Sizing Agents Market by Type (Natural and Synthetic), Application (Textile & Fiber, Paper & Paperboard, Cosmetics, Food & Beverage), And Region (Asia Pacific, Europe, North America, South America, Middle East & Africa) - Global Forecast to 2023

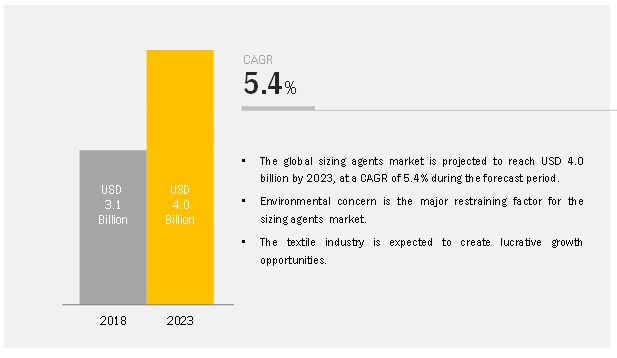

The global sizing agents market is estimated to be USD 3.1 billion in 2018 and is projected to reach USD 4.0 billion by 2023, at a CAGR of 5.4% during the same period. The study involved four major activities in estimating the current market size for sizing agents. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet have been referred to, so as to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, whitepapers, certified publications, articles by recognized authors, gold standard & silver standard websites, associations, regulatory bodies, trade directories, and databases.

Primary Research

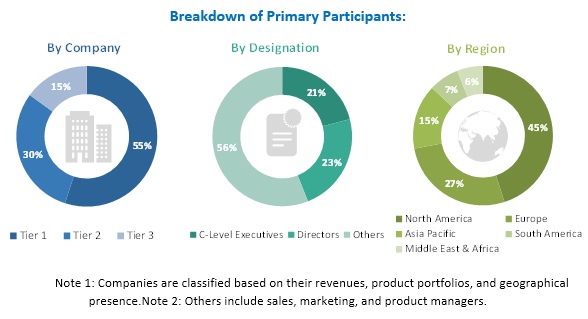

The sizing agents market comprises several stakeholders such as raw material suppliers, end product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the developments in paper & paperboard and textile industries. The supply side is characterized by market consolidation activities undertaken by paper & paperboard and textile producers. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation:

Both top-down and bottom-up approaches were used to estimate and validate the total size of the sizing agents market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation:

After arriving at the overall market size-using the market size estimation processes as explained abovethe market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides, in the paper & paperboard and textile industries.Report Objectives:

- To define, describe, and analyze the sizing agents market based on type, application, and region

- To forecast and analyze the size of the sizing agents market (in terms of value) in five key regions, namely, APAC, North America, Europe, South America, and the Middle East & Africa

- To forecast and analyze the sizing agents market at the country level in each region

- To strategically analyze each submarket with respect to the individual growth trends and its contribution to the overall sizing agents market

- To analyze the drivers in the sizing agents market for the stakeholders by identifying high-growth segments of the market

- To identify significant market trends and factors driving or inhibiting the growth of the sizing agents market and its submarkets

- To strategically profile the key players in the sizing agents market and comprehensively analyze their growth strategies

Scope of the Report:

Report Metric |

Details |

|

Market size available for years |

20162023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast units |

Value (USD Billion), Volume (Kiloton) |

|

Segments covered |

Type, Application, and Region |

|

Geographies covered |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies covered |

BASF (Germany), Aries Chemical (US), Pulcra Chemicals (Germany), Kemira OYJ (Finland), Solenis (US), and Omnova Solutions (US) |

Scope of the Report

This report categorizes the sizing agents market based on type, application, and region.

Sizing Agents Market, by Type:

- Natural Sizing Agents

- Synthetic Sizing Agents

Sizing Agents Market, by Application:

- Textile & Fiber

- Paper & Paperboard

- Others (Cosmetics, Food & Beverage, Glass Fiber)

Sizing agents Market, by Region:

- APAC

- North America

- Europe

- South America

- Middle East & Africa

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

Regional Analysis

- A further breakdown of the regional sizing agents market to the country level with additional applications and/or types

Country Information

- Additional country information (up to 3)

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

The global sizing agents market is estimated to be USD 3.1 billion in 2018 and is projected to reach USD 4.0 billion by 2023, at a CAGR of 5.4% during the same period. The growth in the production of textile & clothing industry and paper & paperboard products due to the demand for paper-based packaging is expected to drive the sizing agents market.

By type, the synthetic segment is expected to be the largest contributor to the sizing agents market during the forecast period.

