Specialty Tapes Market by Resin (Acrylic, Rubber, Silicone), Backing Material (Pvc, Woven/Non-Woven, Paper), End-Use Industry (Healthcare& Hygiene, Automotive, Electrical & Electronics), and Region – Global Forecast to 2026

Updated on : September 03, 2025

Specialty Tapes Market

The global specialty tapes market was valued at USD 45.9 billion in 2020 and is projected to reach USD 67.2 billion by 2026, growing at 6.4% cagr from 2020 to 2026. The driving factor for the specialty tapes market is the growing use of specialty tapes in diverse end-use industries.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Specialty Tapes Market

COVID-19 has made a significant economic impact on various financial as well as industrial sectors, such as travel and tourism, manufacturing, and aviation. The worst economic recession is expected during 2020-2021, according to World Bank and IMF. With the increasing number of countries imposing and extending lockdowns, economic activities are declining, impacting the global economy.

In the recent past, the global economy became substantially more interconnected. The adverse consequences of various steps related to the containment of COVID-19 are evident from global supply chain disruptions, weaker demand for imported products and services, and an increase in the unemployment rate. Risk aversion has increased in the financial market, with all-time low interest rates and sharp declines in equity and commodity prices. Consumer and business confidence have also reduced significantly.

Specialty Tapes Market Dynamics

Driver: Growing use of specialty tapes in diverse end-use industries

Specialty tapes are used in end-use industries such as electrical & electronics, healthcare & hygiene, automotive, white goods, paper & printing, building & construction, and retail & graphics. The growing applications of specialty tapes are expected to drive the market.

The trend toward using flatter and micro-electronic devices continues, increasing the application of specialty tapes in the electrical & electronics industry. Similarly, the specialty tapes market in the healthcare & hygiene end-use industry is expected to register the highest growth rate during the forecast period. This growth is attributed to the rise in the aging population and growing chronic diseases. In addition, the demand for in-vitro diagnostics, hydrophilic films, transdermal drug delivery patches, and oral dissolvable films are driving the market in the healthcare industry, globally. Furthermore, building & construction is also one of the growing end-use industries of specialty tapes in regions such as APAC, South America, and the Middle East. These tapes are used for HVAC, glazing, abatement, and insulation, thereby driving the market in the building & construction industry.

Restraint: Volatility in raw material prices

Price and availability of raw materials are the key factors that need to be considered by specialty tape manufacturers to decide the cost structure of their products. Natural rubber, films, foams, paper, PP, PVC, adhesives, and release liner are the raw materials used in the manufacturing of specialty tapes. Most of these raw materials are petroleum-based derivatives that are vulnerable to fluctuations in commodity prices. Oil prices have been highly volatile in the past due to the increasing global demand and unrest in the Middle East. The uncertainty and fluctuations in the cost and the availability of feedstock impact the growth of the market.

The adhesives industry is affected by higher manufacturing costs resulting from increased energy costs. In addition, the consistently increasing global demand for chemicals and the capacity constraints in the supply of these primary chemicals and resin feedstock have fueled the raw material prices. These supply shortages of monomers such as Piperylene and C9 monomers used to make adhesives raw materials have increased the cost of the raw materials.

All these factors are restraining the market growth.

Opportunity: Replacing traditional fastening systems

Mechanical fastenings such as nuts and bolts, screws and rivets, and mechanical interlocks are traditionally considered as the strongest and the most reliable joining methods. But joining dissimilar surfaces is challenging as the material is likely to crack due to tensile stress under high pressure. So its lacks reliability and long-term attachment. By replacing traditional fastening systems with specialty tapes, new applications of specialty tapes for fixing and fastening are developed. These tapes remove the challenges of traditional fastening systems and enhance the lifespan of the product. In addition, it eliminates rust & corrosion; reduces noise & vibration, manufacturing & assembly time; and enhances product design. These are proven to increase efficiency and performance while lowering production and material costs.

Challenge: Intense competition in the market posing challenge to new entrant

The specialty tapes market is consolidated in nature, and several tier-1 players such as 3M Company, Avery Dennison, and other players have their own network of convertors, owing to which they can easily cater to the local as well as regional end users such as automotive product manufacturers, among others. Moreover, a strong production footprint and sales and distribution network help them to maintain a presence in the market. Owing to this, tier-1 players offer significant competition to local, regional as well as new entrant in the market.

The flame retardancy and electrical insulation properties are expected to drive the demand for PVC specialty tapes

A wide range of PVC specialty tapes is used for special applications such as manufacturing and assembling of electronic components. These tapes are used for bandolier of electronic components, masking connectors on printed circuit boards, and other applications. APAC is the fastest-growing PVC specialty tapes market, especially in the electrical & electronics end-use industry. There is a considerable increase in the number of industries operating in the automotive, construction, electronics, and healthcare sectors. This rise will lead to the increased requirement of the wiring harness and other electrical components, which, in turn, would lead to a rise in the need for electrical insulation. Thus, the demand for PVC specialty tapes is expected to be high in China, India, and other rapidly developing countries in APAC compared to other regions.

Good adhesion to a plastics, non-polar, and low-energy surfaces is increasing the demand for rubber specialty tapes

APAC is the fastest-growing rubber specialty tapes market, in terms of both volume and value. Rubber adhesives are widely used in industries such as electrical & electronics, healthcare & hygiene, automotive, white goods, paper & printing, building & construction, and retail & graphics. The vulcanization of rubber and refining of petroleum processes enabled adhesives that are better, stronger, and easier to use are manufactured on a large scale in this region. The adhesives provide an added advantage of flexibility during the production process of automotive components. Hence, a strong demand for rubber specialty tapes from various international manufacturers of automotive and electronics is witnessed in China.

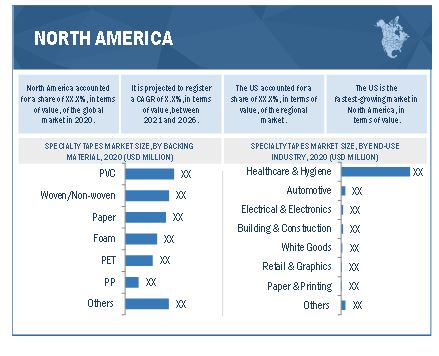

North America is one of the leading markets for specialty tapes

North America is one of the leading markets for specialty tapes. The region has been a dominating market in terms of demand as well as product innovation. The US accounted for the largest share, in terms of value and volume, of the North American specialty tapes market in 2020. Canada and Mexico also contribute significantly to the market. Technological advancements in the manufacturing sector drive the market in this region.

Specialty Tapes Market Players

The key players operating in the market are 3M Company (US), Nitto Denko Corporation (Japan), tesa SE (Germany), Lintec Corporation (Japan), Avery Dennison Corporation (US), Scapa Group Plc (UK), Intertape Polymer Group, Inc. (US), Berry Global Inc. (US), Saint-Gobain Performance Plastics Corporation (France), and Lohmann GMBH & Co. Kg, Nichiban Co. Ltd (Germany).

