Mooring Inspection Market by Type (BWI, AWI), Technology (CVI, MPI, UT, Electromagnetic Detection, Mooring Line Dimension Measurement, Others), Region (APAC Latin America, North America, Middle East & Africa, Europe) - Global Forecast to 2020

The mooring inspection market is projected to reach USD 362.5 million by 2020, at a CAGR of 3.4%. Inspection process can be a visual examination or assessment of specific characteristics of mooring components with the help of nondestructive techniques. These inspections can be dangerous for the divers and mooring components as inspection process involves assessment of continuously moving components.

Offshore industry relies on regular mooring inspection of mooring components for assuring the reliability of these systems, but the available technologies are not always reliable or suitable enough. Various techniques that are used for examining the mooring components by the offshore industry includes CVI, MPI, UT, and electromagnetic detection, among others.

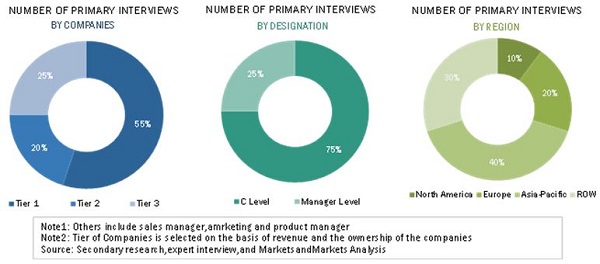

Various secondary sources have been referred to, such as encyclopedias, directories, and databases, to identify and collect information useful for this extensive, commercial study of mooring inspection. The primary sources include interviews of experts from related industries as well as key suppliers to obtain and verify critical information as well as to assess the future prospects of the mooring inspection market.

To know about the assumptions considered for the study, download the pdf brochure

The global mooring inspection market has a diversified ecosystem of upstream players, including raw material suppliers, along with downstream stakeholders, vendors, end users, and government organizations.

Key Players in Mooring Inspection Market

Inspection service providers include Welaptega (Canada), Oceaneering International (U.S.), DeepOcean (Netherlands), Acteon Group (U.K.), InterMoor (U.S.), Deep Sea Mooring (Norway), DOF Subsea (Norway), Moffatt & Nichol (U.S.), Delmar (U.S.) and so on. CVI, MPI, UT, and electromagnetic detection are some of the major applications that are addressed through different types (above water inspection and below water inspection) of mooring inspection.

The report provides detailed qualitative and quantitative analysis of the global mooring inspection market, along with market drivers, restraints, opportunities, and challenges. The top players of this market are profiled in detail, along with recent developments and other strategic industry-related activities.

Target Audience in Mooring Inspection Market

- Government and Research Organizations

- Association and Industrial Bodies

- Inspection Service Providers

Mooring Inspection Market Report Scope

This research report categorizes the global mooring inspection market on the basis of technology, region, and type, forecasting revenues as well as analyzing trends in each of the submarkets.

-

On the basis of Technology:

- CVI

- MPI

- UT

- Electromagnetic Detection

- Mooring Line Dimension Measurement

- Others

-

On the basis of Type

- Below Water Inspection (BWI)

- Above Water Inspection (AWI)

-

On the basis of Region

- Asia-Pacific

- Latin America

- North America

- Middle East & Africa

- Europe

The following customization options are available for the report:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Further country-wise breakdown of the global mooring inspection market

- Company information

- Detailed analysis and profiling of additional market players (Up to three)

The global mooring inspection market is projected to reach USD 362.5 Million by 2020, at a CAGR of 3.4% from 2015 to 2020. The market will grow due to the regulatory requirements for periodic inspection and rising concerns towards increasing mooring safety.

Among all technology segment, the close visual inspection segment is the most popular and fastest-growing segment owing to its reliability in the inspection process. It is considered as the most reliable inspection technique and is commonly used in mooring inspection process. It can be used for both below and above water inspection. In below water inspection, both ROV and diver can perform CVI inspection for the detection of any degradation or failure in mooring systems.

