Plain Bearing Market by Type, End-Use Industry (Automotive, Industrial, Aerospace, Energy, Construction Machinery, Agricultural & Gardening Equipment, Oilfield Machinery, Office Products) and Region - Global Forecast to 2026

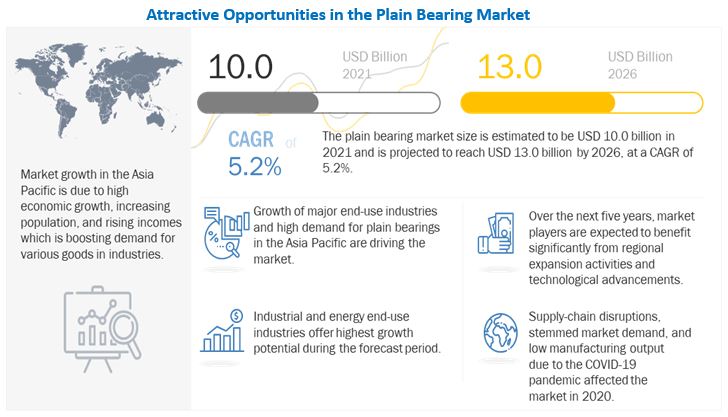

[222 Pages Report] The global plain bearing market size is estimated at USD 10.0 billion in 2021 and is projected to reach USD 13.0 billion by 2026, at a CAGR of 5.2% between 2021 and 2026. The market is propelled by the growth of various end-use industries. Increasing investments in infrastructure, new industrial projects, and the development of heavy machinery in China, India, the US, Germany, and Brazil have also boosted market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Plain Bearing Market

The pandemic is estimated to have huge impact on various factors of the value chain of plain bearings, which is expected to reflect during the forecast period, especially in the year 2021. The various impact of COVID-19 are as follows:

- Impact on plain bearing market: The COVID-19 pandemic had a slight impact on the plain bearing market. Plain bearings have significant potential in the automotive, aerospace, energy, and construction industries. The impact of COVID-19 was higher on the market for larger bearings and lower for smaller bearings since production and sales in discrete industries such as cement, mining, etc. were slow largely due to lockdowns around the world.

- Impact on plain bearing manufacturers: The impact of COVID-19 outbreak resulted in the majority of manufacturing plants of plain bearings have either been closed or are operating with limited capacity.

- Impact on end-use industries: The highest affected end-use industry by COVID-19 is aerospace. Suspension of air travel across various geographies due to the COVID-19 pandemic severely impacted airliners. Mass grounding of aircraft fleets and lack of new major purchase orders and deliveries have impacted the businesses of aircraft OEMs. The aircraft leasing company, AeroCentury Corp. filed for bankruptcy in March 2021 as the demand for leasing for domestic and foreign carriers declined during the pandemic.

Plain Bearings Market Dynamics

Driver: Increasing demand for plain bearings from end-use industries

The plain bearing market majorly depends upon end-use industries such as automotive, aerospace, energy, construction machinery, oilfield machinery, agriculture, gardening equipment, and office products for growth. The latest International Monetary Fund (IMF) reports suggests that the Asia Pacific region remains the engine of global growth and grew at a rate of 5.3% before the COVID-19 pandemic. Increasing population, rapid urbanization, and rising income of the middle class in the Asia Pacific region are factors fueling the growth of the automotive, agriculture, gardening, construction, and office products industries in China, India, and Japan.

Restraint: Volatility in raw material prices

The price volatility of raw materials is one of the main restraints for the growth of the global plain bearing market. The major raw materials essential for the production of plain bearings are different metals such as steel, tin-based alloys, chrome steel, and engineering plastics. Extreme fluctuations have been observed in the prices of the different metals and crude oil in the global market. This directly affects the production of plain bearings, thus impacting the overall growth of the market.

Opportunities: Growth prospects in emerging economies

At present, major plain bearing material manufacturers in North America and Europe follow strict government rules and regulations. However, emerging regions have fewer or no rules in the industry, although there are several regulations regarding the use of environment-friendly and hygienic plain bearing products. As a result, emerging markets in the Middle East & Africa and Asia Pacific offer opportunities for manufacturers of plain bearings. The high growth potential in the emerging regions can be attributed to the strong performance of end-use industries such as automotive, aerospace, energy, agriculture, construction, mining, and oil & gas.

Challenges: Increasing number of counterfeit bearings

Counterfeit bearings are a major concern all over the world. The production and distribution of fake bearings routinely victimize both, the end user and OEM and can significantly jeopardize safety. This dangerous, illegal, and highly unethical practice is prevalent and occurs in every market segment. According to the World Bearing Association (WBA), most of the customs seizures coming into Europe and the US originate from China. According to a study published by the International Chamber of Commerce (ICC), the annual economic and social costs resulting from counterfeit bearings amounts to USD 1.7 billion worldwide.

Several cases related to counterfeit bearing products have been registered in recent years. The manufacture and trade of counterfeit products, which increasingly affects all brands and markets, is a growing global concern. For instance, over the past few years, the SKF Group has been carrying out several operations against counterfeit products in countries such as Germany, Italy, Holland, Greece, Sweden, China, and the US, seizing hundreds of tons of counterfeit bearings. Recently, in Spain, police authorities have confiscated 15 tons counterfeit bearings. Counterfeit bearings of NSK packaging and labels were seized in Hebei Province, China. More than 23,000 fake boxes and cartons which were confiscated pending further investigation and potential prosecution were discovered in Linxi County, Xintai City.

