Sliding Bearing Market by Railway (Locomotive, Wagon, Coach, DMU, EMU, Light Rail, Metro & High-Speed), Type (Thrust, Radial, Angular Contact & Linear), Application (Engine, Brake, Bogie, Interior & Exterior), Material & Region - Global Forecast to 2027

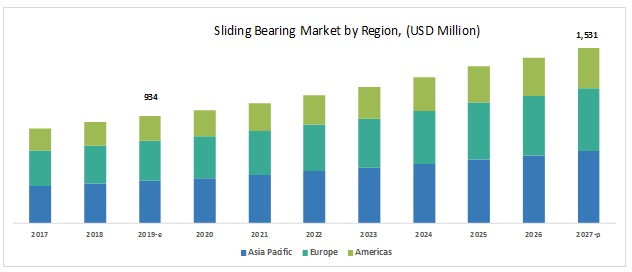

[138 Pages Report] The sliding bearing market for railways is projected to reach USD 1,531 million by 2027 from USD 934 million in 2019, at a CAGR of 6.4% during the forecast period. The market is primarily driven by the increasing demand for high efficiency, rising railway development projects, and the increasing demand for light rail & metros due to growing urbanization.

Radial type is expected to be the largest segment in the sliding bearing market, by technology, during the forecast period

Radial sliding bearing segment holds the maximum share of the railway sliding bearing market during the period of 2017–2027. The radial sliding bearing finds application in most of the systems/components such as engines, wheelsets, stabilizers, suspension system, and doors. According to MarketsandMarkets insights, radial plain bearings contributed maximum share owing to their advantages such as their capability of handling heavy radial & axial loads, lubrication-free, resistance to abrasion & contamination, low cost, longer life span, and superior performance. The rising demand for metros, light rail, and high-speed trains will directly spur the demand for radial sliding bearings in the coming years.

Bogie is estimated to be the largest segment in the Sliding bearing market, by application, during the forecast period

The Bogie segment leads the sliding bearing market for railway, by application, during the review period. A single bogie consists of various components such as wheelset, stabilizer, bolster, dampers, swing links, and tilting mechanisms. Altogether a single bogie has 10-12 units of sliding bearings, and as the bogie is a basic requirement for all locomotives, EMUs, DMUs, coaches, wagons, metros, and high-speed trains, the demand for sliding bearing would be more in this application. Furthermore, the rising potential for freight transport between the countries has prompted the need for custom-designed cars. This requires modification in the bogies to sustain such heavy loads. These modifications will lead to the requirement of more number of sliding bearing, which will consequently boost the demand for sliding bearings for bogie application.

Metallic type is estimated to hold the maximum share in the Sliding bearing market, by material, from 2019 to 2027

The metallic sliding bearing segment is expected to lead the market during the review period as metallic bearings can bear high load and withstand high temperature. It is used in the critical application areas like engine components such as crankshaft, connecting rod, cam shaft, and valves (inlet and exhaust); wheelsets; and some exterior components. The metallic sliding bearing will continue to dominate the market in the future because of its superior performance in withstanding high temperature and harsh environment.

Asia Pacific is expected to account for the largest market share during the forecast period

Asia Pacific is projected to lead the sliding bearing market during the forecast period due to its higher demand for railways compared with other regions such as Europe and the Americas. Further, the railway network extension plans by regional governments have also spurred the demand for locomotives, wagons, and coaches. Additionally, the country-level projects to make public transportation more convenient and reduce the traffic congestions will boost the demand for this market. For instance, the Chinese government has invested approximately USD 148 billion to deploy more metros in the cities of Baotou, Urumqi, and Xiamen. Similar kind of efforts are observed in other Asian countries such as India, Japan, and Thailand. All such upcoming demands in railways will consequently drive the fitment of sliding bearings for several applications. All these factors have resulted in the growth of the market in the region. NTN Corporation, THK, Longxi Bearing Group, and MinebeaMitsumi are some of the key players serving the demand in the regional market.