Specialty Tapes Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 45.9 billion |

|

Revenue Forecast in 2026 |

USD 67.2 billion |

|

CAGR |

6.4% |

|

Years considered for the study |

2017-2026 |

|

Base year |

2020 |

|

Forecast period |

2021-2026 |

|

Units considered |

Value (USD) and Volume (MSM) |

|

Segments |

By Resin Type, By Backing Material, By End-use Industry, By Region |

|

Regions covered |

APAC, Europe, North America, South America, and Middle East & Africa |

|

Companies profiled |

The major market players 3M Company (US), Nitto Denko Corporation (Japan), tesa SE (Germany), Lintec Corporation (Japan), Avery Dennison Corporation (US), Scapa Group Plc (UK), Intertape Polymer Group, Inc. (US), Berry Global Inc. (US), Saint-Gobain Performance Plastics Corporation (France), and Lohmann GMBH & Co. Kg, Nichiban Co. Ltd (Germany). |

This research report categorizes the specialty tapes market based on type, method, end-use industry, and region.

Specialty Tapes Market by Resin Type:

- Acrylic

- Rubber

- Silicone

- Others

Specialty Tapes Market by Backing Material:

- Polyvinyl Chloride (PVC)

- Paper

- Woven/Non-Woven

- PET

- Foam

- Polypropylene (PP)

- Others

Specialty Tapes Market by End-Use Industry:

- Electrical & Electronics

- Healthcare & Hygiene

- Automotive

- White Goods

- Paper & Printing

- Building & Construction

- Retail & Graphics

- Others

Specialty Tapes Market by Region:

- APAC

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments in Specialty Tapes Market

- In January 2019, tesa SE introduced six new aluminum foil tapes, which are available with and without a liner. The products include tesa 50525, tesa 50565, and tesa 50575. These tapes are used in appliances, including refrigerators to seal liners of the freezer for better heat transfer.

- In October 2019, 3M acquired Acelity Inc. (US) in the second half of 2019. Acelity is a recognized leading provider of advanced wound care technologies and solutions and had revenues of USD 1.5 billion in 2018. This acquisition is an excellent complement to 3M's Health Care business and bolsters the company's Medical Solutions business and supports its growth strategy to offer comprehensive, advanced, and surgical wound care solutions.

Frequently Asked Questions (FAQ):

What is the End User of the Specialty Tapes Market?

Specialty tapes are used in end-use industries such as electrical & electronics, healthcare & hygiene, automotive, white goods, paper & printing, building & construction, and retail & graphics.

What is the current size of the global specialty tapes market?

The global specialty tapes market size was USD 45.9 billion in 2020 and is projected to reach USD 67.2 billion by 2026, at a CAGR of 6.4% between 2020 and 2026.

Who are the major players of the specialty tapes market?

Companies such as 3M Company, Nitto Denko Corporation, Tesa SE, Lintec Corporation, Avery Dennison Corporation, Scapa Group Plc, Intertape Polymer Group, Inc., Berry Global Inc., Saint-Gobain Performance Plastics Corporation, Lohmann GMBH & Co. Kg, Nichiban Co. Ltd, Dermamed Coatings Company, LLC, CCT Tapes, Gergonne - The Adhesive Solution, Adhesives Research, INC., Advance Tapes International, Shurtape Technologies, LLC, Mactac, LLC, American Biltrite Inc., Yem Chio Co. Ltd, ATP Adhesive Systems AG, Wuan Huaxia Nanfang Adhesive Tapes Co., Ltd.

Where will all these developments take the industry in the mid-to-long term?

Continuous developments in the market, including new product launches, mergers & acquisitions, investments & expansions, and partnership and agreement are expected to help the market grow. New product launch and merger & acquisition are the key strategies adopted by companies operating in this market.

Which segment has the potential to register the highest market share for specialty tapes?

The healthcare & hygiene segment is the fastest-growing segment in the forecasted period. Overall global production and population increase are linked. Growth and penetration of products in the healthcare sector in developing countries, along with growth in disposable income, is driving the market for healthcare specialty tapes. The aging global population is also a key driver of this segment.

Which is the fastest-growing region in the market?

APAC is the fastest-growing specialty tapes market due to the growth in the end-use industries such as electricals & electronics, healthcare & hygiene, automotive, white goods, paper & printing, retail & graphics, and building & construction in China, India, Japan, South Korea, Indonesia, and Taiwan. The leading global players are shifting their production base, establishing sales offices, and enhancing distribution channels to developing regions, including APAC, which offer sustained demand to increase their profit margins. The gradual shift of manufacturing facilities to countries having high demand and lower production cost is positively influencing the market growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET INCLUSIONS AND EXCLUSIONS

1.3.1 MARKET INCLUSIONS

1.3.2 MARKET EXCLUSIONS

1.4 MARKET SCOPE

1.5 YEARS CONSIDERED FOR THE STUDY

1.6 CURRENCY

1.7 UNIT CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 1 SPECIALTY TAPES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key primary data sources

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

FIGURE 2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: SPECIALTY TAPES MARKET

FIGURE 4 SPECIALTY TAPES MARKET, BY REGION

FIGURE 5 SPECIALTY TAPES MARKET, BY END-USE INDUSTRY

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH, BY RESIN TYPE

2.3 MARKET FORECAST APPROACH

2.3.1 SUPPLY-SIDE FORECAST:

2.3.2 DEMAND-SIDE FORECAST:

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 SPECIALTY TAPES MARKET: DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 RISK ANALYSIS ASSESSMENT

2.8 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 50)

TABLE 1 SPECIALTY TAPES MARKET SNAPSHOT

FIGURE 8 SILICONE SEGMENT TO BE THE FASTEST-GROWING RESIN FOR SPECIALTY TAPES

FIGURE 9 WOVEN/NON-WOVEN TO BE THE LARGEST BACKING MATERIAL TYPE BY 2026

FIGURE 10 HEALTHCARE & HYGIENE TO BE THE FASTEST-GROWING END-USE INDUSTRY OF SPECIALTY TAPES

FIGURE 11 APAC MIDDLE EAST & AFRICA TO BE THE FASTEST-GROWING SPECIALTY TAPES MARKET

FIGURE 12 APAC ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2020

TABLE 2 MAJOR PLAYERS PROFILED IN THIS REPORT

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN THE SPECIALTY TAPES MARKET

FIGURE 13 EMERGING ECONOMIES OFFER ATTRACTIVE OPPORTUNITIES FOR THE SPECIALTY TAPES MARKET

4.2 SPECIALTY TAPES MARKET, BY RESIN TYPE

FIGURE 14 SILICONE SEGMENT TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

