Mooring Systems Market by Application (FPSO, TLP, SPAR, Semi-submersible and FLNG), Anchorage (DEA, VLA, and Suction), Mooring type (Spread, SPM, DP, and Tendon), Depth (Shallow & Deep/Ultra-deep), and Region - Global Trends & Forecast to 2020

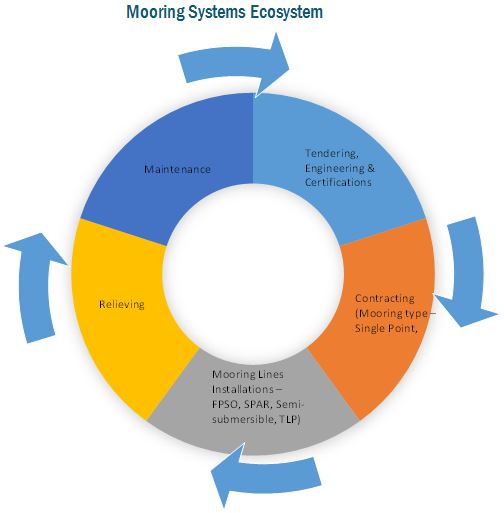

[140 Pages Report] The mooring systems market is estimated to be USD 1.58 Billion in 2015. The market is projected to grow at a CAGR of 3.7% from 2015 to 2020. Mooring systems are combined package that includes mooring lines, anchors, connectors, winches, fairleads, which is installed onto the vessels for the station keeping of the floating platforms. Mooring systems includes applications related to type of production vessels such as FPSOs, SPARs, semi-submersibles, tension leg platforms, and to depth like shallow and deep/ultra-deep. Rapid technological developments improving the drilling and production capability of rigs and vessels aid exploration and production activities in the deep-water and ultra-deep-water areas across the globe. These provide the boost for the market.

Years considered for the study:

Base Year: 2014

Forecast years: 2015-estimated, 2020-predicted

Research Methodology:

- Major applications (vessels) were identified along with number of mooring systems installed in each type of application

- Secondarys were conducted to find the number of vessels installed globally across various countries and their contribution to the mooring market

- The mooring type was identified as per the applicative vessels and the split was calculated by conducting primarys with industry participants, subject matter experts, C-level executives of key market players, and industry consultants among other experts, which helped to obtain and verify critical qualitative and quantitative information as well as assess future market prospects

- Top companies revenues (regional/global), mooring systems pricing, and industry trends along with top-down, bottom-up, and MnM KNOW were used to estimate the market size

- This was further broken down into several segments and subsegments on the basis of information gathered

This study answers several questions for the stakeholders, which include OEMs, EPC companies, oil & gas service providers, distributers & suppliers, consulting firms, private equity groups, investment houses, equity research firms, and other stakeholders. It gives them information about market segments to focus in next two to five years for prioritizing the efforts and investments.

Scope of the Report:

- This study estimates the global market of mooring systems, in terms of dollar value, till 2020

- It offers a detailed qualitative and quantitative analysis of this market

- It provides a comprehensive review of major market drivers, restraints, opportunities, challenges, winning imperatives, and key issues of the market

- It covers various important aspects of the market. These include analysis of value chain, Porters Five Forces model, competitive landscape, market dynamics, market estimates in terms of value, and future trends in the market.

The market has been segmented into -

On the following basis:

- By Application:

- Floating Production Storage & Offloading (FPSO)

- Tension Leg Platform (TLP)

- SPAR, Semi-Submersible

- Floating Liquefied Natural Gas (FLNG)

- By Anchorage:

- Drag Embedment Anchors (DEA)

- Vertical Load Anchors (VLA)

- Suction Anchors

- By Mooring Type:

- Single Point

- Spread Mooring

- Dynamic Positioning

- Tendon

- By Depth:

- Shallow (<1000 m)

- Deep/Ultra-deep (>1000 m)

- By Region:

- North America

- South America

- Europe

- Asia-Pacific

- Middle East & Africa

Available Customization

With the market data provided above, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Detailed analysis and profiling of additional market players (Up to 5)

The increase in the energy demand has resulted in the rise in oil & gas production from the regions such as North America and the Middle East. Due to the maturing onshore oil & gas fields there has been a shift of exploration & production activities towards offshore reserves.

