Steel Wire Market by Form (Non-rope, Rope), Type (Carbon Steel, Alloy Steel, Stainless Steel), End-use Industry (Construction, Automotive, Energy, Agriculture, Industrial), Thickness, and Region-Global Forecast to 2025

Updated on : August 25, 2025

Steel Wire Market

The steel wire market is projected to reach USD 124.7 billion by 2025, at a cagr 6.0%. The steel wire industry is growing due to the rise in demand for steel wires from various applications, globally. The demand for steel wire s is expected to decline in 2020 due to COVID-19. However, the end of lockdown and recovery in the end-use industries will stimulate the demand during the forecast period.

Steel Wire Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on global steel wire market

The steel wire market is expected to witness a decline in 2020 due to the COVID-19 pandemic. This deadly virus has adversely affected the entire globe, especially the North American and European regions. To prevent the further spread of this virus, companies have shut down their operations and manufacturing facilities. This has led to a reduction in the consumption of steel wires across industrial manufacturing, mining, automotive, aerospace & defence, and other industries.

Increasing demand from the construction end-use industry to drive the demand for steel wire

The construction industry is the largest application industry in the steel wire market in terms of volume. Steel wire find wide applications in construction industry in road, river & railway bridges and flyovers, atomic reactor domes, slabs, silos, hangers, aqueducts, high-rise buildings, viaducts, and railway sleeper construction. The increased demand from these applications is expected to drive the steel wire market during the forecasted period.

Emergence of plastic and hybrid ropes is a major restrain for the steel wire market

Plastic ropes have higher strength with lower weight as compared to steel wire ropes. Currently, most end-use industries use steel wire ropes due to the lack of awareness about the advantages of using plastic ropes and the high price of plastic fibers. With the rising advancements in plastic materials, plastic ropes are likely to become a better alternative to conventional ropes. Plastic ropes have minimum stretch, due to which, even if the rope breaks, it falls to the ground without snapping back like wire rope, thereby causing no injuries.

In mining applications, plastic ropes are expected to get wide acceptance in the future due to their performance excellence. Efforts are being made to transition from steel cables to custom-engineered plastic ropes for undertaking crucial tasks during mining. Plastic ropes are expected to be in higher demand due to their ergonomic characteristic.

Recovery in automotive end-use industry post COVID-19

The automotive end-use industry is the worst-affected industry due to the COVID-19 pandemic. The automotive demand fell by 19% in the first ten months of 2020 as compared with 2019. According to the World Steel Association, the consumption of finished steel is expected to fall by 17% in 2020 in the automotive end-use industry; the consumption is expected to grow in the post-pandemic situation. The finished steel consumption is expected to grow by 13% globally. Europe is the hub for the automotive industry; the growth in the automotive sector is an opportunity for steel wire manufacturers in the region. Also, various governments have offered stimulus packages for the automotive industry in the European region, which is expected to help the automotive manufacturers in the region.

Need to maintain uninterrupted supply chain and operate at full capacity post COVID-19

The global construction, automotive, mechanical manufacturing, and metal industries have witnessed adverse and immediate consequences of the COVID-19 pandemic. These are the worst-affected industries, and the biggest challenge for steel wire manufacturers is to resume production at their original capacities and make up for the revenue loss and damage caused by the pandemic. The COVID-19 pandemic has created ripples across the global steel wire industries due to the closure of national and international borders, leading to disrupted supply chains. The challenges in the current and future scenarios for the steel wire industry are to ensure the smooth flow of global supply chains, responsible for rapidly transporting materials and components across borders and fabrication facilities. These industries have to make up for the delays or non-arrival of raw materials.

The carbon steel wire segment accounted for a major share of the steel wire market in terms of value and volume during the forecast period.

The carbon steel wire accounted for a larger share in the steel wire market. The carbon steel wire is used in a wide range of applications such as for tires, cords, hoses, galvanized wires and strands, ACSR strands and armouring of conductor cables, fencing, springs, fasteners, clips, staples, mesh, screws, nails, barbed wires, chains, and steel fibres in concrete. The demand for carbon steel wire is expected to see a decline in 2020 due to the pandemic.