4.3 SPECIALTY TAPES MARKET, BY BACKING MATERIAL

FIGURE 15 WOVEN/NON-WOVEN TO BE THE FASTEST-GROWING BACKING MATERIAL SEGMENT

4.4 APAC SPECIALTY TAPES MARKET, BY END-USE INDUSTRY AND COUNTRY

FIGURE 16 ELECTRICAL & ELECTRONICS AND CHINA ACCOUNTED FOR THE LARGEST SHARE

4.5 SPECIALTY TAPES MARKET, DEVELOPED VS. DEVELOPING COUNTRIES

FIGURE 17 SPECIALTY TAPES MARKET IN DEVELOPING COUNTRIES TO GROW FASTER THAN IN THE DEVELOPED COUNTRIES

4.6 SPECIALTY TAPES MARKET, BY COUNTRY

FIGURE 18 INDIA TO BE THE FASTEST-GROWING MARKET FOR SPECIALTY TAPES

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS OF SPECIALTY TAPES MARKET

TABLE 3 SPECIALTY TAPES MARKET: SUPPLY CHAIN ECOSYSTEM

5.2.1 COVID-19 IMPACT ON VALUE CHAIN

5.2.1.1 Action plan against current vulnerability

5.3 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE SPECIALTY TAPES MARKET

5.3.1 DRIVERS

5.3.1.1 Increase in government relief packages for tackling the COVID-19 pandemic to boost the demand

5.3.1.2 Growing use of specialty tapes in diverse end-use industries

5.3.1.3 Improvement in healthcare systems

5.3.2 RESTRAINTS

5.3.2.1 Volatility in raw material prices

5.3.3 OPPORTUNITIES

5.3.3.1 Replacing traditional fastening systems

5.3.3.2 Supporting the European Green Deal with Adhesives and Sealants

5.3.3.3 Innovation in electro-mobility & batteries

5.3.4 CHALLENGES

5.3.4.1 Implementation of stringent regulatory policies

5.3.4.2 Intense competition in the market poses a challenge to new entrants

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 21 SPECIALTY TAPES MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 4 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4.1 INTENSITY OF COMPETITIVE RIVALRY

5.4.2 BARGAINING POWER OF BUYERS

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 THREAT OF SUBSTITUTES

5.4.5 THREAT OF NEW ENTRANTS

5.5 MACROECONOMIC INDICATORS

5.5.1 INTRODUCTION

5.5.2 TRENDS AND FORECAST OF GDP

TABLE 5 TRENDS AND FORECAST OF GDP, PERCENTAGE CHANGE, 2018–2025

5.6 KEY INDUSTRY TRENDS

5.6.1 TRENDS IN THE ELECTRONICS INDUSTRY

FIGURE 22 ESTIMATED GROWTH RATES FOR THE GLOBAL ELECTRONICS INDUSTRY, BY REGION, FROM 2019 TO 2021

5.6.2 TRENDS IN THE AUTOMOTIVE INDUSTRY

TABLE 6 AUTOMOTIVE INDUSTRY PRODUCTION (2019–2020)

5.6.2.1 ELECTRIC VEHICLE MODELS, 2019–2028

TABLE 7 ELECTRIC VEHICLE MODELS, 2019–2028

5.6.3 TRENDS AND FORECASTS IN THE BUILDING & CONSTRUCTION INDUSTRY

FIGURE 23 GLOBAL SPENDING IN THE CONSTRUCTION INDUSTRY, 2017–2025

5.7 ENVIRONMENTAL REGULATIONS & ROLE OF GOVERNMENT

TABLE 8 REGULATIONS AND STRATEGIES

5.8 COVID-19 IMPACT ANALYSIS

5.8.1 COVID-19 ECONOMIC ASSESSMENT

FIGURE 24 LATEST WORLD ECONOMIC OUTLOOK GROWTH PROJECTIONS

5.8.2 COVID-19 ECONOMIC IMPACT – SCENARIO ASSESSMENT

FIGURE 25 FACTORS IMPACTING ECONOMY OF SELECT G20 COUNTRIES IN 2020

5.8.3 IMPACT ON THE CONSTRUCTION INDUSTRY

5.8.4 IMPACT ON THE AUTOMOTIVE INDUSTRY

5.9 PRICING ANALYSIS

FIGURE 26 AVERAGE PRICE COMPETITIVENESS IN SPECIALTY TAPES MARKET, BY REGION

FIGURE 27 AVERAGE PRICE COMPETITIVENESS INMARKET, BY END-USE INDUSTRY

5.10 ADHESIVE TAPES ECOSYSTEM

FIGURE 28 ADHESIVE TAPES ECOSYSTEM

5.11 IMPACT OF TRENDS AND TECHNOLOGY DISRUPTION ON MANUFACTURERS OF SPECIALTY TAPES: YC AND YCC SHIFT

FIGURE 29 SPECIALTY TAPES INDUSTRY: YC AND YCC SHIFT

5.11.1 AUTOMOTIVE & TRANSPORTATION

5.11.1.1 Electric vehicles

5.11.1.2 Shared mobility

5.11.1.3 Types of batteries for electric power vehicles

5.11.2 AEROSPACE

5.11.2.1 Ultralight and light aircraft

5.11.2.2 Unmanned Aircraft Systems (UAS) or Drones

5.11.3 HEALTHCARE

5.11.3.1 Wearable medical devices

5.11.3.2 Microfluidics-based POC and LOC diagnostic devices for laboratory testing

5.11.4 ELECTRONICS

5.11.4.1 Digitalization

5.11.4.2 Artificial intelligence

5.11.4.3 Augmented reality

5.12 TRADE SCENARIO: KEY EXPORTING AND IMPORTING COUNTRIES

TABLE 9 INTENSITY OF TRADE, BY KEY COUNTRY

5.12.1 MAJOR IMPORTERS

TABLE 10 MAJOR IMPORTERS OF SELF-ADHESIVE TAPES, PLATES, SHEETS, FILMS, FOILS, STRIPS, AND OTHER FLAT SHAPES MADE OF PLASTICS, 2018–2020 (USD THOUSAND)

TABLE 11 MAJOR IMPORTERS OF SELF-ADHESIVE TAPES, PLATES, SHEETS, FILMS, FOILS, STRIPS, AND OTHER FLAT SHAPES OF PLASTICS AND IMPACT OF COVID-19 ON TRADE

5.12.2 MAJOR EXPORTERS

TABLE 12 MAJOR EXPORTERS OF SELF-ADHESIVE TAPES, PLATES, SHEETS, FILMS, FOILS, STRIPS, AND OTHER FLAT SHAPES OF PLASTICS, 2018–2020 (USD THOUSAND)

TABLE 13 MAJOR EXPORTERS OF SELF-ADHESIVE TAPES, PLATES, SHEETS, FILMS, FOILS, STRIPS, AND OTHER FLAT SHAPES OF PLASTICS AND IMPACT OF COVID-19 ON TRADE

5.13 PATENT ANALYSIS

FIGURE 30 OVERALL R&D SPENDING, BY KEY PLAYERS, 2020 (USD MILLION)

