Steel Wire Rope & Plastic Rope Market by Type of Lay (Regular Lay, Lang Lay), Material Type (PP, PET, Nylon, HMPE, Specialty fibers), Application (Marine & Fishing, Sports & Leisure, Oil & Gas, Industrial & Crane) Region - Global Forecast to 2026

Updated on : August 07, 2024

Steel Wire Rope Market and Plastic Rope Market

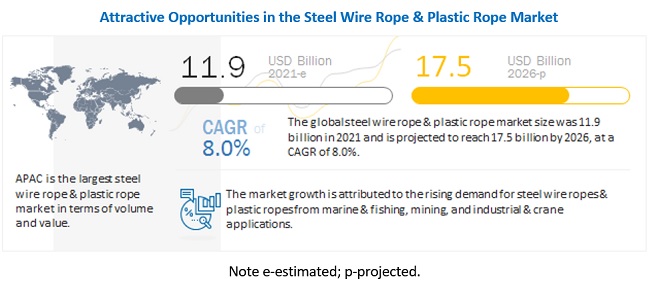

The steel wire rope market and plastic rope market was valued at USD 11.9 billion in 2021 and is projected to reach USD 17.5 billion by 2026, growing at 8.0% cagr from 2021 to 2026. The global steel wire rope & plastic rope industry is growing due to the rise in demand for steel wire ropes & plastic ropes from various applications, globally. The demand for steel wire ropes & plastic ropes has declined in 2020 due to COVID-19. However, the end of lockdown and recovery in the end-use applications will stimulate the demand during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on global steel wire rope & plastic rope market

The steel wire rope & plastic rope market has witnessed a decline in 2020 due to the COVID-19 pandemic. This deadly virus has adversely affected the entire globe, especially the North American and European regions. To prevent the further spread of this virus, companies have shut down their operations and manufacturing facilities. This has led to a reduction in the consumption of steel wire ropes & plastic ropes across marine & fishing, sports & leisure, oil & gas, industrial & crane, mining, construction, and other applications.

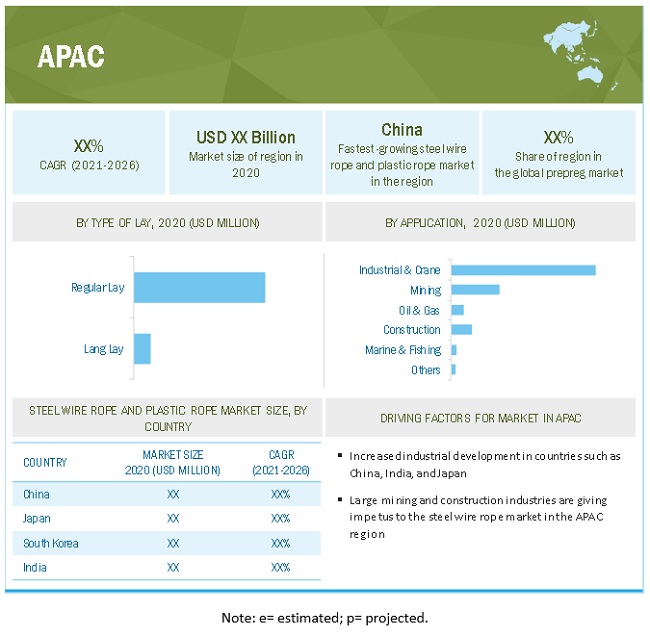

Growing fishing and mining sectors in APAC

Steel wire ropes and plastic ropes have high applicability in the marine & fishing and mining sectors. Plastic ropes are less prone to corrosion and have floating properties that make them suitable for use in fishing activities. In mining applications, steel wire ropes are preferred due to their high load-bearing strength. In APAC, the fishing and mining sectors are among the booming sectors, especially in countries such as China, Indonesia, Japan, and India. APAC led the total aquaculture production and accounted for 89% of the global aquaculture production in 2013. In addition, APAC has the world’s largest mineral reserves. This is expected to help the steel wire ropes and plastic ropes manufacturers with immense growth opportunities in the region.

High cost of raw materials and frequent preventive maintenance of plastic ropes is a major restrain for the market

Plastic ropes are made from plastic fibers, which are highly expensive in nature. Raw materials or plastic fibers, such as PE, PP, and nylon, used for manufacturing ropes are more expensive than steel. High-performance specialty fibers, such as HMPE, LCP, and aramid, are more expensive than the above-mentioned raw materials. More the strength of the fiber, the higher is the price.

Once plastic ropes are made, they need to be regularly checked so that the replacement costs can be prevented. Although plastic ropes possess high strength, during long-term usage, plastic fibers become susceptible to abrasion and UV radiation, due to which they have to undergo frequent inspections for frays and other damages. It becomes difficult to visually access the functioning faults of plastic ropes, which can be done easily in the case of steel wire ropes. Therefore, high preventive maintenance requirements of plastic ropes discourage end-use industries from opting for plastic ropes despite the fact that these ropes are safer to use as compared to steel wire ropes.

Market recovery post COVID-19

The COVID-19 outbreak has drastically altered the demand for steel wire ropes & plastic ropes across the globe due to a decline in demand from the end-use applications. The pandemic has abruptly interrupted the operations and global supply chain across various industries, which in turn has slowed down the growth of the steel wire rope & plastic rope market. Various countries have imposed lockdown to prevent the further spread of the virus. Europe and North America are the most severely affected regions due to COVID-19. Companies need to cope with this sudden impact brought by the pandemic and have to efficiently work on their supply chain and improve their distribution network to capture the demand for steel wire ropes & plastic ropes in the near future and tackle the sudden fluctuations in the market.

Need to maintain uninterrupted supply chain and operate at full capacity post COVID-19

The global marine & fishing, industrial & crane, construction, and other industries have witnessed adverse and immediate consequences of the COVID-19 pandemic. These are the worst-affected industries, and the biggest challenge for steel wire ropes & plastic ropes manufacturers is to resume production at their original capacities and make up for the revenue loss and damage caused by the pandemic. The COVID-19 pandemic has created ripples across the global steel wire rope & plastic rope industries due to the closure of national and international borders, leading to disrupted supply chains. The challenges in the current and future scenarios for the steel wire rope & plastic rope industry are to ensure the smooth flow of global supply chains, responsible for rapidly transporting materials and components across borders and fabrication facilities. These industries have to make up for the delays or non-arrival of raw materials.

