Starter Cultures Market by Application (Dairy & dairy-based products, Meat & seafood, alcoholic & non-alcoholic beverages), Form, Composition (Multi-strain mix, Single strain, and Multi-strain), Microorganism and Region - Global Forecast to 2027

By 2022, the global starter culture market is expected to be worth USD 1.1 billion. It is expected to grow at a 5.5% CAGR to USD 1.5 billion by 2027. The global starter culture market is expected to grow due to the growing demand for fermented dairy products, such as yogurt and cheese. Several innovations in the yogurt sector have been fueling the demand for starter cultures, and manufacturers have been exploring the multifunctional properties of these products. Technological advancements have also helped widen the application of starter cultures across different industries. The addition of starter cultures provides a basis for ensuring that products are manufactured on a consistent schedule without compromising on quality.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Health benefits provided by starter cultures

There has been an increasing demand for fermented dairy products as an important component of a nutritional diet. The main reason for this is the health benefits of fermented foods due to the interaction of ingested live microorganisms with the host. Fermented dairy products have long been a vital part of a balanced diet. Historically, the fermentation process resulted in a delayed and unpredictable sourness of milk caused by microbes naturally present in milk. However, in under-regulated settings, current microbiological techniques have resulted in the manufacture of various fermented milk products with increased nutritional value. These products are a significant component of functional foods. Extensive research is being conducted to develop dairy products that integrate probiotic organisms to increase their value. By using probiotic starter microorganisms, potential health benefits can be introduced to meat products. Starter cultures made of lactic acid bacteria produce lactic acid that acts on meat proteins, thereby modifying their water biding capacity and increasing microbial safety. Additionally, microbial substances, namely, bacteriocins produced by gram-positive species of the lactic acid bacterial group, have been found to play an important microbial role with a significant effect on the safety and preservation of food.

Restraints: Strict monitoring of conditions for the growth of starter cultures

Warm temperature promotes the growth of microbial starter cultures. If the temperature drops, the growth of the cultures halts, and it results in an incomplete fermentation process. There is a direct relation between ambient temperature and the activity of cultures. For example, if the environmental conditions for kefir preparation are not optimal, the cultures will hibernate, and the fermentation process will retard. This results in poor quality products and affects the market. Similarly, the temperature requirements of thermophilic and mesophilic bacteria are very precise, and any temperature variation can adversely affect the starter cultures.

Opportunities: High-growth potential markets of Asia Pacific and South America

Currently, Europe dominates the starter cultures market. Still, manufacturers are exploring the Asia Pacific and South American markets as the usage of starter cultures in these markets is expected to witness high growth in the coming years. According to the Food and Agriculture Organization (FAO), the middle-class population inhabiting the region has shifted its diet preferences from staple cereals to meat, dairy products, fruits, and vegetables. Despite the dairy industry being unorganized, the region still has a huge scope for growth. India and China claim to have a higher consumption of milk. They are expected to build a larger market, owing to the increasing demand for milk and other dairy products. The high dairy consumption in countries such as India and China is expected to drive the growth prospects in the region. Milk production in the Asia Pacific region has shown the highest growth since the last decade, and this trend is set to continue in the coming years.

Challenges: Lack of awareness regarding the selection of starter cultures

The selection of the right type of starter cultures is a key aspect that many companies have not figured out perfectly. This selection is important for the flavor and texture profiles in full-fat cheeses. However, it is even more important in the production of low-fat cheeses that are susceptible to the development of off-flavors. A starter cultures that produces high-quality standard fat cheddar may not be suitable for producing a quality low-fat variant. Similarly, the type of bacteria used (thermophilic or mesophilic) also plays a key role in the overall property of the food item.

Starter cultures play an important role in cheese manufacture because of their metabolism, and it determines the specific texture and flavor development of the product. Hence, the selection of the right type of starter cultures is a complex method that requires validation at a laboratory level and factory-scale. Lack of awareness among experts on the characteristics of the strain can lead to huge production losses, and hence, this factor has been acting as a major restraint for the starter culture market. Adequate training provided to the professionals in regard to the product functions and characteristics can help the manufacturers attain the desired quality product, with minimal production losses.

The dairy and dairy products segment is estimated to grow at the highest CAGR during the forecast period

The dairy & dairy-based application segment is expected to account for a larger share in 2022. This is attributed to the increasing production and consumption of fermented diary-based products worldwide. Cheese occupied the largest share among dairy applications, followed by yogurt. A starter culture is majorly used in cheese production, as it helps it attain uniformity and improves its flavor and texture.

The freeze-dried segment is estimated to account for the largest share in the starter cultures market in 2022

Through freeze-drying, microorganisms can be preserved without causing severe damage to their physical or molecular functions. As a result, the adoption of the freeze-drying method has increased significantly for microbe-based applications. These cultures can easily be rehydrated, depending on the application’s requirement. Freeze drying is used in various applications, such as fermented milk and cheese. All these factors attributes the freeze dried segment to occupy largest share.

To know about the assumptions considered for the study, download the pdf brochure

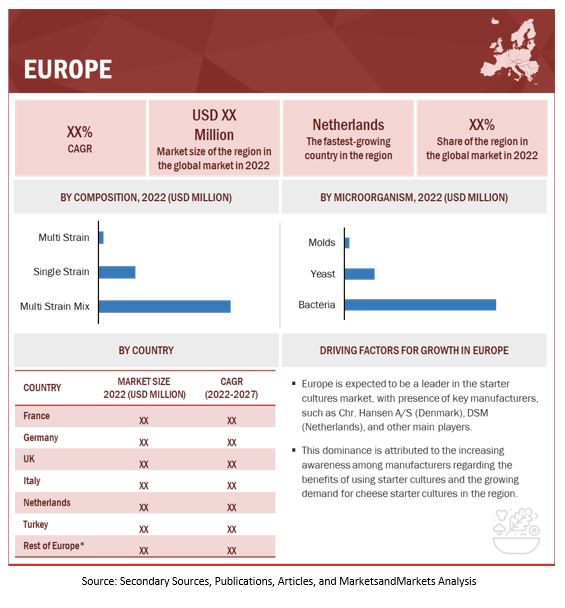

Europe dominated the starter culture market, with a value of USD 388.9 million in 2021; it is projected to reach USD 541.7 million by 2027, at a CAGR of 5.7% during the forecast period.

