Textile Chemicals Market by Fiber (Natural, Synthetic), Product Type (Coating & Sizing, Colorants & Auxiliaries, Finishing Agents, Desizing Agents, Surfactants), Application (Apparel, Home Textile, Technical Textile) & Region - Global Forecast to 2026

Textile Chemicals Market

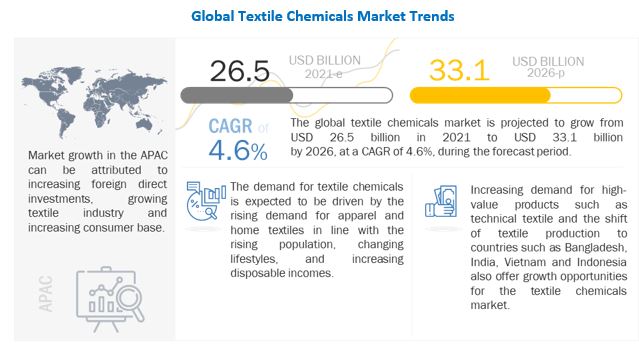

The global textile chemicals market was valued at USD 26.5 billion in 2021 and is projected to reach USD 33.1 billion by 2026, growing at a cagr 4.6% from 2021 to 2026. The driving factor for the market is chemicals' growing demand for technical textiles. Also growing adoption of low VOC and biodegradable materials for textile manufacturing is expected to provide lucrative opportunities for the growth of textile chemicals.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Textile Chemicals Market

The global Textile Chemicals market includes major Tier I and II suppliers Dow, Inc. (US), BASF SE (Germany), Wacker Chemie AG(Germany), Huntsman Corporation(US), Solvay (Belgium) among others. These suppliers have their manufacturing facilities spread across various countries across the Asia Pacific, Europe, North America, and Rest of the World. COVID-19 has impacted their businesses as well.

The global textile chemicals market is expected to witness a decrease in its growth rate in 2020-2021, as the manufacturing industry is badly hit by the covid-19 pandemic. The pandemic has affected both material, labor, and key cost components of construction projects. The pandemic has led to production stoppage in several textile chemicals-producing countries that are under lockdown. APAC and NA are the leading producers of textile chemicals for various end-use industries. All these factors have led to disruption in the supply chain of the Textile Chemicals market as operations have slowed down in many manufacturing units.

Textile Chemicals Market Dynamics

Driver: Increase in demand for Technical textile

Technical textile is a special kind of material or fabric designed for specific purposes. They offer unique and exclusive characteristics which are far different from those of regular fabric. These textiles combine advanced technology and improved properties such as mechanical resistance, elasticity, reinforcement, anti-dust, tenacity, insulation, thermal & fire resistance, and resistance to UV and IR. Technical textiles are generally used for non-aesthetic applications in automobile, medical & personal hygiene, sports & leisure, pollution control & filtration, agriculture, industrial, packaging, and clothing. Thus, growth in the consumption of technical textiles in these applications is fueling the demand for textile chemicals which are used in technical textile to impart advanced properties.

Technical textile is one of the most innovative product segments in the global textile industry due to its growing attractiveness and adaptability. The continuous expansion of automotive and medical industries is continuously fueling the demand for technical textiles. Emerging economies such as China and India are putting more emphasis on adopting the latest technologies and manufacturing processes in various industry segments. This has initiated the adoption of technical textiles across various industrial verticals, thereby, ramping up the demand for textile chemicals as well

Restraint: Stringent environmental regulations regarding disposal of textile effluents

About 90% of the organic chemicals and auxiliaries which are used in pre-treatment and dyeing operations are not retained by the fiber. The major portion of these chemicals is discharged with wastewater and others are released into the air. Volatile organic compounds (VOCs) may be released from activities such as printing processes, cleaning with organic solvents, heat treatments such as thermofixation, drying, curing, and vulcanization.

Furthermore, CO2, SO2, NOx emissions, and particulates are released through the burning of fossil fuels. Thermal energy produced in boiler houses for baths, drying, and curing processes also contribute significantly to air pollution. Conventional textile dyeing processes generate high levels of contaminants, such as unfixed dyestuffs and salts, which may be released into effluent water streams. Increasing stringent regulations are being imposed that mandate release of cleaner mill waste-water to minimize the effect. These regulations emphasized the importance of recovery and reuse operations, thereby, adding to the cost. These stringent regulations are making companies focus on developing products which restrict their market operations and necessitates more R&D spending on new products/better technology which are environment-friendly and sustainable.

Opportunity: Growing adoption of low VOC and biodegradable materials for textile manufacturing

Under the pressure of governments and non-governmental organizations and end-users, textile manufacturers and suppliers are increasingly being forced to supply textiles that are sustainably produced and are free of hazardous chemicals. Large brands and retailers are asking their suppliers to establish the sustainability of their products. For this purpose, restricted substance lists (RSLs) indicating prohibited chemicals and/or their limit values are established. In addition to RSLs that describe the chemicals to be avoided, so-called positive lists are published, specifying chemical substances that can be used. The Swiss company, Bluesign, for instance, has established a positive list, including dyestuffs and chemicals, which are available to the company’s partners.

