Meat Starter Cultures Market by Application (Sausages, Salami, Dry-cured meat, and Others), Microorganism(Bacteria, and Fungi), Composition (Multi-strain mix, Single strain, and Multi-strain), Form, and Region - Global Forecast to 2025

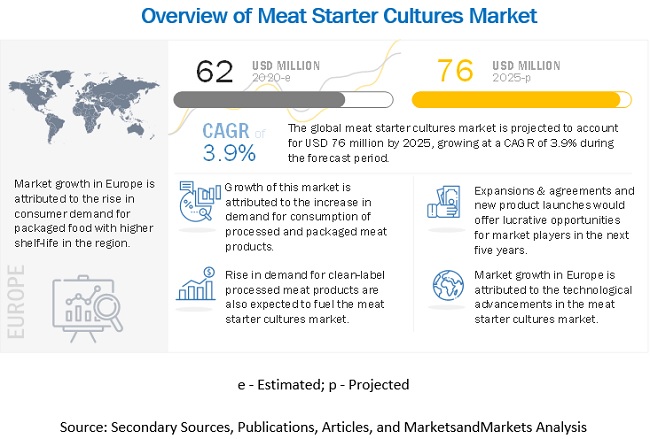

[173 Pages Report] According to MarketsandMarkets, the global meat starter cultures market size was valued at USD 62 million in 2020 and projected to reach USD 76 million by 2025, recording a CAGR of 3.9%. It is witnessing significant growth due to increasing demand for processed meat products with higher shelf-life. The growing demand for processed and convenience meat among consumers is creating a demand for meat starter cultures. With the advancement of new technologies and innovative technologies in the food and beverage sector, the incorporation of meat starter cultures across various industries is increasing. Europe segment is going to dominate the market due to its high production of processed meat products.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Consumer inclination toward food products with higher shelf-life

The food & beverage industry has witnessed emerging trends in recent years, and this is evident from the innovations and developments taking place in the packaged food segment. Packaged convenience food products have been increasingly becoming an integral part of the daily consumption around the world, especially in the North American and European regions. Busier lifestyles of consumers have been driving growth in convenience foods, and the food manufacturers have been dynamic in investing in the production of new products that could meet the rising consumer demand for packaged convenience food products.

Packaging offers protection and resistance against microbial (bacteria and fungi) growth, which results in food-borne illnesses otherwise. The shelf-life of food products also increases considerably. The packaged food products also ensure that food safety and quality are tested before it is consumed, according to the details provided on the package. These also provide the microbial safety of food products before they are kept for storage in inventories or handled during transportation. Moreover, packaged food augments the shelf-life of food products and mitigates food wastage. According to RTS, an innovative commercial waste management organization, around 40% of food is wasted in the US every year. However, developing countries such as China and India are also among the countries with major food wastage, globally.

The packaged frozen meat demand is high in North America and Europe, where the per capita consumption of meat is higher compared to the Asian countries. The use of meat starter cultures in various meat applications such as sausages, salami, and dry-cured meat results in increasing the shelf-life of the meat products by retaining their texture and flavor for a longer span, and mitigates wastage.

The outbreak of the coronavirus in 2020 led to high unemployment rates and stalled dining at restaurants for several months; the shutdown during the pandemic has been causing people to cook more at home. The longer people stayed at their homes, they have been dependent on packaged food products and propelled the demand for food with a higher shelf-life.

Restraints: Stringent government regulations for the use of starter cultures in processed meat products

Stringent regulations have proved to be a major hindrance stifling the market for starter cultures. Some of the global organizations involved in providing regulatory norms include the World Trade Organization (WTO), European Food and Feed Cultures Association (EFFCA), and other regulatory bodies. The regulations for starter cultures as listed by the different organizations include the following:

World Trade Organization

The World Trade Organization (WTO) has laid down stringent rules and regulations for the import and export of living microbes. The manufacturer has to obtain an environment clearance certificate, quality certificate, and some other related certifications before manufacturing microorganisms at the industrial level. Since the starter culture industry involves high risk with respect to the health and environment, it would not be easy for new manufacturers to enter the starter culture market. There have been special regulatory measures present for companies to discard the culture and biological effluent after the production.

European Food Safety Authority & Qualified Presumption of Safety

The uses of bacteria must conform to the general food safety standards, such as the European General Food Law (European Parliament and the Council, 2002). The European Food Safety Authority (EFSA) had announced five ‘generic’ approaches for the safety assessment of microorganisms in food with a history of safe use. This approach includes a qualified presumption of safety (QPS) in food. QPS derives basic knowledge of the microorganisms that includes its pathogenicity, taxonomy, familiarity, and application in food. The Scientific Committee of EFSA indicates that a thorough knowledge of the microorganism is sufficient for awarding the QPS status for numerous species from the groups of lactic acid bacteria and yeast.

Opportunities: increased in organized retail sector boosts distribution and availability of packaged meat products

The development of the retail sector in the form of supermarkets, hypermarkets, and convenience stores is a major factor driving the growth of packaged meat products. The modern urban consumers have been highly driven by convenience and hygiene, which has been pushing their purchases from the retail stores. The increasing adoption rate of packaged meat products has been a promising take for the growth of the meat starter cultures. The COVID-19 pandemic has impacted the retail sector globally. Due to the nation-wide lockdown during the pandemic, the food manufactures have been emphasizing the meat products with higher shelf-life, which is expected to propel the market for meat starter cultures in the coming years. The outbreak of COVID-19 has created a shift toward an organized retail market for preventing any further virus outbreaks. These developments underscore the need for the food value chain to move from open-air markets to an organized retail model that keeps meat products fresher for long. This is expected to propel the demand for meat starter cultures during the forecast period. Large food retail chains such as Walmart, Tesco, Spar, and 7-Eleven have been expanding their presence in developed countries such as the UK, Germany, and the US and in emerging markets such as China, Brazil, and Argentina. For instance, Walmart is the largest American multinational retail corporation with over 11,000 stores across 27 countries.

