Cultured Meat Market Size, Share, Share, Industry Growth, Trends Report by Source (Poultry, Beef, Seafood, Pork, Duck), End Use (Nuggets, Burgers, Meatballs, Sausages, Hot Dogs), and Region (North America, Europe, Asia Pacific, South America, Middle East & Africa) - Global Forecast to 2034

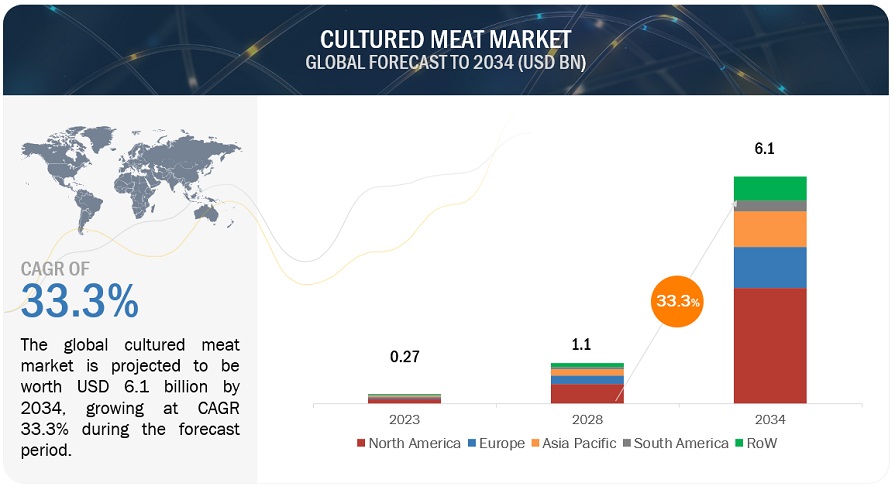

The Cultured Meat Market is estimated at USD 272.4 million in 2023 and is projected to reach USD 6,169.6 million by 2034, at a CAGR of 33.3% from 2028 to 2034.

The cultured meat market is rapidly gaining popularity due to increasing global demand for sustainable and ethical food options. Cultured meat, also known as lab-grown or cell-based meat, is produced by cultivating animal cells in a controlled environment, providing a more environmentally friendly and animal-friendly alternative to traditional livestock farming. This emerging industry is attracting substantial investments and innovative startups, with an expanding product range including beef, chicken, pork, and seafood. Market players are addressing consumer concerns about taste, texture, and cost-effectiveness to make cultured meat a mainstream choice. As environmental and ethical considerations continue to drive consumer choices, the cultured meat market is positioned for significant expansion, potentially revolutionizing the way meat is produced and consumed in the future. Several startups, including Mosa Meat (Netherlands), Memphis Meats (US), JUST, Inc (US), and Integriculture (Japan), are engaged in the development of cultured meat. These companies are conducting research and development to reduce the product's price and scale up production to increase the likelihood of commercialization. A 2021 paper titled “Global greenhouse gas emissions from animal-based foods are twice those of plant-based foods” emphasized that global greenhouse gas emissions from animal-based foods are twice as high as those from plant-based foods. This underscores the urgent need for sustainable food production. The revelation that animal agriculture is responsible for a significant portion of these emissions, with beef alone accounting for a quarter, has had a profound impact on the growth of the cultured meat market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Drivers: Technologies advancements in cellular agriculture

The rise of Industry 4.0 has transformed the global food industry, bringing in new culinary trends. One of the emerging trends is cellular agriculture, which focuses on creating agricultural products from cultured cells in bioreactors instead of traditional livestock farming. This approach combines digital, physical, biotechnological, and food science elements, allowing for the production of meat, dairy, and egg substitutes. In the case of cultured meat, animal cells are cultivated in bioreactors to create muscle tissue components. To make cellular agriculture a successful industry, it's essential to make the process cost-effective and scalable, and integrate it into the food supply chain. Technological advancements within Industry 4.0, such as the development of animal cell lines, genetically modified microorganisms, cost-effective culture media, efficient bioprocessing techniques, large-scale bioreactors, and scalable solutions, are expected to drive the growth of cellular agriculture by reducing production costs and making the process more sustainable and innovative.

Restraints: High setup cost

The initial upfront cost of establishing a laboratory with bioreactors is quite high, leading to a high initial price for the final product. This cost challenge makes it tough for manufacturers to expand their production of cultured meat, limiting their ability to meet consumer demand. One method of producing cultured meat is through microcarriers, which cost USD 0.16 per square centimeter. For a 2,000 L bioreactor tank, around 5 million microcarriers, each about 500 μm or 0.5 mm in size, are needed, costing about USD 16,000 per tank. Another cost factor is the medium for producing cell cultures, such as fetal bovine serum (FBS), which is pricey at around USD 84.50 for 50 ml. These costs are expected to drive up the overall production expenses.

Opportunities: High per capita meat consumption and imports in emerging Southeast Asian economics

The increasing demand for meat in Southeast Asian nations such as Vietnam, Malaysia, Thailand, the Philippines, and Indonesia is leading to a rise in large-scale meat imports due to limited domestic supply. Malaysia specifically has a high per capita consumption of poultry meat, with potential for further growth. In general, per capita consumption of poultry meat in Asia is higher than that of beef and sheep meat. The small-scale and unorganized nature of the livestock industry in these countries has made it difficult to meet domestic demand, prompting imports of meat and meat products from countries such as the US and Germany. Cultured meat, whether grown domestically or imported, could help meet this demand. This presents an opportunity for businesses in the cultured meat market to develop products tailored to these emerging markets' specific requirements. Furthermore, as these nations undergo economic growth and dietary shifts, leading to an increased meat demand, traditional livestock farming becomes increasingly unsustainable. This has raised concerns about resource depletion, environmental impact, and food security. Cultured meat provides a more sustainable and ethical alternative, reducing the strain on land, water, and other resources. It also addresses concerns about animal welfare and pathogen contamination, making it an appealing choice for consumers in the region and likely to drive the expansion of the cultured meat market.

