Satellite Antenna Market by Platform (Land fixed, Land mobile, Airborne, Maritime, Space), Antenna Type (Phased Array, Multiple Input Multiple Output, Others), Technology (SOTM, SOTP), Component Type, Frequency and Region - Global Forecast to 2026

Updated on : Oct 22, 2024

The Satellite Antenna Market is experiencing significant growth due to increasing demand for satellite communication in industries such as telecommunications, defense, and broadcasting. Technological advancements, including the development of high-frequency antennas and miniaturized satellite systems, have enhanced the efficiency and performance of satellite communication, driving further adoption. With the rising need for high-speed data transfer, connectivity in remote areas, and advancements in 5G and IoT technologies, the market is poised for expansion. Additionally, growing investments in space exploration and satellite constellations are creating new opportunities for market players, further boosting the demand for innovative satellite antenna solutions.

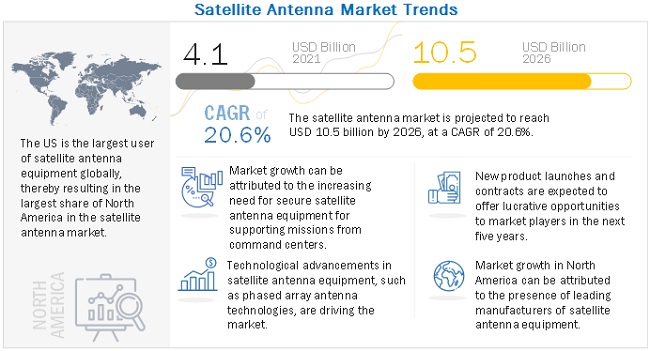

The Satellite Antenna Market was valued at $4.1 billion in 2021 and is estimated to grow from $5.8 billion in 2023 to $10.5 billion by 2026 growing at a CAGR (Compound Annual Growth Rate) of 20.6%, during the forecast period. Satellite antenna equipment is an integral part of communication in the commercial and defense industry.

The deployment of low earth orbit (LEO) satellites and constellations of satellites for communication applications has increased their demand across the globe. Other factors driving the Satellite Antenna Industry growth include growing demand for Ku- and Ka-band satellites, and the growing fleet of autonomous and connected vehicles used for various applications in the military and commercial sectors, which require customized satellite antennas.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Satellite Antenna Market

The COVID-19 pandemic has caused significant damage to the economic activities of countries across the world. The manufacturing of satellite antenna equipment, including systems, subsystems, and components, has also been impacted. Although satellite antenna equipment are critically important for a proper outcome from a satellite, disruptions in the supply chain have halted their manufacturing processes for the time being. Resuming manufacturing activities depends on the level of COVID-19 exposure, the level at which manufacturing operations are running, and import-export regulations, among other factors. While companies may still be taking in orders, delivery schedules may not be fixed.

Satellite Antenna Market Dynamics

Driver: Increasing use of electronically steered phased antennas

Increased demand for communication on the move (COTM) solutions for platforms such as commercial vehicles, military vehicles, trains, and boats has led to the greater use of electronically steered phased antennas (ESPA). These antennas can track and maintain satellite links even when platforms such as military vehicles, trains, or boats, are in motion. Hybrid beam steering is used in these phased array antennas for COTM, both electronically for elevation and mechanically for azimuth. An antenna terminal steering plays a major role in acquiring a satellite link. ESPA eliminates mechanical motion.

In April 2019, the US Air Force Space and Missile Systems Center (SMC), in partnership with the Pentagon’s Defense Innovation Unit, awarded a contract to Atlas Space Operations (US) to prototype an electronically steered antenna array to support the Air Force’s multi-band, multi-mission requirements.

In January 2021, L3Harris Technologies (US) completed the development of an electronic phased array ground antenna for the US Space Force. Lockheed Martin (US) and Atlas Space Operations developed ESPA prototypes. The antenna developed by L3Harris Technologies, like those from Lockheed Martin and Atlas Space Operations, was integrated with the Space Force’s Satellite Control Network to demonstrate multiple simultaneous satellite contacts. The satellite control network (SCN) is an aging network of parabolic dish antennas to fly military satellites.

Restraints: High costs associated with development and maintenance of infrastructure to support satellite antennas

The high cost incurred in the development and maintenance of earth station infrastructure is one of the major factors hindering market growth. Most of the required components are typically custom-fabricated or purchased from commercial off-the-shelf (COTS) vendors, which is expensive. Besides, the design, development, and construction of antennas and their components require several hours of work by trained personnel. The level of skill required itself poses a significant barrier to entry. Significant investments are required in the R&D, manufacturing, system integration, and assembly stages of the value chains of these systems.

