Submarine Combat Systems Market by System (Sensors, Electronic Support Measures, Armaments), Submarine Type (Ship Submersible Hunter Killer, Ship Submersible Nuclear, Ship Submersible Ballistic Nuclear), Retrofit, Region - Global Forecast to 2022

The Submarine Combat Systems Market is estimated to be valued at USD 4.97 Billion in 2016 and is projected to reach USD 11.67 Billion by 2022, at a CAGR of 15.3%. This report covers the forecast of the market and its dynamics over the next six years, while also recognizing market application gaps, and recent developments in the market. Submarine combat systems are a system of systems such as sensors, electronic support measures, and armaments.

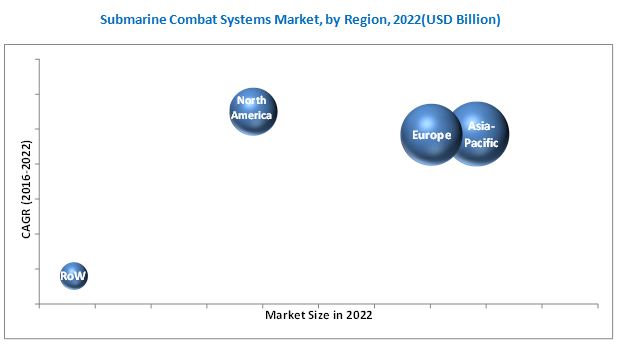

The Submarine Combat Systems Market is estimated to be valued at USD 4.97 Billion in 2016 and reach USD 11.67 Billion in 2022, at a CAGR of 15.3%. The growth in the Asia-Pacific and European regions is attributed to the acquisitions of new submarines and submarine upgradation programs in some countries. The increasing focus on maritime security and submarine upgradation programs are the major drivers in the submarine combat systems market.

Based on systems,submarine combat systems market are classified into sensors, electronic support measures, and armaments. The armament systems segment is expected to growth at highest rate. The increase in new submarine orders along with the replacement of obsolete armaments are expected to drive this market. Electronic support measures are an essential part of submarine combat systems to increase the survivability and stealth features of submarines and hence this segment is expected to witness growth during the forecast period.

Submarine combat systems market by submarine types, include, Ship Submersible Hunter Killer (SSK), Ship Submersible Nuclear (SSN), and Ship Submersible Ballistic Nuclear (SSBN). By operation, SSK submarines are the largest in number in operation around the world. The other types of submarines are limited to a few countries that have the technologies to design the SSN and SSBN submarines. The U.S., the U.K., France, Russia, and China are operators of SSN and SSBN submarines.

Retrofit of submarines is a potential market for submarine combat systems manufacturers. The procurement of new submarines is capital intensive, along with the lengthy periods required for their induction. Mid-life upgrades are a cost-effective and time efficient way for navies, and enable them to utilize submarines for their full life cycle. The North American and European regions are lucrative retrofit markets for submarine combat systems.

The Asia-Pacific region is estimated to have accounted for the largest share of the submarine combat systems market in 2016, followed by Europe and North America. Recent geopolitical developments such as, the South China Sea dispute between China and its neighboring countries such as, Taiwan, Brunei, Malaysia, Philippines, and Vietnam over Spratly and Paracel islands is a major factor in the high investments in naval assets. In Europe, Russia’s growing maritime assertiveness is likely to drive the demand for submarine combat systems. These factors have indirectly fueled the growth of the market.

The growth of the submarine combat systems market could, however, be affected by certain major restraints in the coming years. These factors include, declining defense budgets of the developed economies of the world, such as, the U.S., Canada, the U.K., Germany, and stringent arms transfer rules and regulations laid down for the defense industry. The major challenge for system manufacturers is the high integration and maintenance costs.

