Target Acquisition Systems Market by Subsystem (Cameras, Scopes & Sights, Detecting & Locating Systems, Modules), Platform (Land, Airborne, Naval), End Use (Military, Homeland Security), Range, and Region (2019-2024)

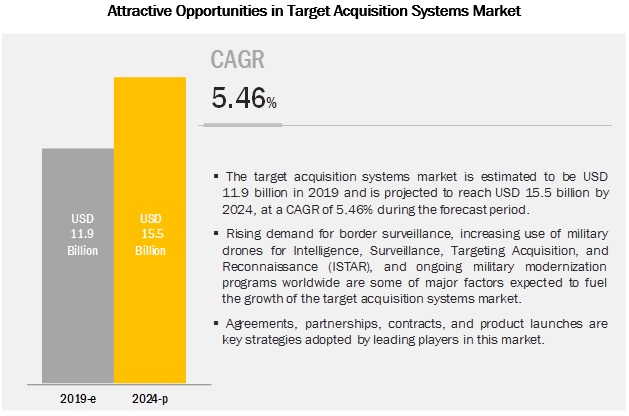

[147 Pages Report] The target acquisition systems market is projected to grow from USD 11.9 billion in 2019 to USD 15.5 billion by 2024, at a CAGR of 5.46% from 2019 to 2024.

Some of the factors that are expected to fuel the growth of the target acquisition systems market are advancements in automatic weapons, increasing defense expenditure of countries, rise in demand for artillery systems by military forces, and ongoing military modernization programs worldwide.

Based on platform, the naval segment is expected to grow at the highest CAGR during the forecast period

Based on platform, the naval segment of the target acquisition systems market is projected to grow at the highest CAGR during the forecast period. The growth of this segment can be attributed to the procurement of widely used target acquisition systems, such as destroyers, corvettes, frigates, offshore patrol vessels, unmanned surface vessels, and amphibious ships.

Based on end use, the military segment is expected to lead the target acquisition systems market from 2019 to 2024

Based on end use, the military segment of the target acquisition systems market is expected to grow at a higher CAGR as compared to the homeland security segment during the forecast period. The growing use of unmanned systems for surveillance is expected to drive the demand for the target acquisition systems used in ISR applications. The US has a large contribution to the military modernization programs, and companies focus on the US as it has a huge defense budget.

Based on range, the short range (08 km) segment is expected to grow at the highest CAGR in the target acquisition systems market from 2019 to 2024

Based on range, the short range (08 km) segment is expected to grow at the highest CAGR during the forecast period. The growth of the short range segment can be attributed to the increasing demand for short range target acquisition systems for greater accuracy as compared to long-range artillery systems.

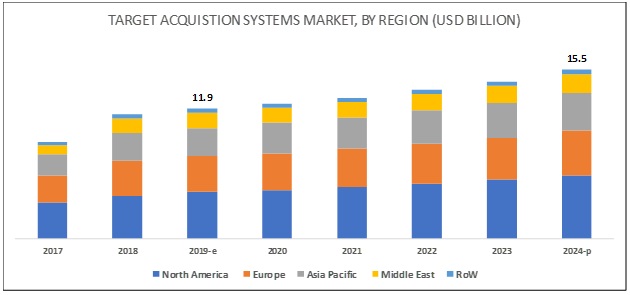

The Asia Pacific region is expected to grow at the highest CAGR from 2019 to 2024

Asia Pacific is expected to grow at the highest CAGR during the forecast period, due to the increase in defense expenditure by India and China and the expansion of military capabilities. Strong domestic production base and increasing use of automatic weapons on combat vehicles and naval platforms are some of the other factors expected to drive the growth of the target acquisition systems market in Asia Pacific.

