the market.

Based on material, the polypropylene segment dominated the sealing & strapping packaging tapes market. This dominance is attributed to the fact that it is majorly used for manufacturing sealing & strapping tapes owing to its elasticity and resistance to humidity.

By type of adhesive, the acrylic segment is projected to account for the largest share during the forecast period.

The acrylic segment accounted for a significant share of the overall sealing & strapping packaging tapes market because of its ease of use, low cost, and wide acceptability in end-use industries such as packaging, medical, and consumer & office supplies. However, the rubber-based segment is projected to grow at the highest rate because of its better adhesion properties.

By application, the strapping & bundling sector is expected to be the fastest-growing application during the forecast period.

By application, the carton sealing tapes segment will dominate the sealing & strapping packaging tapes market. This dominance is attributed to the wide range of applications in various end-use industries, including healthcare, food & beverage, automotive, electrical, electronics, and e-commerce, for the safe transport of packaged goods.

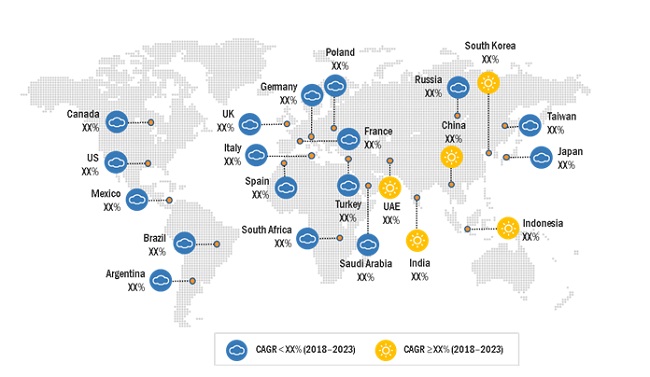

Asia Pacific to dominate the market during the forecast period.

China was the largest market for sealing & strapping packaging tapes, globally. The Asia Pacific market is projected to grow at the highest CAGR from 2018 to 2023. The key factors driving the growth of the Asia Pacific sealing & strapping packaging tapes market include the booming packaging industry in countries such as China, India, Vietnam, Indonesia, and Japan, cheap labor cost, and availability of domestically produced raw materials. In addition, the growing demand for sealing & strapping packaging tapes in China, Japan, and India is driving by the ever-increasing awareness of sustainable and economical packaging, and rising disposable income is expected to create opportunities for the sealing & strapping packaging tapes market in the region.

Market Dynamics

Driver: Wide acceptance of packaging tapes due to ease of applicability

Sealing & strapping packaging tapes are user-friendly due to their ease of applicability as compared to conventional methods. The increasing demand for specific requirements, such as reduced vibration and bonding dissimilar materials, has driven the sealing & strapping packaging tapes market. Sealing & strapping packaging tapes exhibit high-speed processing and do not involve hassles of mixing up the materials or waste handling and do not release harmful content into the environment. They maintain sufficient tackiness at room temperature and hence do not require additional water, solvent, and heat to build strong adhesive forces. These tapes have a cohesive hold so that they can be conveniently manipulated by hand. These can be removed from the surface without leaving any residue. Thus, sealing & strapping packaging tapes maintain tackiness under normal environmental conditions when compared to conventional tapes. Moreover, the replacement of organic solvents as adhesives carrier fluids for surface preparation has also contributed to the growing demand for these tapes. Sealing & strapping packaging tapes are also expected to replace mechanical fasteners due to their ability to reduce vibrations and stress that arise due to used mechanical parts.

Restraint: Rise in raw material prices

The price and availability of raw materials are vital factors for any type of packaging tape manufacturers to decide the cost structure for its products. Acrylic, synthetic rubber, natural rubber, and inorganic & organic chemicals are raw materials used in the manufacturing of sealing & strapping packaging tapes. Most of these raw materials are petroleum-based derivatives and are vulnerable to fluctuations in commodity prices. Oil prices were highly volatile in the past due to the increasing global demand and political unrest in the Middle East. The uncertainty and fluctuations in the cost and availability of feedstock impact the growth of the market.

