Smart Grid Security Market by Solution, Service, Deployment Mode (Cloud, On-premises), Subsystem (SCADA/ICS, AMI, Demand Response, and Home Energy Management), Security Type (Endpoint, Network, Application, Database), and Region - Global Forecast to 2021

[157 Pages Report] The smart grid security market size is estimated to grow from USD 4.29 billion in 2016 to USD 7.00 billion by 2021, at a Compound Annual Growth Rate (CAGR) of 10.3% during the forecast period. 2015 is considered the base year, while the forecast period is 20162021.

Smart Grid Security Market Dynamics:

Drivers

- Global development of smart grids

- Increased sophistication of cyber-attacks

- Need to comply with standards and regulations

Restraints

- Lack of security awareness among smart grid stakeholders

Opportunities

- Continuous evolution of smart grid

- Integrated offering of smart grid IT and cybersecurity solutions

Challenges

- Maintain cybersecurity standards over time

Global Developments of Smart Grids:

Most of the countries are transforming the traditional grid to smart grid technology. There are around 100 smart grid deployment projects across the globe, distributed among various phases of the smart grid deployment such as Advanced Metering Infrastructure Residential (AMI R), Advanced Metering Infrastructure Industrial (AMI I), Peak Load Management (PLM), Outage Management System (OMS), and Power Quality Management (PQM).

The most number of smart grid projects in North America are in developed countries such as the U.S. and Canada. A large number of smart grid projects in U.S. are funded by the American Recovery and Reinvestment Act of 2009 (ARRA). The Smart Grid Fund in Canada has been supporting the deployment projects since 2011. Asian countries have the second largest number of smart grid projects with the Indian Smart Grid Forum accounting for the highest implementation of smart grid projects in India. The New Energy and Industrial Technology Development Organization (NEDO), along with local utility bodies, is implementing smart grid projects in Japan.

To know about the assumptions considered for the study, download the pdf brochure

The following are the major objectives of the study:

- To define, describe, and forecast the global smart grid security market on the basis of components (solutions and services), deployment modes, subsystems, enforcement areas, and regions

- To provide a detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and detail the competitive landscape for the market leaders

- To forecast the market size of the various market-segments with respect to the regions (along with countries), namely, North America, Europe, Asia-Pacific, Middle-East & Africa (MEA), and Latin America

- To strategically profile key players and comprehensively analyze their growth strategies and core competencies2

- To track and analyze competitive developments, such as partnerships & collaborations, mergers & acquisitions, business expansions, new product launches, and Research & Development (R&D) activities in the market

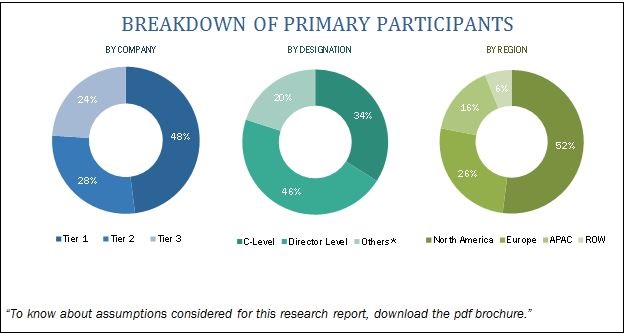

The research methodology used to estimate and forecast the global market begins with capturing data on key vendors revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global smart grid security market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments. The breakdown of primary profiles is depicted in the below figure:

The smart grid security market ecosystem comprises smart grid security vendors, such as BAE Systems PLC (U.K.), IBM Corporation (U.S.), Cisco Systems, Inc. (U.S.), Intel Corporation (Intel Security) (U.S.), Siemens AG (Germany), Symantec Corporation (U.S.), N-Dimension Solutions (Canada), Elster Solutions (U.S.), AlertEnterprise (U.S.), and Leidos (U.S.); service providers; system integrators; and enterprises. Other stakeholders of the market include security service providers, national/state governments, cloud service providers, utility companies, IT service providers, resellers, enterprise users, and technology providers.

Major Market Developments: Smart Grid Security Market

In November 2016, Siemens expanded its strategic alliance with Atos and strengthened its capabilities in the field of Industrial Security, Machine Intelligence, Industrial Data Analytics, Service Enhancing Technologies and Web of Systems.

In October 2016, N-Dimension partnered with Wortham Power Gen Insurance, a leading power utility insurance broker, to deliver a cost-effective security solution to utility companies along with backup insurance.