Key Market Players

Major players in the target acquisition systems market include Rheinmetall (Germany), BAE Systems (UK), Israel Aerospace Industries (Israel), Aselsan A.S. (Turkey), Elbit Systems (Israel), Hensoldt (Germany), Leonardo (Italy), and Raytheon Company (US), among others. These players have adopted various growth strategies, such as contracts, agreements, and partnerships, to further expand their presence in the global target acquisition systems market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017-2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2024 |

|

Forecast monetary unit |

Value (USD) |

|

Segments covered |

By Sub-system, Platform, End Use, Range, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, the Middle East, Rest of the World |

|

Companies covered |

Rheinmetall AG (Germany), BAE Systems (UK), Israel Aerospace Industries (Israel), Aselsan A.S. (Turkey), Elbit Systems (Israel), and Hensoldt (Germany), Lockheed Martin Corporation (US), Safran (France), Leonardo (Italy), and Raytheon Company (US), among others |

This research report categorizes the target acquisition systems market based on sub-system, end use, platform, range, and region.

Based on Sub-system, the target acquisition systems market is segmented as follows:

- Cameras

- Scopes & Sights

- Detecting & Locating Systems:

- Modules

- Others

- Add-on Systems

Based on Platform, the target acquisition systems market is segmented as follows:

- Land

- Airborne

- Naval

Based on End Use, the target acquisition systems market is segmented as follows:

- Military

- Homeland Security

Based on Range, the target acquisition systems market is segmented as follows:

- Short Range (08 km)

- Medium Range (8250 km)

- Long Range (Above 250 km)

Based on Region, the target acquisition systems market is segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World (RoW)

Recent Developments

- In February 2019, Hensoldt partnered with Electtronica, Indra, and Thales to develop a Medium Altitude Long Endurance (MALE) PROGRAM with a future-proof Intelligence, Surveillance, Target Acquisition, and Reconnaissance (ISTAR) function.

- In November 2018, Israel Aerospace Industries secured a contract worth USD 550.0 million from an Asia Pacific country for the supply of its advanced Sky Capture air-defense system.

- In November 2018, Elbit Systems launched a new Forward Observer system, HattoriX, which can acquire Category 1 (CAT-1) targets with a target location error of a few meters.

- In March 2018, Aselsan A.S. signed a technology transfer deal with Barzan Holding, a military technology firm based in Qatar to produce Aselsan A.S. Stabilized Advanced Remote Weapon System and electro-optical reconnaissance and surveillance systems.

- In December 2018, Raytheon secured a contract worth USD 40.0 million from the US Navy for the repair of the multi-spectral targeting systems of the H-60 aircraft.

Key Questions Addressed by the Report

- What are your views on the growth perspective of the target acquisition systems market? What are key dynamics and trends that govern the market, such as drivers and opportunities?

- What are the key sustainability strategies adopted by leading players operating in the target acquisition systems market?

- What are the new emerging technologies and use cases disrupting the defense Industry?

- What are the key trends and opportunities in the target acquisition systems market across different regions and their respective countries?

- Who are the key players and innovators in the partnership ecosystem?

- How is the competitive landscape changing in the client ecosystem and impacting company revenue shares?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Markets Covered

1.2.2 Regional Scope

1.2.3 Years Considered for the Study

1.3 Currency & Pricing

1.4 Limitations

1.5 Market Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.2 Market Definition & Scope

2.2.1 Segment Definitions

2.2.1.1 Target Acquisition Systems Market, By Sub-System

2.2.1.2 Target Acquisition Systems Market, By Platform

2.2.1.3 Target Acquisition Systems Market, By End Use

2.2.1.4 Target Acquisition Systems Market, By Range

2.2.2 Exclusions

2.2.3 Primary Data

2.2.3.1 Key Data From Primary Sources

2.2.3.2 Breakdown of Primaries

2.3 Research Approach & Methodology

2.3.1 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.4.1 Market Sizing & Forecasting