The BWI segment accounted for the largest share of the mooring inspection market in 2014. BWI is the largest segment of the market owing to the higher inspection cost of BWI as compared to AWI; underwater inspection requires sophisticated equipment, diving experts, and risk-based assessment of mooring components.

Offshore industry relies on regular mooring inspection of mooring components for assuring the reliability of these systems, but the available technologies are not always reliable or suitable enough. Various techniques that are used for examining the mooring components by the offshore industry includes CVI, MPI, UT, and electromagnetic detection, among others.

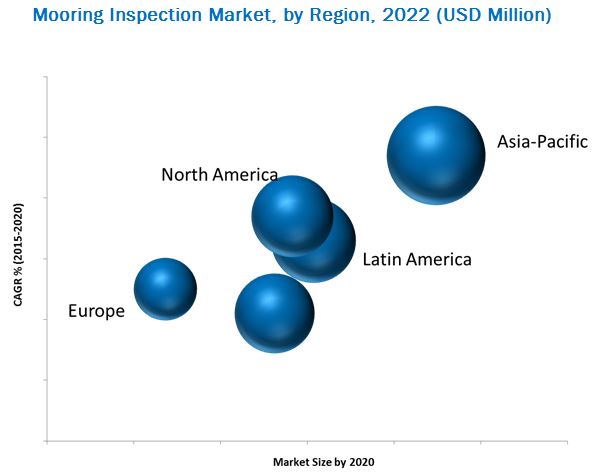

Asia-Pacific held the largest share of the global mooring inspection market in 2014 and is expected to continue doing so during the forecast period. Southeast Asia dominated the Asia-Pacific mooring inspection market, in 2014. The market in Australia is projected to grow at the highest CAGR between 2015 & 2020 in Asia-Pacific.

Key Mooring Inspection Market Industry Players

The factors inhibiting the global mooring inspection market are lack of advanced inspection technologies in the industry and lack of financial support towards R&D from service companies as well as government bodies. The key market players such as Welaptega (Canada), Oceaneering International (U.S.), DeepOcean (Netherlands), Acteon Group (U.K.), InterMoor (U.S.), Deep Sea Mooring (Norway), DOF Subsea (Norway), Moffatt & Nichol (U.S.), and Delmar (U.S.) have adopted various strategies to increase their market shares. Agreements/contracts/partnerships, new product/technology launches, expansions, acquisitions, and research & development are some of the important strategies adopted by the market players to achieve growth in the mooring inspection market.

Frequently Asked Questions (FAQ):

What is the Mooring Inspection Market growth?

Growing at a CAGR of 3.4% between 2015 and 2020.

Who leading market players in Mooring Inspection industry?

The major market players in mooring inspection market are Welaptega (Canada), Oceaneering International (U.S.), DeepOcean (Netherlands), Acteon Group (U.K.), Deep Sea Mooring (Norway), DOF Subsea (Norway), Moffatt & Nichol (U.S.), Delmar (U.S.), and other global players that are expanding their reach into the mooring inspection market considering the lucrative business opportunities.

How big is the Mooring Inspection Market?

The global mooring inspection market is projected to reach USD 362.5 Million by 2020.

Which segments are covered in Mooring Inspection Market report?

By Type (BWI, AWI) & Technology (CVI, MPI, UT, Electromagnetic Detection, Mooring Line Dimension Measurement).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Regional Scope

1.3.2 Markets Covered

1.3.3 Years Considered in the Report

1.4 Currency & Pricing

1.5 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Research Data

2.1.1 Key Data From Secondary Sources

2.1.2 Key Data From Primary Sources

2.1.2.1 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Market Share Estimation

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 26)