The adhesives industry is affected by higher manufacturing costs resulting from increased energy costs. Also, the consistently growing global demand for chemicals and the capacity constraints in the supply of these primary chemicals and resin feedstock have fueled the rise in raw material prices. These supply shortages of monomers used to make adhesive raw materials such as Piperylene and C9 monomers have increased the cost of sealing & strapping packaging tapes. Hence, fluctuations in the prices of these raw materials act as a restraint to this industry.

Opportunity: Emerging economies in the Asia Pacific region

New types of biodegradable sealing & strapping packaging tapes are developed. The demand for biodegradable and eco-friendly packaging tapes has increased since the past few years due to stringent environmental regulations and consumer preferences.

For commodity sealing & strapping packaging tapes, the innovation of hot-melt-based technology enables an adhesive tape manufacturer or converter to coat an adhesive on a backing material such as OPP (oriented polypropylene) film without any release of solvents or water. The shift toward hot-melt-based systems is especially increasing in the Asia Pacific region. Innovations such as curable adhesives (UV- and EB- for both rubber and acrylic systems) are in more demand for this type of specialty packaging tapes.

Challenge: Stringent government regulations reshaping the packaging tapes market

The chemical industry is facing challenges from various regulatory authorities, such as Control of Substances Hazardous to Health (COSHH), European Union (EU), Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH), Globally Harmonized System (GHS), and Environmental Protection Agency (EPA) in Europe and North America. The manufacturers in Europe and North America are following these regulations regarding the production as well as the use of tapes for various applications to reduce the effect of VOCs (Volatile organic compounds).

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016 2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018 2023 |

|

Forecast units |

Billion (USD), Square meters |

|

Segments covered |

Material, Type of Adhesive, Application, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies covered |

Key market players including, |

The research report categorizes the Sealing & Strapping Packaging Tapes Market to forecast the revenues and analyze the trends in each of the following sub-segments:

By Material,

- Paper

- Polypropylene

- Polyvinyl Chloride

- Others

By Type of Adhesive,

- Acrylic

- Rubber-Based

- Silicone

- Others

By Application,

- Carton Sealing Tapes

- Strapping & Building

By Region,

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Spain

- France

- Asia Pacific

- China

- Japan

- India

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- Turkey

- South Africa

- Rest of the Middle East & Africa

- South America

- Brazil

- Argentina

- Rest of South America

Key Market Players

Avery Dennison Corporation (US), 3M Company (US), Nitto Denko Corporation (Japan), Intertape Polymer Group (Canada), Tesa SE (Germany).

Recent Developments

- In November 2018, Intertape Polymer Group acquired the control of a 29% stake for USD 9.9 Million in Powerband (India). Acquiring a controlling interest in Powerband in 2016 provided the company with additional capacity for acrylic carton-sealing tapes in a low-cost manufacturing region to export these competitively-priced tape products to North America and Europe. Since then, having the overseas asset has enabled IPG to expand its market share in North America and negotiate better terms on raw materials for the US production of similar packaging tapes.

- In September 2018, Scapa acquired Systagenix Wound Management Manufacturing Limited (US). With this acquisition, both the companies entered into an exclusive five-year manufacturing & supply agreement. With this acquisition, the company would be able to strengthen its product portfolio and cater to the increasing demand, thereby growing its geographic penetration.

- In May 2018, Tesa SE acquired the FormFormForm Ltd. (UK), a manufacturer of adhesive tapes and self-adhesive systems solutions. This acquisition strengthened Tesa SEs product portfolio, geographical reach, go-to-market channels, and the industries it served.

- In February 2017, Shurtape Technologies, LLC, a leading producer of adhesive tapes, acquired Syntac Coated Products, LLC (US), a designer and manufacturer of specialty adhesive coated products.

Critical questions the report answers:

- What are the key sustainability strategies adopted by major market players?

- What are the upcoming trends in the aftermarket? What impact do they make post-2020?

- What will be the revenue-generating pockets for the key players in the market?

- Which segment or region will lead the market, and why?

