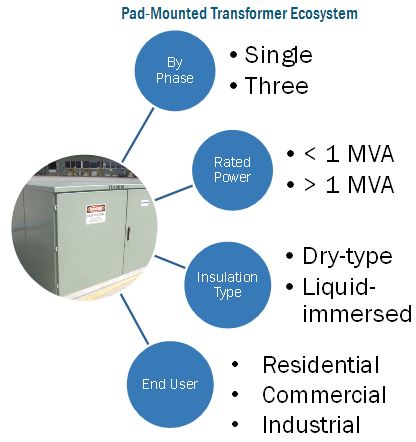

Pad-mounted Transformer Market by End User (Industrial, Commercial, and Residential), by Phase (Single and Three), by Rated Power (<1 MVA and >1 MVA), by Insulation Type (Dry-type and Liquid-Immersed) & by Region - Global Forecast to 2020

[166 Pages Report] The Pad-mounted transformer market is estimated to reach USD 6 Billion by 2020. The current market size is valued at USD 4.5 Billion and is estimated to grow at a CAGR of 5.21% for the forecast period from 2015 to 2020. The report segments pad-mounted transformers on the basis of its phase, rated power, insulation type, and by end user. The only other technology available is pole-mounted transformer. Pole-mounted transformers are currently limited by rated power as high rated power pole mounted transformers are bigger in size and need strong poles with proper balancing to mount. Other than that, there is no technology at present which can replace pad-mounted transformers.

Years considered for the study: 6

Base Year: 2014

Forecast years: 2015-estimated, 2020-predicted

Research Methodology:

- Major regions were identified along with countries contributing the maximum share

- Secondarys’ were conducted to find the split (by phase, by rated power, by end user, and by insulation type) pad-mounted transformer in the regions and their contribution

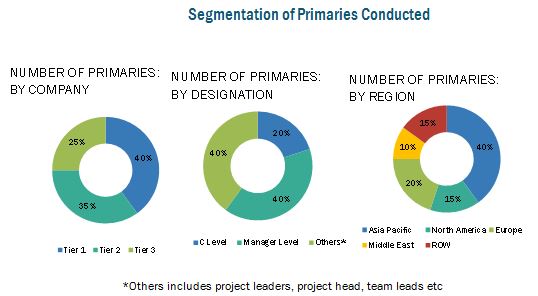

- End users were identified on the basis of transformer contracts in the region and the split was calculated by conducting primaries with industry participants, subject matter experts, C-level executives of key market players, and industry consultants among other experts, which helped to obtain and verify critical qualitative and quantitative information as well as assess future market prospects

- Top companies revenues (regional/global), pad-mounted transformer pricing, and industry trends along with top-down, bottom-up, and MnM KNOW were used to estimate market value

- This was further broken down into several segments and subsegments on the basis of information gathered

The study answers several questions for the stakeholders which includes pad-mounted transformer manufacturers, EPC companies, utility service providers, distributers & suppliers, consulting firms, private equity groups, investment houses, equity research firms and other stakeholders. It gives them information about market segments to focus on in the next two to five years, for prioritizing efforts and investments

Scope of the Report:

- This study estimates the global pad-mounted transformer market of pad-mounted transformer, in terms of dollar value, till 2020

- It offers a detailed qualitative and quantitative analysis of this market

- It provides a comprehensive review of major market drivers, restraints, opportunities, challenges, winning imperatives, and key issues of the market

- It covers various important aspects of the market. These include analysis of value chain, Porter’s Five Forces model, competitive landscape, market dynamics, market estimates in terms of value, and future trends in the pad-mounted transformer market.

The pad-mounted transformer market has been segmented into -

On the basis of Rated Power Type

- > 1 MVA

- < 1 MVA

On the basis of Phase

- Single

- Three

On the basis of Insulation

- Dry-type

- Liquid-immersed

On the basis of End User

- Residential

- Commercial

- Industrial

On the basis of Region

- North America

- South America

- Asia-Pacific

- Middle East & Africa

- Europe

Available Customization

With the market data provided above, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (Up to 5)

Customer Interested in this report also can view

Smart Transformers Market by Type (Power, Distribution, Specialty, and Instrument), Application (Smart Grid, Traction Locomotive, Electric Vehicle Charging, and Others) & by Region - Global Trends & Forecast to 2020

Power Transformer Market by Rating (Small Power Transformer (Up to 60MVA), Medium Power Transformer (61 – 600MVA), Large Power Transformer (Above 600MVA)), by Type of Cooling Method (Oil-Cooled and Air-Cooled), & Region - Global Trends & Forecasts to 2020