The growth of the segment is mainly attributed to the demand for synthetic sizing agents such as polyvinyl alcohol and styrene among others. They are increasingly consumed in various applications such as textile & fiber and paper& paperboard applications. The above-mentioned factors are responsible for driving the demand for sizing agents during the forecast period.

By application, the textile & fiber segment is expected to be the largest contributor to the sizing agents market during the forecast period.

The growth of the segment is mainly driven by increasing global production of textile and clothing products. Furthermore, the various physical properties possessed by sizing agents help in strengthening of the yarn and impart abrasion resistance. The demand for sizing agents has increased owing to the huge textile production capacity and strong demand for textile and clothing. Moreover, expansion of automotive, aerospace, and medical industries and shift from the traditional low-value textile to high-value textile products also support the growth of the sizing agents market.

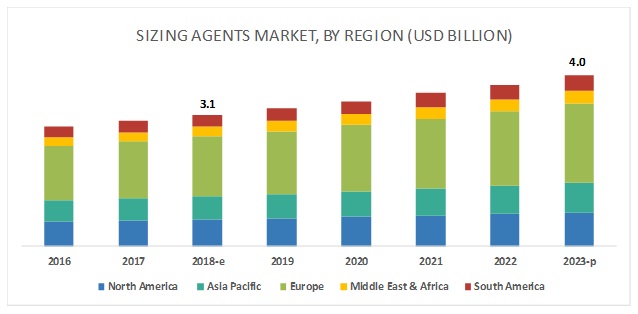

APAC is expected to account for the largest market size during the forecast period.

The growth of the market in the region is mainly driven by the shift of production facilities from North America and Europe to APAC. China, India, Japan, and Southeast Asia are the major contributors to the pulp & paper and textile & clothing production. APAC is one of the largest exporters of textile & clothing products across the globe. The growth of the packaging industry in the region, owing to increasing per capita expenditure on food & beverage and growing industrialization, is further expected to create the demand for paper-based packaging in the region. This, in turn, is expected to drive the sizing agents market in the region.

Key Market Players

Companies such as BASF (Germany), Aries Chemical (US), Pulcra Chemicals (Germany), Kemira OYJ (Finland), Solenis (US), Omnova Solutions (US), Buckman Laboratories (US), Seiko PMC Corporation (Japan), Evonik (Germany), and Bodo Moller Chemie (Germany) are the leading players in the sizing agents market, globally. Diversified product portfolio, high depth in application reach, and technical assistance to customers are factors responsible for strengthening the position of these companies in the sizing agents market. They have also been adopting various organic growth strategies such as expansion to enhance their current position in the sizing agents market.

Recent Developments

- In January 2017, Kemira OYJ expanded the production of alkaline succinic anhydride (ASA) sizing agents in Nanjing site in China. These agents are used for improving water-resistance in the middle to high-end paper and in packaging board. The expansion will help the company expand its reach in APAC.

Key Questions addressed by the report

- Which are the future revenue pockets in sizing agents market?

- Which key developments are expected to have a high impact on the sizing agents market?

- Which product technologies are expected to cannibalize existing technologies?

- How is the regulations scenario further expected to impact the market?

- What will be the future product mix of the sizing agents market?

- What are the prime strategies of leaders in the sizing agents market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Segmentation

1.3.1 Regions Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Primary Data

2.1.2 Key Data From Primary Sources

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.3.1 Market Breakdown and Data Triangulation

2.4 Assumptions and Limitations

2.4.1 Assumptions for the Study

2.4.2 Limitations of the Study

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities in the Sizing Agents Market

4.2 Sizing Agents Market Growth, By Region

4.3 APAC: Sizing Agents Market, By Application and Country

4.4 Sizing Agents Market, By Application

4.5 Sizing Agents Market, By Major Countries

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Sizing Agents Due to Wide Industrial Application