Europe is one of the major consumers of starter culture globally, owing to the high demand from yogurt and cheese manufacturers. Due to this, a few leading starter culture manufacturers are established across this region, such as Chr. Hansen Holding A/S (Denmark), DSM (Netherlands), and LB Bulgaricum (Bulgaria). Dairy is one of the major revenue-generating sectors in the Asia Pacific region, with innovations witnessed in countries such as India and China. Hence, in terms of growth, it is expected that the Asia Pacific region would be growing at the highest rate, driven by the increasing number of dairy and meat-based manufacturers using a starter culture.

Key Market Players

The key players in this market include Chr. Hansen Holding A/S (Denmark), DuPont (US), IFF(US) and LB Bulgaricum (Bulgaria).

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2022–2027 |

|

Base year considered |

2021 |

|

Forecast period considered |

2022–2027 |

|

Units considered |

Value (USD), Volume (KT) |

|

Segments covered |

By application, form, composition, microorganisms and region |

|

Regions covered |

North America, Asia Pacific, Europe, South America and RoW |

|

Companies studied |

|

This research report categorizes the starter cultures market, based on application, form, composition, microorganisms and region

Target Audience

- Manufacturers, dealers, and suppliers of starter cultures

- Government bodies

- Food & beverage retailers, wholesalers, and distributors

- Raw material suppliers

- Associations

- INRA - Institut national de la recherche agronomique

- The US Pharmacopeial Convention (USP), Food Chemical Codex

- EDA - European Dairy Association

- EuropaBio - European Association for Bioindustries

- Regulatory bodies & institutions

- US Food and Drug Administration (US FDA)

- European Food Safety Authority (EFSA)

- Food Safety and Standards Authority of India (FSSAI)

- Food Standards Australia New Zealand (FSANZ)

- Logistics companies & transporters

- Food & beverage processing industry

- Commercial R&D institutions

- Life sciences laboratories and institutions

By Application

- Dairy & dairy products

- Cheese

- Yoghurt

- Butter & cream

- Others

- Meat & seafood

- Alcoholic & non-alcoholic beverages

- Other applications

By Microorganism:

- Yeast

- Thermophilic

- Mesophilic

- Bacteria

- Mold

By Form:

- Frozen

- Freeze-Dried

By Composition:

- Single strain

- Multi strain

- Multi strain mix

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In June 2021, DSM has announced the launch of its new yogurt culture: Delvo Fresh YS-042. The culture – an extension of DSM’s Delvo Fresh culture portfolio – enables manufacturers to create stirred yogurt that stays extra mild, creamy, and thick throughout its shelf life, without the need for texturizers or additional proteins.

- In April 2021, Chr. Hansen Holding A/S launched the ‘FreshQ’ culture to unlock the benefits of bioprotection for producers experiencing challenged cold chains, long fermentation, and in-process holding times. The special food cultures could be applied to a broad range of fermented dairy products, such as yogurt and white cheese.

- In February 2021, IFF completed the previously announced merger of IFF and DuPont’s Nutrition & Biosciences (“N&B”) business. The combined company would continue to operate under the name IFF. The shares of the combined company’s common stock will trade on the New York Stock Exchange under the symbol “IFF.” The complementary portfolios give the company leadership positions within the taste, texture, scent, nutrition, enzymes, cultures, soy proteins, and probiotic ingredient categories.

- In November 2020, Chr. Hansen launched YoFlex Premium & nu-trish Premium for high-texture yogurt with fewer additives. The product would improve the margins by reducing the need for expensive skim milk powder. It would create healthier, premium yogurts with optimal probiotics.

FAQs:

Which region is projected to account for the largest share in the starter cultures market?

Europe dominated the starter cultures market, with a value of USD 388 million in 2021; it is projected to reach USD 541 million by 2027, at a CAGR of 5.7% during the forecast period.

What is the current size of the starter cultures market?

The global starter cultures market is estimated to be valued at USD 1.1 billion in 2022. It is projected to reach USD 1.5 billion by 2027, recording a CAGR of 5.5% during the forecast period.

Which are the key players in the market, and how intense is the competition?

Key players in this market include Chr. Hansen Holding A/S (Denmark), DuPont (US) and IFF(US). Since starter cultures is a fast-growing market, the existing players are fixated upon improving their market shares, while startups are being established rapidly. The starter culture market can be classified as a competitive market as it has a large number of organized players, accounting for a major part of the market share, present at the global level, and unorganized players present at the local level in several countries.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION: STARTER CULTURE MARKET

1.3.1 INCLUSIONS AND EXCLUSIONS

1.3.2 GEOGRAPHIC SCOPE

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 STARTER CULTURE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

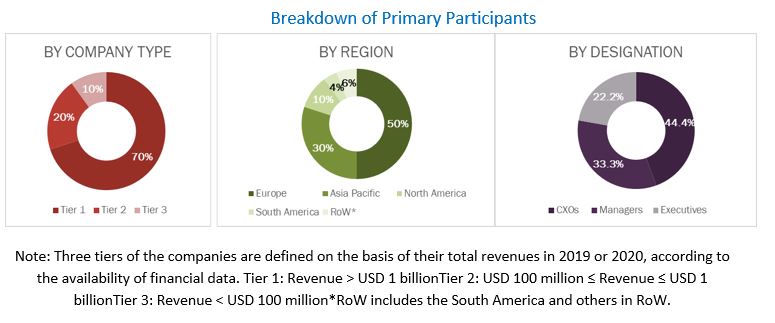

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 STARTER CULTURES MARKET SIZE ESTIMATION, BY TYPE (SUPPLY-SIDE)