TABLE 14 NUMBER OF GRANTED PATENTS FROM 2015 TO MAY 2021

FIGURE 31 SHARE OF GRANTED PATENTS, BY KEY PLAYERS (TILL MAY 2021)

TABLE 15 C1–C5 CLASSIFICATION SCHEME

FIGURE 32 GRANTED PATENTS SHARE BY JURISDICTION (TILL MAY 2021)

5.14 CASE STUDY

5.15 TECHNOLOGY ANALYSIS

5.15.1 WATER-BASED

5.15.2 SOLVENT-BASED

5.15.3 HOT-MELTS

6 SPECIALTY TAPES MARKET, BY RESIN TYPE (Page No. - 95)

6.1 INTRODUCTION

FIGURE 33 ACRYLIC WAS THE LARGEST RESIN TYPE SEGMENT IN THE MARKET IN 2020

TABLE 16 SPECIALTY TAPES MARKET SIZE, BY RESIN TYPE, 2017–2019 (USD MILLION)

TABLE 17 MARKET SIZE, BY RESIN TYPE, 2020–2026 (USD MILLION)

TABLE 18 MARKET SIZE, BY RESIN TYPE, 2017–2019 (MSM)

TABLE 19 MARKET SIZE, BY RESIN TYPE, 2020–2026 (MSM)

6.2 ACRYLIC

6.2.1 HIGHER DURABILITY THAN OTHER SPECIALTY TAPES IS BOOSTING THE DEMAND FOR ACRYLIC SPECIALTY TAPES

TABLE 20 ACRYLIC SPECIALTY TAPES MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 21 ACRYLIC MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 22 ACRYLIC MARKET SIZE, BY REGION, 2017–2019 (MSM)

TABLE 23 ACRYLIC MARKET SIZE, BY REGION, 2020–2026 (MSM)

6.3 RUBBER

6.3.1 GOOD ADHESION TO PLASTICS, NON-POLAR, AND LOW-ENERGY SURFACES IS INCREASING THE DEMAND FOR RUBBER SPECIALTY TAPES IN APAC

TABLE 24 RUBBER SPECIALTY TAPES MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 25 RUBBER SPECIALTY TAPES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 26 RUBBER SPECIALTY TAPES MARKET SIZE, BY REGION, 2017–2019 (MSM)

TABLE 27 RUBBER SPECIALTY TAPES MARKET SIZE, BY REGION, 2020–2026 (MSM)

6.4 SILICONE

6.4.1 WIDE USAGE IN ELECTRICALS & ELECTRONICS, HEALTHCARE & HYGIENE, AND AUTOMOTIVE INDUSTRIES IS DRIVING THE SILICONE SPECIALTY TAPES MARKET

TABLE 28 SILICONE MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 29 SILICONEMARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 30 SILICONE MARKET SIZE, BY REGION, 2017–2019 (MSM)

TABLE 31 SILICONE MARKET SIZE, BY REGION, 2020–2026 (MSM)

6.5 OTHERS

TABLE 32 OTHER SPECIALTY TAPES MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 33 OTHERMARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 34 OTHER MARKET SIZE, BY REGION, 2017–2019 (MSM)

TABLE 35 OTHER MARKET SIZE, BY REGION, 2020–2026 (MSM)

7 SPECIALTY TAPES MARKET, BY BACKING MATERIAL (Page No. - 105)

7.1 INTRODUCTION

TABLE 36 SPECIALTY TAPES MARKET SIZE, BY BACKING MATERIAL, 2017–2019 (USD MILLION)

TABLE 37 MARKET SIZE, BY BACKING MATERIAL, 2020–2026 (USD MILLION)

TABLE 38 MARKET SIZE, BY BACKING MATERIAL, 2017–2019 (MSM)

TABLE 39 MARKET SIZE, BY BACKING MATERIAL, 2020–2026 (MSM)

FIGURE 34 PVC BACKING MATERIAL HELD THE LARGEST SHARE IN THE SPECIALTY TAPES MARKET IN 2020

7.2 POLYVINYL CHLORIDE (PVC)

7.2.1 FLAME RETARDANCY AND ELECTRICAL INSULATION PROPERTIES TO DRIVE THE DEMAND FOR PVC SPECIALTY TAPES

TABLE 40 PVC SPECIALTY TAPES MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 41 PVC SPECIALTY TAPES SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 42 PVC SPECIALTY TAPE MARKET SIZE, BY REGION, 2017–2019 (MSM)

TABLE 43 PVC SPECIALTY TAPES SIZE, BY REGION, 2020–2026 (MSM)

7.3 WOVEN/NON-WOVEN

7.3.1 LOW THICKNESS AND GOOD ADHESION TO A VARIETY OF SUBSTRATES ARE EXPECTED TO DRIVE THE DEMAND FOR WOVEN/NON-WOVEN SPECIALTY TAPES

TABLE 44 WOVEN/NON-WOVEN SPECIALTY TAPES MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 45 WOVEN/NON-WOVEN SPECIALTY TAPES SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 46 WOVEN/NON-WOVEN SPECIALTY TAPES MARKET SIZE, BY REGION, 2017–2019 (MSM)

TABLE 47 WOVEN/NON-WOVEN SPECIALTY TAPE SIZE, BY REGION, 2020–2026 (MSM)

7.4 PAPER

7.4.1 REPULPABLE NATURE OF PAPER TO DRIVE THE USE OF PAPER BACKING MATERIAL IN SPECIALTY TAPES

TABLE 48 PAPER SPECIALTY TAPES MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 49 PAPER SPECIALTY TAPE SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 50 PAPER SPECIALTY TAPES MARKET SIZE, BY REGION, 2017–2019 (MSM)

TABLE 51 PAPER SPECIALTY TAPES SIZE, BY REGION, 2020–2026 (MSM)

7.5 PET

7.5.1 GROWING DEMAND IN CONSUMER GOODS, AUTOMOTIVE, AND BUILDING & CONSTRUCTION INDUSTRIES TO SPUR THE DEMAND FOR PET BACKING MATERIAL IN SPECIALTY TAPES

TABLE 52 PET SPECIALTY TAPES MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 53 PET SPECIALTY TAPE SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 54 PET SPECIALTY TAPES SIZE, BY REGION, 2017–2019 (MSM)

TABLE 55 PET SPECIALTY TAPES MARKET SIZE, BY REGION, 2020–2026 (MSM)

7.6 FOAM

7.6.1 GROWING AWARENESS ABOUT ACRYLIC FOAM TAPES IN WIND ENERGY, AUTOMOBILE, AND DEFENSE INDUSTRIES HAS INCREASED THE NUMBER OF FOAM SPECIALTY TAPE MANUFACTURERS

TABLE 56 FOAM SPECIALTY TAPES MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 57 FOAM SPECIALTY TAPE SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 58 FOAM SPECIALTY TAPES SIZE, BY REGION, 2017–2019 (MSM)

TABLE 59 FOAM SPECIALTY TAPES MARKET SIZE, BY REGION, 2020–2026 (MSM)