In August 2016, IBM launched a group of cyber security professionals and ethical hackers named IBM X-Force Red. The group is aimed at detecting the vulnerabilities in organizations IT infrastructure and mitigating the cyber threats.

Key Target Audience

- National/state governments

- Municipal authorities

- Utility companies

- IT solution providers

- Smart grid security companies

- Cloud service providers

- System integrators

- Information security consulting firms

- Networking solution providers

- IT security agencies

The study answers several questions for the stakeholders, primarily, which market segments to focus in the next two to five years for prioritizing the efforts and investments.

Scope of the Smart Grid Security Market Research Report

|

Report Metrics |

Details |

|

Market size available for years |

20162021 |

|

Base year considered |

2015 |

|

Forecast period |

20162021 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Solution, Service, Deployment Mode (Cloud, On-premises), Subsystem (SCADA/ICS, AMI, Demand Response, and Home Energy Management), Security Type (Endpoint, Network, Application, Database), and Region |

|

Geographies covered |

North America, Europe, Asia-Pacific, Middle-East & Africa (MEA), and Latin America |

|

Companies covered |

BAE Systems PLC (U.K.), IBM Corporation (U.S.), Cisco Systems, Inc. (U.S.), Intel Corporation (Intel Security) (U.S.), Siemens AG (Germany), Symantec Corporation (U.S.), N-Dimension Solutions (Canada), Elster Solutions (U.S.), AlertEnterprise (U.S.), and Leidos (U.S.) |

The research report categorizes the Smart Grid Security Market to forecast the revenues and analyze trends in each of the following subsegments:

By Solution

- Antivirus and antimalware

- Firewall

- Identity and Access Management (IAM)

- Encryption

- Security and vulnerability management

- Intrusion Detection System/Intrusion Prevention System (IDS/IPS)

- Distributed Denial of Service (DDoS)

- Others (Data Loss Prevention (DLP), incident response, fraud detection, and Security Information and Event Management (SIEM))

Smart Grid Security Market Research By Service

- Professional services

- Consulting

- Education and training

- Support and maintenance

- Managed services

By Deployment Mode

- Cloud

- On-Premises

By Subsystem

- Supervisory Control and Data Acquisition (SCADA)/Industrial Control System (ICS)

- Advanced metering infrastructure

- Demand response

- Home energy management

By Security Type

- Endpoint security

- Network security

- Application security

- Database security

By Region

- North America

- Europe

- Middle East and Africa (MEA)

- Asia-Pacific (APAC)

- Latin America

- Critical questions which the report answers

- What are the new opportunities which the smart grid security vendors are exploring?

- Who are the key players in the market and how intense is the competition?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North American smart grid security market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

The smart grid security market size is expected to grow from USD 4.29 billion in 2016 to USD 7.00 billion by 2021, at a Compound Annual Growth Rate (CAGR) of 10.3% during the forecast period. The major growth drivers of the market include the global development of smart grids and increased sophistication of cyber-attacks.

The smart grid security market includes solutions and services that are provided to secure the critical infrastructure of a smart grid. A whole new range of applications and technologies, such as Supervisory Control and Data Acquisition (SCADA)/Industrial Control System (ICS), Advanced Metering Infrastructure (AMI), demand response management system, and home energy management are introduced in the grid system to improve the transmission & distribution process and minimize energy consumption.

Major security types in smart grid security are network security, application security, database security, and endpoint security. The application security is expected to grow at the highest CAGR during the forecast period because of the growing trends of smart grid, Internet of Things (IoT), and connected devices.

Network security holds the largest share of the smart grid security market in 2016. The growth is fuelled by the growing attacks on the critical infrastructure in utility organizations. The application security is expected to grow at the highest CAGR during the forecast period due to the increasing adoption of web and mobile-based business applications, which are susceptible to advanced cyber threats. The demand-response subsystem is expected to grow at the highest CAGR, due to the rising need of organizations to balance the energy demand and supply and for efficient business operations.

