Package Boilers Market by Type (Fire-Tube, Water-Tube, Electric), Fuel (Oil, Gas, Biomass), Design (D-Type, A-Type, O-Type), End-Use Industry (Food & Beverage, Chemical, Oil & Gas, Paper & Pulp), and Region - Global Forecast to 2022

[157 Pages Report] Package Boilers Market was valued at USD 8.54 Billion in 2016 and is projected to reach USD 11.06 Billion by 2022, at a CAGR of 4.40% from 2017 to 2022.

The objectives of this study are:

- To identify key market dynamics such as drivers, restraints, opportunities, and challenges impacting the growth of the package boilers market

- To define and segment the package boilers market based on design, fuel, type, end-use industry, and region

- To analyze and forecast the demand for package boilers, in terms of value

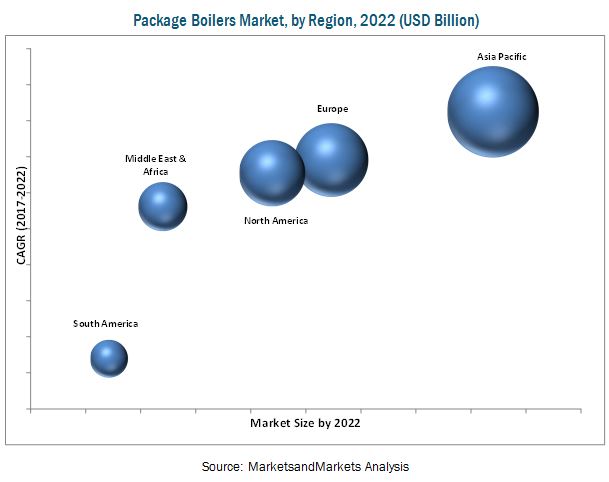

- To estimate, analyze, and forecast the package boilers market with respect to key countries across various regions, such as North America, Asia Pacific, Europe, South America, and the Middle East & Africa

- To analyze and forecast the demand for package boilers across different end-use industries, such as food & beverage, chemical, oil & gas, and paper & pulp

- To analyze recent developments such as expansions, partnerships & collaborations, agreements & contracts, and new product launches

- To analyze opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To strategically identify and profile key players in the package boilers market

Years considered for the study are:

- Base Year 2016

- Estimated Year 2017

- Projected Year 2022

- Forecast Period 2017 to 2022

For company profiles, 2016 has been considered as the base year. In the cases, wherein information was unavailable for the base year, the years prior to it have been considered.

Research Methodology

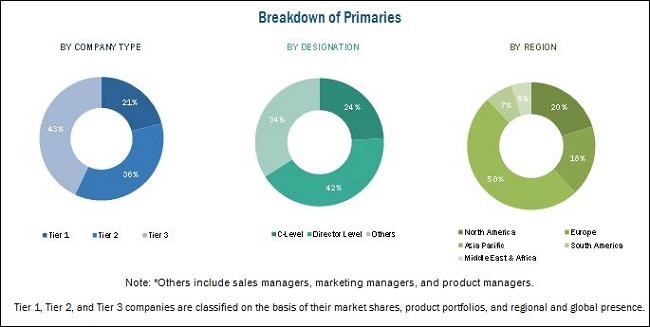

This study estimates the size of the package boilers market for 2017 and projects its demand till 2022. It also provides a detailed qualitative and quantitative analysis of the package boilers market. Various secondary sources, including directories, industry journals, and databases (such as D&B Hoovers, Bloomberg, Chemical Weekly, Factiva, government and private websites, and associations) have been used to identify and collect information useful for this extensive commercial study of the package boilers market. Primary sources such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as assess future prospects of the package boilers market. The breakdown of profiles of primaries is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the package boilers market includes raw material suppliers and manufacturers of package boilers. Cleaver-Brooks, Inc. (US), Thermax Limited (India), Hurst Boiler & Welding Co., Inc. (US) Johnston Boiler Company (US), Calderas Powermaster (Mexico), IHI Corporation (Japan), Mitsubishi Hitachi Power Systems, Ltd. (Japan), Amec Foster Wheeler Plc. (UK), Babcock & Wilcox Enterprises, Inc. (US), Forbes Marshall Private Limited (India), Parker Boiler Company (US), Miura Boilers (US), and Superior Boiler Works, Inc. (Malaysia) are key players operating in the package boilers market. Products manufactured by these companies are used in various end-use industries, such as food & beverage, chemical, oil & gas, and paper & pulp.