5.2.2 Restraints

5.2.2.1 Environmental Concerns

5.2.3 Challenges

5.2.3.1 Fluctuating Prices of Raw Materials and Cyclic Nature of the Textile Industry

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Overview

5.4.1 Trends and Forecast of GDP

5.4.2 Textiles and Clothing Export, By Country

6 Sizing Agents Market, By Type (Page No. - 38)

6.1 Introduction

6.2 Natural Sizing Agents

6.2.1 Starch

6.2.1.1 Textile Industry to Drive the Demand During the Forecast Period

6.2.2 Rosin

6.2.2.1 Increased Used in Paper & Paperboard Application to Drive the Demand

6.2.3 Others

6.3 Synthetic Sizing Agents

6.3.1 Polyvinyl Alcohol

6.3.1.1 Increased Demand in Textile Industry and Improved Efficiency in Its Properties to Drive the Market

6.3.2 Styrene

6.3.2.1 Increased Demand for Paperboard Packaging to Drive the Demand

6.3.3 Others

7 Sizing Agents Market, By Application (Page No. - 43)

7.1 Introduction

7.2 Paper & Paperboard

7.2.1 High Water Repellency of Sizing Agents to Drive Its Demand in the Paper& Paperboard Application

7.3 Textile & Fiber

7.3.1 Reduction in Breakage of Yarn to Drive the Demand for Sizing Agents in the Textile & Fiber Application

7.4 Others

7.4.1 Increased Demand in Glass Fibers and Cosmetics to Drive the Market for Sizing Agents During the Forecast Period

8 Sizing Agents Market, By Region (Page No. - 49)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 Technological Advancements in the Textile Industry are Expected to Drive the Market for Sizing Agents in the US

8.2.2 Canada

8.2.2.1 High Living Standards and Increasing E-Commerce Industry in Canada are Boosting the Sizing Agents Market

8.2.3 Mexico

8.2.3.1 Improving Paper Industry and Low Labor Costs Drive the Market of Sizing Agents

8.3 Europe

8.3.1 Germany

8.3.1.1 Rapid Growth of the Textile & Clothing Industry to Drive the Sizing Agents Market

8.3.2 France

8.3.2.1 Growth in the Textile Industry to Drive the Sizing Agents Market

8.3.3 UK

8.3.3.1 Technological Advancement in Textile Manufacturing to Drive the Sizing Agents Market

8.3.4 Italy

8.3.4.1 Promotion of Branded Fabrics and an Increase in the Production of Papers to Drive the Demand for Sizing Agents

8.3.5 Turkey

8.3.5.1 Growing Investment in Technology and Innovation to Drive the Sizing Agents Market

8.3.6 Spain

8.3.6.1 Incorporation on New Textile Manufacturing Industries has Helped the Growth of the Sizing Agents Market

8.3.7 Rest of Europe

8.4 APAC

8.4.1 China

8.4.1.1 Structural Changes in the Textile and Apparel Industry and Rising Demand for Paper and Paperboard Products to Drive the Market

8.4.2 Bangladesh

8.4.2.1 Availability of Cheap Labor and Increase in Exports of Garments to Boost the Growth of the Sizing Agents Market

8.4.3 India

8.4.3.1 100% Fdi in the Textile Industry and Easy Availability of Cheap Labor to Drive the Market for Sizing Agents in India

8.4.4 Indonesia

8.4.4.1 Increase in Textile & Apparel Export and Expansion of Paper & Pulp Production Mill to Drive the Demand for Sizing Agents

8.4.5 Rest of APAC

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.1.1 Rising Population and Improved Government Spending to Boost the Sizing Agents Market Growth

8.5.2 South Africa

8.5.2.1 Significant Technological Change in the Textile Industry and Emerging Paper Industry Will Drive the Sizing Agents Market

8.5.3 UAE

8.5.3.1 Large Presence of Textile and Paper Manufacturing Facilities Drives the Market of Sizing Agents

8.5.4 Rest of Middle East & Africa

8.5.4.1 Rising Industrial Activities Expected to Drive the Market for Sizing Agents

8.6 South America

8.6.1 Brazil

8.6.1.1 Rapid Growth of the Paper & Paperboard Industry to Drive the Sizing Agents Market

8.6.2 Argentina

8.6.2.1 Textile & Fiber Application of Sizing Agents to Grow at A High Rate in Argentina

8.6.3 Rest of South America

9 Competitive Landscape (Page No. - 80)

9.1 Introduction

9.2 Market Ranking of Key Players

9.3 Competitive Scenario

9.3.1 Expansion

10 Company Profiles (Page No. - 82)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 Kemira Oyj

10.2 Solenis

10.3 BASF

10.4 Omnova Solutions

10.5 Buckman

10.6 Pulcra Chemicals

10.7 Evonik Industries

10.8 Seiko PMC Corporation

10.9 Bodo Moller Chemie

10.10 Aries Chemical

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

10.11 Other Companies

10.11.1 Indokem

10.11.2 Mizobata Chemical

10.11.3 Nalco Water

10.11.4 CP Kelco

10.11.5 Jai Aravali Industries

10.11.6 Polyscope Polymers Bv

10.11.7 Harima Chemicals

10.11.8 Avebe

10.11.9 Rhea Chemicals

11 Appendix (Page No. - 103)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (83 Tables)

Table 1 Real GDP Growth of the Key Countries, 20162022 (USD Billion)