Dyes are a major part of textile chemicals used in the fabrication of textiles. However, it has created a huge pollution problem as it is one of the most chemically intensive industries and is the second-worst polluter of clean water after the agriculture sector. There is growing consumer consciousness to purchase eco-friendly clothing and garments. The Manufacturers are opting for low-VOC technologies and eco-friendly dyeing process used to color garments. Consumers are also willing to pay a higher price for such products. Thus, this new wave of low-VOC products use is bringing major opportunities for several clothing manufacturers in terms of developing better technology. Thus, growing adoption low VOC content and biodegradable chemicals are offering new opportunities for market players in the textile chemicals market.

Challenges: Cyclic nature of textile industry

Industries that are susceptible to changing economic cycles are cyclic in nature. In industries such as textiles and commodities, fluctuations in the capital market become wider due to the cyclical natures of their businesses pertaining to dynamic economic cycles. Textile stocks have been more volatile than large benchmark indices.

Furthermore, the raw materials for synthetic textiles are majorly derived from crude oil. Hence, fluctuations in the prices of oil and cotton are expected to adversely impact profit margins in the textile industry. Cotton yarn and synthetic fiber manufacturers are expected to be directly impacted by the rise in the prices of raw materials. This is expected to impact the final textile product manufacturers due to the increase production costs. Thus, fluctuations in crude oil prices and changing economic cycles pose a major challenge for market players in the textile chemicals market.

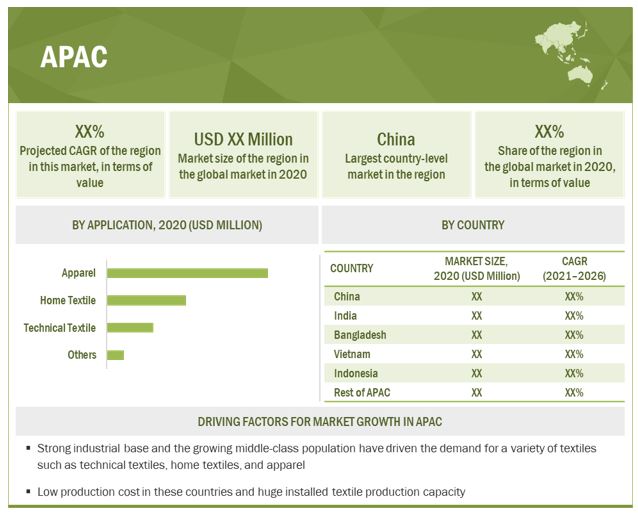

APAC is the largest market for Textile chemicals

APAC accounted for the largest share of the Textile chemicals market in 2020. The textile chemicals market in APAC is driven by the demand from countries such as China, Japan, and India. Rapid industrialization, mainly in emerging economies such as China and India, has been one of the major factors driving the global textile chemicals market.

Textile Chemicals Market Players

Textile chemicals is a diversified and competitive market with a large number of global players and few regional and local players. Dow, Inc. (US), BASF SE (Germany), Wacker Chemie AG(Germany), Huntsman Corporation(US), Solvay (Belgium) are some of the key players in the market.

Textile Chemicals Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 26.5 billion |

|

Revenue Forecast in 2026 |

USD 33.1 billion |

|

CAGR |

4.6% |

|

Market Size Available for Years |

2019-2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021-2026 |

|

Forecast Units |

Value (USD million) |

|

Segments Covered |

Product Type, Fiber Type, Application, and Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, Middle East, |

|

Companies Covered |

Some of the leading players operating in the Textile Chemicals market include Dow, Inc. (US), BASF SE (Germany), Wacker Chemie AG(Germany), Huntsman Corporation(US), Solvay (Belgium) |

This research report categorizes the Textile chemicals market based on Product Type, Fiber Type, Application, and region.

Textile Chemicals Market, By Fiber Type

- Natural Fiber

- Synthetic Fiber

Textile Chemicals Market, By Product Type

- Coating & Sizing Agents

- Colorants & Auxiliaries

- Finishing Agents

- Surfactants

- Desizing Agents

- Bleaching Agents

- Others

Textile Chemicals Market, By Application

- Apparel

- Home Textile

- Technical Textile

- Others

Textile Chemicals Market, By Region

- Asia Pacific

- North America

- Europe

- Middle East

- South America

Recent Developments

- In February 2021, Dow introduced innovative durable water-repellent finishing to enable increasingly sustainable textiles. DOWSIL IE-8749 Emulsion treatment improves fabric retention. Further DOWSIL IE-8749 Emulsion finish does not need to be regularly heat-treated to restore the water repellency performance, which is a key advantage in the durability of the final product. By incorporating DOWSIL IE-8749 Emulsion treatment in their finishing processes, textile finishers receive greater control over the final smooth feel of the fabric.