Key Market Players

Some of the key players in the sliding bearing market are Schaeffler (Germany), SKF (Sweden), NTN Corporation (Japan), MinebeaMitsumi (Japan), Timken (US), GGB Bearing (US), and THK (Japan). Continental adopted the strategies of collaboration and new product development to retain its leading position in the market. SKF adopted supply contracts as a key strategy to sustain its market position.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2027 |

|

Base Year Considered |

2018 |

|

Forecast Period |

2019–2027 |

|

Forecast Units |

Value (USD million) and Volume (‘000 units) |

|

Segments Covered |

Sliding bearing market for railway, by railway type, applications, bearing type, material, and region |

|

Geographies Covered |

Asia Pacific, Europe, and the Americas |

|

Companies Covered |

Schaeffler (Germany), SKF (Sweden), NTN Corporation (Japan), MinebeaMitsumi (Japan), Timken (US) |

This research report categorizes the sliding bearing market for railway based on railway types, railway applications, bearing types, by materials, and regions.

Market for Railway, By Application

- Engine

- Brakes

- Bogie

- Interior

- Exterior

Market for Railway, By Bearing Type

- Linear

- Thrust

- Radial

- Angular contact

- Others

Market for Railway, By Material

- Metallic

- Non-metallic

Market for Railway, By Railway Type

- Locomotive

- Diesel Multiple Unit (DMU)

- Electric Multiple Unit (EMU)

- Coach

- Wagon

- Light and Metro rail

- High-speed train

Market for Railway, By Region

- Asia Pacific

- Europe

- The Americas

Recent Developments

-

In March 2019, SKF collaborated with ATS to develop solutions to reduce life cycle cost for rail freight. SKF and Advanced Truck Systems (ATS) agreed to collaborate in equipping the new 2-piece bogie system from ATS with high capacity wheel bearings and a condition monitoring system to reduce on-track failures and enable predictive maintenance.

Key questions addressed by the report

- Our study suggests that Asia Pacific is the largest market for sliding bearing. What is the market size of the global sliding bearing market in 2019, by region? What would be the regional growth rate for the next eight years?

- Which are the major components for each application, and how many units of plain bearings for those system/components under each application for different railway types?

- Which types of plain bearing have major demand in different railway types? What is the size of the global sliding bearing market in 2019, by bearing type? What would be the regional growth rate for the next eight years?

- What is the market trend of sliding bearing in different railway types? What are the upcoming regulatory changes, and market trends would impact the sliding bearing market? What would be the regional growth rate for the next eight years?

- What is the average selling price of different components considered under the study, and what are the pricing trends of these components?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources for Base Numbers (Railway)

2.2.2 Key Secondary Sources for Market Sizing

2.2.3 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in Sliding Bearing Market for Railway

4.2 Market for Railway in Asia Pacific, By Bearing Type and Country

4.3 Market for Railway, By Country

4.4 Market for Railway, By Bearing Type

4.5 Market for Railway, By Application

4.6 Market for Railway, By Material

4.7 Market for Railway, By Railway Type

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Efficiency, Reliability, and Cost Effectiveness

5.2.1.2 Increasing Railway Infrastructure Investments and Supply Contracts

5.2.2 Restraints

5.2.2.1 Use of Sliding Bearings in Limited Railway Applications

5.2.3 Opportunities

5.2.3.1 Rising Demand for Hybrid & Autonomous Trains Technology

5.2.3.2 Increasing Usage of Non-Metallic Sliding Bearings

5.2.4 Challenges

5.2.4.1 Volatility of Raw Material Prices

6 Sliding Bearing Market for Railway, By Application (Page No. - 42)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, Europe, and Americas

6.1 Introduction

6.1.1 Research Methodology

6.1.2 Assumptions & Definitions

6.1.3 Industry Insights

6.2 Engine

6.2.1 Diesel Locomotives Hold the Maximum Share for Sliding Bearing in the Global Market

6.3 Brakes

6.3.1 Brake Caliper Have Nearly 4 Units of Sliding Bearings

6.4 Bogie

6.4.1 Bogie Application Hold the Maximum Share in the Sliding Bearing Market

6.5 Interior

6.5.1 Interior Application is Anticipated to Be One of the Fastest Market During the Forecast Period

6.6 Exterior

6.6.1 Asia Pacific is Estimated to Be the Largest Market for Exterior Application

7 Sliding Bearing Market for Railway, By Bearing Type (Page No. - 51)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, Europe, and Americas