Key Target Audience

- Manufacturers of Package Boilers

- Traders, Distributors, and Suppliers of Package Boilers

- End-Use Industries Operating in the Package Boilers Supply Chain

- Government and Research Organizations

- Filter Associations

- Research and Consulting Firms

- R&D Institutions

- Environment Support Agencies

- Investment Banks and Private Equity Firms

Scope of the Report: This research report categorizes the package boilers market on the basis of type, design, fuel, end-use industry, and region. The report forecasts revenues as well as analyzes trends in each of these submarkets.

Package Boilers Market, by Design:

- D-type Package Boilers

- A-type Package Boilers

- O-type Package Boilers

Package Boilers Market, by Type:

- Fire-tube Package Boilers

- Water-tube Package Boilers

- Electric Boilers

- Others

Package Boilers Market, by Fuel:

- Oil

- Gas

- Biomass

- Others

Package Boilers Market, by End-Use Industry:

- Food & Beverage

- Chemical

- Oil & Gas

- Paper & Pulp

- Others

Package Boilers Market, by Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to specific needs of companies. The following customization options are available for the report:

- New Product Analysis

Product matrix, which offers a detailed comparison of new products and market trends in each industry

- Regional Analysis

Further breakdown of a region on the basis of country and end-use industry

- Company Information

Detailed analysis and profiling of additional market players (up to five)

The package boilers market is estimated to be USD 8.92 Billion in 2017 and is projected to reach USD 11.06 Billion by 2022, at a CAGR of 4.40% from 2017 to 2022. This growth can be attributed to the increased demand for package boilers from the food & beverage industry. The demand for package boilers is growing significantly across various regions worldwide, due to advantages associated with the use of package boilers, such as easy installation and low maintenance costs as compared to large industrial boilers. Furthermore, research & development activities are being carried to enhance the features of package boilers.

Based on design, the D-type segment of the package boilers market is projected to grow at the highest CAGR from 2017 to 2022. D-type package boilers reduce the overall project cycle time and lower costs of steam generating equipment. These boilers are utilized in power plants, paper & pulp industry, manufacturing and processing facilities, hospitals, petrochemical industry, ethanol plants, and saw mills.

Based on type, the fire-tube package boilers segment accounted for the largest share of the package boilers market in 2016. This large share can be attributed to the increasing use of fire-tube package boilers in various process industries and marine applications, as these boilers are easy to handle and can conveniently be transported from one place to another.

The food & beverage end-use industry segment is projected to lead the package boilers market during the forecast period. The food & beverage industry has become highly advanced, sophisticated, and technical due to strict air quality compliance and rise in the production capacities of food & beverage units. Package boilers are primarily used to generate steam required to carry out various processes in the food & beverage industry. Thus, the increasing applicability of package boilers in the food & beverage industry has contributed to the growth of the package boilers market.

The oil fuel segment is projected to lead the package boilers market from 2017 to 2022. Oil-based package boilers have gained popularity in regions with limited access to natural gas, such as the Northeast Asia. Boiler manufacturers are currently offering heating oil blended with biodiesel, which allows end users to reduce their dependence on foreign oil. These biodiesel blends also produce less pollution as compared to pure heating oil. Thus, biodiesel blends as a fuel source in package boilers have contributed to the growth of the oil segment of the package boilers market.

The package boilers market in the Asia Pacific region is projected to grow at the highest CAGR during the forecast period. Rapid industrialization and infrastructural developments in the Asia Pacific region offer lucrative growth opportunities to manufacturers of package boilers.

However, the formulation of stringent emission standards is acting as a key restraint to the growth of the package boilers market.

Cleaver-Brooks, Inc. (US), Thermax Limited (India), Hurst Boiler & Welding Co., Inc. (US) Johnston Boiler Company (US), Calderas Powermaster (Mexico), IHI Corporation (Japan), Mitsubishi Hitachi Power Systems, Ltd. (Japan), Amec Foster Wheeler Plc. (UK), Babcock & Wilcox Enterprises, Inc. (US), Forbes Marshall Private Limited (India), Parker Boiler Company (US), Miura Boilers (US), Superior Boiler Works, Inc. (Malaysia), English Boiler & Tube, Inc. (US), Aalborg Engineering A/S (Denmark), John Thompson (UK), York-Shipley Global (US), Rentech Boiler Systems Inc. (US), Williams & Davis Boilers (US), Mackenzie Industries (Malaysia), Vapor Power International, LLC (US), and Kawasaki Thermal Engineering (Japan) are key companies operating in the package boilers market. These players, with a wide market reach and established distribution networks, are increasingly investing in research & development activities for the development of advanced package boilers. They also have strong technical and market development capabilities, which enable them to upgrade their existing products for new applications.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regional Scope