Key players operating in the submarine combat systems market are, Lockheed Martin Corporation (U.S.), SAAB AB (Sweden), Kongsberg Gruppen ASA (Norway), General Dynamics Corporation (U.S.), Atlas Elektronik GmbH (Germany). Contracts and partnerships are the major growth strategies adopted by the top players to strengthen their positions in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered

1.4 Currency

1.5 Distribution Channel Participants

1.6 Limitations

1.7 Market Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 37)

4.1 Attractive Opportunities in the Submarine Combat Systems Market

4.2 Europe Submarine Combat Systems Market

4.3 Submarine Combat Systems, By Line-Fit

4.4 Submarine Combat Systems Market, By Retrofit

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Submarine Combat Systems Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Importance of Submarines in Naval Warfare

5.3.1.2 Ongoing Submarine Upgradation Programs to Drive the Market for Combat Systems

5.3.2 Restraints

5.3.2.1 Cutting of Defense Budgets in Developed Economies

5.3.3 Opportunities

5.3.3.1 Increasing Requirement of Advanced Integrated Combat Systems By Naval Forces of Different Countries Across the Globe

5.3.3.2 Increasing Application of Electronic Support Measures Systems (ESMs) in Submarines

5.3.3.3 Expanding Role of Submarines From Hunter Killed to Strategic Deterrent

5.3.4 Challenges

5.3.4.1 Technological Challenges Being Faced in the Integration of Combat Systems in Submarines

5.3.4.2 High Maintenance and Retrofitting Costs of Submarine Combat Systems

6 Industry Trends (Page No. - 48)

6.1 Introduction

6.2 Technological Trends

6.2.1 Technological Advancements in Submarine Combat Systems, By Company

6.2.2 Supercavitation Technology

6.2.3 Development of Open System Data Communication Architectures

6.3 Strategic Benchmarking

6.3.1 Contract Mapping, By Key Players

6.4 Innovations & Patent Registrations

7 Submarine Combat Systems Market, By System (Page No. - 54)

7.1 Introduction

7.2 Sensors

7.3 Electronic Support Measures (ESM)

7.4 Armaments

7.5 Torpedoes

7.6 Cruise Missiles

7.7 Ballistic Missile

7.8 Mines

8 Submarine Combat Systems Market, By Submarine Type (Page No. - 67)

8.1 Introduction

8.2 SSK

8.3 SSN

8.4 SSBN

8.5 SSGN

9 Submarine Combat Systems Market, By Retrofit (Page No. - 75)

9.1 Introduction

9.1.1 Submarine Combat Systems Retrofit Market, By Region

9.1.1.1 North America

9.1.1.2 Europe

9.1.1.3 Asia-Pacific

9.1.1.4 Rest of the World

9.1.2 Submarine Combat Systems Retrofit Market, By System

9.1.2.1 Sensors: Submarine Combat Systems Retrofit Market, By Region, 2015-2026 (USD Million)

9.1.2.2 Electronic Support Measures: Submarine Combat Systems Retrofit Market, By Region, 2015-2026 (USD Million)

10 Submarine Combat Systems Market, By Region (Page No. - 83)

10.1 Introduction

10.1.1 System By Region

10.1.2 Submarine Type By Region

10.2 North America

10.2.1 By System

10.2.2 By Submarine Type

10.2.3 By Retrofit

10.2.4 By Country

10.2.4.1 U.S.

10.2.4.1.1 By System

10.2.4.1.2 By Submarine Type

10.2.4.2 Canada

10.3 Europe

10.3.1 By System

10.3.2 By Submarine Type

10.3.3 By Retrofit

10.3.4 By Country

10.3.4.1 Russia

10.3.4.1.1 By System

10.3.4.1.2 By Submarine Type

10.3.4.2 France

10.3.4.2.1 By System

10.3.4.2.2 By Submarine Type

10.3.4.3 U.K.

10.3.4.3.1 By System

10.3.4.3.2 By Submarine Type

10.3.4.4 Germany

10.3.4.4.1 By System

10.3.4.4.2 By Submarine Type

10.3.4.5 Spain

10.3.4.5.1 By System

10.3.4.5.2 By Submarine Type

10.3.4.6 Sweden

10.3.4.6.1 By System