Frequently Asked Questions (FAQ):

What are sealing & strapping packaging tapes?

What are the factors influencing the growth of sealing & strapping packaging tapes Market?

What are the factors contributing to the final price of sealing & strapping packaging tapes?

What is the materials used for manufacturing sealing & strapping packaging tapes?

Which material segment is projected to grow at the highest growth rate in the sealing & strapping packaging tapes market?

What are the types of adesives considered in the scope of the study?

What are the application areas of sealing & strapping packaging tapes?

How is the seam sealing packaging tapes market Aligned?

Who are the major manufacturers?

What are the restraining factors for the sealing & strapping packaging tapes market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regional Scope

1.3.2 Periodization Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Developing Economies to Register High Growth in Demand for Sealing & Strapping Packaging Tapes

4.2 Sealing & Strapping Packaging Tapes Market, By Material

4.3 Sealing & Strapping Packaging Tapes Market, By Type of Adhesive

4.4 Sealing & Strapping Packaging Tapes Market, By Application

4.5 Asia Pacific Sealing & Strapping Packaging Tapes Market, By Application and Country

4.6 Sealing & Strapping Packaging Tapes Market: Key Countries

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Wide Range of Applications in the Packaging Industry

5.2.1.2 Increasing Demand From the Asia Pacific Region

5.2.1.3 Wide Acceptance of Packaging Tapes Due to Ease of Applicability

5.2.2 Restraints

5.2.2.1 Rise in Raw Material Prices

5.2.3 Opportunities

5.2.3.1 Emerging Economies in the Asia Pacific Region

5.2.4 Challenges

5.2.4.1 Stringent Government Regulations Reshaping the Packaging Tapes Market

6 Sealing & Strapping Tapes Market, By Material (Page No. - 38)

6.1 Introduction

6.2 Paper

6.3 Polypropylene

6.4 Polyvinyl Chloride

6.5 Others

7 Sealing & Strapping Packaging Tapes Market, By Type of Adhesive (Page No. - 42)

7.1 Introduction

7.2 Acrylic

7.3 Rubber

7.4 Silicone

7.5 Others

8 Sealing & Strapping Packaging Tapes Market, By Application (Page No. - 46)

8.1 Introduction

8.2 Carton Sealing

8.3 Strapping & Bundling

9 Sealing & Strapping Packaging Tapes Market, By Region (Page No. - 49)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 The US is the Largest Country-Level Market for Sealing & Strapping Packaging Tapes, Globally

9.2.2 Mexico

9.2.2.1 Rapidly Growing Packaging Industry to Drive the Sealing & Strapping Packaging Tapes Market in Mexico

9.2.3 Canada

9.2.3.1 Growing Demand for Carton Sealing Tapes From the E-Commerce Industry to Support the Canadian Sealing & Strapping Packaging Tapes Market

9.3 Europe

9.3.1 Germany

9.3.1.1 Germany to Dominate the Sealing & Strapping Packaging Tapes Market in Europe

9.3.2 Italy

9.3.2.1 Growth in Automotive Industry in Italy Driving the Sealing & Strapping Packaging Tapes Market

9.3.3 Spain

9.3.3.1 Strapping & Bundling to Witness High Growth During Forecast Period

9.3.4 France

9.3.4.1 France has Potential Market for Sealing & Strapping Packaging Tapes

9.3.5 UK

9.3.5.1 Carton Sealing Tapes to Witness High Consumption in the UK By 2023

9.3.6 Russia

9.3.6.1 Strapping & Bundling to Witness High Growth in Russia By 2023

9.3.7 Poland

9.3.7.1 Poland to Grow at A Significant Rate in the Sealing & Strapping Packaging Tapes Market

9.3.8 Rest of Europe

9.3.8.1 Strapping & Bundling to Growth at the Highest Rate in the Rest of Europe Region By 2023

9.4 Asia Pacific

9.4.1 China

9.4.1.1 China Dominates the Sealing & Strapping Packaging Tapes Market in the Asia Pacific Region

9.4.2 India

9.4.2.1 India to Be the Fastest Growing Country in the Asia Pacific Sealing & Strapping Packaging Tapes Market

9.4.3 Japan

9.4.3.1 Japan to Have the Second-Largest Share in the Asia Pacific Sealing & Strapping Packaging Tapes Market

9.4.4 Taiwan

9.4.4.1 Stable Economic Growth of the Country Drives the Sealing & Strapping Packaging Tapes Market in Asia Pacific

9.4.5 Indonesia

9.4.5.1 Heavy Investments in the Indonesian Market to Drive the Sealing & Strapping Packaging Tapes Market in the Country