Challenges: Increased demand for plant-based protien

The shift in consumer preference towards natural protein options has increased the demand for plant-based foods. The preliminary draft of Canada’s new Food Guide, released in 2017, emphasizes plant-based foods. In 2016, the dietary guidelines released by the Chinese government emphasized a 50% reduction in meat consumption between 2016 and 2030, presenting a challenge for cultured meat product manufacturers. Meat consumption has declined in the US, and recent product introductions have showcased a variety of protein-based ingredients. Companies like Beyond Meat (US) and Impossible Foods (US) have successfully entered the mainstream market. For example, Beyond Meat (US) introduced Beyond Sausage, a plant-based alternative that resembles and cooks like pork. Impossible Foods (US) makes burgers using natural ingredients such as wheat, coconut oil, and potatoes. Therefore, plant-based alternatives are expected to compete with cultured meat products.

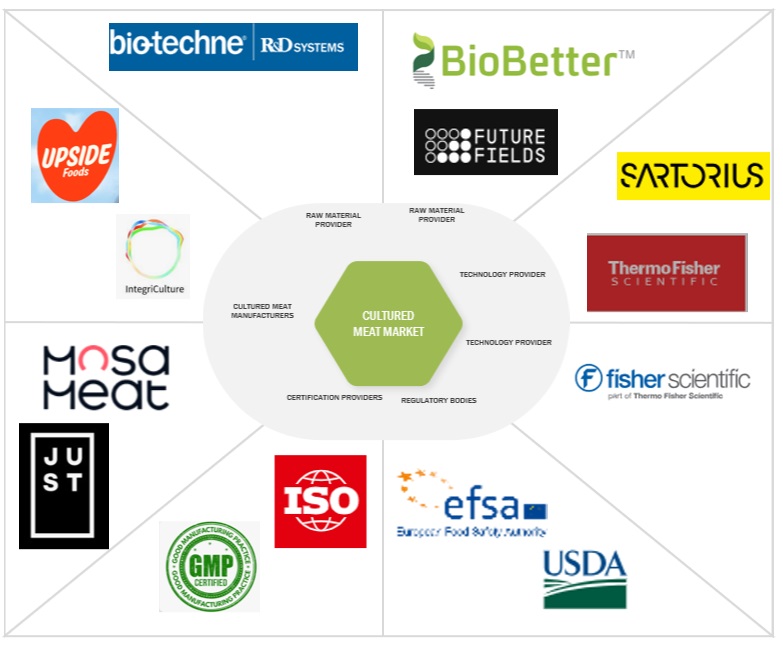

Market Ecosystem

Based on source, poultry is estimated to account for the largest market share of the cultured meat market.

The global demand for poultry meat is increasing due to its affordability and health benefits. This has resulted in a significant growth of the cultivated poultry meat market. As more people seek sustainable and ethical sources of protein, the cultivated poultry meat industry is expected to expand. Producers are focusing on developing lab-grown poultry products to meet the increasing demand as the poultry meat market is projected to grow by 2030. This aligns with the shift towards environmentally and animal-friendly food production methods, making cultivated poultry meat a promising and sustainable solution for the future. Additionally, the popularity of poultry products in quick-service restaurants (QSRs) has led manufacturers to develop innovative alternative products to meet future demand from meat consumers. Cultured chicken products, especially in nugget form, are expected to dominate the market, with a lower price compared to other sources, and gain wide popularity worldwide. For instance, KFC in Russia collaborated with the 3D Bioprinting Solutions research laboratory in 2020 to use 3D bioprinting technology to produce authentic chicken meat directly cultivated from animal cells. SuperMeat, an Israel-based startup, is one of the key manufacturers engaged in developing lab-grown chicken.

Based on the end-use of cultured meat, nuggets is anticipated to have the highest growth rate in the cultured meat market.

The cultivated nuggets market has seen significant growth due to improvements in cost-efficiency and regulatory acceptance, making sustainable and ethical meat alternatives more accessible and attractive to consumers. This reflects the growing demand for environmentally responsible and ethically produced food options, which is driving the expansion of the cultivated nuggets market. A major milestone has been reached as the Singapore Food Agency has approved "cultivated chicken" as an ingredient in chicken nuggets, marking the first time lab-grown meat has been approved for consumption. Eat Just, a leading company in this field, previously revealed that in 2019, the cost to produce each chicken nugget was $50. However, the company has since reduced production costs significantly, making the price of these cultivated chicken nuggets competitive with high-quality chicken products available in restaurants, according to The Times.

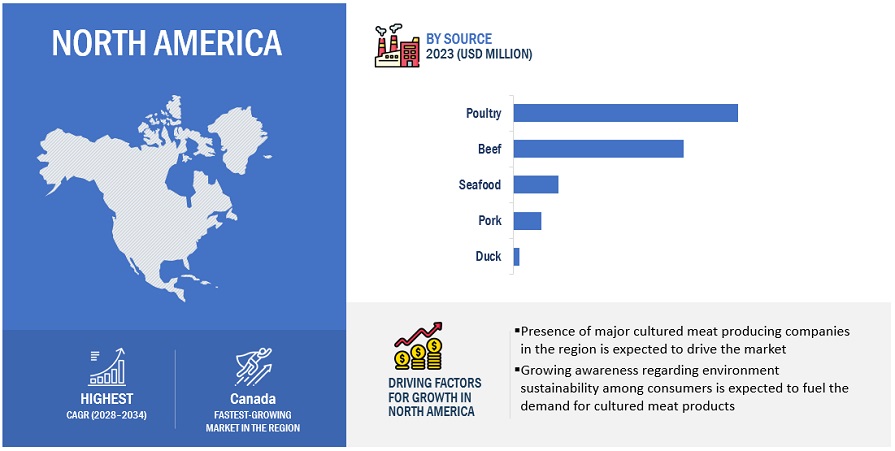

The North America market is projected to contribute the largest share of the global cultured meat market.