FIGURE 5 STARTER CULTURE MARKET SIZE ESTIMATION (DEMAND-SIDE)

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 38)

TABLE 1 STARTER CULTURES MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 7 MARKET FOR STARTER CULTURES, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 8 MARKET FOR STARTER CULTURES, BY COMPOSITION, 2022 VS. 2027 (USD MILLION)

FIGURE 9 MARKET FOR STARTER CULTURES, BY FORM, 2022 VS. 2027 (USD MILLION)

FIGURE 10 MARKET FOR STARTER CULTURES, BY MICROORGANISM, 2022 VS. 2027 (USD MILLION)

FIGURE 11 STARTER CULTURE MARKET SHARE & GROWTH (VALUE), BY REGION

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 OPPORTUNITIES IN THE STARTER CULTURE MARKET

FIGURE 12 RISING DEMAND FOR FERMENTED DAIRY PRODUCTS DRIVING THE MARKET FOR STARTER CULTURE

4.2 MARKET FOR STARTER CULTURES, BY MICROORGANISM, 2022

FIGURE 13 MAJORITY OF THE FERMENTATION PROCESSES IN DAIRY AND MEAT APPLICATIONS INVOLVE BACTERIAL CULTURES

4.3 EUROPE: MARKET FOR STARTER CULTURES, BY KEY APPLICATION AND KEY COUNTRY

FIGURE 14 FRANCE WAS ONE OF THE MAJOR CONSUMERS OF STARTER CULTURE IN 2022

4.4 MARKET FOR STARTER CULTURES, BY REGION

FIGURE 15 EUROPE ACCOUNTED FOR LARGEST SHARE OF STARTER CULTURE MARKET IN 2022

4.5 MARKET FOR STARTER CULTURES, BY KEY COUNTRY

FIGURE 16 ASIAN COUNTRIES PROJECTED TO WITNESS HIGH GROWTH DURING THE FORECAST PERIOD (2022-2027)

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 STARTER CULTURE MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing production of dairy-based products and meat and seafood

FIGURE 18 GLOBAL PRODUCTION OF CHEESE, 2017–2025 (THOUSAND TONNE)

FIGURE 19 GLOBAL PRODUCTION OF BUTTER, 2017–2025 (THOUSAND TONNE)

5.2.1.2 Technological advancements

5.2.1.3 Health benefits provided by starter cultures

5.2.1.4 Growing consumption of functional drinks

5.2.2 RESTRAINTS

5.2.2.1 Stringent regulations concerning the use of starter cultures

5.2.2.2 Strict monitoring of conditions for the growth of starter cultures

5.2.3 OPPORTUNITIES

5.2.3.1 Growth prospects for untapped industrial applications

5.2.3.2 High-growth potential markets of Asia Pacific and South America

FIGURE 20 ASIA: MILK PRODUCTION, 2017–2025 (THOUSAND LITERS)

5.2.4 CHALLENGES

5.2.4.1 Fluctuations in the prices of raw materials

5.2.4.2 Lack of awareness regarding the selection of starter cultures

5.3 IMPACT OF COVID-19 ON THE STARTER CULTURE MARKET

6 INDUSTRY TRENDS (Page No. - 54)

6.1 INTRODUCTION

6.2 REGULATORY FRAMEWORK

6.2.1 NORTH AMERICA

6.2.1.1 United States

6.2.1.2 Canada

6.2.2 EUROPE

6.2.3 ASIA PACIFIC

6.2.3.1 India

6.2.3.2 China

6.2.3.3 Russia

6.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 2 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 3 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 4 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 5 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.4 PATENT ANALYSIS

FIGURE 21 NO OF PATENTS GRANTED FOR STARTER CULTURE MARKET, 2011-2021

FIGURE 22 REGIONAL ANALYSIS OF PATENT GRANTED FOR STARTER CULTURES MARKET, 2011-2021

TABLE 7 PATENTS PERTAINING TO STARTER CULTURE, 2021

6.5 VALUE CHAIN ANALYSIS

FIGURE 23 STARTER CULTURE: VALUE CHAIN ANALYSIS

6.6 TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 24 TRENDS/DISRUPTIONS IMPACTING BUYERS: CHR. HANSEN HOLDINGS A/S COMPANY

6.7 KEY CONFERENCES & EVENTS FROM 2022 TO 2023

TABLE 8 STARTER CULTURE MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6.8 CASE STUDIES

6.8.1 SAFETY AND ORGANOLEPTIC CONCERNS

TABLE 9 COMPETITION BETWEEN STARTER CULTURES AND WILD MICROBIAL POPULATIONS IN SAUSAGE FERMENTATION

6.8.2 TACKLING FOOD LOSS AND WASTE

TABLE 10 DUPONT’S STARTER CULTURE SUPPORTING PLANT-BASED FOODS BY EXTENDING THE SHELF LIFE OF YOGHURTS BY TEN DAYS

6.9 SUPPLY CHAIN ANALYSIS

FIGURE 25 STARTER CULTURE MARKET: SUPPLY CHAIN ANALYSIS

6.10 PORTER’S FIVE FORCES ANALYSIS

TABLE 11 STARTER CULTURE MARKET: PORTER’S FIVE FORCES ANALYSIS

6.10.1 THREAT OF NEW ENTRANTS

6.10.2 THREAT OF SUBSTITUTES

6.10.3 BARGAINING POWER OF SUPPLIERS

6.10.4 BARGAINING POWER OF BUYERS

6.10.5 INTENSITY OF COMPETITIVE RIVALRY

6.11 TECHNOLOGY ANALYSIS

6.11.1 INDICATION-SPECIFIC FORMULATIONS TO IMPROVE THE METABOLIC ACTIVITY OF MICROBES

6.11.2 MICROENCAPSULATION TO ENHANCE VIABILITY OF STARTER CULTURE

6.11.3 PROBIOTICS/STARTER CULTURE AND ARTIFICIAL INTELLIGENCE

6.12 PRICE ANALYSIS

6.12.1 INTRODUCTION

FIGURE 26 PRICE ANALYSIS: STARTER CULTURE MARKET, BY FORM, 2017-2021 (USD PER/KG)