Plain bearing market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Based on end-use industry, automotive accounted for the largest market share in 2020

The automobile end-use industry segment accounted for the largest share of the global plain bearing market in 2020. This is mainly attributed to the increasing demand for plain bearings in the automobile industry. Plain bearings are used in the automobile industry for manufacturing variable intake systems, center armrests, belt tensioners, stub axels, gear actuators, convertible top systems, pedal systems, seating systems, steering systems, throttle valves, and door hinges, among others.

Based on type, journal plain bearing accounted for the largest market share in 2020

The journal type segment contributed the largest share to the global plain bearing market in 2020; This is mainly attributed to the increasing demand for journal bearings from varied end-use industries such as automobile, aerospace, construction machinery, and energy. In addition, journal bearings have properties such as excellent strength and shock resistance. There is no rolling element in these bearings. These bearings work efficiently in heavily loaded systems, wherein sufficient clearance and lubrication is provided

Asia Pacific accounted for the largest share of the plain bearing market in 2020

The Asia-Pacific region led the global plain bearing market in 2020, owing to the rise in demand for plain bearings from varied end-use industries such as automobile, aerospace, construction, and energy in this region. China, India, and Japan are leading countries in terms of production and consumption of plain bearings in the Asia-Pacific region. Asia Pacific is a rapidly developing region that offers many opportunities for the industry players. Most of the leading players of North America and Europe are planning to move their production base to this region because of the availability of inexpensive raw materials, low production costs, and the need to better serve the local market.

Key Market Players

NTN Corporation (Japan), SKF Group (Sweden), Schaeffler Group (Germany), Timken Company (US), THK Co., Ltd. (Japan), NSK Ltd. (Japan), MinebeaMitsumi Inc. (Japan), RBC Bearings Incorporated (US), and SGL Carbon (Germany), ElringKlinger AG (Germany), GGB (France), igus (Germany), Kashima Bearings, Inc (Japan), Boston Gear LLC (US), Thomson Industries, Inc. (US), ZOLLERN GmbH & Co. KG (Germany), PBC Linear (US), GGT Gleitlager AG (Switzerland), Midwest Control Products Corp. (US), Accurate Bushing Company (US), AEC (India), Chiavette Unificate S.p.A. (Italy), HepcoMotion (UK), Alloy Bearings (New Zealand), and Kingsbury, Inc. (US) are among the key players leading the market.

Scope of the report

|

Report Metric |

Details |

|

Market Size Available for Years |

2016–2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

Type and End-use industry |

|

Geographies Covered |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies Covered |

NTN Corporation (Japan), SKF Group (Sweden), Schaeffler Group (Germany), Timken Company (US), THK Co., Ltd. (Japan), NSK Ltd. (Japan), MinebeaMitsumi Inc. (Japan), RBC Bearings Incorporated (US), and SGL Carbon (Germany), ElringKlinger AG (Germany), GGB (France), igus (Germany), Kashima Bearings, Inc (Japan), Boston Gear LLC (US), Thomson Industries, Inc. (US), ZOLLERN GmbH & Co. KG (Germany), PBC Linear (US), GGT Gleitlager AG (Switzerland), Midwest Control Products Corp. (US), Accurate Bushing Company (US), AEC (India), Chiavette Unificate S.p.A. (Italy), HepcoMotion (UK), Alloy Bearings (New Zealand), and Kingsbury, Inc. (US) |

This research report categorizes the plain bearing market based on type, end-use industry and region and forecasts revenues as well as analyzes trends in each of these submarkets.

Based on Type, the plain bearing market has been segmented into:

- Journal

- Linear

- Thrust

- Angular Contact

- Others

Based on End-use Industry, the plain bearing market has been segmented into:

- Automotive

- Industrial

- Aerospace

- Energy

- Construction Machinery

- Agriculture & Gardening Equipment

- Oilfield Machinery

- Office Products

- Others

Based on Region, the plain bearing market has been segmented into:

- Asia-Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In March 2021, SKF Group, invested USD 44.3 million in expanding and modernizing its manufacturing facility in Airasca, Italy. The investment is expected to bring the manufacture of super-precision bearings for industrial applications to the Group's largest manufacturing site in Italy.

- In December 2020, Timken Company, acquired the assets of Aurora Bearing Company. Aurora Bearing Company manufactures rod ends and spherical plain bearings which serve a diverse range of industrial sectors including aerospace and defense, racing, off-highway equipment, and packaging.

- In August 2020, NTN Corporation, started its first overseas mass-production of precision bearings for machine tools at NTN Mettmann (Deutschland) GmbH, a subsidiary of the manufacturing company, NTN Kugellagerfabrik (Deutschland) GmbH in Germany.

Frequently Asked Questions (FAQ):

What is plain bearing?

According to the American Bearing Manufacturers Association (ABMA), an association representing global manufacturers of bearings, a plain bearing is the simplest type of bearing comprising just the bearing surface and no rolling elements. Plain bearings are cylindrical sleeves that bear light to moderate radial loads. It is a mechanical element used to reduce friction between rotating shafts and stationary support members. Plain bearings function via a sliding action instead of the rolling action utilized by ball, roller, and needle bearings. Plain bearings exhibit superior properties such as dimensional & operational stability at high temperatures and pressures; are often inexpensive, compact, and lightweight; and have high load-carrying capacities.

What is the current size of the global plain bearing market?

The global plain bearing market is estimated at USD 10.0 billion in 2021 and is projected to reach USD 13.0 billion by 2026, at a CAGR of 5.2% between 2021 and 2026.

Who are the winners in the global plain bearing market?

