Less Lethal Ammunition Market by End User (Law Enforcement, Military, Self Defense), Product (Rubber Bullets, Bean Bag Rounds, Plastic Bullets, Paintballs), Weapon Type (Shotguns, Launchers), and Region (2018-2023)

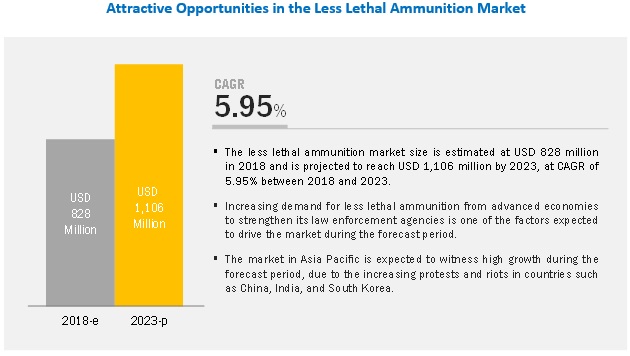

[156 Pages Report] The Less Lethal Ammunition Market size is expected to grow at a CAGR of 5.95% during the forecast period. Factors such as the increasing demand for less lethal ammunition such as rubber bullets, bean bag rounds, and smoke munitions across the world are expected to drive the less lethal ammunition market during the forecast period.

See how this study impacted revenues for other players in Less Lethal Ammunition Market

Client’s Problem Statement

Client contacted MarketsandMarkets Research with an intent to obtain a detailed report to understand market dynamics of less lethal cartridges, tactical cartridges, saluting cartridges and propellant launching cartridges for riot control, home defence, homeland security, prison control, among others. Furthermore, client also wanted to analyse major three manufacturers each for 15 NATO countries, along with market landscape, major legal requirements and procurement/distribution channels and, networks through which import/export of products takes place in the country.

MnM Approach

This will have information on market interconnectedness MnM assisted the client with an outside-in perspective on the market potential of various less lethal shotgun ammunition types used for different application such as law enforcement sports, hunting and shooting and military and self-defence among others. Further, MnM identified laws, policies, distribution/procurement channels, relevant to less lethal ammunition for the countries identified by the client such as U.S., Canada, Russia, France, Germany, China, Bangladesh, Indonesia and Turkey among others.

Revenue Impact (RI)

Our work resulted in the client with a projected market potential of $1.1 Bn in the time period of 5 years.

By end user, law enforcement segment is projected to grow at the highest CAGR during the forecast period.

Based on end user, the less lethal ammunition market is segmented into law enforcement, military, self-defense, and others. The law enforcement segment is projected to grow at the highest CAGR during the forecast period. The growth of this segment can be attributed to the rising trend of militarization of law enforcement agencies worldwide, along with increasing incidences of political disputes and civil unrest.

The rubber bullets segment is expected to lead the less lethal ammunition market during the forecast period.

Based on product, the rubber bullets segment estimated to lead the less lethal ammunition market in 2018. Due to an increase in protests and riots across the world, most countries prefer rubber bullets to bring situations under control. For example, In 2018, the police personnel in Gauteng used rubber bullets to disperse about 2,000 workers belonging to the National Union of Public Service and Allied Workers (Nupsaw), who were protesting outside Dis-Chem's office in Midrand, Johannesburg. In addition, the police of Argentina fired rubber bullets at protesters who marched in front of the Congress against the upcoming 2019 Budget Bill, which contains steep spending cuts aimed at erasing the country's fiscal deficit.

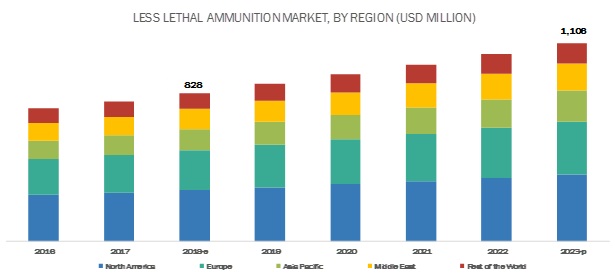

North America expected to be the largest market for less lethal market during the forecast period.

