Single Sign-on Market by Type (Enterprise, Federated & Web-based, Windows Integrated), Organization Size (Small & Medium Enterprises, Large Enterprises), Deployment Mode (Cloud, On-Premises), Vertical, Region - Global Forecast to 2021

[129 Pages Report] The single sign-on (SSO) market size is estimated to grow from USD 845.6 Million in 2016 to USD 1,599.8 Million by 2021, at a Compound Annual Growth Rate (CAGR) of 13.6% from 2016 to 2021. Major growth drivers for the single sign-on market include the convenience offered by single sign-on to manage multiple applications as well as domains and boost productivity along with helping the IT department and administrators to manage multiple accounts for numerous users.

Objectives of the study:

- To define, describe, and forecast the single sign-on market based on five regions, namely, North America, Europe, Asia-Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To provide detailed information regarding the major factors influencing the growth of the single sign-on market (drivers, restraints, opportunities, and challenges)

- To analyze each subsegment with respect to individual growth trends, prospects, and contribution to the total market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To strategically profile key market players and comprehensively analyze their core competencies

- To track and analyze competitive developments, such as new product launches, mergers & acquisitions, partnerships, agreements, and collaborations in the global market

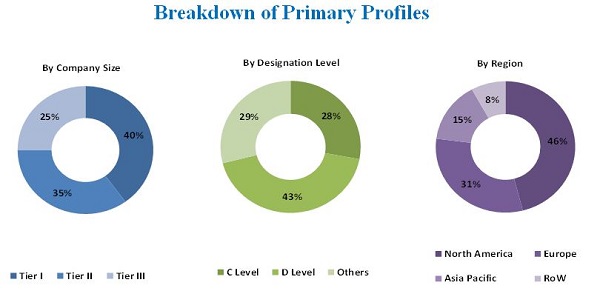

The research methodology used to estimate and forecast the single sign-on market begins with capturing data on key vendor revenues and the market size of individual segments through secondary sources such as industry associations, trade journals, and so on. Vendor offerings are also taken into consideration to determine market segmentation. The bottom-up procedure was employed to arrive at the overall size of the global market from the individual technology segments. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key industry personnel, such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary discussion participants is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The single sign-on ecosystem comprises vendors, such as, IBM Corporation (U.S.), Oracle Corporation (U.S.), Dell Software (U.S.), CA Technologies (U.S.), OKTA, Inc. (U.S.), OneLogin, Inc. (U.S.), Ping Identity Corporation (U.S.), SailPoint Technologies, Inc. (U.S.), Centrify Corporation (U.S.), and NetIQ Corporation (U.S.). Other stakeholders of the single sign-on market include IT security providers, cloud IAM service providers, social communication media service providers, government organizations, and regulatory bodies.

The target audiences of the single sign-on market report are:

- IT Service Providers and Distributors

- Cyber Security Vendors

- IAM Service Vendors

- Single Sign-on Vendors

- Value Added Resellers

- Government Bodies and Departments

- Cloud Service Providers

- System Integrators

- Technology Consultants

“Study answers several questions for the stakeholders, primarily which market segments to focus in the next two to five years for prioritizing the efforts and investments”.

Scope of the Report

The research report categorizes the single sign-on market to forecast the revenues and analyze the trends in each of the following subsegments:

By Type

- Enterprise Single Sign-on

- Federated & Web-based Single Sign-on

- Windows Integrated Single Sign-on

By Deployment Mode

- Cloud

- On-Premises

By Organization Size

- Large Enterprises

- SME’s

By Industry Vertical

- BFSI

- IT & Telecom

- Retail & CPG

- Public Sector & Utilities

- Education, Communications Media & Services

- Healthcare & Life Sciences

- Travel & Hospitality

- Others

By Region

- North America

- Europe

- Middle East & Africa (MEA)

- Asia-Pacific (APAC)

- Latin America

Available Customizations

- With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North America single sign-on market