FIGURE 27 PRICE ANALYSIS: STARTER CULTURE MARKET, BY REGION, 2017-2021 (USD PER/KG)

7 STARTER CULTURES MARKET, BY APPLICATION (Page No. - 72)

7.1 INTRODUCTION

FIGURE 28 STARTER CULTURES MARKET SIZE, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 12 STARTER CULTURE MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 13 STARTER CULTURE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

7.2 DAIRY & DAIRY-BASED PRODUCTS

7.2.1 CHEESE CONTRIBUTED TO THE LARGEST SHARE

TABLE 14 DAIRY & DAIRY-BASED PRODUCTS: STARTER CULTURES MARKET SIZE, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 15 DAIRY & DAIRY-BASED PRODUCTS: MARKET SIZE FOR STARTER CULTURES, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 16 DAIRY & DAIRY-BASED PRODUCTS: MARKET SIZE FOR STARTER CULTURES, BY REGION, 2017–2021 (USD MILLION)

TABLE 17 DAIRY & DAIRY-BASED PRODUCTS: MARKET SIZE FOR STARTER CULTURES, BY REGION, 2022–2027 (USD MILLION)

TABLE 18 CHEESE: STARTER CULTURES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 19 CHEESE: MARKET SIZE FOR STARTER CULTURES, BY REGION, 2022–2027 (USD MILLION)

TABLE 20 YOGURT: STARTER CULTURES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 21 YOGURT: MARKET SIZE FOR STARTER CULTURES, BY REGION, 2022–2027 (USD MILLION)

TABLE 22 BUTTER & CREAM: STARTER CULTURES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 23 BUTTER & CREAM: MARKET SIZE FOR STARTER CULTURES, BY REGION, 2022–2027 (USD MILLION)

TABLE 24 OTHERS: STARTER CULTURES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 25 OTHERS: MARKET SIZE FOR STARTER CULTURES, BY REGION, 2022–2027 (USD MILLION)

7.3 MEAT & SEAFOOD

7.3.1 STARTER CULTURES HELP IN THE EFFECTIVE PRESERVATION OF FERMENTED MEAT

TABLE 26 MEAT & SEAFOOD: STARTER CULTURES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 27 MEAT & SEAFOOD: MARKET SIZE FOR STARTER CULTURES, BY REGION, 2022–2027 (USD MILLION)

7.4 ALCOHOLIC & NON-ALCOHOLIC BEVERAGES

7.4.1 INCREASING CONSUMPTION OF ALOCOHOLIC AND NON-ALCOHOLIC BEVERAGES DRIVING THE GROWTH OF STARTER CULTURES

TABLE 28 ALCOHOLIC & NON-ALCOHOLIC BEVERAGES: STARTER CULTURES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 29 ALCOHOLIC & NON-ALCOHOLIC BEVERAGES: MARKET SIZE FOR STARTER CULTURES, BY REGION, 2022–2027 (USD MILLION)

7.5 OTHERS

7.5.1 LACTOBACILLUS SAKEI AND LACTOBACILLUS ACIDOPHILUS ARE USED AS STARTER CULTURES IN SOURDOUGH BREAD

TABLE 30 OTHER APPLICATIONS: STARTER CULTURES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 31 OTHER APPLICATIONS: MARKET SIZE FOR STARTER CULTURES, BY REGION, 2022–2027 (USD MILLION)

8 STARTER CULTURES MARKET, BY MICROORGANISM (Page No. - 84)

8.1 INTRODUCTION

FIGURE 29 STARTER CULTURES MARKET SIZE, BY MICROORGANISM, 2022 VS. 2027 (USD MILLION)

TABLE 32 MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 33 MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

8.2 BACTERIA

8.2.1 THERMOPHILIC BACTERIA ARE THE MOST PREFERRED STARTER CULTURE

TABLE 34 BACTERIAL: STARTER CULTURES MARKET SIZE, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 35 BACTERIAL: MARKET SIZE FOR STARTER CULTURES, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 36 BACTERIA: MARKET SIZE FOR STARTER CULTURES, BY REGION, 2017–2021 (USD MILLION)

TABLE 37 BACTERIA: MARKET SIZE FOR STARTER CULTURES, BY REGION, 2022–2027 (USD MILLION)

TABLE 38 THERMOPHILIC BACTERIAL STARTER CULTURES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 39 THERMOPHILIC BACTERIAL STARTER CULTURES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 40 MESOPHILIC BACTERIAL STARTER CULTURES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 41 MESOPHILIC BACTERIAL STARTER CULTURES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.3 YEASTS

8.3.1 YEAST IS MOSTLY USED AS A STARTER CULTURE IN BREAD DOUGH

TABLE 42 YEAST-BASED STARTER CULTURES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 43 YEAST-BASED STARTER CULTURE MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.4 MOLDS

8.4.1 MOLDS ARE MOSTLY USED IN SAUSAGES AND OTHER MEAT ITEMS

TABLE 44 MOLD-BASED STARTER CULTURES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 45 MOLD-BASED STARTER CULTURE MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9 STARTER CULTURES MARKET, BY FORM (Page No. - 93)

9.1 INTRODUCTION

FIGURE 30 STARTER CULTURES MARKET SIZE, BY FORM, 2022 VS. 2027 (USD MILLION)

TABLE 46 STARTER CULTURE MARKET SIZE, BY FORM, 2017–2021 (USD MILLION)