- In June 2020, Dow launched a new generation hybrid binder for the formulation of water-borne screen printing inks which enable achieving superior durability, color brightness, and opacity in fabrics made of synthetic and natural fibers for the growing streetwear and sportswear markets. The DOWSIL Print 041 Textile Printing Ink Binder enables drop-in, waterborne alternative formulations when compared to conventional textile printing inks, combining high performance, cost-effectiveness, and superior sustainability.

- In December 2020, Wacker launched renewables-based silicone sealants through its ELASTOSIL eco brand. It is the first approach that encompasses and compensates all fossil-based raw materials and additives in the product formulation by using bio-based methanol. The ELASTOSIL eco portfolio also includes a chalk-filled alkoxy-curing silicone sealant which due to its matt appearance and outstanding adhesion profile, is high-grade in weather-seal applications.

- In October 2019, Wacker presented new polymer- and silicone-based products for the manufacture of coatings, adhesives, and sealants at ABRAFATI 2019.

Frequently Asked Questions (FAQ):

How big is the Textile Chemicals Market?

Textile Chemicals Market worth $33.1 billion by 2026.

What is the growth rate of Textile Chemicals Market?

Textile Chemicals Market grows at a CAGR of 4.6% during the forecast period.

Does this report cover volume tables in addition to the value tables?

No

Which countries are considered in the European region?

The report includes the following European countries

- Germany

- UK

- France

- Spain

- Italy

- Belgium

- Turkey

What is the COVID-19 impact on the Textile chemicals market?

Industry experts believe that COVID-19 would have a significant impact on Textile chemicals market. There seems to be decrease in the demand for Textile chemicals from end-use industries, during COVID-19. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.3.1 TEXTILE CHEMICALS MARKET – FORECAST TO 2026

1.4 SCOPE OF THE STUDY

1.4.1 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key primary insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.3 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

2.6 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY (Page No. - 31)