Retail sales were robust until the coronavirus pandemic hit. However, according to the US Census Bureau’s data in 2020, the US retail sales in the second quarter swayed 8.1% from the same quarter in 2019. Retail stores were shut down and consumers stayed home to avoid the pandemic. This contributed to a 24.9% increase in online sales, as shoppers felt safer having their goods delivered. Also, according to an article published on The Guardian in 2020, the monthly British Retail Consortium-ShopperTrak survey showed the number of British citizens venturing out to shop in the month of May was just 20% of what it was in 2019. The study also stated that the pandemic led consumers to prevent retail shopping, else a major percentage of people would prefer retail shopping. The consumer psyche revolves around the shopping experience and the physical touch of the product before purchase. Therefore, post-pandemic era there would be a surge in demand for organized retail stores, resulting in increased demand for packaged meat products.

Challenges: Lack of proper technology for the usage and monitoring of meat starter cultures in developing regions

The meat starter cultures market is highly consolidated in the emerging markets across Asia, Africa, and South America. The usage of meat starter cultures in small & medium enterprises has been a challenge due to lack of resources or the technology and facilities required to monitor high-quality meat starter cultures. Moreover, the selection of the right composition of starter culture is a key aspect that many companies have not figured out perfectly. This selection plays a crucial role in sustaining the flavor and texture of meat applications. The type of bacteria used (thermophilic or mesophilic) also plays a key role in the overall property of the meat products. The selection of the right composition of meat starter culture is a complex method that requires validation at a laboratory level and factory-scale. Lack of awareness among experts on the characteristics of the strain can lead to huge production losses, and hence, this factor has been posing as a major challenge for the meat starter culture market. Adequate training provided to the professionals in regard to the product functions and characteristics can help the manufacturers attain the desired quality end-product, with minimal production losses. Furthermore, the use of meat starter cultures requires advanced technology such as microbial count monitoring devices, pH measuring devices, and devices to determine bacterial community composition. Thus, the lack of these devices and huge initial set-up costs involved poses as a challenge for the use of meat starter cultures in developing countries.

By microorganism, the bacteria is projected to account for the largest share in the meat starter cultures market during the forecast period

Based on microorganism, bacteria dominated the market. Starter cultures are used to initiate the fermentation of meat products such as sausages, salami, and dry-cured meat. There are two types of microorganisms that are mainly used as meat starter cultures, namely, bacteria and fungi. Bacteria-based starter cultures are that are majorly used in the industry include lactic acid bacteria (LAB) and coagulase-negative staphylococci (CNS). These are the dominant microorganisms that are used in meat products to prohibit pathogens and spoilage microorganisms during the pre-and post-processing of meat products.

By application, sausages segment is projected to account for the largest share in the meat starter cultures market during the forecast period

By application, the market is segmented into sausages, salami, dry-cured meat, and others (such as pepperoni and other processed meat products). The meat sausages segment, akin to most other non-processed fresh meats and meat preparations, comprises perishable food products, and most sausage manufacturers have been looking for additional safety or longer shelf life, either in terms of less spoilage or delayed oxidation. Meat starter cultures are used to provide additional safety and delay spoilage by shifting the uncontrolled fermentation that spoils the meat to a controlled fermentation by safe bacteria. Meat starter cultures ferment the sausages and preserve their flavor, texture, color, and increase their shelf-life by averting wastage.

To know about the assumptions considered for the study, download the pdf brochure

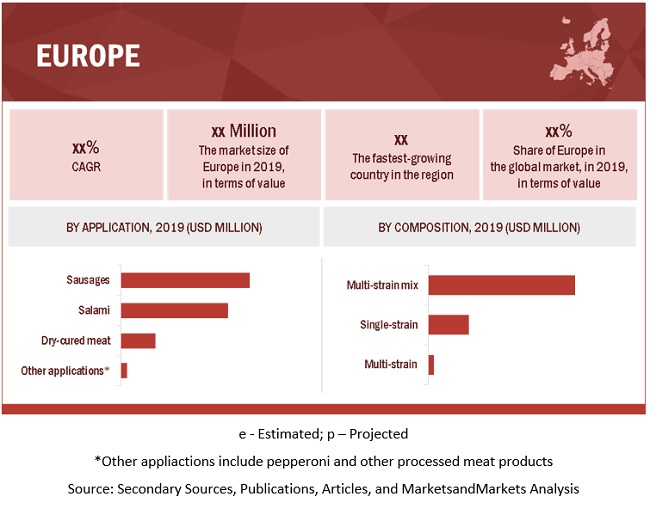

Europe is projected to account for the largest market share during the forecast period

Europe has been a major contributor to the growth of the processed meat industry, as a huge percentage of consumers have been inclined toward packaged meat applications such as sausages, salami, and dry-cured meat. The busier lifestyles of consumers in Western European countries such as Germany, the UK, France, and Italy have been propelling the demand for meat products with higher shelf-life. Therefore, augmenting the demand for meat starter cultures in this region. The European region consists of some of the major manufacturers from the meat starter culture market, such as Chr. Hansen (Denmark), DSM (Netherlands), Kerry Group (Ireland), Biochem SRL (Italy), and Sacco SRL (Italy). These key players have been bolstering the usage of meat starter cultures in this region by offering technologically advanced equipment for monitoring and usage of meat starter cultures.