7.1 Introduction

7.1.1 Research Methodology

7.1.2 Assumptions & Definitions

7.1.3 Industry Insights

7.2 Linear

7.2.1 Asia Pacific Leads the Linear Sliding Bearing Market

7.3 Thrust

7.3.1 Europe is the Second Largest Market for Thrust Sliding Bearing Type

7.4 Radial

7.4.1 Radial Sliding Bearings Hold the Maximum Share in 2019

7.5 Angular Contact

7.5.1 Angular Contact Find Application in Tilting Mechanism and Couplings

7.6 Others

7.6.1 Asia Pacific Leads the Linear Sliding Bearing Market

8 Sliding Bearing Market for Railway, By Material (Page No. - 60)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, Europe, and Americas

8.1 Introduction

8.1.1 Research Methodology

8.1.2 Assumptions & Definitions

8.1.3 Primary Insights

8.2 Metallic

8.2.1 Metallic Sliding Bearing Leads the Market, By Material

8.3 Non-Metallic

8.3.1 Non-Metallic is Estimated to Be Fastest Growing Market From 2019 to 2027

9 Sliding Bearing Market for Railway, By Railway Type (Page No. - 66)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, Europe, and Americas

9.1 Introduction

9.1.1 Research Methodology

9.1.2 Assumptions & Definitions

9.1.3 Industry Insights

9.2 Locomotive

9.2.1 Asia Pacific Leads the Sliding Bearing Market for Locomotives

9.3 Diesel Multiple Unit (DMU)

9.3.1 Americas is One of the Prominent Market for Sliding Bearing in This Segment

9.4 Electric Multiple Unit (EMU)

9.4.1 Europe Leads the Electric Multiple Unit Market in 2019

9.5 Coach

9.5.1 Asia Pacific is Anticipated to Hold Maximum Share for Coach Segment

9.6 Wagon

9.6.1 Wagons Hold the Largest Market, By Railway Type for Sliding Bearing

9.7 Light Rail & Metro

9.7.1 Light Rail & Metro is One of the Fastest Growing Market for Sliding Bearing

9.8 High-Speed Train

9.8.1 Among All Railway Types, High-Speed Train is Anticipated to Grow at the Highest Cagr During the Cagr Period

10 Sliding Bearing Market for Railway, By Region (Page No. - 76)

Note - The Chapter is Further Segmented at Regional and Country Level By Bearing Type: Thrust, Radial, Linear, Angular Contact & Others