To know about the assumptions considered for the study, download the pdf brochure

APAC held the largest market share in the steel wire rope & plastic rope market

The region has a largest share in terms of volume and value in the steel wire rope & plastic rope market owing to its increasing demand from industrial & crane, mining, and construction sectors. Due to COVID-19, numerous industries and companies have halted their production sites across various countries that has led to reduced demand for steel wire ropes & plastic ropes in APAC countries. The recovery in the end-use applications with restoration in the supply chain would drive the steel wire ropes & plastic ropes demand during the forecast period

Steel Wire Rope and Plastic Rope Market Players

The key players in the global steel wire rope & plastic rope market are:

- Cortland Limited (US)

- WireCo WorldGroup Inc., (US)

- Samson Rope Technologies (US)

- Southern Ropes (South Africa)

- English Braids Ltd. (UK)

- Marlow Ropes (UK)

- Teufelberger Holding AG (Austria)

- Bekaert SA (Belgium)

- Usha Martin (India)

- Gustav Wolf (Germany)

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the steel wire rope & plastic rope industry. The study includes an in-depth competitive analysis of these key players in the steel wire rope & plastic rope market, with their company profiles, recent developments, and key market strategies.

Steel Wire Rope and Plastic Rope Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2017–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments |

By Type, Application and Region |

|

Regions |

Europe, North America, APAC, MEA, and Latin America |

|

Companies |

Cortland Limited (US), WireCo WorldGroup Inc., (US), Samson Rope Technologies (US), Southern Ropes (South Africa) and English Braids Ltd. (UK), are some of the key players in the steel wire rope & plastic rope market. Marlow Ropes (UK), Teufelberger Holding AG (Austria), Bekaert SA (Belgium), Usha Martin (India) and Gustav Wolf (Germany) |

This research report categorizes the steel wire rope & plastic rope market based on type, resin type, end-use application, and region.

Steel wire ropes: By Type of Lay:

- Regular Lay

- Lang Lay

Plastic ropes: By Material Type:

- Polypropylene

- Polyester

- Nylon

- HMPE

- Specialty Fibers

By Application:

- Marine & Fishing

- Sports & Leisure

- Oil & Gas

- Industrial & Crane

- Mining

- Construction

- Others

By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments

- In August 2020, Samson Rope Technologies Launched HyperClimb rope solution with excellent stationary and moving rope system. This rope is a double braid, 11.7mm polyester rope with low elongation capability.

- In February 2020, AGRO and Bekaert start a joint venture in Colombia. AGRO, a global leader in manufacturing high-quality inner springs merged with Bekaert for producing high-end steel wire innerspring systems. This merger will help to increase the supply of ropes in Central America.

- In June 2019, WireCo WorldGroup entered into an agreement to supply replacement hangers for the George Washington Bridge. The company will be supplying its patented high-temperature socketing material.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the steel wire rope & plastic rope market?

High demand from end-use applications due to superior performance properties has driving the market.

Which is the fastest-growing region-level market for steel wire rope & plastic rope?

APAC is the fastest-growing steel wire rope & plastic rope market due to the presence of major manufacturers and the burgeoning growth of various end-use applications.

What are the factors contributing to the final price of steel wire rope & plastic rope?

Raw material plays a vital role in the costs. The cost of these materials contributes largely to the final pricing of steel wire ropes & plastic ropes.

What are the challenges in the steel wire rope & plastic rope market?

Corrosion of steel wire ropes and lack of awareness of advantages of plastic ropes are the major challenge in the steel wire rope & plastic rope market.

Which type of lay in steel wire ropes holds the largest market share?

Regular type of lay in terms of value hold the largest share due to wide uses in multiple end-use applications.

How is the steel wire rope & plastic rope market aligned?

The market is growing at a significant pace. It is a potential market and many manufactures are planning business strategies to expand their business.

Who are the major manufacturers?

Cortland Limited (US), WireCo WorldGroup Inc., (US), Samson Rope Technologies (US), Southern Ropes (South Africa) and English Braids Ltd. (UK), are some of the key players in the steel wire rope & plastic rope market.

Which type of materials are used in the production of plastic ropes?

Polypropylene, polyester, nylon, HMPE and specialty fiber are the major materials used in manufacturing plastic ropes.

What are the major applications for steel wire rope & plastic rope?

The major applications of steel wire ropes & plastic ropes marine & fishing, sports & leisure, industrial & crane, oil & gas, mining, construction and others.

What is the biggest opportunity in the plastic rope market?

Increasing use of HMPE and specialty fiber ropes for mooring in marine applications is the major opportunity of the plastic rope market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 STEEL WIRE ROPE & PLASTIC ROPE MARKET SEGMENTATION

1.3.1 REGIONS COVERED FOR STEEL WIRE ROPE MARKET

1.3.2 REGIONS COVERED FOR PLASTIC ROPE MARKET

1.3.3 YEARS CONSIDERED IN THE REPORT

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 2 STEEL WIRE ROPE & PLASTIC ROPE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

TABLE 1 PRIMARIES

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.2.3 SUPPLY-SIDE ANALYSIS

2.2.4 DEMAND-SIDE ANALYSIS

2.3 DATA TRIANGULATION

FIGURE 5 STEEL WIRE ROPE & PLASTIC ROPE MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS

2.6 STEEL WIRE ROPE & PLASTIC ROPE MARKET – FORECAST TO 2025, RISK ASSESSMENT

TABLE 2 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 6 REGULAR LAY SEGMENT DOMINATED THE STEEL WIRE ROPE MARKET IN 2020

FIGURE 7 POLYPROPYLENE SEGMENT LED THE PLASTIC ROPE MARKET IN 2020

FIGURE 8 INDUSTRIAL & CRANE APPLICATION LED THE OVERALL STEEL WIRE ROPE & PLASTIC ROPE MARKET

FIGURE 9 APAC TO BE THE LARGEST AND FASTEST-GROWING STEEL WIRE ROPE & PLASTIC ROPE MARKET

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE OPPORTUNITIES IN STEEL WIRE ROPE & PLASTIC ROPE MARKET

FIGURE 10 SIGNIFICANT GROWTH EXPECTED IN THE STEEL WIRE ROPE & PLASTIC ROPE MARKET BETWEEN 2021 AND 2026

4.2 STEEL WIRE ROPE & PLASTIC ROPE MARKET, BY APPLICATION AND REGION

FIGURE 11 APAC AND INDUSTRIAL & CRANE APPLICATION TO DRIVE STEEL WIRE ROPE & PLASTIC ROPE MARKET BETWEEN 2021 AND 2026

4.3 STEEL WIRE ROPE MARKET, BY TYPE OF LAY (2020)

FIGURE 12 REGULAR LAY ACCOUNTED FOR LARGER SHARE OF STEEL WIRE MARKET

4.4 PLASTIC ROPE MARKET SHARE, BY MATERIAL TYPE (2020)

FIGURE 13 PROPYLENE MATERIAL TYPE ACCOUNTED FOR LARGEST SHARE OF PLASTIC ROPE MARKET

4.5 STEEL WIRE ROPE MARKET, BY COUNTRY

FIGURE 14 CHINA TO BE FASTEST-GROWING STEEL WIRE ROPE MARKET (2021–2026)