2.5 Limitations

3 Executive Summary (Page No. - 34)

4 Premium Insights (Page No. - 37)

4.1 Attractive Growth Opportunities in Target Acquisition Systems Market

4.2 Land Target Acquisition Systems Market, By Application

4.3 Airborne Target Acquisition Systems Market, By Application

4.4 Target Acquisition Systems Market, By Range

4.5 Military Target Acquisition Systems Market, By Application

4.6 Target Acquisition Systems Market, By Region

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Advancements in Automatic Weapon Systems

5.2.1.2 Ongoing Military Modernization Programs Worldwide

5.2.1.3 Adoption of Tas-Supported Equipment By Military Forces

5.2.1.4 Increasing Defense Expenditure of Countries

5.2.1.5 Increasing Demand for Autonomy in Weapon Systems

5.2.1.6 Rise in Demand for Artillery Systems By Military Forces

5.2.2 Opportunities

5.2.2.1 Increased R&D Investments for Technological Advancements in Defense Operations

5.2.3 Challenges

5.2.3.1 Complexity and High Operational Cost

5.2.3.2 Integration of Automatic Weapon Systems With A Wide Range of Platforms

5.2.3.3 Extreme Weather Conditions Hamper the Accuracy of Target Acquisition Systems

5.2.3.4 Regulatory Challenges for Sales to Overseas Countries

6 Industry Trends (Page No. - 48)

6.1 Introduction

6.2 Technology Trends

6.2.1 Integrated Weapon Systems

6.2.2 Trajectory Correction Systems (TCS)

6.2.3 Advancements in Low-Light Optics, Thermal Vision & Image Intensification

6.2.4 Squad Binocular Night Vision Goggles

6.2.5 Long-Range Observation, Target Acquisition & Laser Designation System

6.2.6 Next-Generation Electro-Optical Laser Target Locator

6.2.7 Adoption of Artificial Intelligence (AI)/Automatic Target Recognition (ATR) Technology for Improved Situational Awareness

6.2.8 Big Data Analytics

6.3 Innovations & Patents Registrations

7 Target Acquisition Systems Market, By Sub-System (Page No. - 52)

7.1 Introduction

7.2 Cameras

7.2.1 Advancement in Integrating Situational Awareness Applications With Cameras

7.3 Scopes & Sights

7.3.1 Image Intensifiers Integrated With Nextgen Scopes for All-Weather Target Acquisition

7.4 Detecting & Locating Systems

7.4.1 Increased Need for Firing Accuracy Expected to Drive the Growth of Target Acquisition Systems Market

7.5 Modules

7.5.1 Increased Need for Real Time Situational Awareness is Expected to Drive the Growth of Modules

7.6 Add-On Systems

7.6.1 Increasing Need for Additional Systems to Enhance Target Acquisition

7.7 Others

8 Target Acquisition Systems Market, By Platform (Page No. - 58)

8.1 Introduction

8.2 Land

8.2.1 Armored Vehicles

8.2.1.1 Increasing Demand for Surveillance Vehicles is Expected to Drive Demand for Vehicle Based Target Acquisition Systems Market

8.2.2 Man-Portable Systems

8.2.2.1 Increasing Internal and External Security Threats is Expected to Increase the Demand for Man-Portable Target Acquisition Systems

8.2.3 Infantry Soldiers

8.2.3.1 Increasing Demand for Intelligence, Surveillance and Reconnaissance (ISR) Applications

8.2.4 Surveillance Towers

8.2.4.1 Increasing Need for Autonomous Border Surveillance Will Drive the Market for Target Acquisition Systems

8.3 Naval

8.3.1 Combat Ships

8.3.1.1 Increasing Naval Warfare to Drive Target Acquisition Systems for Combat Ships

8.3.2 Submarines

8.3.2.1 Increasing Investments in Maritime Security and Enhancement of Naval Capabilities

8.3.3 Unmanned Surface Vehicles (USV)

8.3.3.1 Rising Demand for Maritime Security for Protection of Shallow Waters & Ports

8.4 Airborne

8.4.1 Combat Aircraft

8.4.1.1 Increasing Number of Procurements for Combat Aircraft in the Us, Europe, and Asia Pacific

8.4.2 Unmanned Aerial Vehicles (UAV)

8.4.2.1 Increasing Use in Various Military Applications is Expected to Drive the Target Acquisition Systems Market for UAVs