9.4.6 South Korea

9.4.6.1 South Korea is Projected to Witness Significant Growth in the Sealing & Strapping Packaging Tapes Market

9.4.7 Rest of Asia Pacific

9.4.7.1 Strapping & Bundling is Projected to Be the Fastest Growing Segment in the Sealing & Strapping Packaging Tapes Market in Rest of Asia Pacific

9.5 Middle East & Africa

9.5.1 Turkey

9.5.1.1 Carton Sealing Tapes to Remain the Largest Segment in the Sealing & Strapping Packaging Tapes Market in Turkey

9.5.2 South Africa

9.5.2.1 The Growing Industrialization and Urbanization is Projected to Support the Growth of the Sealing & Strapping Packaging Tapes Market in South Africa

9.5.3 Rest of the Middle East & Africa

9.5.3.1 Strapping & Bundling to Be the Fastest Growing Segment in the Sealing & Strapping Packaging Tapes Market in Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.1.1 Brazil to Be the Largest Market for Sealing & Strapping Packaging Tapes in South America

9.6.2 Argentina

9.6.2.1 Developing Packaging Industries to Drive the Sealing & Strapping Packaging Tapes Market in Argentina

9.6.3 Rest of South America

9.6.3.1 Carton Sealing Tape to Remain the Largely Used Application in the Sealing & Strapping Packaging Tapes Market in Rest of South America

10 Competitive Landscape (Page No. - 95)

10.1 Overview

10.2 Competitive Leadership Mapping, 2017

10.2.1 Visionary Leaders

10.2.2 Innovators

10.2.3 Dynamic Differentiator

10.2.4 Emerging Companies

10.3 Source: Marketsandmarkets Analysis

10.4 Market Ranking

11 Company Profiles (Page No. - 99)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Avery Dennison Corporation

11.2 3M Company

11.3 Nitto Denko Corporation.

11.4 Intertape Polymer Group

11.5 Tesa SE

11.6 Scapa Group PLC

11.7 Shurtapes Technologies

11.8 Nichiban

11.9 Mactac

11.10 Wuhan Huaxia Nanfeng Adhesive Tapes

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11.11 Other Companies

11.11.1 Ajit Industries

11.11.2 Advanced Tapes International

11.11.3 Canadian Technical Tape Ltd.

11.11.4 Industrias Tuk, S.A. De C.V.

11.11.5 Berry Plastics Corporation.

11.11.6 Adchem Corporation

11.11.7 CCT Tapes

11.11.8 Dewal Industries

11.11.9 Adhesive Research, Inc.

11.11.10 Gergonne the Adhesive Solution

12 Appendix (Page No. - 120)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (97 Tables)

Table 1 USD Conversion Rates, 20142017

Table 2 Sealing & Strapping Tapes Market Size, By Material, 20162023 (USD Million)

Table 3 Sealing & Strapping Tapes Market Size, By Material, 20162023 (Million Meters)

Table 4 Market Size, By Type of Adhesive, 20162023 (USD Million)

Table 5 Sealing & Strapping Packaging Tapes Market Size, By Type of Adhesive, 20162023 (Million Square Meters)

Table 6 Market Size, By Application, 20162023 (USD Million)

Table 7 Sealing & Strapping Packaging Tapes Market Size, By Application, 2016-2023 (Million Square Meters)

Table 8 Market Size, By Region, 20162023 (USD Million)

Table 9 Sealing & Strapping Packaging Tapes Market Size, By Region, 20162023 (Million Square Meters)