4.6 PLASTIC ROPE MARKET, BY COUNTRY

FIGURE 15 CHINA TO BE FASTEST-GROWING PLASTIC ROPE MARKETS (2021–2026)

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN STEEL WIRE ROPE & PLASTIC ROPE MARKET

5.2.1 DRIVERS

5.2.1.1 High strength and low weight of plastic ropes

5.2.1.2 Safety aspects of plastic ropes

5.2.1.3 Infrastructural development, increased industrial activities, and growth in mining industry

TABLE 3 STEEL WIRE ROPE & PLASTIC ROPE MARKET GROWTH IN MINING INDUSTRY: MEGA DEALS OF MINING INDUSTRY, 2019-2020

5.2.2 RESTRAINTS

5.2.2.1 High cost of raw materials and frequent preventive maintenance of plastic ropes

5.2.2.2 Declining economy due to COVID-19

5.2.3 OPPORTUNITIES

5.2.3.1 Plastic ropes as a better alternative to steel wire ropes

5.2.3.2 Growing fishing and mining sectors in APAC

5.2.3.3 Increasing use of HMPE and specialty fiber ropes for mooring in marine applications

5.2.4 CHALLENGES

5.2.4.1 Lack of awareness about advantages of use of plastic ropes

5.2.4.2 Corrosion of steel wire ropes

5.3 SUPPLY CHAIN ANALYSIS

TABLE 4 STEEL WIRE ROPE & PLASTIC ROPE MARKET: SUPPLY CHAIN

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 STEEL WIRE ROPE & PLASTIC ROPE MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF BUYERS

5.4.2 BARGAINING POWER OF SUPPLIERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTES

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 5 STEEL WIRE ROPE & PLASTIC WIRE ROPE MARKET: PORTER’S FIVE FORCES ANALYSIS

5.5 ECOSYSTEM: STEEL WIRE ROPE MARKET

5.6 VALUE CHAIN ANALYSIS

FIGURE 18 VALUE CHAIN ANALYSIS

5.7 IMPACT OF COVID-19 ON STEEL WIRE ROPE & PLASTIC ROPE VALUE CHAIN

5.7.1 RAW MATERIALS

5.7.2 ROPE MANUFACTURERS

5.7.3 APPLICATIONS

5.8 TECHNOLOGY ANALYSIS

5.9 PRICING ANALYSIS

5.10 AVERAGE SELLING PRICE

TABLE 6 STEEL WIRE ROPES & PLASTIC ROPES AVERAGE SELLING PRICE, BY REGION

5.11 PATENT ANALYSIS

5.11.1 INTRODUCTION

5.11.2 METHODOLOGY

5.11.3 DOCUMENT TYPE

FIGURE 19 PUBLICATION TRENDS - LAST 10 YEARS

5.11.4 INSIGHT

FIGURE 20 PATENT JURISDICTION ANALYSIS, 2020

5.11.5 TOP APPLICANTS OF PATENTS

FIGURE 21 TOP APPLICANTS OF PATENTS

5.11.6 LIST OF PATENTS BY CHINA UNIVERSITY OF MINING AND TECHNOLOGY

5.11.7 LIST OF PATENTS BY ZOOMLION HEAVY IND SCI & TECH.

5.11.8 LIST OF PATENTS BY KONE CORP.

5.11.9 LIST OF PATENTS BY JIANGSU FASTEN TECH DEVELOPMENT CENTER CO LTD.

5.11.10 LIST OF PATENTS BY UNIV TAIYUAN TECHNOLOGY

5.11.11 LIST OF PATENTS BY XUZHOU COAL MINE SAFETY EQUIPMENT MFT CO LTD

5.11.12 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

5.12 TARIFF AND REGULATIONS

5.13 KEY MARKET FOR IMPORT/EXPORT

5.13.1 US

5.13.2 GERMANY

5.13.3 FRANCE

5.13.4 CHINA

5.14 COVID-19 IMPACT ON THE MARKET

5.15 CASE STUDY ANALYSIS

5.16 STEEL WIRE ROPE & PLASTIC ROPE YC AND YCC SHIFT

6 STEEL WIRE ROPE &PLASTIC ROPE MARKET, BY TYPE (Page No. - 73)

6.1 INTRODUCTION

6.2 STEEL WIRE ROPE MARKET, BY TYPE OF LAY

6.2.1 INTRODUCTION

FIGURE 22 REGULAR LAY SEGMENT TO DOMINATE THE MARKET FOR STEEL WIRE ROPES

TABLE 7 STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2017-2020 (USD MILLION)

TABLE 8 STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2017–2020 (KILOTON)

TABLE 9 STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2021–2026 (USD MILLION)

TABLE 10 STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2021–2026 (KILOTON)

6.2.2 REGULAR LAY

6.2.2.1 Regular lay ropes are used in a wide range of applications, starting from industrial to fishing & marine

FIGURE 23 APAC TO BE THE LARGEST MARKET FOR REGULAR LAY STEEL WIRE ROPES

TABLE 11 REGULAR LAY STEEL WIRE ROPE MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

TABLE 12 REGULAR LAY STEEL WIRE ROPE MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 13 REGULAR LAY STEEL WIRE ROPE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 14 REGULAR LAY STEEL WIRE ROPE MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

6.2.3 LANG LAY

6.2.3.1 Lang lay ropes have higher flexibility and abrasion resistance

TABLE 15 LANG LAY STEEL WIRE ROPE MARKET, BY REGION, 2017-2020 (USD MILLION)

TABLE 16 LANG LAY STEEL WIRE ROPE MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 17 LANG LAY STEEL WIRE ROPE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 18 LANG LAY STEEL WIRE ROPE MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

6.3 PLASTIC ROPE MARKET, BY MATERIAL TYPE

6.3.1 INTRODUCTION

FIGURE 24 POLYPROPYLENE SEGMENT LED THE PLASTIC ROPE MARKET

TABLE 19 PLASTIC ROPE MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 20 PLASTIC ROPE MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 21 PLASTIC ROPE MARKET SIZE, BY MATERIAL TYPE, 2021–2026 (USD MILLION)

TABLE 22 PLASTIC ROPE MARKET SIZE, BY MATERIAL TYPE, 2021–2026 (KILOTON)