4.1 Attractive Opportunities in the Mooring Inspection Market

4.2 Global Mooring Inspection System Market

4.3 Mooring Inspection System Market Scenario in Asia-Pacific

4.4 Mooring Inspection Market Attractiveness, By Type (2020)

5 Market Overview (Page No. - 30)

5.1 Introduction

5.1.1 Mooring Inspection

5.1.2 Drivers

5.1.2.1 Rising Concerns Towards Increasing Mooring Safety

5.1.2.2 Regulations Driving Scheduled Inspection Practices

5.1.3 Restraints

5.1.3.1 Decrease in Oil Prices

5.1.4 Opportunities

5.1.4.1 Development of Accurate and Reliable Inspection Technology and Process

5.1.5 Challenges

5.1.5.1 Lack of Reliable Mooring Tension Monitoring Systems

5.1.5.2 Lack of Financial Support to Develop Advanced Inspection Technology

6 Mooring Inspection Market, By Type (Page No. - 35)

6.1 Introduction

6.2 BWI Mooring Inspection

6.2.1 BWI Mooring Inspection Market in Diver Inspection

6.2.2 BWI Mooring Inspection Market in Rov Inspection

6.3 AWI Mooring Inspection

7 Mooring Inspection Market, By Technology (Page No. - 41)

7.1 Introduction

7.2 By Technology

7.2.1 Close Visual Inspection

7.2.2 Magnetic Particle Inspection

7.2.3 Ultrasonic Testing

7.2.4 Electromagnetic Detection

7.2.5 Mooring Line Dimension Measurement

8 Mooring Inspection Market, By Region (Page No. - 48)

8.1 Introduction

8.2 North America

8.3 Europe

8.4 Asia-Pacific

8.5 Latin America

8.6 Middle East & Africa

9 Competitive Landscape (Page No. - 69)

9.1 Overview

9.2 Future Trends

9.3 Expansions

9.4 New Product/Technology Launches

9.5 Agreements/Contracts/Partnerships

9.6 Mergers & Acquisitions

10 Company Profiles (Page No. - 73)

(Overview, Financial*, Products & Services, Strategy, and Developments)

10.1 Introduction

10.2 Oceaneering International, Inc.

10.3 DOF Subsea

10.4 Welaptega Marine Limited

10.5 Deepocean Group Holding Bv

10.6 Acteon Group Ltd.

10.7 Delmar Systems, Inc.

10.8 Moffatt & Nichol

10.9 Deep Sea Mooring as

10.10 Viking Seatech Ltd.

*Details Might Not Be Captured in Case of Unlisted Companies

11 Appendix (Page No. - 94)

11.1 Other Developments

11.2 Available Customizations

11.3 Discussion Guide

11.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.5 Related Reports

List of Tables (34 Tables)

Table 1 Mooring Inspection Market in Asia-Pacific to Register High Growth Between 2015 and 2020

Table 2 Mooring Inspection Market, By Type, 2013–2020 (USD Million)

Table 3 BWI Mooring Inspection Market, By Region, 2013–2020 (USD Billion)

Table 4 BWI Mooring Inspection Market in Diver Inspection,2013–2020 (USD Million)

Table 5 BWI Mooring Inspection Market in ROV Inspection,2013–2020 (USD Million)

Table 6 AWI Mooring Inspection Market, By Region, 2013–2020 (USD Million)

Table 7 Mooring Inspection Market, By Technology, 2013–2020 (USD Million)

Table 8 Mooring Inspection Market for Close Visual Inspection , By Region, 2013–2020 (USD Million)

Table 9 Mooring Inspection Market for Magnetic Particle Inspection, By Region, 2013–2020 (USD Million)

Table 10 Mooring Inspection Market for Ultrasonic Testing, By Region, 2013–2020 (USD Million)

Table 11 Mooring Inspection Market for Electromagnetic Detection Technology, By Region, 2013–2020 (USD Million)

Table 12 Mooring Inspection Market for Mooring Line Dimension Measurement Technology, By Region, 2013–2020 (USD Million)

Table 13 Mooring Inspection Market, By Region, 2013–2020 (USD Million)

Table 14 North America: Mooring Inspection Market, By Type,2013–2020 (USD Million)

Table 15 North America: Mooring Inspection Market, By Country, 2013–2020 (USD Million)