- Further breakdown of the Europe market

- Further breakdown of the APAC on market

- Further breakdown of the MEA market

- Further breakdown of the Latin America market

Company Information

- Detailed analysis and profiling of additional market players

The single sign-on market is estimated to grow from USD 845.6 Million in 2016 to USD 1599.8 Million by 2021, at a Compound Annual Growth Rate (CAGR) of 13.6% during the forecast period. Single sign-on services are gaining importance among the corporates as it adds to the convenience of the user while minimizing the IT administrator’s overhead by reducing instances of password loss. Hence, the adoption of single sign-on is increasing in various industries, which is one of the major growth factors of the market.

The report provides insights on the single sign-on market, which is segmented by type, deployment mode, organization size, vertical, and region. Among types, the enterprise SSO segment has the largest market share and is expected to dominate the overall market during the forecast period. Enterprise SSO offers high level of security controls to the users within organization for both internal and external applications. Currently, federated & web-based SSO has the largest market share and is considered as an attractive option for organizations who seek to increase website and application use.

Among deployment types, cloud-based deployment is preferred more by SME’s as it requires less capital investment, helps decrease the operational and maintenance costs, and reduces the management efforts. It is expected to register the highest growth rate during the forecast period. Large enterprises prefer on-premises based solutions, which is estimated to have the largest market share during the forecast period.

By organization size, the end users are SMEs and large enterprises. Currently, large enterprises segment dominated the single sign-on market with the largest market share and will continue to do so during the forecast period. The advent of cloud, mobile, and social media is driving the market for large enterprises. On the other hand, the SME’s segment is expected to have the highest CAGR as the single sign-on vendors are offering attractive packages to the SMEs that fits their business needs.

Among the verticals, the BFSI segment has the largest market share in the overall market. This is attributed to the increasing demand for centralized session management from the industry. Education, communications media & services segment is expected to reflect the highest growth rate during the forecast period.

North America is expected to account for the maximum share of the single sign-on market during the forecast period due to the implementation of single sign-on solutions across varied industries in this region. However, major growth is expected to be witnessed in the Asia-Pacific region, which is expected to grow at the highest CAGR by 2021, mainly attributed to the increasing adoption of single sign-on solutions across India, China, Japan, and Australia.

Single sign-on offers numerous benefits to the users and organization, but at the same time accompanies ample security risks, which is a restraining factor for the market. If not configured securely, SSO can be as dangerous and risky as using same password for multiple accounts. The organizations need to learn how to balance the convenience of authentication method with the risks that are accompanied by it. Hence single sign-on vendors are innovating their product portfolio to manage this obstacle of handling complexity.

The Single sign-on market is highly competitive and consists of few big players and many innovators and start-ups. The big players are opting for acquisitions, mergers, collaborations, and partnerships as the key strategies to enhance their client base and to strengthen their product portfolio. On the other hand, the small players are focusing on innovation and new product development to stay competitive in the market or differentiate their offerings from competitors. For instance, in June 2016, IBM partnered with Credit Mutuel Arkea to improve the bank’s ability to verify customer identity. New product development has also been adopted by top players to innovate in this market space.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in the Market

4.2 Market By Region

4.3 Single Sign-On Market

4.4 Potential of the Market

4.5 Market By Organization Size

4.6 Lifecycle Analysis, By Region (2016)

5 Single Sign-On Market Overview (Page No. - 32)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 By Type

5.3.2 By Deployment Mode

5.3.3 By Organization Size

5.3.4 By Vertical

5.3.5 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Brings Convenience to Manage Multiple Applications and Domains and Boosts Productivity