Transformer Monitoring System Market by Type (Hardware Solutions and IT Solutions), Application (Distribution Transformers, and Power Transformers), Service (Oil/Gas Monitoring, and Bushing Monitoring), and Region - Global Forecast to 2021

The pad-mounted transformer market is expected to grow at a decent rate of 5.21% from 2015 to 2020. It is projected to reach USD 6 Billion by 2020. The growth in the market is supported by large investments planned for upgradation and expansion of power transmission & distribution networks across globe. Developing countries are expanding their power grid networks to meet the growing demand for electricity from industries, as well as connecting the rural sector to the power grid for domestic use. Large industries are coming up in developing countries like China, and India due to industrialization and are expected to create a good demand for pad-mounted transformers.

Industrial end users are expected to grow at the highest rate in the end user segment. The key driving factor will be favorable government policies for the growth of industries in various countries such as Mexico, China, Brazil, and India. The U.S. has come up with new norms for the efficiency of distribution transformers which will be implemented from 1st January, 2016. More efficient pad-mounted transformers will reduce electricity wastage and thereby increase savings in terms of power and capital. This new policy reform is expected to drive the pad-mounted transformer market in the U.S.

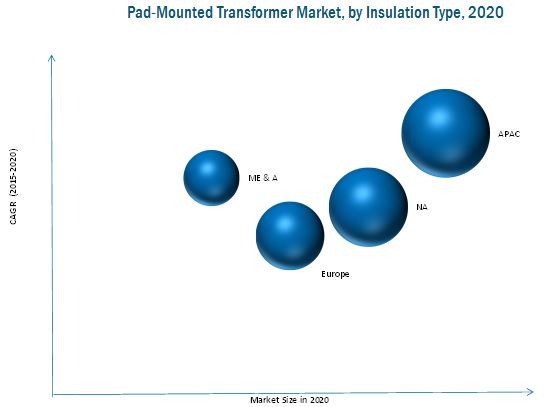

The three phase pad-mounted transformer market is estimated to grow at the highest rate in the segmentation on the basis of phase. The key driving factor for this market is the increase in power consuming appliances in the residential sector which requires high capacity pad-mounted transformers. Also, in most of the countries, utility power is supplied in three phase, so three phase pad-mounted transformers are more suitable in such situations over single phase pad-mounted transformers. On the basis of insulation type, dry-type is estimated to grow at a higher rate as compared to liquid-immersed as it has lower maintenance cost and is safer to use.

Asia Pacific is the largest pad-mounted transformer market by size and is estimated to grow at the highest rate due to high demand for power products from China. High economic growth rate of China has created a good demand for power distribution products such as pad-mounted transformers. Along with that, new policy reforms in India to support the growth of industries have made India a very lucrative market for the OEM manufacturers. This is also likely to create a huge demand for pad-mounted transformers in the region.

The major factors restraining the growth of pad-mounted transformer market over its substitutes is that it requires land for installation and has to be placed inside an enclosure to prevent contact with flammable materials (liquid-immersed pad-mounted transformer). This requires additional cost which is not required in case of pole mounted transformers.

The market is dominated by a few international players which hold more than 50% share of the pad-mounted transformer market. Major leaders are ABB Ltd. (Switzerland), Schneider Electric (France), Siemens AG (Germany), GE (U.S.), and Eaton Corporation Plc. (Ireland). These players are expanding their market share by winning new projects for power transmission & distribution and by opening manufacturing facilities in regions with high demand.

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 27)

3.1 Introduction

3.2 Current Scenario

3.3 Future Trends

3.4 Conclusion

4 Premium Insights (Page No. - 31)

4.1 At tractive Market Opportunities in the Pad Mounted Transformer Market

4.2 Global Pad-Mounted Transformer Market

4.3 Pad Mounted Transformer Market, By End User

4.4 Asia-Pacific, the Largest Liquid-Immersed Pad Mounted Transformer Market in 2014

4.5 Pad-Mounted Transformer Market: By End User

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Rated Power

5.2.2 By Phase

5.2.3 By End User

5.2.4 By Insulation Type

5.2.5 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Need for Replacing Aging T&D Infrastructure and Power Grid Expansion