7.7 POLYPROPYLENE (PP)

7.7.1 GROWING DEMAND FOR FAST-MOVING CONSUMER GOODS TO DRIVE THE DEMAND FOR PP SPECIALTY TAPES

TABLE 60 PP SPECIALTY TAPES MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 61 PP SPECIALTY TAPES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 62 PP SPECIALTY TAPES SIZE, BY REGION, 2017–2019 (MSM)

TABLE 63 PP SPECIALTY TAPE SIZE, BY REGION, 2020–2026 (MSM)

7.8 OTHERS

TABLE 64 OTHER SPECIALTY TAPES MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 65 OTHER SPECIALTY TAPES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 66 OTHER SPECIALTY TAPES SIZE, BY REGION, 2017–2019 (MSM)

TABLE 67 OTHERS SPECIALTY TAPE SIZE, BY REGION, 2020–2026 (MSM)

8 SPECIALTY TAPES MARKET, BY END-USE INDUSTRY (Page No. - 120)

8.1 INTRODUCTION

FIGURE 35 HEALTHCARE & HYGIENE SEGMENT TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

TABLE 68 SPECIALTY TAPES MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 69 MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 70 MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (MSM)

TABLE 71 MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (MSM)

8.2 ELECTRICAL & ELECTRONICS

8.2.1 SOCIO-ECONOMIC DEVELOPMENTS, INCLUDING RISING DISPOSABLE INCOME IN DEVELOPING COUNTRIES TO DRIVE THE MARKET

TABLE 72 MAJOR APPLICATIONS OF SPECIALTY TAPES IN THE ELECTRICAL & ELECTRONICS SECTOR

TABLE 73 SPECIALTY TAPES MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2017–2019 (USD MILLION)

TABLE 74 MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2020–2026 (USD MILLION)

TABLE 75 SPECIALTY TAPES MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2017–2019 (MSM)

TABLE 76 MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2020–2026 (MSM)

8.3 HEALTHCARE & HYGIENE

8.3.1 RISING DISPOSABLE INCOME AND HIGH PRODUCT PENETRATION IN THE HEALTHCARE INDUSTRY TO DRIVE THE MARKET

TABLE 77 MAJOR APPLICATIONS OF SPECIALTY TAPES IN THE HEALTHCARE & HYGIENE SECTOR

TABLE 78 SPECIALTY TAPES MARKET SIZE IN HEALTHCARE & HYGIENE, BY REGION, 2017–2019 (USD MILLION)

TABLE 79 SPECIALTY TAPES MARKET SIZE IN HEALTHCARE & HYGIENE, BY REGION, 2020–2026 (USD MILLION)

TABLE 80 MARKET SIZE IN HEALTHCARE & HYGIENE, BY REGION, 2017–2019 (MSM)

TABLE 81 SPECIALTY TAPES MARKET SIZE IN HEALTHCARE & HYGIENE, BY REGION, 2020–2026 (MSM)

8.4 AUTOMOTIVE

8.4.1 THE GROWING FOCUS ON LIGHTWEIGHT HYBRID AND ELECTRIC VEHICLES WILL BOOST THE DEMAND FOR SPECIALTY TAPES IN THE AUTOMOTIVE SECTOR

TABLE 82 SPECIALTY TAPES MARKET SIZE IN AUTOMOTIVE, BY REGION, 2017–2019 (USD MILLION)

TABLE 83 MARKET SIZE IN AUTOMOTIVE, BY REGION, 2020–2026 (USD MILLION)

TABLE 84 MARKET SIZE IN AUTOMOTIVE, BY REGION, 2017–2019 (MSM)

TABLE 85 MARKET SIZE IN AUTOMOTIVE, BY REGION, 2020–2026 (MSM)

8.5 WHITE GOODS

8.5.1 SPECIALTY TAPES FOR TRIM AND GRAPHICS MOCK-UPS, SOUND DEADENING, WIRE HARNESSING, AND PROTECTION IN HEATING ELEMENTS ARE DRIVING THE MARKET

TABLE 86 MAJOR APPLICATIONS OF SPECIALTY TAPES IN THE WHITE GOODS SEGMENT

TABLE 87 SPECIALTY TAPES MARKET SIZE IN WHITE GOODS, BY REGION, 2017–2019 (USD MILLION)

TABLE 88 MARKET SIZE IN WHITE GOODS, BY REGION, 2020–2026 (USD MILLION)

TABLE 89 MARKET SIZE IN WHITE GOODS, BY REGION, 2017–2019 (MSM)

TABLE 90 MARKET SIZE IN WHITE GOODS BY REGION, 2020–2026 (MSM)

8.6 PAPER & PRINTING

8.6.1 THE MARKET IN THE PAPER & PRINTING SEGMENT IS EXPECTED TO WITNESS HIGH GROWTH IN APAC

TABLE 91 SPECIALTY TAPES MARKET SIZE IN PAPER & PRINTING, BY REGION, 2017–2019 (USD MILLION)

TABLE 92 MARKET SIZE IN PAPER & PRINTING, BY REGION, 2020–2026 (USD MILLION)

TABLE 93 MARKET SIZE IN PAPER & PRINTING, BY REGION, 2017–2019 (MSM)

TABLE 94 MARKET SIZE IN PAPER & PRINTING, BY REGION, 2020–2026 (MSM)

8.7 BUILDING & CONSTRUCTION

8.7.1 GROWTH OF THE HOUSING SECTORS IN EMERGING COUNTRIES IS DRIVING THE MARKET IN THE BUILDING & CONSTRUCTION INDUSTRY

TABLE 95 MAJOR APPLICATIONS OF SPECIALTY TAPES IN THE BUILDING & CONSTRUCTION SEGMENT

TABLE 96 SPECIALTY TAPES MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2017–2019 (USD MILLION)

TABLE 97 SPECIALTY TAPES MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2020–2026 (USD MILLION)

TABLE 98 SPECIALTY TAPES MARKET SIZE IN BUILDING & CONSTRUCTION BY REGION, 2017–2019 (MSM)

TABLE 99 MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2020–2026 (MSM)

8.8 RETAIL & GRAPHICS

8.8.1 THE INNOVATIVE MOUNTING TAPES SUCH AS THE ACXPLUS PRODUCT RANGE FROM TESA IS DRIVING THE SPECIALTY TAPES MARKET

TABLE 100 MAJOR APPLICATIONS OF SPECIALTY TAPES IN THE RETAIL & GRAPHICS SEGMENT

TABLE 101 SPECIALTY TAPES MARKET SIZE IN RETAIL & GRAPHICS, BY REGION, 2017–2019 (USD MILLION)

TABLE 102 MARKET SIZE IN RETAIL & GRAPHICS, BY REGION, 2020–2026 (USD MILLION)

TABLE 103 MARKET SIZE IN RETAIL & GRAPHICS, BY REGION, 2017–2019 (MSM)