4 PREMIUM INSIGHTS (Page No. - 35)

4.1 ATTRACTIVE OPPORTUNITIES IN THE TEXTILE CHEMICALS MARKET

4.2 APAC TEXTILE CHEMICALS MARKET

4.3 TEXTILE CHEMICALS MARKET, BY COUNTRY

5 MARKET OVERVIEW (Page No. - 38)

5.1 MARKET DYNAMICS

5.1.1 DRIVERS

5.1.1.1 Increasing demand for technical textile

5.1.1.2 Increasing trend towards better home furnishing and aesthetics

5.1.1.3 Increasing demand for sports and activewear

5.1.2 RESTRAINTS

5.1.2.1 Stringent environmental regulations regarding disposal of textile effluents

5.1.3 OPPORTUNITIES

5.1.3.1 Growing adoption of low VOC and biodegradable materials for textile manufacturing

5.1.4 CHALLENGES

5.1.4.1 Cyclic nature of textile industry

5.2 PORTER’S FIVE FORCES ANALYSIS

5.2.1 THREAT OF NEW ENTRANTS

5.2.2 BARGAINING POWER OF BUYERS

5.2.3 THREAT OF SUBSTITUTES

5.2.4 BARGAINING POWER OF SUPPLIERS

5.2.5 INTENSITY OF COMPETITIVE RIVALRY

5.3 MACROECONOMIC OVERVIEW AND TRENDS

5.3.1 INTRODUCTION

5.3.2 TRENDS AND FORECAST OF GDP

5.3.3 TEXTILES AND CLOTHING EXPORT, BY COUNTRY

6 TEXTILE CHEMICALS MARKET, BY FIBER TYPE (Page No. - 46)

6.1 INTRODUCTION

6.2 NATURAL FIBER

6.2.1 GROWTH IN TEXTILE MANUFACTURING HAS DRIVEN THE MARKET

6.2.1.1 Cotton

6.2.1.2 Wool

6.2.1.3 Others

6.3 SYNTHETIC FIBER

6.3.1 SYNTHETIC FIBERS HAVE WIDE INDUSTRIAL APPLICATIONS

6.3.1.1 Polyester

6.3.1.2 Polyamide

6.3.1.3 Viscose

6.3.1.4 Others

7 TEXTILE CHEMICALS MARKET, BY PRODUCT TYPE (Page No. - 50)

7.1 INTRODUCTION

7.2 COATING & SIZING AGENTS

7.2.1 COATING & SIZING AGENTS HELPS TO IMPROVE WEAVING EFFICIENCY

7.3 COLORANT & AUXILIARIES

7.3.1 COLORANT & AUXILIARIES ARE MAINLY USED FOR COLORING TEXTILES

7.4 FINISHING AGENTS

7.4.1 FINISHING AGENTS ARE USED TO IMPROVE THE SMOOTHNESS OR ROUGHNESS OF TEXTILES

7.5 SURFACTANTS

7.5.1 SURFACTANTS ARE WIDELY USED IN THE TEXTILE INDUSTRY

7.6 DESIZING AGENTS

7.6.1 DESIZING AGENTS RE MAJORLY USED FOR REMOVAL OF STARCH FROM FABRICS

7.7 BLEACHING AGENTS

7.7.1 BLEACHING AGENTS ARE USED TO REMOVE COLOR FROM TEXTILES

7.8 OTHERS

8 TEXTILE CHEMICALS MARKET, BY APPLICATION (Page No. - 54)

8.1 INTRODUCTION

8.2 APPAREL

8.2.1 APPAREL MARKET IS DRIVEN BY ECONOMIC GROWTH AND INCREASING DISPOSABLE INCOME

8.2.1.1 Sportswear

8.2.1.2 Intimates

8.2.1.3 Outerwear

8.3 HOME TEXTILES

8.3.1 DEMAND FOR NEW STYLES, COLORS, AND CHANGING INTERIOR DESIGN TRENDS HAVE DRIVEN THE MARKET FOR HOME TEXTILES

8.3.1.1 Bed Linens

8.3.1.2 Carpet

8.3.1.3 Curtains

8.3.1.4 Others

8.4 TECHNICAL TEXTILES

8.4.1 TECHNICAL TEXTILES ARE MAJORLY USED IN NON-ESTHETIC APPLICATIONS

8.5 OTHERS

9 TEXTILE CHEMICALS MARKET, BY REGION (Page No. - 58)

9.1 INTRODUCTION

9.2 APAC

9.2.1 CHINA

9.2.1.1 Increasing demand for face masks and personal protective equipment drive the textile chemicals market in China

9.2.2 INDIA

9.2.2.1 Rising R&D activities in the Textile Chemicals to drive the market

9.2.3 BANGLADESH

9.2.3.1 Increasing garment exports are driving the textile chemicals market

9.2.4 VIETNAM

9.2.4.1 Market in Vietnam has high growth potential which is turn in driving the textile chemical market

9.2.5 INDONESIA

9.2.5.1 Increase in investments in the textiles and apparel industry has driven the market

9.2.6 REST OF APAC

9.3 NORTH AMERICA

9.3.1 US

9.3.1.1 The US to lead the market in North America by 2026

9.3.2 CANADA

9.3.2.1 Canada has a technologically advanced industrial economy drives market growth

9.3.3 MEXICO

9.3.3.1 Growing demand for industrial fabrics boosts the market in Mexico

9.4 EUROPE

9.4.1 GERMANY

9.4.1.1 Market in Germany is growing due to investment in the textile industry

9.4.2 UK

9.4.2.1 Increased opportunities for the UK to export textile goods has driven the market

9.4.3 FRANCE

9.4.3.1 Country’s textile industry is highly developed and mature with domestic and international presence

9.4.4 ITALY

9.4.4.1 Increasing demand from water treatment industries to drive the market

9.4.5 SPAIN

9.4.5.1 Increase the demand for apparel, which, in turn, will support the textile chemicals market

9.4.6 BELGIUM

9.4.6.1 New technological trends and new applications in the textile industry has driven the market

9.4.7 TURKEY

9.4.7.1 Turkey investments in raw materials to drive the grow of textile chemicals

9.4.8 REST OF EUROPE

9.5 MIDDLE EAST & AFRICA

9.5.1 SAUDI ARABIA

9.5.1.1 Saudi Arabia to be the fastest-growing market for textile industry in the region

9.5.2 UAE

9.5.2.1 Growth in the textile industry to drive the market

9.5.3 EGYPT

9.5.3.1 New investments and by adopting the latest technologies has driven the market

9.5.4 REST OF MIDDLE EAST & AFRICA

9.6 SOUTH AMERICA

9.6.1 BRAZIL

9.6.1.1 Brazil to dominate the textile chemicals market in South America

9.6.2 ARGENTINA

9.6.2.1 Growing demand in of Textile Chemicals in manufacturing will drive the market

9.6.3 REST OF SOUTH AMERICA

10 COMPETITIVE LANDSCAPE (Page No. - 111)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

10.3 MARKET RANKING

10.3.1 ARCHROMA

10.3.2 DOW, INC.

10.3.3 HUNTSMAN CORPORATION

10.3.4 TANATEX CHEMICALS

10.3.5 RUDOLF GMBH

10.4 COMPANY EVALUATION QUADRANT

10.4.1.1 Star

10.4.1.2 Pervasive

10.4.1.3 Emerging leader

10.4.1.4 PARTICIPANT

10.5 COMPETITIVE BENCHMARKING

10.5.1 STRENGTH OF PRODUCT PORTFOLIO

10.5.1.1.1 BUSINESS STRATEGY EXCELLENCE

10.6 COMPETITIVE SCENARIO AND TRENDS

10.6.1 DEALS

10.6.2 OTHERS

11 COMPANY PROFILES (Page No. - 128)

11.1 KEY COMPANIES

11.1.1 DOW, INC.

11.1.1.1 Business overview

11.1.1.2 Products and Solutions

11.1.1.3 Recent developments

11.1.1.4 MnM view

11.1.1.4.1 Key strengths/right to win

11.1.1.4.2 Strategic choices made

11.1.1.4.3 Weaknesses and competitive threats

11.1.2 BASF SE

11.1.2.1 Business overview

