Space Robotics Market by Solution, Services (Satellite Servicing, On-orbit Assembly & Manufacturing, De-orbiting Services, Re-supply, Surface Mobility, & Launch Support), Application, End-User, and region (2017-2023)

The space robotics market is estimated to be USD 2.58 billion in 2017 and is projected to reach USD 4.36 billion by 2023, at a CAGR of 8.64% during the forecast period. The base year considered for the study is 2017 and the forecast period is from 2018 to 2023.

Objectives of the Study:

The report analyzes the space robotics market on the basis of solution, application, end user, and region. Based on solution, the market has been segmented into product and services. The product segment has been further divided into robotics and subsystems (rovers, space probes, Robotic Servicing Vehicles (RSV), gripping and docking systems, robotic arms/manipulator system, deorbiting robots/systems and crawler-transporter), sensors and autonomous systems, software, and services segment (on-orbit assembly and manufacturing, satellite servicing, de-orbiting services, surface mobility, launch support services and resupply). Based on application, the space robotics market has been segmented into deep space segment (space transportation, and space exploration), near space (in-space 3D printing, space operations/scientific experimentation, space transportation, space exploration and in-space maintenance & inspection), and ground. Based on end user, the market has been segmented into government and commercial. The government segment has been further divided into space agencies, and departments of defense, among others. The space robotics market has been studied for North America, Europe, Asia Pacific, and Rest of the World.

The report provides in-depth market intelligence regarding the market dynamics and major factors influencing the growth of the space robotics market (drivers, opportunities, and industry-specific challenges), along with an analysis of micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market. The report also covers competitive developments, such as long-term contracts, partnerships, expansions, new product launches, agreements, and research & development activities in the market, in addition to the business and corporate strategies adopted by key market players.

Research Methodology:

Market size estimation for various segments and subsegments of the space robotics market was arrived at by referring to varied secondary sources, such as press releases, company annual reports, NASA space robotics documents, European space robotics documents, white papers, publications, and industry outlooks, and in corroboration with primaries. Furthermore, the market was triangulated with the help of statistical techniques using econometric tools. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to acquire the final quantitative and qualitative data. This data is consolidated with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the space robotics market comprises space agencies, intelligence communities, space robotics solution providers, software providers, and end users. Some of the key players in the market include Maxar Technologies (US), Motiv Space Systems (US), Altius Space Machines (US), Northrop Grumman (US), Honeybee Robotics (US), Astrobotic Technology (US), Made In Space (US), and Effective Space Solutions Limited (UK). These players have adopted contracts, new product developments, and agreements & partnerships strategies to strengthen their positions in the market.

Target Audience:

- Space Regulatory Authorities

- Space Agencies

- Space Research Institutes

- Space Insurance Organizations

- Space Industry

- Spacecraft Operators

Scope of the Report:

This research report categorizes the market into the following segments and subsegments:

Space Robotics Market, By Solution

- Product

- Robotics and Subsystems

- Sensors and Autonomous Systems

- Software

- Others

- Services

- On-orbit Assembly & Manufacturing

- Satellite Servicing

- De-orbiting Services

- Surface Mobility

- Launch Support

- Re-supply

Space Robotics Market, By Application

- Deep Space

- Space Transportation

- Space Exploration

- Near Space

- In-space 3D Printing

- Space Operations/Scientific Experimentation

- Space Transportation

- Space Exploration

- In-space Maintenance & Inspection

- Ground

Space Robotics Market, By End User

- Government

- Space Agencies

- Departments of Defense

- Others (Academic and Research Institutions, etc.)

- Commercial

- Satellite Operators/Owners

- Launch Service Providers

- Others (Satellite Manufacturers, NewSpace companies, etc.)

Space Robotics Market, By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Customizations Available for the Report:

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of a company. The following customization options are available for the report:

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

The space robotics market is estimated to be USD 2.88 billion in 2018 and is projected to reach USD 4.36 billion by 2023, at a CAGR of 8.64% from 2018 to 2023. The growth of the space robotics market is driven by several factors, including the growing demand for servicing existing geostationary satellites, debris removal, and technological advancements in autonomous systems, and the increasing demand for on-orbit manufacturing and assembly in the International Space Station (ISS) from government agencies and commercial entities.