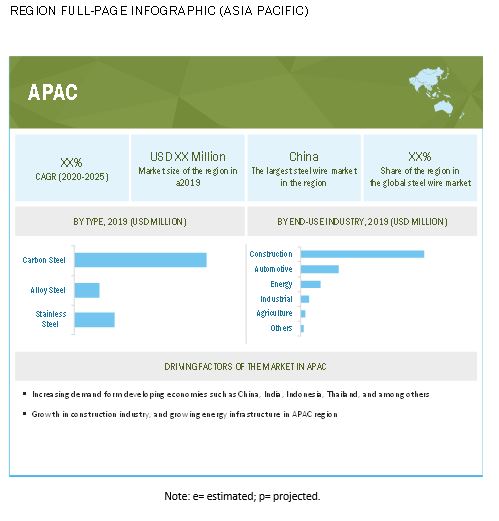

APAC held the largest market share in the steel wire market

The region has a largest share in the steel wires market owing to its increasing demand from construction & infrastructure projects, growing automotive production, growing energy transfer infrastructure, and increasing industrial manufacturing. The region has presence of number of tire one manufacturers, electricity consumption is growing in the region which has huge opportunity for steel wire markets in these sectors.

Steel Wire Market Players

The key players in the global steel wire market are:

- ArcelorMittal (the Luxembourg),

- Nippon Steel (Japan)

- JFE Steel Corporation (Japan)

- Bekaert SA (Belgium)

- Tata Steel Limited (India)

- Kobe Steel Limited (Japan)

- The Heico Companies (United States),

- Ferrier Nord (Italy)

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the steel wire industry. The study includes an in-depth competitive analysis of these key players in the steel wire market, with their company profiles, recent developments, and key market strategies.

Steel Wire Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 93.2 billion |

|

Revenue Forecast in 2025 |

USD 124.7 billion |

|

CAGR |

6.0% |

|

Years considered for the study |

2016–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments |

Fiber Type, Application and Region |

|

Regions |

Europe, North America, APAC, MEA, and Latin America |

|

Companies |

ArcelorMittal (Luxembourg), Nippon Steel (Japan), JFE Steel Corporation (Japan), TATA Steel Limited (India) and Kobe Steel, Ltd. (Japan), are some of the key players in the steel wire market. JSW Steel Ltd. (India), Bekaert SA (Belgium), The Heico Companies (United States), Ferrier Nord (Italy) and Byelorussian Steel Works (Belarus) |

This research report categorizes the steel wire market based on form, type, thickness, end-use industry, and region.

Steel Wire Market by Form:

- Non-rope

- Rope

Steel Wire Market by Type:

- Carbon Steel

- Alloy Steel

- Stainless Steel

Steel Wire Market by Thickness:

- 0.01 mm to 0.8 mm

- 0.8 mm to 1.6 mm

- 1.6 mm to 4 mm

- 4 mm & above

Steel Wire Market by End-use Industry:

- Construction

- Automotive

- Energy

- Agriculture

- Industrial

- Others

Steel Wire Market by Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments

- In March 2018, The company launched ‘SmartFAB’, which is India’s first branded welded fabric, a construction reinforcement solution. This product commonly known as wire mesh aiming to bring value, convenience and speed to various construction projects.

- In January 2019, Byelorussian Steel Works signed the supply contract with a Continental (Germany) in order to supply around 32.8 thousand tons of steel cords. This agreement helped company to maintain their competitive position in the market.

- In April 2018, Bekaert SA reached to and acquisition agreement with Bridon-Bekaert Ropes Group and took full ownership. The company adopted this strategy to grow their business globally and to create significant value over the period.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the steel wire & market?

High demand from end-use industries due to superior performance properties of steel wire has driving the market.

Which is the fastest-growing region-level market for steel wires?

APAC is the fastest-growing steel wire market due to the presence of major steel wire manufacturers and the burgeoning growth of various end-use industries.

What are the factors contributing to the final price of steel wires?

Raw material plays a vital role in the costs. The cost of these materials contributes largely to the final pricing of steel wire.

What are the challenges in the steel wire & market?

Reducing the cost of & steel wire is the major challenge in the steel wire market.

Which type of fibre holds the largest market share?

Polyester fibre-based steel wire & hold the largest share due to low cost and ease of manufacturing.

How is the steel wire market aligned?

The market is growing at a significant pace. It is a potential market and many manufactures are planning business strategies to expand their business.

Who are the major manufacturers?

Forbo International SA (Switzerland), Ahlstrom-Munksjo (Finland), Habasit AG (Switzerland), Toray Industries Inc. (Japan), and ContiTech AG (Germany) are a few of the key players in the steel wire market.