6.3.2 POLYPROPYLENE

6.3.2.1 Polypropylene ropes, slightly thicker than polyester and nylon ones, have good chemical resistance

FIGURE 25 MARINE & FISHING TO BE THE LARGEST APPLICATION FOR POLYPROPYLENE ROPES

TABLE 23 POLYPROPYLENE ROPE MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

TABLE 24 POLYPROPYLENE ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 25 POLYPROPYLENE ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 26 POLYPROPYLENE ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

FIGURE 26 NORTH AMERICA TO BE THE LARGEST MARKET FOR POLYPROPYLENE ROPES

TABLE 27 POLYPROPYLENE ROPE MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

TABLE 28 POLYPROPYLENE ROPE MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 29 POLYPROPYLENE ROPE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 30 POLYPROPYLENE ROPE MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

6.3.3 POLYESTER

6.3.3.1 Polyester ropes retain their strength when exposed to moisture

FIGURE 27 MARINE & FISHING TO BE THE LEADING APPLICATION FOR POLYESTER ROPES

TABLE 31 POLYESTER ROPE MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

TABLE 32 POLYESTER ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 33 POLYESTER ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 34 POLYESTER ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

FIGURE 28 NORTH AMERICA TO BE THE LARGEST MARKET FOR POLYESTER ROPES

TABLE 35 POLYESTER ROPE MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

TABLE 36 POLYESTER ROPE MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 37 POLYESTER ROPE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 38 POLYESTER ROPE MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

6.3.4 NYLON

6.3.4.1 Widely used as towing lines due to good elastic properties

FIGURE 29 MARINE & FISHING TO BE THE LARGEST APPLICATION FOR NYLON ROPE MARKET

TABLE 39 NYLON ROPE MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

TABLE 40 NYLON ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 41 NYLON ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 42 NYLON ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 43 NYLON ROPE MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

TABLE 44 NYLON ROPE MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 45 NYLON ROPE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 46 NYLON ROPE MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

6.3.5 HMPE

6.3.5.1 Sui TABLE for use in marine & fishing application as they float in water

TABLE 47 HMPE ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 48 HMPE ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 49 HMPE ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 50 HMPE ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 51 HMPE ROPE MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

TABLE 52 HMPE ROPE MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 53 HMPE ROPE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 54 HMPE ROPE MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

6.3.6 SPECIALTY FIBERS

6.3.6.1 Finding applications in various end-use industries

TABLE 55 SPECIALTY FIBER ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 56 SPECIALTY FIBER ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 57 SPECIALTY FIBER ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 58 SPECIALTY FIBER ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 59 SPECIALTY FIBER ROPE MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

TABLE 60 SPECIALTY FIBER ROPE MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 61 SPECIALTY FIBER ROPE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 62 SPECIALTY FIBER ROPE MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

7 STEEL WIRE ROPE & PLASTIC ROPE MARKET, BY APPLICATION (Page No. - 98)

7.1 INTRODUCTION

FIGURE 30 INDUSTRIAL & CRANE TO BE THE LARGEST SEGMENT OF THE MARKET

TABLE 63 STEEL WIRE ROPE & & PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 64 STEEL WIRE ROPE & PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 65 STEEL WIRE ROPE & PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 66 STEEL WIRE ROPE & PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

7.2 STEEL WIRE ROPE MARKET, BY APPLICATION

7.2.1 INTRODUCTION

FIGURE 31 STEEL WIRE ROPE MARKET TO REGISTER THE HIGHEST GROWTH IN THE INDUSTRIAL & CRANE APPLICATION

TABLE 67 FINISHED STEEL CONSUMPTION SHARE WORLDWIDE, BY END-USE INDUSTRY, 2019

TABLE 68 STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 69 STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 70 STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 71 STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

7.2.2 INDUSTRIAL & CRANE

7.2.2.1 High demand for steel wire ropes due to resistance to rotation, abrasion, and corrosion

FIGURE 32 APAC TO DRIVE THE STEEL WIRE ROPES MARKET IN THE INDUSTRIAL & CRANE APPLICATION

TABLE 72 STEEL WIRE ROPE MARKET SIZE IN INDUSTRIAL & CRANE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 73 STEEL WIRE ROPE MARKET SIZE IN INDUSTRIAL & CRANE APPLICATION, BY REGION, 2017–2020 (KILOTON)

TABLE 74 STEEL WIRE ROPE MARKET SIZE IN INDUSTRIAL & CRANE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 75 STEEL WIRE ROPE MARKET SIZE IN INDUSTRIAL & CRANE APPLICATION, BY REGION, 2021–2026 (KILOTON)

7.2.3 MINING

7.2.3.1 Use of steel wire ropes due to high tensile strength and breaking load

FIGURE 33 APAC TO DOMINATE STEEL WIRE ROPE MARKET IN MINING APPLICATION

TABLE 76 STEEL WIRE ROPE MARKET SIZE IN MINING APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 77 STEEL WIRE ROPE MARKET SIZE IN MINING APPLICATION, BY REGION, 2017–2020 (KILOTON)

TABLE 78 STEEL WIRE ROPE MARKET SIZE IN MINING APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 79 STEEL WIRE ROPE MARKET SIZE IN MINING APPLICATION, BY REGION, 2021–2026 (KILOTON)

7.2.4 OIL & GAS

7.2.4.1 High strength steel wire ropes complying with safety standards in oil & gas applications

FIGURE 34 NORTH AMERICA TO DOMINATE THE STEEL WIRE ROPE MARKET IN OIL & GAS APPLICATION

TABLE 80 STEEL WIRE ROPE MARKET SIZE IN OIL & GAS APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 81 STEEL WIRE ROPE MARKET SIZE IN OIL & GAS APPLICATION, BY REGION, 2017–2020 (KILOTON)

TABLE 82 STEEL WIRE ROPE MARKET SIZE IN OIL & GAS APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 83 STEEL WIRE ROPE MARKET SIZE IN OIL & GAS APPLICATION, BY REGION, 2021–2026 (KILOTON)

7.2.5 CONSTRUCTION

7.2.5.1 Growth in construction activities in APAC increasing demand for steel wire ropes

TABLE 84 STEEL WIRE ROPE MARKET SIZE IN CONSTRUCTION APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 85 STEEL WIRE ROPE MARKET SIZE IN CONSTRUCTION APPLICATION, BY REGION, 2017–2020 (KILOTON)

TABLE 86 STEEL WIRE ROPE MARKET SIZE IN CONSTRUCTION APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 87 STEEL WIRE ROPE MARKET SIZE IN CONSTRUCTION APPLICATION, BY REGION, 2021–2026 (KILOTON)