TABLE 47 STARTER CULTURE MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

TABLE 48 STARTER CULTURE MARKET SIZE, BY FORM, 2017–2021 (KILOTONS)

TABLE 49 STARTER CULTURE MARKET SIZE, BY FORM, 2022–2027 (KILOTONS)

9.2 FREEZE-DRIED

9.2.1 LYOPHILIZATION EASES TRANSPORT AND STORAGE PROPERTIES FOR STARTER CULTURE

TABLE 50 FREEZE-DRIED: STARTER CULTURES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 51 FREEZE-DRIED: STARTER CULTURE MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.3 FROZEN

9.3.1 TEMPERATURE REQUIREMENTS ARE THE MAJOR RESTRAINT FOR STORAGE/TRANSPORTATION OF FROZEN STARTER CULTURE

TABLE 52 FROZEN: STARTER CULTURES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 53 FROZEN: STARTER CULTURE MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10 STARTER CULTURES MARKET, BY COMPOSITION (Page No. - 99)

10.1 INTRODUCTION

FIGURE 31 STARTER CULTURES MARKET SIZE, BY COMPOSITION, 2022 VS. 2027 (USD MILLION)

TABLE 54 STARTER CULTURE MARKET SIZE, BY COMPOSITION, 2017–2021 (USD MILLION)

TABLE 55 STARTER CULTURE MARKET SIZE, BY COMPOSITION, 2022–2027 (USD MILLION)

10.2 MULTI-STRAIN MIX

10.2.1 MULTI-STRAIN MIX HELPS INCORPORATE ADJUNCT FUNCTIONS TO THE FINAL PRODUCT, THEREBY EXPERIENCING MASSIVE DEMAND

TABLE 56 MULTI-STRAIN MIX: STARTER CULTURES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 57 MULTI-STRAIN MIX: STARTER CULTURE MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.3 SINGLE STRAIN

10.3.1 SINGLE STRAIN STARTER CULTURE MAJORLY HELPS ATTAIN UNIFORM FLAVOR PROFILE DEVELOPMENT

TABLE 58 SINGLE STRAIN: STARTER CULTURES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 59 SINGLE STRAIN: MARKET SIZE FOR STARTER CULTURES, BY REGION, 2022–2027 (USD MILLION)

10.4 MULTI-STRAIN

10.4.1 MULTI-STRAIN MESOPHILIC STARTER CULTURES HAVE BEEN IN HIGH DEMAND ACROSS DEVELOPING ECONOMIES

TABLE 60 MULTI-STRAIN: STARTER CULTURES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 61 MULTI-STRAIN: MARKET SIZE FOR STARTER CULTURES, BY REGION, 2022–2027 (USD MILLION)

11 STARTER CULTURES MARKET, BY REGION (Page No. - 106)

11.1 INTRODUCTION

FIGURE 32 EUROPE TO DOMINATE THE MARKET THROUGH 2027 (USD BILLION)

FIGURE 33 ASIA PACIFIC COUNTRIES TO RECORD THE FASTEST GROWTH DURING THE FORECAST PERIOD

TABLE 62 STARTER CULTURES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 63 MARKET SIZE FOR STARTER CULTURES, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

TABLE 64 NORTH AMERICA: STARTER CULTURES MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY DAIRY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY DAIRY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY BACTERIA, 2017–2021 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY BACTERIA, 2022–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY COMPOSITION, 2017–2021 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY COMPOSITION, 2022–2027 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY FORM, 2017–2021 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY FORM, 2022–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY FORM, 2017–2021 (KILOTONS)

TABLE 79 NORTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY FORM, 2022–2027 (KILOTONS)

11.2.1 US

11.2.1.1 The dairy industry is expected to drive the starter cultures market in the US

TABLE 80 US: STARTER CULTURES MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 81 US: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 82 US: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 83 US: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

11.2.2 MEXICO

11.2.2.1 Increasing dairy exports to drive the market growth in Mexico

TABLE 84 MEXICO: STARTER CULTURES MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 85 MEXICO: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 86 MEXICO: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 87 MEXICO: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

11.2.3 CANADA

11.2.3.1 Local manufacturers dominate the starter cultures market in the country

TABLE 88 CANADA: STARTER CULTURES MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 89 CANADA: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 90 CANADA: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 91 CANADA: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

11.3 EUROPE

FIGURE 34 EUROPE: MARKET SNAPSHOT

TABLE 92 EUROPE: STARTER CULTURES MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 93 EUROPE: MARKET SIZE FOR STARTER CULTURES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 94 EUROPE: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 95 EUROPE: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 96 EUROPE: MARKET SIZE FOR STARTER CULTURES, BY DAIRY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 97 EUROPE: MARKET SIZE FOR STARTER CULTURES, BY DAIRY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 98 EUROPE: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 99 EUROPE: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

TABLE 100 EUROPE: MARKET SIZE FOR STARTER CULTURES, BY BACTERIA, 2017–2021 (USD MILLION)

TABLE 101 EUROPE: MARKET SIZE FOR STARTER CULTURES, BY BACTERIA, 2022–2027 (USD MILLION)

TABLE 102 EUROPE: MARKET SIZE FOR STARTER CULTURES, BY COMPOSITION, 2017–2021 (USD MILLION)

TABLE 103 EUROPE: MARKET SIZE FOR STARTER CULTURES, BY COMPOSITION, 2022–2027 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE FOR STARTER CULTURES, BY FORM, 2017–2021 (USD MILLION)

TABLE 105 EUROPE: MARKET SIZE FOR STARTER CULTURES, BY FORM, 2022–2027 (USD MILLION)

TABLE 106 EUROPE: MARKET SIZE FOR STARTER CULTURES, BY FORM, 2017–2021 (KILOTONS)

TABLE 107 EUROPE: MARKET SIZE FOR STARTER CULTURES, BY FORM, 2022–2027 (KILOTONS)