5.4.1.2 Reduces the Overheads of IT Administrators

5.4.2 Restraints

5.4.2.1 Security Risks Associated With SSO

5.4.3 Opportunities

5.4.3.1 Adoption of New Technologies

5.4.3.2 SSO Helps to Facilitate B2b Communication

5.4.3.3 Improved Security Capabilities

5.4.4 Challenges

5.4.4.1 Single Point of Failure

6 Single Sign-On Market, By Type (Page No. - 40)

6.1 Introduction

6.2 Enterprise Single Sign-On

6.3 Federated and Web-Based Single Sign-On

6.4 Windows Integrated Single Sign-On

7 Single Sign-On Market, By Deployment Mode (Page No. - 46)

7.1 Introduction

7.2 Cloud Application

7.3 On-Premise Gateway

8 Global Single Sign-On Market, By Organization Size (Page No. - 50)

8.1 Introduction

8.2 Large Enterprises

8.3 Small and Medium Enterprises (SMES)

9 Global Single Sign-On Market, By Vertical (Page No. - 54)

9.1 Introduction

9.2 BFSI

9.3 IT & Telecom

9.4 Retail & CPG

9.5 Education, Communications Media & Services

9.6 Travel & Hospitality

9.7 Public Sector & Utilities

9.8 Healthcare & Life Sciences

9.9 Others

10 Regional Analysis (Page No. - 65)

10.1 Introduction

10.2 North America

10.3 Europe

10.4 Asia-Pacific

10.5 Middle East & Africa

10.6 Latin America

11 Competitive Landscape (Page No. - 82)

11.1 Overview

11.2 Competitive Situation and Trends

11.2.1 Mergers & Acquisitions

11.2.2 Partnerships, Collaborations & Agreements

11.2.3 New Product Launches

11.2.4 Expansions

12 Company Profiles (Page No. - 88)

12.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

12.2 IBM Corporation

12.3 CA Technologies

12.4 Dell Inc.

12.5 Oracle Corporation

12.6 Okta, Inc.

12.7 Onelogin, Inc.

12.8 Ping Identity Corporation

12.9 Netiq Corporation

12.10 Sailpoint Technologies, Inc.

12.11 Centrify Corporation

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Key Innovators (Page No. - 112)

13.1 Bitium

13.1.1 Business Overview

13.1.2 Push for Single Sign-On

13.2 Salesforce.Com

13.2.1 Business Overview

13.2.2 Push for Single Sign-On

13.3 Loginradius

13.3.1 Business Overview

13.3.2 Push for Single Sign-On

13.4 Imprivata

13.4.1 Business Overview

13.4.2 Push for Single Sign-On

13.5 Auth0

13.5.1 Business Overview

13.5.2 Push for Single Sign-On

14 Appendix (Page No. - 115)

14.1 New Product Launches

14.2 Partnerships

14.3 Acquisitions, Mergers and Joint Ventures

15 Appendix (Page No. - 118)

15.1 Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Introducing RT: Real-Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

List of Tables (65 Tables)

Table 1 Single Sign-On Market and Growth Rate, 2014-2021 (USD Million, Y-O-Y%)

Table 2 Market, By Type, 2014-2021 (USD Million)

Table 3 Enterprise SSO: Market By Region, 2014–2021 (USD Million)

Table 4 Enterprise SSO: Market By Vertical, 2014-2021 (USD Million)

Table 5 Federated and Web-Based SSO: Market By Region, 2014-2021 (USD Million)

Table 6 Federated and Web-Based SSO: Market By Vertical, 2014-2021 (USD Million)

Table 7 Windows Integrated SSO: Market By Region, 2014-2021 (USD Million)

Table 8 Windows Integrated SSO: Market By Vertical, 2014-2021 (USD Million)

Table 9 Single Sign-On Market, By Deployment Mode, 2014-2021 (USD Million)

Table 10 Cloud Application: Market By Region, 2014-2021 (USD Million)

Table 11 On-Premise Gateway: Market By Region, 2014-2021 (USD Million)

Table 12 Global Market By Organization Size, 2014–2021 (USD Million)

Table 13 Large Enterprise: Market Size, By Region, 2014–2021 (USD Million)