Key Market Players:

Chr. Hansen (Denmark), DSM (Netherlands), Kerry (Ireland), DuPont (US), Frutarom (Israel), Galactic (Belgium), Lallemand (Canada), Proquiga (Spain), Westcombe (UK), Biochem SRL (Italy), RAPS GmbH (Germany), DnR Sausages Supplies. (Canada), Sacco System (Italy), Canada Compound (Canada), Biovitec (France), Genesis Laboratories (Bulgaria), Meat Cracks (Germany), THT S.A. (Belgium), Stuffers Supply Co. (Canada), MicroTec GmbH (Germany), and Codex-Ing Biotech (US).

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period considered |

2020–2025 |

|

Units considered |

Value (USD) & Volume (Kg) |

|

Segments covered |

Applications, composition, microorganism, and region |

|

Regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies studied |

|

This research report categorizes the meat starter cultures market based on application, microorganism. composition, and region.

By Application

- Sausages

- Salami

- Dry-cured meat

- Other applications*

*Other applications includes pepperoni and other processed meat products

By Composition

- Multi-strain mix

- Single strain

- Multi-strain

By Microorganism

- Bacteria

- Fungi

By Form

- Freeze-dried

- Frozen

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

- South America

- Africa

- Middle East

Recent Developments

- In July 2018, DuPont (US) expanded its research & development division by setting up an innovation and application system in Japan. This would serve as a hub for food developments that will allow markets to leverage strong innovation capabilities.

- In January 2019, Chr. Hansen (Denmark) launched a new starter culture in extension to its Bactoferm Series to primarily offer color, color stability, and development of flavor in dried, cured meats, such as dried sausages as per the rising demand in the North American and European regions.

Frequently Asked Questions (FAQ):

Which are the major types of application considered in this study and which segments are projected to have promising growth rate in future?

Sausages is currently accounting for dominant share in the meat starter cultures market followed by salami and dry-cured meat. However, salami is projected to experiencing highest growth rate in next five years, as the beneficial and attractive meat starter cultures are purified and produced under hygienic conditions to provide the desired acidification, flavor, and color of the salami according to the consumer’s preferences.

What are some of the drivers fueling the growth of meat starter cultures market?

Global meat starter cultures market is characterized by following drivers:

Consumer inclination toward packaged food products with higher shelf-life:

Packaged convenience food products have been increasingly becoming an integral part of the daily consumption around the world, especially in the North American and European regions. Busier lifestyles of consumers have been driving growth in convenience foods, and the food manufacturers have been dynamic in investing in the production of new products that could meet the rising consumer demand for packaged convenience food products. The packaged frozen meat demand is high in North America and Europe, where the per capita consumption of meat is higher compared to the Asian countries. The use of meat starter cultures in various meat applications such as sausages, salami, and dry-cured meat results in increasing the shelf-life of the meat products by retaining their texture and flavor for a longer span, and mitigates wastage.

Augmenting demand for clean-label processed meat products:

In recent times, consumers have been more aware of health and wellness and have been selective in their daily consumptions. Consumers have been conscious about the proteins and nutrients intake from non-preservative food products for their overall physical and mental growth and development. This resulted in a shift in consumer preferences toward clean-label food products. Since ages, meat has been a prominent source of high-quality proteins for humans, and in recent times, meat has been consumed either in the fresh or processed form. The synthetic or processed food products consist of nitrites and nitrates in larger quantities, and higher consumption of such food products have proven to be detrimental to the human body and may also lead to cancer in some cases. Therefore, the augmenting demand for safe and healthy food products is fueling the demand for organic animal husbandry. Additionally, organic processed meat products have negligible use of artificial chemicals, resulting in their usage for the manufacturing of clean-label meat products.

I am interested in Asia Pacific market for composition segment. Is the customization available for the same? What all information would be included in the same?

Yes, customization for Asia Pacific market for application can be provided on various aspects including market size (application and sub types of composition), forecast, market trends, company profiles & competitive landscape. Exclusive insights on below Asia Pacific countries will be provided:

- China

- Japan

- India

- South Korea

- Thailand

- Rest of Asia Pacific (Indonesia, the Philippines, Malaysia, Singapore, and Vietnam)

Also, you can let us know if there are any other countries of your interest

I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

Yes, detailed explanation of research methodology can be provided over a scheduled call, it will also enable us to explain all your queries in detail. For a brief overview and knowledge: Multiple approaches have been adopted to understand the holistic view of this market including:

- Demand-side approach (Based on global market)

- Supply-side approach (Based on raw material by region)

- Primary interviews with industry experts

- Revenue mapping of key players and analyzing their market share

- Data triangulation

Can you provide the market trend analysis for meat starter cultures in specific to application?