Moreover, satellite communication services are used for highly sophisticated defense systems, due to which any incident of system failure is unfavorable. These services should be accurate, reliable, durable, energy-efficient, and have a wide detection range. Companies in this market should develop highly functional and efficient ground facilities to maintain market leadership and stay competitive. This translates into significant investments in testing and infrastructure and collaborations with universities, research institutes, and other companies.

Opportunities: Development of ultra-compact satellite antennas for advanced ground combat vehicles

Ultra-compact satellite antennas are designed to operate with the new generation of Ka-band high-throughput satellites, supporting data speeds of up to 2 Mbps for any IP-based voice, video, or data Beyond-Line-of-Sight (BLoS) applications. Ultra-compact satellite antennas provide full-duplex satellite communication, linking advanced ground combat vehicles to ground control stations. The forward link provides command and control capabilities, while the return link transfers sensor data. These integrated terminals comprise very small aperture terminal technologies.

In 2019, GETSAT Terminal (Israel), a leading developer of micronized and integrated satellite communication solutions, partnered with Unmanned Systems Technology to demonstrate its expertise in developing ultra-compact satellite antennas for advanced ground terminals.

Challenges: Radio spectrum availability issues

There has been a rise in the number of next-generation satellite launches since 2015. CubeSat, a type of miniaturized satellite, operates in the ultra-high frequency (UHF) band (435-438 MHz). The International Amateur Radio Union (IARU) regulates the uplink and downlink frequencies allotted to CubeSat. However, CubeSat offers limited frequency bandwidth and low achievable data rates in the UHF band, which has necessitated the migration of satellites to the X and KA band frequencies. Deployment of satellites in these bands requires the issuance of special licenses by regulatory authorities.

For instance, the International Telecommunication Union (ITU) Radio Regulations monitor the utilization of radio frequencies and formulate laws to manage radio communication services. Every country has a governing authority that allocates a specific operating frequency for a satellite mission. However, obtaining the license to launch and deploy a satellite in high band frequencies is a time-consuming and costly process, requiring proper documentation for band allotment. Thus, radio spectrum availability issues act as a key challenge to the growth of the satellite antenna market.

Based on platform, airborne segment is estimated to lead the satellite antenna market from 2021 to 2026.

The market is projected to grow further due to the increasing need for high-definition intelligence, surveillance, and reconnaissance (ISR) videos, and increasing number of connected commercial aircraft, rising adoption of UAVs and rising number of private aviation companies worldwide supporting market growth. In December 2019, The French Airforce have enhanced their Airborne Satellite communication capabilities by adopting new Thales technologies. The French Defense agency awarded a contract to Thales to design and built the next-generation Syracuse 4 satellite communication system. This contract enables French defense forces to improvise the SATCOM system in the Charles De Gaulle Aircraft Carrier and the Rafale combat aircraft.

Based on technology, SOTM segment is expected to lead the satellite antenna market from 2021 to 2026.

This is due to increasing need for uninterrupted mobile broadband coverage in remote and far-flung regions, streaming information and entertainment, extensive use of small satellites for commercialization and data transferability, technological advancements in transport and logistics network, and increasing demand for broadband connections and VSAT connectivity. In July 2021, the Digital Communications Commission (DCC) accepted the sector regulator’s call to allow VSAT operators to provide satellite-based cellular backhaul connectivity to telcos to ensure uninterrupted mobile broadband coverage in remote and far-flung regions.

Based on region, North America is expected to lead the satellite antenna market from 2021 to 2026.

The US is a lucrative market for satellite antenna equipment in the North American region. The US government is increasingly investing in advanced satellite antenna technologies to enhance the quality and effectiveness of satellite communication. The increasing investment on satellite antenna equipment to enhance defense and surveillance capabilities of the armed forces, modernization of existing communication in military platforms, critical infrastructure and law enforcement agencies are increasingly using satellite antenna equipment are key factors expected to drive the satellite antenna market in North America. In August 2020, The US Special Operations Command (USSOCOM) awarded Cubic Mission Solutions (CMS) a follow-on, single-award, indefinite-delivery/indefinite-quantity (ID/IQ) contract with a ceiling of USD 172 million. The contract is for the delivery of Ground Area Transmit Receive (GATR) inflatable SATCOM terminals and baseband communications equipment in support of the communications requirements of Special Operations Forces (SOF).