11.1.2.2 Products and Solutions

11.1.2.3 Recent developments

11.1.2.4 MnM view

11.1.2.4.1 Key strengths/right to win

11.1.2.4.2 Strategic choices made

11.1.2.4.3 Weaknesses and competitive threats

11.1.3 WACKER CHEMIE AG

11.1.3.1 Business overview

11.1.3.2 Products and Solutions

11.1.3.3 Recent developments

11.1.3.4 MnM view

11.1.3.4.1 Key strengths/right to win

11.1.3.4.2 Strategic choices made

11.1.3.4.3 Weaknesses and competitive threats

11.1.4 HUNTSMAN CORPORATION

11.1.4.1 Business overview

11.1.4.2 Products and Solutions

11.1.4.3 Recent developments

11.1.4.4 MnM view

11.1.4.4.1 Key strengths/right to win

11.1.4.4.2 Strategic choices made

11.1.4.4.3 Weaknesses and competitive threats

11.1.5 SOLVAY

11.1.5.1 Business overview

11.1.5.2 Recent developments

11.1.5.3 MnM view

11.1.6 ARCHROMA

11.1.6.1 Business overview

11.1.6.2 Products and Solutions

11.1.6.3 Recent developments

11.1.6.4 MNM view

11.1.6.4.1 Key strengths/right to win

11.1.6.4.2 Strategic choices made

11.1.6.4.3 Weaknesses and competitive threats

11.1.7 EVONIK INDUSTRIES AG

11.1.7.1 Business overview

11.1.7.2 Products and Solutions

11.1.7.3 Recent developments

11.1.7.4 MnM view

11.1.8 RUDOLF GMBH

11.1.8.1 Business overview

11.1.8.2 Products and Solutions

11.1.8.3 Recent developments

11.1.8.4 MnM view

11.1.8.4.1 Key strengths/right to win

11.1.8.4.2 Strategic choices made

11.1.8.4.3 Weaknesses and competitive threats

11.1.9 TANATEX CHEMICALS

11.1.9.1 Business overview

11.1.9.2 Products and Solutions

11.1.9.3 Recent developments

11.1.9.4 MnM view

11.1.9.4.1 Key strengths/right to win

11.1.9.4.2 Strategic choices made

11.1.9.4.3 Weaknesses and competitive threats

11.1.10 DYSTAR SINGAPORE PTE LTD.

11.1.10.1 Business overview

11.1.10.2 Products and Solutions

11.1.10.3 MnM view

11.2 OTHER PLAYERS

11.2.1 EKSOY

11.2.2 SETAS

11.2.3 BOZZETTO GROUP

11.2.4 CHT GROUP

11.2.5 PULCRA CHEMICALS

11.2.6 ROSSARI BIOTECH

11.2.7 VESKIM

11.2.8 THE SEYDEL COMPANIES, INC.

11.2.9 CRODA INTERNATIONAL PLC

11.2.10 RESIL CHEMICALS

11.2.11 SAREX

11.2.12 OMNOVA SOLUTIONS

11.2.13 COVESTRO AG

11.2.14 FINEOTEX CHEMICAL LIMITED

11.2.15 MATEX

12 APPENDIX (Page No. - 179)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

LIST OF TABLES (184 Tables)

TABLE 1 TEXTILE CHEMICALS MARKET SIZE, INCLUSIONS & EXCLUSIONS

TABLE 2 TRENDS AND FORECAST OF PER CAPITA GDP (USD)

TABLE 3 TEXTILE AND CLOTHING EXPORT OF KEY 29 KEY COUNTRIES IN 2020

TABLE 4 TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 5 TEXTILE CHEMICALS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD BILLION)

TABLE 6 TEXTILE CHEMICALS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 7 TEXTILE CHEMICALS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 8 TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 9 HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 10 TEXTILE CHEMICALS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 11 HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY PRODUCT TYPE, 2015–2018 (USD MILLION)

TABLE 12 TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 13 HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 14 APAC: TEXTILE CHEMICALS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 15 APAC: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 16 APAC: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 17 APAC: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 18 APAC: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 19 CHINA: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 20 CHINA: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 21 CHINA: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 22 CHINA: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 23 INDIA: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 24 INDIA: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 25 INDIA: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 26 INDIA: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 27 BANGLADESH: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 28 BANGLADESH: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 29 BANGLADESH: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 30 BANGLADESH: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 31 VIETNAM: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 32 VIETNAM: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 33 VIETNAM: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 34 VIETNAM: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 35 INDONESIA: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 36 INDONESIA: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 37 INDONESIA: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 38 INDONESIA: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 39 REST OF APAC: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 40 REST OF APAC: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 41 REST OF APAC: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 42 REST OF APAC: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 43 NORTH AMERICA: TEXTILE CHEMICALS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 44 NORTH AMERICA: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 45 NORTH AMERICA: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 46 NORTH AMERICA: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 47 NORTH AMERICA: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 48 US: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 49 US: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 50 US: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 51 US: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015-2018 (USD MILLION)