Yes, market trend analysis for meat starter cultures specific to application such as sausages, salami, dry-cured meat, and other application on global level can be provided. In addition to detailing of trends, it will include impact of various trends in application industry and what are the market opportunities of players planning for market explanation in these application areas. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MEAT STARTER CULTURES MARKET SEGMENTATION

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2019

1.7 VOLUME UNIT CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 MEAT STARTER CULTURES MARKET: RESEARCH DESIGN

FIGURE 3 KEY DATA FROM PRIMARY SOURCES

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH ONE (DEMAND SIDE)

2.2.2 APPROACH TWO (SUPPLY SIDE)

2.3 DATA TRIANGULATION

FIGURE 4 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

2.6 SCENARIO-BASED MODELING

2.7 INTRODUCTION TO COVID-19

2.8 COVID-19 HEALTH ASSESSMENT

FIGURE 5 COVID-19: THE GLOBAL PROPAGATION

FIGURE 6 COVID-19 PROPAGATION: SELECT COUNTRIES

2.9 COVID-19 ECONOMIC ASSESSMENT

FIGURE 7 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.9.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 8 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 9 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 42)

TABLE 2 MEAT STARTER CULTURES MARKET SHARE SNAPSHOT, 2020 VS. 2025, BY VALUE

FIGURE 10 IMPACT OF COVID-19 ON MEAT STARTER CULTURES MARKET SIZE, BY SCENARIO, 2020 VS. 2021 (USD MILLION)

FIGURE 11 MARKET SIZE, BY COMPOSITION, 2020 VS. 2025 (USD MILLION)

FIGURE 12 MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 13 MARKET SIZE, BY MICROORGANISM, 2020 VS. 2025 (USD MILLION)

FIGURE 14 MARKET SHARE (VALUE), BY REGION, 2019

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MEAT STARTER CULTURES MARKET

FIGURE 15 GROWING DEMAND FOR PROCESSED AND PACKAGED MEAT IS EXPECTED TO PROPEL THE MARKET FOR MEAT STARTER CULTURES

4.2 MEAT STARTER CULTURES MARKET: MAJOR REGIONAL SUBMARKETS

FIGURE 16 EUROPE WAS THE LARGEST MARKET GLOBALLY FOR MEAT STARTER CULTURES IN 2019

4.3 EUROPE: MARKET, BY KEY APPLICATION & COUNTRY

FIGURE 17 GERMANY ACCOUNTED FOR THE LARGEST SHARE IN THE EUROPEAN MARKET IN 2019

4.4 MARKET, BY APPLICATION & REGION

FIGURE 18 EUROPE IS PROJECTED TO DOMINATE THE MARKET FOR MEAT STARTER CULTURES DURING THE FORECAST PERIOD

4.5 MARKET, BY COMPOSITION

FIGURE 19 THE MULTI-STRAIN MIX SEGMENT IS PROJECTED TO DOMINATE THE MEAT STARTER CULTURES MARKET DURING THE FORECAST PERIOD

4.6 MARKET, BY MICROORGANISM

FIGURE 20 EUROPE DOMINATED BOTH MICROORGANISMS OF MEAT STARTER CULTURES IN 2019

FIGURE 21 COVID-19 IMPACT ON THE MEAT STARTER CULTURES MARKET COMPARISON OF PRE- AND POST-COVID-19 SCENARIOS

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 MEAT STARTER CULTURES MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Consumer inclination toward packaged food products with higher shelf-life

FIGURE 23 INDIA: ANNUAL WASTAGE PER PRODUCTION VOLUME

5.2.1.2 Augmenting demand for clean-label processed meat products

FIGURE 24 US: MEAT PRODUCTION, BY MEAT TYPE, 2017 (BILLION KG)

5.2.1.3 Technological advancements for the development of meat starter cultures

5.2.2 RESTRAINTS

5.2.2.1 Stringent government regulations for the use of starter cultures in processed meat products

5.2.2.2 Concern over the quality of starter cultures used in meat products

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in the organized retail sector boosts distribution and availability of packaged meat products

FIGURE 25 US: RETAIL SALES, 2010–2019 (USD TRILLION)

5.2.3.2 Rise in consumer adaption rate for packaged meat products in Asia Pacific and meat exports in South America

TABLE 3 FROZEN BEEF IMPORTS, BY COUNTRY, 2019 (USD BILLION)

5.2.4 CHALLENGES

5.2.4.1 Lack of proper technology for the usage and monitoring of meat starter cultures in developing regions

5.2.4.2 Rise in vegan population and consumer shift toward plant-based meat alternatives

FIGURE 26 US: ANNUAL SALES OF PLANT-BASED FOOD & BEVERAGES, 2017–2019 (USD BILLION)

5.3 COVID-19 DRIVERS

5.4 ECOSYSTEM/MARKET MAP

FIGURE 27 MARKET ECOSYSTEM

FIGURE 28 MARKET MAP

5.5 GLOBAL AVERAGE PRICE OF MEAT STARTER CULTURES (USD/KG)

5.6 SUPPLY CHAIN

FIGURE 29 MARKET: SUPPLY CHAIN

5.7 VALUE CHAIN

FIGURE 30 MARKET: VALUE CHAIN

5.8 PATENT ANALYSIS

TABLE 4 PATENT REGISTRATION, 2013–2017

5.9 YC - YCC SHIFT

FIGURE 31 YC & YCC SHIFT FOR THE MEAT STARTER CULTURES MARKET

6 MEAT STARTER CULTURES MARKET, BY APPLICATION (Page No. - 67)

6.1 INTRODUCTION

FIGURE 32 MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

TABLE 5 MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

6.1.1 COVID-19 IMPACT ON THE MEAT STARTER CULTURES MARKET, BY APPLICATION

6.1.1.1 Optimistic Scenario

TABLE6 OPTIMISTIC SCENARIO: MEAT STARTER CULTURE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

6.1.1.2 Realistic Scenario

TABLE7 REALISTIC SCENARIO: MEAT STARTER CULTURE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

6.1.1.3 Pessimistic Scenario

TABLE8 PESSIMISTIC SCENARIO: MEAT STARTER CULTURE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

6.2 SAUSAGES

6.2.1 RISE IN DEMAND FOR SAUSAGES AS BREAKFAST MEAT AUGMENTS THE DEMAND FOR MEAT STARTER CULTURES

TABLE9 MARKET SIZE FOR SAUSAGES, BY REGION, 2018–2025 (USD THOUSAND)

