Stem Cell Banking Market by Source (PSC, BMSC, ADSC, hESC, DPSC, NSC), Service Type (Sample Processing, Analysis, Collection, Storage), Application (Personalized Storage, Clinical (Autoimmune, Hematopoietic Disorders), Research) - Global Forecasts to 2023

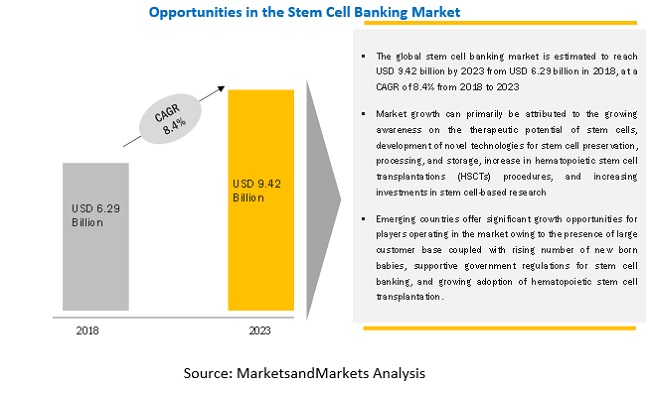

The global stem cell banking market is projected to reach USD 9.30 Billion by 2023, at a CAGR of 8.2%. Factors such as the growing awareness on the therapeutic potential of stem cells; development of novel technologies for stem cell preservation, processing and storage; increase in hematopoietic stem cell transplantation (HSCT) procedures; and increasing investments in stem cell-based research are driving the growth of the stem cell banking market. However, the high operational costs associated with stem cell banking and stringent regulatory frameworks are expected to restrain market growth to a certain extent.

By source, the placental stem cells segment is expected to be the largest segment of the market

Based on source, the stem cell banking market is segmented into placental, embryonic, bone marrow, adipose tissue, dental pulp, and other stem cell sources. Of all these segments, the placental stem cells segment is expected to account for the largest share of 73.9% of the stem cell banking market in 2018. The large share of this segment can largely be attributed to the significant rise in the number of placental and cord banks across major markets (especially the US and Europe) coupled with growing public awareness about the therapeutic potential of stem cell sources.

By application, the personalized banking applications segment is expected to grow at the highest rate during the forecast period

Based on application, the stem cell banking market is categorized into three major segments, namely, clinical applications, research applications, and personalized banking applications. The personalized banking applications segment is expected to account for the largest share and grow at the fastest CAGR in the stem cell banking in 2018. This is attributed to the premium pricing of service plans charged by service providers and specific advantages offered by personalized banking over community & public banking (such as exclusive member rights for stored stem cells as well as efficient quality analysis, sample testing, and sample processing.

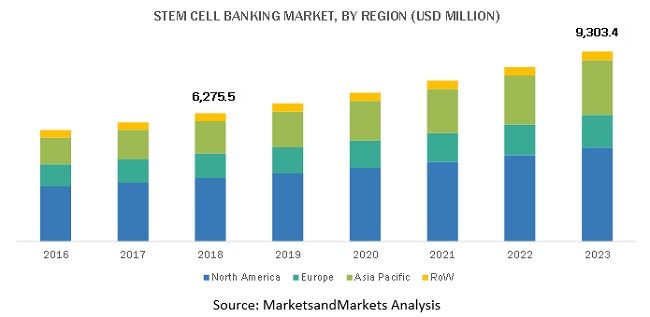

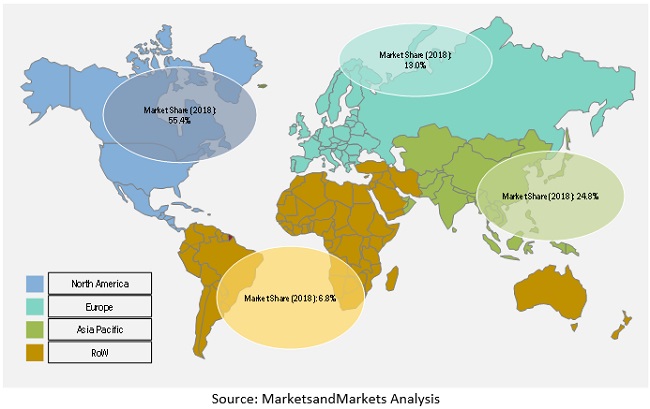

North America dominated the market

North America is expected to account for the largest share of the global stem cell banking market in 2018, followed by Asia Pacific. Factors such as expanding network of stem cell banking services across the region, ongoing approval of stem cell lines for disease treatment (especially for hematopoietic & autoimmune disorders), recent technological advancements in the field of stem cell collection and preservation techniques, and rising public-private investments for stem cell researches are driving the growth of the stem cell banking market in the North America.