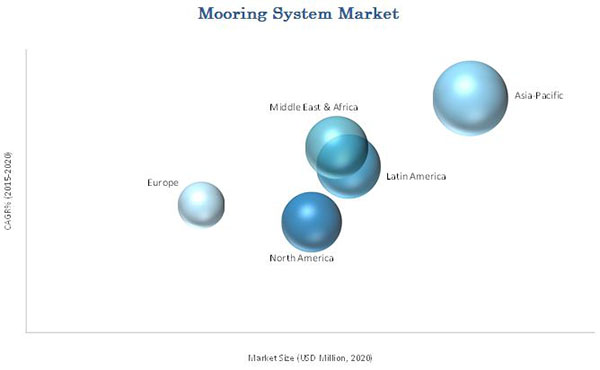

The global mooring systems market is expected to grow from USD 1.58 Billion in 2015 to USD 1.89 Billion by 2020, at a CAGR of 3.7%. Asia-Pacific accounted for the largest market share and is projected to grow at the highest CAGR during the forecast period.

The Market for mooring systems has also been classified on the basis of applications such as shallow water, deepwater, and ultra-deepwater based operations. Nearly half of the mooring systems is covered by shallow water applications, but with the advent of advanced technology, the operators are entering into deepwater and ultra-deepwater zones. Moreover, decreasing production in shallow water basins and large potential of untapped subsea hydrocarbon reserves are contributing in the increasing focus in deepwater drilling. There has been increasing deepwater oil discoveries in India, Africa, Australia, the U.S., Russia, and Norway. Oil discoveries in African region especially Ghana, Congo, Mozambique, and Angola are creating lucrative business opportunities, where market players are trying to focus on enhancing their revenue.

The mooring systems market has also been classified on the basis of mooring type into single point mooring, spread mooring, tendon mooring, and dynamic positioning. Single point mooring occupy the major share among mooring types and is expected to grow at a steady rate during the forecast period. It finds its major application in the vessel type FPSO and FLNG. It is preferred over the spread mooring due to its ability of easy weathervane, requirement of less mooring legs, and easy offloading. The single point mooring market is expected to grow from an estimated size of USD 0.68 billion in 2015 to USD 0.83 billion by 2020. Various drivers pushing the market are rapid technological advancements in drilling and exploration techniques, which in turn help increasing focus on deepwater & ultra-deepwater locations.

The recent decline of oil prices have affected the exploration & production activities across various regions and so the revenues of oil & gas operators. Trickling down the effect, there has been decline in new vessel installation in the field and so the growth of mooring systems is sluggish in 2015. Various players in the market are focusing on contracts & agreements for their geographical expansion and surge in the customer base.

Table Of Contents

1 Introduction (Page No. - 14)

1.1 Objectives Of The Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for The Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

10.3.1 Brazil

2.1.2.2 Key Industry Insights

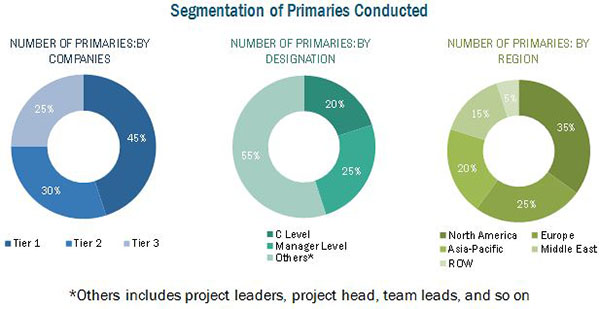

2.1.2.3 Breakdown Of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Asia-Pacific is Expected to Account for The Largest Market Share During The Forecast Period