North America is expected to lead the less lethal ammunition market during the forecast period. One of the key factors driving the market is the continuous upgrade of non-lethal weapons and munitions with the latest technologies. The US is the major country increasingly investing in less lethal ammunition and related technologies.

Key Market Players

Key players profiled in the less lethal ammunition market report include The Safariland Group (US), Combined Systems, Inc. (US), Federal Ammunition (US), Nonlethal Technologies (US), Rheinmetall AG (Germany), ST Engineering (Singapore), Security Devices International, Inc. (US), Lamperd Less Lethal, Inc. (Canada), Condor Non-Lethal Technologies (Brazil), Less Lethal Africa (South Africa), MAXAM Outdoors S.A. (Spain), and Sellier & Bellot (Czech Republic), among others). Acquisitions, agreements, and new product launches were the key strategies adopted by the industry players to achieve growth in the less lethal ammunition market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Product, End User, Weapon Type, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, the Middle East, and Rest of the World |

|

Companies covered |

The Safariland Group (US), Combined Systems Inc. (US), Less Lethal Africa (South Africa), ST Engineering (Singapore), and Lightfield Ammunition Corporation (US), among others |

This research report categorizes the global less lethal ammunition market into the following segments and subsegments:

Less Lethal Ammunition Market, By End User

- Law Enforcement

- Military

- Self Defense

- Other (Sporting and Wildlife Control Agencies)

Less Lethal Ammunition Market, By Product

- Rubber Bullets

- Bean Bag Rounds

- Polyethylene/Plastic Bullets

- OC/CS and Smoke Munitions

- Flash Bang Rounds

- Paintballs

- Other (Wax Bullets, Wooden Bullets, Sponge Grenades)

Less Lethal Ammunition Market, By Weapon Type

-

Shotguns, By Caliber

- 12 gauge

- Others (16 gauge, 20 gauge, 410 gauge)

-

Launchers, By Caliber

- 37/38mm

- 40mm

- Others

- Others (Pistols, Rifles, Paintball Guns)

Less Lethal Ammunition Market, By Region

-

North America

- US

- Canada

-

Europe

- UK

- France

- Germany

- Russia

- Rest of Europe

-

Asia Pacific

- India

- China

- Japan

- Australia

- Rest of Asia Pacific

-

Middle East

- Turkey

- Israel

- Saudi Arabia

- Rest of Middle East

-

Rest of the World

- Africa

- Latin America

Recent Developments

- Defense Technology, a brand of The Safariland Group, launched 40mm Blunt Impact Projectile (BIP) Collapsible Gel Rounds.

- Rheinmetall received a contract worth USD 3 million from the US Marine Corps to supply day and night-capable 40mm x 46 practice cartridges. These cartridges contain no environmentally damaging substances and are being produced by American Rheinmetall Munitions, Inc.

- Lamperd Less Lethal, Inc. announced the signing of an agreement with Defense Optics Group Corporation that deals with dealers in the UK, Africa, Canada, and the US.

Key Questions

- How will the drivers, challenges, and opportunities for the less lethal ammunition market affect its dynamics and the subsequent market analysis of the associated trends?

- What are the key sustainability strategies adopted by leading players operating in the less lethal ammunition market?

- Who are the upcoming disrupters in this market that can be potential targets for partnership/mergers?

- Who are the top players operating in this market?