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Package Boilers Market

4.2 Package Boilers Market, By Region

4.3 Package Boilers Market, By Design

4.4 Asia Pacific Package Boilers Market, By End-Use Industry and Country

4.5 Package Boilers Market: Emerging vs Developed Countries

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Package Boilers in the Food & Beverage Industry

5.2.2 Restraints

5.2.2.1 Stringent Government Regulations for Meeting Emission Standards

5.2.3 Opportunities

5.2.3.1 Adoption of Burner Technology for Reducing NOX Emissions

5.2.3.2 Growing Focus on Clean and Renewable Energy Sources

5.2.4 Challenges

5.2.4.1 Boiler Efficiency and Steam Quality

5.2.4.2 High R&D Investments

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Bargaining Power of Buyers

5.3.3 Threat of Substitutes

5.3.4 Bargaining Power of Suppliers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicators

5.4.1 Trends and Forecast of GDP

5.5 Industry Outlook

5.5.1 Chemical Industry

6 Package Boilers Market, By Design (Page No. - 49)

6.1 Introduction

6.2 D-Type Package Boilers

6.3 A-Type Package Boilers

6.4 O-Type Package Boiler

7 Package Boilers Market, By End-Use Industry (Page No. - 55)

7.1 Introduction

7.2 Food & Beverage

7.3 Chemical

7.4 Oil & Gas

7.5 Paper & Pulp

7.6 Others

8 Package Boilers Market, By Fuel (Page No. - 65)

8.1 Introduction

8.2 Oil

8.3 Gas

8.4 Biomass

8.5 Others

9 Package Boilers Market, By Type (Page No. - 73)

9.1 Introduction

9.2 Fire-Tube Package Boilers

9.3 Water-Tube Package Boilers

9.4 Electric Boilers

9.5 Others

10 Regional Analysis (Page No. - 82)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 Australia

10.3.5 South Korea

10.3.6 Indonesia

10.3.7 Rest of Asia Pacific

10.4 Europe

10.4.1 Germany

10.4.2 Russia

10.4.3 UK

10.4.4 Italy

10.4.5 Spain

10.4.6 France

10.4.7 Rest of Europe

10.5 Middle East & Africa

10.5.1 Iran

10.5.2 UAE

10.5.3 Saudi Arabia

10.5.4 South Africa

10.5.5 Rest of the Middle East & Africa

10.6 South America

10.6.1 Brazil

10.6.2 Argentina

10.6.3 Rest of South America

11 Competitive Landscape (Page No. - 119)

11.1 Introduction

11.2 Competitive Leadership Mapping

11.2.1 Dynamic Differentiators

11.2.2 Innovators

11.2.3 Visionary Leaders

11.2.4 Emerging Companies

11.3 Competitive Benchmarking

11.3.1 Strength of Product Portfolio (For All 25 Companies)

11.3.2 Business Strategies Excellence (For All 25 Companies)

11.4 Market Player Ranking

12 Company Profiles (Page No. - 124)

(Business Overview, Products Offered, Scorecard of Product Offering, Scorecard of Business Strategy, and New Product Launch)

12.1 Cleaver-Brooks, Inc.

12.2 Mitsubishi Hitachi Power Systems, Ltd.

12.3 Babcock & Wilcox Enterprises, Inc.

12.4 Amec Foster Wheeler PLC

12.5 Thermax Limited

12.6 Hurst Boiler & Welding Company, Inc.

12.7 Johnston Boiler Company

12.8 Calderas Powermaster

12.9 IHI Corporation

12.10 Forbes Marshall Private Limited

12.11 Other Players in Package Boiler Market

12.11.1 Fulton

12.11.2 York-Shipley Global

12.11.3 Parker Boiler Company

12.11.4 Microtech Boilers Private Limited

12.11.5 John Thompson

12.11.6 Aalborg Engineering A/S

12.11.7 Rentec Boilers Systems

12.11.8 Miura

12.11.9 Aerco International Inc.

12.11.10 Kawasaki Thermal Engineering Co., Ltd.

12.11.11 Williams & Davis Boilers

12.11.12 Vapor Power International, LLC

12.11.13 English Boiler and Tube, Inc.

12.11.14 Mackenzie Industries

12.11.15 Superior Boiler Works, Inc.

*Details Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 149)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Introducing RT: Real Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (75 Tables)