4.2 Mooring Systems, By Depth

4.3 Mooring Systems Market Anchorage vs. Components, 2015

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rapid Technological Advancements

5.2.1.2 Increasing Focus on Deep & Ultra-Deepwater Locations

5.2.1.2.1 Demand & Supply Scenario Of Crude Oil

5.2.2 Restraints

5.2.2.1 High Cost Associated With Deepwater Projects

5.2.2.2 Oil Price Slump

5.2.3 Opportunities

5.2.3.1 Discoveries in The Arctic Region

5.2.3.2 Liberalization Of Mexican Oil & Gas Industry

5.2.4 Challenges

5.2.4.1 Rising Environmental Concerns

5.3 Impact Of Market Dynamics

5.4 Global Mooring Systems, By Depth

5.5 Top Countries Shallow Water Depth Mooring Systems, By Country

5.6 Top Countries Deep/Ultra-Deep Water Depth Mooring Systems, By Country

5.7 Global Mooring Systems, By Component

5.8 Industry Trends

5.9 Supply Chain Analysis

5.1 Porters Five Forces Analysis

5.10.1 Threat Of New Entrants

5.10.2 Threat Of Substitutes

5.10.3 Bargaining Power Of Suppliers

5.10.4 Bargaining Power Of Buyers

5.10.5 Intensity Of Competitive Rivalry

6 Global Mooring Systems Market, By Depth (Page No. - 52)

6.1 Introduction

6.2 Shallow Water Depth Mooring Systems, By Region

6.3 Deep & Ultra-Deep Water Depth Market, By Region

7 Mooring Systems, By Application (Page No. - 56)

7.1 Introduction

7.2 FPSO Mooring Systems, By Region

7.3 Semi-Submersible Market, By Region

7.4 TLP Market, By Region

7.5 SPAR Market, By Region

7.6 Flng Market, By Region

8 Mooring Systems, By Type (Page No. - 63)

8.1 Introduction

8.2 SPM Mooring Systems, By Region

8.3 SMS Mooring Systems, By Region

8.4 TM Mooring Systems, By Region

8.5 DP Mooring Systems, By Region

9 Mooring System Market, By Anchorage Type (Page No. - 69)

9.1 Introduction

9.2 DEA Anchorage Type Mooring Systems, By Region

9.3 VLA Anchorage Type Market, By Region

9.4 Suction Anchorage Type Market, By Region

10 Mooring Systems, By Region (Page No. - 74)

10.1 Introduction

10.2 Asia-Pacific

10.2.1 China

10.2.2 Australia

10.3 Latin America

10.3.1 Brazil

10.4 Middle East & Africa

10.4.1 Angola

10.4.2 UAE

10.4.3 Saudi Arabia

10.4.4 Qatar

10.4.5 Nigeria

10.5 North America

10.5.1 United States

10.5.2 Mexico

10.6 Europe

10.6.1 Norway

10.6.2 U.K.

11 Competitive Landscape (Page No. - 101)

11.1 Overview

11.2 Competitive Situation & Trends

11.2.1 Contracts & Agreements

11.2.2 New Product/Technology Development

11.2.3 Mergers & Acquisitions

11.2.4 Joint Ventures/Partnerships, 20122014

11.2.5 Expansion

11.2.6 Other Developments

12 Company Profiles (Page No. - 108)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 SBM Offshore N.V.

12.3 BW Offshore Ltd.

12.4 Delmar Systems, Inc.

12.5 Mampaey Offshore Industries

12.6 Modec, Inc.

12.7 Grup Servicii Petroliere S.A.

12.8 National Oilwell Varco, Inc.

12.9 Trellborg AB

12.10 Bluewater Holding B.V.

12.11 Cargotec Corporation

12.12 Timberland Equipment Limited

12.13 Usha Martin Limited

12.14 Volkerwessels

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case Of Unlisted Companies.