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Satellite antenna is dominated by a few globally established players such as Thales Group (France), L3Harris Technologies (US), Honeywell International Inc. (US), Hughes Network Systems (US), Viasat, Inc. (US), among others, which are the key manufacturers that secured satellite antenna equipment contracts in the last few years. Major focus was given to the contracts and new product development due to the changing requirements of commercial, homeland security and defense & space users across the world.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By platform, by technology, by frequency, by antenna type, by component type and by region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and The Rest of World (Africa, and Latin America) |

|

Companies covered |

Thales Group (France), L3Harris Technologies (US), Honeywell International Inc. (US), Hughes Network Systems (US), Viasat, Inc. (US) are some of the major players of Satellite antenna market. (25 Companies) |

The study categorizes the Satellite antenna equipment market based on solutions, vertical, technology, connectivity, frequency, platform, and region.

By Platform

- Land Mobile

- Land Fixed

- Airborne

- Maritime

- Space

By Antenna type

- Phased Array

- Multiple Input Multiple Output

- Others

By Component type

- Reflectors

- Feed Horns

- Feed Networks

- Low Noise Converters

- Others

By Frequency

- L & S Band

- X Band

- KA Band

- KU Band

- VHF/UHF Band

- EFH/SHF Band

- Multi Band

- Q Band

By Technology

- SOTM

- SOTP

By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the world

Recent Developments

- In June 2021, Gilat Satellite Networks received a contract from Peru’s programa Nacional de telecomunicaciones (Pronatel) for the delivery of internet services to hundreds of sites in Peru.

- In May 2021, ASELSAN signed a contract with Türksat for the Ka-Band National Satellite Communication HUB System and Modem Development Project. The systems to be developed under the project will support the delivery of uninterrupted broadband satellite internet service, especially in challenging terrains where there is no terrestrial infrastructure. These systems will also provide air and sea platforms with easier access to broadband satellite internet service.

- In April 2021, L3harris Technologies received contracts from a country in Asia for a fully integrated suite of soldier radios and satellite antenna as part of the country’s software-defined radio modernization program.

- In April 2021, Cobham SATCOM And Alphatron Marine signed a certified service center contract, further increasing the partner network. the addition of Alphatron marine to Cobham satcom’s extensive world-class service network will further enable sailor and sea users to access efficient, high-quality, and cost-efficient services wherever they are in the world.

- In February 2021, Viasat was awarded a contract by airbus to upgrade the Ultra- High Frequency (uhf) Satellite Communications (SATCOM) Network Control Stations (NCS), delivering the uhf skynet capability to the UK Ministry of Defense (MOD).

- In December 2020, L3Harris Technologies received a competitive award for its Falcon Iv an/prc-163 2-channel handheld radios, along with related equipment and services, as part of the us army’s 2-channel leader radio IDIQ contract.

- In October 2020, Cobham SATCOM and Inmarsat were awarded a new contract to connect 732 fishing vessels active in the Maldives economic exclusion zone to Inmarsat’s fleet one maritime broadband services.

- In June 2020, Iridium Communications signed a contract with Relativity Space to deliver satellites to the LEO. The contract included flexible timing for up to 6 dedicated launches to deploy Iridium’s ground spare satellites.

- In April 2020, L3Harris Technologies was awarded a 5-year, Ceiling, Indefinite Delivery, Indefinite Quantity (IDIQ) contract by the US Space Force’s Space And Missile Systems Center (SMC) has awarded a, with an initial delivery order of USD 30.6 million for the air force and army anti-jam modem (a3m). A3m provides the department of the air force and army with a secure, wideband, anti-jam satellite communications terminal modem for tactical satellite communication operations.

Frequently Asked Questions (FAQ):

Which are the major companies in the satellite antenna market? What are their major strategies to strengthen their market presence?

Some of the key players in the satellite antenna market are Thales Group (France), L3Harris Technologies (US), Honeywell International Inc. (US), Viasat, Inc. (US), among others, are the key manufacturers that secured satellite antenna equipment contracts in the last few years. Contracts was the key strategies adopted by these companies to strengthen their presence in the satellite antenna market.

What are the drivers and opportunities for the satellite antenna market?