- Where are the new geographies that can be potential revenue pockets for less lethal ammunition?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Growth Opportunities in Less Lethal Ammunition Market

4.2 Less Lethal Ammunition Market, By Product

4.3 Less Lethal Ammunition Market, By Weapon Type

4.4 Shotguns Less Lethal Ammunition Market Share, By Caliber, 2018 (%)

4.5 Asia Pacific Less Lethal Ammunition Market, By Weapon Type and Country

4.6 Less Lethal Ammunition Market, By Region

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Political Disputes and Civil Unrest

5.2.1.2 Increasing Demand for Alternative of Lead Loads Ammunition for Police Shooting

5.2.2 Restraints

5.2.2.1 Stringent Environmental and Governmental Regulations

5.2.3 Opportunities

5.2.3.1 Increase in Development of Advanced and Environment-Friendly Less Lethal Ammunition

5.2.3.2 Increasing Budget Allocation to Law Enforcement Agencies for the Use of Less Lethal Ammunition

5.2.4 Challenges

5.2.4.1 Trafficking and Indiscriminate Use of Less Lethal Ammunition

5.2.4.2 Apprehensions Among End Users

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Technology Trends

6.2.1 Less Lethal Directed Energy Laser Weapons

6.2.2 Multimeter-Wave Electromagnetic

6.2.3 Pulsed-Energy Projectile (PEP)

6.2.4 Electromagnetic Pulse Bomb (E-Bomb)

6.2.5 Malodorants

6.2.6 Calmative Agents

6.3 Innovation & Patent Registrations

7 Less Lethal Ammunition Market, By End User (Page No. - 47)

7.1 Introduction

7.2 Law Enforcement

7.2.1 Law Enforcement Segment is Growing at the Highest Growth Rate

7.3 Military

7.3.1 Military Forces Use Less Lethal Ammunition for Safeguarding Critical Facilities and Special Operation Among Others

7.4 Self Defense

7.4.1 Less Lethal Ammunition Plays A Pivotal Role for Personal Safety

7.5 Others

8 Less Lethal Ammunition Market, By Product (Page No. - 49)

8.1 Introduction

8.2 Rubber Bullet

8.2.1 The Use of 12-Gauge Shotgun and 40mm Rubber Bullet, Drives the Market of Less Lethal Ammunition

8.3 Bean Bag Rounds

8.3.1 37/40mm Bean Bag Rounds are Mostly Used as A Crowd Control Management By Law Enforcement Agency

8.4 Polyethylene/Plastic Bullets

8.4.1 India Mostly Use Plastic Bullets as A Less Lethal Ammunition

8.5 OC/CS & Smoke Munitions

8.5.1 Smoke Munitions is Widely Used for Medium to Long Distance to Ensure the Physical Integrity of Law Enforcement

8.6 Flash Bang Rounds

8.6.1 Due to Unbearable Producing Sound Between 140-180 DB, It is Widely Accepted By All the Countries

8.7 Paintballs

8.7.1 Widely Used By Law Enforcement Agencies for Tactical Combat Training and Crowd Control

8.8 Others

9 Less Lethal Ammunition Market, By Weapon Type (Page No. - 53)

9.1 Introduction

9.2 Shotguns

9.2.1 12 Gauge

9.2.1.1 12 -Gauge Shotguns are Commonly Used to Fire A Number of Projectiles

9.2.2 Others

9.3 Launchers

9.3.1 37/38mm

9.3.1.1 Suitable for Shooting Range of 50m Or Closer

9.3.2 40mm

9.3.2.1 40mm Less Lethal Ammunition Market is Growing at the Highest Growth Rate

9.3.3 Others

9.4 Others

10 Regional Analysis (Page No. - 57)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 Increasing R&D for Techno-Efficient Less Lethal Ammunition is Driving the US Market

10.2.2 Canada

10.2.2.1 Riots/Unrest in Canada Leads to Procurement of New Less Lethal Ammunition

10.3 Europe

10.3.1 UK

10.3.1.1 Increasing Threats From International and Domestic Terrorism, Espionage and Other Hostile Foreign Activity, Drive the Market of Less Lethal Ammunition in the Uk