8.4.3 Aerostats/Balloons

8.4.3.1 Increasing Need for Border Surveillance Due to Border Disputes and Drug Trafficking

9 Target Acquisition Systems Market, By End Use (Page No. - 65)

9.1 Introduction

9.2 Military

9.2.1 Intelligence, Surveillance & Reconnaissance (ISR)

9.2.1.1 Demand for Unmanned Systems for Surveillance

9.2.2 Weapon Targeting

9.2.2.1 Demand for Accurate Location of Enemies

9.3 Homeland Security

9.3.1 Border Security

9.3.1.1 Increasing Illegal Immigration Will Drive Border Security Market

9.3.2 Coastal & Maritime Surveillance

9.3.2.1 Increasing Demand for Coastal Protection is Expected to Drive the Coastal & Maritime Surveillance Market

9.3.3 Search & Rescue

9.3.3.1 Advancement in EO/IR Technology is Expected to Drive the Search & Rescue Market

9.3.4 Critical Infrastructure

9.3.4.1 Increasing Terrorist Threats and Biohazard Attacks

10 Target Acquisition Systems Market, By Range (Page No. - 70)

10.1 Introduction

10.2 Long Range Target Acquisition Systems

10.2.1 Increasing Threats From Intercontinental Ballistic Missiles Across the Globe

10.3 Medium Range Target Acquisition Systems

10.3.1 Medium Range Systems are Extensively Used in Warzone for Aiming at the Target With Maximum Accuracy

10.4 Short Range Target Acquisition Systems

10.4.1 Increasing Focus of Air and Surface Targets

11 Regional Analysis (Page No. - 74)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 Increasing Procurement of Target Acquisition Systems in the Country is Driving the Growth of the Market

11.2.2 Canada

11.2.2.1 High Focus on Modernization of Weapon Systems Expected to Drive the Market for Target Acquisition Systems in Canada

11.3 Europe

11.3.1 UK

11.3.1.1 Upgradation of Its Warrior Infantry Fighting Vehicles is Driving the Growth of Target Acquisition Systems Market in the UK

11.3.2 Russia

11.3.2.1 Tensions With Ukraine and Other Nato Countries and Procurement of Military Equipment

11.3.3 France

11.3.3.1 Increasing Demand for Equipment for Special Forces is Expected to Drive the Growth of the Target Acquisition Systems Market in France

11.3.4 Italy

11.3.4.1 Increasing Defense Procurements and Launch of Various Programs

11.3.5 Germany

11.3.5.1 Government Initiatives for Procurement of Armored Vehicles is Expected to Drive the Market in Germany

11.3.6 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.1.1 Increasing Focus on Modernization of Automation Weapons and Research and Development for Military

11.4.2 Japan

11.4.2.1 High-End Indigenous Military Technologies, Drives the Market of Target Acquisition Systems in Japan

11.4.3 India

11.4.3.1 Increasing Instances of Terrorist Strikes, Border Disputes,And Sensitive Multi-Cultural Issues

11.4.4 South Korea

11.4.4.1 Soldiers Modernization Programs, Addition of Advanced Armored Vehicles, and Conflict With North Korea

11.4.5 Rest of Asia Pacific

11.5 Middle East

11.5.1 Israel

11.5.1.1 Israeli Government Invests Significantly to Enhance Its Military Strength to Defend Its Territories Threats

11.5.2 Saudi Arabia

11.5.2.1 Increasing Military Expenditure and Tensions Between Neighboring Countries

11.5.3 Rest of Middle East

11.6 Rest of the World

11.6.1 Africa

11.6.1.1 Rising Concerns Regarding Terrorism are Expected to Drive the Growth of the Target Acquisition Systems Market in Africa

11.6.2 South America

11.6.2.1 Increasing the Procurements of Locating & Targeting Systems is Expected to Drive the Target Acquisition Systems Market in Latin America.