Which fibres are used in steel wire?

Polyester, polyamide, aramid, and composites are the major resins used in manufacturing steel wires.

What are the major applications for steel wire?

The major applications of steel wire includes transmission belts, conveyor belts, automotive carpet, flame resistance apparel, and protective apparel.

What is the biggest restraint in the steel wire market?

Stringent government regulations is the major restraint of the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 STEEL WIRE MARKET SEGMENTATION

1.3.2 STEEL WIRE MARKET, REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

FIGURE 1 STEEL WIRE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.2.3 SUPPLY-SIDE ANALYSIS

2.3 DATA TRIANGULATION

FIGURE 4 STEEL WIRE MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 31)

FIGURE 5 NON-ROPE STEEL WIRE DOMINATED THE GLOBAL MARKET IN 2019

FIGURE 6 CARBON STEEL DOMINATED THE GLOBAL MARKET IN 2019

FIGURE 7 CONSTRUCTION WAS THE LARGEST END-USE INDUSTRY IN THE STEEL WIRE MARKET

FIGURE 8 1.6 MM TO 4 MM THICKNESS SEGMENT WAS THE LARGEST SEGMENT IN THE STEEL WIRE MARKET

FIGURE 9 APAC ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

4 PREMIUM INSIGHTS (Page No. - 34)

4.1 ATTRACTIVE OPPORTUNITIES IN THE STEEL WIRE MARKET

FIGURE 10 HIGH DEMAND FROM THE CONSTRUCTION INDUSTRY TO DRIVE THE MARKET

4.2 STEEL WIRE MARKET, BY TYPE

FIGURE 11 CARBON STEEL WIRE ACCOUNTED FOR THE LARGEST SHARE OF THE GLOBAL MARKET IN 2019

4.3 GLOBAL STEEL WIRE MARKET, BY FORM

FIGURE 12 NON-ROPE FORM LED THE DEMAND IN 2019

4.4 GLOBAL STEEL WIRE MARKET, BY THICKNESS

FIGURE 13 1.6 MM TO 4 MM THICKNESS SEGMENT LED THE DEMAND IN 2019

4.5 GLOBAL & EUROPE: STEEL WIRE MARKET, BY END-USE INDUSTRY

FIGURE 14 CONSTRUCTION INDUSTRY DOMINATED THE MARKET IN 2019

4.6 STEEL WIRE MARKET, BY KEY COUNTRY

FIGURE 15 GERMANY TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 37)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE STEEL WIRE MARKET

5.2.1 DRIVERS

5.2.1.1 European expenditure on infrastructure development projects

5.2.1.2 Rise in the use of galvanized steel wire

5.2.2 RESTRAINTS

5.2.2.1 Emergence of plastic and hybrid ropes

5.2.3 OPPORTUNITIES

5.2.3.1 Recovery in automotive end-use industry post COVID-19

5.2.4 CHALLENGES

5.2.4.1 Need to maintain uninterrupted supply chain and operate at full capacity post COVID-19

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 STEEL WIRE MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 18 SUPPLY CHAIN ANALYSIS

5.4.1 RAW MATERIALS

5.4.2 MANUFACTURING

5.4.3 APPLICATION

5.5 TECHNOLOGY ANALYSIS

5.6 VALUE CHAIN ANALYSIS & IMPACT OF COVID-19

5.6.1 RAW MATERIALS

5.6.2 WIRE MANUFACTURERS

5.6.3 END-USERS

5.7 PRICING ANALYSIS

5.7.1 AVERAGE SELLING PRICE

TABLE 1 STEEL WIRE AVERAGE SELLING PRICE, BY REGION

5.8 KEY MARKET FOR IMPORT/EXPORT

5.8.1 CHINA

5.8.2 SOUTH KOREA

5.8.3 JAPAN

5.8.4 GERMANY

5.8.5 US

5.8.6 INDIA

5.9 PATENT ANALYSIS

5.9.1 METHODOLOGY

5.9.2 DOCUMENT TYPE

FIGURE 19 PATENT PUBLICATION TRENDS, 2014–2020

5.9.3 INSIGHTS

FIGURE 20 PATENT JURISDICTION ANALYSIS FOR STEEL WIRE, 2019

5.9.4 APPLICANTS OF STEEL WIRE PATENTS IN 2019

FIGURE 21 APPLICANTS OF STEEL WIRE PATENTS IN 2019

5.1 REGULATORY LANDSCAPE

5.11 CASE STUDY ANALYSIS

6 STEEL WIRE MARKET, BY FORM (Page No. - 50)

6.1 INTRODUCTION

FIGURE 22 NON-ROPE FORM OF STEEL WIRE TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