TABLE 52 CANADA: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 53 CANADA: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 54 CANADA: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 55 CANADA: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015-2018 (USD MILLION)

TABLE 56 MEXICO: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 57 MEXICO: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 58 MEXICO: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 59 MEXICO: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015-2018 (USD MILLION)

TABLE 60 EUROPE: TEXTILE CHEMICALS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 61 EUROPE: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 62 EUROPE: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 63 EUROPE: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 64 EUROPE: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 65 GERMANY: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 66 GERMANY: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 67 GERMANY: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 68 GERMANY: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015-2018 (USD MILLION)

TABLE 69 UK: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 70 UK: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 71 UK: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 72 UK: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 73 FRANCE: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 74 FRANCE: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 75 FRANCE: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 76 FRANCE: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 77 ITALY: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 78 ITALY: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 79 ITALY: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 80 ITALY: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 81 SPAIN: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 82 SPAIN: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 83 SPAIN: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 84 SPAIN: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 85 BELGIUM: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 86 BELGIUM: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 87 BELGIUM: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 88 BELGIUM: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 89 TURKEY: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 90 TURKEY: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 91 TURKEY: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 92 TURKEY: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 93 REST OF EUROPE: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 94 REST OF EUROPE: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 95 REST OF EUROPE: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 96 REST OF EUROPE: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 97 MIDDLE EAST & AFRICA: TEXTILE CHEMICALS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 98 MIDDLE EAST & AFRICA: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 99 MIDDLE EAST & AFRICA: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 100 MIDDLE EAST & AFRICA: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 101 MIDDLE EAST & AFRICA: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015–2018 (USD MILLION)

TABLE 102 SAUDI ARABIA: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 103 SAUDI ARABIA: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 104 SAUDI ARABIA: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 105 SAUDI ARABIA: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015-2018 (USD MILLION)

TABLE 106 UAE: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 107 UAE: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 108 UAE: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 109 UAE: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015-2018 (USD MILLION)

TABLE 110 EGYPT: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 111 EGYPT: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 112 EGYPT: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 113 EGYPT: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015-2018 (USD MILLION)

TABLE 114 REST OF MIDDLE EAST & AFRICA: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 115 REST OF MIDDLE EAST & AFRICA: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 116 REST OF MIDDLE EAST & AFRICA: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 117 REST OF MIDDLE EAST & AFRICA: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015-2018 (USD MILLION)

TABLE 118 SOUTH AMERICA: TEXTILE CHEMICALS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 119 SOUTH AMERICA: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 120 SOUTH AMERICA: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 121 SOUTH AMERICA: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 122 SOUTH AMERICA: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015-2018 (USD MILLION)

TABLE 123 BRAZIL: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 124 BRAZIL: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 125 BRAZIL: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 126 BRAZIL: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015-2018 (USD MILLION)

TABLE 127 ARGENTINA: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 128 ARGENTINA: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 129 ARGENTINA: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 130 ARGENTINA: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015-2018 (USD MILLION)

TABLE 131 REST OF SOUTH AMERICA: TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 132 REST OF SOUTH AMERICA: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY FIBER TYPE, 2015–2018 (USD MILLION)

TABLE 133 REST OF SOUTH AMERICA: TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 134 REST OF SOUTH AMERICA: HISTORIC TEXTILE CHEMICALS MARKET SIZE, BY APPLICATION, 2015-2018 (USD MILLION)