7.2.6 MARINE & FISHING

7.2.6.1 Steel wire ropes ensuring high breaking strength in marine & fishing applications

TABLE 88 STEEL WIRE ROPE MARKET SIZE IN MARINE & FISHING APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 89 STEEL WIRE ROPE MARKET SIZE IN MARINE & FISHING APPLICATION, BY REGION, 2017–2020 (KILOTON)

TABLE 90 STEEL WIRE ROPE MARKET SIZE IN MARINE & FISHING APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 91 STEEL WIRE ROPE MARKET SIZE IN MARINE & FISHING APPLICATION, BY REGION, 2021–2026 (KILOTON)

7.2.7 OTHERS

TABLE 92 STEEL WIRE ROPE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 93 STEEL WIRE ROPE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (KILOTON)

TABLE 94 STEEL WIRE ROPE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

TABLE 95 STEEL WIRE ROPE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2026 (KILOTON)

7.3 PLASTIC ROPE MARKET, BY APPLICATION

7.3.1 INTRODUCTION

FIGURE 35 MARINE & FISHING TO BE THE LARGEST APPLICATION OF PLASTIC ROPES

TABLE 96 PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 97 PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 98 PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 99 PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

7.3.2 MARINE & FISHING

7.3.2.1 Low weight, high strength, and abrasion resistance properties helpful in marine & fishing applications

FIGURE 36 NORTH AMERICA TO DRIVE THE PLASTIC ROPE MARKET IN MARINE & FISHING APPLICATION

TABLE 100 PLASTIC ROPE MARKET SIZE IN MARINE & FISHING APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 101 PLASTIC ROPE MARKET SIZE IN MARINE & FISHING APPLICATION, BY REGION, 2017–2020 (KILOTON)

TABLE 102 PLASTIC ROPE MARKET SIZE IN MARINE & FISHING APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 103 PLASTIC ROPE MARKET SIZE IN MARINE & FISHING APPLICATION, BY REGION, 2021–2026 (KILOTON)

FIGURE 37 POLYESTER SEGMENT LED THE PLASTIC ROPE MARKET IN MARINE & FISHING APPLICATION

TABLE 104 PLASTIC ROPE MARKET SIZE IN MARINE & FISHING APPLICATION, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 105 PLASTIC ROPE MARKET SIZE IN MARINE & FISHING APPLICATION, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 106 PLASTIC ROPE MARKET SIZE IN MARINE & FISHING APPLICATION, BY MATERIAL TYPE, 2021–2026 (USD MILLION)

TABLE 107 PLASTIC ROPE MARKET SIZE IN MARINE & FISHING APPLICATION, BY MATERIAL TYPE, 2021–2026 (KILOTON)

7.3.3 OIL & GAS

7.3.3.1 High demand for polyester and HMPE ropes in oil & gas applications

TABLE 108 PLASTIC ROPE MARKET SIZE IN OIL & GAS APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 109 PLASTIC ROPE MARKET SIZE IN OIL & GAS APPLICATION, BY REGION, 2017–2020 (KILOTON)

TABLE 110 PLASTIC ROPE MARKET SIZE IN OIL & GAS APPLICATION, BY REGION, 2021–202 (USD MILLION)

TABLE 111 PLASTIC ROPE MARKET SIZE IN OIL & GAS APPLICATION, BY REGION, 2021–2026 (KILOTON)

FIGURE 38 POLYESTER SEGMENT LED THE PLASTIC ROPE MARKET IN OIL & GAS APPLICATION

TABLE 112 PLASTIC ROPE MARKET SIZE IN OIL & GAS APPLICATION, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 113 PLASTIC ROPE MARKET SIZE IN OIL & GAS APPLICATION, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 114 PLASTIC ROPE MARKET SIZE IN OIL & GAS APPLICATION, BY MATERIAL TYPE, 2021–2026 (USD MILLION)

TABLE 115 PLASTIC ROPE MARKET SIZE IN OIL & GAS APPLICATION, BY MATERIAL TYPE, 2021–2026 (KILOTON)

7.3.4 SPORTS & LEISURE

7.3.4.1 Use of fitness ropes, parachute cords, and camping ropes

FIGURE 39 NORTH AMERICA TO LEAD THE PLASTIC ROPES MARKET IN SPORTS & LEISURE APPLICATION

TABLE 116 PLASTIC ROPE MARKET SIZE IN SPORTS & LEISURE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 117 PLASTIC ROPE MARKET SIZE IN SPORTS & LEISURE APPLICATION, BY REGION, 2017–2020 (KILOTON)

TABLE 118 PLASTIC ROPE MARKET SIZE IN SPORTS & LEISURE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 119 PLASTIC ROPE MARKET SIZE IN SPORTS & LEISURE APPLICATION, BY REGION, 2021–2026 (KILOTON)

TABLE 120 PLASTIC ROPE MARKET SIZE IN SPORTS & LEISURE APPLICATION, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 121 PLASTIC ROPE MARKET SIZE IN SPORTS & LEISURE APPLICATION, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 122 PLASTIC ROPE MARKET SIZE IN SPORTS & LEISURE APPLICATION, BY MATERIAL TYPE, 2021–2026 (USD MILLION)

TABLE 123 PLASTIC ROPE MARKET SIZE IN SPORTS & LEISURE APPLICATION, BY MATERIAL TYPE, 2021–2026 (KILOTON)

7.3.5 CRANE

7.3.5.1 Plastic ropes can withstand extreme environmental conditions

FIGURE 40 NORTH AMERICA TO LEAD PLASTIC ROPES MARKET IN THE CRANE APPLICATION

TABLE 124 PLASTIC ROPE MARKET SIZE IN CRANE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 125 PLASTIC ROPE MARKET SIZE IN CRANE APPLICATION, BY REGION, 2017–2020 (KILOTON)

TABLE 126 PLASTIC ROPE MARKET SIZE IN CRANE APPLICATION, BY REGION, 2021–2020 (USD MILLION)

TABLE 127 PLASTIC ROPE MARKET SIZE IN CRANE APPLICATION, BY REGION, 2021–2026 (KILOTON)

TABLE 128 PLASTIC ROPE MARKET SIZE IN CRANE APPLICATION, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 129 PLASTIC ROPE MARKET SIZE IN CRANE APPLICATION, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 130 PLASTIC ROPE MARKET SIZE IN CRANE APPLICATION, BY MATERIAL TYPE, 2021–2026 (USD MILLION)

TABLE 131 PLASTIC ROPE MARKET SIZE IN CRANE APPLICATION, BY MATERIAL TYPE, 2021–2026 (KILOTON)