10.3.2 Russia

10.3.2.1 Rubber Bullets Segment in Russia is Projected to Grow at the Highest Growth Rate

10.3.3 Germany

10.3.3.1 Significant Technological Advancement in the Riot Policing Sector Would Drive the Less Lethal Ammunition Market

10.3.4 France

10.3.4.1 The Growth of Less Lethal Ammunition in France is Due to Significant Progress in Safeguarding Its Internal Security

10.3.5 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.1.1 Factors Such as Unrest Due to Turmoil in Tibetan Region and Infiltration in the Country, Would Drive Less Lethal Market in China

10.4.2 India

10.4.2.1 Plastic Bullets is Projected to Grow at the Highest Growth Rate in India

10.4.3 Japan

10.4.3.1 The Factors Such as Protest Government and Unrest in the Country, Will Drive the Less Lethal Ammunition Market in Japan

10.4.4 Australia

10.4.4.1 Law Enforcement Segment is Projected to Grow at the Highest Growth Rate

10.4.5 Rest of Asia Pacific

10.5 Middle East

10.5.1 Israel

10.5.1.1 Increase in Investment for the Procurement of Advanced Less Lethal Ammunition Will Drive the Market in Israel

10.5.2 Turkey

10.5.2.1 Internal Security is One of the Major Factor Which Will Drive the Less Lethal Ammunition Market in Turkey

10.5.3 Saudi Arabia

10.5.3.1 Increase in Funding for the Development of Less Lethal Ammunition Will Drive the Market in Saudi Arabia

10.5.4 Rest of the Middle East

10.6 Rest of the World

10.6.1 Latin America

10.6.1.1 Rubber Bullet Segment is Projected to Grow at the Highest Growth Rate in Latin America

10.6.2 Africa

10.6.2.1 Factors Such as Rising Cases of Corruption, Porous Border and Civil Unrest Will Drive This Market

11 Competitive Landscape (Page No. - 100)

11.1 Introduction

11.2 Top Players in the Less Lethal Ammunition Market

11.3 Competitive Situations and Trends

11.4 Procurement Agency and End User for Less Lethal Ammunition

11.5 Policy & Regulations for Less Lethal Ammunition

11.6 Manufacturers and Proprietors/Distributors/Dealers for Less Lethal Ammunition

12 Company Profiles (Page No. - 106)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Federal Ammunition

12.2 Lightfield Ammunition Corporation

12.3 Combined Systems, Inc.

12.4 Nonlethal Technologies, Inc

12.5 Security Devices International, Inc.

12.6 The Safariland Group

12.7 Mace Security International, Inc.

12.8 Amtec Less Lethal Systems Inc

12.9 Sage Control Ordnance, Inc

12.10 Winchester Ammunition

12.11 Lamperd Less Lethal, Inc.

12.12 Chemring Group PLC

12.13 Verney-Carron SA

12.14 Rheinmetall AG

12.15 Brenneke Ammunition GmbH

12.16 Trust Eibarres SA

12.17 Maxam Outdoors S.A.

12.18 China North Industries Corporation (Norinco)

12.19 Ispra Ltd

12.20 Condor Non-Lethal Technologies

12.21 Companhia Brasileira De Cartuchos (CBC)

12.22 Less Lethal Africa

12.23 Industrial Cartridge (Pty) Ltd

12.24 ST Engineering

12.25 Aguila Ammunition

12.26 Fiocchi Munizioni S.P.A.

12.27 Nobel Sport Security

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 150)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customization

13.3.1 Country-Level Analysis

13.3.2 Additional Company Profiles (Upto 5)

13.4 Related Reports

13.5 Author Details

List of Tables (94 Tables)

Table 1 Countries Most Likely to Experience Civil Unrest

Table 2 Weapons & Equipment Used By Swat Teams in the U.S.