Table 16 North America: Mooring Inspection Market, By Technology, 2013–2020 (USD Million)

Table 17 Europe: Mooring Inspection Market, By Type, 2013–2020 (USD Million)

Table 18 Europe: Mooring Inspection Market, By Country,2013–2020 (USD Million)

Table 19 Europe: Mooring Inspection Market, By Technology,2013–2020 (USD Million)

Table 20 Asia Pacific: Mooring Inspection Market, By Type,2013–2020 (USD Million)

Table 21 Asia Pacific: Mooring Inspection Market, By Country,2013–2020 (USD Million)

Table 22 Asia Pacific: Mooring Inspection Market, By Technology, 2013–2020 (USD Million)

Table 23 Latin America: Mooring Inspection Market, By Type,2013–2020 (USD Million)

Table 24 Latin America: Mooring Inspection Market, By Country, 2013–2020 (USD Million)

Table 25 Latin America: Mooring Inspection Market, By Technology, 2013–2020 (USD Million)

Table 26 Middle East & Africa: Mooring Inspection Market, By Type, 2013–2020 (USD Million)

Table 27 Middle East & Africa: Mooring Inspection Market, By Country, 2013–2020 (USD Million)

Table 28 Middle East & Africa: Mooring Inspection Market, By Technology, 2013–2020 (USD Million)

Table 29 Expansion, 2010–2016

Table 30 New Product/Technology Launches, 2010–2016

Table 31 Agreements/Contracts/Partnerships, 2010–2016

Table 32 Mergers & Acquisitions, 2010–2015

Table 33 Expansion

Table 34 Agreements/Contracts/Partnerships, 2010–2016

List of Figures (31 Figures)

Figure 1 Mooring Inspection Market: Market Segmentation

Figure 2 Mooring Inspection Market, Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Mooring Inspection Market: Data Triangulation

Figure 7 BWI Segment Dominated the Mooring Inspection Market in 2015

Figure 8 CVI Segment to Dominate the Mooring Inspection Market During the Forecast Period

Figure 9 Asia-Pacific Dominated the Mooring Inspection Market in 2014 and is Expected to Grow at the Highest CAGR

Figure 10 The Mooring Inspection Market is Projected to Grow at A High CAGR During the Forecast Period

Figure 11 The Asia-Pacific Mooring Inspection Market is Projected to Register the Highest Growth Between 2015 and 2020

Figure 12 South East Asia is the Growth Engine of the Region

Figure 13 Below Water Inspection Type is Largest Segment Between 2015 and 2020

Figure 14 Drivers, Restraints, Opportunities & Challenges in the Mooring Inspection Industry

Figure 15 The BWI Segment Dominated the Mooring Inspection Market

Figure 16 The Diver Inspection Segment Dominated the Mooring Inspection Market

Figure 17 Mooring Inspection Market, 2015 & 2020 (USD Million)

Figure 18 Asia-Pacific Expected to Be A Lucrative Region for the Mooring Inspection Market During the Forecast Period

Figure 19 Asia-Pacific Expected to Witness High Growth in the Mooring Inspection Market for Close Visual Inspection

Figure 20 North America: Market Snapshot

Figure 21 Europe: Market Snapshot

Figure 22 Asia Pacific: Market Snapshot

Figure 23 Latin America Market Snapshot

Figure 24 Middle East & Africa Market Snapshot

Figure 25 Companies Adopted Agreements/Contracts/Partnerships as the Key Growth Strategy Between 2010 and 2016

Figure 26 Battle for Market Share: Agreements/Contracts/Partnerships Was the Key Strategy

Figure 27 Regional Revenue Mix of Top Market Players

Figure 28 Oceaneering: Company Snapshot

Figure 29 Oceaneering International, Inc.: SWOT Analysis

Figure 30 DOF Subsea: Company Snapshot

Figure 31 DOF Subsea: SWOT Analysis

Growth opportunities and latent adjacency in Mooring Inspection Market