TABLE 135 TEXTILE CHEMICALS MARKET: DEALS

TABLE 136 TEXTILE CHEMICALS MARKET: OTHERS

TABLE 137 DOW, INC.: BUSINESS OVERVIEW

TABLE 138 DOW, INC.: PRODUCT OFFERED

TABLE 139 DOW, INC.: NEW PRODUCT LAUNCHES

TABLE 140 BASF SE: BUSINESS OVERVIEW

TABLE 141 BASF SE: PRODUCT OFFERED

TABLE 142 BASF SE: DEALS

TABLE 143 WACKER CHEMIE AG: BUSINESS OVERVIEW

TABLE 144 WACKER CHEMIE AG: PRODUCT OFFERED

TABLE 145 WACKER CHEMIE AG: NEW PRODUCT LAUNCHES

TABLE 146 WACKER CHEMIE AG: DEALS

TABLE 147 HUNTSMAN CORPORATION: BUSINESS OVERVIEW

TABLE 148 HUNTSMAN CORPORATION: PRODUCTS OFFERED

TABLE 149 HUNTSMAN CORPORATION: NEW PRODUCT LAUNCHES

TABLE 150 HUNTSMAN CORPORATION: DEALS

TABLE 151 SOLVAY: BUSINESS OVERVIEW

TABLE 152 SOLVAY: PRODUCT OFFERED

TABLE 153 SOLVAY: NEW PRODUCT LAUNCHES

TABLE 154 ARCHROMA: BUSINESS OVERVIEW

TABLE 155 ARCHROMA: PRODUCT OFFERED

TABLE 156 ARCHROMA: NEW PRODUCT LAUNCHES

TABLE 157 ARCHROMA: DEALS

TABLE 158 EVONIK INDUSTRIES AG: BUSINESS OVERVIEW

TABLE 159 EVONIK INDUSTRIES AG: PRODUCT OFFERED

TABLE 160 EVONIK INDUSTRIES AG: DEALS

TABLE 161 RUDOLF GMBH: BUSINESS OVERVIEW

TABLE 162 RUDOLF GMBH: PRODUCT OFFERED

TABLE 163 RUDOLF GMBH: NEW PRODUCT LAUNCHES

TABLE 164 TANATEX CHEMICALS: BUSINESS OVERVIEW

TABLE 165 TANATEX CHEMICALS: PRODUCTS OFFERED

TABLE 166 TANATEX CHEMICALS: NEW PRODUCT LAUNCHES

TABLE 167 TANATEX CHEMICALS: DEALS

TABLE 168 DYSTAR SINGAPORE PTE LTD.: BUSINESS OVERVIEW

TABLE 169 DYSTAR SINGAPORE PTE LTD.: PRODUCT OFFERED

TABLE 170 EKSOY: BUSINESS OVERVIEW

TABLE 171 SETAS: BUSINESS OVERVIEW

TABLE 172 BOZZETTO GROUP: BUSINESS OVERVIEW

TABLE 173 CHT GROUP: BUSINESS OVERVIEW

TABLE 174 PULCRA CHEMICALS: BUSINESS OVERVIEW

TABLE 175 ROSSARI BIOTECH: BUSINESS OVERVIEW

TABLE 176 VESKIM: BUSINESS OVERVIEW

TABLE 177 THE SEYDEL COMPANIES, INC.: BUSINESS OVERVIEW

TABLE 178 CRODA INTERNATIONAL PLC: BUSINESS OVERVIEW

TABLE 179 RESIL CHEMICALS: BUSINESS OVERVIEW

TABLE 180 SAREX: BUSINESS OVERVIEW

TABLE 181 OMNOVA SOLUTIONS: BUSINESS OVERVIEW

TABLE 182 COVESTRO AG: BUSINESS OVERVIEW

TABLE 183 FINEOTEX CHEMICAL LIMITED: BUSINESS OVERVIEW

TABLE 184 MATEX: BUSINESS OVERVIEW

LIST OF FIGURES (28 Figures)

FIGURE 1 TEXTILE CHEMICALS MARKET SEGMENTATION

FIGURE 2 TEXTILE CHEMICALS MARKET: RESEARCH DESIGN

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

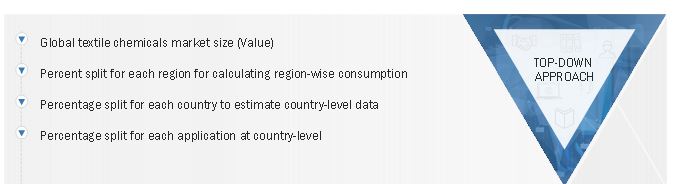

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: SUPPLY-SIDE

FIGURE 6 TEXTILE CHEMICALS: DATA TRIANGULATION

FIGURE 7 SYNTHETIC FIBER SEGMENT TO LEAD OVERALL TEXTILE CHEMICALS MARKET

FIGURE 8 COATING & SIZING AGENTS TO BE THE LARGEST PRODUCT TYPES

FIGURE 9 APPAREL TO DOMINATE THE OVERALL TEXTILE CHEMICALS MARKET, 2021–2026

FIGURE 10 APAC WAS THE LARGEST TEXTILE CHEMICALS MARKET IN 2020

FIGURE 11 EMERGING ECONOMIES TO OFFER LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