5.3.1.2 Implementation of Energy Efficient Standards

5.3.1.3 Available in Higher Capacities

5.3.2 Restraints

5.3.2.1 Requires Ground Space for Installations

5.3.2.2 Lack of Proper Distribution Network

5.3.3 Opportunities

5.3.3.1 Increasing Demand for Power

5.3.3.2 Development of Renewable Energy Power Grid

5.3.4 Challenges

5.3.4.1 Raw Material Cost Volatility

5.3.4.2 Delays in Grid Expansion Projects

5.4 Impact of Market Dynamics

5.5 Value Chain Analysis

5.6 Porter’s Five Forces Analysis

5.6.1 Threat of New Entrants

5.6.1.1 Initial Capital Investment is High

5.6.1.2 Established Players

5.6.2 Threat of Substitutes

5.6.3 Bargaining Power of Suppliers

5.6.4 Bargaining Power of Buyers

5.6.5 Intensity of Competitive Rivalry

5.6.5.1 Market Dominated By A Few Players

6 Global Pad Mounted Transformer Market, By Insulation Type (Page No. - 56)

6.1 Introduction

6.2 Dry-Type Pad Mounted Transformer Market

6.3 Liquid-Immersed Pad Mounted Transformer Market

7 Global Pad Mounted Transformer Market, By Phase (Page No. - 61)

7.1 Introduction

7.2 Pad Mounted Transformer Market By Single Phase

7.3 Three Phase Pad Mounted Transformer Market

8 Global Pad-Mounted Transformer Market, By Rated Power (Page No. - 65)

8.1 Introduction

8.2 By Rated Power <1 MVA

8.3 Pad Mounted Transformer Market By Rated Power >1 MVA

9 Global Pad Mounted Transformer Market, By End User (Page No. - 70)

9.1 Introduction

9.2 Residential End User Pad Mounted Transformer Market

9.3 Commercial End User Pad Mounted Transformer Market

9.4 Industrial End User Pad Mounted Transformer Market

10 Pad Mounted Transformer Market, By Region (Page No. - 80)

10.1 Introduction

10.1.1 Global Pad Mounted Transformer Market

10.2 Asia-Pacific

10.2.1 By Rated Power

10.2.2 By Phase

10.2.3 By End User

10.2.4 By Insulation Type

10.2.5 By Country

10.2.5.1 China: By Market Size, By Phase

10.2.5.2 India: By Market Size, By Phase

10.2.5.3 Japan: By Market Size, By Phase

10.3 North America

10.3.1 By Rated Power

10.3.2 By Phase

10.3.3 By End User

10.3.4 By Insulation Type

10.3.5 By Country

10.3.5.1 U.S.: By Market Size, By Phase

10.3.5.2 Canada: By Market Size, By Phase

10.3.5.3 Mexico: By Market Size, By Phase

10.4 Europe

10.4.1 By Rated Power

10.4.2 By Phase

10.4.3 By End User

10.4.4 By Insulation Type

10.4.5 By Country

10.4.5.1 Russia: By Market Size, By Phase

10.4.5.2 Germany: By Market Size, By Phase

10.4.5.3 U.K.: By Market Size, By Phase

10.5 Middle East & Africa

10.5.1 By Rated Power

10.5.2 By Phase

10.5.3 By End User

10.5.4 By Insulation Type

10.5.5 By Country

10.5.5.1 Saudi Arabia: By Market Size, By Phase

10.5.5.2 South Africa: By Market Size, By Phase

10.5.5.3 UAE: By Market Size, By Phase

10.6 South America

10.6.1 By Rated Power

10.6.2 By Phase

10.6.3 By End User

10.6.4 By Insulation Type

10.6.5 By Country

10.6.5.1 Brazil: Pad Mounted Transformer Market Size, By Phase

10.6.5.2 Argentina: Pad Mounted Transformer Market Size, By Phase

11 Competitive Landscape (Page No. - 108)

11.1 Overview

11.2 Competitive Situation & Trends

11.2.1 Contracts and Agreements

11.2.2 Expansions

11.2.3 New Product/Service/Technology Developments

11.2.4 Mergers and Acquisitions

11.2.5 Other Developments

12 Company Profiles (Page No. - 118)

12.1 Introduction

12.2 ABB Ltd.

12.2.1 Business Overview

12.2.2 Products & Services: ABB Ltd.

12.2.3 Developments, 2012-2015

12.2.4 SWOT Analysis

12.2.5 MnM View

12.3 Eaton Corporation PLC.

12.3.1 Business Overview

12.3.2 Products & Services

12.3.3 Developments, 2012-2015

12.3.4 SWOT Analysis

12.3.5 MnM View

12.4 General Electric

12.4.1 Business Overview

12.4.2 Products & Services

12.4.3 Developments, 2012-2014