6.1.1 STEEL WIRE MARKET, BY FORM

TABLE 2 MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 3 MARKET SIZE, BY FORM, 2018–2025 (KILOTON)

6.2 NON-ROPE

6.2.1 NON-ROPE FORM STEEL WIRE MARKET, BY REGION

TABLE 4 MARKET SIZE IN NON-ROPE FORM, BY REGION, 2018–2025 (USD MILLION)

TABLE 5 MARKET SIZE IN NON-ROPE FORM, BY REGION, 2018–2025 (KILOTON)

6.3 ROPE FORM

6.3.1 ROPE FORM STEEL WIRE MARKET, BY REGION

TABLE 6 MARKET SIZE IN ROPE FORM, BY REGION, 2018–2025 (USD MILLION)

TABLE 7 MARKET SIZE IN ROPE FORM, BY REGION, 2018–2025 (KILOTON)

7 STEEL WIRE MARKET, BY TYPE (Page No. - 55)

7.1 INTRODUCTION

FIGURE 23 CARBON STEEL TO DOMINATE THE STEEL WIRE MARKET DURING THE FORECAST PERIOD

7.1.1 STEEL WIRE MARKET, BY TYPE

TABLE 8 MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 9 MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

7.2 CARBON STEEL WIRE

7.2.1 HIGH CARBON STEEL

7.2.2 MEDIUM CARBON STEEL

7.2.3 LOW CARBON STEEL

FIGURE 24 APAC TO LEAD THE CARBON STEEL MARKET DURING THE FORECAST PERIOD

7.2.4 CARBON STEEL WIRE MARKET, BY REGION

TABLE 10 CARBON MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 11 CARBON MARKET SIZE, BY REGION 2018–2025 (KILOTON)

7.3 ALLOY STEEL WIRE

7.3.1 ALLOY STEEL WIRE MARKET, BY REGION

TABLE 12 ALLOY MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 13 ALLOY MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

7.4 STAINLESS STEEL WIRE

7.4.1 STAINLESS STEEL WIRE MARKET, BY REGION

TABLE 14 STAINLESS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 15 STAINLESS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

8 STEEL WIRE MARKET, BY THICKNESS (Page No. - 62)

8.1 INTRODUCTION

FIGURE 25 1.6 MM TO 4 MM THICKNESS SEGMENT OF STEEL WIRE TO DOMINATE THE STEEL WIRE MARKET DURING THE FORECAST PERIOD

8.1.1 STEEL WIRE MARKET, BY THICKNESS

TABLE 16 MARKET SIZE, BY THICKNESS, 2018–2025 (USD MILLION)

TABLE 17 MARKET SIZE, BY THICKNESS, 2018–2025 (KILOTON)

8.2 O.01 MM TO 0.8 MM DIAMETER

8.2.1 STEEL WIRE MARKET IN 0.01 MM TO 0.8 MM THICKNESS SEGMENT, BY REGION

TABLE 18 0.01 MM TO 0.8 MM THICKNESS STEEL WIRE MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 19 0.01 MM TO 0.8 MM THICKNESS MARKET, BY REGION, 2018–2025 (KILOTON)

8.3 0.8 MM TO 1.6 MM THICKNESS

8.3.1 STEEL WIRE MARKET IN 0.8 MM TO 1.6 MM THICKNESS SEGMENT, BY REGION

TABLE 20 0.8 MM TO 1.6 MM THICKNESS STEEL WIRE MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 0.8 MM TO 1.6 MM THICKNESS MARKET, BY REGION, 2018–2025 (KILOTON)

8.4 1.6 MM TO 4 MM THICKNESS

FIGURE 26 APAC TO HOLD THE LARGEST SHARE IN 1.6 MM TO 4 MM THICKNESS SEGMENT DURING THE FORECAST PERIOD

8.4.1 STEEL WIRE MARKET IN 1.6 MM TO 4 MM THICKNESS SEGMENT, BY REGION

TABLE 22 1.6 MM TO 4 MM THICKNESS STEEL WIRE MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 23 1.6 MM TO 4 MM THICKNESS MARKET, BY REGION, 2018–2025 (KILOTON)