10.3.4.6.2 By Submarine Type

10.3.4.7 Norway

10.3.4.7.1 By System

10.3.4.7.2 By Submarine Type

10.3.4.8 Turkey

10.3.4.8.1 By System

10.3.4.8.2 By Submarine Type

10.4 Asia-Pacific

10.4.1 By System

10.4.2 By Submarine Type

10.4.3 By Retrofit

10.4.4 By Country

10.4.4.1 China

10.4.4.1.1 By System

10.4.4.1.2 By Submarine Type

10.4.4.2 India

10.4.4.2.1 By System

10.4.4.2.2 By Submarine Type

10.4.4.3 Japan

10.4.4.3.1 By System

10.4.4.3.2 By Submarine Type

10.4.4.4 Pakistan

10.4.4.4.1 System

10.4.4.4.2 By Submarine Type

10.4.4.5 South Korea

10.4.4.5.1 By System

10.4.4.5.2 By Submarine Type

10.4.4.6 Thailand

10.4.4.6.1 By System

10.4.4.6.2 By Submarine Type

10.4.4.7 Singapore

10.4.4.7.1 By System

10.4.4.7.2 By Submarine Type

10.5 Rest of the World (RoW)

10.5.1 RoW Submarine Combat System Market

10.5.2 By System

10.5.3 By Submarine Type

10.5.4 By Retrofit

10.5.5 RoW Submarine Combat Systems Retrofit Market

10.5.6 By Country

10.5.6.1 Brazil

10.5.6.1.1 By System

10.5.6.1.2 By Submarine Type

10.5.6.2 Israel

10.5.6.2.1 By System

10.5.6.2.2 By Submarine Type

10.5.6.3 Egypt

10.5.6.3.1 By System

10.5.6.3.2 By Submarine Type

11 Competitive Landscape (Page No. - 144)

11.1 Introduction

11.2 Competitive Situations and Trends

11.2.1 Contracts

11.2.2 Agreements/Partnerships

11.2.3 New Product Launches

11.2.4 Mergers & Acquisitions

12 Company Profiles (Page No. - 154)

(Overview, Products and Services, Financials, Strategy & Development)*

12.1 Introduction

12.2 Lockheed Martin Corporation

12.3 Saab AB

12.4 General Dynamics Corporation

12.5 Kongsberg Gruppen ASA

12.6 Atlas Elektronik GmbH

12.7 BAE Systems PLC

12.8 Raytheon Company

12.9 Leonardo-Finmeccanica SAP

12.10 DCNS SA

12.11 Havelsan Inc.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 179)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real Time Market Intelligence

13.4 Available Customizations

13.5 Author Details

List of Tables (106 Tables)

Table 1 Influencing Factors: Region-Wise Analysis

Table 2 Submarine Capabilities

Table 3 Number of Submarines, By Country, 2016

Table 4 Innovations & Patent Registrations, 2010-2015

Table 5 Submarine Combat System Market Size, By System, 2015-2022 (USD Million)

Table 6 Submarine Types and Their Sensors

Table 7 Sensors: Submarine Combat System Market Size, By Region, 2015-2022 (USD Million)

Table 8 Categories of Electronic Support Measures

Table 9 Electronic Support Measures: Market Size, By Region, 2015-2022 (USD Million)

Table 10 Companies and Their Torpedo Products

Table 11 Companies and Their Cruise Missiles

Table 12 Companies and Their Ballistic Missiles

Table 13 Types of Mines

Table 14 Armaments: Submarine Combat Systems Industry Size, By Region, 2015-2022 (USD Million)

Table 15 Submarine Combat Systems Industry Size, By Submarine Type, 2015-2022 (USD Million)

Table 16 SSK Size, By Region, 2015-2022 (USD Million)

Table 17 SSN Size, By Region, 2015-2022 (USD Million)

Table 18 SSBN Size, By Region, 2015-2022 (USD Million)

Table 19 North America: Submarine Combat Systems Retrofit Market Size, By Country, 2015-2026 (USD Million)

Table 20 Retrofit Market: Canada Submarine Combat Systems Industry Size, 2015-2026 (USD Million)

Table 21 Sensors: Submarine Combat Systems Retrofit Market, By Region, 2015-2026 (USD Million)

Table 22 Electronic Support Measures: Submarine Combat Systems Retrofit Market, By Region, 2015-2026 (USD Million)

Table 23 Submarine Combat Systems Industry Size, By Region, 2015-2022 (USD Million)

Table 24 Sensors: Market, By Region, 2015-2022 (USD Million)