Stem Cell Banking Market Dynamics

Market growth is primarily driven by growing public awareness related to the therapeutic potential of stem cells; development of novel technologies for stem cell preservation, processing, and storage; rising number of hematopoietic stem cell transplantations (HSCTs); and increasing stem cell-based research. On the other hand, the high operational costs associated with stem cell banking and stringent regulatory frameworks are expected to limit market growth. The limited adoption of stem cell banking services across developing countries and socio-ethical concerns related to embryonic stem cells (ESCs) are key challenges faced by the majority of market stakeholders in the stem cell banking services industry.

Drivers: Growing awareness on the therapeutic potential of stem cells

With the increased availability of clinical evidence, public awareness regarding the therapeutic potential of stem cells is on the rise across the globe. Moreover, stem cells have been proven to treat ~80 diseases and disorders including hematopoietic disorders, immunodeficiency diseases, metabolic disorders, cancer, and degenerative neuromuscular disorders. With the continued rise in per capita disposable income across developing nations and an expected decline in product costs associated with stem cell therapies, public awareness and the adoption of stem cell therapies, as well as stem cell banking services, are expected to grow during the study period.

Restraints: High operational costs of stem cell banking

Cell banks, tissue banks, and biobanks incur significant expenditure during the sample processing, quality testing, and sample preservation and storage processes. This does not include spending on the purchase and maintenance of premium-priced instruments, reagents, and consumables. This results in high operational costs for service providers. Moreover, increasingly stringent and mandatory regulatory requirements related to stem cell preservation and banking—as well as the costly licensing/approval process for the establishment of stem cell banks in developed nations—are expected to further contribute to the overall operational costs for stem cell banking service providers.

Stem Cell Banking Market Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2016-2023 |

|

Base Year Considered |

2017 |

|

Forecast Period |

2018–2023 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Source, service type application, and region |

|

Geographies Covered |

North America, Europe, APAC, and the RoW |

|

Companies Covered |

Cord Blood Registry (CBR) Systems (US), Cordlife Group Limited (Singapore), Cryo-Cell International (US), ViaCord (US), Cryo-Save AG (Netherlands), LifeCell International (India), StemCyte (US), Global Cord Blood Corporation (China), Smart Cells International (UK), Vita34 AG (Germany), and CryoHoldco (Mexico). |

This report categorizes the stem cell banking market into the following segments and subsegments:

By Source

- Placental Stem Cells (PSCS)

- Adipose Tissue-Derived Stem Cells (ADSCS)

- Bone Marrow-Derived Stem Cells (BMSCS)

- Human Embryo-Derived Stem Cells (HESCS)

- Dental Pulp-Derived Stem Cells (DPSCS)

- Other Stem Cell Sources

By Service Type

- Sample Preservation and Storage

- Sample Analysis

- Sample Processing

- Sample Collection and Transportation

By Application

- Personalized Banking Applications

-

Research Applications

- Disease Treatment Studies

- Life Science Research

- Drug Discovery

-

Clinical Application

- Hematopoietic Disorders

- Autoimmune Disorders

- Other Diseases

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Stem Cell Banking Market Key Players

Global stem cell banking market was dominated by Cord Blood Registry (CBR) Systems (US), Cordlife Group Limited (Singapore), Cryo-Cell International (US), and ViaCord (US). Other key players in the stem cell banking market included Cryo-Save AG (Netherlands), LifeCell International (India), StemCyte (US), Global Cord Blood Corporation (China), Smart Cells International (UK), Vita34 AG (Germany), and CryoHoldco (Mexico), among others.

Cord Blood Registry (CBR) Systems held the leading position in the global stem cell banking market in 2017. The company has a widespread presence and large customer base in the US. The company primarily focuses on advancing its umbilical cord preservation services through the adoption of inorganic growth strategies such as collaborations and partnerships. In regard to this, in 2017, the company collaborated with the New York Stem Cell Foundation (US) to develop induced pluripotent stem cells from umbilical cords. In addition to this, in 2015, the company entered into a strategic collaboration with Global Cord Blood Corporation (China) to integrated their methodologies for the collection, processing, and storage of umbilical cords and improve the overall stem cell banking service standards in the US and China.

