Signals Intelligence (SIGINT) Market by Type (Electronic Intelligence (ELINT) & Communications Intelligence (COMINT)), Application (Airborne, Naval, Ground (Vehicle-Mounted, Soldiers, & Base Station), Space, & Cyber), and Region - Global Forecast to 2025

Updated on : May 23, 2023

Signals Intelligence (SIGINT) Market Statistics

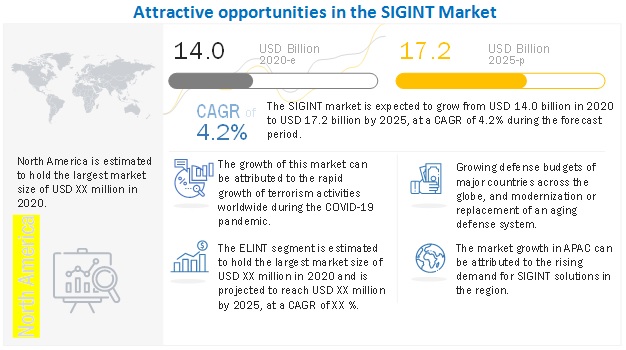

The global Signals Intelligence (SIGINT) Market size is projected to grow from USD 14.0 billion in 2020 to USD 17.2 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 4.2% during the forecast period. The major driving factors for the SIGINT market are the increasing terrorism, growing defense budget of major countries across the globe, and modernization or replacement of an aging defense system.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The global COVID-19 pandemic has brought a significant threat to the safety, health, and well-being of societies and communities around the world. While COVID-19 and several measures taken by governments around the globe have contributed to the suppression of the activities of violent extremists and terrorist groups, the new normal created by the crisis can also play into the hands of violent extremists and terrorist groups.

According to the UNITAR report on IMPACT OF COVID-19 ON VIOLENT EXTREMISM AND TERRORISM, with the spread of COVID-19, the pandemic seems to have turned into the most dominating force in extremist communications, forums, and chatrooms online.

Signals Intelligence (SIGINT) Market Dynamics

Driver: Growing defense budgets of major countries across the globe

National security is the security of a nation-state, regarded as a duty of government. It includes the nation’s citizens, economy, and institutions. National security is a vital priority in several countries around the world and requires a large budget in order to be built and maintained. The total world military expenditure was about USD 1.8 trillion in 2018, a 2.6% increase from 2017.

The US spends the most on defense, and more than the next seven countries combined. The US spent USD 649 billion on defense in 2018, and the next seven countries (China, Saudi Arabia, India, France, Russia, the UK, and Germany) spent a combined total of USD 609 billion. National security in the US is the third most expensive government program after Social Security and Medicare. Historically, the US has consistently spent more on defense than any other G-7 nation.

Restraint: High cost involved in signals intelligence system deployment

The adoption of advanced and innovative technologies and products is a constant challenge for militaries due to budgetary limitations and the lack of skilled personnel. Budget constraints often hinder the adoption of advanced communication systems. Countries in the European Union recovering from economic stress have also shown intentions to cut their respective defense budgets. Countries around the world are exploring and inviting new alternatives to military systems to reduce costs. Therefore, the SIGINT industry is shifting from defense suppliers to commercial providers.

For instance, the declining defense budgets of some major economies, such as Saudi Arabia, UK, France, and Germany, would affect the demand for SIGINT systems in the near future, which in turn, is acting as a challenge for the growth of the SIGINT market. Being a capital intensive market, the market in the emerging economies is not growing at the desired pace.

Opportunity: Increasing presence of signals intelligence in the public domain

SIGINT capabilities are majorly used by the government and defense sector, but SIGINT solutions are expanding its reach in other applications areas including maritime domain awareness; Radio Frequency (RF) spectrum mapping; eavesdropping, jamming, and hijacking of satellite communications; and cyber-surveillance. Maritime domain awareness is the most mature commercial SIGINT application, which gives an effective understanding of any vessel or object in the maritime domain that could affect the security, safety, economy, or the environment. Various industries are now equipped with SIGINT systems for protection and security.

For instance, Elbit Systems received a USD 15 million contracts from Energean Israel to supply a comprehensive solution for the Floating Production Storage and Offloading (FPSO) platform of the offshore Karish-Tanin gas fields. The technological suite includes a wide range of sensors, radars, sonars, and a command and control center, along with equipping rapid interception boats with a dedicated suite of sensors. The security solution offers the capability to detect and identify both surface and underwater threats and will assist security teams in responding efficiently.

Challenge: Incapability to address multiple threats

The diversity of threats is a major challenge for the SIGINT market. The increasing use of electromagnetic spectrum for civil and commercial applications for activities, such as broadband, live television streaming, and navigation, has enabled the use of different frequencies for several electronic devices. This has made frequency detection difficult. Militaries across the world are concentrating on gathering intelligence regarding threats through the detection of frequency hopping, a tactical indicator to display threat category, the frequency of transmission, signal parameters, signal detection, and other relevant data.

The purpose is to interrupt, search, identify, and locate the sources of the enemy’s electromagnetic radiations. This helps in the recognition of diverse threats and accordingly employs the military forces. However, to successfully implement these functions, current defense SIGINT systems need to be developed.

On the basis of application, Cyber segment to grow at the highest CAGR during the forecast period

Cyber threat intelligence is the information that the defense sector uses to understand the potential threat. Attackers such as hacktivists, script-kiddies, cyber terrorists, cybercriminals, and targeted intrusion target business operations and IT systems, so it is very important to have a level of knowledge of such threats. In order to provide effective protection from cyber-attacks, intelligence provides means to collect, analyze, and sort all of the cyber-attack data related to the attacker and attack procedures used.