Companies such as NTN Corporation (Japan), SKF Group (Sweden), Schaeffler Group (Germany), Timken Company (US), NSK Ltd. (Japan), MinebeaMitsumi Inc. (Japan), fall under the winners category. These are leading players in the plain bearing market, globally, and are some of the leading players operating in the plain bearing market. These players have adopted the strategies of expansions, mergers & acquisitions, partnerships, new product launches & investments, and new technology & new process developments to increase their presence in the global market.

What is the COVID-19 impact on plain bearings value chain?

COVID-19 outbreak is expected to have a major impact on the global demand for plain bearing in various end-use industries. The outbreak and the spread of the COVID-19 led to major supply chain disruptions across the world, thereby resulting in non-delivery of raw materials used for manufacturing plain bearings in the different regions.

What are the key regions in the global plain bearing market?

In terms of region, the highest consumption was observed to be in Asia Pacific. This is primarily due to growing demand from the automotive and industrial industry. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 PLAIN BEARING MARKET, BY TYPE: INCLUSIONS & EXCLUSIONS

TABLE 2 PLAIN BEARING MARKET, BY END-USE INDUSTRY: INCLUSIONS & EXCLUSIONS

TABLE 3 PLAIN BEARING MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.4 PLAIN BEARING MARKET SEGMENTATION

FIGURE 1 PLAIN BEARING MARKET: SEGMENTATION

FIGURE 2 PLAIN BEARING MARKET: REGIONS COVERED

1.4.1 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 3 PLAIN BEARING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 List of participating companies for primary research

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 BASE NUMBER CALCULATION

2.3.1 SUPPLY SIDE APPROACH

2.3.2 DEMAND SIDE APPROACH

2.4 DATA TRIANGULATION

FIGURE 7 MARKET BREAKDOWN AND DATA TRIANGULATION

2.5 ASSUMPTIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 46)

TABLE 4 GLOBAL PLAIN BEARING MARKET SNAPSHOT

FIGURE 8 AUTOMOTIVE SEGMENT ACC0UNTED FOR LARGEST SHARE OF END-USE INDUSTRY SEGMENT OF PLAIN BEARING MARKET IN 2020

FIGURE 9 JOURNAL TYPE SEGMENT ACCOUNTED FOR LARGEST SHARE OF PLAIN BEARING MARKET IN 2020

FIGURE 10 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF PLAIN BEARING MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN PLAIN BEARING MARKET

FIGURE 11 INCREASING APPLICATIONS IN ENERGY END-USE INDUSTRY EXPECTED TO DRIVE MARKET

4.2 PLAIN BEARING MARKET, BY TYPE

FIGURE 12 JOURNAL SEGMENT PROJECTED TO GROW AT HIGHEST CAGR BETWEEN 2021 AND 2026

4.3 ASIA PACIFIC PLAIN BEARING MARKET, BY END-USE INDUSTRY & COUNTRY

FIGURE 13 AUTOMOTIVE SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES OF ASIA PACIFIC PLAIN BEARING MARKET IN 2021

4.4 PLAIN BEARING MARKET, BY MAJOR COUNTRIES

FIGURE 14 PLAIN BEARING MARKET IN CHINA TO GROW AT HIGHEST CAGR BETWEEN 2021 AND 2026

5 MARKET OVERVIEW (Page No. - 52)

5.1 MARKET DYNAMICS

FIGURE 15 PLAIN BEARING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Rising demand for plain bearings from end-use industries

FIGURE 16 GROWTH IN INFRASTRUCTURE CONSTRUCTION (2020-2030)

TABLE 5 AIR PASSENGER TRAFFIC 2018-2039

5.1.1.2 Cost-effective production of plain bearings in Asia Pacific

5.1.2 RESTRAINTS

5.1.2.1 Volatility in prices of raw materials

TABLE 6 GLOBAL OIL & GAS PRICES, USD/BBL (2016–2020)

5.1.3 OPPORTUNITIES

5.1.3.1 Growth prospects in emerging economies

5.1.3.2 Development of smart bearing technology

5.1.3.3 Applications in renewable energy sector

FIGURE 17 RENEWABLE ELECTRICITY CAPACITY GROWTH BY TECHNOLOGY

5.1.4 CHALLENGES

5.1.4.1 Increasing number of counterfeit bearings

TABLE 7 SEIZURE OF COUNTERFEIT BEARINGS IN CHINESE CUSTOMS DEPARTMENT

5.1.4.2 Supply chain, trade, and economic disruptions due to COVID-19 pandemic

TABLE 8 IMPACT OF COVID-19 ON PLAIN BEARING SUPPLY CHAIN

5.2 PORTER’S FIVE FORCES

FIGURE 18 PLAIN BEARING MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 9 PLAIN BEARING MARKET: PORTER’S FIVE FORCES ANALYSIS