Cordlife secured the second position in the global stem cell banking market in 2017. The company is a leading player in the Asian stem cell banking market with its robust presence across eight countries and high-quality services. To sustain its leading position in the Asian region, the company mainly focuses on increasing its customer base through agreements. For instance, in 2017, the company entered into an agreement with IPS Trading and Service Joint Stock Company (Vietnam) to offer umbilical cord banking services and non-invasive metabolic newborn screening in Vietnam. Similarly, in 2016, the company collaborated with Bio Secure Company Limited (Myanmar) to offer umbilical cord banking services in Myanmar.

Cryo-Cell International held the third position in the stem cell banking market in 2017. The company is one of the key private stem cell banking providers in the global market. The company’s key strengths are its significant geographic presence and unique state-of-the-art technology for banking operations. The company mainly focuses on acquiring patents for the collection, testing, processing, and preservation of umbilical cord blood and tissues. For instance, in 2015, the company acquired assets of Prepacyte-CB (a cord blood business of CytoMedical Design Group LLC) to advance its existing technology for processing of cord blood and tissues.

Recent Developments:

- In 2017, Life Cell International (India), launched upgraded and enhanced its umbilical cord collection kit

- In 2017, Vita34 AG (Germany) acquired Seracell Pharma AG (Germany) to strengthen its position in the German stem cell banking market.

- In 2016, StemCyte India Therapeutics Pvt. Ltd. (India), a subsidiary of StemCyte (US) received accreditation from The Foundation for the Accreditation of Cellular Therapy (FACT) for both public and private stem cell banking services.

- In 2015, Cord Blood Registry (CBR) Systems (US) entered into a collaboration agreement with New York Stem Cell Foundation (US) to develop induced pluripotent stem cells from umbilical cords

Key questions addressed in the report:

- What are the growth opportunities related to stem cell banking market across major regions in the future?

- Emerging countries have immense opportunities for the growth and adoption of stem cell banking. Will this scenario continue in the next five years?

- What are the various types of stem cell banking services and their market share in the overall market?

- What are the new trends and advancements in the applications segment?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Markets Covered