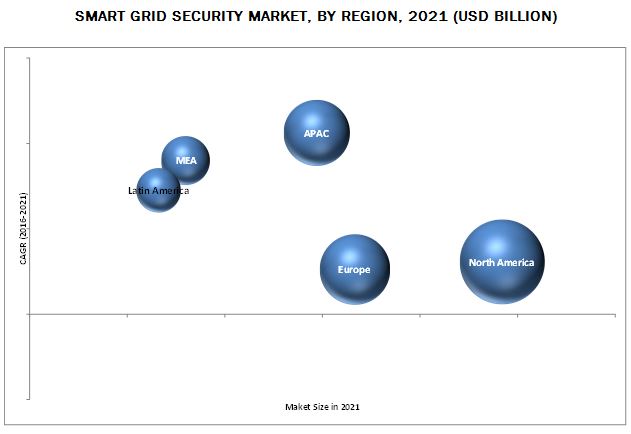

The global market has been segmented on the basis of regions into North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America to provide a region-specific analysis in the report. The North American region, followed by Europe, is expected to become the largest revenue generating region for smart grid security vendors in 2016. This is mainly because in the developed economies of the U.S. and Canada, there is high focus on innovations obtained from research and development and technology. The APAC region is expected to be the fastest growing region in the smart grid security market. The growth in this region is primarily driven by the growing adoption of smart grid, web, and mobile-based business applications.

Security of various smart grid subsystems is crucial to make them perform their individual functions efficiently

Supervisory Control and Data Acquisition /Industrial Control System

ICS is a software & hardware integrated system that controls and monitors the industrial operations performed by different machineries. ICS includes different technologies, such as Distributed Control Systems (DCS), SCADA, and PLC. SCADA is a process control software application that acquires real-time information from different locations and controls equipment & conditions. It includes hardware and software components and is used in power plants. ICS security is the ability of organizations to secure their automation processes and related critical information from cyber intrusions for an uninterrupted and sustained productivity of utilities & grids. Securing these systems has become a major concern in the present age of APTs, such as Stuxnet and Havex RAT. Hence, the market for ICS/SCADA security seems to witness a significant share in the total smart grid security market.

Advanced Metering Infrastructure

AMI is the combination of devices, solutions, and services that enables two-way communication between utilities and consumers. AMI detects outages and facilitates real-time energy consumption patterns for end-users, thereby providing personalized tariff plans & other enhanced services. A continual stream of revenue is not only generated by smart meter rollouts, but also through appropriate services & capabilities in Meter Communication Infrastructure (MCI) and Meter Data Management (MDM). Due to these functions and features of AMI, it becomes an important component in the smart grid infrastructure, whose protection is key objective of the utility companies. The rapid adoption of smart grid technology in emerging economies indicates the growth of AMI security in the recent years.

Demand Response

Demand response is a change in the energy consumption of an electric utility customer to enhance the balance of demand for power with the supply. Due to the difficulties in energy storage, the power companies try to match the demand & supply of the electricity using demand response system. This avoids the consequences of generating excess energy and getting trapped in power shortage situations. As demand response management systems is a critical and essential part of smart grid infrastructure, the attack on the system causes huge loss to utility companies. Thus, smart grid industry is heavily deploying demand response security solutions and the market segment is expected to grow significantly in the future.

- Critical questions which the report answers

- What are the new opportunities which the smart grid security vendors are exploring?

- Who are the key players in the market and how intense is the competition?

The smart grid security market faces challenges related to maintenance of cyber security standards over time and upgradation of communication protocols. Factors such as lack of security awareness among smart grid stakeholders limit the market growth.

Major vendors that offer smart grid security solutions across the globe are BAE Systems PLC (U.K.), IBM Corporation (U.S.), Cisco Systems, Inc. (U.S.), Intel Corporation (Intel Security) (U.S.), Siemens AG (Germany), Symantec Corporation (U.S.), N-Dimension Solutions (Canada), Elster Solutions (U.S.), AlertEnterprise (U.S.), and Leidos (U.S.). These vendors have adopted different types of organic and inorganic growth strategies such as new product launches, partnerships & collaborations, and mergers & acquisitions to expand their offerings in the smart grid security market.

To speak to our analyst for a discussion on the above findings, clicking on the Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data Points Taken From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in Smart Grid Security Market

4.2 Market By Security Type

4.3 Market By Region and Solution

4.4 Market Potential

4.5 Lifecycle Analysis, By Region, 2016

5 Smart Grid Security Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 By Solution

5.3.2 By Service

5.3.3 By Deployment Mode

5.3.4 By Subsystem

5.3.5 By Security Type

5.3.6 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Global Development of Smart Grids