TABLE 104 MARKET SIZE IN RETAIL & GRAPHICS, BY REGION, 2020–2026 (MSM)

8.9 OTHERS

TABLE 105 SPECIALTY TAPES MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2017–2019 (USD MILLION)

TABLE 106 MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2020–2026 (USD MILLION)

TABLE 107 MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2017–2019 (MSM)

TABLE 108 MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2020–2026 (MSM)

9 SPECIALTY TAPES MARKET, BY REGION (Page No. - 139)

9.1 INTRODUCTION

FIGURE 36 APAC AND MIDDLE EAST & AFRICA TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 109 SPECIALTY TAPES MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 110 MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 111 MARKET SIZE, BY REGION, 2017–2019 (MSM)

TABLE 112 MARKET SIZE, BY REGION, 2020–2026 (MSM)

9.2 APAC

9.2.1 IMPACT OF COVID-19 ON APAC

FIGURE 37 APAC: SPECIALTY TAPES MARKET SNAPSHOT

TABLE 114 APAC: MARKET SIZE, BY RESIN TYPE, 2020–2026 (USD MILLION)

TABLE 115 APAC: MARKET SIZE, BY RESIN TYPE, 2017–2019 (MSM)

TABLE 116 APAC: MARKET SIZE, BY RESIN TYPE, 2020–2026 (MSM)

TABLE 117 APAC: MARKET SIZE, BY BACKING MATERIAL, 2017–2019 (USD MILLION)

TABLE 118 APAC: MARKET SIZE, BY BACKING MATERIAL, 2020–2026 (USD MILLION)

TABLE 119 APAC: MARKET SIZE, BY BACKING MATERIAL, 2017–2019 (MSM)

TABLE 120 APAC: MARKET SIZE, BY BACKING MATERIAL, 2020–2026 (MSM)

TABLE 121 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 122 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 123 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (MSM)

TABLE 124 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (MSM)

TABLE 125 APAC: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 126 APAC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 127 APAC: MARKET SIZE, BY COUNTRY, 2017–2019 (MSM)

TABLE 128 APAC: MARKET SIZE, BY COUNTRY, 2020–2026 (MSM)

9.2.2 CHINA

9.2.2.1 The demand for specialty tapes is high in the country as it is one of the largest manufacturers of automobiles

9.2.3 INDIA

9.2.3.1 The country’s healthcare sector is growing rapidly and is expected to drive the specialty tapes market

9.2.4 JAPAN

9.2.4.1 The country is the third-largest specialty tapes consumer in the region

9.2.5 SOUTH KOREA

9.2.5.1 Stringent environmental regulations has led to a slowdown in the market growth

9.2.6 INDONESIA

9.2.6.1 Availability of low-cost raw materials & labor in comparison to other APAC countries is a driver for the market

9.2.7 TAIWAN

9.2.7.1 Specialty tapes export volume is higher than the domestic sales in the country

9.2.8 REST OF APAC

9.3 NORTH AMERICA

9.3.1 IMPACT OF COVID-19 ON NORTH AMERICA

FIGURE 38 NORTH AMERICA: SPECIALTY TAPES MARKET SNAPSHOT

TABLE 129 NORTH AMERICA: MARKET SIZE, BY RESIN TYPE, 2017–2019 (USD MILLION)

TABLE 130 NORTH AMERICA: MARKET SIZE, BY RESIN TYPE, 2020–2026 (USD MILLION)

TABLE 131 NORTH AMERICA: MARKET SIZE, BY RESIN TYPE, 2017–2019 (MSM)

TABLE 132 NORTH AMERICA: MARKET SIZE, BY RESIN TYPE, 2020–2026 (MSM)

TABLE 133 NORTH AMERICA: MARKET SIZE, BY BACKING MATERIAL, 2017–2019 (USD MILLION)

TABLE 134 NORTH AMERICA: MARKET SIZE, BY BACKING MATERIAL, 2020–2026 (USD MILLION)

TABLE 135 NORTH AMERICA: MARKET SIZE, BY BACKING MATERIAL, 2017–2019 (MSM)

TABLE 136 NORTH AMERICA: MARKET SIZE, BY BACKING MATERIAL, 2020–2026 (MSM)

TABLE 137 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 138 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 139 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (MSM)

TABLE 140 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (MSM)

TABLE 141 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 142 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 143 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2019 (MSM)

TABLE 144 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (MSM)

9.3.2 US

9.3.2.1 Increase in demand from the automotive, aerospace, and electronics industries to drive the specialty tapes market

9.3.3 CANADA

9.3.3.1 Significant growth is expected in the technology-intensive areas

9.3.4 MEXICO

9.3.4.1 Growing demand from key industries, such as healthcare & hygiene, electrical & electronics, and automotive, is expected to propel the demand for specialty tapes

9.4 EUROPE

9.4.1 COVID-19 IMPACT ON EUROPE

FIGURE 39 EUROPE: SPECIALTY TAPES MARKET SNAPSHOT

TABLE 145 EUROPE: MARKET SIZE, BY RESIN TYPE, 2017–2019 (USD MILLION)

TABLE 146 EUROPE: MARKET SIZE, BY RESIN TYPE, 2020–2026 (USD MILLION)

TABLE 147 EUROPE: MARKET SIZE, BY RESIN TYPE, 2017–2019 (MSM)

TABLE 148 EUROPE: MARKET SIZE, BY RESIN TYPE, 2020–2026 (MSM)

TABLE 149 EUROPE: MARKET SIZE, BY BACKING MATERIAL, 2017–2019 (USD MILLION)

TABLE 150 EUROPE: MARKET SIZE, BY BACKING MATERIAL, 2020–2026 (USD MILLION)

TABLE 151 EUROPE: MARKET SIZE, BY BACKING MATERIAL, 2017–2019 (MSM)

TABLE 152 EUROPE: MARKET SIZE, BY BACKING MATERIAL, 2020–2026 (MSM)

TABLE 153 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 154 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 155 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (MSM)

TABLE 156 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (MSM)

TABLE 157 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 158 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 159 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2019 (MSM)

TABLE 160 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (MSM)

9.4.2 GERMANY

9.4.2.1 Major automotive companies are planning to expand their production capacity in the country, which will drive the demand for specialty tapes

9.4.3 ITALY

9.4.3.1 The high growth in the automotive industry is expected to drive the specialty tapes market

9.4.4 FRANCE

9.4.4.1 The expenditure on healthcare is expected to increase in the, thereby providing significant growth opportunities to the market

9.4.5 UK

9.4.5.1 Advanced technological infrastructure and increased R&D investments attract companies globally to invest in the country

9.4.6 NETHERLANDS

9.4.6.1 Rise in demand for adhesives in various industries to increase the demand for specialty tapes

9.4.7 SPAIN

9.4.7.1 Growth in the transportation sector and recovery of the construction sector is propelling the demand for specialty tapes