Table 10 North America: Sealing & Strapping Packaging Tapes Market Size, By Country, 20162023 (USD Million)

Table 11 North America: Polypropylene Sealing Market Size, By Country, 20162023 (Million Square Meters)

Table 12 North America: Sealing & Strapping Packaging Tapes Carton Sealing Tapes Market Size, By Material, 20162023 (USD Million)

Table 13 North America: Box Sealing Tapes Market Size, By Material, 20162023 (Million Square Meters)

Table 14 North America: Strapping Tapes Market Size, By Type of Adhesive, 20162023 (USD Million)

Table 15 North America: Sealing & Strapping Packaging Tapes Market Size, By Type of Adhesive, 20162023 (Million Square Meters)

Table 16 North America: Sealing & Strapping Packaging Tapes Polypropylene Sealing Market Size, By Application, 20162023 (USD Million)

Table 17 North America: Carton Sealing Tapes Market Size, By Application, 20162023 (Million Square Meters)

Table 18 US: Box Sealing Tapes Market Size, By Application, 20162023 (USD Million)

Table 19 US: Strapping Tapes Market Size, By Application, 20162023 (Million Square Meters)

Table 20 Mexico: Sealing & Strapping Packaging Tapes Market Size, By Application, 20162023 (USD Million)

Table 21 Mexico: Polypropylene Sealing Market Size, By Application, 20162023 (Million Square Meters)

Table 22 Canada: Sealing & Strapping Packaging Tapes Carton Sealing Tapes Market Size, By Application, 20162023 (USD Million)

Table 23 Canada: Box Sealing Tapes Market Size, By Application, 20162023 (Million Square Meters)

Table 24 Europe: Sealing & Strapping Packaging Tapes Market Size, By Country, 20162023 (USD Million)

Table 25 Europe: Polypropylene Sealing Market Size, By Country, 20162023 (Million Square Meters)

Table 26 Europe: Sealing & Strapping Packaging Tapes Carton Sealing Tapes Market Size, By Material, 20162023 (USD Million)

Table 27 Europe: Box Sealing Tapes Market Size, By Material, 20162023 (Million Square Meters)

Table 28 Europe: Strapping Tapes Market Size, By Type of Adhesive, 20162023 (USD Million)

Table 29 Europe: Sealing & Strapping Packaging Tapes Market Size, By Type of Adhesive, 20162023 (Million Square Meters)

Table 30 Europe: Polypropylene Sealing Market Size, By Application, 20162023 (USD Million)

Table 31 Europe: Carton Sealing Tapes Market Size, By Application, 20162023 (Million Square Meters)

Table 32 Germany: Box Sealing Tapes Market Size, By Application, 20162023 (USD Million)

Table 33 Germany: Strapping Tapes Market Size, By Application, 20162023 (Million Square Meters)

Table 34 Italy: Sealing & Strapping Packaging Tapes Market Size, By Application, 20162023 (USD Million)

Table 35 Italy: Polypropylene Sealing Market Size, By Application, 20162023 (Million Square Meters)

Table 36 Spain: Carton Sealing Tapes Market Size, By Application, 20162023 (USD Million)

Table 37 Spain: Box Sealing Tapes Market Size, By Application, 20162023 (Million Square Meters)

Table 38 France: Strapping Tapes Market Size, By Application, 20162023 (USD Million)

Table 39 France: Sealing & Strapping Packaging Tapes Market Size, By Application, 20162023 (Million Square Meters)

Table 40 UK: Polypropylene Sealing Market Size, By Application, 20162023 (USD Million)

Table 41 UK: Carton Sealing Tapes Market Size, By Application, 20162023 (Million Square Meters)

Table 42 Russia: Box Sealing Tapes Market Size, By Application, 20162023 (USD Million)

Table 43 Russia: Strapping Tapes Market Size, By Application, 20162023 (Million Square Meters)

Table 44 Poland: Sealing & Strapping Packaging Tapes Market Size, By Application, 20162023 (USD Million)