Table 14 SMES: Single Sign on Market Size, By Region, 2014–2021 (USD Million)

Table 15 Global Market, By Vertical, 2014-2021 (USD Million)

Table 16 BFSI: Market By Region, 2014-2021 (USD Million)

Table 17 BFSI: Market By Type, 2014-2021 (USD Million)

Table 18 IT & Telecom: Market By Region, 2014-2021 (USD Million)

Table 19 IT & Telecom: Market By Type, 2014-2021 (USD Million)

Table 20 Retail & CPG: Market By Region, 2014-2021 (USD Million)

Table 21 Retail & CPG: Market By Type, 2014-2021 (USD Million)

Table 22 Education, Communications Media & Services: Market By Region, 2014-2021 (USD Million)

Table 23 Education, Communications Media & Services: Market, By Type, 2014-2021 (USD Million)

Table 24 Travel & Hospitality: Market By Region, 2014-2021 (USD Million)

Table 25 Travel & Hospitality: Market By Type, 2014-2021 (USD Million)

Table 26 Public Sector & Utilities: Market By Region, 2014-2021 (USD Million)

Table 27 Public Sector & Utilities: Market By Type, 2014-2021 (USD Million)

Table 28 Healthcare & Life Sciences: Market By Region, 2014-2021 (USD Million)

Table 29 Healthcare & Life Sciences: Market By Type, 2014-2021 (USD Million)

Table 30 Others: Market By Region, 2014-2021 (USD Million)

Table 31 Others: Market By Type, 2014-2021 (USD Million)

Table 32 Single Sign-On Market, By Region, 2014-2021 (USD Million)

Table 33 North America Market By Type, 2014–2021 (USD Million)

Table 34 North America Enterprise Market By Vertical, 2014–2021 (USD Million)

Table 35 North America Federated and Web-Based Market By Vertical, 2014–2021 (USD Million)

Table 36 North America Windows Integrated Market By Vertical, 2014–2021 (USD Million)

Table 37 North America Market By Organization Size, 2014–2021 (USD Million)

Table 38 North America Market By Deployment Mode, 2014–2021 (USD Million)

Table 39 North America Market By Vertical, 2014–2021 (USD Million)

Table 40 Europe Single Sign-On Market By Type, 2014–2021 (USD Million)

Table 41 Europe Market By Organization Size, 2014–2021 (USD Million)

Table 42 Europe: Market By Deployment Mode, 2014–2021 (USD Million)

Table 43 Europe Market By Application, 2013–2020 (USD Million)

Table 44 Asia-Pacific Market By Type, 2014–2021 (USD Million)

Table 45 Asia-Pacific Enterprise Market By Vertical, 2014–2021 (USD Million)

Table 46 Asia-Pacific Federated and Web-Based Market By Vertical, 2014–2021 (USD Million)

Table 47 Asia-Pacific Market By Vertical, 2014–2021 (USD Million)

Table 48 Asia-Pacific Market By Organization Size, 2014–2021 (USD Million)

Table 49 Asia-Pacific Market By Deployment Mode, 2014–2021 (USD Million)

Table 50 Asia-Pacific Market By Vertical, 2014–2021 (USD Million)

Table 51 Middle East & Africa Market By Type, 2014–2021 (USD Million)

Table 52 Middle East & Africa Market By Organization Size, 2014–2021 (USD Million)

Table 53 Middle East & Africa Market By Deployment Mode, 2014–2021 (USD Million)

Table 54 Middle East & Africa Market By Vertical, 2014–2021 (USD Million)

Table 55 Latin America Market By Type, 2014–2021 (USD Million)

Table 56 Latin America Market By Organization Size, 2014–2021 (USD Million)

Table 57 Latin America Market By Deployment Mode, 2014–2021 (USD Million)

Table 58 Latin America Single Sign-On Market By Vertical, 2014–2021 (USD Million)