9.4.8 POLAND

9.4.8.1 Automotive is one of the key industries of the country’s economy

9.4.9 RUSSIA

9.4.9.1 The launch of 12 National Projects by the Russian administration provides immense growth opportunities for different industries, driving the specialty tapes market

9.5 MIDDLE EAST & AFRICA

9.5.1 COVID-19 IMPACT ON MIDDLE EAST & AFRICA

FIGURE 40 HEALTHCARE & HYGIENE TO BE THE FASTEST-GROWING END-USE INDUSTRY OF SPECIALTY TAPES IN THE MIDDLE EAST & AFRICAN MARKET

TABLE 161 MIDDLE EAST & AFRICA: SPECIALTY TAPES MARKET SIZE, BY RESIN TYPE, 2017–2019 (USD MILLION)

TABLE 162 MIDDLE EAST & AFRICA: MARKET SIZE, BY RESIN TYPE, 2020–2026 (USD MILLION)

TABLE 163 MIDDLE EAST & AFRICA: MARKET SIZE, BY RESIN TYPE, 2017–2019 (MSM)

TABLE 164 MIDDLE EAST & AFRICA: MARKET SIZE, BY RESIN TYPE, 2020–2026 (MSM)

TABLE 165 MIDDLE EAST & AFRICA: MARKET SIZE, BY BACKING MATERIAL, 2017–2019 (USD MILLION)

TABLE 166 MIDDLE EAST & AFRICA: MARKET SIZE, BY BACKING MATERIAL, 2020–2026 (USD MILLION)

TABLE 167 MIDDLE EAST & AFRICA: MARKET SIZE, BY BACKING MATERIAL, 2017–2019 (MSM)

TABLE 168 MIDDLE EAST & AFRICA: MARKET SIZE, BY BACKING MATERIAL, 2020–2026 (MSM)

TABLE 169 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 171 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (MSM)

TABLE 172 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (MSM)

TABLE 173 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 174 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 175 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2017–2019 (MSM)

TABLE 176 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (MSM)

9.5.2 SOUTH AFRICA

9.5.2.1 Low production costs and access to new markets fuel the growth of the specialty tapes market in the country

9.5.3 TURKEY

9.5.3.1 Rapid expansion of trade activities is increasing the demand for specialty tapes

9.5.4 REST OF THE MIDDLE EAST & AFRICA

9.6 SOUTH AMERICA

9.6.1 IMPACT OF COVID-19 ON SOUTH AMERICA

FIGURE 41 HEALTHCARE & HYGIENE IS THE KEY END-USE INDUSTRY IN THE REGION

TABLE 177 SOUTH AMERICA: SPECIALTY TAPES MARKET SIZE, BY RESIN TYPE, 2017–2019 (USD MILLION)

TABLE 178 SOUTH AMERICA: MARKET SIZE, BY RESIN TYPE, 2020–2026 (USD MILLION)

TABLE 179 SOUTH AMERICA: MARKET SIZE, BY RESIN TYPE, 2017–2019 (MSM)

TABLE 180 SOUTH AMERICA: MARKET SIZE, BY RESIN TYPE, 2020–2026 (MSM)

TABLE 181 SOUTH AMERICA: MARKET SIZE, BY BACKING MATERIAL, 2017–2019 (USD MILLION)

TABLE 182 SOUTH AMERICA: MARKET SIZE, BY BACKING MATERIAL, 2020–2026 (USD MILLION)

TABLE 183 SOUTH AMERICA: MARKET SIZE, BY BACKING MATERIAL, 2017–2019 (MSM)

TABLE 184 SOUTH AMERICA: MARKET SIZE, BY BACKING MATERIAL, 2020–2026 (MSM)

TABLE 185 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 186 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 187 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (MSM)

TABLE 188 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (MSM)

TABLE 189 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 190 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 191 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2019 (MSM)

TABLE 192 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (MSM)

9.6.2 BRAZIL

9.6.2.1 Automotive and building & construction industries offer high growth potential for specialty tapes manufacturers in the country

9.6.3 REST OF SOUTH AMERICA

10 COMPETITIVE LANDSCAPE (Page No. - 193)

10.1 OVERVIEW

FIGURE 42 STRATEGIES FOLLOWED BY LEADING PLAYERS

10.2 MARKET SHARE ANALYSIS

TABLE 193 SPECIALTY TAPES MARKET: DEGREE OF COMPETITION

FIGURE 43 MARKET: MARKET SHARE ANALYSIS IN 2020

10.2.1 MARKET RANKING ANALYSIS

FIGURE 44 RANKING OF KEY PLAYERS

10.3 COMPANY REVENUE ANALYSIS

FIGURE 45 REVENUE ANALYSIS FOR KEY COMPANIES IN THE PAST 5 YEARS

10.4 COMPANY EVALUATION QUADRANT, 2020

10.4.1 STAR

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE

10.4.4 PARTICIPANTS

FIGURE 46 SPECIALTY TAPES MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2020

10.5 SME MATRIX, 2020

10.5.1 PROGRESSIVE COMPANIES

10.5.2 DYNAMIC COMPANIES

10.5.3 STARTING BLOCKS

10.5.4 RESPONSIVE COMPANIES

FIGURE 47 SPECIALTY TAPES MARKET: EMERGING COMPANIES COMPETITIVE LEADERSHIP MAPPING, 2020

10.6 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 48 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN SPECIALTY TAPES MARKET

10.7 BUSINESS STRATEGY EXCELLENCE

FIGURE 49 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN SPECIALTY TAPES MARKET