Based on solution, the satellite servicing segment is estimated to lead the space robotics market in 2018. The growth of the satellite servicing segment can be attributed to the increasing demand and requirement for space-based services, such as satellite servicing, de-orbiting services, surface mobility, and resupply services.

Based on application, the near space segment of the space robotics market is expected to grow at the highest CAGR during the forecast period. Growth of the near space segment can be attributed to the demand for resupply missions for the International Space Station (ISS), on-orbit satellite manufacturing, and increasing need to service the existing geosynchronous satellites.

Based on end user, the commercial segment of the space robotics market is projected to grow at a higher CAGR, as compared to the government segment, during the forecast period due to the growing demand for satellite servicing, refueling and mission extension services which offer opportunities for satellite operators/owners by extending the life of satellites and thus generate revenue from existing satellite fleets, and provide greater flexibility in managing in-orbit satellite fleets.

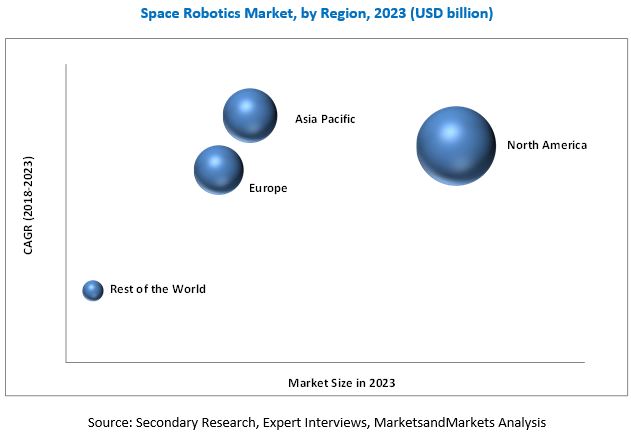

North America is estimated to account for the largest share of the space robotics market in 2018. This can be attributed to the high demand for space robotics activities from prominent organizations, such as NASA and the Department of Defense due to the increasing reliance on space assets and for enabling safety in space operations.

Regulatory implementations by various space regulatory authorities is the major factor expected to restrain the growth of the space robotics market.

Some of the major players operating in the space robotics market include Maxar Technologies (US), Motiv Space Systems (US), Altius Space Machines (US), Northrop Grumman (US), Honeybee Robotics (US), Astrobotic Technology (US), Made In Space (US), and Effective Space Solutions Limited (UK). These key players offer various space robotics products and services. New product developments, partnerships, and contracts are the major growth strategies adopted by these players to strengthen their positions in the space robotics market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

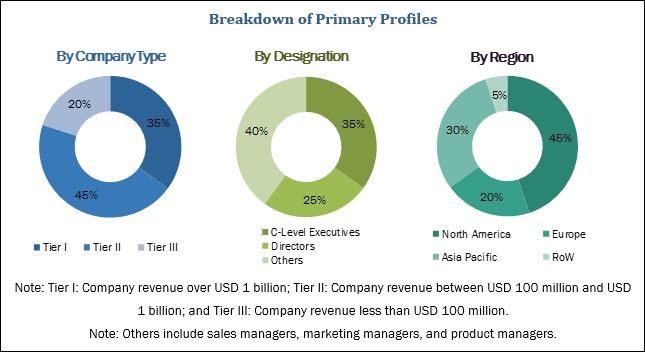

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 31)

4.1 Attractive Growth Opportunities in the Space Robotics Market

4.2 Space Robotics Market for Services, By Type

4.3 Space Robotics Market in Near Space Application, By Function

4.4 Space Robotics Market for Commercial End User, By Type

4.5 Space Robotics Market, By Region

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Significant Investments in Research and Development By Private Firms Leading to Rising Number of Space Exploration Missions