Table 45 Poland: Polypropylene Sealing Market Size, By Application, 20162023 (Million Square Meters)

Table 46 Rest of Europe: Carton Sealing Tapes Market Size, By Application, 20162023 (USD Million)

Table 47 Rest of Europe: Box Sealing Tapes Market Size, By Application, 20162023 (Million Square Meters)

Table 48 Asia Pacific: Sealing & Strapping Packaging Tapes Market Size, By Country, 20162023 (USD Million)

Table 49 Asia Pacific: Polypropylene Sealing Market Size, By Country, 20162023 (Million Square Meters)

Table 50 Asia Pacific: Carton Sealing Tapes Market Size, By Material, 20162023 (USD Million)

Table 51 Asia Pacific: Box Sealing Tapes Market Size, By Material, 20162023 (Million Square Meters)

Table 52 Asia Pacific: Strapping Tapes Market Size, By Type of Adhesive, 20162023 (USD Million)

Table 53 Asia Pacific: Sealing & Strapping Packaging Tapes Market Size, By Type of Adhesive, 20162023 (Million Square Meters)

Table 54 Asia Pacific: Polypropylene Sealing Market Size, By Application, 20162023 (USD Million)

Table 55 Asia Pacific: Carton Sealing Tapes Market Size, By Application, 20162023 (Million Square Meters)

Table 56 China: Box Sealing Tapes Market Size, By Application, 20162023 (USD Million)

Table 57 China: Strapping Tapes Market Size, By Application, 20162023 (Million Square Meters)

Table 58 India: Sealing & Strapping Packaging Tapes Sealing & Strapping Packaging Tapes Market Size, By Application, 20162023 (USD Million)

Table 59 India: Polypropylene Sealing Market Size, By Application, 20162023 (Million Square Meters)

Table 60 Japan: Carton Sealing Tapes Market Size, By Application, 20162023 (USD Million)

Table 61 Japan: Box Sealing Tapes Market Size, By Application, 20162023 (Million Square Meters)

Table 62 Taiwan: Strapping Tapes Market Size, By Application, 20162023 (USD Million)

Table 63 Taiwan: Sealing & Strapping Packaging Tapes Market Size, By Application, 20162023 (Million Square Meters)

Table 64 Indonesia: Polypropylene Sealing Market Size, By Application, 20162023 (USD Million)

Table 65 Indonesia: Carton Sealing Tapes Market Size, By Application, 20162023 (Million Square Meters)

Table 66 South Korea: Box Sealing Tapes Market Size, By Application, 20162023 (USD Million)

Table 67 South Korea: Strapping Tapes Market Size, By Application, 20162023 (Million Square Meters)

Table 68 Rest of Asia Pacific: Sealing & Strapping Packaging Tapes Market Size, By Application, 20162023 (USD Million)

Table 69 Rest of Asia Pacific: Polypropylene Sealing Market Size, By Application, 20162023 (Million Square Meters)

Table 70 Middle East & Africa: Sealing & Strapping Packaging Tapes Market Size, By Country, 20162023 (USD Million)

Table 71 Middle East & Africa: Polypropylene Sealing Market Size, By Country, 20162023 (Million Square Meters)

Table 72 Middle East & Africa: Carton Sealing Tapes Market Size, By Material, 20162023 (USD Million)

Table 73 Middle East & Africa: Box Sealing Tapes Market Size, By Material, 20162023 (Million Square Meters)

Table 74 Middle East & Africa: Strapping Tapes Market Size, By Type of Adhesive, 20162023 (USD Million)

Table 75 Middle East & Africa: Sealing & Strapping Packaging Tapes Market Size, By Type of Adhesive, 20162023 (Million Square Meters)

Table 76 Middle East & Africa: Polypropylene Sealing Market Size, By Application, 20162023 (USD Million)

Table 77 Middle East & Africa: Carton Sealing Tapes Market Size, By Application, 20162023 (Million Square Meters)

Table 78 Turkey: Sealing & Strapping Packaging Tapes Box Sealing Tapes Market Size, By Application, 20162023 (USD Million)