10.8 COMPETITIVE SCENARIO

10.8.1 MARKET EVALUATION FRAMEWORK

TABLE 194 STRATEGIC DEVELOPMENTS, BY COMPANY

TABLE 195 MOST FOLLOWED STRATEGY

TABLE 196 GROWTH STRATEGIES ADOPTED, BY KEY COMPANIES

10.8.2 MARKET EVALUATION MATRIX

TABLE 197 COMPANY PRODUCT FOOTPRINT

TABLE 198 COMPANY REGION FOOTPRINT

TABLE 199 COMPANY INDUSTRY FOOTPRINT

10.9 STRATEGIC DEVELOPMENTS

TABLE 200 NEW PRODUCT LAUNCH/DEVELOPMENT, 2016–2021

TABLE 201 DEALS, 2016–2021

TABLE 202 OTHERS, 2016–2021

11 COMPANY PROFILES (Page No. - 210)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 KEY COMPANIES

11.1.1 3M COMPANY

TABLE 203 3M COMPANY: COMPANY OVERVIEW

FIGURE 50 3M COMPANY: COMPANY SNAPSHOT

TABLE 204 3M COMPANY: NEW PRODUCT LAUNCH

TABLE 205 3M COMPANY: DEALS

TABLE 206 3M COMPANY: OTHER DEVELOPMENTS

11.1.2 NITTO DENKO CORPORATION

TABLE 207 NITTO DENKO CORPORATION: COMPANY OVERVIEW

FIGURE 51 NITTO DENKO CORPORATION: COMPANY SNAPSHOT

TABLE 208 NITTO DENKO CORPORATION: DEALS

11.1.3 TESA SE

TABLE 209 TESA SE CORPORATION: COMPANY OVERVIEW

FIGURE 52 TESA SE: COMPANY SNAPSHOT

TABLE 210 TESA SE: NEW PRODUCT LAUNCH

TABLE 211 TESA SE: DEALS

TABLE 212 TESA SE: OTHER DEVELOPMENTS

11.1.4 LINTEC CORPORATION

TABLE 213 LINTEC CORPORATION: COMPANY OVERVIEW

FIGURE 53 LINTEC CORPORATION: COMPANY SNAPSHOT

11.1.5 AVERY DENNISON CORPORATION

TABLE 214 AVERY DENNISON CORPORATION: COMPANY OVERVIEW

FIGURE 54 AVERY DENNISON CORPORATION: COMPANY SNAPSHOT

TABLE 215 AVERY DENNISON CORPORATION: NEW PRODUCT LAUNCH

TABLE 216 AVERY DENNISON CORPORATION: DEALS

11.1.6 SCAPA GROUP PLC

TABLE 217 SCAPA GROUP PLC: COMPANY OVERVIEW

FIGURE 55 SCAPA GROUP PLC: COMPANY SNAPSHOT

TABLE 218 SCAPA GROUP PLC: DEALS

11.1.7 INTERTAPE POLYMER GROUP, INC.

TABLE 219 INTERTAPE POLYMER GROUP INC.: COMPANY OVERVIEW

FIGURE 56 INTERTAPE POLYMER GROUP, INC.: COMPANY SNAPSHOT

TABLE 220 INTERTAPE POLYMER GROUP, INC.: DEALS

TABLE 221 INTERTAPE POLYMER GROUP, INC.: OTHER DEVELOPMENTS

11.1.8 BERRY GLOBAL INC.

TABLE 222 BERRY GLOBAL INC.: COMPANY OVERVIEW

FIGURE 57 BERRY GLOBAL INC.: COMPANY SNAPSHOT

11.1.9 SAINT-GOBAIN PERFORMANCE PLASTICS CORPORATION

TABLE 223 SAINT-GOBAIN PERFORMANCE PLASTICS CORPORATION: COMPANY OVERVIEW

FIGURE 58 SAINT-GOBAIN PERFORMANCE PLASTICS CORPORATION: COMPANY SNAPSHOT

11.1.10 LOHMANN GMBH & CO. KG

TABLE 224 LOHMANN GMBH & CO. KG: COMPANY OVERVIEW

11.2 OTHER KEY COMPANIES

11.2.1 NICHIBAN CO. LTD

11.2.2 DERMAMED COATINGS COMPANY, LLC

11.2.3 CCT TAPES

11.2.4 GERGONNE - THE ADHESIVE SOLUTION

11.2.5 ADHESIVES RESEARCH, INC.

11.2.6 ADVANCE TAPES INTERNATIONAL

11.2.7 SHURTAPE TECHNOLOGIES, LLC

11.2.8 MACTAC, LLC

11.2.9 AMERICAN BILTRITE INC.

11.2.10 YEM CHIO CO. LTD

11.2.11 ATP ADHESIVE SYSTEMS AG

11.2.12 WUAN HUAXIA NANFANG ADHESIVE TAPES CO., LTD

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

12 ADJACENT/RELATED MARKETS (Page No. - 256)

12.1 INTRODUCTION

12.2 LIMITATION

12.3 HEALTHCARE ADHESIVE TAPES MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.3.3 HEALTHCARE ADHESIVE TAPES MARKET, BY RESIN TYPE

12.3.3.1 Introduction

TABLE 225 HEALTHCARE ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2016–2023 (USD MILLION)

TABLE 226 HEALTHCARE ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2016–2023 (MSM)

12.3.3.2 Acrylic

12.3.3.3 Silicone

12.3.3.4 Rubber

12.3.3.5 Others

12.3.4 HEALTHCARE ADHESIVE TAPES MARKET, BY BACKING MATERIAL

12.3.4.1 Introduction

TABLE 227 HEALTHCARE ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2016–2023 (USD MILLION)

TABLE 228 HEALTHCARE ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2016–2023 (MSM)

12.3.4.2 Paper

12.3.4.3 Fabric

12.3.4.4 Plastic

12.3.4.5 Others

12.3.5 HEALTHCARE ADHESIVE TAPES MARKET, BY APPLICATION

12.3.5.1 Introduction

TABLE 229 VARIOUS APPLICATIONS OF HEALTHCARE ADHESIVE TAPES

TABLE 230 HEALTHCARE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2023 (USD MILLION)

TABLE 231 HEALTHCARE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2023 (MSM)

12.3.5.2 Surgery

12.3.5.3 Wound dressing

12.3.5.4 Splints

12.3.5.5 Secure IV Lines

12.3.5.6 Ostomy seals

12.3.5.7 Hygiene

12.3.5.8 Bandages, transdermal patches, and blister protection

12.3.5.9 Diagnostic, monitoring & medical devices, and optical care

12.3.5.10 Other applications

12.3.5.10.1 Burn injury treatment

12.3.5.10.2 Sport-related fatalities

12.3.6 HEALTHCARE ADHESIVE TAPES MARKET, BY REGION

12.3.6.1 Introduction

TABLE 232 HEALTHCARE ADHESIVE TAPES MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 233 HEALTHCARE ADHESIVE TAPES MARKET SIZE, BY REGION, 2016–2023 (MSM)

12.3.6.2 North America

12.3.6.3 Europe

12.3.6.4 APAC

12.3.6.5 South America

12.3.6.6 Middle East & Africa

13 APPENDIX (Page No. - 267)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involves four major activities in estimating the current market size of specialty tapes. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Specialty Tapes Market Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, ICIS, and OneSource have been referred to identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Specialty Tapes Market Primary Research

The specialty tapes market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. In the primary research, experts from the supply and demand sides were interviewed to obtain qualitative and quantitative information and validate the data for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology & innovation directors, and related key executives from various leading companies and organizations operating in the specialty tapes market.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Specialty Tapes Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the specialty tapes market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global specialty tapes Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were used, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market was validated using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources - the top-down approach, the bottom-up approach, and expert interviews. Only when the values arrived at from the three points matched, the data was assumed to be correct.

Specialty Tapes Market Report Objectives

- To define, describe, and forecast the size of the specialty tapes market, in terms of both value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To forecast the market size by resin type, backing material, end-use industry and region

- To forecast the market size with respect to five main regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments in the market, such as new product development, merger & acquisition, investment & expansion and joint venture & partnership

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Note: 1. Micro markets are defined as the subsegments of the specialty tapes market included in the report.

2. Core competencies of companies are determined in terms of the key developments, SWOT analysis, and key strategies adopted to sustain in the market.

Specialty Tapes Market Report Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the specialty tapes market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Specialty Tapes Market