5.2.1 THREAT OF NEW ENTRANTS

5.2.2 THREAT OF SUBSTITUTES

5.2.3 BARGAINING POWER OF SUPPLIERS

5.2.4 BARGAINING POWER OF BUYERS

5.2.5 INTENSITY OF COMPETITIVE RIVALRY

5.3 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS: PLAIN BEARING MARKET

5.3.1 PROMINENT COMPANIES

5.3.2 SMALL & MEDIUM ENTERPRISES

5.4 ECOSYSTEM MARKET MAP

FIGURE 20 ECOSYSTEM MAP FOR PLAIN BEARING MARKET

TABLE 10 PLAIN BEARING MARKET: ECOSYSTEM

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 21 YC AND YCC SHIFT

5.6 REGULATORY LANDSCAPE

TABLE 11 LEGAL REQUIREMENTS FOR BEARING MATERIALS

5.7 CASE STUDY ANALYSIS

5.7.1 REPRODUCTION OF AN AXIAL ANGULAR BALL BEARING

5.7.2 KAMAN CORPORATION RECEIVES AN ADDITIONAL CONTRACT ON K-MAX HELICOPTERS (2018)

5.8 TECHNOLOGY TRENDS

5.8.1 ADVANCEMENTS IN LUBRICANT PERFORMANCE; INCREASING USE OF GREASELESS BEARINGS

5.8.2 INNOVATION IN BEARING PERFORMANCE DUE TO ADVANCEMENTS IN MATERIAL SCIENCES

5.8.3 SUB-MICRON COATING, POLYMER COATED, AND ENGINEERED PLASTIC BEARINGS

5.9 IMPACT ANALYSIS OF COVID-19

5.9.1 COVID-19 HEALTH ASSESSMENT

FIGURE 22 COUNTRY-WISE SPREAD OF COVID-19

5.9.2 EFFECTS ON GDPS OF COUNTRIES

FIGURE 23 IMPACT OF COVID-19 ON COUNTRIES IN 2020

TABLE 12 THREE SCENARIO-BASED ANALYSES OF IMPACT OF COVID-19 ON GLOBAL ECONOMY

5.9.3 IMPACT ON PLAIN BEARING MARKET

5.10 PATENT ANALYSIS

5.10.1 INTRODUCTION

FIGURE 24 PUBLICATION TRENDS (2011-2021)

5.10.2 INSIGHTS

FIGURE 25 PLAIN BEARING PATENTS, TREND ANALYSIS

5.11 TOP PATENT HOLDERS

6 PLAIN BEARING MARKET, BY TYPE (Page No. - 75)

6.1 INTRODUCTION

FIGURE 26 PLAIN BEARING MARKET, BY TYPE, 2021 & 2026 (USD MILLION)

TABLE 13 PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 14 PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.2 JOURNAL PLAIN BEARING

6.2.1 MOST COMMON AND IN-DEMAND PLAIN BEARING

TABLE 15 JOURNAL PLAIN BEARING MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 16 JOURNAL PLAIN BEARING MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3 LINEAR PLAIN BEARING

6.3.1 HIGH STATIC LOAD BEARING CAPACITY DRIVES DEMAND FROM AUTOMOTIVE, INDUSTRIAL, AEROSPACE, AND ENERGY END-USE INDUSTRIES

TABLE 17 LINEAR PLAIN BEARING MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 18 LINEAR PLAIN BEARING MARKET, BY REGION, 2021–2026 (USD MILLION)

6.4 THRUST PLAIN BEARING

6.4.1 USED IN MACHINERY & EQUIPMENT TO CONTROL AXIAL LOADS

TABLE 19 THRUST PLAIN BEARING MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 20 THRUST PLAIN BEARING MARKET, BY REGION, 2021–2026 (USD MILLION)

6.5 ANGULAR CONTACT PLAIN BEARING

6.5.1 HIGH DEMAND DUE TO RESISTANCE TO HIGH THRUST, IMPACT, AND RADIAL LOADS

TABLE 21 ANGULAR CONTACT PLAIN BEARING MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 22 ANGULAR CONTACT PLAIN BEARING MARKET, BY REGION, 2021–2026 (USD MILLION)

6.6 OTHERS

TABLE 23 OTHER PLAIN BEARINGS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 24 OTHER PLAIN BEARINGS MARKET, BY REGION, 2021–2026 (USD MILLION)

7 PLAIN BEARING MARKET, BY END-USE INDUSTRY (Page No. - 82)

7.1 INTRODUCTION

FIGURE 27 PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021 & 2026 (USD MILLION)

TABLE 25 PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 26 PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

7.2 AUTOMOTIVE

7.2.1 AUTOMOTIVE SEGMENT ACCOUNTS FOR HIGHEST CONSUMPTION OF PLAIN BEARINGS

TABLE 27 PLAIN BEARING MARKET FOR AUTOMOTIVE, BY REGION, 2016–2020 (USD MILLION)

TABLE 28 PLAIN BEARING MARKET FOR AUTOMOTIVE, BY REGION, 2021–2026 (USD MILLION)

7.3 INDUSTRIAL

7.3.1 FASTEST-GROWING END-USE INDUSTRY

TABLE 29 PLAIN BEARING MARKET FOR INDUSTRIAL, BY REGION, 2016–2020 (USD MILLION)

TABLE 30 PLAIN BEARING MARKET FOR INDUSTRIAL, BY REGION, 2021–2026 (USD MILLION)

7.4 AEROSPACE

7.4.1 ASIA PACIFIC TO LEAD DEMAND DURING FORECAST PERIOD

TABLE 31 PLAIN BEARING MARKET FOR AEROSPACE, BY REGION, 2016–2020 (USD MILLION)

TABLE 32 PLAIN BEARING MARKET FOR AEROSPACE, BY REGION, 2021–2026 (USD MILLION)

7.5 ENERGY

7.5.1 RENEWABLE ENERGY SEGMENT OFFERS LUCRATIVE GROWTH OPPORTUNITIES

TABLE 33 PLAIN BEARING MARKET FOR ENERGY, BY REGION, 2016–2020 (USD MILLION)

TABLE 34 PLAIN BEARING MARKET FOR ENERGY, BY REGION, 2021–2026 (USD MILLION)