North America is expected to lead the cultured meat industry due to its strong economy, continuous innovations, and high investment in research and development. The shift towards cultured meat products is being driven by concerns about health associated with traditional meat consumption, increasing investor interest in alternative proteins, and the potential to create customized proteins that meet specific nutritional needs. Metropolitan areas in the US and Canada are expected to spearhead this growth as they are more open to alternative proteins and meat substitutes, leading to a higher number of flexitarians. The growing demand for alternative protein in the region also supports increased investments in cultured meat companies. Key players such as JUST, Inc. and Memphis Meat, coupled with product innovations, are expected to propel the cultured meat market. Additionally, companies are working to reduce production costs linked with cultured meat to make it more affordable than traditional meat.

Key Market Players

The key players in this market include Cargill, Incorporated (US), ADM (US), International Flavors & Fragrances (US), Evonik Industries AG (Germany), BASF SE (Germany), DSM (Netherlands), Ajinomoto (Japan), Novozymes (Denmark), CHR. HANSEN (Denmark), TEGASA (Spain), Nutreco (Netherlands), Kemin Industries Inc (US), Adisseo (France), BRF (Brazil), Solvay (Belgium), Global Nutrition International (France), Centafarm SRL (Italy), Bentoli (US), Nuqo Cultured meat (France), Novus International Inc. (US), Palital Cultured meat B.V. (Netherlands), VITAFORMS (US), ALLTECH (US), Neospark Drugs and Chemicals Private Limited (India), and Tex Biosciences (P) Ltd. (India). These players in this market are focusing on increasing their presence through expansion and collaboration. These companies have a strong presence in North America, Asia Pacific, and Europe.

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2023–2034 |

|

Base year considered |

2023 |

|

Forecast period considered |

2028–2034 |

|

Units considered |

Value (USD), Volume (Tons) |

|

)Segments Covered |

By Source, By End Use, and By Region. |

|

Regions covered |

North America, Europe, South America, Asia Pacific, and RoW |

|

Companies covered |

|

Key stakeholders

- Venture capitalists and investors

- Meat processors, traders, distributors, importers, exporters, and suppliers

- Food retailers

- Commercial research & development (R&D) organizations and financial institutions

- Livestock research organizations

- Cultured meat associations and regulatory bodies such as the Cultured Meat Foundation, and Future Food

- Other associations such as the United States Cattlemen’s Association (USCA), National Cattlemen’s Beef Association, and the National Pork Producers Council

Cultured meat Market:

By Source

- Poultry

- Beef

- Pork

- Seafood

- Duck

By End Use

- Nuggets

- Burgers

- Meatballs

- Hot Dogs

- Others (Pet Food & Foie Gras)

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In September 2023, Eat Just Inc. announced a strategic partnership with Halal Products Development Company (HPDC), wholly owned by the Public Investment Fund of Saudi Arabia. Through this collaboration, HPDC would provide advisory solutions to help Eat Just obtain “Halal” certification and approvals needed to operate as a Halal food distributor. The partnership would also leverage HPDC’s services to help Eat Just develop a sustainable strategy to enter the Halal market, paving the way to export its products to local and regional markets.

- In April 2023, BlueNalu announced the signing of a Letter of Intent (LOI) with Nutreco, a prominent player in animal nutrition and aquafeed. This marked their third agreement, following initial collaborations in December 2019 and Nutreco’s participation in BlueNalu’s Series A round financing. The LOI underscored their mutual commitment to establishing and expanding a food-grade supply chain for cell-cultured seafood production. It also signified Nutreco’s investment in developing food grade supply chain infrastructure in tandem with BlueNalu’s progression from pilot-scale development to regulatory stages and commercialization efforts. This partnership’s initial phase would focus on reducing cell feed costs and defining specifications for crucial raw materials necessary for creating BlueNalu’s unique cell-cultured seafood products.

- On November 2022, Mosa Meat announced an agreement with Singapore-based Esco Aster that would eventually introduce Mosa Meat’s cultivated beef to Singapore. Singapore is currently the only market where cultivated meat is approved, providing a unique and accessible entry point. Thus, the agreement would position Mosa Meat to tap into a pioneering market and expand its global reach.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share of the cultured meat market?

The North America region accounted for the largest share in terms of value at USD 41.5 million in 2023 and is expected to grow at a CAGR of 33.4% during the forecast period.

What is the current size of the global cultured meat market?

The cultured meat market is estimated at USD 272.4 million in 2023 and is projected to reach USD 6,169.6 million by 2034, at a CAGR of 33.3% from 2028 to 2034.

Which are the major key players in the cultured meat market?

The key players in this market include Mosa Meat (Netherlands), UPSIDE FOODS (US), JUST, Inc. (US), Integriculture Inc. (Japan), and BioCraft, Inc. (US).

What are the factors driving the cultured meat market?

Increasing demand for alternative protein

Technological advancements in cellular agriculture

Enhanced food safety

Investments by key industry giants

Focus on animal welfare

Which segment by end-use accounted for the largest cultured meat market share?

By end use, the nuggets dominated the market for cultured meat and were valued the largest at USD 114.6 million in 2023. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

-

5.3 MACROECONOMIC INDICATORSCULTURED MEAT TO BE RESILIENT AND SUSTAINABLE PROTEIN SOURCECRUCIAL ROLE OF INVESTMENT TRENDS IN CULTURED MEAT INNOVATIONDRIVERS- Increasing demand for alternative protein- Technological advancements in cellular agriculture- Enhanced food safety- Investments by key industry giants- Environmental sustainability- Focus on animal welfare- Health benefits offered by cultured meatRESTRAINTS- Stringent regulatory environment- High setup costOPPORTUNITIES- High per capita meat consumption and imports in emerging Southeast Asian economiesCHALLENGES- Skepticism among consumers- Increased demand for plant-based protein

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISCELL SOURCINGCELL CULTIVATIONCELL DIFFERENTIATIONTISSUE STRUCTURINGPOST-PRODUCTION PROCESSINGQUALITY CONTROLPACKAGING & DISTRIBUTION

-

6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 6.4 TARIFF AND REGULATORY LANDSCAPE