13 Appendix (Page No. - 136)

13.1 Insights Of Industry Experts

13.2 Discussion Guide

13.3 Introducing RT: Real Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

List Of Tables (68 Tables)

Table 1 Consumption Of Crude Oil, By Region , 20102014 (Million Tons)

Table 2 Production Of Crude Oil, By Region, 20102014 ( Million Tons)

Table 3 Impact Of Market Dynamics

Table 4 Mooring Systems Market Size (Top Countries), By Depth,20132020 (USD Million)

Table 5 Shallow Water Depth Market Size, By Top Countries, 20132020 (USD Million)

Table 6 Deep/Ultra-Deep Water Depth Market Size, By Top Countries, 20132020 (USD Million)

Table 7 Market Size, By Component, 20132020 (USD Million)

Table 8 Market Size, By Depth, 20132020 (USD Million)

Table 9 Shallow Water Depth Market Size, By Region,20132020 (USD Million)

Table 10 Deep & Ultra-Deep Water Depth Market Size, By Region, 20132020 (USD Million)

Table 11 Market Size, By Application, 20132020 (USD Million)

Table 12 FPSO Market Size, By Region, 20132020 (USD Million)

Table 13 Semi-Submersible Market Size, By Region,20132020 (USD Million)

Table 14 TLP Market Size, By Region, 20132020 (USD Million)

Table 15 SPAR Market Size, By Region, 20132020 (USD Million)

Table 16 FLNG Market Size, By Region, 20132020 (USD Million)

Table 17 Market Size, By Type, 20132020 (USD Million)

Table 18 SPM Market Size, By Region, 20132020 (USD Million)

Table 19 SMS Market Size, By Region, 20132020 (USD Million)

Table 20 TM Market Size, By Region, 20132020 (USD Million)

Table 21 DP Market Size, By Region, 20132020 (USD Million)

Table 22 Market Size, By Anchorage Type,20132020 (USD Million)

Table 23 DEA Anchorage Type Mooring System Market Size, By Region,20132020 (USD Million)

Table 24 VLA Anchorage Type Mooring System Market Size, By Region,20132020 (USD Million)

Table 25 Suction Anchorage Type Mooring System Market Size, By Region, 20132020 (USD Million)

Table 26 Mooring System Market, By Region, 20132020 (USD Million)

Table 27 Asia-Pacific: Market Size, By Country,20132020 (USD Million)

Table 28 Asia-Pacific: Market Size, By Application,20132020 (USD Million)

Table 29 Asia-Pacific: Market Size, By Anchorage,20132020 (USD Million)

Table 30 Asia-Pacific: Market Size, By Type,20132020 (USD Million)

Table 31 Asia-Pacific: Market Size, By Depth,20132020 (USD Million)

Table 32 China Mooring System Market Size, By Depth, 20132020 (USD Million

Table 33 Australia: Market Size, By Depth,20132020 (USD Million)

Table 34 Latin America: Mooring System Market Size, By Country,20132020 (USD Million)

Table 35 Latin America: Market Size, By Application,20132020 (USD Million)

Table 36 Latin America Market Size, By Anchorage,20132020 (USD Million)

Table 37 Latin America: Market Size, By Type,20132020 (USD Million)

Table 38 Latin America: Mooring System Market Size, By Depth,20132020 (USD Million)

Table 39 Brazil: Mooring System Market Size, By Depth,20132020 (USD Million)

Table 40 Middle East & Africa Mooring System Market Size, By Country,20132020 (USD Million)

Table 41 Middle East & Africa: Market Size, By Application, 20132020 (USD Million)

Table 42 Middle East & Africa: Market Size, By Anchorage, 20132020 (USD Million)

Table 43 Middle East & Africa: Market Size, By Type,20132020 (USD Million)

Table 44 Middle East & Africa: Market Size, By Depth,20132020 (USD Million)