Table 3 Less Lethal Ammunition Market is Primarily Driven By Law Enforecement Agencies Due to Rising Unrest

Table 4 Stringent Environmental and Governmental Regulations Act as A Major Restraint for the Less Lethal Ammunition Market Growth

Table 5 Increasing Research and Development is Expected to Offer Significant Growth Opportunities in the Less Lethal Ammunition Market

Table 6 Trafficking and Indiscriminate Use of Less Lethal Ammunition is Posing Critical Challenges to the Industry

Table 7 Details of Active Denial Systems Technology for Non-Lethal Weapons

Table 8 Innovation & Patent Registrations

Table 9 Less Lethal Ammunition Market, By End User, 2016-2023 (USD Million)

Table 10 Less Lethal Ammunition Market, By Product, 2016-2023 (USD Million)

Table 11 Less Lethal Ammunition Market, By Weapon Type, 2016-2023 (USD Million)

Table 12 Shotguns Less Lethal Ammunition Market, By Caliber, 2016-2023 (USD Million)

Table 13 Launchers Less Lethal Ammunition Market, By Caliber, 2016-2023 (USD Million)

Table 14 Less Lethal Ammunition Market Size, By Region, 2018–2023 (USD Million)

Table 15 North America Less Lethal Ammunition Market Size, By Product, 2016–2023 (USD Million)

Table 16 North America Less Lethal Ammunition Market Size, By End User, 2016–2023 (USD Million)

Table 17 North America Less Lethal Ammunition Market Size, By Weapon Type, 2016–2023 (USD Million)

Table 18 North America Less Lethal Ammunition Market Size, By Country, 2016-2023 (USD Million)

Table 19 US Less Lethal Ammunition Market Size, By Product, 2016–2023 (USD Million)

Table 20 US Less Lethal Ammunition Market Size, By End User, 2016–2023 (USD Million)

Table 21 US Less Lethal Ammunition Market Size, By Weapon Type, 2016–2023 (USD Million)

Table 22 Canada: Distribution Channels of Less Lethal Ammunition Market

Table 23 Canada Less Lethal Ammunition Market Size, By Product, 2016–2023 (USD Million)

Table 24 Canada Less Lethal Ammunition Market Size, By End User, 2016–2023 (USD Million)

Table 25 Canada Less Lethal Ammunition Market Size, By Weapon Type, 2016–2023 (USD Million)

Table 26 Europe Less Lethal Ammunition Market Size, By Product, 2016–2023 (USD Million)

Table 27 Europe Less Lethal Ammunition Market Size, By End User, 2016–2023 (USD Million)

Table 28 Europe Less Lethal Ammunition Market Size, By Weapon Type, 2016–2023 (USD Million)

Table 29 Europe Less Lethal Ammunition Market Size, By Country, 2016-2023 (USD Million)

Table 30 UK: Distribution Channels of Less Lethal Ammunition Market

Table 31 UK Less Lethal Ammunition Market Size, By Product, 2016–2023 (USD Million)

Table 32 UK Less Lethal Ammunition Market Size, By Weapon Type, 2016–2023 (USD Million)

Table 33 UK Less Lethal Ammunition Market Size, By End User, 2016–2023 (USD Million)

Table 34 Russia Less Lethal Ammunition Market Size, By Product, 2016–2023 (USD Million)

Table 35 Russia Less Lethal Ammunition Market Size, By End User, 2016–2023 (USD Million)

Table 36 Russia Less Lethal Ammunition Market Size, By Weapon Type, 2016–2023 (USD Million)

Table 37 Germany Less Lethal Ammunition Market Size, By Product, 2016–2023 (USD Million)

Table 38 Germany Less Lethal Ammunition Market Size, By End User, 2016–2023 (USD Million)

Table 39 Germany Less Lethal Ammunition Market Size, By Weapon Type, 2016–2023 (USD Million)

Table 40 France Less Lethal Ammunition Market Size, By Product, 2016–2023 (USD Million)

Table 41 France Less Lethal Ammunition Market Size, By End User, 2016–2023 (USD Million)

Table 42 France Less Lethal Ammunition Market Size, By Weapon Type, 2016–2023 (USD Million)

Table 43 Rest of Europe Less Lethal Ammunition Market Size, By Product, 2016–2023 (USD Million)