6.3 SALAMI

6.3.1 MEAT STARTER CULTURE DEMAND HAS BEEN RISING DUE TO INCREASING DEMAND FOR SALAMI IN EUROPE

TABLE10 MARKET SIZE FOR SALAMI, BY REGION, 2018–2025 (USD THOUSAND)

6.4 DRY-CURED MEATS

6.4.1 MEAT STARTER CULTURES HELP IN THE EFFECTIVE PRESERVATION OF DRY-CURED MEAT

TABLE 11 MARKET SIZE FOR DRY-CURED MEAT, BY REGION, 2018–2025 (USD THOUSAND)

6.5 OTHER APPLICATIONS

6.5.1 CHANGING CONSUMER PREFERENCES AUGMENTS DEMAND FOR CLEAN-LABEL MEAT PRODUCTS

TABLE 12 MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2018–2025 (USD THOUSAND)

7 MEAT STARTER CULTURES MARKET, BY COMPOSITION (Page No. - 73)

7.1 INTRODUCTION

FIGURE 33 MARKET SIZE, BY COMPOSITION, 2020 VS. 2025 (USD MILLION)

TABLE 13 MARKET SIZE, BY COMPOSITION, 2018–2025 (USD MILLION)

7.1.1 COVID-19 IMPACT ON THE MEAT STARTER CULTURES MARKET, BY COMPOSITION

7.1.1.1 Optimistic Scenario

TABLE14 OPTIMISTIC SCENARIO: MEAT STARTER CULTURE MARKET SIZE, BY COMPOSITION, 2018–2021 (USD MILLION)

7.1.1.2 Realistic Scenario

TABLE15 REALISTIC SCENARIO: MEAT STARTER CULTURE MARKET SIZE, BY COMPOSITION, 2018–2021 (USD MILLION)

7.1.1.3 Pessimistic Scenario

TABLE16 PESSIMISTIC SCENARIO: MEAT STARTER CULTURE MARKET SIZE, BY COMPOSITION, 2018–2021 (USD MILLION)

7.2 MULTI-STRAIN MIX

7.2.1 MULTI-STRAIN MIX HELPS INCORPORATE ADJUNCT FUNCTIONS TO THE MEAT PRODUCT

TABLE17 MULTI-STRAIN MIX MEAT STARTER CULTURE MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

7.3 SINGLE-STRAIN

7.3.1 SINGLE-STRAIN STARTER CULTURES MAJORLY HELPS ATTAIN UNIFORM FLAVOR PROFILE DEVELOPMENT

TABLE18 SINGLE-STRAIN MEAT STARTER CULTURE MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

7.4 MULTI-STRAIN

7.4.1 MULTI-STRAIN MESOPHILIC STARTER CULTURES HAVE BEEN IN HIGH DEMAND ACROSS DEVELOPING ECONOMIES

TABLE 19 MULTI-STRAIN MEAT STARTER CULTURE MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

8 MEAT STARTER CULTURES MARKET, BY MICROORGANISM (Page No. - 79)

8.1 INTRODUCTION

FIGURE 34 MARKET SIZE, BY MICROORGANISM, 2020 VS. 2025 (USD MILLION)

TABLE 20 MARKET SIZE, BY MICROORGANISM, 2018–2025 (USD MILLION)

8.1.1 COVID-19 IMPACT ON THE MEAT STARTER CULTURE MARKET, BY MICROORGANISM

8.1.1.1 Optimistic Scenario

TABLE21 OPTIMISTIC SCENARIO: MEAT STARTER CULTURE MARKET SIZE, BY MICROORGANISM, 2018–2021 (USD MILLION)

8.1.1.2 Realistic Scenario

TABLE22 REALISTIC SCENARIO: MEAT STARTER CULTURE MARKET SIZE, BY MICROORGANISM, 2018–2021 (USD MILLION)

8.1.1.3 Pessimistic Scenario

TABLE23 PESSIMISTIC SCENARIO: MEAT STARTER CULTURE MARKET SIZE, BY MICROORGANISM, 2018–2021 (USD MILLION)

8.2 BACTERIA

8.2.1 LACTIC ACID BACTERIA (LAB) ARE THE MOST PREFERRED IN THE MEAT INDUSTRY

TABLE 24 BACTERIA-BASED MEAT STARTER CULTURES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.3 FUNGI

8.3.1 MOLDS AND YEAST ARE MOSTLY USED IN SAUSAGES AND OTHER MEAT ITEMS

TABLE25 FUNGI-BASED MEAT STARTER CULTURE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9 MEAT STARTER CULTURES MARKET, BY FORM (Page No. - 84)

9.1 INTRODUCTION

9.2 FREEZE-DRIED

9.3 FROZEN

10 MEAT STARTER CULTURES MARKET, BY REGION (Page No. - 86)

10.1 INTRODUCTION

FIGURE 35 REGIONAL SNAPSHOT: NORTH AMERICA HAS SIGNIFICANT GROWTH RATES FOR MEAT STARTER CULTURES

TABLE26 MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE27 MARKET SIZE, BY REGION, 2018–2025 (KG)