Table 25 Electronic Support Measures: Market, By Region, 2015-2022 (USD Million)

Table 26 Armaments: Market, By Region, 2015-2022 (USD Million)

Table 27 Submarine Combat Systems Industry Size, By Submarine Type, 2015-2022 (USD Million)

Table 28 North America: Submarine Combat Systems Industry Size, By Type, 2015-2022 (USD Million)

Table 30 North America: Submarine Combat Systems Retrofit Industry Size, By Country , 2015-2026 (USD Million)

Table 31 North America: Submarine Combat Systems Retrofit Industry Size, By Country, 2015-2026 (USD Million)

Table 32 North America: Submarine Combat Systems Industry Size, By Country, 2015-2022 (USD Million)

Table 33 U.S. : Submarine Fleet Size and Oems

Table 34 U.S.: Submarine Combat System Market, By System, 2015-2022 (USD Million)

Table 35 U.S.: Submarine Combat System Market Size, By Submarine Type, 2015-2022 (USD Million)

Table 36 Canada : Submarine Fleet Size and Oems

Table 37 Europe: Submarine Combat Systems Industry Size, By System, 2015-2022 (USD Million)

Table 38 Europe: Submarine Combat Systems Industry Size, By Submarine Type, 2015-2022 (USD Million)

Table 39 Europe: Submarine Combat Systems Retrofit Industry Size, By Country, 2015-2026 (USD Million)

Table 40 Europe: Submarine Combat Systems Industry Size, By Country, 2016-2022 (USD Million)

Table 41 Russia : Submarine Fleet Size and Oems

Table 42 Russia: Submarine Combat Systems Industry Size, By System, 2015-2022 (USD Million)

Table 43 Russia: Submarine Combat Systems Industry Size, By Submarine Type, 2015-2022 (USD Million)

Table 44 France : Submarine Fleet Size and Oems

Table 45 France: Submarine Combat Systems Industry Size, By System, 2015-2022 (USD Million)

Table 46 France: Submarine Combat Systems Industry Size, By Submarine Type, 2015-2022 (USD Million)

Table 47 U.K. : Submarine Fleet Size and Oems

Table 48 U.K.: Market Size, By System, 2015-2022 (USD Million)

Table 49 U.K.: Market Size, By Submarine Type, 2015-2022 (USD Million)

Table 50 Germany : Submarine Fleet Size and Oems

Table 51 Germany: Market Size, By System, 2015-2022 (USD Million)

Table 52 Germany: Market Size, By Submarine Type, 2015-2022 (USD Million)

Table 53 Spain : Submarine Fleet Size and Oems

Table 54 Spain: Market Size, By System, 2015-2022 (USD Million)

Table 55 Spain: Submarine Combat Systems Industry Size, By Submarine Type, 2015-2022 (USD Million)

Table 56 Sweden : Submarine Fleet Size and Oems

Table 57 Sweden: Market Size, By System, 2015-2022 (USD Million)

Table 58 Sweden: Su Marketbmarine Combat Systems Industry Size, By Submarine Type, 2015-2022 (USD Million)

Table 59 Norway : Submarine Fleet Size and Oems

Table 60 Norway: Submarine Combat Systems Industry Size, By System, 2015-2022 (USD Million)

Table 61 Norway: Market Size, By Submarine Type, 2015-2022 (USD Million)

Table 62 Turkey : Submarine Fleet Size and Oems

Table 63 Turkey: Submarine Combat Systems Industry Size, By System, 2015-2022 (USD Million)

Table 64 Turkey: Submarine Combat System Market Size, By Submarine Type, 2015-2022 (USD Million)

Table 65 Asia-Pacific: Market Size, By System, 2015-2022 (USD Million)

Table 66 Asia-Pacific: Submarine Combat Systems Industry Size, By Submarine Type, 2015-2022 (USD Million)

Table 67 Asia-Pacific: Market Size, By Country, 2015-2026 (USD Million)

Table 68 Asia-Pacific: Submarine Combat Systems Industry Size, By Country, 2015-2022 (USD Million)

Table 69 China : Submarine Fleet Size and Oems

Table 70 China: Submarine Combat Systems Industry Size, By System, 2015-2022 (USD Million)