5.2.1.2 Increasing Levels of Robotic Autonomy

5.2.1.3 Rising Demand for GEO Satellites Across the Globe

5.2.1.4 Growing Space Congestion Due to the Increasing Number of New Satellite Launches

5.2.2 Restraints

5.2.2.1 Legal and Regulatory Issues

5.2.3 Opportunities

5.2.3.1 Rising Demand for On-Orbit Satellite Servicing

5.2.3.2 Entry of Private Companies in the Space Robotics Industry

5.2.3.3 Technological Upgradations in Space Industry Leading to the Development of Low-Cost Space Systems

5.2.4 Challenges

5.2.4.1 Scarcity of Intellectual Assets in Many Countries

5.2.4.2 Technical Challenges

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Technology Trends

6.3.1 Artificial Intelligence (AI) in Space Robotics

6.3.2 3d Printing

6.3.3 Sensor Integration Technology

6.3.4 Development of Small Satellites Using Additive Manufacturing Process

6.3.5 Space Robot Technology

6.4 Emerging Trends

6.4.1 Space Debris Removal

6.4.2 Satellite Constellations

6.4.3 Planetary Protection Technologies

6.5 Venture Capital Funding

6.5.1 Innovations & Patent Registrations

7 Space Robotics Market, By Solution (Page No. - 47)

7.1 Introduction

7.2 Services

7.2.1 On-Orbit Assembly & Manufacturing

7.2.2 Satellite Servicing

7.2.3 De-Orbiting Services

7.2.4 Re-Supply

7.2.5 Surface Mobility

7.2.6 Launch Support

7.3 Products

7.3.1 Robotics & Subsystems

7.3.1.1 Rovers/Spacecraft Landers

7.3.1.2 Space Probes

7.3.1.3 Robotic Servicing Vehicles

7.3.1.4 Gripping & Docking Systems

7.3.1.5 Robotic Arms/Manipulator Systems

7.3.1.6 Deorbiting Robots/Systems

7.3.1.7 Crawler-Transporters

7.3.2 Sensors & Autonomous Systems

7.3.3 Software

7.3.4 Others

8 Space Robotics Market, By Application (Page No. - 54)

8.1 Introduction

8.2 Deep Space

8.2.1 Space Exploration

8.2.2 Space Transportation

8.3 Near Space

8.3.1 In-Space 3d Printing

8.3.2 Space Operations/Scientific Experimentation

8.3.3 Space Exploration

8.3.4 In-Space Maintenance & Inspection

8.3.5 Space Transportation

8.4 Ground

9 Space Robotics Market, By End User (Page No. - 60)

9.1 Introduction

9.2 Commercial

9.2.1 Satellite Operators/Owners

9.2.2 Launch Service Providers

9.2.3 Others

9.3 Government

9.3.1 Space Agencies

9.3.2 Departments of Defense (DOD)

9.3.3 Others

10 Regional Analysis (Page No. - 65)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.3 Europe

10.3.1 Russia

10.3.2 France

10.3.3 Germany

10.3.4 UK

10.3.5 Italy

10.3.6 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 South Korea

10.4.5 Rest of Asia Pacific

10.5 Rest of the World

10.5.1 Middle East

10.5.2 South America

10.5.3 Africa

11 Competitive Landscape (Page No. - 93)

11.1 Introduction

11.2 Competitive Analysis

11.3 Market Ranking Analysis

11.4 Competitive Scenario

11.4.1 Contracts

11.4.2 Partnerships

11.4.3 Acquisitions

11.4.4 Expansions

12 Company Profiles (Page No. - 99)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Altius Space Machines

12.2 Astrobotic Technology

12.3 Olis Robotics

12.4 Effective Space Solutions

12.5 Honeybee Robotics

12.6 Ispace

12.7 Made in Space

12.8 Maxar Technologies

12.9 Metecs

12.10 Northrop Grumman

12.11 Motiv Space Systems

12.12 Stinger Ghaffarian Technologies (SGT)

12.13 Space Applications Services

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 123)

13.1 Discussion Guide

13.1.1 Key Insights From Industry Expert

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Available Customization

13.4 Related Reports

13.5 Author Details

List of Tables (70 Tables)