7.6 CONSTRUCTION MACHINERY

7.6.1 MIDDLE EAST & AFRICA REGION EXPECTED TO WITNESS HIGH DEMAND FOR PLAIN BEARINGS USED IN CONSTRUCTION MACHINERY

TABLE 35 PLAIN BEARING MARKET FOR CONSTRUCTION MACHINERY, BY REGION, 2016–2020 (USD MILLION)

TABLE 36 PLAIN BEARING MARKET FOR CONSTRUCTION MACHINERY, BY REGION, 2021–2026 (USD MILLION)

7.7 AGRICULTURAL & GARDENING EQUIPMENT

7.7.1 AGRARIAN COUNTRIES EXPECTED TO STIMULATE MARKET DEMAND

TABLE 37 PLAIN BEARING MARKET FOR AGRICULTURAL & GARDENING EQUIPMENT, BY REGION, 2016–2020 (USD MILLION)

TABLE 38 PLAIN BEARING MARKET FOR AGRICULTURAL & GARDENING EQUIPMENT, BY REGION, 2021–2026 (USD MILLION)

7.8 OILFIELD MACHINERY

7.8.1 INCREASING DEMAND FOR OIL & DOWNSTREAM PRODUCTS TO DRIVE MARKET

TABLE 39 PLAIN BEARING MARKET FOR OILFIELD MACHINERY, BY REGION, 2016–2020 (USD MILLION)

TABLE 40 PLAIN BEARING MARKET FOR OILFIELD MACHINERY, BY REGION, 2021–2026 (USD MILLION)

7.9 OFFICE PRODUCTS

7.9.1 RISE IN REMOTE WORKING EXPECTED TO DRIVE MARKET

TABLE 41 PLAIN BEARING MARKET FOR OFFICE PRODUCTS, BY REGION, 2016–2020 (USD MILLION)

TABLE 42 PLAIN BEARING MARKET FOR OFFICE PRODUCTS, BY REGION, 2021–2026 (USD MILLION)

7.10 OTHERS

TABLE 43 PLAIN BEARING MARKET FOR OTHERS, BY REGION, 2016–2020 (USD MILLION)

TABLE 44 PLAIN BEARING MARKET FOR OTHERS, BY REGION, 2021–2026 (USD MILLION)

8 PLAIN BEARING MARKET, BY REGION (Page No. - 93)

8.1 INTRODUCTION

FIGURE 28 PLAIN BEARING MARKET: GLOBAL SNAPSHOT (2021-2026)

TABLE 45 PLAIN BEARING MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 46 PLAIN BEARING MARKET, BY REGION, 2021–2026 (USD MILLION)

8.2 ASIA PACIFIC

FIGURE 29 ASIA PACIFIC PLAIN BEARING MARKET SNAPSHOT

TABLE 47 ASIA PACIFIC PLAIN BEARING MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 48 ASIA PACIFIC PLAIN BEARING MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 49 ASIA PACIFIC PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 50 ASIA PACIFIC PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 51 ASIA PACIFIC PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 52 ASIA PACIFIC PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.2.1 CHINA

8.2.1.1 China accounts for largest share of market in Asia Pacific region

TABLE 53 CHINA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 54 CHINA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 55 CHINA PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 56 CHINA PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.2.2 JAPAN

8.2.2.1 Automotive industry to boost plain bearing market in Japan

TABLE 57 JAPAN PLAIN BEARING MARKET, BY END-USE INDSUTRY, 2016–2020 (USD MILLION)

TABLE 58 JAPAN PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 59 JAPAN PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 60 JAPAN PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.2.3 INDIA

8.2.3.1 Building & construction industry to drive market

TABLE 61 INDIA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 62 INDIA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 63 INDIA PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 64 INDIA PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.2.4 SOUTH KOREA

8.2.4.1 Energy sector to boost market

TABLE 65 SOUTH KOREA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 66 SOUTH KOREA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 67 SOUTH KOREA PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 68 SOUTH KOREA PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.2.5 THAILAND

8.2.5.1 Growing automotive industry to increase demand for plain bearings

TABLE 69 THAILAND PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 70 THAILAND PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 71 THAILAND PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 72 THAILAND PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.2.6 AUSTRALIA

8.2.6.1 Aerospace industry to drive market in Australia

TABLE 73 AUSTRALIA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 74 AUSTRALIA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 75 AUSTRALIA PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 76 AUSTRALIA PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.2.7 SINGAPORE

8.2.7.1 Increasing investments in energy sector to boost market

TABLE 77 SINGAPORE PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 78 SINGAPORE PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 79 SINGAPORE PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 80 SINGAPORE PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.2.8 REST OF ASIA PACIFIC

TABLE 81 REST OF ASIA PACIFIC PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 82 REST OF ASIA PACIFIC PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 83 REST OF ASIA PACIFIC PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 84 REST OF ASIA PACIFIC PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.3 EUROPE

TABLE 85 EUROPE PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 86 EUROPE PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

FIGURE 30 EUROPE PLAIN BEARING MARKET SNAPSHOT

TABLE 87 EUROPE PLAIN BEARING MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 88 EUROPE PLAIN BEARING MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 89 EUROPE PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 90 EUROPE PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.3.1 GERMANY

8.3.1.1 Germany accounts for largest market share in European region

TABLE 91 GERMANY PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 92 GERMANY PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 93 GERMANY PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 94 GERMANY PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.3.2 FRANCE

8.3.2.1 Automotive industry to drive market growth

TABLE 95 FRANCE PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 96 FRANCE PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 97 FRANCE PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 98 FRANCE PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.3.3 UK