The market for satellite antenna equipment has grown substantially across the globe, and especially in Asia Pacific, where increase in developing new technologies and procurement of new aircrafts in such as China, India, and South Korea, will offer several opportunities for satellite antenna equipment industry companies. The rising R&D activities to develop satellite antenna equipment products are also expected to boost the growth of the market around the world.

North America and Europe are key developer of SATCOM equipment as most key manufacturers and leading players in this market are based in these regions. Some of these manufacturers are L3Harris Technologies (US), Honeywell International Inc. (US), Viasat, Inc. (US).

Which region is expected to grow at the highest rate in the next five years?

The market in Asia Pacific is projected to grow at the highest CAGR of from 2021 to 2026, showcasing strong demand from satellite antenna equipment in the region. India has increased investment in advancement of satellite antenna equipment which is driving the market.

Which type of satellite antenna equipment is expected to significantly lead in the coming years?

Land fixed satellite antenna segment of the satellite antenna market is projected to witness the highest CAGR due to increasing use of C2 (command and control) centers and increasing need of the fastest, most secure, and the widest coverage international and intercontinental data network for enterprise systems in between 2021 to 2026. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

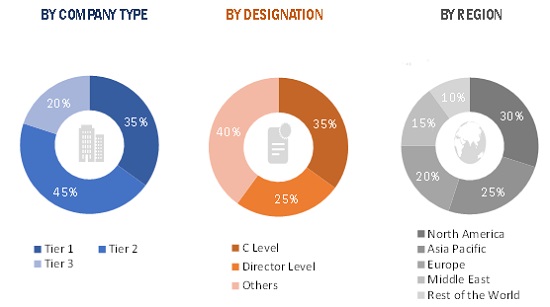

The study involved various activities in estimating the current size of the Satellite antenna Market. Exhaustive secondary research was done to collect information on the Satellite antenna market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the Satellite antenna Market.

Secondary Research

The market ranking of companies was determined using the secondary data made available through paid and unpaid sources and by analyzing the product portfolios of major companies. These companies were rated on the basis of performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred to for this research study include financial statements of companies offering Satellite antennas and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the Satellite antenna market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information regarding the Satellite antenna market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Rest of the world. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

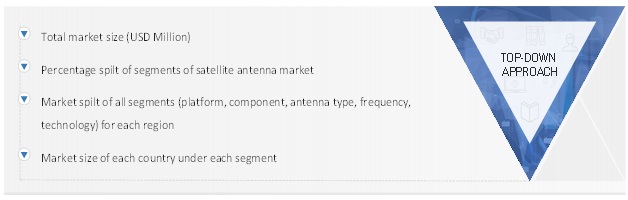

Market Size Estimation

The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in the land fixed, land mobile, airborne, maritime, and space platforms, at a regional level. Such procurements provide information on the demand aspects of satellite antenna products and services in each platform. For each platform, all possible application areas where satellite antenna are integrated or installed were mapped.

Note: An analysis of technological, military funding, year-on-year launches, and operational cost were carried out to arrive at the CAGR and understand the market dynamics of all countries in the report. The market share for all solutions, antenna type, technology, component type, frequency and platform was arrived at based on the current and upcoming launches of satellite antenna products and services in every country from 2018 to 2026.

Satellite Antenna Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the size of the Satellite antenna market based on platform, antenna type, technology, component type, frequency, and region.

- To forecast the size of the various segments of the Satellite antenna market based on five regions—North America, Europe, Asia Pacific, the Middle East, and the rest of the world—along with key countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends prevailing in the market

- To analyze micromarkets with respect to individual technological trends, prospects, and their contribution to the overall market

- To provide a detailed competitive landscape of the market and analyze competitive growth strategies such as product launches and developments, contracts, partnerships, agreements, and collaborations adopted by key players in the market

- To identify the detailed financial positions, product portfolios, and key developments of leading companies in the market

- To strategically profile key market players and comprehensively analyze their market rank analysis and core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

Additional country-level analysis of the Satellite antenna Market

Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Satellite antenna Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Satellite Antenna Market

If you have the report of "TV satellite antenna of Market", I can buy it. please let know; ykkim@wiworld.co.kr

I need to know the statistics of 9 meter and 13 meter antenna HUB used for satellite communications

We are seeking to size the market (in annual revenues) and CAGR for land and maritime based helical antenna assemblies, specifically for UHF Satcom band.

I am looking to better understand the market size of satelllite antenna market in the context of LEO/MEO and GEO satellites.

I want annual sales figures of satellite dish and the materials used for its manufacturing, including cost of materials.