7.3.6 OTHERS

TABLE 132 PLASTIC ROPE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 133 PLASTIC ROPE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (KILOTON)

TABLE 134 PLASTIC ROPE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

TABLE 135 PLASTIC ROPE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2026 (KILOTON)

TABLE 136 PLASTIC ROPE MARKET SIZE IN OTHER APPLICATION, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 137 PLASTIC ROPE MARKET SIZE IN OTHER APPLICATIONS, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 138 PLASTIC ROPE MARKET SIZE IN OTHER APPLICATION, BY MATERIAL TYPE, 2021–2026 (USD MILLION)

TABLE 139 PLASTIC ROPE MARKET SIZE IN OTHER APPLICATIONS, BY MATERIAL TYPE, 2021–2026 (KILOTON)

8 STEEL WIRE ROPE & PLASTIC ROPE MARKET, BY REGION (Page No. - 133)

8.1 INTRODUCTION

TABLE 140 STEEL WIRE ROPE & PLASTIC ROPE MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 141 STEEL WIRE ROPES & PLASTIC ROPE MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 142 STEEL WIRE ROPE & PLASTIC ROPE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 143 STEEL WIRE ROPES & PLASTIC ROPE MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

8.2 APAC: STEEL WIRE ROPE MARKET

FIGURE 41 APAC: STEEL WIRE ROPE MARKET SNAPSHOT

TABLE 144 APAC: FINISHED STEEL CONSUMPTION, 2019 (KILOTON)

TABLE 145 APAC: STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2017–2020 (USD MILLION)

TABLE 146 APAC: STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2017–2020 (KILOTON)

TABLE 147 APAC: STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2021–2026 (USD MILLION)

TABLE 148 APAC: STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2021–2026 (KILOTON)

TABLE 149 APAC: STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 150 APAC: STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 151 APAC: STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 152 APAC: STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 153 APAC: STEEL WIRE ROPE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 154 APAC: STEEL WIRE ROPE MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 155 APAC: STEEL WIRE ROPE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 156 APAC: STEEL WIRE ROPE MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

8.2.1 CHINA

8.2.1.1 Increase in urban population to influence market indirectly

8.2.2 JAPAN

8.2.2.1 Investment in transportation sector to propel demand for steel wire ropes

8.2.3 SOUTH KOREA

8.2.3.1 Government efforts to boost manufacturing sector

8.2.4 INDIA

8.2.4.1 Improved infrastructure and increased manufacturing activities influencing market positively

8.2.5 REST OF APAC

8.3 APAC: PLASTIC ROPE MARKET

TABLE 157 APAC: PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

TABLE 158 APAC: PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

TABLE 159 APAC: PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2021-2026 (USD MILLION)

TABLE 160 APAC: PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2021-2026 (KILOTON)

TABLE 161 APAC: PLASTIC ROPE MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

TABLE 162 APAC: PLASTIC ROPE MARKET SIZE, BY COUNTRY, 2017-2020 (KILOTON)

TABLE 163 APAC: PLASTIC ROPE MARKET SIZE, BY COUNTRY, 2021-2026 (USD MILLION)

TABLE 164 APAC: PLASTIC ROPE MARKET SIZE, BY COUNTRY, 2021-2026 (KILOTON)

8.3.1 CHINA

8.3.1.1 New offshore oil & gas discoveries to help market growth

8.3.2 JAPAN

8.3.2.1 Marine & fishing sector impacting market positively

8.3.3 SOUTH KOREA

8.3.3.1 High demand for plastic ropes in construction sector

8.3.4 INDIA

8.3.4.1 Growth in aquaculture promising for plastic ropes market growth

8.3.5 REST OF APAC

8.4 NORTH AMERICA: STEEL WIRE ROPE MARKET

FIGURE 42 NORTH AMERICA: STEEL WIRE ROPE MARKET SNAPSHOT

TABLE 165 NORTH AMERICA: FINISHED STEEL CONSUMPTION, BY COUNTRY, 2019 (KILOTON)

TABLE 166 NORTH AMERICA: STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2017–2020 (USD MILLION)

TABLE 167 NORTH AMERICA: STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2017–2020 (KILOTON)

TABLE 168 NORTH AMERICA: STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2021–2026 (USD MILLION)

TABLE 169 NORTH AMERICA: STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2021–20256(KILOTON)

TABLE 170 NORTH AMERICA: STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2017–20250 (USD MILLION)

TABLE 171 NORTH AMERICA: STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 172 NORTH AMERICA: STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 173 NORTH AMERICA: STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 174 NORTH AMERICA: STEEL WIRE ROPE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 175 NORTH AMERICA: STEEL WIRE ROPE MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 176 NORTH AMERICA: STEEL WIRE ROPE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 177 NORTH AMERICA: STEEL WIRE ROPE MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

8.4.1 US

8.4.1.1 Presence of prominent oil & gas industry

8.4.2 CANADA

8.4.2.1 High consumption of steel wire ropes due to large-scale mining activities

8.5 NORTH AMERICA: PLASTIC ROPE MARKET

TABLE 178 NORTH AMERICA: PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 179 NORTH AMERICA: PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 180 NORTH AMERICA: PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 181 NORTH AMERICA: PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 182 NORTH AMERICA: PLASTIC ROPE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 183 NORTH AMERICA: PLASTIC ROPE MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 184 NORTH AMERICA: PLASTIC ROPE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 185 NORTH AMERICA: PLASTIC ROPE MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

8.5.1 US

8.5.1.1 Fishing, crane, and construction to drive market

8.5.2 CANADA

8.5.2.1 Collaboration between government and marine sector associations supporting market growth

8.6 EUROPE: STEEL WIRE ROPE MARKET

FIGURE 43 EUROPE: STEEL WIRE ROPE MARKET SNAPSHOT

TABLE 186 EUROPE: STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2017–2020 (USD MILLION)

TABLE 187 EUROPE: STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2018–2025 (KILOTON)

TABLE 188 EUROPE: STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2021–2026 (USD MILLION)

TABLE 189 EUROPE: STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2021–2026 (KILOTON)

TABLE 190 EUROPE: STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 191 EUROPE: STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 192 EUROPE: STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 193 EUROPE: STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 194 EUROPE: STEEL WIRE ROPE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 195 EUROPE: STEEL WIRE ROPE MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 196 EUROPE: STEEL WIRE ROPE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 197 EUROPE: STEEL WIRE ROPE MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