8.5 4 MM AND ABOVE

8.5.1 STEEL WIRE MARKET IN 4 MM AND ABOVE THICKNESS SEGMENT, BY REGION

TABLE 24 4 MM AND ABOVE THICKNESS STEEL WIRE MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 25 4 MM AND ABOVE THICKNESS MARKET, BY REGION, 2018–2025 (KILOTON)

9 STEEL WIRE MARKET, BY END-USE INDUSTRY (Page No. - 69)

9.1 INTRODUCTION

FIGURE 27 AUTOMOTIVE INDUSTRY TO WITNESS THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 26 FINISHED STEEL CONSUMPTION SHARE WORLDWIDE, BY END-USE INDUSTRY, 2019

9.1.1 STEEL WIRE MARKET, BY END-USE INDUSTRY

TABLE 27 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 28 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.2 CONSTRUCTION

FIGURE 28 CONSTRUCTION INDUSTRY TO DOMINATE THE GLOBAL STEEL WIRE MARKET DURING THE FORECAST PERIOD

9.2.1 STEEL WIRE MARKET IN CONSTRUCTION END-USE INDUSTRY, BY REGION

TABLE 29 MARKET SIZE IN CONSTRUCTION END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 30 MARKET SIZE IN CONSTRUCTION END-USE INDUSTRY, BY REGION, 2018–2025 (KILOTON)

9.3 AUTOMOTIVE

9.3.1 STEEL WIRE MARKET IN AUTOMOTIVE END-USE INDUSTRY, BY REGION

TABLE 31 MARKET SIZE IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 32 MARKET SIZE IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2018–2025 (KILOTON)

9.4 ENERGY

9.4.1 STEEL WIRE MARKET IN ENERGY END-USE INDUSTRY, BY REGION

TABLE 33 MARKET SIZE IN ENERGY END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 34 MARKET SIZE IN ENERGY END-USE INDUSTRY, BY REGION, 2018–2025 (KILOTON)

9.5 AGRICULTURE

9.5.1 STEEL WIRE MARKET IN AGRICULTURE END-USE INDUSTRY, BY REGION

TABLE 35 MARKET SIZE IN AGRICULTURE END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 36 MARKET SIZE IN AGRICULTURE END-USE INDUSTRY, BY REGION, 2018–2025 (KILOTON)

9.6 INDUSTRIAL

9.6.1 STEEL WIRE MARKET IN INDUSTRIAL END-USE INDUSTRY, BY REGION

TABLE 37 MARKET SIZE IN INDUSTRIAL END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 38 MARKET SIZE IN INDUSTRIAL END-USE INDUSTRY, BY REGION, 2018–2025 (KILOTON)

9.7 OTHER END-USE INDUSTRIES

9.7.1 STEEL WIRE MARKET IN OTHER END-USE INDUSTRIES, BY REGION

TABLE 39 MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2025 (USD MILLION)

TABLE 40 MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2025 (KILOTON)

10 STEEL WIRE MARKET, BY REGION (Page No. - 79)

10.1 INTRODUCTION

FIGURE 29 GERMANY PROJECTED TO REGISTER HIGHEST IN STEEL WIRE MARKET, 2020–2025, IN TERMS OF VALUE

TABLE 41 STEEL WIRE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 42 MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

10.2 APAC

FIGURE 30 APAC: STEEL WIRE MARKET SNAPSHOT

TABLE 43 APAC: FINISHED STEEL CONSUMPTION, 2019 (KILOTON)

10.2.1 APAC MARKET, BY FORM

TABLE 44 APAC: MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 45 APAC: MARKET SIZE, BY FORM, 2018–2025 (KILOTON)

10.2.2 APAC MARKET, BY TYPE

TABLE 46 APAC: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 47 APAC: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

10.2.3 APAC MARKET, BY END-USE INDUSTRY

TABLE 48 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 49 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.2.4 APAC MARKET, BY THICKNESS

TABLE 50 APAC: MARKET SIZE, BY THICKNESS, 2018–2025 (USD MILLION)

TABLE 51 APAC: MARKET SIZE, BY THICKNESS, 2018–2025 (KILOTON)

10.2.5 APAC MARKET, BY COUNTRY

TABLE 52 APAC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 53 APAC: MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