8.3.3.1 Fastest-growing market for plain bearings in European region

TABLE 99 UK PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 100 UK PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 101 UK PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 102 UK PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.3.4 ITALY

8.3.4.1 Aerospace industry to drive demand for plain bearings in Italy

TABLE 103 ITALY PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 104 ITALY PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 105 ITALY PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 106 ITALY PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.3.5 SPAIN

8.3.5.1 Growing energy sector to boost market growth

TABLE 107 SPAIN PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 108 SPAIN PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 109 SPAIN PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 110 SPAIN PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.3.6 RUSSIA

8.3.6.1 Automotive industry to drive demand for plain bearings in Russia

TABLE 111 RUSSIA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 112 RUSSIA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 113 RUSSIA PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 114 RUSSIA PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.3.7 REST OF EUROPE

TABLE 115 REST OF EUROPE PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 116 REST OF EUROPE PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 117 REST OF EUROPE PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 118 REST OF EUROPE PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.4 NORTH AMERICA

TABLE 119 NORTH AMERICA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 120 NORTH AMERICA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

FIGURE 31 NORTH AMERICA PLAIN BEARING MARKET SNAPSHOT

TABLE 121 NORTH AMERICA PLAIN BEARING MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 122 NORTH AMERICA PLAIN BEARING MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 123 NORTH AMERICA PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 124 NORTH AMERICA PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.4.1 US

8.4.1.1 US accounts for largest market share in North American region

TABLE 125 US PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 126 US PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 127 US PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 128 US PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.4.2 CANADA

8.4.2.1 Automotive industry to propel market growth

TABLE 129 CANADA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 130 CANADA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 131 CANADA PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 132 CANADA PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.4.3 MEXICO

8.4.3.1 Energy sector to boost market in Mexico

TABLE 133 MEXICO PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 134 MEXICO PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 135 MEXICO PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 136 MEXICO PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.5 MIDDLE EAST & AFRICA

TABLE 137 MIDDLE EAST & AFRICA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 138 MIDDLE EAST & AFRICA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 139 MIDDLE EAST & AFRICA PLAIN BEARING MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 140 MIDDLE EAST & AFRICA PLAIN BEARING MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 141 MIDDLE EAST & AFRICA PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 142 MIDDLE EAST & AFRICA PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.5.1 SAUDI ARABIA

8.5.1.1 Saudi Arabia accounts for largest market share in Middle East & Africa region

TABLE 143 SAUDI ARABIA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 144 SAUDI ARABIA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 145 SAUDI ARABIA PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 146 SAUDI ARABIA PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.5.2 QATAR

8.5.2.1 Increasing investments in construction industry to boost market growth

TABLE 147 QATAR PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 148 QATAR PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 149 QATAR PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 150 QATAR PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.5.3 TURKEY

8.5.3.1 Aerospace industry to drive market in Turkey

TABLE 151 TURKEY PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 152 TURKEY PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 153 TURKEY PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 154 TURKEY PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 155 REST OF MIDDLE EAST & AFRICA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 156 REST OF MIDDLE EAST & AFRICA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 157 REST OF MIDDLE EAST & AFRICA PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 158 REST OF MIDDLE EAST & AFRICA PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.6 SOUTH AMERICA

TABLE 159 SOUTH AMERICA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 160 SOUTH AMERICA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 161 SOUTH AMERICA PLAIN BEARING MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 162 SOUTH AMERICA PLAIN BEARING MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 163 SOUTH AMERICA PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 164 SOUTH AMERICA PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.6.1 BRAZIL

8.6.1.1 Brazil accounts for largest market share in South American region

TABLE 165 BRAZIL PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 166 BRAZIL PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 167 BRAZIL PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 168 BRAZIL PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.6.2 ARGENTINA

8.6.2.1 Agricultural sector to increase demand for plain bearings in Argentina

TABLE 169 ARGENTINA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 170 ARGENTINA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 171 ARGENTINA PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 172 ARGENTINA PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.6.3 PERU

8.6.3.1 Mining industry to drive plain bearings market in Peru

TABLE 173 PERU PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 174 PERU PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 175 PERU PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 176 PERU PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.6.4 REST OF SOUTH AMERICA

TABLE 177 REST OF SOUTH AMERICA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 178 REST OF SOUTH AMERICA PLAIN BEARING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 179 REST OF SOUTH AMERICA PLAIN BEARING MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 180 REST OF SOUTH AMERICA PLAIN BEARING MARKET, BY TYPE, 2021–2026 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 159)

9.1 OVERVIEW

9.2 KEY PLAYER STRATEGIES

TABLE 181 OVERVIEW OF STRATEGIES ADOPTED BY PLAIN BEARING MANUFACTURERS

9.3 REVENUE ANALYSIS

9.3.1 REVENUE ANALYSIS OF TOP PLAYERS IN PLAIN BEARING MARKET

FIGURE 32 TOP FIVE PLAYERS – REVENUE ANALYSIS (2016-2020)

9.4 MARKET SHARE ANALYSIS: PLAIN BEARING MARKET (2020)

FIGURE 33 SKF GROUP ACCOUNTED FOR LARGEST SHARE IN PLAIN BEARING MARKET IN 2020

TABLE 182 PLAIN BEARING MARKET: DEGREE OF COMPETITION

9.4.1 NTN CORPORATION

9.4.2 NSK LTD.

9.4.3 TIMKEN COMPANY

9.4.4 SKF GROUP

9.4.5 SCHAEFFLER TECHNOLOGIES AG & CO. KG

9.5 COMPETITIVE LANDSCAPE MAPPING, 2020

9.5.1 STAR

9.5.2 EMERGING LEADERS

9.5.3 PERVASIVE

9.5.4 PARTICIPANTS

FIGURE 34 PLAIN BEARING MARKET: COMPETITIVE LANDSCAPE MAPPING, 2020

9.6 COMPETITIVE BENCHMARKING

9.6.1 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 35 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN PLAIN BEARING MARKET