10.1 Introduction

10.1.1 Research Methodology

10.1.2 Assumptions & Definitions

10.1.3 Industry Insights

10.2 Asia Pacific

10.2.1 China

10.2.1.1 China is the Largest Market in Asia Pacific

10.2.2 India

10.2.2.1 India is the Fastest Growing Market

10.2.3 Japan

10.2.3.1 Japan is Second Largest Market in Asia Pacific as of 2019

10.2.4 South Korea

10.2.4.1 Radial is Estimated to Be Largest Market in South Korea as of 2019

10.3 Europe

10.3.1 Germany

10.3.1.1 Germany is Estimated to Be the Largest Market for Sliding Bearing

10.3.2 France

10.3.2.1 France is the Second Largest Market in Europe Under the Review Period

10.3.3 Spain

10.3.3.1 Thrust Sliding Bearing is the Second Largest Market for Spain

10.3.4 Italy

10.3.4.1 Radial Sliding Bearing Leads the Italian Market

10.3.5 Russia

10.3.5.1 Russia is Estimated to Grow at Significant Rate During the Forecast Period

10.3.6 UK

10.3.6.1 Radial Sliding Bearing Type Leads the UK Market in 2019

10.4 Americas

10.4.1 Brazil

10.4.1.1 Radial Sliding Bearing Hold the Largest Share in Brazil

10.4.2 Canada

10.4.2.1 Thrust Sliding Bearing Type is Second Largest for Canadian Market in 2019

10.4.3 Mexico

10.4.3.1 Mexico is Second Largest Market in Americas Region as of 2019

10.4.4 US

10.4.4.1 US is the Largest Market in Americas Region

11 Competitive Landscape (Page No. - 101)

11.1 Overview

11.2 Sliding Bearing Market for Railway: Market Ranking Analysis

11.3 Competitive Leadership Mapping

11.3.1 Terminology

11.3.1.1 Visionary Leaders

11.3.1.2 Innovators

11.3.1.3 Dynamic Differentiators

11.3.1.4 Emerging Companies

11.3.2 Strength of Product Portfolio

11.3.3 Business Strategy Excellence

11.4 Competitive Scenario

11.4.1 New Product Launches/New Product Developments

11.4.2 Supply Contract/Partnerships/Joint Ventures/Collaborations

11.4.3 Mergers & Acquisitions

11.4.4 Expansions

12 Company Profiles (Page No. - 111)

(Business Overview, Products Offered, Recent Developments & SWOT Analysis)*

12.1 SKF

12.2 Schaeffler

12.3 NTN Corporation

12.4 Minebeamitsumi

12.5 Timken

12.6 GGB Bearing (Enpro Industries)

12.7 THK

12.8 Fujian Longxi Bearing

12.9 RBC Bearings

12.10 Igus

12.11 Additional Companies

12.11.1 Asia Pacific

12.11.1.1 Menon Bearings

12.11.1.2 Nachi-Fujikoshi

12.11.1.3 NSK

12.11.1.4 LYC Bearing

12.11.2 Europe

12.11.2.1 Zollern

12.11.2.2 GGT Gleit-Technik

12.11.2.3 Lhg-Gleitlagerkomponenten

12.11.2.4 Nadella

12.11.3 North America

12.11.3.1 Federal-Mogul Corporation

12.11.3.2 Aurora Bearing Company

*Details on Business Overview, Products Offered, Recent Developments & SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 131)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.4.1 Sliding Bearing Market, By Application & Country

13.4.1.1 Engine

13.4.1.2 Bogie

13.4.1.3 Brakes

13.4.1.4 Interior

13.4.1.5 Exterior

13.4.2 Detailed Analysis and Profiling of Additional Market Players (Upto 3)

The Sliding Bearing Market for Railway, By Application Can Be Offered at Country-Level (Countries Covered in the Region Segment)

13.5 Related Reports

13.6 Author Details

List of Tables (80 Tables)

Table 1 Currency Exchange Rates (W.R.T. Per USD)

Table 2 Upcoming Railway Projects

Table 3 Sliding Bearing Market for Railway, By Application, 2017- 2027 (Thousand Units)

Table 4 Market for Railway, By Application, 2017- 2027 (USD Million)

Table 5 Engine: Market for Railway, By Region, 2017–2027 (Thousand Units)

Table 6 Engine: Market for Railway, By Region, 2017–2027 (USD Million)

Table 7 Brakes: Market for Railway, By Region, 2017–2027 (Thousand Units)

Table 8 Brakes: Market for Railway, By Region, 2017–2027 (USD Million)

Table 9 Bogie: Market for Railway, By Region, 2017–2027 (Thousand Units)

Table 10 Bogie: Market for Railway, By Region, 2017–2027 (USD Million)

Table 11 Interior: Market for Railway, By Region, 2017–2027 (Thousand Units)

Table 12 Interior: Market for Railway, By Region, 2017–2027 (USD Million)

Table 13 Exterior: Market for Railway, By Region, 2017–2027 (Thousand Units)

Table 14 Exterior: Market for Railway, By Region, 2017–2027 (USD Million)

Table 15 Sliding Bearing Market for Railway, By Bearing Type, 2017–2027 (Thousand Units)

Table 16 Market for Railway, By Bearing Type, 2017–2027 (USD Million)

Table 17 Linear: Market for Railway, By Region, 2017–2027 (Thousand Units)

Table 18 Linear: Market for Railway, By Region, 2017–2027 (USD Million)

Table 19 Thrust: Market for Railway, By Region, 2017–2027 (Thousand Units)