-

6.5 REGULATORY FRAMEWORKNORTH AMERICA- US- CanadaEUROPEASIA PACIFIC

-

6.6 PATENT ANALYSIS

- 6.7 TRADE ANALYSIS

-

6.8 PRICING ANALYSISINDICATIVE AVERAGE SELLING PRICE TREND ANALYSIS

-

6.9 CULTURED MEAT MARKET: ECOSYSTEM MARKET MAPDEMAND SIDESUPPLY SIDE

-

6.10 TECHNOLOGY ANALYSISSCAFFOLDING TECHNOLOGY3D BIOPRINTING

-

6.11 CASE STUDIESREVOLUTIONIZING CELL CULTURE WITH ETHICAL AND FBS-FREE SOLUTIONS

-

6.12 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSKEY STAKEHOLDERS AND BUYING CRITERIABUYING CRITERIA

- 6.14 KEY CONFERENCES AND EVENTS, 2023–2024

- 7.1 INTRODUCTION

-

7.2 POULTRYHIGH DEMAND FROM QUICK-SERVICE RESTAURANTS TO DRIVE DEMAND FOR CULTURED POULTRY MEAT PRODUCTS

-

7.3 PORKCULTURED PORK MARKET TO THRIVE AMID GLOBAL DEMAND SURGE AND SUSTAINABILITY CONCERNS

-

7.4 BEEFRISING DEMAND FOR SUSTAINABLE & ETHICAL PROTEIN TO DRIVE CULTURED BEEF MARKET GROWTH

-

7.5 SEAFOODRISING CONSUMPTION OF FISH MAW TO CONTRIBUTE TO CULTURED MEAT MARKET GROWTH

-

7.6 DUCKHIGH AVAILABILITY OF DUCK MEAT IN SUPERMARKETS TO DRIVE GROWTH

- 8.1 INTRODUCTION

-

8.2 NUGGETSCOST-EFFICIENCY AND REGULATORY ACCEPTANCE TO DRIVE MARKET GROWTH

-

8.3 BURGERSINNOVATIONS AND SCALING EFFORTS TO DRIVE MARKET GROWTH

-

8.4 MEATBALLSCOMBINATION OF ENVIRONMENTAL AWARENESS, TECHNOLOGICAL PROGRESS, AND CULINARY VERSATILITY TO PROPEL MARKET GROWTH

-

8.5 SAUSAGESINCREASED DEMAND FOR CLEAN MEAT PRODUCTS TO DRIVE MARKET GROWTH

-

8.6 HOT DOGSCULTURED HOT DOG MARKET TO GROW AMID GLOBAL MEAT DEMAND AND SUSTAINABILITY CONCERNS

- 8.7 OTHER END USES

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Rising US meat consumption to spark demand for cultured meatCANADA- Canada’s meat export strength to drive cultured meat evolutionMEXICO- Mexico’s cultured meat pioneers to drive market growth

-

9.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- High acceptance of cultured meat in Germany to drive market growthUK- UK to be prominent hub for cellular agriculture, thereby driving market growthNETHERLANDS- Increased presence of cultured meat manufacturers and research centers to facilitate market growthFRANCE- Unsupportive regulatory environment expected to hinder market growthSPAIN- Strategic developments undertaken by market players to drive growthITALY- Governmental ban on cultured meat to restrict market growthREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Substantial investments and governmental support to propel market growthJAPAN- Increasing protein-rich diet to facilitate market growthSINGAPORE- Increasing acceptance among consumers and governmental approval to drive market growthINDIA- Increased environmental threats owing to upsurge in meat consumption to facilitate market growthAUSTRALIA & NEW ZEALAND- Environmental awareness to fuel demand for cultured meat in AustraliaREST OF ASIA PACIFIC

-

9.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACTBRAZIL- Brazil’s established meat industry to drive market growthREST OF SOUTH AMERICA

-

9.6 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: RECESSION IMPACTUAE- Gradual developments in cultured meat sector to drive market growthREST OF MIDDLE EAST & AFRICA

- 10.1 OVERVIEW

- 10.2 MARKET SHARE ANALYSIS, 2022

- 10.3 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.4 REVENUE ANALYSIS

- 10.5 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

-

10.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.7 COMPANY FOOTPRINT

-

10.8 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

10.9 COMPETITIVE SCENARIODEALSOTHERS

-

11.1 MAJOR PLAYERSMOSA MEAT- Business overview- Products offered- Recent developments- MnM viewUPSIDE FOODS- Business overview- Products offered- Recent developments- MnM viewEAT JUST, INC.- Business overview- Products offered- MnM viewINTEGRICULTURE INC.- Business overview- Products offered- MnM viewMEWERY- Business overview- Products offered- MnM viewBIOCRAFT, INC.- Business overview- Products offered- MnM viewFINLESS FOODS, INC.- Business overview- Products offered- MnM viewAVANT MEATS- Business overview- Products offered- MnM viewBLUENALU- Business overview- Products offered- Recent developments- MnM viewFORK & GOOD- Business overview- Products offered- MnM viewMISSION BARNS- Business overview- Products offered- MnM viewCUBIQ FOODS- Business overviewIVY FARM TECHNOLOGIES LIMITED- Business overviewMEATABLE- Business overview

-

11.2 STARTUPS/SMES/OTHER PLAYERSBIOTECH FOODS- Business overviewO MEAT- Business overviewBIOBQ- Business overviewPEARLITA FOODS- Business overviewWILDBIO- Business overviewGOURMEY- Business overviewPEACE OF MEAT- Business overviewWILD TYPELABFARMSHIOK MEATS PTE LTDCLEARMEATEAT JUST, INC.