12 Competitive Landscape (Page No. - 106)

12.1 Introduction

12.2 Competitive Scenario

12.3 Major Players, 2018

12.4 Competitive Leadership Mapping

12.4.1 Visionary Leaders

12.4.2 Innovators

12.4.3 Dynamic Differentiators

12.4.4 Emerging Companies

12.5 Competitive Scenario

12.5.1 New Product Launches

12.5.2 Contracts

12.5.3 Partnerships & Agreements

13 Company Profiles (Page No. - 113)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Aselsan A.S.

13.2 Bae Systems PLC

13.3 Elbit Systems Ltd.

13.4 Hensoldt

13.5 Instro Precision Limited

13.6 Israel Aerospace Industries

13.7 Wuhan Joho Technology Co. Ltd.

13.8 Kearfott Corporation

13.9 Leonardo

13.10 Lockheed Martin Corporation

13.11 Raytheon

13.12 Rheinmetall AG

13.13 Safran Group

13.14 Thales

13.15 Iacit

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 142)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets Subscription Portal

14.3 Available Customization

14.4 Related Reports

14.5 Author Details

List of Tables (93 Tables)

Table 1 USD Exchange Rates

Table 2 Procurement Plans for Artillery Systems, By Country, 20132020

Table 3 Effect of Weather on Air Defense Operations & Artillery Operations

Table 4 Innovations & Patent Registrations, 2013-2018

Table 5 Target Acquisition Systems Market Size, By Sub-System, 20172024 (USD Million)

Table 6 Cameras Market Size, By Region, 20172024 (USD Million)

Table 7 Scopes & Sights Market Size, By Region, 20172024 (USD Million)

Table 8 Detecting & Locating Systems Market Size, By Region, 20172024 (USD Million)

Table 9 Modules Market Size, By Region, 20172024 (USD Million)

Table 10 Add-On Systems Market Size, By Region, 20172024 (USD Million)

Table 11 Other Sub-Systems Market Size, By Region, 20172024 (USD Million)

Table 12 Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 13 Land Target Acquisition Systems Market Size, By Application, 20172024 (USD Million)

Table 14 Land Target Acquisition Systems Market Size, By Region, 20172024 (USD Million)

Table 15 Naval Target Acquisition Systems Market Size, By Application, 20172024 (USD Million)

Table 16 Naval Target Acquisition Systems Market Size, By Region, 20172024 (USD Million)

Table 17 Airborne Target Acquisition Systems Market Size, By Application, 20172024 (USD Million)

Table 18 Airborne Target Acquisition Systems Market Size, By Region, 20172024 (USD Million)

Table 19 Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 20 Target Acquisition Systems Market for Military, By Application, 20172024 (USD Million)

Table 21 Military Target Acquisition Systems Market Size, By Region, 20172024 (USD Million)

Table 22 Target Acquisition Systems Market for Homeland Security, By Application, 20172024 (USD Million)

Table 23 Homeland Security Target Acquisition Systems Market Size, By Region, 20172024 (USD Million)

Table 24 Target Acquisition Systems Market Size, By Range, 20172024 (USD Million)

Table 25 Long Range Target Acquisition Systems Market Size, By Region, 20172024 (USD Million)

Table 26 Medium Range Target Acquisition Systems Market Size, By Region, 20172024 (USD Million)

Table 27 Short Range Target Acquisition Systems Market Size, By Region, 20172024 (USD Million)

Table 28 Target Acquisition Systems Market Size, By Region, 20172024 (USD Million)

Table 29 North America Target Acquisition Systems Market Size, By Sub-System, 20172024 (USD Million)

Table 30 North America Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 31 North America Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 32 North America Target Acquisition Systems Market Size, By Range, 20172024 (USD Million)

Table 33 North America Target Acquisition Systems Market Size, By Country, 20172024 (USD Million)