Table 20 Thrust: Market for Railway, By Region, 2017–2029 (USD Million)

Table 21 Radial: Market for Railway, By Region, 2017–2027 (Thousand Units)

Table 22 Radial: Market for Railway, By Region, 2017–2027 (USD Million)

Table 23 Angular Contact: Market for Railway, By Region, 2017–2027 (Thousand Units)

Table 24 Angular Contact: Market for Railway, By Region, 2017–2027 (USD Million)

Table 25 Others: Market for Railway, By Region, 2017–2027 (Thousand Units)

Table 26 Others: Market for Railway, By Region, 2017–2027 (USD Million)

Table 27 Market for Railway, By Material, 2017–2027 (Thousand Units)

Table 28 Market for Railway, By Material, 2017–2027 (USD Million)

Table 29 Metallic: Market for Railway, By Region, 2017–2027 (Thousand Units)

Table 30 Metallic: Market for Railway, By Region, 2017–2027 (USD Million)

Table 31 Non-Metallic: Market for Railway, By Region, 2017–2027 (Thousand Units)

Table 32 Non-Metallic: Market for Railway, By Region, 2017–2027 (USD Million)

Table 33 Sliding Bearing Market for Railway, By Railway Type, 2017–2027 (Thousand Units)

Table 34 Locomotive: Market for Railway, By Region, 2017–2027 (Thousand Units)

Table 35 Diesel Multiple Unit: Market for Railway, By Region, 2017–2027 (Thousand Units)

Table 36 Electric Multiple Unit: Market for Railway, By Region, 2017–2027 (Thousand Units)

Table 37 Coach:Market for Railway, By Region, 2017–2027 (Thousand Units)

Table 38 Wagon: Market for Railway, By Region, 2017–2027 (Thousand Units)

Table 39 Light Train & Metro: Market for Railway, By Region, 2017–2027 (Thousand Units)

Table 40 High-Speed Train: Market for Railway, By Region, 2017–2027 (Thousand Units)

Table 41 Sliding Bearing Market for Railway, By Region, 2017–2027 (Thousand Units)

Table 42 Market for Railway, By Region, 2017–2027 (USD Million)

Table 43 Asia Pacific: Market for Railway, By Country, 2017–2027 (Thousand Units)

Table 44 Asia Pacific: Market for Railway, By Country, 2017–2027 (USD Million)

Table 45 China: Market for Railway, By Bearing Type, 2017–2027 (Thousand Units)

Table 46 China: Market for Railway, By Bearing Type, 2017–2027 (USD Million)

Table 47 India: Market for Railway, By Bearing Type, 2017–2027 (Thousand Units)

Table 48 India: Market for Railway, By Bearing Type, 2017–2027 (USD Million)

Table 49 Japan: Market for Railway, By Bearing Type, 2017–2027 (Thousand Units)

Table 50 Japan: Market for Railway, By Bearing Type, 2017–2027 (USD Million)

Table 51 South Korea: Market for Railway, By Bearing Type, 2017–2027 (Thousand Units)

Table 52 South Korea: Market for Railway, By Bearing Type, 2017–2027 (USD Million)

Table 53 Europe: Market for Railway, By Country, 2017–2027 (Thousand Units)

Table 54 Europe: Market for Railway, By Country, 2017–2027 (USD Million)

Table 55 Germany: Market for Railway, By Bearing Type, 2017–2027 (Thousand Units)

Table 56 Germany: Market for Railway, By Bearing Type, 2017–2027 (USD Million)

Table 57 France: Market for Railway, By Bearing Type, 2017–2027 (Thousand Units)

Table 58 France: Market for Railway, By Bearing Type, 2017–2027 (USD Million)

Table 59 Spain: Sliding Bearing Market for Railway, By Bearing Type, 2017–2027 (Thousand Units)

Table 60 Spain: Market for Railway, By Bearing Type, 2017–2027 (USD Million)

Table 61 Italy: Market for Railway, By Bearing Type, 2017–2027 (Thousand Units)

Table 62 Italy: Market for Railway, By Bearing Type, 2017–2027 (USD Million)