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

-

12.3 MEAT SUBSTITUTES MARKETMARKET DEFINITIONMARKET OVERVIEW

-

12.4 PLANT-BASED MEAT MARKETMARKET DEFINITIONMARKET OVERVIEW

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019–2022

- TABLE 2 CULTURED MEAT MARKET SNAPSHOT, 2028 VS. 2034 (NORMAL SCENARIO)

- TABLE 3 SURVEY CONDUCTED ON “ATTITUDES TO IN VITRO MEAT: A SURVEY OF POTENTIAL CONSUMERS IN THE UNITED STATES”

- TABLE 4 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 LIST OF MAJOR PATENTS PERTAINING TO CULTURED MEAT MARKET, 2013–2022

- TABLE 8 IMPORT VALUE OF CULTURED MEAT FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 9 EXPORT VALUE OF CULTURED MEAT FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 10 NUGGETS: GLOBAL CULTURED MEAT MARKET, BY REGION, 2020–2022 (USD PER KG)

- TABLE 11 BURGERS: GLOBAL CULTURED MEAT MARKET, BY REGION, 2020–2022 (USD PER KG)

- TABLE 12 MEATBALLS: GLOBAL CULTURED MEAT MARKET, BY REGION, 2020–2022 (USD PER KG)

- TABLE 13 CULTURED MEAT MARKET: ECOSYSTEM

- TABLE 14 CULTURED MEAT MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR CULTURED MEAT, BY END USE (%)

- TABLE 16 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- TABLE 17 KEY CONFERENCES AND EVENTS IN CULTURED MEAT MARKET, 2023–2024

- TABLE 18 CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023–2034 (USD MILLION)

- TABLE 19 CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023–2034 (TONS)

- TABLE 20 CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023–2034 (USD MILLION)

- TABLE 21 CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023–2034 (TONS)

- TABLE 22 CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023–2034 (USD MILLION)

- TABLE 23 CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023–2034 (TONS)

- TABLE 24 CULTURED POULTRY MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 25 CULTURED POULTRY MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 26 CULTURED POULTRY MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 27 CULTURED POULTRY MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 28 CULTURED POULTRY MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 29 CULTURED POULTRY MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 30 CULTURED PORK MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 31 CULTURED PORK MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 32 CULTURED PORK MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 33 CULTURED PORK MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 34 CULTURED PORK MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 35 CULTURED PORK MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 36 CULTURED BEEF MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 37 CULTURED BEEF MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 38 CULTURED BEEF MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 39 CULTURED BEEF MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 40 CULTURED BEEF MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 41 CULTURED BEEF MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 42 CULTURED SEAFOOD MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 43 CULTURED SEAFOOD MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 44 CULTURED SEAFOOD MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 45 CULTURED SEAFOOD MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 46 CULTURED SEAFOOD MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 47 CULTURED SEAFOOD MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 48 CULTURED DUCK MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 49 CULTURED DUCK MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 50 CULTURED DUCK MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 51 CULTURED DUCK MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 52 CULTURED DUCK MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 53 CULTURED DUCK MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 54 CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023–2034 (USD MILLION)

- TABLE 55 CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023–2034 (T0NS)

- TABLE 56 CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023–2034 (USD MILLION)

- TABLE 57 CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023–2034 (TONS)

- TABLE 58 CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023–2034 (USD MILLION)

- TABLE 59 CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023–2034 (TONS)

- TABLE 60 NUGGETS: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 61 NUGGETS: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 62 NUGGETS: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 63 NUGGETS: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 64 NUGGETS: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 65 NUGGETS: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 66 BURGERS: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 67 BURGERS: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 68 BURGERS: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 69 BURGERS: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 70 BURGERS: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 71 BURGERS: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 72 MEATBALLS: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 73 MEATBALLS: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 74 MEATBALLS: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 75 MEATBALLS: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 76 MEATBALLS: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 77 MEATBALLS: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 78 SAUSAGES: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 79 SAUSAGES: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 80 SAUSAGES: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 81 SAUSAGES: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 82 SAUSAGES: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 83 SAUSAGES: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 84 HOT DOGS: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 85 HOT DOGS: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 86 HOT DOGS: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 87 HOT DOGS: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 88 HOT DOGS: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 89 HOT DOGS: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 90 OTHER END USES: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 91 OTHER END USES: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 92 OTHER END USES: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 93 OTHER END USES: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 94 OTHER END USES: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023–2034 (USD MILLION)

- TABLE 95 OTHER END USES: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023–2034 (TONS)

- TABLE 96 OPTIMISTIC SCENARIO: CULTURED MEAT MARKET, BY REGION, 2023–2034 (USD MILLION)

- TABLE 97 OPTIMISTIC SCENARIO: CULTURED MEAT MARKET, BY REGION, 2023–2034 (TONS)

- TABLE 98 NORMAL SCENARIO: CULTURED MEAT MARKET, BY REGION, 2023–2034 (USD MILLION)

- TABLE 99 NORMAL SCENARIO: CULTURED MEAT MARKET, BY REGION, 2023–2034 (TONS)

- TABLE 100 PESSIMISTIC SCENARIO: CULTURED MEAT MARKET, BY REGION, 2023–2034 (USD MILLION)

- TABLE 101 PESSIMISTIC SCENARIO: CULTURED MEAT MARKET, BY REGION, 2023–2034 (TONS)

- TABLE 102 NORTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY COUNTRY, 2023–2034 (USD MILLION)

- TABLE 103 NORTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY COUNTRY, 2023–2034 (TONS)

- TABLE 104 NORTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY COUNTRY, 2023–2034 (USD MILLION)

- TABLE 105 NORTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY COUNTRY, 2023–2034 (TONS)

- TABLE 106 NORTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY COUNTRY, 2023–2034 (USD MILLION)

- TABLE 107 NORTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY COUNTRY, 2023–2034 (TONS)

- TABLE 108 NORTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023–2034 (USD MILLION)

- TABLE 109 NORTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023–2034 (TONS)

- TABLE 110 NORTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023–2034 (USD MILLION)

- TABLE 111 NORTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023–2034 (TONS)

- TABLE 112 NORTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023–2034 (USD MILLION)

- TABLE 113 NORTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023–2034 (TONS)

- TABLE 114 NORTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023–2034 (USD MILLION)

- TABLE 115 NORTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023–2034 (TONS)

- TABLE 116 NORTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023–2034 (USD MILLION)

- TABLE 117 NORTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023–2034 (TONS)

- TABLE 118 NORTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023–2034 (USD MILLION)

- TABLE 119 NORTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023–2034 (TONS)

- TABLE 120 EUROPE: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY COUNTRY, 2023–2034 (USD MILLION)