Table 34 US Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 35 US Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 36 Canada Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 37 Canada Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 38 Europe Target Acquisition Systems Market Size, By Sub-System, 20172024 (USD Million)

Table 39 Europe Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 40 Europe Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 41 Europe Target Acquisition Systems Market Size, By Range, 20172024 (USD Million)

Table 42 Europe Target Acquisition Systems Market Size, By Country, 20172024 (USD Million)

Table 43 UK Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 44 UK Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 45 Russia Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 46 Russia Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 47 France Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 48 France Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 49 Italy Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 50 Italy Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 51 Germany Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 52 Germany Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 53 Rest of Europe Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 54 Rest of Europe Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 55 Asia Pacific Target Acquisition Systems Market Size, By Sub-System, 20172024 (USD Million)

Table 56 Asia Pacific Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 57 Asia Pacific Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 58 Asia Pacific Target Acquisition Systems Market Size, By Range, 20172024 (USD Million)

Table 59 Asia Pacific Target Acquisition Systems Market Size, By Country, 20172024 (USD Million)

Table 60 China Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 61 China Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 62 Japan Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 63 Japan Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 64 India Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 65 India Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 66 South Korea Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 67 South Korea Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 68 Rest of Asia Pacific Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 69 Rest of Asia Pacific Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 70 Middle East Target Acquisition Systems Market Size, By Sub-System, 20172024 (USD Million)

Table 71 Middle East Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 72 Middle East Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 73 Middle East Target Acquisition Systems Market Size, By Range, 20172024 (USD Million)

Table 74 Middle East Target Acquisition Systems Market Size, By Country, 20172024 (USD Million)

Table 75 Israel Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 76 Israel Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 77 Saudi Arabia Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 78 Saudi Arabia Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 79 Rest of the Middle East Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 80 Rest of the Middle East Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 81 Rest of the World Target Acquisition Systems Market Size, By Sub-System, 20172024 (USD Million)

Table 82 Rest of the World Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 83 Rest of the World Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 84 Rest of the World Target Acquisition Systems Market Size, By Range, 20172024 (USD Million)

Table 85 Rest of the World Target Acquisition Systems Market Size, By Region, 20172024 (USD Million)

Table 86 Africa Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 87 Africa Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 88 South America Target Acquisition Systems Market Size, By End Use, 20172024 (USD Million)

Table 89 South America Target Acquisition Systems Market Size, By Platform, 20172024 (USD Million)

Table 90 New Product Launches, 2018

Table 91 Contracts, December 2015February 2019

Table 92 Partnerships & Agreements, 2018

Table 93 Bae Systems PLC: Company Snapshot

List of Figures (43 Figures)

Figure 1 Research Flow

Figure 2 Target Acquisition Systems Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation & Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Assumptions of the Research Study

Figure 8 Land Segment Projected to Lead Target Acquisition Systems Market From 2019 to 2024

Figure 9 Military Segment Projected to Lead Target Acquisition Systems Market From 2019 to 2024

Figure 10 Detecting & Locating Systems Segment Projected to Lead Target Acquisition Systems Market From 2019 to 2024

Figure 11 North America is Projected to Lead Target Acquisition Systems Market From 2019 to 2024

Figure 12 Rising Demand for Border Surveillance and Ongoing Military Modernization Programs are Some of the Major Factors Driving the Target Acquisition Systems Market

Figure 13 Armored Vehicles Segment Expected to Lead Land Target Acquisition Systems Market From 2019 to 2024

Figure 14 Combat Aircraft Segment Expected to Lead Airborne Target Acquisition Systems Market From 2019 to 2024

Figure 15 Medium Range (8250 Km) Segment Expected to Lead Target Acquisition Systems Market During Forecast Period

Figure 16 Intelligence, Surveillance & Reconnaissance Segment Expected to Lead Military Target Acquisition Systems Market From 2019 to 2024

Figure 17 Asia Pacific Expected to Lead Target Acquisition Systems Market During Forecast Period