Table 59 Mergers & Acquisitions, 2014–2015

Table 60 Partnerships, Agreements, Joint Ventures & Collaborations, 2013–2016

Table 61 New Product Launches, 2012–2016

Table 62 Single Sign-On Market: Expansions 2015

Table 63 New Product Launches, 2015–2016

Table 64 Partnerships, 2014–2016

Table 65 Acquisitions, Mergers and Joint Ventures, 2014–2016

List of Figures (43 Figures)

Figure 1 Single Sign-On Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Market Breakdown & Data Triangulation

Figure 5 The Asia-Pacific Single Sign-On Market is Projected to Grow at the Highest CAGR Between 2016 and 2021

Figure 6 The Enterprise Single Sign-On Type Segment is Projected to Lead the Market During the Forecast Period

Figure 7 Among Deployment Modes, the Cloud Application Segment of the Market is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 8 The Small- and Medium-Sized Enterprises Segment of the Market is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 9 Among Verticals, the Healthcare & Life Sciences Segment of the Market is Estimated to Grow at the Highest CAGR During the Forecast Period

Figure 10 The North American Region is Estimated to Account for the Largest Share in the Market in 2016

Figure 11 Growing Need for Convenient Access to Various Applications and Domains Through A Single Login is Driving the Single Sign-On Market

Figure 12 The North American Region is Expected to Lead the Enterprise Single Sign-On Segment of the Market Between 2016 and 2021

Figure 13 The North American Region is Expected to Lead the Market During the Forecast Period

Figure 14 The Single Sign-On Market in the Asia-Pacific Region is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 15 The Large Enterprises Segment is Expected to Lead the Market From 2016 to 2021

Figure 16 Regional Lifecycle – the Single Sign-On Market in the Asia-Pacific Region is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 17 The Need to Access Multiple Applications and Domains By Using Single Login Credentials has Resulted in the Evolution of Single Sign-On Solutions

Figure 18 Market Segmentation: By Type

Figure 19 Market Segmentation: By Deployment Mode

Figure 20 Market Segmentation: By Organization Size

Figure 21 Market Segmentation: By Vertical

Figure 22 Market Segmentation: By Region

Figure 23 Global Market Drivers, Restraints, Opportunities, and Challenges

Figure 24 Among Types, the Enterprise Single Sign-On (SSO) Segment is Expected to Lead the Market During the Forecast Period

Figure 25 Among Deployment Modes, the Cloud Application Segment is Leading the Market

Figure 26 Large Enterprises Segment Dominates the Market

Figure 27 The BFSI Segment Dominates the Global Single Sign-On Market

Figure 28 Asia-Pacific is Expected to Be the Fastest-Growing Market for Single Sign-On During the Forecast Period

Figure 29 Geographic Snapshot (2015-2020): Asia-Pacific is the Most Lucrative Region for the Market

Figure 30 North America Market Snapshot

Figure 31 Asia-Pacific Single Sign-On Market Snapshot

Figure 32 Companies Adopted Partnership, Collaboration, and Acquisitions & Agreements as the Key Strategy to Grow in the Market

Figure 33 Market Evaluation Framework

Figure 34 Battle for Market Share: the Strategy of Partnerships, Collaborations & Agreements is Estimated to Account for the Largest Share During the Forecast Period

Figure 35 Geographic Revenue Mix of Top 5 Market Players

Figure 36 IBM Corporation: Company Snapshot

Figure 37 IBM Corporation: SWOT Analysis

Figure 38 CA Technologies: Company Snapshot

Figure 39 CA Technologies: SWOT Analysis

Figure 40 Dell Inc.: SWOT Analysis

Figure 41 Oracle Corporation: Company Snapshot

Figure 42 Oracle Corporation: SWOT Analysis

Figure 43 Okta, Inc.: SWOT Analysis

Growth opportunities and latent adjacency in Single Sign-on Market

Interested in SAML market

Interested in SSO area