Table 79 Turkey: Strapping Tapes Market Size, By Application, 20162023 (Million Square Meters)

Table 80 South Africa: Sealing & Strapping Packaging Tapes Market Size, By Application, 20162023 (USD Million)

Table 81 South Africa: Polypropylene Sealing Market Size, By Type, 20162023 (Million Square Meters)

Table 82 Rest of the Middle East & Africa: Carton Sealing Tapes Market Size, By Application, 20162023 (USD Million)

Table 83 Rest of the Middle East & Africa: Box Sealing Tapes Market Size, By Application, 20162023 (Million Square Meters)

Table 84 South America: Sealing & Strapping Packaging Tapes Market Size, By Country, 20162023 (USD Million)

Table 85 South America: Polypropylene Sealing Market Size, By Country, 20162023 (Million Square Meters)

Table 86 South America: Carton Sealing Tapes Market Size, By Material, 20162023 (USD Million)

Table 87 South America: Box Sealing Tapes Market Size, By Material, 20162023 (Million Square Meters)

Table 88 South America: Strapping Tapes Market Size, By Type of Adhesive, 20162023 (USD Million)

Table 89 South America: Sealing & Strapping Packaging Tapes Market Size, By Type of Adhesive, 20162023 (Million Square Meters)

Table 90 South America: Polypropylene Sealing Market Size, By Application, 20162023 (USD Million)

Table 91 South America: Carton Sealing Tapes Market Size, By Application, 20162023 (Million Square Meters)

Table 92 Brazil: Box Sealing Tapes Market Size, By Application, 20162023 (USD Million)

Table 93 Brazil: Strapping Tapes Market Size, By Application, 20162023 (Million Square Meters)

Table 94 Argentina: Sealing & Strapping Packaging Tapes Sealing & Strapping Packaging Tapes Market Size, By Application, 20162023 (USD Million)

Table 95 Argentina: Polypropylene Sealing Market Size, By Application, 20162023 (Million Square Meters)

Table 96 Rest of South America: Carton Sealing Tapes Market Size, By Application, 20162023 (USD Million)

Table 97 Rest of South America: Box Sealing Tapes Market Size, By Application, 20162023 (Million Square Meters)

List of Figures (35 Figures)

Figure 1 Sealing & Strapping Packaging Tapes Market Segmentation

Figure 2 Sealing & Strapping Packaging Tapes Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Sealing & Strapping Packaging Tapes Market: Data Triangulation

Figure 6 Polypropylene Material to Dominate the Market Through the Forecast Period

Figure 7 Rubber-Based Segment Accounted for the Largest Market Share in 2017

Figure 8 Strapping & Bundling is Projected to Be the Fastest Growing Application, During the Forecast Period

Figure 9 Asia Pacific Dominated the Market in 2017

Figure 10 Growing Packaging Industry in Developing Economies Presents Attractive Opportunities for the Market

Figure 11 Polypropylene Material to Grow at the Highest Rate During the Forecast Period

Figure 12 Acrylic Segment to Dominate the Market Through 2023

Figure 13 Carton Sealing Tapes to Dominate the Market Through 2023

Figure 14 China is Estimated to Be the Largest Market for Sealing & Strapping Packaging Tapes in 2018

Figure 15 India to Grow at the Highest CAGR From 2018 to 2023

Figure 16 Growing Demand From the Asia Pacific Region and Wide Range of Applications in the Packaging Industry Fuel the Growth of the Market

Figure 17 Sealing & Strapping Tapes Market Size, By Material, 2018 vs 2023 (USD Million)

Figure 18 Sealing & Strapping Packaging Tapes Market Size, By Type of Adhesive, 2018 vs 2023 (USD Million)

Figure 19 Sealing & Strapping Packaging Tapes Market Size, By Application, 2018 & 2023 (USD Million)

Figure 20 Geographic Snapshot (20182023): China Projected to Register the Highest Growth Rate

Figure 21 Asia Pacific Sealing & Strapping Packaging Tapes Market Snapshot

Figure 22 Asia Pacific Sealing & Strapping Packaging Tapes Packaging Market: Key Countries (2017)

