Combat Management System Market by Sub-System (Self-Defense, Situational Awareness, Track Management, Identification, Unmanned Vehicle), Component (Hardware, Software), Platform (Destroyers, Submarines, Frigates, Corvettes) and Region - Global Forecast to 2022

[131 Pages Report] The combat management system market is projected to grow from USD 298.3 Million in 2016 to USD 365.5 Million by 2022, at a CAGR of 3.57% during the forecast period. The base year considered for the study is 2016 and the forecast period is from 2017 to 2022.

Objectives of the Study:

The report analyzes the combat management system market based on component, sub-system, and platform. These segments and subsegments have been mapped across major regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW). The report provides an in-depth market intelligence regarding major market dynamics, such as drivers, restraints, opportunities, and industry-specific challenges that may influence the growth of the market, along with an analysis of micromarkets with respect to individual growth trends, future prospects, and their contribution to the overall market.

The report also covers competitive developments, such as long-term contracts, agreements, and research & development activities in the combat management system market, in addition to business and corporate strategies adopted by key market players.

The combat management system market is projected to grow from USD 306.7 Million in 2017 to USD 365.5 Million by 2022, at a CAGR of 3.57% during the forecast period. Major drivers influencing the growth of the market include growing demand for advanced situational awareness systems in naval ships & submarines and increase in upgradation of legacy combat management systems by different navies across the world.

The combat management system market has been segmented on the basis of component, sub-system, platform, and region. Based on component, the market has been classified into software and hardware, and the hardware segment has been further divided into control consoles, combat data center, and data network switchers. The software segment is estimated to lead the market is 2017 and is also projected to grow at a higher CAGR than the hardware segment during the forecast period, owing to the high development cost of software, which is based on the complex architecture of the combat management system.

Based on sub-system, the combat management system market has been segmented into self-defense management system, situational awareness system, track management system, weapon management system, display system, identification system, and unmanned vehicle control system. The unmanned vehicle control system segment is projected to grow at the highest CAGR during the forecast period, owing to the increasing adoption of unmanned vehicles, such as UAVs, UUVs, and UGVs in naval combat operations. Based on platform, the market has been segmented into destroyers, submarines, frigates, amphibious ships, corvettes, fast attack craft (FAC), and aircraft carriers. The corvettes segment is projected to grow at the highest CAGR during the forecast period due to the increase in deliveries of corvettes.

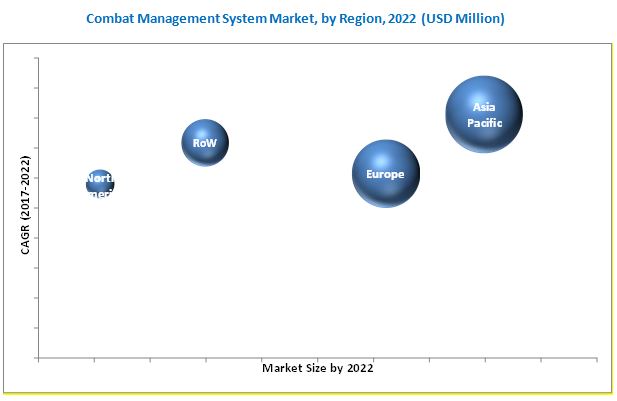

Based on region, the combat management system market has been segmented into North America, Europe, Asia Pacific, and Rest of the World (RoW). The Asia Pacific market is projected to grow at the highest CAGR from 2017 to 2022, due to the growing ship building activities and increasing deliveries of combat vessels in the region. Asia Pacific countries, such as China, India, and Japan, are also increasingly investing in the development of future-centric naval technologies

Proven capability and fidelity of legacy systems are restraining the growth of the combat management system market. Products offered by various companies in the market have been listed in this report. The recent developments section of the report includes recent and significant developments made by various companies. Major companies profiled in the report include BAE Systems plc (UK), Elbit Systems Ltd. (Israel), Kongsberg Gruppen ASA (Norway), Leonardo S.p.A. (Italy), Lockheed Martin Corporation (US), Raytheon Company (US), Saab AB (Sweden), and Thales Group (France), among others. Contracts accounted for the major share of all growth strategies adopted by leading players in the market. The contract strategy enabled companies to strengthen their market share in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

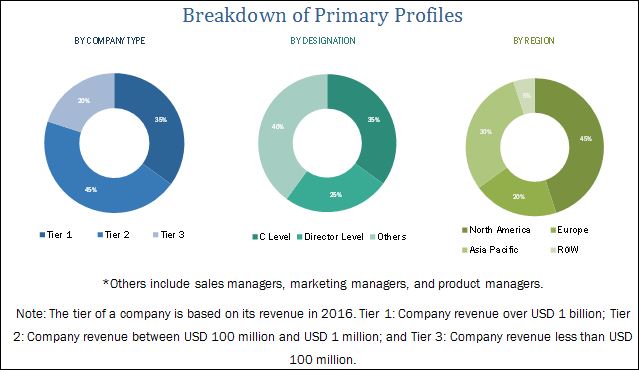

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Combat Management System Market