Table 1 Vc Funding Companies in the Satellite Industry (2015-2016)

Table 2 Innovations & Patent Registrations, 2012-2016

Table 3 Space Robotics Market for Services, By Type, 20162023 (USD Million)

Table 4 Space Robotics Market for On-Orbit Assembly & Manufacturing, By Region, 20162023 (USD Million)

Table 5 Space Robotics Market for Satellite Servicing, By Region, 20162023 (USD Million)

Table 6 Space Robotics Market for De-Orbiting Services, By Region, 20162023 (USD Million)

Table 7 Space Robotics Market for Resupply, By Region, 20162023 (USD Million)

Table 8 Space Robotics Market for Surface Mobility, By Region, 20162023 (USD Million)

Table 9 Space Robotics Market for Launch Support, By Region, 20162023 (USD Million)

Table 10 Space Robotics Market Size, By Application, 20162023 (USD Million)

Table 11 Space Robotics Market in Deep Space, By Function, 20162023 (USD Million)

Table 12 Space Robotics Market in Deep Space, By Region, 20162023 (USD Million)

Table 13 Space Robotics Market Size in Near Space, By Function, 2016-2023 (USD Million)

Table 14 Space Robotics Market Size in Near Space, By Region, 20162023 (USD Million)

Table 15 Space Robotics Market in Ground, By Region, 20162023 (USD Million)

Table 16 Space Robotics Market, By End User, 20162023 (USD Million)

Table 17 Space Robotics Market for Commercial, By Region, 20162023 (USD Million)

Table 18 Space Robotics Market for Commercial, By Type, 20162023 (USD Million)

Table 19 Space Robotics Market for Government, By Region, 20162023 (USD Million)

Table 20 Space Robotics Market for Government, By Type, 20162023 (USD Million)

Table 21 Space Robotics Market Size, By Region, 20162023 (USD Million)

Table 22 North America Space Robotics Market for Services, By Type, 20162023 (USD Million)

Table 23 North America Space Robotics Market Size, By Application, 20162023 (USD Million)

Table 24 North America Space Robotics Market Size, By End User, 20162023 (USD Million)

Table 25 North America Space Robotics Market Size, By Country, 20162023 (USD Million)

Table 26 US Space Robotics Market Size, By Application, 20162023 (USD Million)

Table 27 US Space Robotics Market Size, By End User, 20162023 (USD Million)

Table 28 Canada Space Robotics Market Size, By Application, 20162023 (USD Million)

Table 29 Canada Space Robotics Market Size, By End User, 20162023 (USD Million)

Table 30 Europe Space Robotics Market Size, By Solution, 20162023 (USD Million)

Table 31 Europe: Market Size, By Application, 2016-2023 (USD Million)

Table 32 Europe: Market Size, By End User, 20162023 (USD Million)

Table 33 Europe: Market Size, By Country, 20162023 (USD Million)

Table 34 Russia Space Robotics Market Size, By Application, 20162023 (USD Million)

Table 35 Russia: Market Size, By End User, 20162023(USD Million)

Table 36 France Space Robotics Market Size, By Application, 20162023 (USD Million)

Table 37 France Market Size, By End User, 2016-2023(USD Million)

Table 38 Germany Market Size, By Application, 20162023 (USD Million)

Table 39 Germany Market Size, By End User, 20162023(USD Million)

Table 40 UK Space Robotics Market Size, By Application, 20162023 (USD Million)

Table 41 UK Market Size, By End User, 20162023(USD Million)

Table 42 Italy Space Robotics Market Size, By Application, 20162023 (USD Million)

Table 43 Italy Market Size, By End User, 2016-2023(USD Million)

Table 44 Rest of Europe Market Size, By Application, 20162023 (USD Million)

Table 45 Rest of Europe Market Size, By End User, 20162023 (USD Million)

Table 46 Asia Pacific Space Robotics Market for Services, By Type, 20162023 (USD Million)

Table 47 Asia Pacific Market Size, By Application, 20162023 (USD Million)

Table 48 Asia Pacific Space Robotics Market Size, By End User, 20162023 (USD Million)