Table 71 China: Market Size, By Submarine Type, 2015-2022 (USD Million)

Table 72 India : Submarine Fleet Size and Oems

Table 73 India: Submarine Combat Systems Industry Size, By System, 2015-2022 (USD Million)

Table 74 India: Market Size, By Submarine Type, 2015-2022 (USD Million)

Table 75 Japan : Submarine Fleet Size and Oems

Table 76 Japan: Submarine Combat Systems Industry Size, By System, 2015-2022 (USD Million)

Table 77 Japan: Market Size, By Submarine Type, 2015-2019 (USD Million)

Table 78 Pakistan : Submarine Fleet Size and Oems

Table 79 Pakistan: Submarine Combat Systems Industry Size, By System, 2015-2022 (USD Million)

Table 80 Pakistan: Market Size, By Submarine Type, 2015-2022 (USD Million)

Table 81 South Korea : Submarine Fleet Size and Oems

Table 82 South Korea: Market Size, By System, 2015-2022 (USD Million)

Table 83 South Korea: Market Size, By Submarine Type, 2015-2022 (USD Million)

Table 84 Thailand : Submarine Fleet Size and Oems

Table 85 Thailand: Submarine Combat System Market Size, By System, 2015-2022 (USD Million)

Table 86 Thailand: Submarine Combat System Market Size, By Submarine Type, 2015-2022 (USD Million)

Table 87 Singapore : Submarine Fleet Size and Oems

Table 88 Singapore: Submarine Combat Systems Industry Size, By System, 2015-2022 (USD Million)

Table 89 Singapore: Submarine Combat Systems Industry Size, By Submarine Type, 2015-2022 (USD Million)

Table 90 RoW: Submarine Combat Systems Industry Size, By System, 2015-2022 (USD Million)

Table 91 RoW: Market Size, By Submarine Type, 2015-2022 (USD Million)

Table 92 RoW: Submarine Combat Systems Retrofit Market, By Country, 2015-2026 (USD Million)

Table 93 RoW: Market Size, By Country, 2015-2022 (USD Million)

Table 94 Brazil : Submarine Fleet Size and Oems

Table 95 Brazil: Submarine Combat Systems Industry Size, By System, 2015-2022 (USD Million)

Table 96 Brazil: Market Size, By Submarine Type, 2015-2022 (USD Million)

Table 97 Israel : Submarine Fleet Size and Oems

Table 98 Israel: Submarine Combat Systems Industry Size, By System, 2015-2022 (USD Million)

Table 99 Israel: Market Size, By Submarine Type, 2015-2022 (USD Million)

Table 100 Egypt : Submarine Fleet Size and Oems

Table 101 Egypt: Market Size, By System, 2015-2022 (USD Million)

Table 102 Egypt: Market Size, By Submarine Type, 2015-2022 (USD Million)

Table 103 Contracts, December 2011 to November 2016

Table 104 Agreements/Partnerships, December 2011 to November 2016

Table 105 New Product Launches, December 2011 to November 2016

Table 106 Mergers & Acquisitions, December 2011 to November 2016

List of Figures (82 Figures)

Figure 1 Submarine Combat Systems Industry Segmentation

Figure 2 Years Considered for the Study

Figure 3 Report Flow

Figure 4 Research Design

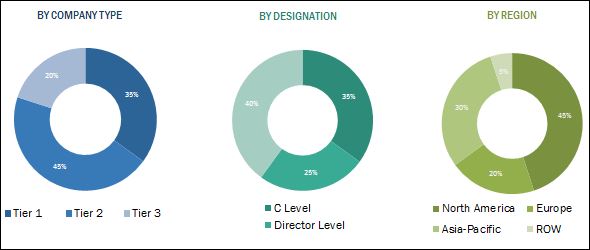

Figure 5 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Data Triangulation

Figure 9 The Armaments System Segment to Account for Largest Market Share in the Market in 2022

Figure 10 Retrofit Market (Mid Life Upgradation): By Region (2016-2026)

Figure 11 Contracts Were the Key Growth Strategies Adopted By Market Players From December, 2011 to November, 2016

Figure 12 Increase in Naval Spending Across the Globe to Boost the Growth of the Market