10.2.6 CHINA

10.2.6.1 China steel wire market, by end-use industry

TABLE 54 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 55 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.2.7 JAPAN

10.2.7.1 Japan steel wire market, by end-use industry

TABLE 56 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 57 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.2.8 INDIA

10.2.8.1 India steel wire market, by end-use industry

TABLE 58 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 59 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.2.9 SOUTH KOREA

10.2.9.1 South Korea steel wire market, by end-use industry

TABLE 60 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 61 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.2.10 REST OF APAC

10.2.10.1 Rest of APAC steel wire market, by end-use industry

TABLE 62 REST OF APAC: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 63 REST OF APAC: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.3 EUROPE

FIGURE 31 EUROPE: STEEL WIRE MARKET SNAPSHOT

FIGURE 32 AUTOMOTIVE TO BE THE FASTEST-GROWING END-USE INDUSTRY IN THE EUROPEAN MARKET DURING THE FORECAST PERIOD

10.3.1 EUROPE STEEL WIRE MARKET, BY FORM

TABLE 64 EUROPE: MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 65 EUROPE: MARKET SIZE, BY FORM, 2018–2025 (KILOTON)

10.3.2 EUROPE MARKET, BY TYPE

TABLE 66 EUROPE: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 67 EUROPE: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

10.3.3 EUROPE MARKET, BY END-USE INDUSTRY

TABLE 68 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 69 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.3.4 EUROPE MARKET, BY THICKNESS

TABLE 70 EUROPE: MARKET SIZE, BY THICKNESS, 2018–2025 (USD MILLION)

TABLE 71 EUROPE: MARKET SIZE, BY THICKNESS, 2018–2025 (KILOTON)

10.3.5 EUROPE MARKET, BY COUNTRY

TABLE 72 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 73 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

10.3.6 GERMANY

10.3.6.1 Germany steel wire market, by end-use industry

TABLE 74 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 75 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.3.7 UK

10.3.7.1 UK steel wire market, by end-use industry

TABLE 76 UK: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 77 UK: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.3.8 RUSSIA

10.3.8.1 Russia steel wire market, by end-use industry

TABLE 78 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 79 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.3.9 SWEDEN

10.3.9.1 Sweden steel wire market, by end-use industry

TABLE 80 SWEDEN: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 81 SWEDEN: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.3.10 POLAND

10.3.10.1 Poland steel wire market, by end-use industry

TABLE 82 POLAND: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 83 POLAND: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.3.11 CZECH REPUBLIC

10.3.11.1 Czech Republic steel wire market, by end-use industry

TABLE 84 CZECH REPUBLIC: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 85 CZECH REPUBLIC: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.3.12 AUSTRIA

10.3.12.1 Austria steel wire market, by end-use industry

TABLE 86 AUSTRIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 87 AUSTRIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.3.13 REST OF EUROPE

10.3.13.1 Rest of Europe steel wire market, by end-use industry

TABLE 88 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 89 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.4 NORTH AMERICA

FIGURE 33 NORTH AMERICA: STEEL WIRE MARKET SNAPSHOT

TABLE 90 NORTH AMERICA: FINISHED STEEL CONSUMPTION, BY COUNTRY, 2019 (KILOTON)

10.4.1 NORTH AMERICA STEEL WIRE MARKET, BY FORM

TABLE 91 NORTH AMERICA: MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY FORM, 2018–2025 (KILOTON)

10.4.2 NORTH AMERICA STEEL WIRE MARKET, BY TYPE

TABLE 93 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

10.4.3 NORTH AMERICA MARKET, BY END-USE INDUSTRY

TABLE 95 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.4.4 NORTH AMERICA MARKET, BY THICKNESS

TABLE 97 NORTH AMERICA: MARKET SIZE, BY THICKNESS, 2018–2025 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET SIZE, BY THICKNESS, 2018–2025 (KILOTON)

10.4.5 NORTH AMERICA MARKET, BY COUNTRY

TABLE 99 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

10.4.6 US

10.4.6.1 US steel wire market, by end-use industry

TABLE 101 US: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 102 US: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.4.7 CANADA

10.4.7.1 Canada steel wire market, by end-use industry

TABLE 103 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 104 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.5 MIDDLE EAST & AFRICA