- TABLE 121 EUROPE: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY COUNTRY, 2023–2034 (TONS)

- TABLE 122 EUROPE: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY COUNTRY, 2023–2034 (USD MILLION)

- TABLE 123 EUROPE: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY COUNTRY, 2023–2034 (TONS)

- TABLE 124 EUROPE: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY COUNTRY, 2023–2034 (USD MILLION)

- TABLE 125 EUROPE: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY COUNTRY, 2023–2034 (TONS)

- TABLE 126 EUROPE: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023–2034 (USD MILLION)

- TABLE 127 EUROPE: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023–2034 (TONS)

- TABLE 128 EUROPE: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023–2034 (USD MILLION)

- TABLE 129 EUROPE: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023–2034 (TONS)

- TABLE 130 EUROPE: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023–2034 (USD MILLION)

- TABLE 131 EUROPE: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023–2034 (TONS)

- TABLE 132 EUROPE: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023–2034 (USD MILLION)

- TABLE 133 EUROPE: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023–2034 (TONS)

- TABLE 134 EUROPE: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023–2034 (USD MILLION)

- TABLE 135 EUROPE: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023–2034 (TONS)

- TABLE 136 EUROPE: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023–2034 (USD MILLION)

- TABLE 137 EUROPE: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023–2034 (TONS)

- TABLE 138 ASIA PACIFIC: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY COUNTRY, 2023–2034 (USD MILLION)

- TABLE 139 ASIA PACIFIC: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY COUNTRY, 2023–2034 (TONS)

- TABLE 140 ASIA PACIFIC: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY COUNTRY, 2023–2034 (USD MILLION)

- TABLE 141 ASIA PACIFIC: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY COUNTRY, 2023–2034 (TONS)

- TABLE 142 ASIA PACIFIC: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY COUNTRY, 2023–2034 (USD MILLION)

- TABLE 143 ASIA PACIFIC: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY COUNTRY, 2023–2034 (TONS)

- TABLE 144 ASIA PACIFIC: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023–2034 (USD MILLION)

- TABLE 145 ASIA PACIFIC: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023–2034 (TONS)

- TABLE 146 ASIA PACIFIC: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023–2034 (USD MILLION)

- TABLE 147 ASIA PACIFIC: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023–2034 (TONS)

- TABLE 148 ASIA PACIFIC: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023–2034 (USD MILLION)

- TABLE 149 ASIA PACIFIC: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023–2034 (TONS)

- TABLE 150 ASIA PACIFIC: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023–2034 (USD MILLION)

- TABLE 151 ASIA PACIFIC: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023–2034 (TONS)

- TABLE 152 ASIA PACIFIC: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023–2034 (USD MILLION)

- TABLE 153 ASIA PACIFIC: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023–2034 (TONS)

- TABLE 154 ASIA PACIFIC: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023–2034 (USD MILLION)

- TABLE 155 ASIA PACIFIC: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023–2034 (TONS)

- TABLE 156 SOUTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY COUNTRY, 2023–2034 (USD MILLION)

- TABLE 157 SOUTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY COUNTRY, 2023–2034 (TONS)

- TABLE 158 SOUTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY COUNTRY, 2023–2034 (USD MILLION)

- TABLE 159 SOUTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY COUNTRY, 2023–2034 (TONS)

- TABLE 160 SOUTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY COUNTRY, 2023–2034 (USD MILLION)

- TABLE 161 SOUTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY COUNTRY, 2023–2034 (TONS)

- TABLE 162 SOUTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023–2034 (USD MILLION)

- TABLE 163 SOUTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023–2034 (TONS)

- TABLE 164 SOUTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023–2034 (USD MILLION)

- TABLE 165 SOUTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023–2034 (TONS)

- TABLE 166 SOUTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023–2034 (USD MILLION)

- TABLE 167 SOUTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023–2034 (TONS)

- TABLE 168 SOUTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023–2034 (USD MILLION)

- TABLE 169 SOUTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023–2034 (TONS)

- TABLE 170 SOUTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023–2034 (USD MILLION)

- TABLE 171 SOUTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023–2034 (TONS)

- TABLE 172 SOUTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023–2034 (USD MILLION)

- TABLE 173 SOUTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023–2034 (TONS)

- TABLE 174 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY COUNTRY, 2023–2034 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY COUNTRY, 2023–2034 (TONS)

- TABLE 176 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY COUNTRY, 2023–2034 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY COUNTRY, 2023–2034 (TONS)

- TABLE 178 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY COUNTRY, 2023–2034 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY COUNTRY, 2023–2034 (TONS)

- TABLE 180 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023–2034 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023–2034 (TONS)

- TABLE 182 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023–2034 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023–2034 (TONS)

- TABLE 184 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023–2034 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023–2034 (TONS)

- TABLE 186 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023–2034 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023–2034 (TONS)

- TABLE 188 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023–2034 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023–2034 (TONS)

- TABLE 190 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023–2034 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023–2034 (TONS)

- TABLE 192 CULTURED MEAT MARKET: DEGREE OF COMPETITION (COMPETITIVE)

- TABLE 193 STRATEGIES ADOPTED BY KEY PLAYERS IN CULTURED MEAT MARKET

- TABLE 194 COMPANY FOOTPRINT, BY SOURCE

- TABLE 195 COMPANY FOOTPRINT, BY REGION

- TABLE 196 OVERALL COMPANY FOOTPRINT

- TABLE 197 CULTURED MEAT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 198 CULTURED MEAT MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 199 CULTURED MEAT MARKET: DEALS, 2019–2023