11.3.1 FRANCE

11.3.1.1 The meat industry is expected to drive the starter cultures market in France

TABLE 108 FRANCE: STARTER CULTURES MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 109 FRANCE: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 110 FRANCE: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 111 FRANCE: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

11.3.2 GERMANY

11.3.2.1 Increasing dairy exports drive market growth in Germany

TABLE 112 GERMANY: STARTER CULTURES MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 113 GERMANY: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 114 GERMANY: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 115 GERMANY: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

11.3.3 NETHERLANDS

11.3.3.1 Local manufacturers dominate the starter cultures market in the country

TABLE 116 NETHERLANDS: STARTER CULTURES MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 117 NETHERLANDS: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 118 NETHERLANDS: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 119 NETHERLANDS: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

11.3.4 UK

11.3.4.1 The well-established dairy industry is expected to drive the demand for starter culture

TABLE 120 UK: STARTER CULTURES MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 121 UK: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 122 UK: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 123 UK: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

11.3.5 TURKEY

11.3.5.1 Growth in meat demand is driving the market for starter culture

TABLE 124 TURKEY: STARTER CULTURES MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 125 TURKEY: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 126 TURKEY: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 127 TURKEY: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

11.3.6 ITALY

11.3.6.1 Increasing production and export are expected to drive the market for starter culture

TABLE 128 ITALY: STARTER CULTURES MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 129 ITALY: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 130 ITALY: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 131 ITALY: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

11.3.7 REST OF EUROPE

11.3.7.1 Switzerland is a leading dairy-based product market, which drives the demand for starter culture

TABLE 132 REST OF EUROPE: STARTER CULTURES MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 133 REST OF EUROPE: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 134 REST OF EUROPE: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 135 REST OF EUROPE: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 136 ASIA PACIFIC: STARTER CULTURES MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET SIZE FOR STARTER CULTURES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET SIZE FOR STARTER CULTURES, BY DAIRY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET SIZE FOR STARTER CULTURES, BY DAIRY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET SIZE FOR STARTER CULTURES, BY BACTERIA, 2017–2021 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET SIZE FOR STARTER CULTURES, BY BACTERIA, 2022–2027 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET SIZE FOR STARTER CULTURES, BY COMPOSITION, 2017–2021 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET SIZE FOR STARTER CULTURES, BY COMPOSITION, 2022–2027 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET SIZE FOR STARTER CULTURES, BY FORM, 2017–2021 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET SIZE FOR STARTER CULTURES, BY FORM, 2022–2027 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET SIZE FOR STARTER CULTURES, BY FORM, 2017–2021 (KILOTONS)

TABLE 151 ASIA PACIFIC: MARKET SIZE FOR STARTER CULTURES, BY FORM, 2022–2027 (KILOTONS)

11.4.1 CHINA

11.4.1.1 The meat industry is expected to drive the starter cultures market in China

TABLE 152 CHINA: STARTER CULTURES MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 153 CHINA: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 154 CHINA: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 155 CHINA: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

11.4.2 INDIA

11.4.2.1 Large-scale production of butter and increasing awareness regarding the benefits of starter culture are driving the market

TABLE 156 INDIA: STARTER CULTURES MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 157 INDIA: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 158 INDIA: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 159 INDIA: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

11.4.3 AUSTRALIA & NEW ZEALAND

11.4.3.1 Well-established dairy and meat industries are expected to generate future demand for starter culture

FIGURE 36 AUSTRALIA AND NEW ZEALAND: CHEESE CONSUMPTION, 2011 VS. 2016 (KG PER CAPITA)

TABLE 160 AUSTRALIA & NZ: STARTER CULTURES MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 161 AUSTRALIA & NZ: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 162 AUSTRALIA & NZ: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 163 AUSTRALIA & NZ: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

11.4.4 JAPAN

11.4.4.1 Large-scale consumption of yogurt and fish is a major driver for growth in Japan

TABLE 164 JAPAN: STARTER CULTURES MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 165 JAPAN: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 166 JAPAN: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 167 JAPAN: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

11.4.5 MALAYSIA

11.4.5.1 Increasing demand for meat & seafood is expected to be a major driver for starter culture

TABLE 168 MALAYSIA: STARTER CULTURES MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 169 MALAYSIA: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 170 MALAYSIA: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 171 MALAYSIA: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

11.4.6 REST OF ASIA PACIFIC

11.4.6.1 Growth in meat & seafood demand drives the market for starter culture

TABLE 172 REST OF ASIA PACIFIC: STARTER CULTURES MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 173 REST OF ASIA PACIFIC: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 174 REST OF ASIA PACIFIC: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 175 REST OF ASIA PACIFIC: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

11.5 SOUTH AMERICA

TABLE 176 SOUTH AMERICA: STARTER CULTURES MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 177 SOUTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 178 SOUTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 179 SOUTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 180 SOUTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY DAIRY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 181 SOUTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY DAIRY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 182 SOUTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 183 SOUTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

TABLE 184 SOUTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY BACTERIA, 2017–2021 (USD MILLION)

TABLE 185 SOUTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY BACTERIA, 2022–2027 (USD MILLION)

TABLE 186 SOUTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY COMPOSITION, 2017–2021 (USD MILLION)

TABLE 187 SOUTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY COMPOSITION, 2022–2027 (USD MILLION)

TABLE 188 SOUTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY FORM, 2017–2021 (USD MILLION)

TABLE 189 SOUTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY FORM, 2022–2027 (USD MILLION)

TABLE 190 SOUTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY FORM, 2017–2021 (KILOTONS)

TABLE 191 SOUTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY FORM, 2022–2027 (KILOTONS)

11.5.1 BRAZIL

11.5.1.1 Brazil’s dairy industry positively impacts the starter cultures market

TABLE 192 BRAZIL: STARTER CULTURES MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 193 BRAZIL: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 194 BRAZIL: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 195 BRAZIL: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