8.6.1 GERMANY

8.6.1.1 Presence of well-known crane and elevator brands supporting market development

8.6.2 FRANCE

8.6.2.1 Demand for superyachts to boost market growth

8.6.3 UK

8.6.3.1 Large base of construction and oil & gas industries fueling demand

8.6.4 ITALY

8.6.4.1 Growth of oil & gas and mining sectors to boost market

8.6.5 SPAIN

8.6.5.1 High consumption of gasoline affecting steel wire ropes market positively

8.6.6 REST OF EUROPE

8.7 EUROPE: PLASTIC ROPE MARKET

TABLE 198 EUROPE: PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 199 EUROPE: PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 200 EUROPE: PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 201 EUROPE: PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 202 EUROPE: PLASTIC ROPE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 203 EUROPE: PLASTIC ROPE MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 204 EUROPE: PLASTIC ROPE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 205 EUROPE: PLASTIC ROPE MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

8.7.1 GERMANY

8.7.1.1 Most significant market for plastic ropes in the region

8.7.2 FRANCE

8.7.2.1 Well-established end-use applications boosting market growth

8.7.3 UK

8.7.3.1 Strict regulations in oil & gas sector demanding plastic ropes

8.7.4 NORWAY

8.7.4.1 Promising market for plastic ropes in marine segment

8.7.5 ITALY

8.7.5.1 Increased consumer awareness driving demand for plastic ropes

8.7.6 REST OF EUROPE

8.8 MIDDLE EAST & AFRICA (MEA): STEEL WIRE ROPE MARKET

TABLE 206 MEA: FINISHED STEEL CONSUMPTION, BY COUNTRY, 2019 (KILOTON)

TABLE 207 MEA: STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2017–2020 (USD MILLION)

TABLE 208 MEA: STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2017–2020 (KILOTON)

TABLE 209 MEA: STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2021–2026 (USD MILLION)

TABLE 210 MEA: STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2021–2026 (KILOTON)

TABLE 211 MEA: STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 212 MEA: STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 213 MEA: STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 214 MEA: STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 215 MEA: STEEL WIRE ROPE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 216 MEA: STEEL WIRE ROPE MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 217 MEA: STEEL WIRE ROPE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 218 MEA: STEEL WIRE ROPE MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

8.8.1 UAE

8.8.1.1 Favorable business environment supporting market growth

8.8.2 SOUTH AFRICA

8.8.2.1 Diversified economy offering lucrative opportunities for market

8.8.3 SAUDI ARABIA

8.8.3.1 Largest exporter of petroleum creating huge growth potential for steel wire ropes market

8.8.4 REST OF MEA

8.9 MIDDLE EAST & AFRICA (MEA): PLASTIC ROPE MARKET

TABLE 219 MEA: PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 220 MEA: PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 221 MEA: PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 222 MEA: PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 223 MEA: PLASTIC ROPE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 224 MEA: PLASTIC ROPE MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 225 MEA: PLASTIC ROPE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 226 MEA: PLASTIC ROPE MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

8.9.1 UAE

8.9.1.1 Extensive use of plastic ropes in oil & gas applications

8.9.2 SOUTH AFRICA

8.9.2.1 Growing economy helping market growth

8.9.3 SAUDI ARABIA

8.9.3.1 Presence of oil and petroleum reserves boosting market

8.9.4 REST OF MEA

8.10 LATIN AMERICA: STEEL WIRE ROPE MARKET

TABLE 227 LATIN AMERICA: FINISHED STEEL CONSUMPTION, BY COUNTRY, 2019 (KILOTON)

TABLE 228 LATIN AMERICA: STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2017–2020 (USD MILLION)

TABLE 229 LATIN AMERICA: STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2017–2020 (KILOTON)

TABLE 230 LATIN AMERICA: STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2021–2026 (USD MILLION)

TABLE 231 LATIN AMERICA: STEEL WIRE ROPE MARKET SIZE, BY TYPE OF LAY, 2021–2026 (KILOTON)

TABLE 232 LATIN AMERICA: STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 233 LATIN AMERICA: STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 234 LATIN AMERICA: STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 235 LATIN AMERICA: STEEL WIRE ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 236 LATIN AMERICA: STEEL WIRE ROPE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 237 LATIN AMERICA: STEEL WIRE ROPE MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 238 LATIN AMERICA: STEEL WIRE ROPE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 239 LATIN AMERICA: STEEL WIRE ROPE MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

8.10.1 BRAZIL

8.10.1.1 Economic growth to boost steel wire ropes market

8.10.2 MEXICO

8.10.2.1 Extensive use of steel wire ropes in offshore oil & gas facilities

8.10.3 REST OF LATIN AMERICA

8.11 LATIN AMERICA: PLASTIC ROPE MARKET

TABLE 240 LATIN AMERICA: PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 241 LATIN AMERICA: PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 242 LATIN AMERICA: PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 243 LATIN AMERICA: PLASTIC ROPE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 244 LATIN AMERICA: PLASTIC ROPE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 245 LATIN AMERICA: PLASTIC ROPE MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 246 LATIN AMERICA: PLASTIC ROPE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 247 LATIN AMERICA: PLASTIC ROPE MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

8.11.1 BRAZIL

8.11.1.1 Mining sector providing growth opportunities for plastic rope market

8.11.2 MEXICO

8.11.2.1 Oil & gas and marine sectors significantly contribute to market growth

8.11.3 REST OF LATIN AMERICA

9 COMPETITIVE LANDSCAPE (Page No. - 182)

9.1 OVERVIEW

FIGURE 44 NEW PRODUCT LAUNCH/DEVELOPMENT, AGREEMENT, AND EXPANSION ARE KEY GROWTH STRATEGIES ADOPTED BETWEEN 2016 AND 2021

9.2 MARKET SHARE ANALYSIS

FIGURE 45 WIRECO WORLDGROUP INC. LED STEEL WIRE ROPE & PLASTIC ROPE MARKET IN 2020

TABLE 248 DEGREE OF COMPETITION: COMPETITIVE

9.3 MARKET RANKING

FIGURE 46 MARKET RANKING OF KEY PLAYERS

9.4 COMPANY EVALUATION MATRIX

9.4.1 STAR

9.4.2 PERVASIVE

9.4.3 PARTICIPANTS

9.4.4 EMERGING LEADERS

FIGURE 47 STEEL WIRE ROPE & PLASTIC ROPE MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2020

9.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 249 COMPANY PRODUCT FOOTPRINT