Table 45 Angola: Market Size, By Depth,20132020 (USD Million

Table 46 UAE: Market Size, By Depth, 20132020 (USD Million

Table 47 Saudi Arabia Market Size, By Depth,20132020 (USD Million

Table 48 Qatar: Market Size, By Depth, 20132020 (USD Million

Table 49 Nigeria: Mooring System Market Size, By Depth,20132020 (USD Million

Table 50 North America: Mooring System Market Size, By Country,20132020 (USD Million)

Table 51 North America: Market Size, By Application,20132020 (USD Million)

Table 52 North America: Market Size, By Anchorage,20132020 (USD Million)

Table 53 North America: Market Size, By Type,20132020 (USD Million)

Table 54 North America: Market Size, By Depth,20132020 (USD Million)

Table 55 U.S.: Mooring System Market Size, By Depth, 20132020 (USD Million

Table 56 Mexico: Mooring System Market Size, By Depth,20132020 (USD Million

Table 57 Europe: Mooring System Market Size, By Country,20132020 (USD Million)

Table 58 Europe: Market Size, By Application,20132020 (USD Million)

Table 59 Europe: Market Size, By Anchorage,20132020 (USD Million)

Table 60 Europe: Market Size, By Type, 20132020 (USD Million)

Table 61 Europe: Market Size, By Depth,20132020 (USD Million)

Table 62 Norway: Mooring System Market Size, By Depth,20132020 (USD Million

Table 63 U.K. Mooring System Market Size, By Depth, 20132020 (USD Million

Table 64 Contracts & Agreements, 2015

Table 65 New Product Development, 2015

Table 66 Mergers & Acquisitions, 20122015

Table 67 Expansions, 2013

Table 68 Other Developments, 20122014

List Of Figures (63 Figures)

Figure 1 Markets Covered: Mooring Systems

Figure 2 Mooring Systems: Research Design

Figure 3 Breakdown Of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 FPSO Segment Expected to Dominate The Market During The Forecast Period

Figure 8 Shallow Water Depth Mooring Systems Segment Expected to Account for Maximum Demand During The Forecast Period

Figure 9 Asia-Pacific Expected to Dominate The Market During The Forecast Period

Figure 10 Asia-Pacific Accounted for The Largest Market Share in Market in 2014

Figure 11 Attractive Market Opportunities in The Market

Figure 12 Asia-Pacific Expected to Grow at The Highest CAGR During The Forecast Period

Figure 13 Shallow Water Depth Mooring Systems Expected to Dominate The Market in The Forecast Period

Figure 14 DEA Segment is Projected to Account for The Highest Share in The Market During The Forecast Period

Figure 15 SPM Segment Expected to Grow Faster Than Other Mooring Types During The Forecast Period

Figure 16 TLP Segment Expected to Grow Fastest in this Market During The Forecast Period

Figure 17 Anchorage vs. Component: Market Share in 2015

Figure 18 Brent Crude Oil Prices, (USD Per Barrel)

Figure 19 Regional Distribution Of Undiscovered Arctic Region Oil Resources

Figure 20 Shallow Water Depth Mooring Systems is Expected to Be The Highest Growing Market During The Forecast Period

Figure 21 Australia Expected to Be The Highest-Growing Market for Shallow Water Depth Market During The Forecast Period

Figure 22 Australia Expected to Be The Highest-Growing Market in The Deep/Ultra-Deep Water Depth Market During The Forecast Period

Figure 23 Mooring System Market: Supply Chain Analysis

Figure 24 Porters Five Forces Analysis: Mooring System Market

Figure 25 Shallow Water Depth Mooring System Market Projected to Grow Rapidly During The Forecast Period

Figure 26 Asia-Pacific Market Expected to Grow Rapidly for Shallow Water Depth Mooring Systems During The Forecast Period