11.5.2 ARGENTINA

11.5.2.1 Growing demand for cheese to drive the demand for starter culture

TABLE 196 ARGENTINA: STARTER CULTURES MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 197 ARGENTINA: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 198 ARGENTINA: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 199 ARGENTINA: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

11.5.3 REST OF SOUTH AMERICA

11.5.3.1 High demand for meat & seafood products acts as a major growth driver for starter culture

TABLE 200 REST OF SOUTH AMERICA: STARTER CULTURES MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 201 REST OF SOUTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 202 REST OF SOUTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 203 REST OF SOUTH AMERICA: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

11.6 REST OF THE WORLD (ROW)

TABLE 204 ROW: STARTER CULTURES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 205 ROW: MARKET SIZE FOR STARTER CULTURES, BY REGION, 2022–2027 (USD MILLION)

TABLE 206 ROW: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 207 ROW: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 208 ROW: MARKET SIZE FOR STARTER CULTURES, BY DAIRY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 209 ROW: MARKET SIZE FOR STARTER CULTURES, BY DAIRY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 210 ROW: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 211 ROW: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

TABLE 212 ROW: MARKET SIZE FOR STARTER CULTURES, BY BACTERIA, 2017–2021 (USD MILLION)

TABLE 213 ROW: MARKET SIZE FOR STARTER CULTURES, BY BACTERIA, 2022–2027 (USD MILLION)

TABLE 214 ROW: MARKET SIZE FOR STARTER CULTURES, BY COMPOSITION, 2017–2021 (USD MILLION)

TABLE 215 ROW: MARKET SIZE FOR STARTER CULTURES, BY COMPOSITION, 2022–2027 (USD MILLION)

TABLE 216 ROW: MARKET SIZE FOR STARTER CULTURES, BY FORM, 2017–2021 (USD MILLION)

TABLE 217 ROW: MARKET SIZE FOR STARTER CULTURES, BY FORM, 2022–2027 (USD MILLION)

TABLE 218 ROW: MARKET SIZE FOR STARTER CULTURES, BY FORM, 2017–2021 (KILOTONS)

TABLE 219 ROW: MARKET SIZE FOR STARTER CULTURES, BY FORM, 2022–2027 (KILOTONS)

11.6.1 MIDDLE EAST

11.6.1.1 Increasing penetration of market players drives the demand for starter culture to have a positive impact

TABLE 220 MIDDLE EAST: STARTER CULTURE MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 221 MIDDLE EAST: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 222 MIDDLE EAST: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 223 MIDDLE EAST: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

11.6.2 AFRICA

11.6.2.1 High consumption of cheese has fueled the demand for starter culture among manufacturers

TABLE 224 AFRICA: STARTER CULTURES MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 225 AFRICA: MARKET SIZE FOR STARTER CULTURES, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 226 AFRICA: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 227 AFRICA: MARKET SIZE FOR STARTER CULTURES, BY MICROORGANISM, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 178)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS, 2021

TABLE 228 STARTER CULTURES MARKET: DEGREE OF COMPETITION (COMPETATIVE)

12.3 KEY PLAYER STRATEGIES

FIGURE 37 KEY PLAYER STRATEGIES: STATER CULTURES MARKET

12.4 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 38 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE STARTER CULTURES MARKET, 2019–2021 (USD MILLION)

12.5 COVID-19-SPECIFIC COMPANY RESPONSE

12.5.1 CHR. HANSEN HOLDING A/S (DENMARK)

12.5.2 IFF (US)

12.5.3 DSM (NETHERLANDS)

12.6 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.6.1 STARS

12.6.2 EMERGING LEADERS

12.6.3 PERVASIVE PLAYERS

12.6.4 PARTICIPANTS

FIGURE 39 STARTER CULTURES MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

12.6.5 PRODUCT FOOTPRINT

TABLE 229 COMPANY APPLICATION FOOTPRINT

TABLE 230 COMPANY BY MICROORGANISM FOOTPRINT

TABLE 231 COMPANY BY FORM FOOTPRINT

TABLE 232 COMPANY BY COMPOSITION FOOTPRINT

TABLE 233 COMPANY BY REGIONAL FOOTPRINT

TABLE 234 OVERALL COMPANY FOOTPRINT

12.7 STARTER CULTURES MARKET, START-UP/SME EVALUATION QUADRANT, 2021

12.7.1 PROGRESSIVE COMPANIES

12.7.2 STARTING BLOCKS

12.7.3 RESPONSIVE COMPANIES

12.7.4 DYNAMIC COMPANIES

TABLE 235 STARTER CULTURE: DETAILED LIST OF KEY STARTUP/SMES

TABLE 236 STARTER CULTURE: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

FIGURE 40 STARTER CULTURES MARKET: COMPANY EVALUATION QUADRANT, 2021 (START-UP/SME)