TABLE 105 MIDDLE EAST & AFRICA: FINISHED STEEL CONSUMPTION, BY COUNTRY, 2019 (KILOTON)

10.5.1 MIDDLE EAST & AFRICA STEEL WIRE MARKET, BY FORM

TABLE 106 MIDDLE EAST & AFRICA: MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 107 MIDDLE EAST & AFRICA: MARKET SIZE, BY FORM, 2018–2025 (KILOTON)

10.5.2 MIDDLE EAST & AFRICA MARKET, BY TYPE

TABLE 108 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 109 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

10.5.3 MIDDLE EAST & AFRICA MARKET, BY END-USE INDUSTRY

TABLE 110 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 111 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.5.4 MIDDLE EAST & AFRICA MARKET, BY THICKNESS

TABLE 112 MIDDLE EAST & AFRICA: MARKET SIZE, BY THICKNESS, 2018–2025 (USD MILLION)

TABLE 113 MIDDLE EAST & AFRICA: MARKET SIZE, BY THICKNESS, 2018–2025 (KILOTON)

10.5.5 MIDDLE EAST & AFRICA MARKET, BY COUNTRY

TABLE 114 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 115 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

10.5.6 UAE

10.5.6.1 UAE steel wire market, by end-use industry

TABLE 116 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 117 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.5.7 SOUTH AFRICA

10.5.7.1 South Africa steel wire market, by end-use industry

TABLE 118 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 119 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.5.8 REST OF MIDDLE EAST & AFRICA

10.5.8.1 Rest of Middle East & Africa steel wire market, by end-use industry

TABLE 120 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 121 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.6 LATIN AMERICA

TABLE 122 LATIN AMERICA: FINISHED STEEL CONSUMPTION, BY COUNTRY, 2019 (KILOTON)

10.6.1 LATIN AMERICA STEEL WIRE MARKET, BY FORM

TABLE 123 LATIN AMERICA: MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 124 LATIN AMERICA: MARKET SIZE, BY FORM, 2018–2025 (KILOTON)

10.6.2 LATIN AMERICA MARKET, BY TYPE

TABLE 125 LATIN AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 126 LATIN AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

10.6.3 LATIN AMERICA MARKET, BY END-USE INDUSTRY

TABLE 127 LATIN AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 128 LATIN AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.6.4 LATIN AMERICA MARKET, BY THICKNESS

TABLE 129 LATIN AMERICA: MARKET SIZE, BY THICKNESS, 2018–2025 (USD MILLION)

TABLE 130 LATIN AMERICA: MARKET SIZE, BY THICKNESS, 2018–2025 (KILOTON)

10.6.5 LATIN AMERICA MARKET, BY COUNTRY

TABLE 131 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 132 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

10.6.6 BRAZIL

10.6.6.1 Brazil steel wire market, by end-use industry

TABLE 133 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 134 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.6.7 MEXICO

10.6.7.1 Mexico steel wire market, by end-use industry

TABLE 135 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 136 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10.6.8 REST OF LATIN AMERICA

10.6.8.1 Rest of Latin America steel wire market, by end-use industry

TABLE 137 REST OF LATIN AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 138 REST OF LATIN AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

11 COMPETITIVE LANDSCAPE (Page No. - 130)

11.1 INTRODUCTION

FIGURE 34 ACQUISITION, AGREEMENT, AND JOINT VENTURE ARE THE KEY GROWTH STRATEGIES ADOPTED BETWEEN 2015 AND 2020

11.2 MARKET SHARE ANALYSIS

FIGURE 35 ARCELORMITTAL LED THE STEEL WIRE MARKET IN 2019

11.3 MARKET RANKING

FIGURE 36 COMPANY RANKING: STEEL WIRE MARKET

11.4 MARKET EVALUATION FRAMEWORK

11.4.1 NEW PRODUCT LAUNCH/NEW PRODUCT DEVELOPMENT

TABLE 139 NEW PRODUCT LAUNCH/NEW PRODUCT DEVELOPMENT, 2015–2020

11.4.2 AGREEMENT/PARTNERSHIP/JOINT VENTURE

TABLE 140 AGREEMENT/PARTNERSHIP/JOINT VENTURE, 2015-2020

11.4.3 EXPANSION

TABLE 141 EXPANSION, 2015-2020

11.4.4 MERGER/ACQUISITION

TABLE 142 MERGER/ACQUISITION, 2015–2020

11.5 REVENUE ANALYSIS OF TOP MARKET PLAYERS

TABLE 143 REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2016–2019

11.6 COMPANY EVALUATION MATRIX

11.6.1 STAR

11.6.2 PERVASIVE

11.6.3 PARTICIPANTS

11.6.4 EMERGING LEADERS

FIGURE 37 STEEL WIRE MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 38 STEEL WIRE MARKET (EUROPE): COMPETITIVE LEADERSHIP MAPPING, 2019