Table 63 Russia: Market for Railway, By Bearing Type, 2017–2027 (Thousand Units)

Table 64 Russia: Market for Railway, By Bearing Type, 2017–2027 (USD Million)

Table 65 UK: Market for Railway, By Bearing Type, 2017–2027 (Thousand Units)

Table 66 UK: Market for Railway, By Bearing Type, 2017–2027 (USD Million)

Table 67 Americas: Market for Railway, By Country, 2017–2027 (Thousand Units)

Table 68 Americas: Market for Railway, By Country, 2017–2027 (USD Million)

Table 69 Brazil: Market for Railway, By Bearing Type, 2017–2027 (Thousand Units)

Table 70 Brazil: Market for Railway, By Bearing Type, 2017–2027 USD Million)

Table 71 Canada: Market for Railway, By Bearing Type, 2017–2027 (Thousand Units)

Table 72 Canada: Market for Railway, By Bearing Type, 2017–2027 (USD Million)

Table 73 Mexico: Sliding Bearing Market for Railway, By Bearing Type, 2017–2027 (Thousand Units)

Table 74 Mexico: Market for Railway, By Bearing Type, 2017–2027 (USD Million)

Table 75 US: Market for Railway, By Bearing Type, 2017–2027 (Thousand Units)

Table 76 US: Market for Railway, By Bearing Type, 2017–2027 (USD Million)

Table 77 New Product Launches/New Product Developments, 2015–2019

Table 78 Supply Contract/Partnerships/Joint Ventures/Collaborations, 2018–2019

Table 79 Mergers & Acquisitions, 2017-2018

Table 80 Expansions, 2015–2016

List of Figures (40 Figures)

Figure 1 Market Segmentation: Sliding Bearing Market for Railway

Figure 2 Market for Railway: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Bottom-Up Approach: Market for Railway, By Bearing Type

Figure 6 Data Triangulation

Figure 7 Sliding Bearing Market for Railway Industry: Market Outlook

Figure 8 Market for Railways, By Application, 2019 vs. 2027 (USD Million)

Figure 9 High-Speed Train, Light & Metro Rail, Electric Multiple Unit (EMU) Bring Lucrative Opportunities for Railway Sliding Bearing Manufacturers 33

Figure 10 Radial Sliding Bearing and China Accounted for the Largest Share in Bearing Type and Country-Level Market, Respectively, 2019

Figure 11 India Expected to Grow at the Fastest Rate During the Forecast Period

Figure 12 Radial Sliding Bearing to Hold the Largest Share, By Bearing Type, 2019 vs. 2027 (USD Million)

Figure 13 Bogie Segment to Be the Largest During the Forecast Period, By Application, 2019 vs. 2027 (USD Million)

Figure 14 Metallic Segment Expected to Hold the Largest Market Share, By Material, 2019 vs. 2027 (USD Million)

Figure 15 Wagon Segment Expected to Lead the Market, By Railway Type, 2019 vs. 2027 (Thousand Units)

Figure 16 Market for Railway, By Application, 2019 vs. 2027 (USD Million)

Figure 17 Market for Railway, By Type, 2019 vs. 2027 (USD Million)

Figure 18 Market for Railway, By Material, 2019 vs. 2027 (USD Million)

Figure 19 Market for Railway, By Railway Type, 2019 vs. 2027 (Thousand Units)

Figure 20 Market for Railway, By Region, 2019 vs. 2027 (USD Million)

Figure 21 Market for Railway: Asia Pacific Snapshot

Figure 22 Sliding Bearing Market for Railway: Asia Pacific Snapshot

Figure 23 Market for Railway: Market Ranking Analysis, 2018

Figure 24 Market for Railway: Competitive Leadership Mapping (2018)

Figure 25 Company-Wise Product Offering Analysis

Figure 26 Company-Wise Business Strategy Analysis

Figure 27 Companies Adopted New Product Development & Expansions as the Key Growth Strategies From 2014 to 2018