5.4.1.2 Increased Sophistication of Cyberattacks

5.4.1.3 Need to Comply With Standards and Regulations

5.4.2 Restraints

5.4.2.1 Lack of Security Awareness Among Smart Grid Stakeholders

5.4.3 Opportunities

5.4.3.1 Continuous Evolution of Smart Grids

5.4.3.2 Integrated Offering of Smart Grid IT and Cybersecurity Solutions

5.4.4 Challenges

5.4.4.1 Maintaining Cybersecurity Standards Over Time

6 Industry Trends (Page No. - 44)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Strategic Benchmarking

6.4 Smart Grid Security Standards

6.4.1 National Institute of Standards and Technology (NIST)

6.4.2 Ieee Smart Grid

6.4.3 Enisa

7 Smart Grid Security Market Analysis, By Solution (Page No. - 47)

7.1 Introduction

7.2 Firewall

7.3 Identity and Access Management (IAM)

7.4 Antivirus/Antimalware

7.5 Encryption

7.6 Security and Vulnerability Management (SVM)

7.7 Intrusion Detection System/Intrusion Prevention System (IDS/IPS)

7.8 Distributed Denial of Service (DDOS)

7.9 Others

8 Market Analysis, By Service (Page No. - 57)

8.1 Introduction

8.2 Professional Services

8.2.1 Consulting

8.2.2 Education and Training

8.2.3 Support and Maintenance

8.3 Managed Services

9 Market Analysis, By Deployment Mode (Page No. - 63)

9.1 Introduction

9.2 Cloud

9.3 On-Premises

10 Smart Grid Security Market Analysis, By Subsystem (Page No. - 67)

10.1 Introduction

10.2 Supervisory Control and Data Acquisition/Industrial Control System (SCADA/ICS)

10.3 Advanced Metering Infrastructure (AMI)

10.4 Demand Response

10.5 Home Energy Management

11 Market Analysis, By Security Type (Page No. - 73)

11.1 Introduction

11.2 Endpoint Security

11.3 Network Security

11.4 Application Security

11.5 Database Security

12 Market Analysis, By Region (Page No. - 78)

12.1 Introduction

12.2 North America

12.2.1 United States

12.2.2 Canada

12.3 Europe

12.3.1 United Kingdom

12.3.2 Germany

12.3.3 France

12.3.4 Rest of Europe (Spain, Denmark and Italy)

12.4 Asia-Pacific (APAC)

12.4.1 China

12.4.2 Japan

12.4.3 Australia

12.4.4 Rest of APAC (India, Singapore, South Korea, and Malaysia)

12.5 Middle East and Africa

12.5.1 The Middle East (UAE, Saudi Arabia, Turkey)

12.5.2 Africa (South Africa and Nigeria)

12.6 Latin America

12.6.1 Brazil

12.6.2 Mexico

12.6.3 Rest of Latin America (Argentina, Colombia, and Chile)

13 Market, Competitive Landscape (Page No. - 103)

13.1 Overview

13.2 Vendor Analysis

13.3 Competitive Situation and Trends

13.3.1 New Product Launches

13.3.2 Agreements, Partnerships, and Collaborations

13.3.3 Mergers and Acquisitions

13.3.4 Business Expansions

14 Company Profiles (Page No. - 112)

14.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

14.2 BAE Systems PLC

14.3 IBM Corporation

14.4 Cisco Systems, Inc.

14.5 Intel Security (Mcafee)

14.6 Siemens AG

14.7 Symantec Corporation

14.8 N-Dimension Solutions, Inc.

14.9 Elster Solutions

14.10 Alertenterprise

14.11 Leidos

14.12 Key Innovators

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 145)

15.1 Other Developments

15.1.1 Other Developments: Partnerships, Agreements, and Collaborations

15.1.2 Other Developments: New Product Launches

15.2 Industry Experts

15.3 Discussion Guide

15.4 Knowledge Store: Marketsandmarkets Subscription Portal

15.5 Introduction RT: Real-Time Market Intelligence

15.6 Available Customizations

15.7 Related Reports

15.8 Author Details

List of Tables (72 Tables)

Table 1 Smart Grid Security Market Size and Growth Rate, 20142021 (USD Million, Y-O-Y %)

Table 2 Market Size, By Solution, 20142021 (USD Million)

Table 3 Firewall Solution: Market Size, By Region, 20142021 (USD Million)

Table 4 IAM Solution: Market Size, By Region, 20142021 (USD Million)

Table 5 Antivirus/Antimalware Solution: Market Size, By Region, 20142021 (USD Million)

Table 6 Encryption Solution: Market Size, By Region, 20142021 (USD Million)

Table 7 SVM Solution: Market Size, By Region, 20142021 (USD Million)

Table 8 IDS/IPS Solution: Market Size, By Region, 20142021 (USD Million)

Table 9 DDOS Solution: Market Size, By Region, 20142021 (USD Million)