Table 44 Rest of Europe Less Lethal Ammunition Market Size, By End User, 2016–2023 (USD Million)

Table 45 Rest of Europe Less Lethal Ammunition Market Size, By Weapon Type, 2016–2023 (USD Million)

Table 46 Asia Pacific Less Lethal Ammunition Market Size, By Product, 2016–2023 (USD Million)

Table 47 Asia Pacific Less Lethal Ammunition Market Size, By End User, 2016–2023 (USD Million)

Table 48 Asia Pacific Less Lethal Ammunition Market Size, By Weapon Type, 2016–2023 (USD Million)

Table 49 Asia Pacific Less Lethal Ammunition Market Size, By Country, 2016–2023 (USD Million)

Table 50 China Less Lethal Ammunition Market Size, By Product, 2016–2023 (USD Million)

Table 51 China Less Lethal Ammunition Market Size, By End User, 2016–2023 (USD Million)

Table 52 China Less Lethal Ammunition Market Size, By Weapon Type, 2016–2023 (USD Million)

Table 53 India Less Lethal Ammunition Market Size, By Product, 2016–2023 (USD Million)

Table 54 India Less Lethal Ammunition Market Size, By End User, 2016–2023 (USD Million)

Table 55 India Less Lethal Ammunition Market Size, By Cartridge Type, 2016–2023 (USD Million)

Table 56 Japan Less Lethal Ammunition Market Size, By Product, 2016–2023 (USD Million)

Table 57 Japan Less Lethal Ammunition Market Size, By End User, 2016–2023 (USD Million)

Table 58 Japan Less Lethal Ammunition Market Size, By Weapon Type, 2016–2023 (USD Million)

Table 59 Australia Less Lethal Ammunition Market Size, By Product, 2016–2023 (USD Million)

Table 60 Australia Less Lethal Ammunition Market Size, By End User, 2016–2023 (USD Million)

Table 61 Australia Less Lethal Ammunition Market Size, By Weapon Type, 2016–2023 (USD Million)

Table 62 Rest of Asia Pacific Less Lethal Ammunition Market Size, By Product, 2016–2023 (USD Million)

Table 63 Rest of Asia Pacific Less Lethal Ammunition Market Size, By End User, 2016–2023 (USD Million)

Table 64 Rest of Asia Pacific Less Lethal Ammunition Market Size, By Weapon Type, 2016–2023 (USD Million)

Table 65 Middle East Less Lethal Ammunition Market Size, By Product, 2016–2023 (USD Million)

Table 66 Midddle East Less Lethal Ammunition Market Size, By End User, 2016–2023 (USD Million)

Table 67 Middle East Less Lethal Ammunition Market Size, By Weapon Type, 2016–2023 (USD Million)

Table 68 Middle East Less Lethal Ammunition Market Size, By Country, 2016-2023 (USD Million)

Table 69 Israel Less Lethal Ammunition Market Size, By Product, 2016–2023 (USD Million)

Table 70 Israel Less Lethal Ammunition Market Size, By End User, 2016–2023 (USD Million)

Table 71 Israel Less Lethal Ammunition Market Size, By Weapon Type, 2016–2023 (USD Million)

Table 72 Turkey Less Lethal Ammunition Market Size, By Product, 2016–2023 (USD Million)

Table 73 Turkey Less Lethal Ammunition Market Size, By End User, 2016–2023 (USD Million)

Table 74 Turkey Less Lethal Ammunition Market Size, By Weapon Type, 2016–2023 (USD Million)

Table 75 Saudi Arabia Less Lethal Ammunition Market Size, By Product, 2016–2023 (USD Million)

Table 76 Saudi Arabia Less Lethal Ammunition Market Size, By End User, 2016–2023 (USD Million)

Table 77 Saudi Arabia Less Lethal Ammunition Market Size, By Weapon Type, 2016–2023 (USD Million)