- TABLE 200 CULTURED MEAT MARKET: OTHERS, 2019–2023

- TABLE 201 MOSA MEAT: BUSINESS OVERVIEW

- TABLE 202 MOSA MEAT: DEALS

- TABLE 203 MOSA MEAT: OTHERS

- TABLE 204 UPSIDE FOODS: BUSINESS OVERVIEW

- TABLE 205 UPSIDE FOODS: DEALS

- TABLE 206 UPSIDE FOODS: OTHERS

- TABLE 207 EAT JUST, INC.: BUSINESS OVERVIEW

- TABLE 208 EAT JUST, INC.: DEALS

- TABLE 209 INTEGRICULTURE INC.: BUSINESS OVERVIEW

- TABLE 210 INTEGRICULTURE INC.: DEALS

- TABLE 211 MEWERY: BUSINESS OVERVIEW

- TABLE 212 BIOCRAFT, INC.: BUSINESS OVERVIEW

- TABLE 213 FINLESS FOODS, INC.: BUSINESS OVERVIEW

- TABLE 214 FINLESS FOODS, INC.: DEALS

- TABLE 215 AVANT MEATS: BUSINESS OVERVIEW

- TABLE 216 AVANT MEATS: DEALS

- TABLE 217 AVANT MEATS: OTHERS

- TABLE 218 BLUENALU: BUSINESS OVERVIEW

- TABLE 219 BLUENALU: DEALS

- TABLE 220 BLUENALU: OTHERS

- TABLE 221 FORK & GOOD: BUSINESS OVERVIEW

- TABLE 222 MISSION BARNS: BUSINESS OVERVIEW

- TABLE 223 MISSION BARNS: DEALS

- TABLE 224 CUBIQ FOODS: BUSINESS OVERVIEW

- TABLE 225 IVY FARM TECHNOLOGIES LIMITED: BUSINESS OVERVIEW

- TABLE 226 MEATABLE: BUSINESS OVERVIEW

- TABLE 227 BIOTECH FOODS: BUSINESS OVERVIEW

- TABLE 228 O MEAT: BUSINESS OVERVIEW

- TABLE 229 BIOBQ: BUSINESS OVERVIEW

- TABLE 230 PEARLITA FOODS: BUSINESS OVERVIEW

- TABLE 231 WILDBIO: BUSINESS OVERVIEW

- TABLE 232 GOURMEY: BUSINESS OVERVIEW

- TABLE 233 PEACE OF MEAT: BUSINESS OVERVIEW

- TABLE 234 MEAT SUBSTITUTES MARKET, BY SOURCE, 2017–2020 (USD MILLION)

- TABLE 235 MEAT SUBSTITUTES MARKET, BY SOURCE, 2021–2027 (USD MILLION)

- TABLE 236 MEAT SUBSTITUTES MARKET, BY SOURCE, 2017–2020 (KT)

- TABLE 237 MEAT SUBSTITUTES MARKET, BY SOURCE, 2021–2027 (KT)

- TABLE 238 PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

- TABLE 239 PLANT-BASED MEAT MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 240 PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (TONS)

- TABLE 241 PLANT-BASED MEAT MARKET, BY SOURCE, 2022–2027 (TONS)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 REGIONAL SEGMENTATION

- FIGURE 3 CULTURED MEAT MARKET: RESEARCH DESIGN

- FIGURE 4 DATA TRIANGULATION METHODOLOGY

- FIGURE 5 INDICATORS OF RECESSION

- FIGURE 6 WORLD INFLATION RATE, 2011–2021

- FIGURE 7 GLOBAL GROSS DOMESTIC PRODUCT, 2011–2021 (USD TRILLION)

- FIGURE 8 RECESSION INDICATORS AND THEIR IMPACT ON CULTURED MEAT MARKET

- FIGURE 9 CULTURED MEAT MARKET SIZE, BY SOURCE (NORMAL SCENARIO), 2028 VS. 2034 (USD MILLION)

- FIGURE 10 CULTURED MEAT MARKET SIZE, BY END USE (NORMAL SCENARIO), 2028 VS. 2034 (USD MILLION)

- FIGURE 11 REGION-WISE CULTURED MEAT MARKET SHARE AND CAGR (NORMAL SCENARIO), 2023

- FIGURE 12 GROWING HEALTH CONCERNS RELATED TO TRADITIONAL MEAT AND SHORTFALL IN SUPPLY OF MEAT PRODUCTS TO DRIVE CULTURED MEAT MARKET GROWTH IN NORMAL SCENARIO

- FIGURE 13 NORTH AMERICA PROJECTED TO DOMINATE CULTURED MEAT MARKET BY 2034

- FIGURE 14 NUGGETS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 POULTRY SEGMENT PROJECTED TO DOMINATE MARKET BY 2028

- FIGURE 16 CANADA PROJECTED TO BE FASTEST-GROWING COUNTRY-LEVEL MARKET FOR CULTURED MEAT IN NORMAL SCENARIO

- FIGURE 17 CULTURED MEAT MARKET DYNAMICS

- FIGURE 18 PROJECTED PER CAPITA POULTRY CONSUMPTION IN SOUTHEAST ASIAN COUNTRIES, 2021–2029

- FIGURE 19 CULTURED MEAT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 REVENUE SHIFT FOR CULTURED MEAT MARKET

- FIGURE 21 NUMBER OF PATENTS GRANTED FOR CULTURED MEAT IN GLOBAL MARKET, 2013–2022

- FIGURE 22 REGIONAL ANALYSIS OF PATENTS GRANTED IN CULTURED MEAT MARKET

- FIGURE 23 CULTURED MEAT: MARKET MAP

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING CULTURED MEAT FOR DIFFERENT END USES

- FIGURE 25 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 26 CULTURED MEAT MARKET SIZE IN OPTIMISTIC SCENARIO, BY SOURCE, 2028 VS. 2034 (USD MILLION)

- FIGURE 27 CULTURED MEAT MARKET SIZE IN NORMAL SCENARIO, BY SOURCE, 2028 VS. 2034 (USD MILLION)

- FIGURE 28 CULTURED MEAT MARKET SIZE IN PESSIMISTIC SCENARIO, BY SOURCE, 2028 VS. 2034 (USD MILLION)

- FIGURE 29 CULTURED MEAT MARKET SIZE IN NORMAL SCENARIO, BY END USE, 2028 VS. 2034 (USD MILLION)

- FIGURE 30 CULTURED MEAT MARKET SIZE IN OPTIMISTIC SCENARIO, BY END USE, 2028 VS. 2034 (USD MILLION)