Figure 13 Russia is Projected to Lead the Europe Market By 2022

Figure 14 The Asia-Pacific Region is Estimated to Account for the Largest Share in Submarine Combat Systems in 2022

Figure 15 The North American Region is Estimated to Account for the Largest Share in the Retrofit Segment of the Market in 2016

Figure 16 Submarine Combat Systems Industry: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Defense Budget of Developed Economies, 2010-2014

Figure 18 Top Contracts in Submarine Combat System Market

Figure 19 Submarine Combat System Market, By System, 2016-2022 (USD Billion)

Figure 20 Armaments Segment to Lead the Submarine Combat System Market During the Forecast Period

Figure 21 Sensors: Submarine Combat System Market, By Region, 2015-2022 (USD Billion)

Figure 22 Asia-Pacific Region Projected to Lead the Market for Sensors During the Forecast Period

Figure 23 Electronic Support Measures: Submarine Combat System Market, By Region, 2015-2022 (USD Billion)

Figure 24 Asia-Pacific is Projected to Lead the Market for Electronic Support Measures During the Forecast Period

Figure 25 Armaments: Submarine Combat System Market, By Region, 2015-2022 (USD Billion)

Figure 26 Asia-Pacific Projected to Lead the Market for Armaments During the Forecast Period

Figure 27 Based on Submarine Type, the SSN Segment to Lead the Market During the Forecast Period

Figure 28 SSK Market, By Region, 2015-2022 (USD Billion)

Figure 29 SSN Market, By Region, 2015-2022 (USD Billion)

Figure 30 SSBN Market, By Region, 2015-2022 (USD Billion)

Figure 31 Submarine Combat Systems Retrofit Market, By Region, 2015-2026 (USD Billion)

Figure 32 Europe: Market, By Retrofit, 2015-2026 (USD Billion)

Figure 33 Asia-Pacific: Market, By Retrofit, 2015-2026 (USD Billion)

Figure 34 Rest of the World: Market, By Retrofit, 2015-2026 (USD Billion)

Figure 35 Submarine Combat Systems Retrofit Market, By System, 2015-2026 (USD Billion)

Figure 36 The North America Region Accounted for the Largest Share of the Market in 2016

Figure 37 Submarine Combat System Market, By Region, 2015-2022 (USD Billion)

Figure 38 Europe Market, By System, 2015-2022 (USD Billion)

Figure 39 Europe Market, By Submarine Type, 2015-2022 (USD Billion)

Figure 40 Europe Submarine Combat Systems Retrofit Market, By Country, 2015-2026 (USD Billion)

Figure 41 Europe Market, By Country, 2015-2022 (USD Billion)

Figure 42 Russia Market, By System, 2015-2022 (USD Billion)

Figure 43 Russia Market, By Submarine Type, 2015-2022 (USD Billion)

Figure 44 Turkey Market, By System, 2015-2022 (USD Billion)

Figure 45 Turkey Market, By Submarine Type, 2015-2022 (USD Billion)

Figure 46 Asia-Pacific Market, By System, 2015-2022 (USD Billion)

Figure 47 Asia-Pacific Market, By Submarine Type, 2015-2022 (USD Billion)

Figure 48 Asia-Pacific Submarine Combat Systems Retrofit Market, By Country, 2015-2026 (USD Billion)

Figure 49 China Market, By System, 2015-2022 (USD Billion)

Figure 50 China: Market, By Submarine Type, 2015-2022 (USD Billion)

Figure 51 India: Market, By System, 2015-2022 (USD Billion)

Figure 52 India: Submarine Combat Systems Industry, By Submarine Type, 2015-2022 (USD Billion)

Figure 53 Pakistan: Submarine Combat Systems Industry, By System, 2015-2022 (USD Billion)

Figure 54 Pakistan: Submarine Combat Systems Industry, By Submarine Type, 2015-2022 (USD Billion)

Figure 55 South Korea: Submarine Combat Systems Industry, By System, 2015-2022 (USD Billion)

Figure 56 South Korea: Submarine Combat Systems Industry, By Submarine Type, 2015-2022 (USD Billion)