Table 1 Package Boilers Market Snapshot

Table 2 Global Air Pollutant Emission Limits

Table 3 China: Thermal Power Boiler Air Pollutant Limits

Table 4 Trends and Forecast of GDP, 2015-2021 (USD Billion)

Table 5 Package Boilers Market, By Design, 20152022 (USD Million)

Table 6 D-Type Package Boilers Segment, By Region, 20152022 (USD Million)

Table 7 A-Type Package Boilers Segment, By Region, 20152022 (USD Million)

Table 8 O-Type Package Boilers Segment, By Region, 20152022 (USD Million)

Table 9 Package Boilers Market, By End-Use Industry, 2015-2022 (USD Million)

Table 10 Package Boiler in Food & Beverage Segment Market Size, By Region, 2015-2022 (USD Million)

Table 11 Package Boiler in Chemical Segment Market Size, By Region, 2015-2022 (USD Million)

Table 12 Package Boiler in Oil & Gas Segment Market Size, By Region, 2015-2022 (USD Million)

Table 13 Package Boiler in Paper & Pulp Segment Market Size, By Region, 2015-2022 (USD Million)

Table 14 Package Boiler in Others Segment Market Size, By Region, 2015-2022 (USD Million)

Table 15 Package Boilers Market, By Fuel, 20152022 (USD Million)

Table 16 Oil Fuel Segment, By Region, 20152022 (USD Million)

Table 17 Gas Fuel Segment, By Region, 20152022 (USD Million)

Table 18 Biomass Fuel Segment, By Region, 20152022 (USD Million)

Table 19 Others Fuel Segment, By Region, 20152022 (USD Million)

Table 20 Package Boilers Market, By Type, 20152022 (USD Million)

Table 21 Fire-Tube Package Boilers Segment, By Region, 20152022 (USD Million)

Table 22 Water-Tube Package Boilers Segment, By Region, 20152022 (USD Million)

Table 23 Electric Boilers Segment, By Region, 20152022 (USD Million)

Table 24 Others Type Segment, By Region, 20152022 (USD Million)

Table 25 Package Boilers Market, By Region, 20152022 (USD Million)

Table 26 North America Package Boilers Market, By Country, 20152022 (USD Million)

Table 27 North America Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 28 North America Package Boilers Market, By Type, 20152022 (USD Million)

Table 29 North America Package Boilers Market, By Fuel, 20152022 (USD Million)

Table 30 North America Package Boilers Market, By Design, 20152022 (USD Million)

Table 31 US Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 32 Canada Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 33 Mexico Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 34 Asia Pacific Package Boilers Market, By Country, 20152022 (USD Million)

Table 35 Asia Pacific Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 36 Asia Pacific Package Boilers Market, By Type, 20152022 (USD Million)

Table 37 Asia Pacific Package Boilers Market, By Fuel, 20152022 (USD Million)

Table 38 Asia Pacific Package Boilers Market, By Design, 20152022 (USD Million)

Table 39 China Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 40 Japan Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 41 India Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 42 Australia Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 43 South Korea Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 44 Indonesia Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 45 Rest of the Asia Pacific Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 46 Europe Package Boilers Market, By Country, 20152022 (USD Million)

Table 47 Europe Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 48 Europe Package Boilers Market, By Type, 20152022 (USD Million)

Table 49 Europe Package Boilers Market, By Fuel, 20152022 (USD Million)

Table 50 Europe Package Boilers Market, By Design, 20152022 (USD Million)

Table 51 Germany Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 52 Russia Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 53 UK Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 54 Italy Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 55 Spain Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 56 France Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 57 Rest of Europe Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 58 Middle East & Africa Package Boilers Market, By Country, 20152022 (USD Million)

Table 59 Middle East & Africa Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 60 Middle East & Africa Package Boilers Market, By Type, 20152022 (USD Million)

Table 61 Middle East & Africa Package Boilers Market, By Fuel, 20152022 (USD Million)

Table 62 Middle East & Africa Package Boilers Market, By Design, 20152022 (USD Million)

Table 63 Iran Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 64 UAE Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 65 Saudi Arabia Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 66 South Africa Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 67 Rest of Middle East & Africa Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 68 South America Package Boilers Market, By Country, 20152022 (USD Million)

Table 69 South America Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 70 South America Package Boilers Market, By Type, 20152022 (USD Million)

Table 71 South America Package Boilers Market, By Fuel, 20152022 (USD Million)

Table 72 South America Package Boilers Market, By Design, 20152022 (USD Million)

Table 73 Brazil Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 74 Argentina Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

Table 75 Rest of South America Package Boilers Market, By End-Use Industry, 20152022 (USD Million)