Table 78 Rest of the Middle East Less Lethal Ammunition Market Size, By Product, 2016–2023 (USD Million)

Table 79 Rest of the Middle East Less Lethal Ammunition Market Size, By End User, 2016–2023 (USD Million)

Table 80 Rest of the Middle East Less Lethal Ammunition Market Size, By Weapon Type, 2016–2023 (USD Million)

Table 81 RoW Less Lethal Ammunition Market Size, By Product, 2016–2023 (USD Million)

Table 82 RoW Less Lethal Ammunition Market Size, By End User, 2016–2023 (USD Million)

Table 83 RoW Less Lethal Ammunition Market Size, By Weapon Type, 2016–2023 (USD Million)

Table 84 RoW Less Lethal Ammunition Market Size, By Country, 2016-2023 (USD Million)

Table 85 Israel Less Lethal Ammunition Market Size, By Product, 2016–2023 (USD Million)

Table 86 Latin America Less Lethal Ammunition Market Size, By End User, 2016–2023 (USD Million)

Table 87 Latin America Less Lethal Ammunition Market Size, By Cartridge Type, 2016–2023 (USD Million)

Table 88 Africa Less Lethal Ammunition Market Size, By Product, 2016–2023 (USD Million)

Table 89 Africa Less Lethal Ammunition Market Size, By End User, 2016–2023 (USD Million)

Table 90 Africa Less Lethal Ammunition Market Size, By Weapon Type, 2016–2023 (USD Million)

Table 91 Top Players in the Less Lethal Ammunition Market

Table 92 Less Lethal Ammunition: Procurement Agency and End User for Top Countries

Table 93 Less Lethal Ammunition: Procurement Agency and End User for Top Countries

Table 94 Less Lethal Ammunition Market: Manufacturers and Proprietors/Distributors/Dealers for Top Countries

List of Figures (33 Figures)

Figure 1 Less Lethal Ammunition Market Segmentation

Figure 2 Research Flow

Figure 3 Less Lethal Ammunition Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Assumptions of the Research Study

Figure 9 Law Enforcement Projected to Lead Less Lethal Ammunition Market From 2018-2023

Figure 10 Shotguns Segment Projected to Lead Less Lethal Ammunition Market During the Forecast Period

Figure 11 Asia Pacific Expected to Be the Game-Changer for Less Lethal Ammunition Market

Figure 12 Increasing Political Violence and Civil Unrest Worldwide Driving the Growth of Less Lethal Ammunition Market From 2018 to 2023

Figure 13 Rubber Bullet Segment Projected to Lead Less Lethal Ammunition Market From 2018 to 2023

Figure 14 Shotguns Segment Projected to Lead Less Lethal Ammunition Market From 2018 to 2023

Figure 15 12 Gauge Segment Projected to Lead Shotguns Less Lethal Ammunition Market From 2018 to 2023

Figure 16 Shotguns Segment to Lead Asia Pacific Less Lethal Ammunition Market in 2018

Figure 17 North America Segment Projected to Lead Less Lethal Ammunition Market From 2018 to 2023

Figure 18 Research and Development for the Alternatives of Lead Loads for Police Shooting Will Drive Less Lethal Ammunition Market

Figure 19 Key Instances of Political Violence and Unrest in the Middle East

Figure 20 Law Enforcement Segment Estimated to Lead the Market During the Forecast Period

Figure 21 Rubber Bullets Segment is Projected to Grow at the Highest CAGR From 2018 to 2023

Figure 22 Shotguns Less Lethal Ammunition Projected to Grow at the Highest CAGR During the Forecast Period

Figure 23 Asia Pacific Region Projected to Grow at the Highest CAGR During the Forecast Period

Figure 24 North America: Less Lethal Ammunition Market Snapshot

Figure 25 Europe: Less Lethal Ammunition Market Snapshot

Figure 26 Asia-Pacific Less Lethal Ammunition Market Snapshot

Figure 27 Companies Adopted New Product Launches and Acqisition as Key Growth Strategy