Table 2 Textile and Clothing Export of Key 25 Countries in 2016

Table 3 Sizing Agents Market Size, By Type, 20162023 (USD Million)

Table 4 Sizing Agents Market Size, By Type, 20162023 (Kiloton)

Table 5 Natural Sizing Agents Market Size, By Sub Type, 20162023 (USD Million)

Table 6 Natural Sizing Agents Market Size, By Sub Type, 20162023 (Kiloton)

Table 7 Synthetic Sizing Agents Market Size, By Sub Type, 20162023 (USD Million)

Table 8 Synthetic Sizing Agents Market Size, By Sub Type, 20162023 (Kiloton)

Table 9 Sizing Agents Market Size, By Application, 20162023 (USD Million)

Table 10 Sizing Agents Market Size, By Application, 20162023 (Kiloton)

Table 11 Sizing Agents Market Size in Paper & Paperboard Application, By Region, 20162023 (USD Million)

Table 12 Sizing Agents Market Size in Paper & Paperboard Application, By Region, 20162023 (Kiloton)

Table 13 Sizing Agents Market Size in Textile & Fiber Application, By Region, 20162023 (USD Million)

Table 14 Sizing Agents Market Size in Textile & Fiber Application, By Region, 20162023 (Kiloton)

Table 15 Sizing Agents Market Size in Other Applications, By Region, 20162023 (USD Million)

Table 16 Sizing Agents Market Size in Other Applications, By Region, 20162023 (Kiloton)

Table 17 Sizing Agents Market Size, By Region, 20162023 (USD Million)

Table 18 Sizing Agents Market Size, By Region, 20162023 (Kiloton)

Table 19 North America: By Market Size, By Country, 20162023 (USD Million)

Table 20 North America: By Market Size, By Country, 20162023 (Kiloton)

Table 21 North America: By Market Size, By Application, 20162023 (USD Million)

Table 22 North America: By Market Size, By Application, 20162023 (Kiloton)

Table 23 US: By Market Size, By Application, 20162023 (USD Million)

Table 24 US: By Market Size, By Application, 20162023 (Kiloton)

Table 25 Canada: By Market Size, By Application, 20162023 (USD Million)

Table 26 Canada: By Market Size, By Application, 20162023 (Kiloton)

Table 27 Mexico: By Market Size, Application, 20162023 (USD Million)

Table 28 Mexico: By Market Size, Application, 20162023 (Kiloton)

Table 29 Europe: By Market Size, By Country, 20162023 (USD Million)

Table 30 Europe: By Market Size, By Country, 20162023 (Kiloton)

Table 31 Europe: By Market Size, By Application, 20162023 (USD Million)

Table 32 Europe: By Market Size, By Application, 20162023 (Kiloton)

Table 33 Germany: By Market Size, By Application, 20162023 (USD Million)

Table 34 Germany: By Market Size, By Application, 20162023 (Kiloton)

Table 35 France: By Market Size, Application, 20162023 (USD Million)

Table 36 France: By Market Size, Application, 20162023 (Kiloton)

Table 37 UK: By Market Size, By Application, 20162023 (USD Million)

Table 38 UK: By Market Size, By Application, 20162023 (Kiloton)

Table 39 Italy: By Market Size, By Application, 20162023 (USD Million)

Table 40 Italy: By Market Size, By Application, 20162023 (Kiloton)

Table 41 Turkey: By Market Size, By Application, 20162023 (USD Million)

Table 42 Turkey: By Market Size, By Application, 20162023 (Kiloton)

Table 43 Spain: By Market Size, By Application, 20162023 (USD Million)

Table 44 Spain: By Market Size, By Application, 20162023 (Kiloton)

Table 45 Rest of Europe: By Market Size, Application, 20162023 (USD Million)

Table 46 Rest of Europe: By Market Size, Application, 20162023(Kiloton)

Table 47 APAC: By Market Size, By Country, 20162023 (USD Million)

Table 48 APAC: By Market Size, By Country, 20162023 (Kiloton)

Table 49 APAC: By Market Size, By Application, 20162023 (USD Million)

Table 50 APAC: By Market Size, By Application, 20162023 (Kiloton)

Table 51 China: By Market Size, By Application, 20162023 (USD Million)

Table 52 China: By Market Size, By Application, 20162023 (Kiloton)

Table 53 Bangladesh: By Market Size, By Application, 20162023 (USD Million)

Table 54 Bangladesh: By Market Size, By Application, 20162023 (Kiloton)

Table 55 India: By Market Size, By Application, 20162023 (USD Million)

Table 56 India: By Market Size, By Application, 20162023 (Kiloton)

