Space Launch Services Market by Service Type (Pre-launch, Post Launch), Payload (Satellite, Human Spacecraft, Cargo, and Space Probes), End User (Commercial, Military and Government), Orbit, Launch Vehicle, Launch type and Region - Global Forecast to 2027

Update: 11/22/2024

Space Launch Services Market Summary

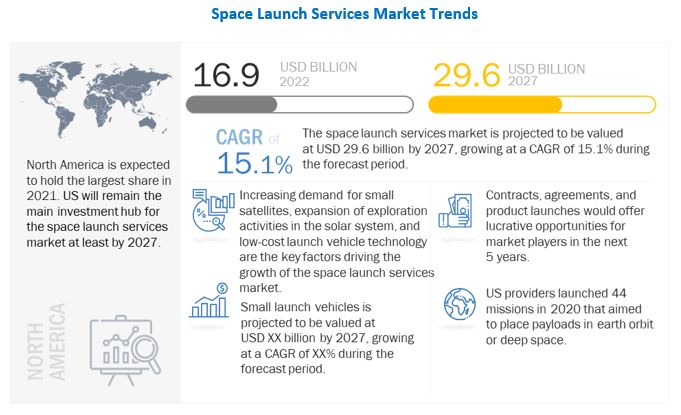

The Global Space Launch Services Market Size is predicted to increase from USD 16.9 billion in 2022 to approximately USD 29.6 billion by 2027, expanding at a CAGR of 15.1% from 2022 to 2027.

Space Launch Services Market Key Takeaways

-

By growing demand from commercial and government sectors, the global space launch services market is expected to rise from USD 16.9 billion in 2022 to USD 29.6 billion by 2027, at a CAGR of 15.1%.

-

By increasing deployment of small satellites for communication, Earth observation, and research, small lift launch vehicles are gaining traction and projected to reach USD 19.67 billion by 2027.

-

By rising military and government satellite missions, this segment is expected to grow at the highest CAGR, driven by miniaturization trends and national security initiatives.

-

By technological advancements like reusable launch vehicles, launch costs are decreasing, encouraging wider satellite deployment and improving the commercial viability of space missions.

-

By regional contribution, the Asia Pacific is emerging as a strategic space hub, with countries like India and China leveraging skilled scientific personnel to achieve significant launch milestones.

-

By post pandemic recovery, challenges such as reduced exports to the Middle East, Africa, and Latin America and delays in R&D have gradually given way to renewed investment and modernization.

-

By lack of dedicated launch vehicles for small satellites, mission delays and limited orbital control remain key constraints, particularly for secondary payloads.

-

By pursuing innovations in launcher recoverability and satellite miniaturization, industry players like SpaceX and Rocket Lab are reshaping access to space with cost efficient and flexible launch options.

Space Launch Services Market Size & Forecast Report

-

2022 Market Size: USD 0.89 billion

-

2027 Projected Market Size: USD 1.81 billion

-

CAGR (2022-2027): 15.1%

-

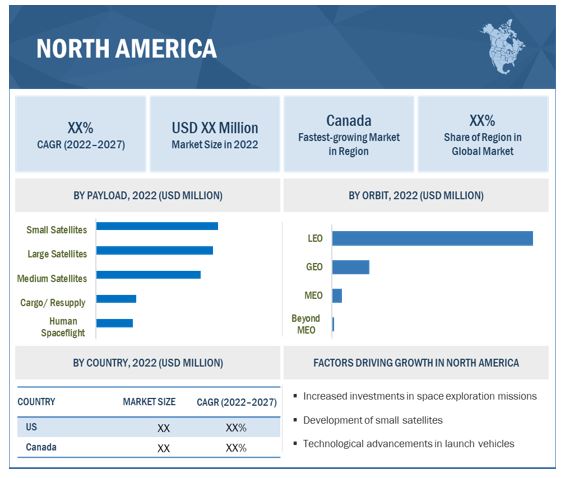

North America: Largest Market Share

The growth of Space Launch Services Industry can be attributed to the increasing demand for payload launches from various end users, including commercial and government sectors, military organizations, space agencies, defense organizations, satellite operators, and private companies.

To know about the assumptions considered for the study, Request for Free Sample Report

Covid-19 Impact on Space launch services Market

The COVID-19 pandemic has caused a large-scale impact on economies across the world. The global manufacturing of space launch vehicles, components, and assembly lines have been impacted. COVID-19 has led to several challenges for many industries. The Aerospace & defense industry is no exception to that. The budget allotted to the defense sector has been reduced by several countries due to the COVID-19 pandemic. This puts most research projects on hold. The export of space launch services to several countries in the Middle East, Africa, and Latin America has also been reduced. All these scenarios affect the development of space launch services.

Space launch services Market Segment Overview

Military and Government segment of the Space Launch Services Market by End user, to grow at highest CAGR during the forecast period

The Military and Government segment is projected to be USD 24,139 million by 2027, at a higher CAGR of 15.1% during the forecast period. The trend of miniaturization of technologies and increasing capabilities of small satellites propel the demand for space launch services.