Figure 23 Sealing & Strapping Packaging Tapes Market: Competitive Leadership Mapping, 2017

Figure 24 Market Ranking of Key Players, 2017

Figure 25 Avery Dennison Corporation: Company Snapshot

Figure 26 Avery Dennison Corporation: SWOT Analysis

Figure 27 3M Company: Company Snapshot

Figure 28 3M Company: SWOT Analysis

Figure 29 Nitto Denko Corporation: Company Snapshot

Figure 30 Nitto Denko Corporation: SWOT Analysis

Figure 31 Intertape Polymer Group: Company Snapshot

Figure 32 Intertape Polymer Group: SWOT Analysis

Figure 33 Tesa SE: Company Snapshot

Figure 34 Tesa SE: SWOT Analysis

Figure 35 Scapa Group PLC: Company Snapshot

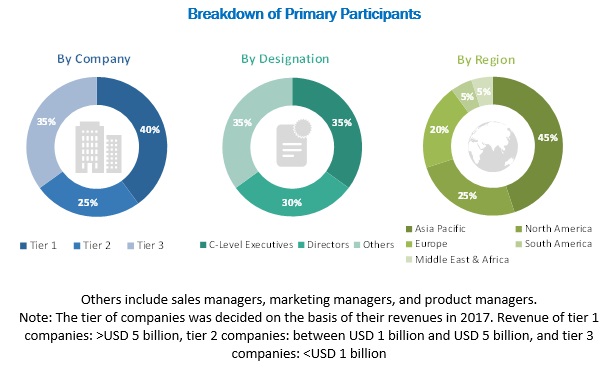

The study involved four major activities for estimating the current market size for the sealing & strapping packaging tapes market. The primary objective of the study is to define, segment, and project the market size on the basis of material, type of adhesive, application, and regions. The study also aims at strategically analyzing micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market. It also provides detailed information about key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges). In addition, the study analyzes competitive developments such as acquisitions, agreements, expansions, and new product launches.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, sales professionals, and related key executives from key companies and organizations operating in the sealing & strapping packaging tapes market. The primary sources from the demand side include key executives from the end-user industries of sealing & strapping packaging tapes technologies such as packaging, food & beverage, healthcare & pharmaceuticals, electronics & automotive, and consumer durables. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of the sealing & strapping packaging tapes market. These approaches were also used extensively to estimate the size of various dependent subsegments in the market. The research methodology used to estimate the market size include the following details:

- The key players were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

- After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Research objectives

- To define, segment, and project the global sealing & strapping packaging tapes market on the basis of material, type of adhesive, application, and region.

- To provide information about key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and their contribution to the total market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market, in terms of value and volume, with respect to four main regions (along with their respective key countries), namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments, such as agreements & joint ventures, mergers & acquisitions, and new product developments in the sealing & strapping packaging tapes market

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Material, Type of Adhesive, Application, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, South America, and Middle East & Africa |

|

Companies covered |

Avery Dennison Corporation (US), 3M Company (US), Nitto Denko Corporation (Japan), Intertape Polymer Group (Canada), Tesa SE (Germany), Scapa Group plc (UK), Shrutapes (US), Nichiban (Japan), Mactac (US), and Wuhan Huaxia Nanfeng Adhesive Tapes (China) |

This research report categorizes the sealing & strapping packaging tapes market based on material, type of adhesive, application, and region.

Based on Material, the market has been segmented as follows:

- Paper

- Polypropylene

- Polyvinyl Chloride

- Polyester

- Others (Reinforced Fiberglass and polyethylene films)

Based on Type of Adhesive, the market has been segmented as follows:

- Acrylic

- Rubber-based

- Silicon

- Others (EVA and Butyl)

Based on Application, the market has been segmented as follows:

- Carton sealing tapes

- Strapping & bundling

Based on Region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the client-specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of the market for different application in various end-use industries.

Geographic Analysis

- Further analysis of the sealing & strapping packaging tapes market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Sealing & Strapping Packaging Tapes Market