Figure 28 Security Devices International Inc: Company Snapshot

Figure 29 Mace Security International, Inc.: Company Snapshot

Figure 30 Lamperd Less Lethal, Inc.: Company Snapshot

Figure 31 Chemring Group PLC: Company Snapshot

Figure 32 Rheinmetall AG: Company Snapshot

Figure 33 ST Engineering: Company Snapshot

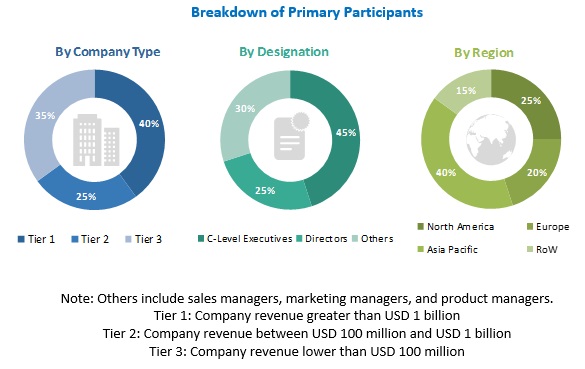

The research study that was conducted on the less lethal ammunition market involved extensive use of secondary sources, directories, and databases such as D&B Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the market. Primary sources that were considered included industry experts from the less lethal ammunition market as well as preferred distributors, suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this industry. In-depth interviews with various primary respondents, including key industry participants, Subject Matter Experts (SMEs), industry consultants, and C-level executives were conducted to obtain and verify critical qualitative and quantitative information pertaining to the less lethal ammunition market as well as assess the growth prospects of the market.

Secondary Research:

The market shares of companies in the less lethal ammunition market were determined using secondary data made available through paid and unpaid sources and analyzing the product portfolios of major companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources that were referred to for this research study on the less lethal ammunition market included financial statements of companies offering less lethal ammunition and information from various trade, business, and professional associations, among others. The secondary data was collected and analyzed to arrive at the overall size of the less lethal ammunition market that was further validated by the primary respondents.

Primary Research:

Extensive primary research was conducted after acquiring knowledge about the current scenario of the less lethal ammunition market through secondary research. Several primary interviews were conducted with market experts from both, demand- and supply-side across five major regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East, and Rest of the World. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the less lethal ammunition market.

The research methodology that was used to estimate the size of the less lethal ammunition market includes the following details:

- Key players in the less lethal ammunition market were identified through secondary research, and their market shares were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and were verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the less lethal ammunition market.

Data Triangulation

After arriving at the overall size of the less lethal ammunition market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below have been implemented, wherever applicable to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both, demand- and supply-side. Along with this, the market size was validated using both, the top-down and bottom-up approaches.

Report Objective

- To define, describe, segment, and forecast the less lethal ammunition market based on end user, product, weapon type, and region from 2018 to 2023

- To identify various subsegments of the less lethal ammunition market

- To provide in-depth market intelligence regarding key market dynamics and factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the less lethal ammunition market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the less lethal ammunition market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To forecast the market size of segments with respect to major regions, namely, North America, Europe, Asia Pacific, the Middle East, and Rest of the World (RoW)

- To analyze competitive developments such as long-term contracts, joint ventures and partnerships, new product launches, and research & development (R&D) activities in the less lethal ammunition market

- To provide a detailed competitive landscape of the less lethal ammunition market, in addition to an analysis of business and corporate strategies adopted by key market players

- To strategically profile key market players and comprehensively analyze their core competencies

Customizations available for the report

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of a company. The following customization options are available for the report:

Country-level Analysis

- Comprehensive market projections for countries categorized under North America, Europe, Asia Pacific, Middle East, and the Rest of the World

- A country-level analysis of the market based on product, end user, and weapon type can be provided

Company Information

- Detailed analysis and profiles of additional market players (Up to 5)

Growth opportunities and latent adjacency in Less Lethal Ammunition Market