1.2.2 Geographic Scope

1.2.3 Years Considered for the Study

1.3 Currency Used

1.4 Market Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Data From Primary Sources

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

2.5 Research Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Stem Cell Banking: Market Overview (2018)

4.2 Stem Cell Banking Market, By Source (2018 vs 2023)

4.3 Market, By Application (2018 vs 2023)

4.4 Market, By Service Type (2018 vs 2023)

4.5 Geographic Snapshot: Market (2018)

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Market Drivers

5.2.1.1 Growing Awareness on the Therapeutic Potential of Stem Cells

5.2.1.2 Development of Novel Technologies for Stem Cell Preservation, Processing, and Storage

5.2.1.3 Increase in HematopOIEtic Stem Cell Transplantation Procedures

5.2.1.4 Increasing Investments in Stem Cell-Based Research

5.2.2 Market Restraints

5.2.2.1 High Operational Costs of Stem Cell Banking

5.2.2.2 Stringent Regulatory Frameworks

5.2.3 Market Opportunities

5.2.3.1 Emerging Countries

5.2.3.2 Rising Global Burden of Major Diseases

5.2.4 Market Challenge

5.2.4.1 Socio-Ethical Concerns Related to Embryonic Stem Cells

6 Stem Cell Banking Market, By Source (Page No. - 41)

6.1 Introduction

6.2 Placental Stem Cells (PSCS)

6.3 Adipose Tissue-Derived Stem Cells (ADSCS)

6.4 Bone Marrow-Derived Stem Cells (BMSCS)

6.5 Human Embryo-Derived Stem Cells (HESCS)

6.6 Dental Pulp-Derived Stem Cells (DPSCS)

6.7 Other Stem Cell Sources

7 Stem Cell Banking Market, By Service Type (Page No. - 49)

7.1 Introduction

7.2 Sample Preservation and Storage

7.3 Sample Analysis

7.4 Sample Processing

7.5 Sample Collection and Transportation

8 Stem Cell Banking Market, By Application (Page No. - 56)

8.1 Introduction

8.2 Personalized Banking Applications

8.3 Research Applications

8.3.1 Disease Treatment Studies

8.3.2 Life Science Research

8.3.3 Drug Discovery

8.4 Clinical Applications

8.4.1 HematopOIEtic Disorders

8.4.2 Autoimmune Disorders

8.4.3 Other Diseases

9 Stem Cell Banking Market, By Region (Page No. - 67)

9.1 Introduction

9.2 North America

9.3 Europe

9.4 Asia Pacific

9.5 RoW

10 Competitive Landscape (Page No. - 90)

10.1 Overview

10.2 Global Market Ranking Analysis (2017)

10.3 Competitive Scenario

10.3.1 Agreements, Partnerships, and Collaborations

10.3.2 Mergers and Acquisitions

10.3.3 Service Launches and Enhancements

10.3.4 Other Developments

11 Company Profile (Page No. - 94)

(Overview, Services Offered, Recent Developments, MnM View)*

11.1 Cord Blood Registry Systems

11.2 Cordlife

11.3 Cryo-Cell International

11.4 Cryo-Save AG (A Subsidiary of Esperite N.V)

11.5 LifeCell International

11.6 StemCyte

11.7 ViaCord (A Subsidiary of Perkinelmer)

11.8 Global Cord Blood

11.9 Smart Cells International

11.10 Vita34

11.11 CryoHoldco

* Overview, Services Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 116)

12.1 Discussion Guide*

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (58 Tables)

Table 1 Operational/Procedural Costs Associated With Stem Cell Banking in the Us (2012)

Table 2 Market, By Source, 2016–2023 (USD Million)

Table 3 Market for Placental Stem Cells, By Region, 2016–2023 (USD Million)

Table 4 Market for Adipose Tissue-Derived Stem Cells, By Region, 2016–2023 (USD Million)

Table 5 Market for Bone Marrow-Derived Stem Cells, By Region, 2016–2023 (USD Million)

Table 6 Market for Human Embryo-Derived Stem Cells, By Region, 2016–2023 (USD Million)

Table 7 Market for Dental Pulp-Derived Stem Cells, By Region, 2016–2023 (USD Million)

Table 8 Market for Other Stem Cell Sources, By Region, 2016–2023 (USD Million)

Table 9 Market, By Service Type, 2016-2023 (USD Million)

Table 10 Market for Sample Preservation and Storage, By Region, 2016-2023 (USD Million)

Table 11 Market for Sample Analysis, By Region, 2016-2023 (USD Million)

Table 12 Market for Sample Processing, By Region, 2016-2023 (USD Million)

Table 13 Market for Sample Collection and Transportation, By Region, 2016-2023 (USD Million)

Table 14 Market, By Application, 2016–2023 (USD Million)

Table 15 Market for Personalized Banking Applications, By Region, 2016–2023 (USD Million)

Table 16 Global Market for Research Applications, By Type, 2016–2023 (USD Million)

Table 17 Market for Research Applications, By Region, 2016–2023 (USD Million)

Table 18 Market for Disease Treatment Studies, By Region, 2016–2023 (USD Million)

Table 19 Market for Life Science Research, By Region, 2016–2023 (USD Million)

Table 20 Market for Drug Discovery, By Region, 2016–2023 (USD Million)

Table 21 Global Market for Clinical Applications, By Disease Area, 2016–2023 (USD Million)

Table 22 Market for Clinical Applications, By Region, 2016–2023 (USD Million)

Table 23 Market for Hematopoietic Disorders, By Region, 2016–2023 (USD Million)

Table 24 Market for Autoimmune Disorders, By Region, 2016–2023 (USD Million)

Table 25 Market for Other Diseases, By Region, 2016–2023 (USD Million)

Table 26 Market, By Region, 2016–2023 (USD Million)

Table 27 Market, By Region (Units Stored)

Table 28 Market, By Country, 2016–2023 (USD Million)

Table 29 North America: Market, By Country, 2016–2023 (USD Million)

Table 30 North America: Market, By Country (Units Stored)

Table 31 North America: Market, By Source, 2016–2023 (USD Million)

Table 32 North America: Market, By Service Type, 2016–2023 (USD Million)

Table 33 North America: Market, By Application, 2016–2023 (USD Million)