Figure 57 RoW Submarine Combat System Market, By Country, 2015-2022 (USD Billion)

Figure 58 RoW Submarine Combat Systems Industry, By System, 2015-2022 (USD Billion)

Figure 59 RoW Submarine Combat Systems Industry, By Submarine Type, 2015-2022 (USD Billion)

Figure 60 RoW Submarine Combat Systems Retrofit Market, By Country, 2015-2026 (USD Million)

Figure 61 Brazil Market, By System, 2015-2022 (USD Billion)

Figure 62 Brazil Market, By Submarine Type, 2020-2022 (USD Billion)

Figure 63 Israel Market, By System, 2015-2022 (USD Billion)

Figure 64 Israel Market, By Submarine Type, 2015-2022 (USD Billion)

Figure 65 Snapshot of Key Growth Strategies Adopted By Companies From December 2011 to November 2016

Figure 66 Submarine Combat System Market Strategies, February 2013 - November 2016

Figure 67 Leading Companies in the Market, By Region

Figure 68 Contracts: the Most Adopted Strategy By Key Players in the Market From December 2011 to November 2016

Figure 69 Regional Revenue Mix of Top Four Players (2015)

Figure 70 Lockheed Martin Corporation: Company Snapshot

Figure 71 Lockheed Martin Corporation: SWOT Analysis

Figure 72 Saab AB: Company Snapshot

Figure 73 Saab AB: SWOT Analysis

Figure 74 General Dynamics Corporation: Company Snapshot

Figure 75 General Dynamics Corporation: SWOT Analysis

Figure 76 Kongsberg Gruppen ASA: Company Snapshot

Figure 77 Kongsberg Gruppen ASA: SWOT Analysis

Figure 78 Atlas Elektronik GmbH: SWOT Analysis

Figure 79 BAE Systems PLC: Company Snapshot

Figure 80 Raytheon Company: Company Snapshot

Figure 81 Leonardo-Finmeccanica SAP: Company Snapshot

Figure 82 DCNS SA: Company Snapshot

Market size estimations for various segments and subsegments of the submarine combat systems market were arrived at through extensive secondary research from government sources, company websites, defense websites, corporate filings such as annual reports, Bloomberg, Factiva, International Maritime Organization (IMO), investor presentations, and financial statements, and trade, business, and professional associations, among others. orroboration with primaries and further market triangulation with the help of statistical techniques using econometric tools was carried out. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the submarine combat systems market comprises manufacturers, distributors, and end-users. The key end-user of the market is the defense sector. Key manufacturers in the market are, Lockheed Martin Corporation (U.S.), SAAB AB (Sweden), Kongsberg Gruppen ASA (Norway), General Dynamics Corporation (U.S.), Atlas Elektronik GmbH (Germany), BAE Systems PLC (U.K.), and Raytheon Company (U.S.) among others.

“This study answers several questions for stakeholders, primarily, which segments they need to focus upon over the next six years to prioritize their efforts and investments.”

Target Audience

- Original Equipment Manufacturers (OEMs)

- Regulatory Bodies

- Component Suppliers

- Military

- Technology Providers

- Distributors

Scope of the Report

This research report categorizes the market into the following segments and subsegments:

-

Submarine Combat Systems Market, By System

- Sensors

- Electronic Support Measures (ESM)

- Armaments

-

Submarine Combat Systems Market, By Submarine Type

- Ship Submersible Hunter Killer (SSK)

- Ship Submersible Nuclear (SSN)

- Ship Submersible Ballistic Nuclear (SSBN)

-

Submarine Combat Systems Market, By Retrofit

- North America

- Europe

- Asia-Pacific

- Rest of the World (RoW)

-

Submarine Combat Systems Market, By Region

- North America

- Europe

- Asia-Pacific

- Rest of the World (RoW)

Customizations available for the report

With the given market data, MarketsandMarkets offers customizations as per the specific needs of a company. The following customization options are available for the report:

-

Country-level Analysis

- Comprehensive market projections for countries categorized under Rest of Europe, Rest of Asia-Pacific, and Rest of the World

-

Company Information

- Detailed analysis and profiles of additional market players (upto five)

Growth opportunities and latent adjacency in Submarine Combat Systems Market