9.6.2 BUSINESS STRATEGY EXCELLENCE

FIGURE 36 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN PLAIN BEARING MARKET

9.7 SME MATRIX, 2020

9.7.1 PROGRESSIVE COMPANIES

9.7.2 DYNAMIC COMPANIES

9.7.3 RESPONSIVE COMPANIES

9.7.4 STARTING BLOCKS

FIGURE 37 PLAIN BEARING MARKET: COMPETITIVE LEADERSHIP MAPPING OF EMERGING COMPANIES, 2020

TABLE 183 COMPANY INDUSTRY FOOTPRINT, 2020

TABLE 184 COMPANY REGIONAL FOOTPRINT, 2020

TABLE 185 COMPANY OVERALL FOOTPRINT, 2020

9.8 KEY MARKET DEVELOPMENTS

TABLE 186 PLAIN BEARING MARKET: NEW PRODUCT LAUNCHES, JANUARY 2016–AUGUST 2021

TABLE 187 PLAIN BEARING MARKET: DEALS, JANUARY 2016–AUGUST 2021

TABLE 188 PLAIN BEARING MARKET: OTHERS, JANUARY 2016–AUGUST 2021

10 COMPANY PROFILES (Page No. - 173)

(Business overview, Products offered, Recent developments: Deals, MNM view, Right to win, Strategic choices made, and Weaknesses and competitive threats)*

10.1 NTN CORPORATION

TABLE 189 NTN CORPORATION: COMPANY OVERVIEW

FIGURE 38 NTN CORPORATION: COMPANY SNAPSHOT

10.2 SKF GROUP

TABLE 190 SKF GROUP: COMPANY OVERVIEW

FIGURE 39 SKF GROUP: COMPANY SNAPSHOT

10.3 SCHAEFFLER GROUP

TABLE 191 SCHAEFFLER GROUP: COMPANY OVERVIEW

FIGURE 40 SCHAEFFLER GROUP: COMPANY SNAPSHOT

10.4 TIMKEN COMPANY

TABLE 192 TIMKEN COMPANY: COMPANY OVERVIEW

FIGURE 41 TIMKEN COMPANY: COMPANY SNAPSHOT

10.5 THK CO., LTD.

TABLE 193 THK CO., LTD.: COMPANY OVERVIEW

FIGURE 42 THK CO., LTD.: COMPANY SNAPSHOT

10.6 NSK LTD.

TABLE 194 NSK LTD.: COMPANY OVERVIEW

FIGURE 43 NSK LTD.: COMPANY SNAPSHOT

10.7 MINEBEAMITSUMI INC.

TABLE 195 MINEBEAMITSUMI INC.: COMPANY OVERVIEW

FIGURE 44 MINEBEAMITSUMI INC.: COMPANY SNAPSHOT

10.8 RBC BEARINGS INCORPORATED

TABLE 196 RBC BEARINGS INCORPORATED.: COMPANY OVERVIEW

FIGURE 45 RBC BEARINGS INCORPORATED: COMPANY SNAPSHOT

10.9 SGL CARBON

TABLE 197 SGL CARBON: COMPANY OVERVIEW

FIGURE 46 SGL CARBON: COMPANY SNAPSHOT

10.10 ELRINGKLINGER AG

TABLE 198 ELRINGKLINGER AG: COMPANY OVERVIEW

FIGURE 47 ELRINGKLINGER AG: COMPANY SNAPSHOT

10.11 GGB

TABLE 199 GGB: COMPANY OVERVIEW

10.12 IGUS

TABLE 200 IGUS: COMPANY OVERVIEW

10.13 KASHIMA BEARINGS, INC.

TABLE 201 KASHIMA BEARINGS, INC.: COMPANY OVERVIEW

10.14 BOSTON GEAR LLC

TABLE 202 BOSTON GEAR LLC: COMPANY OVERVIEW

10.15 THOMSON INDUSTRIES, INC.

TABLE 203 THOMSON INDUSTRIES, INC.: COMPANY OVERVIEW

10.16 ZOLLERN GMBH & CO. KG

TABLE 204 ZOLLERN GMBH & CO. KG: COMPANY OVERVIEW

10.17 PBC LINEAR

TABLE 205 PBC LINEAR: COMPANY OVERVIEW

10.18 GGT GLEITLAGER AG

TABLE 206 GGT GLEITLAGER AG: COMPANY OVERVIEW

10.19 MIDWEST CONTROL PRODUCTS CORP.

TABLE 207 MIDWEST CONTROL PRODUCTS CORP.: COMPANY OVERVIEW

10.2 ACCURATE BUSHING COMPANY

TABLE 208 ACCURATE BUSHING COMPANY: COMPANY OVERVIEW

10.21 AEC

TABLE 209 AEC: COMPANY OVERVIEW

10.22 CHIAVETTE UNIFICATE S.P.A

TABLE 210 CHIAVETTE UNIFICATE S.P.A.: COMPANY OVERVIEW

10.23 HEPCOMOTION

TABLE 211 HEPCOMOTION: COMPANY OVERVIEW

10.24 ALLOY BEARINGS

TABLE 212 ALLOY BEARINGS: COMPANY OVERVIEW

10.25 KINGSBURY, INC.

TABLE 213 KINGSBURY, INC.: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent developments: Deals, MNM view, Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 214)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

Bearing Market Overview

The bearing market involves the manufacture and sale of various types of bearings used in different industrial applications. Bearings are used to support rotating or moving parts of machinery, reduce friction, and facilitate smooth movement. The market is driven by the growing demand from various end-use industries such as automotive, aerospace, construction, and mining.