4.2 Market, By Sub-System

4.3 Market, By Component

4.4 Market, By Platform

4.5 Europe Market By Platform & By Country, 2017

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Platform

5.2.2 By Component

5.2.3 By Sub-System

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Enhanced Situational Awareness

5.3.1.2 Increase in Military Spending of Emerging Countries

5.3.2 Restraints

5.3.2.1 Proven Capability and Fidelity of Legacy Systems

5.3.3 Opportunities

5.3.3.1 Increased Focus on Military Modernization

5.3.4 Challenges

5.3.4.1 High Cost Associated With the Implementation of Communication Technologies

5.3.4.2 Cyber Security Threats

5.4 Technology Trends

5.4.1 Open Architecture

5.4.2 Multi-Sensor Data Fusion

5.4.3 Automated Combat Management System

5.5 Patent/Patent Applications

6 Combat Management System Market, By Sub-System (Page No. - 40)

6.1 Introduction

6.2 Self-Defense Management System

6.3 Identification Systems

6.4 WeAPOn Management Systems

6.5 Track Management Systems

6.6 Display Systems

6.7 Situational Awareness Systems

6.8 Unmanned Vehicle Control Systems

7 Combat Management System Market, By Component (Page No. - 44)

7.1 Introduction

7.2 Software

7.3 Hardware

7.3.1 Control Consoles

7.3.2 Combat Data Centers

7.3.3 Data Network Switchers

8 Combat Management System Market, By Platform (Page No. - 48)

8.1 Introduction

8.2 Destroyers

8.3 Submarines

8.4 Frigates

8.5 Amphibious Ships

8.6 Corvettes

8.7 Fast Attack Craft (FAC)

8.8 Aircraft Carriers

9 Regional Analysis (Page No. - 52)

9.1 Introduction

9.1.1 By Sub-System

9.1.2 By Component

9.1.3 By Platform

9.1.4 By Region

9.2 North America

9.2.1 By Sub-System

9.2.2 By Component

9.2.3 By Platform

9.2.4 By Country

9.2.4.1 US

9.2.4.2 Canada

9.3 Europe

9.3.1 By Sub-System

9.3.2 By Component

9.3.3 By Platform

9.3.4 By Country

9.3.4.1 UK

9.3.4.2 Germany

9.3.4.3 France

9.3.4.4 Russia

9.3.4.5 Rest of Europe

9.4 Asia Pacific

9.4.1 By Sub-System

9.4.2 By Component

9.4.3 By Platform

9.4.4 By Country

9.4.4.1 China

9.4.4.2 India

9.4.4.3 Japan

9.4.4.4 Rest of Asia Pacific

9.5 RoW

9.5.1 By Sub-System

9.5.2 By Component

9.5.3 By Platform

9.5.4 By Country

9.5.4.1 Saudi Arabia

9.5.4.2 Brazil

9.5.4.3 South Africa

10 Competitive Landscape (Page No. - 90)

10.1 Introduction

10.1.1 Visionary Leaders

10.1.2 Innovators

10.1.3 Dynamic Differentiators

10.1.4 Emerging Companies

10.2 Competitive Benchmarking

10.2.1 Strength of Product Portfolio (For 20 Companies)

10.2.2 Business Strategy Excellence (For 20 Companies)

10.3 Ranking of the Key Players in the Combat Management Systems Market in 2017

11 Company Profiles (Page No. - 96)

(Overview, Products and Services, Financials, Strategy & Development)*

11.1 Lockheed Martin Corporation

11.2 Thales Group

11.3 BAE Systems Plc.

11.4 Saab AB

11.5 Kongsberg Gruppen Asa

11.6 Israel Aerospace Industries Ltd.

11.7 Leonardo S.P.A.

11.8 Raytheon Company

11.9 Northrop Grumman Corporation

11.10 Elbit Systems Ltd.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 123)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (71 Tables)

Table 1 Combat Management Systems Market, By Platform

Table 2 Market, By Component

Table 3 Market, By Sub-System

Table 4 Innovation & Patent Applications, 2016-2017

Table 5 Market Size, By Sub-System, 2015-2022 (USD Million)

Table 6 Market Size, By Component, 2015-2022 (USD Million)

Table 7 Hardware Segment, By Type, 2015-2022 (USD Million)

Table 8 Market Size, By Platform, 2015-2022 (USD Million)