12.8 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

12.8.1 PRODUCT LAUNCHES

TABLE 237 PRODUCT LAUNCHES, 2019–2022

12.8.2 DEALS

TABLE 238 DEALS, 2019–2021

12.8.3 OTHERS

TABLE 239 OTHERS, 2020

13 COMPANY PROFILES (Page No. - 195)

(Business overview, Products offered, Recent Developments, MNM view)*

13.1 KEY PLAYERS

13.1.1 CHR. HANSEN HOLDING A/S

TABLE 240 CHR.HANSEN HOLDING A/S: BUSINESS OVERVIEW

FIGURE 41 CHR. HANSEN HOLDING A/S: COMPANY SNAPSHOT

TABLE 241 CHR. HANSEN HOLDING A/S: PRODUCTS OFFERED

TABLE 242 CHR. HANSEN HOLDING A/S: DEALS

TABLE 243 CHR. HANSEN HOLDING A/S: PRODUCT LAUNCHES

13.1.2 IFF

TABLE 244 IFF: BUSINESS OVERVIEW

FIGURE 42 IFF: COMPANY SNAPSHOT

TABLE 245 IFF: PRODUCTS OFFERED

TABLE 246 IFF: DEALS

13.1.3 DSM

TABLE 247 DSM: BUSINESS OVERVIEW

FIGURE 43 DSM: COMPANY SNAPSHOT

TABLE 248 DSM: PRODUCTS OFFERED

TABLE 249 DSM: DEALS

TABLE 250 DSM: PRODUCT LAUNCHES

13.1.4 LB BULGARICUMS

TABLE 251 LB BULGARICUM: BUSINESS OVERVIEW

TABLE 252 LB BULGARICUM: PRODUCTS OFFERED

13.1.5 BIOCHEM SRL

TABLE 253 BIOCHEM S.R.L: BUSINESS OVERVIEW

TABLE 254 BIOCHEM S.R.L: PRODUCTS OFFERED

13.1.6 DALTON BIOTECNOLOGIE S.R.L.

TABLE 255 DALTON BIOTECNOLOGIE S.R.L.: BUSINESS OVERVIEW

TABLE 256 DALTON BIOTECNOLOGIE S.R.L.: PRODUCTS OFFERED

13.1.7 MEDITERRANEA BIOTECNOLOGIE SRL

TABLE 257 MEDITERRANEA BIOTECNOLOGIE SRL: BUSINESS OVERVIEW

TABLE 258 MEDITERRANEA BIOTECNOLOGIE SRL: PRODUCTS OFFERED

13.1.8 GENESIS LABORATORIES

TABLE 259 GENESIS LABORATORIES: BUSINESS OVERVIEW

TABLE 260 GENESIS LABORATORIES: PRODUCTS OFFERED

13.1.9 BIOPROX

TABLE 261 BIOPROX: BUSINESS OVERVIEW

TABLE 262 BIOPROX: PRODUCTS OFFERED

13.1.10 CODEX-ING BIOTECH INGREDIENTS

TABLE 263 CODEX-ING BIOTECH INGREDIENTS: BUSINESS OVERVIEW

TABLE 264 CODEX-ING BIOTECH INGREDIENTS: PRODUCTS OFFERED

13.2 STARTUP’S/SMES

13.2.1 SACCO SYSTEM

TABLE 265 SACCO SYSTEM: BUSINESS OVERVIEW

TABLE 266 SACCO SYSTEM: PRODUCTS OFFERED

TABLE 267 SACCO SYSTEM: DEALS

TABLE 268 SACCO SYSTEM: OTHERS

13.2.2 BIENA

TABLE 269 BIENA: BUSINESS OVERVIEW

TABLE 270 BIENA: PRODUCTS OFFERED

13.2.3 BDF NATURAL INGREDIENTS

TABLE 271 BDF NATURAL INGREDIENTS: BUSINESS OVERVIEW

TABLE 272 BDF NATURAL INGREDIENTS: PRODUCTS OFFERED

TABLE 273 BDF NATURAL INGREDIENTS: DEALS

13.2.4 BENEBIOS INC.

TABLE 274 BENEBIOS INC.: BUSINESS OVERVIEW

TABLE 275 BENEBIOS INC.: PRODUCTS OFFERED

13.2.5 BENNY IMPEX

TABLE 276 BENNY IMPEX: BUSINESS OVERVIEW

TABLE 277 BENNY IMPEX: PRODUCTS OFFERED

13.2.6 ABSOURCE BIOLOGICS PVT. LTD.

13.2.7 KULTURED WELLNESS

13.2.8 BIOLACTER INC.

13.2.9 LACTINA LTD

13.2.10 ALLIANCE, INC.

Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS (Page No. - 238)

14.1 INTRODUCTION

TABLE 278 ADJACENT MARKETS TO STARTER CULTURE MARKET

14.2 LIMITATIONS

14.3 PROIBIOTICS MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

14.3.3 PROBIOTICS MARKET, BY INGREDIENTS

TABLE 279 PROBIOTICS MARKET SIZE, BY INGREDIENT, 2016–2020 (USD BILLION)

TABLE 280 PROBIOTICS MARKET SIZE, BY INGREDIENT, 2021–2026 (USD BILLION)

14.3.4 BACTERIA

TABLE 281 BACTERIA MARKET SIZE, BY REGION, 2016–2020 (USD BILLION)

TABLE 282 BACTERIA MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

14.4 YEAST

TABLE 283 YEAST MARKET SIZE, BY REGION, 2016–2020 (USD BILLION)

TABLE 284 YEAST MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

14.5 MEAT STARTER CULTURE MARKET

14.5.1 MARKET DEFINITION

14.5.2 MARKET OVERVIEW

14.5.3 MEAT STARTER CULTURE MARKET, BY MICROORGANISMS,

TABLE 285 MEAT STARTER CULTURE MARKET SIZE, BY MICROORGANISM, 2018–2025 (USD MILLION)

14.5.4 BACTERIA

TABLE 286 BACTERIA-BASED MEAT STARTER CULTURE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

14.6 FUNGI

TABLE 287 FUNGI-BASED MEAT STARTER CULTURE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

15 APPENDIX (Page No. - 245)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the starter cultures market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects. The following figure depicts the research design applied in drafting this report on the market.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the starter culture market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the starter culture market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- The revenues of major starter cultures manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- All macroeconomic and microeconomic factors affecting the growth of the starter culture market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for starter culture on the basis of application, form, composition, microorganisms and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the starter culture market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe market for starter cultures into the Belgium, Spain, Sweden, Greece, Poland, and Russia

- Further breakdown of the Rest of Asia Pacific market for starter cultures into Indonesia, the Philippines, Thailand, Singapore, and South Korea

- Further breakdown of the Rest of South America market for starter cultures into Chile, Paraguay, Peru, and Colombia

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Starter Cultures Market