Table 10 Others Solution: Market Size, By Region, 20142021 (USD Million)

Table 11 Smart Grid Security Market Size, By Service, 20142021 (USD Million)

Table 12 Professional Services: Market Size, By Region, 20142021 (USD Million)

Table 13 Market Size, By Professional Service, 20142021 (USD Million)

Table 14 Consulting: Market Size, By Region, 20142021 (USD Million)

Table 15 Education and Training: Market Size, By Region, 20142021 (USD Million)

Table 16 Support and Maintenance: Market Size, By Region, 20142021 (USD Million)

Table 17 Managed Services: Market Size, By Region, 20142021 (USD Million)

Table 18 Market Size, By Deployment Mode, 20142021 (USD Million)

Table 19 Cloud Deployment Mode: Market Size, By Region, 20142021 (USD Million)

Table 20 On-Premises: Market Size, By Region, 20142021 (USD Million)

Table 21 Smart Grid Security Market Size, By Subsystem, 20142021 (USD Million)

Table 22 SCADA/ICS Subsystem: Market Size, By Region, 20142021 (USD Million)

Table 23 AMI Subsystem: Market Size, By Region, 20142021 (USD Million)

Table 24 Demand Response Subsystem: Market Size, By Region, 20142021 (USD Million)

Table 25 Home Energy Management Subsystem: Market Size, By Region, 20142021 (USD Million)

Table 26 Market Size, By Security Type, 20142021 (USD Million)

Table 27 Endpoint Security: Market Size, By Region, 20142021 (USD Million)

Table 28 Network Security: Market Size, By Region, 20142021 (USD Million)

Table 29 Application Security: Market Size, By Region, 20142021 (USD Million)

Table 30 Database Security: Market Size, By Region, 20142021 (USD Million)

Table 31 Smart Grid Security Market Size, By Region, 20142021 (USD Million)

Table 32 North America: Market Size, By Solution, 20142021 (USD Million)

Table 33 North America: Market Size, By Service, 20142021 (USD Million)

Table 34 North America: Market Size, By Professional Service, 20142021 (USD Million)

Table 35 North America: Market Size, By Deployment Mode, 20142021 (USD Million)

Table 36 North America: Market Size, By Subsystem, 20142021 (USD Million)

Table 37 North America: Market Size, By Security Type, 20142021 (USD Million)

Table 38 North America: Market Size, By Country, 20142021 (USD Million)

Table 39 Europe: Smart Grid Security Market, By Solution, 20162021 (USD Million)

Table 40 Europe: Market Size, By Service, 20142021 (USD Million)

Table 41 Europe: Market Size, By Professional Service, 20142021 (USD Million)

Table 42 Europe: Market Size, By Deployment Mode, 2014-2021 (USD Million)

Table 43 Europe: Market Size, By Subsystem, 2014-2021 (USD Million)

Table 44 Europe: Market Size, By Security Type, 20142021 (USD Million)

Table 45 Europe: Market Size, By Country, 20142021 (USD Million)

Table 46 APAC: Smart Grid Security Market, By Solution, 20162021 (USD Million)

Table 47 APAC: Market Size, By Service, 20142021 (USD Million)

Table 48 APAC: Market Size, By Professional Service, 20142021 (USD Million)

Table 49 APAC: Market Size, By Deployment Mode, 20142021 (USD Million)

Table 50 APAC: Market Size, By Subsystem, 20142021 (USD Million)

Table 51 APAC: Market Size, By Security Type, 20142021 (USD Million)

Table 52 APAC: Market Size, By Country, 20142021 (USD Million)

Table 53 MEA: Smart Grid Security Market, By Solution, 20162021 (USD Million)

Table 54 MEA: Market Size, By Service, 20142021 (USD Million)

Table 55 MEA: Market Size, By Professional Service, 20142021 (USD Million)

Table 56 MEA: Market Size, By Deployment Mode, 20142021 (USD Million)

Table 57 MEA: Market Size, By Subsystem, 20142021 (USD Million)

Table 58 MEA: Market Size, By Security Type, 20142021 (USD Million)

Table 59 MEA: Market Size, By Sub-Region, 20142021 (USD Million)

Table 60 Latin America: Smart Grid Security Market, By Solution, 20162021 (USD Million)

Table 61 Latin America: Market Size, By Service, 20142021 (USD Million)

Table 62 Latin America: Market Size, By Professional Service, 20142021 (USD Million)

Table 63 Latin America: Market Size, By Deployment Mode, 20142021 (USD Million)