11.7 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 39 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN STEEL WIRE MARKET

11.8 BUSINESS STRATEGY EXCELLENCE

FIGURE 40 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN STEEL WIRE MARKET

12 COMPANY PROFILES (Page No. - 141)

(Business overview, Products offered, Recent developments, SWOT analysis, Winning imperatives, Development and Growth strategies, Threat from competition, Right to win & MnM view

12.1 ARCELORMITTAL

FIGURE 41 ARCELORMITTAL: COMPANY SNAPSHOT

12.2 HBIS GROUP LTD.

12.3 NIPPON STEEL

FIGURE 42 NIPPON STEEL: COMPANY SNAPSHOT

12.4 BEKAERT SA

FIGURE 43 BEKAERT SA: COMPANY SNAPSHOT

12.5 TATA STEEL LIMITED

FIGURE 44 TATA STEEL LIMITED: COMPANY SNAPSHOT

12.6 JSW STEEL LTD.

FIGURE 45 JSW STEEL LTD.: COMPANY SNAPSHOT

12.7 KOBE STEEL, LTD.

FIGURE 46 KOBE STEEL, LTD.: COMPANY SNAPSHOT

12.8 JFE STEEL CORPORATION

FIGURE 47 JFE STEEL CORPORATION: COMPANY SNAPSHOT

12.9 THE HEICO COMPANIES

12.10 JIANGSU SHAGANG GROUP

12.11 FERRIER NORD

FIGURE 48 FERRIER NORD: COMPANY SNAPSHOT

12.12 BYELORUSSIAN STEEL WORKS

FIGURE 49 BYELORUSSIAN STEEL WORKS: COMPANY SNAPSHOT

12.13 INSTEEL INDUSTRIES, INC.

FIGURE 50 INSTEEL INDUSTRIES, INC.: COMPANY SNAPSHOT

12.14 FAGERSTA STAINLESS AB

12.15 FAPRICELA - INDUSTRIA DE TREFILARIA

12.16 VAN MERKSTEIJN INTERNATIONAL

12.17 VOESTALPINE WIRE AUSTRIA GMBH

12.18 DWK DRAHTWERK KOLN GMBH

12.19 INTERSIG N. V.

12.20 HY-TEN GROUP LIMITED

12.21 ZDB DRATOVNA

12.22 VIRAJ PROFILES LTD.

12.23 CB TRAFILATI ACCIAI S.P.A.

12.24 KAMARIDIS GLOBAL WIRE SA

12.25 G.P. MANUFACTURAS DEL ACERO

*Details on Business overview, Products offered, Recent developments, SWOT analysis & MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 194)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

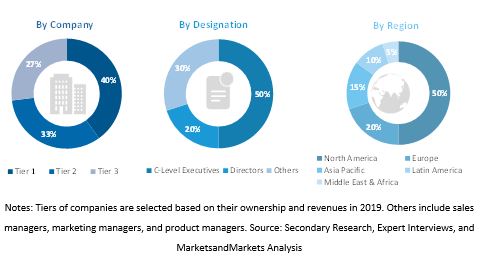

The study involves two major activities in estimating the current size of the steel wire market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Factiva, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The steel wire market comprises several stakeholders, such as raw material suppliers, manufacturers, end-product users, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of mainly the construction, automotive, energy, indistrial, and agriculture end-use industries. Advancements in technology and diverse applications in various end-use industries describe the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total steel wire market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall steel wire market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the automotive & transportation, construction, energy, and industrial end-use industries.

Report Objectives

- To analyze and forecast the global steel wire market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on form, type, thickness, and end-use industry

- To analyze and forecast the market size based on five main regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa (MEA), and Latin America

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC steel wire market

- Further breakdown of Rest of European steel wire market

- Further breakdown of Rest of North American steel wire market

- Further breakdown of Rest of MEA steel wire market

- Further breakdown of Rest of Latin American steel wire market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Steel Wire Market