TABLE28 AVERAGE PRICE OF MEAT STARTER CULTURES, BY REGION (USD/KG)

10.1.1 COVID-19 IMPACT ON THE MEAT STARTER CULTURES MARKET, BY REGION

10.1.1.1 Optimistic Scenario

TABLE29 OPTIMISTIC SCENARIO: MEAT STARTER CULTURES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

10.1.1.2 Realistic Scenario

TABLE30 REALISTIC SCENARIO: MEAT STARTER CULTURE MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

10.1.1.3 Pessimistic Scenario

TABLE31 PESSIMISTIC SCENARIO: MEAT STARTER CULTURE MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

10.2 REGULATORY FRAMEWORK

10.3 NORTH AMERICA

FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

TABLE32 NORTH AMERICA: MEAT STARTER CULTURES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE33 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE34 NORTH AMERICA: SAUSAGES MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE35 NORTH AMERICA: SALAMI MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE36 NORTH AMERICA: DRY-CURED MEAT MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE37 NORTH AMERICA: OTHER APPLICATIONS MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE38 NORTH AMERICA: MARKET SIZE, BY MICROORGANISM, 2018–2025 (USD MILLION)

TABLE39 NORTH AMERICA: MARKET SIZE, BY COMPOSITION, 2018–2025 (USD THOUSAND)

TABLE40 NORTH AMERICA: MULTI-STRAIN MIX MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE41 NORTH AMERICA: SINGLE-STRAIN MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE42 NORTH AMERICA: MULTI-STRAIN MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

10.3.1 US

10.3.1.1 The technological advancements related to meat starter cultures is expected to drive the market in the US

TABLE43 US: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE44 US: MARKET SIZE, BY COMPOSITION, 2018–2025 (USD THOUSAND)

10.3.2 CANADA

10.3.2.1 Local manufacturers dominate the starter cultures market in the country

TABLE45 CANADA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE46 CANADA: MARKET SIZE, BY COMPOSITION, 2018–2025 (USD THOUSAND)

10.3.3 MEXICO

10.3.3.1 Growth in meat exports to drive the market growth in Mexico

TABLE47 MEXICO: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE48 MEXICO: MARKET SIZE, BY COMPOSITION, 2018–2025 (USD THOUSAND)

10.4 EUROPE

FIGURE 37 EUROPE: MARKET SNAPSHOT

TABLE49 EUROPE: MARKET SIZE, BY COUNTRY/REGION, 2018–2025 (USD MILLION)

TABLE50 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE51 EUROPE: MARKET SIZE FOR SAUSAGES, BY COUNTRY/REGION, 2018–2025 (USD THOUSAND)

TABLE52 EUROPE: MEAT STARTER CULTURES SALAMI MARKET SIZE, BY COUNTRY/REGION, 2018–2025 (USD THOUSAND)

TABLE53 EUROPE: MARKET SIZE FOR DRY-CURED MEAT, BY COUNTRY/REGION, 2018–2025 (USD THOUSAND)

TABLE54 EUROPE: MARKET SIZE FOR OTHER APPLICATIONS, BY COUNTRY/REGION, 2018–2025 (USD THOUSAND)

TABLE55 EUROPE: MARKET SIZE, BY MICROORGANISM, 2018–2025 (USD MILLION)

TABLE56 EUROPE: MARKET SIZE, BY COMPOSITION, 2018–2025 (USD THOUSAND)

TABLE57 EUROPE: MULTI-STRAIN MEAT STARTER CULTURES MIX MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE58 EUROPE: SINGLE-STRAIN MEAT STARTER CULTURES MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE59 EUROPE: MULTI-STRAIN MEAT STARTER CULTURE MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

10.4.1 GERMANY

10.4.1.1 Increase in demand for clean-label meat products drive market growth in Germany

TABLE60 GERMANY: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE61 GERMANY: MARKET SIZE, BY COMPOSITION, 2018–2025 (USD THOUSAND)

10.4.2 FRANCE

10.4.2.1 The governments’ support for the meat industry is expected to drive the meat starter cultures market in France

TABLE62 FRANCE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE63 FRANCE: MARKET SIZE, BY COMPOSITION, 2018–2025 (USD THOUSAND)

10.4.3 SPAIN

10.4.3.1 Consumer shift toward nutritional meat products drives growth for meat starter cultures in the country

TABLE64 SPAIN: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE65 SPAIN: MARKET SIZE, BY COMPOSITION, 2018–2025 (USD THOUSAND)

10.4.4 ITALY

10.4.4.1 Increase in meat sales are expected to drive the market for meat starter culture

TABLE66 ITALY: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE67 ITALY: MARKET SIZE, BY COMPOSITION, 2018–2025 (USD THOUSAND)

10.4.5 UK

10.4.5.1 The rise in the vegan population poses a challenge for the meat starter cultures market in the UK

TABLE68 UK: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE69 UK: MARKET SIZE, BY COMPOSITION, 2018–2025 (USD THOUSAND)

10.4.6 NORDICS

10.4.6.1 The rise in demand for clean-label ingredients could propel the meat starter culture market

TABLE70 NORDICS: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE71 NORDICS: MARKET SIZE, BY COMPOSITION, 2018–2025 (USD THOUSAND)