Figure 18 Target Acquisition Systems Market: Drivers, Opportunities & Challenges

Figure 19 Defense Spending of Countries, 20122045 (USD Billion)

Figure 20 Development of Autonomy in Weapon Systems: Frequency of Weapon Systems Compared With Unarmed Systems, Field of Use & Status of Development

Figure 21 Autonomous Functions in Existing Military Systems, By Capability Area

Figure 22 Artillery Systems Market (20162022), USD Billion

Figure 23 The Detecting & Locating Systems Segment Projected to Grow at the Highest CAGR During the Forecast Period

Figure 24 The Naval Based Target Acquisition Systems Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 25 The Military Target Acquisition Systems Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 26 The Short Range Target Acquisition Systems Segment is Projected to Grow at the Highest CAGR During Forecast Period

Figure 27 Target Acquisition Systems Market Snapshot

Figure 28 North America Target Acquisition Systems Market Snapshot

Figure 29 Europe Target Acquisition Systems Market Snapshot

Figure 30 Asia Pacific Target Acquisition Systems Market Snapshot

Figure 31 Middle East Target Acquisition Systems Market Snapshot

Figure 32 Companies Adopted Contracts as Key Growth Strategy From April 2013 to February 2019

Figure 33 Key Players in Target Acquisition Systems Market, 2018

Figure 34 Target Acquisition Systems Market Competitive Leadership Mapping, 2018

Figure 35 Aselsan: Company Snapshot

Figure 36 Elbit Systems Ltd.: Company Snapshot

Figure 37 Israel Aerospace Industries: Company Snapshot

Figure 38 Leonardo: Company Snapshot

Figure 39 Lockheed Martin Corporation: Company Snapshot

Figure 40 Raytheon: Company Snapshot

Figure 41 Rheinmetall AG: Company Snapshot

Figure 42 Safran: Company Snapshot

Figure 43 Thales Group: Company Snapshot

Exhaustive secondary research was undertaken to collect information on the target acquisition systems market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, demand-side and supply-side analysis were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market sizes of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Stockholm International Peace Research Institute (SIPRI), Global Firepower, D&B Hoovers, OEC Atlas Trade, Airbus, Boeing Outlook, company websites, annual reports, SEC filings, Bloomberg, BusinessWeek, and Defense Magazines were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, certified publications, and articles by recognized authors.

Primary Research

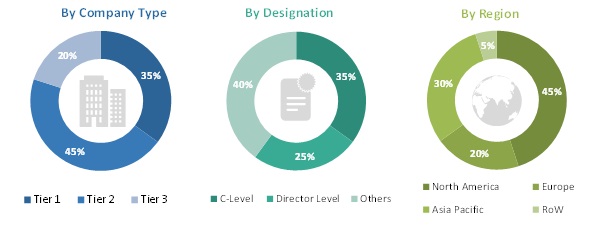

The target acquisition systems market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, integrator and regulatory organizations in the supply chain. The demand side of this market is characterized by various end users, such as government & military organizations. The supply side is characterized by advancements in the target acquisition systems technology, development of target acquisition systems, and software development. The following is the breakdown of primary respondents interviewed to obtain qualitative and quantitative information about the target acquisition systems market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, the top-down and bottom-up approaches were used to estimate and validate the total size of the target acquisition systems market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research, such as product matrix, developments, and geographical presence.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes explained abovethe market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both, the demand and supply sides, in the target acquisition systems industry.

Report Objectives

- To define, describe, and forecast the size of the target acquisition systems market based on sub-system, platform, end use, range, and region

- To identify and analyze key drivers, opportunities, and challenges influencing the growth of the market

- To forecast the size of segments of the target acquisition systems market based on 5 regions, namely, North America, Europe, Asia Pacific, the Middle East, and Rest of the World, along with major countries in each of these regions

- To analyze micromarkets1 with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market rank analysis and core competencies2

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies such as contracts, partnerships, and agreements

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the companys specific needs.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Growth opportunities and latent adjacency in Target Acquisition Systems Market