12.4.4 SWOT Analysis

12.4.5 MnM View

12.5 Schneider Electric Co.

12.5.1 Business Overview

12.5.2 Products and Services

12.5.3 Recent Developments

12.5.4 SWOT Analysis

12.5.5 MnM View

12.6 Siemens AG.

12.6.1 Business Overview

12.6.2 Products & Services

12.6.3 Developments, 2015-2014

12.6.4 SWOT Analysis

12.6.5 MnM View

12.7 Crompton Greaves

12.7.1 Business Overview

12.7.2 Products and Services

12.7.3 Recent Developments

12.8 Ermco.

12.8.1 Business Overview

12.8.2 Products & Services

12.8.3 Developments, 2012-2015

12.9 Federal Pacific

12.9.1 Business Overview

12.9.2 Products & Services

12.9.3 Developments, 2012-2015

12.10 Hitachi

12.10.1 Business Overview

12.10.2 Products and Services

12.10.3 Recent Developments

12.11 Moloney Electric, Inc.

12.11.1 Business Overview

12.11.2 Products & Services

12.11.3 Developments, 2012-2015

12.12 Olsun Electric Corporation

12.12.1 Business Overview

12.12.2 Products & Services

12.12.3 Developments, 2012-2015

12.13 Pacific Crest Transformers, Inc.

12.13.1 Business Overview

12.13.2 Products & Services

12.13.3 Developments, 2012-2015

12.14 Pearl Electric Co. Ltd.

12.14.1 Business Overview

12.14.2 Products & Services

12.14.3 Developments, 2012-2015

12.15 Vantran Industries, Inc.

12.15.1 Business Overview

12.15.2 Products & Services

12.15.3 Developments, 2012-2015

12.16 Wenzhou Rockwell Transformer Co.

12.16.1 Business Overview

12.16.2 Products & Services

12.16.3 Developments, 2012-2015

13 Appendix (Page No. - 158)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Other Developments, 2012-2014

13.4 Introducing RT: Real Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

List of Tables (75 Tables)

Table 1 T&D Losses of Major Developed Countries, 2012

Table 2 T&D Losses of Major Developing Countries, 2012

Table 3 Energy Conservation Standards for Low-Voltage Dry-Type Distribution Transformers

Table 4 Energy Conservation Standards for Liquid-Immersed Distribution Transformers

Table 5 Energy Conservation Standards for Medium-Voltage Dry-Type Distribution Transformers

Table 6 Impact of Pad-mounted Transformer Market Dynamics

Table 7 Pad Mounted Transformer Market Size, By Insulation Type, 2013-2020 (USD Million)

Table 8 Dry-Type Pad Mounted Transformer Market Size, By Region, 2013-2020 (USD Million)

Table 9 Liquid-Immersed Pad Mounted Transformer Market Size, By Region, 2013-2020 (USD Million)

Table 10 Pad Mounted Transformer Market Size, By Phase, 2013-2020 (USD Million)

Table 11 Single Phase Pad Mounted Transformer Market Size, By Region, 2013-2020 (USD Million)

Table 12 Three Phase Pad Mounted Transformer Market Size, By Region, 2013-2020 (USD Million)

Table 13 Pad-Mounted Transformer Market Size, By Rated Power, 2013-2020 (USD Million)

Table 14 Rated Power <1 MVA Pad-Mounted Transformer Market Size, By Region, 2013-2020 (USD Million)

Table 15 Rated Power >1 MVA Market Size, By Region, 2013-2020 (USD Million)

Table 16 By Market Size, By End User, 2013-2020 (USD Million)

Table 17 Residential End User Pad-Mounted Transformers Market Size, By Region, 2013-2020 (USD Million)

Table 18 Residential End User By Market Size, By Rated Power, 2013-2020 (USD Million)

Table 19 Residential End User By Market Size, By Phase, 2013-2020 (USD Million)

Table 20 Residential End User Pad-Mounted Transformers Market Size, By Insulation Type, 2013-2020 (USD Million)

Table 21 Commercial End User By Market Size, By Region, 2013-2020 (USD Million)

Table 22 Commercial End User By Market Size, By Rated Power, 2013-2020 (USD Million)

Table 23 Commercial End User By Market Size, By Phase, 2013-2020 (USD Million)

Table 24 Commercial End User By Market Size, By Insulation Type, 2013-2020 (USD Million)