Table 9 Market Size, By Sub-System, 2015–2022 (USD Million)

Table 10 Market Size, By Component, 2015–2022 (USD Million)

Table 11 Market Size, By Platform, 2015–2022 (USD Million)

Table 12 Market Size, By Region, 2015-2022 (USD Million)

Table 13 North America: Market Size, By Sub-System, 2015–2022 (USD Million)

Table 14 North America: Market Size, By Component, 2015–2022 (USD Million)

Table 15 North America: Market Size, By Platform, 2015–2022 (USD Million)

Table 16 North America: Market Size, By Country, 2015-2022 (USD Million)

Table 17 US: Market Size, By Sub-System, 2015–2022 (USD Million)

Table 18 US: Market Size, By Component, 2015–2022 (USD Million)

Table 19 US: Market Size, By Platform, 2015–2022 (USD Million)

Table 20 Canada: Market Size, By Sub-System, 2015–2022 (USD Thousand)

Table 21 Canada: Market Size, By Component, 2015–2022 (USD Million)

Table 22 Canada: Market Size, By Platform, 2015–2022 (USD Thousand)

Table 23 Europe: Combat Management Systems Market Size, By Sub-System, 2015–2022 (USD Million)

Table 24 Europe: Market Size, By Component, 2015–2022 (USD Million)

Table 25 Europe: Market Size, By Platform, 2015–2022 (USD Million)

Table 26 Europe: Market Size, By Country, 2015-2022 (USD Million)

Table 27 UK: Market Size, By Sub-System, 2015–2022 (USD Million)

Table 28 UK: Market Size, By Component, 2015–2022 (USD Million)

Table 29 UK: Market Size, By Platform, 2015–2022 (USD Million)

Table 30 Germany: Market Size, By Sub-System, 2015–2022 (USD Million)

Table 31 Germany: Market Size, By Component, 2015–2022 (USD Million)

Table 32 Germany: Market Size, By Platform, 2015–2022 (USD Million)

Table 33 France: Market Size, By Sub-System, 2015–2022 (USD Million)

Table 34 France: Market Size, By Component, 2015–2022 (USD Million)

Table 35 France: Market Size, By Platform, 2015–2022 (USD Million)

Table 36 Russia: Market Size, By Sub-System, 2015–2022 (USD Million)

Table 37 Russia: Market Size, By Component, 2015–2022 (USD Million)

Table 38 Russia: Market Size, By Platform, 2015–2022 (USD Million)

Table 39 Rest of Europe: Market Size, By Sub-System, 2015–2022 (USD Million)

Table 40 Rest of Europe: Market Size, By Component, 2015–2022 (USD Million)

Table 41 Rest of Europe: Market Size, By Platform, 2015–2022 (USD Million)

Table 42 Asia Pacific: Market Size, By Sub-System, 2015–2022 (USD Million)

Table 43 Asia Pacific: Combat Management Systems Market Size, By Component, 2015–2022 (USD Million)

Table 44 Asia Pacific: Market Size, By Platform, 2015–2022 (USD Million)

Table 45 Asia Pacific: Market Size, By Country, 2015-2022 (USD Million)

Table 46 China: Market Size, By Sub-System, 2015–2022 (USD Million)

Table 47 China: Combat Management Systems Market Size, By Component, 2015–2022 (USD Million)

Table 48 China: Combat Management Systems Market Size, By Platform, 2015–2022 (USD Million)

Table 49 India: Combat Management Systems Market Size, By Sub-System, 2015–2022 (USD Million)

Table 50 India: Combat Management Systems Market Size, By Component, 2015–2022 (USD Million)

Table 51 India: Combat Management Systems Market Size, By Platform, 2015–2022 (USD Million)

Table 52 Japan: Market Size, By Sub-System, 2015–2022 (USD Million)

Table 53 Japan: Market Size, By Component, 2015–2022 (USD Million)

Table 54 Japan: Market Size, By Platform, 2015–2022 (USD Million)

Table 55 Rest of Asia Pacific: Market Size, By Sub-System, 2015–2022 (USD Million)

Table 56 Rest of Asia Pacific: Market Size, By Component, 2015–2022 (USD Million)

Table 57 Rest of Asia Pacific: Market Size, By Platform, 2015–2022 (USD Million)

Table 58 RoW: Market Size, By Sub-System, 2015–2022 (USD Million)

Table 59 RoW: Market Size, By Component, 2015–2022 (USD Million)

Table 60 RoW: Market Size, By Platform, 2015–2022 (USD Million)

Table 61 RoW: Market Size, By Country, 2015-2022 (USD Million)

Table 62 Saudi Arabia: Market Size, By Sub-System, 2015–2022 (USD Million)

Table 63 Saudi Arabia: Market Size, By Component, 2015–2022 (USD Million)