Table 49 Asia Pacific Market Size, By Country, 20162023 (USD Million)

Table 50 China Space Robotics Market Size, By Application, 20162023 (USD Million)

Table 51 China Market Size, By End User, 20162023(USD Million)

Table 52 Japan Market Size, By Application, 20162023 (USD Million)

Table 53 Japan Market Size, By End User, 20162023 (USD Million)

Table 54 India Space Robotics Market Size, By Application, 20162023 (USD Million)

Table 55 India Market Size, By End User, 20162023(USD Million)

Table 56 South Korea Market Size, By Application, 20162023 (USD Million)

Table 57 South Korea Market Size, By End User, 20162023 (USD Million)

Table 58 Rest of Asia Pacific Space Robotics Market Size, By Application, 20162023 (USD Million)

Table 59 Rest of Asia Pacific Market Size, By End User, 20162023 (USD Million)

Table 60 Rest of the World Space Robotics Market for Services, By Type, 20162023 (USD Million)

Table 61 Rest of the World Market Size, By Application, 20162023 (USD Million)

Table 62 Rest of the World Market Size, By End User, 20162023 (USD Million)

Table 63 Rest of the World Market, By Region, 20162023 (USD Million)

Table 64 Middle East Space Robotics Market Size, By Application, 20162023 (USD Million)

Table 65 Middle East Market Size, By End User, 20162023 (USD Million)

Table 66 South America Market Size, By Application, 20162023 (USD Million)

Table 67 South America Market Size, By End User, 20162023 (USD Million)

Table 68 Africa Market Size, By Application, 20162023 (USD Million)

Table 69 Africa Market Size, By End User, 20162023 (USD Million)

Table 70 Ranking of Key Players in Market, 2017

List of Figures (32 Figures)

Figure 1 Space Robotics Market Segmentation

Figure 2 Research Process Flow

Figure 3 Space Robotics Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Assumptions of the Research Study

Figure 9 Satellite Servicing Subsegment of the Market for Services Projected to Grow at the Highest CAGR During the Forecast Period

Figure 10 Commercial End User Segment Projected to Grow at A Higher CAGR During the Forecast Period

Figure 11 Near Space Application Segment Projected to Lead the Space Robotics Market During the Forecast Period

Figure 12 North America Estimated to Lead the Market in 2018

Figure 13 Demand for Satellite Servicing and Increase in Space Exploration Activities are Driving the Growth of the Space Robotics Market

Figure 14 Satellite Servicing Subsegment Expected to Lead the Market for Services During the Forecast Period

Figure 15 In-Space Maintenance & Inspection Segment Expected to Lead the Market in Near Space Application From 2018 to 2023

Figure 16 Satellite Operators/Owners Segment Expected to Lead the Market for Commercial End User From 2018 to 2023

Figure 17 North America Expected to Lead the Market From 2018 to 2023

Figure 18 Space Robotics Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 Types of Space Debris, 2017

Figure 20 Estimated Number of GEO Satellites Requiring Service During 2016-2023

Figure 21 Value Chain

Figure 22 Satellite Servicing Segment Expected to Grow at Highest Rate During Forecast Period

Figure 23 Near Space Segment Expected to Grow at Highest Rate During Forecast Period

Figure 24 Commercial Segment is Expected to Grow at Higher CAGR During Forecast Period as Compared to Government Segment

Figure 25 Space Robotics Market: Regional Snapshot

Figure 26 North America Space Robotics Market Snapshot

Figure 27 Europe Market Snapshot

Figure 28 Asia Pacific Market Snapshot

Figure 29 Companies Adopted Contracts as the Key Growth Strategy Between July 2012 and September 2018

Figure 30 Leading Companies in the Market, By Region

Figure 31 Maxar Technologies: Company Snapshot

Figure 32 Northrop Grumman: Company Snapshot

Growth opportunities and latent adjacency in Space Robotics Market

How many "major" companies are described in the report? Only US or world-wide? Does the report contain information about their activities, for example, which company(ies) worked on the European Space Station module...?