Table 64 Latin America: Market Size, By Subsystem, 20142021 (USD Million)

Table 65 Latin America: Market Size, By Security Type, 20142021 (USD Million)

Table 66 Latin America: Market Size, By Country, 20142021 (USD Million)

Table 67 New Product Launches, 20152016

Table 68 Agreements, Partnerships, and Collaborations, 2016

Table 69 Mergers and Acquisitions, 20142016

Table 70 Business Expansions, 20142016

Table 71 Other Developments: Partnerships, Agreements, and Collaborations, 20142015

Table 72 Other Developments: New Product Launches, 20142015

List of Figures (54 Figures)

Figure 1 Smart Grid Security Market Research Methodology

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Smart Grid Security: Data Triangulation

Figure 6 North America Held Largest Share in Global Market in 2016

Figure 7 IAM Segment to Hold Largest Share in Smart Grid Security Market, By Solution, During 2016-2021 (USD Million)

Figure 8 Managed Services Segment to Record Higher Growth in Market During 2016-2021 (USD Million)

Figure 9 Cloud Segment to Record Higher Growth in Market, By Deployment Mode, During 2016-2021 (USD Million)

Figure 10 AMI Segment to Hold Largest Share in Market, By Subsystem, During 2016-2021 (USD Million)

Figure 11 Application Security Type to Record Highest Growth in Market During 2016-2021 (USD Million)

Figure 12 Large Scale Development of Smart Grids and Increased Sophistication of Cyberattacks to Create Remarkable Growth Opportunities

Figure 13 Application Security Type to Record Highest Growth During 2016-2021 (USD Million)

Figure 14 North America & IAM Segment Estimated to Hold Largest Share in Global Market, By Region & Solution in 2016

Figure 15 APAC to Record Highest Growth in Global Market, By Region, During 2016-2021 (USD Million)

Figure 16 Regional Lifecycle: APAC Market in the Growth Phase in 2016

Figure 17 Evolution of Smart Grid Security Market

Figure 18 Market Segmentation By Solution

Figure 19 Market Segmentation By Service

Figure 20 Market Segmentation By Deployment Mode

Figure 21 Market Segmentation By Subsystem

Figure 22 Market Segmentation By Security Type

Figure 23 Market Segmentation By Region

Figure 24 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 25 Smart Grid Projects Across the Globe

Figure 26 Value Chain Analysis

Figure 27 New Product Launches

Figure 28 IAM Solution to Hold Highest Share in Market During 2016-2021 (USD Million)

Figure 29 Managed Services to Record Highest Growth in Smart Grid Security Market During 2016-2021 (USD Million)

Figure 30 Cloud Deployment Mode to Record Higher Growth During 2016-2021 (USD Million)

Figure 31 AMI Subsystem to Hold Largest Share of Market During 2016-2021 (USD Million)

Figure 32 Application Security to Record Highest Growth During 2016-2021 (USD Million)

Figure 33 APAC to Offer Huge Growth Opportunities for Smart Grid Security Vendors During 2016-2021

Figure 34 APAC to Record Highest Growth in Global Market During 2016-2021 (USD Million)

Figure 35 North America Market Snapshot

Figure 36 APAC Market Snapshot

Figure 37 Top Companies Adopted New Product Launches as the Key Growth Strategy During 20142016

Figure 38 Vendor Analysis of Smart Grid Security Product Offerings

Figure 39 Vendor Analysis of Business Strategy

Figure 40 Market Evaluation Framework

Figure 41 Battle for Market Share: New Product Launches and Partnerships, Agreements, & Collaborations the Key Strategies Adopted By Leading Market Players Between 2014-2016

Figure 42 Geographic Revenue Mix of Top Players in Global Smart Grid Security Market

Figure 43 BAE Systems PLC: Company Snapshot

Figure 44 BAE Systems PLC: SWOT Analysis

Figure 45 IBM Corporation: Company Snapshot

Figure 46 IBM Corporation: SWOT Analysis

Figure 47 Cisco Systems, Inc.: Company Snapshot

Figure 48 Cisco Systems, Inc.: SWOT Analysis

Figure 49 Intel Security: Company Snapshot

Figure 50 Intel Security: SWOT Analysis

Figure 51 Siemens AG: Company Snapshot

Figure 52 Siemens AG: SWOT Analysis

Figure 53 Symantec Corporation: Company Snapshot

Figure 54 Leidos: Company Snapshot

Growth opportunities and latent adjacency in Smart Grid Security Market