Table 64 Saudi Arabia: Market Size, By Platform, 2015–2022 (USD Million)

Table 65 Brazil: Market Size, By Sub-System, 2015–2022 (USD Million)

Table 66 Brazil: Market Size, By Component, 2015–2022 (USD Million)

Table 67 Brazil: Market Size, By Platform, 2015–2022 (USD Million)

Table 68 South Africa: Market Size, By Sub-System, 2015–2022 (USD Million)

Table 69 South Africa: Market Size, By Component, 2015–2022 (USD Million)

Table 70 South Africa: Market Size, By Platform, 2015–2022 (USD Million)

Table 71 Ranking Analysis of the Key Players in the Market, 2017

List of Figures (38 Figures)

Figure 1 Combat Management Systems Market Segmentation

Figure 2 Research Process Flow

Figure 3 Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Asia Pacific is Estimated to Account for the Largest Share of the Market in 2017

Figure 9 Self-Defence Management System to Dominate the Sub-System Market During the Forecast Period

Figure 10 Based on Component, the Software Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 11 Based on Platform, the Corvettes Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 12 The Demand for Enhanced Situational Awareness is Anticipated to Drive the Growth of the Market During the Forecast Period

Figure 13 The Self-Defense Management Systems Segment is Projected to Be the Largest Segment of the Market During the Forecast Period

Figure 14 The Software Segment is Projected to Lead the Market During the Forecast Period

Figure 15 The Destroyers Segment is Projected to Lead the Market During the Forecast Period

Figure 16 Russia to Lead the European Combat System Market in 2017

Figure 17 Market Dynamics for the Market

Figure 18 Increasing Defense Budgets of Emerging Countries, 2005 & 2016 (USD Billion, %)

Figure 19 Data Processing From Multi-Sensors

Figure 20 The Unmanned Vehicle Control System Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 21 The Software Segment is Projected to Grow at A Higher CAGR During the Forecast Period

Figure 22 The Data Network Switchers Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 23 The Corvettes Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 24 Market in Asia Pacific is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 25 North America Market Snapshot

Figure 26 Europe Market Snapshot

Figure 27 Asia Pacific Market Snapshot

Figure 28 Market (Global) Competitive Leadership Mapping, 2017

Figure 29 Lockheed Martin Corporation: Company Snapshot

Figure 30 Thales Group: Company Snapshot

Figure 31 BAE Systems Plc.: Company Snapshot

Figure 32 Saab AB: Company Snapshot

Figure 33 Kongsberg Gruppen ASA: Company Snapshot

Figure 34 Israel Aerospace Industries Ltd.: Company Snapshot

Figure 35 Leonardo S.P.A.: Company Snapshot

Figure 36 Raytheon Company: Company Snapshot

Figure 37 Northrop Grumman Corporation: Company Snapshot

Figure 38 Elbit Systems Ltd.: Company Snapshot

Market size estimation for various segments and subsegments of the combat management system market was arrived at by referring to varied secondary sources, such as Stockholm International Peace Research Institute (SIPRI), Annual Reports, Presentations, Websites, Press Releases, News Articles, Journals, and Paid Databases, among others. Furthermore, market triangulation was performed with the help of statistical techniques using econometric tools. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to acquire the final quantitative and qualitative data. This data was consolidated with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

To know about the assumptions considered for the study, download the pdf brochure

The combat management system market ecosystem comprises system manufacturers, such as BAE Systems plc (UK), Elbit Systems Ltd. (Israel), Kongsberg Gruppen ASA (Norway), Leonardo S.p.A. (Italy), Lockheed Martin Corporation (US), Raytheon Company (US), Saab AB (Sweden), and Thales Group (France). Major customers of the market include combat vessel & submarine manufacturers and naval systems integrators.

Key Target Audience:

- Manufacturers of Combat Management Systems

- Manufacturers of Combat Management System Components

- Advanced Naval Software Developers

- System Integrators

- Potential Investors (Venture Capitalists)

- Research Institutes and Organizations

Scope of the Report:

This research report categorizes the combat management system market into the following segments and subsegments:

-

Combat Management System Market, By Component

- Software

-

Hardware

- Control Consoles

- Combat Data Center

- Data Network Switchers

-

Combat Management System Market, By Sub-system

- Self-defense Management System

- Situational Awareness System

- Track Management System

- Weapon Management System

- Display System

- Identification System

- Unmanned Vehicle Control System

-

Combat Management System Market, By Platform

- Destroyers

- Submarines

- Frigates

- Amphibious Ships

- Corvettes

- Fast Attack Craft (FAC)

- Aircraft Carriers

-

Combat Management System Market, By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Customizations available for the report:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of a company. The following customization options are available for the report:

-

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Combat Management System Market