Figure 28 SKF: Company Snapshot

Figure 29 SKF: SWOT Analysis

Figure 30 Schaeffler: Company Snapshot

Figure 31 Schaeffler: SWOT Analysis

Figure 32 NTN: Company Snapshot

Figure 33 NTN: SWOT Analysis

Figure 34 Minebeamitsumi: Company Snapshot

Figure 35 Minebeamitsumi: SWOT Analysis

Figure 36 Timken: Company Snapshot

Figure 37 Timken: SWOT Analysis

Figure 38 GGB Bearing (Enpro Industries): Company Snapshot

Figure 39 THK: Company Snapshot

Figure 40 RBC: Company Snapshot

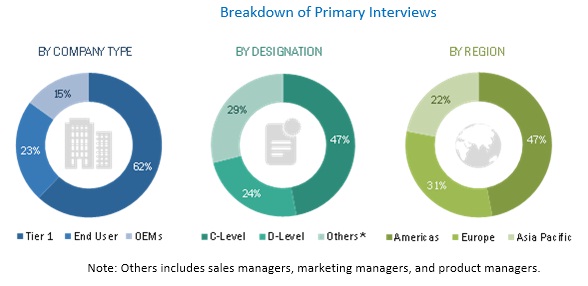

The study involves two key activities to estimate the current size for the sliding bearing market for railway. The first step defines the scope of the research study, which includes railway types, applications, bearing types, materials, and regions to be considered in the study along with the assumptions and limitations to derive the market numbers. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. Bottom-up approach has been followed to derive the market size, in terms of volume and value.

Secondary Research

The secondary sources referred to for this research study include railway industry organizations (such as American Railway Association, China Railway Society, Railway Association of Canada, and International Union of Railways); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and industry associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the sliding bearing market for railway through secondary research. Several primary interviews have been conducted with market experts from both the demand-side (railway OEMs and government bodies) and the supply-side (sliding bearing manufacturers) across major regions, namely, the Americas, Europe, and Asia Pacific. Approximately 70% and 30% of primary interviews have been conducted from the supply-side and industry associations & dealers/distributors, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach has been used to estimate and validate the size of the sliding bearing market for railway, in terms of bearing type. The country-level sales statistics of each considered railway type have been multiplied with country-level penetration of each bearing types-radial, thrust, linear, angular contact, and others (which was derived through extensive secondary sources, and multiple primary interviews). This will provide the country-level market for railway size, by bearing type in terms of volume, which was further added to derive the regional-level market size and further to get the global market for railway, by bearing type, in terms of volume. To arrive at the market size in terms of value, the country-level market was multiplied by the average selling price of each bearing type. Summation of country-level market sizes gave the regional-level market, and then the summation of regional-level markets gave the global market for railway, by bearing type, in terms of value. A similar approach was followed to derive the market for railway by application (engine, brakes, bogie, exterior, and interior), material (metallic and non-metallic), and railway type (diesel multiple unit, electric multiple unit, coaches, wagon, light & metro rail, and high-speed train).

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Report Objectives

- To define, describe, and forecast (2019 to 2027) the sliding bearing market for railway, in terms of volume (thousand units), and value (USD million/billion) at country, and regional level

- To define, describe, and forecast the market for railway, by volume and value, on the basis of type (linear, thrust, radial, angular contact, and others) at country and regional level

- To analyze and forecast the market for market for railway, by volume and value, on the basis of application (engine, brakes, bogie, exterior, and interior) at regional level

- To forecast the market for railway, by volume and value, on the basis of material (metallic and non-metallic) at regional level

- To analyze and forecast the market for railway, in terms of volume, on the basis of railway type (diesel multiple unit, electric multiple unit, coaches, wagon, light & metro rail, and high-speed train) at regional level

- To forecast the volume and the value of the market segments with respect to 3 regions, namely, the Americas, Europe, and Asia Oceania

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the market for railway

- To analyze the market share of the key players operating in the market for railway

- To analyze the competitive landscape and competitive leadership mapping for the global players operating in the market for railway

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and expansions in the sliding bearing market for railway

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Sliding bearing market, By Application & Country

- Engine

- Bogie

- Brakes

- Interior

- Exterior

Growth opportunities and latent adjacency in Sliding Bearing Market