Small lift launch segment to command the Space Launch Services Market by launch vehicle, during the forecast period

The small lift launch vehicles (<350,000 KG) segment is expected to reach USD 19,672 million by 2027 at a CAGR of 14.6% from 2022 to 2027. The small lift launch vehicles segment is witnessing high growth, owing to an increase in deployment of small satellites and cube satellites for commercial end users and increasing demand for small satellite constellations.

The North America market is projected to contribute the largest share from 2022 to 2027

To know about the assumptions considered for the study, download the pdf brochure

Launcher Recoverability

Launcher recoverability technology refers to the utilization of the partial recoverable lower stages of the launch vehicle and is developing further.

The technology is in the design, development, and testing stage, and after overcoming reliability issues, it is expected to increase launcher reliability and reduce launch costs in the long term. The recovered hardware parts of launch vehicles can be damaged while falling back into the sea and are required to be rectified before the launch vehicle can be used again. Also, the hardware to be reused needs to undergo stricter quality control measures compared to conventional disposable launcher systems.

Top 5 Key Players in Space launch services Companies

-

Space X (US),

-

Arianespace (France),

-

Northrop Grumman Corp. (US),

-

United Launch Alliance (US),

-

Rocket Lab (US) and

-

China Aerospace Science and Technology Corporation (China)

Space launch services Market Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 16.9 billion |

| Projected Market Size | USD 29.6 billion |

| Growth Rate | 15.1% |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By service type, By payload, By orbit, By launch vehicle type, By launch type, and By end use |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies covered |

SpaceX (US), Arianespace (France), China Aerospace Science and Technology Corporation (China), United Launch Alliance (US), Northrop Grumman Corporation (US) |

Space launch services Market Dynamics

Driver: Increased deployment of small satellites

Over the past few years, space companies have started production of low-cost small/miniaturized satellites, which enable them to provide services equivalent to major companies that conventionally serve government agencies or public sector industries.

One of the factors responsible for the growth of the satellite industry is the increase in the adoption of small satellites for applications such as Earth observation, communication, and scientific research and the increasing focus on reducing total mission costs.

As launch service providers decide the cost of launch based on the weight of the spacecraft, spacecraft manufacturers are focused on miniaturizing the size of satellites. Small satellites tend to cost less, especially in cases where mission payloads have fewer demanding requirements, which enables a reduction in the size of the launch vehicle and thus the fuel need. In addition, technological advancements, such as reusable launch vehicles designed by SpaceX (US), are expected to further enhance the capabilities of satellites at a significantly lower cost. As satellite launch costs decline, the number of satellite launches is expected to increase.

Restraint : Lack of dedicated launch vehicles

Small satellites are carried as secondary payloads and do not have dedicated launch vehicles. Furthermore, as secondary payloads, small satellite missions are restricted by the lack of control of the launch schedule and destination orbit of the vehicle.

This is due to constraints on the volume and pressure of the stored propellant, primarily for the protection of the primary payload, and the requirement of antenna systems for primary payloads, which may restrict the launch of small satellite payloads in more suitable or favorable mission orbits. Moreover, the primary payload may need a pre-programmed orbital velocity and be placed in a specified orbit, limiting launch windows for small satellite missions. This also limits the fulfillment of the mission requirement for small satellites in some applications.

Therefore, the potential use of small satellites in various applications is dependent on the availability of reliable launch vehicles with a requisite range of performance capabilities. However, current launch vehicle performance capabilities do not effectively span the range of potential payloads.

Opportunity: Technological upgrades in space industry

The high development cost of satellites and other spacecraft has always been a major hindrance to the growth of the space industry. Due to technologies, such as the miniaturization of satellites and payloads, manufacturers seek to leverage cost reduction while performing key operations in the value chain.

Defense domains across the globe are also seeking less expensive multifunctional spacecraft. Recoverable launch vehicles are another technology that is a major opportunity for the space industry. Such technologies have made launches easier and cheaper, driving the growth of the space launch services market.

Challenges: Scarce intellectual assets

The tremendous success of recent space exploration missions by space agencies in the Asia Pacific, such as the Indian Space and Research Organization (ISRO) and the China National Space Administration (CNSA), can be attributed to a large number of qualified scientists and personnel with relevant key skills in the region. Critical space operations rely heavily on intellectual assets, incorporating research & development, patents, software, human resources, and new organizational structures. These assets are strategic factors in value creation for firms.

However, the expansion of the services sector, globalization, deregulation, and the emergence of new information and communication technologies has resulted in the scarcity of intellectual assets across the globe. Countries such as Morocco, South Africa, Nigeria, Somalia, Kenya, Bangladesh, Nepal, and Bhutan, among others, have scarce intellectual assets in terms of qualified personnel for space exploration programs. This has resulted in a lack of space exploration programs in these countries, limiting the growth of the space launch services market.

Space launch services Market Segment Categorization

The study categorizes the space launch services market based on Application, Mobility, Size, Mode of Operation, System, and Region.