Table 25 Industrial End User Pad Mounted Transformer Market Size, By Region, 2013-2020 (USD Million)

Table 26 Industrial End User By Market Size, By Phase, 2013-2020 (USD Million)

Table 27 Industrial End User By Market Size, By Rated Power, 2013-2020 (USD Million)

Table 28 Industrial End User By Market Size, By Insulation Type, 2013-2020 (USD Million)

Table 29 Pad Mounted Transformer Market Size, By Region, 2013-2020 (USD Million)

Table 30 Asia-Pacific: Pad Mounted Transformer Market Size, By Rated Power, 2013-2020 (USD Million)

Table 31 Asia-Pacific: By Pad-mounted Transformer Market Size, By Phase, 2013-2020 (USD Million)

Table 32 Asia-Pacific: By Market Size, By End User, 2013-2020 (USD Million)

Table 33 Asia-Pacific: By Market Size, By Insulation Type, 2013-2020 (USD Million)

Table 34 Asia-Pacific: By Market Size, By Country, 2013-2020 (USD Million)

Table 35 China: By Market Size, By Phase, 2013-2020 (USD Million)

Table 36 India: By Market Size, By Phase, 2013-2020 (USD Million)

Table 37 Japan: By Size, By Phase, 2013-2020 (USD Million)

Table 38 North America: By Pad-mounted Transformer Market Size, By Rated Power, 2013-2020 (USD Million)

Table 39 North America: By Market Size, By Phase, 2013-2020 (USD Million)

Table 40 North America: By Market Size, By End User, 2013-2020 (USD Million)

Table 41 North America: By Market Size, By Insulation Type, 2013-2020 (USD Million)

Table 42 North America: By Market Size, By Country, 2013-2020 (USD Million)

Table 43 U.S.: By Market Size, By Phase, 2013-2020 (USD Million)

Table 44 Canada: By Pad-mounted Transformer Market Size, By Phase, 2013-2020 (USD Million)

Table 45 Mexico: By Market Size, By Phase, 2013-2020 (USD Million)

Table 46 Europe: By Market Size, By Rated Power, 2013-2020 (USD Million)

Table 47 Europe: By Market Size, By Phase, 2013-2020 (USD Million)

Table 48 Europe: By Market Size, By End User, 2013-2020 (USD Million)

Table 49 Europe: By Market Size, By Insulation Type, 2013-2020 (USD Million)

Table 50 Europe: By Market Size, By Country, 2013-2020 (USD Million)

Table 51 Russia: By Market Size, By Phase, 2013-2020 (USD Million)

Table 52 Germany: By Market Size, By Phase, 2013-2020 (USD Million)

Table 53 U.K.: By Market Size, By Phase, 2013-2020 (USD Million)

Table 54 Middle East & Africa: By Pad-mounted Transformer Market Size, By Rated Power, 2013-2020 (USD Million)

Table 55 Middle East & Africa: By Market Size, By Phase, 2013-2020 (USD Million)

Table 56 Middle East & Africa: By Market Size, By End User, 2013-2020 (USD Million)

Table 57 Middle East & Africa: By Market Size, By Insulation Type, 2013-2020 (USD Million)

Table 58 Middle East & Africa: By Market Size, By Country, 2013-2020 (USD Million)

Table 59 Saudi Arabia: By Market Size, By Phase, 2013-2020 (USD Million)

Table 60 South Africa: By Market Size, By Phase, 2013-2020 (USD Million)

Table 61 UAE: By Market Size, By Phase, 2013-2020 (USD Million)

Table 62 South America: By Market Size, By Rated Power, 2013-2020 (USD Million)

Table 63 South America: By Market Size, By Phase, 2013-2020 (USD Million)

Table 64 South America: By Market Size, By End User, 2013-2020 (USD Million)

Table 65 South America: By Market Size, By Insulation Type, 2013-2020 (USD Million)

Table 66 South America: By Market Size, By Country, 2013-2020 (USD Million)

Table 67 Brazil: By Pad-mounted Transformer Market Size, By Phase, 2013-2020 (USD Million)

Table 68 Argentina: By Pad-mounted Transformer Market Size, By Phase, 2013-2020 (USD Million)

Table 69 Contract & Agreements, 2012-2015

Table 70 Expansions, 2012-2015

Table 71 New Product Developments, 2012-2015

Table 72 Mergers & Acquisitions, 2012-2015

Table 73 Other Developments, 2012-2015

Table 74 Contracts & Agreements

Table 75 Expansions

List of Figures (58 Figures)