List of Figures (45 Figures)

Figure 1 Package Boilers Market: Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Package Boilers Market: Data Triangulation

Figure 5 The Food & Beverage Segment is Estimated to Be the Largest End-Use Industry Segment of the Package Boilers Market in 2017

Figure 6 The D-Type Package Boilers Segment is Anticipated to Lead the Package Boilers Market During the Forecast Period

Figure 7 The Oil Fuel Segment is Projected to Lead the Package Boilers Market During the Forecast Period

Figure 8 Package Boilers Market, By Region

Figure 9 The Increasing Demand for Package Boilers From Various End-Use Industries is Driving the Growth of the Market

Figure 10 The Package Boilers Market in the Asia Pacific Region is Projected to Grow at the Highest CAGR Between 2017 and 2022

Figure 11 The D-Type Package Boilers Segment is Projected to Lead the Package Boilers Market Across All Regions From 2017 to 2022

Figure 12 The Food & Beverage End-Use Industry Segment is Estimated to Account for the Largest Share of the Asia Pacific Package Boilers Market in 2017

Figure 13 Drivers, Restraints, Opportunities, and Challenges in the Package Boilers Market

Figure 14 Porters Five Forces Analysis

Figure 15 Growth Rate of the Global Chemical Industry (2015-2018)

Figure 16 The D-Type Package Boilers Segment of the Package Boilers Market is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 17 The Asia Pacific Region Accounted for the Largest Share of the D-Type Package Boilers Segment of the Package Boilers Market in 2016

Figure 18 The A-Type Package Boilers Segment of the Asia Pacific Package Boilers Market is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 19 The Asia Pacific Region is Anticipated to Lead the O-Type Package Boilers Segment of the Package Boilers Market From 2017 to 2022

Figure 20 The Food & Beverage End-Use Industry Segment is Projected to Lead the Package Boilers Market From 2017 to 2022

Figure 21 The Food & Beverage End-Use Industry Segment of the Asia Pacific Package Boilers Market is Projected to Grow at the Highest CAGR Between 2017 and 2022

Figure 22 The Asia Pacific Region is Anticipated to Lead the Chemical End-Use Industry Segment of the Package Boilers Market Between 2017 and 2022

Figure 23 The Oil & Gas End-Use Industry Segment of the Asia Pacific Package Boilers Market is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 24 The Asia Pacific Region Accounted for the Largest Share of the Paper & Pulp End-Use Industry Segment of the Package Boilers Market in 2016

Figure 25 The Others End-Use Industry Segment of the Asia Pacific Package Boilers Market is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 26 The Biomass Fuel Segment of the Package Boilers Market is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 27 The Asia Pacific Region Accounted for the Largest Share of the Oil Fuel Segment of the Package Boilers Market in 2016

Figure 28 The Gas Fuel Segment of the Asia Pacific Package Boilers Market is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 29 The Asia Pacific Region is Projected to Lead the Biomass Fuel Segment of the Package Boilers Market From 2017 to 2022

Figure 30 The Asia Pacific Region is Anticipated to Lead the Others Fuel Segment of the Package Boilers Market From 2017 to 2022

Figure 31 The Fire-Tube Package Boilers Type Segment of the Package Boilers Market is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 32 The Asia Pacific Region is Anticipated to Lead the Fire-Tube Package Boilers Type Segment of the Package Boilers Market Between 2017 and 2022

Figure 33 The Water-Tube Package Boilers Type Segment of the Asia Pacific Package Boilers Market is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 34 The North American Region is Anticipated to Lead the Electric Boilers Type Segment of the Package Boilers Market From 2017 to 2022

Figure 35 The Asia Pacific Region Accounted for the Largest Share of the Others Type Segment of the Package Boilers Market in 2016

Figure 36 The Asia Pacific Region Accounted for the Largest Share of the Package Boilers Market in 2016

Figure 37 The North America Package Boilers Market Snapshot

Figure 38 Asia Pacific Package Boilers Market Snapshot

Figure 39 Europe Package Boilers Market Snapshot

Figure 40 Competitive Leadership Mapping,2016

Figure 41 Cleaver-Brooks Accounted for the Largest Share of the Package Boilers Market

Figure 42 Babcock & Wilcox Enterprises, Inc.: Company Snapshot

Figure 43 Amec Foster Wheeler PLC: Company Snapshot

Figure 44 Thermax Limited: Company Snapshot

Figure 45 IHI Corporation: Company Snapshot

Growth opportunities and latent adjacency in Package Boilers Market