Based on Service Type, the space launch services market has been segmented as follows:

- Pre-launch

- Post launch

Based on Payloaad, the space launch services market has been segmented as follows:

- Satellite

- Stratolite

- Cargo

- Human Spaceflights

- Space Probes

Based on the Orbit, the space launch services market has been segmented as follows:

- LEO

- MEO

- GEO

- Beyond GEO

Based on the Launch Vehicle Type, space launch services market has been segmented as follows:

- Small-lift Launch Vehicle

- Medium to Heavy Launch Vehicle

Based on the Launch Type, space launch services market has been segmented as follows:

- Re-usable

- Single Use

Based on the End Use, space launch services market has been segmented as follows:

- Commercial

- Military

Based on the region, space launch services market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Rest of the World includes Latin America, and Africa

Recent Developments

- In March 2022, Rocket Lab (US) has successfully deployed a second Synthetic Aperture Radar (SAR) satellite to orbit for data and solutions provider Synspective, bringing the total number of satellites deployed by Rocket Lab to 110. In January 2018, Rocket Lab (USA) has launched Electron rocket into space under USD 5 million.

- NASA is working with the private sector on its Artemis program, which intends to land people on the moon by 2024. The human landers for the mission will be created by SpaceX, Blue Origin, and Dynetics (US), according to a NASA announcement made in April 2020.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the Space launch services Market?

Response: The Space Launch Services Market is expected to grow substantially owing to the increased investments in space exploration missions, development of small satellites, and technological advancements in launch vehicles.

What are the key sustainability strategies adopted by leading players operating in the Space launch services?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the Space Launch Services Market. Major players, including Space X (US), Arianespace (France), Northrop Grumman Corp. (US), United Launch Alliance (US), and China Aerospace Science and Technology Corporation (China) have adopted various strategies, such as contracts and agreements, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the Space Launch Services Market?

Response: Some of the major emerging technologies and use cases disrupting the market include Launcher recoverability, reusable rockets, flexible launcher services and advanced payload system.

Who are the key players and innovators in the ecosystem of the Space launch services Market?

Response: Major players and innovators, include Space X (US), Arianespace (France), Northrop Grumman Corp. (US), United Launch Alliance (US), and China Aerospace Science and Technology Corporation (China), Rocket Lab (US) and Antrix Corporation (India).

Which region is expected to hold the highest market share in the Space Launch Services Market?

Response: North America is estimated to account for the largest share of XX% of the space launch services market in 2022. The growth of the space launch services market in North America is mainly driven by increased investments in space exploration missions, development of small satellites, and technological advancements in launch vehicles.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

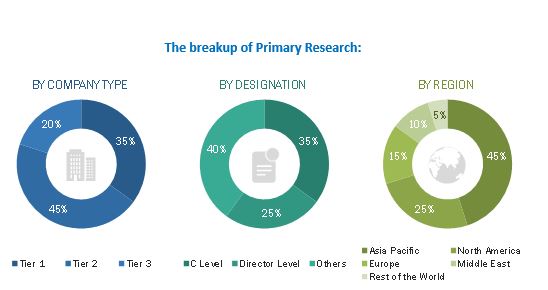

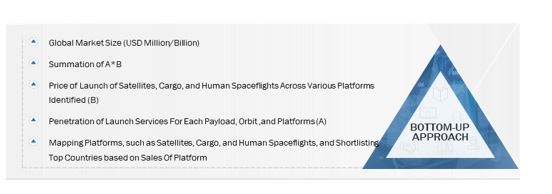

The study involved four major activities in estimating the current size of the space launch services market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included government sources, such as SIPRI; corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from space launch services vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped understand the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using space launch services were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of space launch services and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Surrey Satellite Technology Ltd. |

Head of International Business |

|

Manatsu Space |

Co-Founder |

|

YSPM, LLC |

CEO & Principal Consultant |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the space launch services market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global space launch services market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the space launch services market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the space launch services market.

Report Objectives

- To define, describe, and forecast the space launch services market by service type, payload, orbit, launch vehicle type, launch type, end use, and region

- To analyze the demand- and supply-side indicators influencing the growth of the space launch services market

- To provide in-depth market intelligence regarding key market dynamics, such as drivers, restraints, opportunities, and industry-specific challenges, which influence the growth of the space launch services market

- To forecast the size of various segments of the space launch services market across five main regions, namely, North America, Europe, Asia Pacific, and Rest of the World.

- To analyze micromarkets 1 with respect to individual growth trends, prospects, and their contribution to the space launch services market

- To analyze technological advancements and new product launches in the space launch services market

- To strategically profile key players in the space launch services market and comprehensively analyze their core competencies 2

- To identify products and key developments of leading companies operating in the space launch services market

- To provide a comprehensive analysis of business and corporate strategies adopted by key players operating in the space launch services market

- To provide a detailed competitive landscape of the space launch services market, along with market share ranking of leading players in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Space Launch Services Market

I want to see if the launch market predicted includes fabrication of semiconductors, relaying of power via space, and asteroid mining for obtaining cobalt for battery production. I am looking to make investments in companies that provide these services/products, I want to see if the launch capacity/pricing will be there to close the business case on those areas.

Hi, I'm looking to find more details about the market size and potential of aerial/ground launching to space in the category of 200-400 kg payload. Thanks! Omri Yoffe