Table 57 Indonesia: By Market Size, By Application, 20162023 (USD Million)

Table 58 Indonesia: By Market Size, By Application, 20162023 (Kiloton)

Table 59 Rest of APAC: By Market Size, By Application, 20162023 (USD Million)

Table 60 Rest of APAC: By Market Size, By Application, 20162023 (Kiloton)

Table 61 Middle East & Africa: By Market Size, By Country, 20162023 (USD Million)

Table 62 Middle East & Africa: By Market Size, By Country, 20162023 (Kiloton)

Table 63 Middle East and Africa: By Market Size, By Application, 20162023 (USD Million)

Table 64 Middle East and Africa: By Market Size, By Application, 20162023 (Kiloton)

Table 65 Saudi Arabia: By Market Size, By Application, 20162023 (USD Million)

Table 66 Saudi Arabia: Flotation Reagents Market Size, By Application, 20162023 (Kiloton)

Table 67 South Africa: By Market Size, By Application, 20162023 (USD Million)

Table 68 South Africa: By Market Size, By Application, 20162023 (Kiloton)

Table 69 UAE: By Market Size, By Application, 20162023 (USD Million)

Table 70 UAE: By Market Size, By Application, 20162023 (Kiloton)

Table 71 Rest of Middle East & Africa: By Market Size, Application, 20162023 (USD Million)

Table 72 Rest of Middle East & Africa: By Market Size, Application, 20162023 (Kiloton)

Table 73 South America: By Market Size, By Country, 20162023 (USD Million)

Table 74 South America: By Market Size, By Country, 20162023 (Kiloton)

Table 75 South America: By Market Size, By Application, 20162023 (USD Million)

Table 76 South America: By Market Size, By Application, 20162023 (Kiloton)

Table 77 Brazil: By Market Size, By Application, 20162023 (USD Million)

Table 78 Brazil: By Market Size, By Application, 20162023 (Kiloton)

Table 79 Argentina: By Market Size, By Application, 20162023 (USD Million)

Table 80 Argentina: By Market Size, By Application, 20162023 (Kiloton)

Table 81 Rest of South America: By Market Size, By Application, 20162023 (USD Million)

Table 82 Rest of South America: By Market Size, By Application, 20162023 (Kiloton)

Table 83 Expansion, 20152018

List of Figures (31 Figures)

Figure 1 Sizing Agents Market: Research Design

Figure 2 Sizing Agents Market: Bottom-Up Approach

Figure 3 Sizing Agents Market: Top-Down Approach

Figure 4 Synthetic Segment to Witness Higher Growth in the Sizing Agents Market

Figure 5 Textile & Fiber Application to Lead the Market During the Forecast Period

Figure 6 APAC to Be Fastest-Growing Market During the Forecast Period

Figure 7 Lucrative Growth in the Textile Industry to Drive the Market Growth During the Forecast Period

Figure 8 APAC to Lead the Sizing Agents Market, 20182023

Figure 9 Textile & Fiber Application Accounted for the Highest Share of the Sizing Agents Market, 2017

Figure 10 Textile & Fiber to Account for the Largest Market of the Overall Sizing Agents Market, 20182023

Figure 11 China to Grow at the Highest Rate During the Forecast Period

Figure 12 Drivers, Restraints, and Challenges: Sizing Agents Market

Figure 13 High Bargaining Power of Buyers Owing to the Presence of A Large Number of Manufacturers in the Sizing Agents Market

Figure 14 Synthetic to Be the Larger Type of Sizing Agents During the Forecast Period

Figure 15 Textile & Fiber Segment to Lead the Sizing Agents Market Between 2018 and 2023

Figure 16 China is Projected to Grow at Higher Rate During the Forecast Period

Figure 17 North America: Sizing Agents Market Snapshot

Figure 18 APAC: Sizing Agents Market Snapshot

Figure 19 Key Developments in the Sizing Agents Market (20152018)

Figure 20 Ranking of Sizing Agents Manufacturers in 2017

Figure 21 Kemira Oyj: Business Overview

Figure 22 Kemira Oyj: SWOT Analysis

Figure 23 Solenis: SWOT Analysis

Figure 24 BASF: Business Overview

Figure 25 BASF: SWOT Analysis

Figure 26 Omnova Solutions: Business Overview

Figure 27 Omnova Solutions: SWOT Analysis

Figure 28 Buckman: SWOT Analysis

Figure 29 Pulcra Chemicals: SWOT Analysis

Figure 30 Evonik Industries: Business Overview

Figure 31 Evonik Industries: SWOT Analysis

Growth opportunities and latent adjacency in Sizing Agents Market