10.4.7 RUSSIA

10.4.7.1 Augmenting meat demand and rising local manufacturers propel the meat starter culture market

TABLE72 RUSSIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE73 RUSSIA: MARKET SIZE, BY COMPOSITION, 2018–2025 (USD THOUSAND)

10.4.8 REST OF EUROPE

10.4.8.1 Belgium is among the leading processed meat product market, which drives the demand for meat starter culture

TABLE74 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE75 REST OF EUROPE: MARKET SIZE, BY COMPOSITION, 2018–2025 (USD THOUSAND)

10.5 ASIA PACIFIC

TABLE76 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2018–2025 (USD MILLION)

TABLE77 ASIA PACIFIC: MEAT STARTER CULTURE MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE78 ASIA PACIFIC: MARKET SIZE FOR SAUSAGES, BY COUNTRY/REGION, 2018–2025 (USD THOUSAND)

TABLE79 ASIA PACIFIC: MARKET SIZE FOR SALAMI, BY COUNTRY/REGION, 2018–2025 (USD THOUSAND)

TABLE80 ASIA PACIFIC: MARKET SIZE FOR DRY-CURED MEAT, BY COUNTRY/REGION, 2018–2025 (USD THOUSAND)

TABLE81 ASIA PACIFIC: MARKET SIZE FOR OTHER APPLICATIONS, BY COUNTRY/REGION, 2018–2025 (USD THOUSAND)

TABLE82 ASIA PACIFIC: MARKET SIZE, BY MICROORGANISM, 2018–2025 (USD MILLION)

TABLE83 ASIA PACIFIC: MARKET SIZE, BY COMPOSITION, 2018–2025 (USD THOUSAND)

TABLE84 ASIA PACIFIC: MULTI-STRAIN MEAT STARTER CULTURES MIX MARKET SIZE, BY COUNTRY/REGION, 2018–2025 (USD THOUSAND)

TABLE85 ASIA PACIFIC: SINGLE-STRAIN MEAT STARTER CULTURE MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE86 ASIA PACIFIC: MULTI-STRAIN MEAT STARTER CULTURE MARKET SIZE, BY COUNTRY/REGION, 2018–2025 (USD THOUSAND)

10.5.1 CHINA

10.5.1.1 Consumers are switching toward processed meat products due to various disease outbreak

TABLE 87 CHINA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE88 CHINA: MARKET SIZE, BY COMPOSITION, 2018–2025 (USD THOUSAND)

10.5.2 INDIA

10.5.2.1 Erosion of various traditional culinary habits and adoption of consuming health benefit products gave rise to the consumption of processed meat products

TABLE89 INDIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE90 INDIA: MARKET SIZE, BY COMPOSITION, 2018–2025 (USD THOUSAND)

10.5.3 AUSTRALIA & NEW ZEALAND

10.5.3.1 Meat products make an excellent addition to the diet of people

TABLE91 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE92 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY COMPOSITION, 2018–2025 (USD THOUSAND)

10.5.4 JAPAN

10.5.4.1 Consumers are inclined toward meat intake to maintain health

TABLE93 JAPAN: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE94 JAPAN: MARKET SIZE, BY COMPOSITION, 2018–2025 (USD THOUSAND)

10.5.5 REST OF ASIA PACIFIC

10.5.5.1 Invest in various meat processing techniques to provide better, safety and quality processed meat products

TABLE95 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE96 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPOSITION, 2018–2025 (USD THOUSAND)

10.6 REST OF THE WORLD (ROW)

TABLE 97 ROW: MEAT STARTER CULTURES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE98 ROW: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE99 ROW: MARKET SIZE FOR SAUSAGES, BY REGION, 2018–2025 (USD THOUSAND)

TABLE100 ROW: MARKET SIZE FOR SALAMI, BY REGION, 2018–2025 (USD THOUSAND)

TABLE101 ROW: MARKET SIZE FOR DRY-CURED MEAT, BY REGION, 2018–2025 (USD THOUSAND)

TABLE102 ROW: MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2018–2025 (USD THOUSAND)

TABLE103 ROW: MARKET SIZE, BY MICROORGANISM, 2018–2025 (USD MILLION)

TABLE104 ROW: MARKET SIZE, BY COMPOSITION, 2018–2025 (USD THOUSAND)

TABLE105 ROW: MULTI-STRAIN MIX MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE106 ROW: SINGLE-STRAIN MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE107 ROW: MULTI-STRAIN MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

10.6.1 SOUTH AMERICA

10.6.1.1 Brazil’s meat industry might positively impact the meat starter cultures market in the region

TABLE 108 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 109 SOUTH AMERICA: MARKET SIZE, BY COMPOSITION, 2018–2025 (USD THOUSAND)

10.6.2 MIDDLE EAST

10.6.2.1 Manufacturers are more focused on naturally derives additives in various processed meat products

TABLE 110 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 111 MIDDLE EAST: MARKET SIZE, BY COMPOSITION, 2018–2025 (USD THOUSAND)

10.6.3 AFRICA

10.6.3.1 Sluggish economic & technological developments restrain demand meat starter cultures in the region

TABLE 112 AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 113 AFRICA: MARKET SIZE, BY COMPOSITION, 2018–2025 (USD THOUSAND)

11 COMPETITIVE LANDSCAPE (Page No. - 130)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 38 MARKET EVALUATION FRAMEWORK, 2017–2020

11.3 MARKET SHARE ANALYSIS, 2019

FIGURE 39 MARKET SHARE ANALYSIS OF MAJOR MARKET PLAYERS, 2019

11.4 REVENUE ANALYSIS OF MAJOR MARKET PLAYERS

FIGURE 40 REVENUE ANALYSIS OF MAJOR MARKET PLAYERS, 2015–2019 (USD BILLION)