Figure 27 Middle East & Africa Expected to Be The Highest-Growing Market for Deep & Ultra-Deep Water Depth Mooring Systems During The Forecast Period

Figure 28 TLP Mooring System Market is Projected to Grow Rapidly During The Forecast Period

Figure 29 Asia-Pacific Market Expected to Grow Rapidly in for FPSO Mooring Systems During The Forecast Period

Figure 30 Latin America Expected to Be The Highest-Growing Region in The Semi-Submersible Mooring Systems During The Forecast Period

Figure 31 Asia-Pacific Expected to Be The Highest-Growing Region in The TLP in this Market During The Forecast Period

Figure 32 North America Expected to Be The Highest-Growing Region in The SPAR Market During The Forecast Period

Figure 33 Asia-Pacific Expected to Be The Largest Market for FLNG Market (20182020)

Figure 34 SPM Market is to Grow Rapidly During The Forecast Period

Figure 35 Asia-Pacific Expected to Grow Rapidly in The SPM Mooring System Market During The Forecast Period

Figure 36 Latin America Expected to Be The Highest-Growing for SMS Type Mooring System Market During The Forecast Period

Figure 37 Asia-Pacific Expected to Be The Highest Growing Region for TM Type Mooring System Market During The Forecast Period

Figure 38 Latin America Expected to Be The Highest Growing Region for The DP Mooring System Market During The Forecast Period

Figure 39 Suction Anchors Type Mooring System Market Projected to Grow Rapidly During The Forecast Period

Figure 40 Asia-Pacific Market Expected to Grow Rapidly for DEA Anchorage Type Market During The Forecast Period

Figure 41 Latin America Expected to Be The Highest-Growing Market for VLA Anchorage Type Mooring Systems During The Forecast Period

Figure 42 Asia-Pacific Expected to Be The Highest-Growing Market for Suction Anchorage Type Mooring Systems During The Forecast Period

Figure 43 Regional Snapshot (2015) Mooring System Market Estimated to Grow Rapidly in Australia

Figure 44 U.K. The Biggest Emerging Market, as Shallow, & Deep & Ultra-Deep Water Depths Mooring Systems are Gaining Traction

Figure 45 Asia-Pacific Market Snapshot (2015)- Southeast Asia is Expected to Become The Largest Market in The Region

Figure 46 Latin America Market Snapshot (2015): Deep & Ultra-Deep Water Mooring Systems Segment Expected to Drive The Market in Latin America

Figure 47 Middle East & Africa Mooring System Market Snapshot (2015)- UAE to Become The Fastest-Growing Market in The Region During The Forecast Period

Figure 48 North America Market Snapshot (2015): Canada Expected to Drive The Market for Mooring Systems in North America

Figure 49 Europe: Market Snapshot (2015): Norway Accounts for The Major Share in The European in this Market During The Forecast Period

Figure 50 Companies Adopted Contracts & Agreements and New Product/Service/Technology Development to Capture The Market

Figure 51 Battle for Market Share: Contracts & Agreements is The Key Strategy

Figure 52 Market Evaluation Framework: Top Companies Based on Market Share. 2014

Figure 53 Market Evaluation Framework: Contracts & Agreements, New Product Launches, & Mergers & Acquisitions Fueled Growth Of Companies, 20122015

Figure 54 Regional Revenue Mix Of The Top 5 Market Players

Figure 55 SBM Offshore N.V.: Company Snapshot

Figure 56 BW Offshore Ltd.: Company Snapshot

Figure 57 Modec, Inc.: Company Snapshot

Figure 58 National Oilwell Varco, Inc.: Company Snapshot

Figure 59 Trellborg AB: Company Snapshot

Figure 60 Bluewater Holding B.V.: Business Overview

Figure 61 Cargotec Corporation.: Business Overview

Figure 62 Usha Martin Limited.: Business Overview

Figure 63 Volkerwessels.: Business Overview

Growth opportunities and latent adjacency in Mooring Systems Market