FIGURE 12 APPAREL IS THE LARGEST APPLICATION IN THE APAC TEXTILE CHEMICALS MARKET

FIGURE 13 MARKET IN VIETNAM TO GROW AT THE HIGHEST CAGR FROM 2021 TO 2026

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: TEXTILE CHEMICALS MARKET

FIGURE 15 PORTER’S FIVE FORCES ANALYSIS

FIGURE 16 SYNTHETIC FIBER TO COMMAND LARGEST MARKET SHARE IN FORECAST PERIOD

FIGURE 17 COATING & SIZING AGENT’S TO COMMAND LARGEST MARKET SHARE THROUGH FORECAST PERIOD

FIGURE 18 APPAREL TO COMMAND LARGEST MARKET SHARE THROUGH FORECAST PERIOD

FIGURE 19 CHINA TO BE THE FASTEST-GROWING COUNTRY-LEVEL MARKET FROM 2021 TO 2026

FIGURE 20 APAC: TEXTILE CHEMICALS MARKET SNAPSHOT

FIGURE 21 COMPANIES ADOPTED NEW PRODUCT LAUNCHES AS THE KEY GROWTH STRATEGY, 2016–2020

FIGURE 22 MARKET RANKING OF KEY PLAYERS, 2020

FIGURE 23 TEXTILE CHEMICALS MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2020

FIGURE 24 DOW, INC.: COMPANY SNAPSHOT

FIGURE 25 BASF SE: COMPANY SNAPSHOT

FIGURE 26 WACKER CHEMIE AG: COMPANY SNAPSHOT

FIGURE 27 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

FIGURE 28 SOLVAY: COMPANY SNAPSHOT

The global Textile Chemicals Market is estimated to be USD 26.5 billion in 2021 and is projected to reach USD 33.1 billion by 2026, at a CAGR of 4.6% from 2021 to 2026. Thedriving factor for the Textile Chemicals market is chemicals is growing demand for technical textiles. Also growing adoption of low VOC and biodegradable materials for textile manufacturing is expected to provide lucrative opportunities for the growth of textile chemicals.

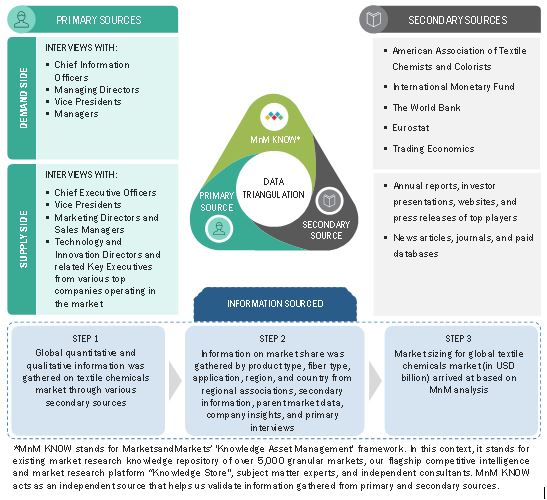

Secondary Research

In the secondary research process, various sources such as Hoovers, Bloomberg Businessweek, Factiva, World Bank, and Industry Journals were used. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases.

Primary Research

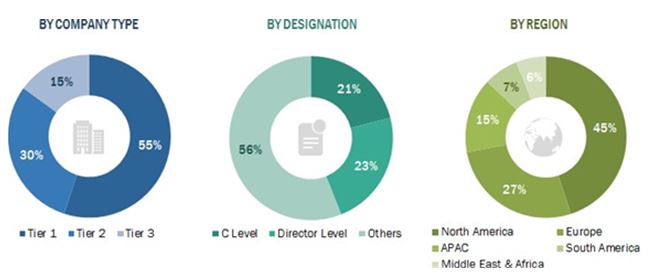

The Textile Chemicals market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. Developments in the Textile Chemicals market characterize the demand side. Market consolidation activities undertaken by manufacturers characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

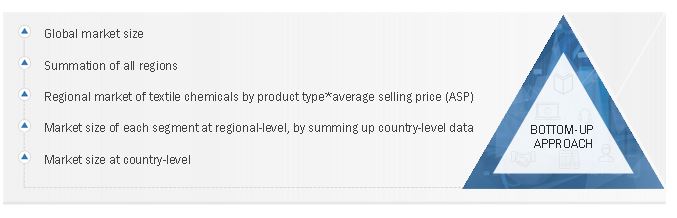

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Textile chemicals market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry and markets were identified through extensive secondary research.

The industry’s supply chain and market size, in terms of value, were determined through

primary and secondary research processes.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Textile chemicals: Bottom-Up Approach

Textile chemicals: Top-Down Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Textile chemicals market.

Report Objectives

- To define, describe, and forecast the Textile chemicals market in terms of value and volume

- To provide detailed information about the key factors influencing the market growth, such as drivers, restraints, opportunities, and challenges

- To analyze and forecast the market size based on product type, fiber type and applications

- To forecast the market size of five main regions, namely, North America, Europe, Asia Pacific (APAC), South America and Middle East and Africa (MEA) (along with the key countries in each region)

- To strategically analyze the micromarkets1 with respect to individual growth trends, growth prospects, and contribution to the overall market

- To analyze the opportunities in the market for stakeholders and draw a competitive landscape for market leaders

- To analyze the competitive developments, such as new product launch, expansion, mergers & acquisitions, and partnership & collaboration in the Textile chemicals market

- To strategically profile the key players and comprehensively analyze their core competencies.

Available Customizations:

- With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies.

- The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Textile Chemicals Market