11.5 COMPETITIVE SCENARIO

11.5.1 EXPANSIONS & INVESTMENTS

TABLE 114 EXPANSIONS & INVESTMENTS, 2018

11.5.2 NEW PRODUCT LAUNCHES

TABLE 115 NEW PRODUCT LAUNCHES, 2019

12 COMPANY EVALUATION MATRIX & COMPANY PROFILES (Page No. - 133)

12.1 OVERVIEW

12.2 COMPANY EVALUATION MATRIX: DEFINITIONS & METHODOLOGY

12.2.1 STARS

12.2.2 EMERGING LEADERS

12.2.3 PERVASIVE PLAYERS

12.2.4 EMERGING COMPANIES

12.3 COMPANY EVALUATION MATRIX, 2019 (OVERALL MARKET)

FIGURE 41 GLOBAL MEAT STARTER CULTURES MARKET COMPANY EVALUATION MATRIX, 2019 (OVERALL MARKET)

13 COMPANY PROFILES (Page No. - 135)

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

13.1 CHR. HANSEN

FIGURE 42 CHR. HANSEN: COMPANY SNAPSHOT

13.2 DUPONT

FIGURE 43 DUPONT: COMPANY SNAPSHOT

13.3 DSM

FIGURE 44 DSM: COMPANY SNAPSHOT

13.4 KERRY GROUP

FIGURE 45 KERRY GROUP: COMPANY SNAPSHOT

13.5 IFF

FIGURE 46 IFF: COMPANY SNAPSHOT

13.6 GALACTIC

13.7 LALLEMAND

13.8 BIOCHEM SRL

13.9 PROQUIGA BIOTECH

13.10 WESTCOMBE

13.11 RAPS GMBH

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

13.12 COMPETITIVE LEADERSHIP MAPPING (START-UP/SME)

13.12.1 PROGRESSIVE COMPANIES

13.12.2 STARTING BLOCKS

13.12.3 RESPONSIVE COMPANIES

13.12.4 DYNAMIC COMPANIES

FIGURE 47 MEAT STARTER CULTURES MARKET COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES, 2019

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

13.13 GENESIS LABORATORIES LTD

13.14 THT PROBIOTICS AND STARTER CULTURES

13.15 CODEX-ING BIOTECH INGREDIENTS

13.16 SACCO SYSTEM

13.17 CANADA COMPOUND

13.18 BIOVITEC

13.19 STUFFERS SUPPLY COMPANY

13.20 MEAT CRACKS

13.21 DNR SAUSAGES SUPPLIES

13.22 MICROTEC GMBH

Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 166)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved four major activities in estimating the meat starter cultures market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the demand-side and supply-side approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of global and regional processed meat manufacturers, meat associations, and government & research organizations. The supply side is characterized by the presence of key CEOs and vice presidents, marketing directors, product innovation directors, and related key executives from manufacturing companies and organizations operating in the market, and frozen meat, packaged meat, and meat starter cultures manufacturing and marketing companies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

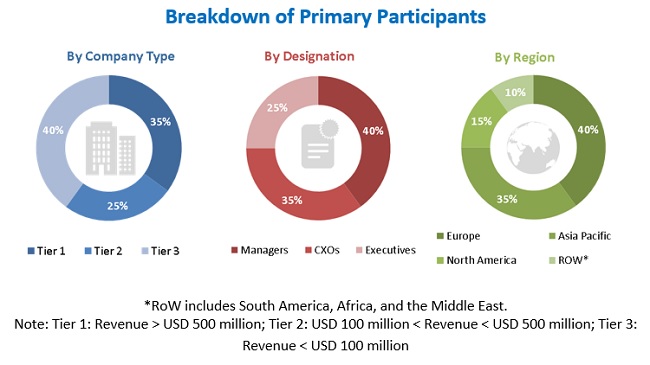

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the demand-side and supply-side approaches were used to estimate and validate the total size of the meat starter cutures market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size include the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the meat starter cultures market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using demand-side and supply-side approaches. It was then verified through primary interviews. Hence, three approaches were adopted—the demand-side approach, the supply-side approach, and the one involving expert interviews. Only when the values arrived at from the three points matches, the data is assumed to be correct.

Report Objectives

- Determining and projecting the size of the meat starter cultures market, with respect to composition, microorganism, application, and regional markets, over a five-year period, ranging from 2020 to 2025

- Analyzing and projecting the optimistic, pessimistic, and realistic impacts of COVID-19 on the market, with respect to composition, microorganism, application, and regional markets between 2020 and 2021

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micro-markets, with respect to individual growth trends, prospects, and their contribution to the total market

Target Audience:

- Global and regional processed meat manufacturers

- Frozen meat manufactures

- Starter cultures manufacturers

- Government and research organizations

- CEOs and vice presidents

- Marketing directors

- Product innovation directors and related key executives from manufacturing companies and organizations operating in the market

- Meat starter cultures manufacturing and marketing companies

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Geographic Analysis

- Further breakdown of the Rest of the European meat starter cultures market into the Belgium, Greece, Ireland, Poland, and other EU & non-EU countries.

- Further breakdown of the Rest of Asia Pacific includes Indonesia, South Korea, Thailand, the Philippines, Malaysia, Singapore, and Vietnam.

Growth opportunities and latent adjacency in Meat Starter Cultures Market