Table 34 North America: Market for Clinical Applications, By Disease Area, 2016–2023 (USD Million)

Table 35 North America: Market for Research Applications, By Type, 2016–2023 (USD Million)

Table 36 Europe: Market, By Country, 2016–2023 (USD Million)

Table 37 Europe: Market, By Country (Units Stored)

Table 38 Europe: Market, By Source, 2016–2023 (USD Million)

Table 39 Europe: Market, By Service Type, 2016–2023 (USD Million)

Table 40 Europe: Market, By Application, 2016–2023 (USD Million)

Table 41 Europe: Market for Clinical Applications, By Disease Area, 2016–2023 (USD Million)

Table 42 Europe: Market for Research Applications, By Type, 2016–2023 (USD Million)

Table 43 Asia Pacific: Market, By Country, 2016–2023 (USD Million)

Table 44 Asia Pacific: Market, By Country (Units Stored)

Table 45 Asia Pacific: Market, By Source, 2016–2023 (USD Million)

Table 46 Asia Pacific: Market, By Service Type, 2016–2023 (USD Million)

Table 47 Asia Pacific: Market, By Application, 2016–2023 (USD Million)

Table 48 Asia Pacific: Market for Clinical Applications, By Disease Area, 2016–2023 (USD Million)

Table 49 Asia Pacific: Market for Research Applications, By Type, 2016–2023 (USD Million)

Table 50 RoW: Market, By Source, 2016–2023 (USD Million)

Table 51 RoW: Market, By Service Type, 2016–2023 (USD Million)

Table 52 RoW: Market, By Application, 2016–2023 (USD Million)

Table 53 RoW: Market for Clinical Applications, By Disease Area, 2016–2023 (USD Million)

Table 54 RoW: Market for Research Applications, By Type, 2016-2023 (USD Million)

Table 55 Major Agreements, Partnerships, and Collaborations (2015–2018)

Table 56 Major Mergers and Acquisitions (2015–2018)

Table 57 Major Service Launches and Enhancements (2015–2018)

Table 58 Other Major Developments (2015–2018)

List of Figures (31 Figures)

Figure 1 Global Market: Research Methodology Steps

Figure 2 Research Design

Figure 3 Market: Bottom-Up Approach

Figure 4 Market: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Placental Stem Cells Segment to Dominate the Global Stem Cell Banking Market During the Forecast Period

Figure 7 Personalized Banking Applications to Witness the Highest Growth During the Forecast Period (2018–2023)

Figure 8 Sample Preservation and Storage to Be the Fastest-Growing Segment of the Stem Cell Banking Services Market During 2018–2023

Figure 9 Asia Pacific to Witness Fastest Growth for Stem Cell Banking Services During the Forecast Period

Figure 10 Rising Awareness on the Therapeutic Potentials of Stem Cells to Drive the Global Market During the Forecast Period

Figure 11 Placental Stem Cells is Poised to Be the Key Cell Type in Global Stem Cell Banking Market During the Forecast Period

Figure 12 Personalized Banking Applications to Dominate the Market in 2023

Figure 13 Sample Preservation and Storage Services to Be the Fastest-Growing Segment During the Forecast Period

Figure 14 North America to Dominate the Global Market During the Forecast Period

Figure 15 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Placental Stem Cells Segment to Dominate the Global Market During the Forecast Period

Figure 17 Market, By Service Type (2018 vs 2023)

Figure 18 Personalized Banking Applications to Witness the Highest Growth During the Forecast Period (2018–2023)

Figure 19 Geographic Snapshot: Asia Pacific to Register the Highest CAGR in Market During the Forecast Period

Figure 20 North America: Market Snapshot

Figure 21 Europe: Market Snapshot

Figure 22 Asia Pacific: Market Snapshot

Figure 23 RoW: Market Snapshot

Figure 24 Global Market Ranking Analysis, By Key Service Providers (2017)

Figure 25 AMAG Pharmaceuticals: Company Snapshot (2017)

Figure 26 Cordlife: Company Snapshot (2017)

Figure 27 Cryo-Cell International: Company Snapshot (2017)

Figure 28 Esperite: Company Snapshot (2016)

Figure 29 Perkinelmer: Company Snapshot (2016)

Figure 30 Global Cord Blood: Company Snapshot (2017)

Figure 31 Vita34 AG : Company Snapshot (2017)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Stem Cell Banking Market