- FIGURE 31 CULTURED MEAT MARKET SIZE IN PESSIMISTIC SCENARIO, BY END USE, 2028 VS. 2034 (USD MILLION)

- FIGURE 32 CANADA TO DOMINATE CULTURED MEAT MARKET AND RECORD HIGHEST CAGR DURING FORECAST PERIOD (NORMAL SCENARIO)

- FIGURE 33 NORTH AMERICA: CULTURED MEAT MARKET SNAPSHOT (NORMAL SCENARIO)

- FIGURE 34 CULTURED MEAT MARKET: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- FIGURE 35 CULTURED MEAT MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 36 CULTURED MEAT MARKET: STARTUP/SME EVALUATION MATRIX, 2022

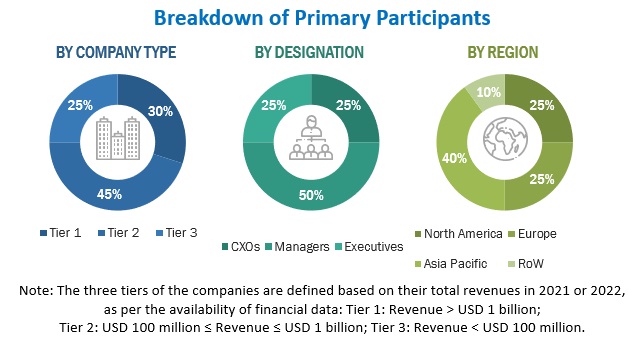

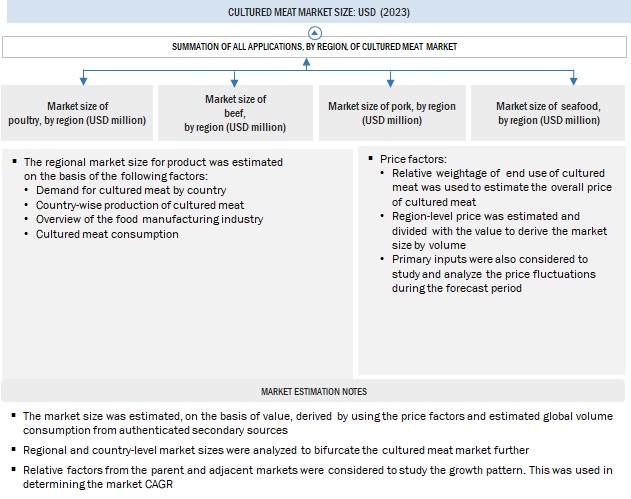

The study involved four major activities in estimating the current size of the cultured meat market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information. This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the cultured meat market.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the cultured meat market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, research, and development teams, and related key executives from distributors, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to types of cultured meat, type, product, consumption, distribution channel, freezing technique, and region. Stakeholders from the demand side, such as food and beverage companies and health and personal care companies who are using cultured meat were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of cultured meat and outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

designation |

|

BioCraft,Inc (US) |

General Manager |

|

Finless Foods (US) |

Sales Manager |

|

BlueNalu (US) |

Individual Industry Expert |

|

Fork & Good (US) |

Marketing Manager |

|

Mission Barns (US) |

Sales Executive |

|

Ivy Farm Technologies Limited (UK) |

Sales Manager |

Cultured Meat Market Size Estimation

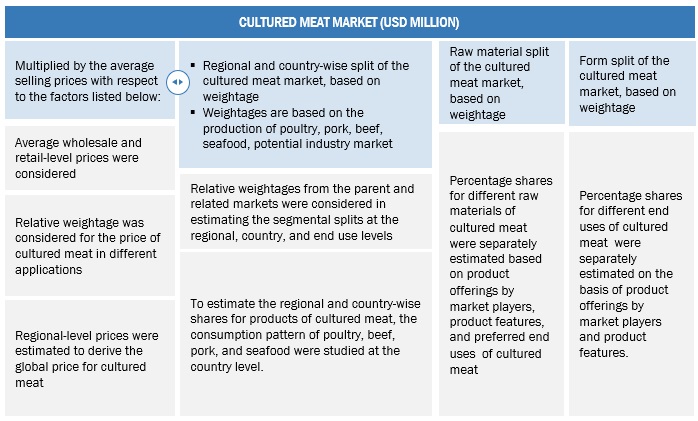

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- The revenues of the major cultured meat players were determined through primary and secondary research, which were used as the basis for market sizing and estimation.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Global cultured meat Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global cultured meat Market: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Cultured Meat Market Definition

According to the Federation of American Scientists, “Cell-cultured meat (also referred to as lab-grown meat, clean meat, in-vitro meat, imitation meat, synthetic meat, and fake meat) is grown in laboratories from animal cell cultures.”

Key Stakeholders

- Venture capitalists and investors

- Meat processors, traders, distributors, importers, exporters, and suppliers

- Food retailers

- Commercial research & development (R&D) organizations and financial institutions

- Livestock research organizations

- Cultured meat associations and regulatory bodies such as the Cultured Meat Foundation, and Future Food

- Other associations such as the United States Cattlemen's Association (USCA), National Cattlemen's Beef Association, and the National Pork Producers Council

Cultured Meat Market Report Objectives

- Determining and projecting the size of the market, with respect to source, end use and regions, over 10 years, ranging from 2024 to 2034

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

- Impact of macro- and microeconomic factors on the market

- Impact of recession on the global market

- Shifts in demand patterns across different subsegments and regions.

- Identifying and profiling the key market players in the market

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis of Cultured Meat Market

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe into Poland, Portugal, Ireland, Sweden, Finland, Austria, Belgium, Bulgaria, Greece, the Czech Republic, Russia, and Denmark.

- Further breakdown of the Rest of Asia Pacific into Malaysia, Myanmar, the Philippines, Indonesia, South Korea, Thailand, Sri Lanka, and Vietnam

- Further breakdown of the Rest of the Middle East & Africa into Saudi Arabia, Iran, Iraq, Oman, Bahrain, Qatar, Kuwait, Egypt, Turkey, Syria, South Africa, Nigeria, Kenya, Morocco, Ghana, and Algeria.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Cultured Meat Market