Plain bearings are a type of bearing that does not use rolling elements, but instead relies on a sliding motion between the bearing and the shaft or other moving parts. The plain bearing market is a sub-segment of the larger bearing market, and both are connected through their use in various industrial applications.

As the bearing market continues to grow, it is expected to have a positive impact on the plain bearing market as well. The use of plain bearings is prevalent in many industrial applications, and their demand is expected to increase along with the overall growth of the bearing market.

Bearing Market Trends

One of the major growth use-cases of the bearing market is the rising demand for electric vehicles. Bearings are an integral part of electric vehicle systems and are required for various applications such as electric motors, powertrains, and wheels. The growing demand for electric vehicles is expected to drive the growth of the bearing market in the coming years.

Top Companies in Bearing Market

Some of the top players in the bearing market include SKF Group, Schaeffler Group, NSK Ltd., NTN Corporation, and Timken Company.

Bearing Market Impact on Different Industries

The bearing market has a significant impact on various industries such as automotive, aerospace, construction, and mining. The demand for bearings in these industries is expected to increase as these industries continue to grow. Additionally, the bearing market also impacts the steel industry, as bearings are typically made from steel and require high-quality steel for their production.

Speak to our Analyst today to know more about Bearing Market!

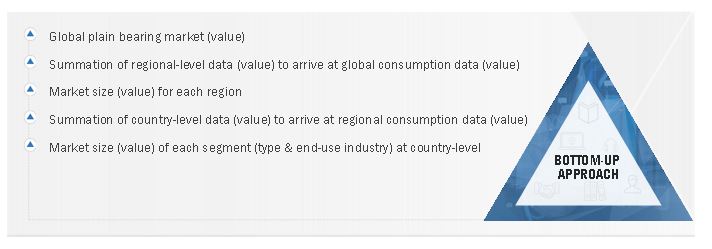

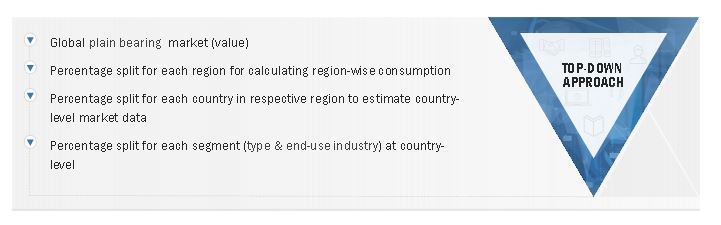

This study involved four major activities in estimating the current size of the plain bearing market. Exhaustive secondary research was undertaken to collect information on the plain bearing market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both, the top-down and bottom-up approaches were employed to estimate the overall size of the market. Thereafter, the market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the plain bearing market.

Secondary Research

As a part of the secondary research process, various secondary sources such as Hoovers, Bloomberg, BusinessWeek, Reuters, and Factiva were referred for identifying and collecting information for this study on the plain bearing market. Secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, authenticated directories, and databases.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the monetary chain of the market, the total pool of players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments undertaken from both, market- and technology oriented perspectives.

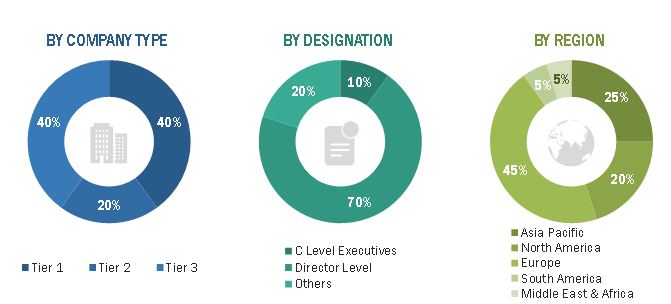

Primary Research

In the primary research process, experts from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents (VPs), marketing directors, and related key executives from major companies and organizations operating in the plain bearing market. Primary sources from the demand side included purchase managers of companies, end users, suppliers, and distributors of plain bearings.

Following is the breakdown of primary respondents interviewed:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the plain bearing market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research

- The supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data

- The research includes the study of reports, reviews, and newsletters of the key market players along with extensive interviews for opinions from leaders, such as directors and marketing executives

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were used, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Report

- To define, describe, and forecast the size of the global plain bearing market, in terms of value based on type, end-use industries and region.

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the global plain bearing market

- To provide the market share analysis of the major players in the plain bearing market

- To analyze and forecast the size of various segments such as end-use industries and type of the plain bearing market based on five major regions—Norths America, Asia Pacific, Europe, South America, and the Middle East & Africa—along with key countries in each of these regions

- To analyze region-specific trends in North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To estimate and forecast the market, in terms of value (USD million) at global and country levels

- To analyze recent developments and competitive strategies, such as acquisitions, expansions, investment and new product launches

- To strategically profile the key players in the market and comprehensively analyze their core competencies

The following customization options are available for the report:

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players (Up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Plain Bearing Market

It is a well-researched document, forecasting the future growth strategy for the consumption of plain bearings worldwide, there is still more scope for technological developments of products, keeping the demands of different sectors in mind.