TABLE 250 COMPANY APPLICATION FOOTPRINT

TABLE 251 COMPANY REGION FOOTPRINT

9.6 MARKET EVALUATION FRAMEWORK

TABLE 252 STEEL WIRE ROPE & PLASTIC ROPE MARKET: NEW PRODUCT LAUNCH/DEVELOPMENT, 2016-2021

TABLE 253 STEEL WIRE ROPE & PLASTIC ROPE MARKET: DEALS, 2016-2021

TABLE 254 STEEL WIRE ROPE & PLASTIC ROPE MARKET: OTHER DEVELOPMENTS, 2016-2021

9.7 REVENUE ANALYSIS OF TOP MARKET PLAYERS

TABLE 255 REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2019, (USD MILLION)

FIGURE 48 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 49 BUSINESS STRATEGY EXCELLENCE

9.8 START-UP/SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

9.8.1 PROGRESSIVE COMPANIES

9.8.2 RESPONSIVE COMPANIES

9.8.3 DYNAMIC COMPANIES

9.8.4 STARTING BLOCKS

FIGURE 50 STEEL WIRE ROPE & PLASTIC ROPE MARKET (START-UPS/SMES): COMPETITIVE LEADERSHIP MAPPING, 2020

10 COMPANY PROFILES (Page No. - 195)

10.1 KEY PLAYERS

(Business overview, Products offered, Deals of the company, SWOT analysis, Winning imperatives, Right to win, Strategic choices made, and Weakness and competitive threats)*

10.1.1 CORTLAND LIMITED

TABLE 256 CORTLAND LIMITED: BUSINESS OVERVIEW

FIGURE 51 CORTLAND LIMITED: SWOT ANALYSIS

10.1.2 WIRECO WORLDGROUP INC.

TABLE 257 WIRECO WORLDGROUP INC.: BUSINESS OVERVIEW

FIGURE 52 WIRECO WORLDGROUP: SWOT ANALYSIS

10.1.3 SAMSON ROPE TECHNOLOGIES

TABLE 258 SAMSON ROPE TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 53 SAMSON ROPE TECHNOLOGIES: SWOT ANALYSIS

10.1.4 SOUTHERN ROPES

TABLE 259 SOUTHERN ROPES: BUSINESS OVERVIEW

FIGURE 54 SOUTHERN ROPES: SWOT ANALYSIS

10.1.5 ENGLISH BRAIDS LTD.

TABLE 260 ENGLISH BRAIDS LTD.: BUSINESS OVERVIEW

FIGURE 55 ENGLISH BRAIDS LTD.: SWOT ANALYSIS

10.1.6 MARLOW ROPES

TABLE 261 MARLOW ROPES: BUSINESS OVERVIEW

10.1.7 TEUFELBERGER HOLDING AG

TABLE 262 TEUFELBERGER HOLDING AG: BUSINESS OVERVIEW

10.1.8 BEKAERT SA

TABLE 263 BEKAERT SA: BUSINESS OVERVIEW

FIGURE 56 BEKAERT SA: COMPANY SNAPSHOT

10.1.9 JIANGSU LANGSHAN WIRE ROPE CO., LTD.

TABLE 264 JIANGSU LANGSHAN WIRE ROPE CO., LTD.: BUSINESS OVERVIEW

10.1.10 USHA MARTIN

TABLE 265 USHA MARTIN: BUSINESS OVERVIEW

FIGURE 57 USHA MARTIN: COMPANY SNAPSHOT

10.1.11 GUSTAV WOLF GMBH

TABLE 266 GUSTAV WOLF GMBH: BUSINESS OVERVIEW

10.1.12 YALE CORDAGE

TABLE 267 YALE CORDAGE: BUSINESS OVERVIEW

10.1.13 LANEX A.S.

TABLE 268 LANEX A.S.: BUSINESS OVERVIEW

10.1.14 TOKYO ROPE MFG. CO., LTD.

TABLE 269 TOKYO ROPE MFG CO., LTD.: BUSINESS OVERVIEW

FIGURE 58 TOKYO ROPE MFG. CO., LTD.: COMPANY SNAPSHOT

10.1.15 BEXCO NV SA

TABLE 270 BEXCO NV SA: BUSINESS OVERVIEW

10.2 OTHER COMPANIES

10.2.1 NOVATEC BRAIDS, LTD.

10.2.2 KATRADIS MARINE ROPES IND. S.A.

10.2.3 DSR

10.2.4 KISWIRE

10.2.5 PFEIFER

10.2.6 SWR, LTD.

10.2.7 MAZZELLA COMPANIES

10.2.8 SHINKO WIRE COMPANY, LTD.

10.2.9 SAINT-GOBAIN PERFORMANCE PLASTICS

10.2.10 PARKER HANNIFIN CORPORATION

*Details on Business overview, Products offered, Deals of the company, SWOT analysis, Winning imperatives, Right to win, Strategic choices made, and Weakness and competitive threats might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 251)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

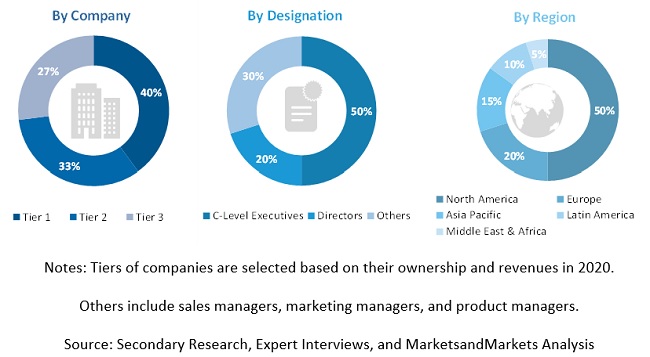

The study involves two major activities in estimating the current size of the steel wire rope & plastic rope market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Factiva, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The steel wire rope & plastic rope market comprises several stakeholders, such as raw material suppliers, manufacturers, end-product users, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of mainly the aerospace & defense, wind energy, automotive, sporting goods, electronics (PCB) and other end-use industries. Advancements in technology and diverse applications in various end-use industries describe the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total steel wire rope & plastic rope market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall steel wire rope & plastic rope market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the marine & fishing, sports & leisure, oil & gas, industrial & crane, mining, construction, and other end-use applications.

Report Objectives

- To analyze and forecast the global steel wire rope & plastic rope market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on by type, and by application

- To analyze and forecast the market size based on five main regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa (MEA), and Latin America

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC steel wire rope & plastic rope market

- Further breakdown of Rest of European steel wire rope & plastic rope market

- Further breakdown of Rest of North American steel wire rope & plastic rope market

- Further breakdown of Rest of MEA steel wire rope & plastic rope market

- Further breakdown of Rest of Latin American steel wire rope & plastic rope market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Steel Wire Rope & Plastic Rope Market