Figure 1 Research Design: Pad-Mounted Transformer Market

Figure 2 Bottom-Up Approach

Figure 3 Top-Down Approach

Figure 4 Assumptions of the Research Study

Figure 5 Limitations of the Research Study

Figure 6 Asia-Pacific Dominated the Pad Mounted Transformer Market in 2014

Figure 7 Liquid-Immersed Pad-Mounted Transformers Dominated the Pad Mounted Transformer Market, in 2014

Figure 8 Asia-Pacific is A Potential Market for Pad-Mounted Transformers

Figure 9 Pad-Mounted Market, Industrial End User, 2015-2020 (USD Million)

Figure 10 High T&D Investments in Asia-Pacific Will Create Opportunities for Pad-Mounted Transformer Market

Figure 11 > 1 MVA Rated Pad-Mounted Transformer to Account for A Major Share (By Value) During the Forecast Period

Figure 12 Industrial End Users Accounted for A Major Share (By Value) of the Pad Mounted Transformer Market in 2014

Figure 13 Asia-Pacific Held Major Share in the Pad Mounted Transformer Market, in 2014

Figure 14 Three Phase Pad Mounted Transformer Estimated to Account for Largest Market Share (Value) By 2020

Figure 15 Market Segmentation: By Rated Power, Type, Phase, End User & Region

Figure 16 Pad Mounted Transformer Market Segmentation: By Cooling Type

Figure 17 Pad Mounted Transformer Market: By Region

Figure 18 Replacement of Aging Infrastructure to Propel Market Growth

Figure 19 Global Steel Price (Jan, 2012 – Dec, 2015) in USD/Tone

Figure 20 Global Aluminum Price (Jan, 2012 – Dec, 2015) in USD/Tone

Figure 21 Global Copper Price (Jan, 2012 – Dec, 2015) in USD/Tone

Figure 22 Value Chain Analysis

Figure 23 Porter’s Five Forces Analysis: Intensity of Competitive Rivalry is High in the Pad-Mounted Transformer Market

Figure 24 Market Share (Value), By Phase, 2014

Figure 25 Market Share (Value), By Phase, 2014

Figure 26 Market Share (Value), By Rated Power, 2014

Figure 27 <1 MVA Power Rated Pad-Mounted Transformers are Expected to Grow at the Highest CAGR

Figure 28 Market Share (Value), By End User, 2014

Figure 29 Market Share (Value), By Region, 2014

Figure 30 Regional Snapshot – Growth Rate of Pad Mounted Transformer Market in Important Countries, 2015–2020

Figure 31 Asia-Pacific Pad Mounted Transformer Market Overview (2014)

Figure 32 North America Pad Mounted Transformer Market Overview (2014)

Figure 33 Companies Adopted Contracts & Agreements and Expansions to Capture the Markets (2012-2015)

Figure 34 Market Evaluation Framework: Top Companies on the Basis of Developments (2012-2015)

Figure 35 Market Evaluation Framework: Top Companies on the Basis of Market Share (2014)

Figure 36 Market Evaluation Framework: Contracts & Agreements, and Expansions Have Fuelled the Growth of Companies During 2012-2015

Figure 37 Geographic Revenue Mix of Top Five Players

Figure 38 ABB Ltd.: Company Snapshot

Figure 39 SWOT Analysis: ABB Ltd.

Figure 40 Eaton: Company Snapshot

Figure 41 SWOT Analysis: Eaton Corporation PLC

Figure 42 GE: Company Snapshot

Figure 43 SWOT Analysis: GE

Figure 44 Schneider Electric Co.: Company Snapshot

Figure 45 SWOT Analysis: Schneider Electric

Figure 46 Siemens: Company Snapshot

Figure 47 SWOT Analysis: Siemens AG

Figure 48 Crompton Greaves Limited: Company Snapshot

Figure 49 Ermco: Company Snapshot

Figure 50 Federal Pacific: Company Snapshot

Figure 51 Hitachi: Company Snapshot

Figure 52 Moloney Electric, Inc. : Company Snapshot

Figure 53 Olsun Electric Corporation: Company Snapshot

Figure 54 Pacific Crest Transformers, Inc. : Company Snapshot

Figure 55 Pearl Electric: Company Snapshot

Figure 56 Vantran Industries, Inc. : Company Snapshot

Figure 57 Wehzhou Rockwell Transformer Co.: Company Snapshot

Figure 58 RT Snapshot

Growth opportunities and latent adjacency in Pad-mounted Transformer Market