APAC to account for the highest CAGR during the forecast period

To know about the assumptions considered for the study, download the pdf brochure

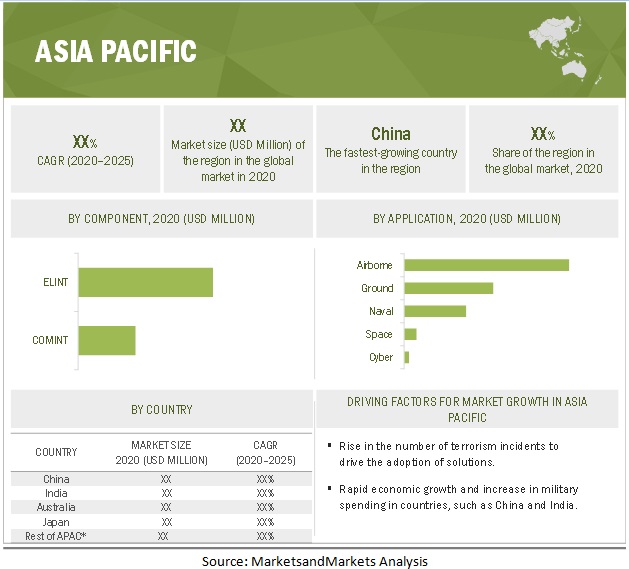

The SIGINT market in Asia Pacific (APAC) is witnessing exponential growth, mainly due to the growing security and border threats from the neighboring countries. Technological advancements and rapid economic development in China, India, Russia, and South Korea have helped in increasing the investments in the APAC SIGINT market. The fast-growing economies of APAC are improving their defense capabilities. The technological advancements in SIGINT solutions and systems in APAC also offer opportunities for the market to grow.

The SIGINT in the APAC region is projected to grow at the highest CAGR during the forecast period. This growth can be attributed to increased funding/investments made by countries in the region toward the development of SIGINT products. In addition, the increased focus of both international and domestic players on the SIGINT market is contributing to the high demand for SIGINT systems in the region. An increase in insurgencies, territorial and political disputes, and terror attacks are also fueling the growth of the SIGINT market in this region. Favorable regulatory policies for the approval of new SIGINT products are further intensifying the interest of players in the APAC market.

Key Market Players

This research study outlines the market potential, market dynamics, and major vendors operating in the SIGINT market. Key and innovative vendors in the SIGINT market include BAE Systems (UK), Lockheed Martin (US), Northrop Grumman (US), Thales (France), Raytheon (US), Elbit Systems (israel), General Dynamics (US), Saab (Sweden), HENSOLDT (Germany), Indra (Spain), Mercury Systems (US), Israel Aerospace Industries (Israel), Rolta India (India), Rolta India (Germany), Systematic (Denmark), L3Harris (US), Cobham (UK), and Leonardo (Italy).

The study includes an in-depth competitive analysis of these key players in the SIGINT market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2020 |

USD 14.0 billion |

|

Revenue forecast for 2025 |

USD 17.2 billion |

|

Growth Rate |

4.2%% CAGR |

|

Forecast units |

Value (Billion USD) |

|

Segments covered |

Type, applications, and regions. |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America. |

|

Key Market Drivers |

|

|

Key Market Opportunities |

|

|

Major companies covered |

BAE Systems (UK), Lockheed Martin (US), Northrop Grumman (US), Thales (France), Raytheon (US), Elbit Systems (israel), General Dynamics (US), Saab (Sweden), HENSOLDT (Germany), Indra (Spain), Mercury Systems (US) |

This research report categorizes the SIGINT to forecast revenues and analyze trends in each of the following submarkets:

Based on the type:

- ELINT

- COMINT

Based on solutions:

-

Airborne

- Fighter Jets

- Special Mission Aircrafts

- Transport Aircrafts

- Unmanned Aerial Vehicles (UAVs)

-

Ground

- Vehicle-Mounted

- Soldiers

- Base Station

-

Naval

- Ships

- Submarines

- Unmanned Marine Vehicles (UMVs)

- Space

- Cyber

Based on the region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Australia

- Rest of APAC

-

Middle East and Africa

- Kingdom of Saudi Arabia

- United Arab Emirates

- Israel

- Turkey

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In September 2020, BAE Systems introduced the newest addition to its Unmanned Undersea Vehicle (UUV) portfolio, the Riptide UUV-12.

- In October 2020, Raytheon Intelligence and Space launched a virtualized testing solution to assess cyber vulnerabilities.

- In July 2020, Saab created a new FCAS center in the UK as a hub for its participation in the Future Combat Air Systems Future Combat Air Systems (FCAS) program. The UK and Sweden signed a MoU on FCAS co-operation in July 2019. Saab is leading Sweden’s FCAS industrial participation in close co-operation with Sweden’s Ministry of Defense.

- In May 2020, Northrop Grumman Corporation expanded its Next Generation Jammer Low Band (NGJ-LB) Capability Block 1 (CB-1) solution team with the addition of proven structure supplier CPI Aero, Inc. based in Edgewood, New York.

Frequently Asked Questions (FAQ):

What is the projected market value of Signals Intelligence Market?

What are the major revenue pockets in the global Signals Intelligence Market currently?

What are the applications in Signals Intelligence Market?

Which are Leading Companies in Signals Intelligence Market?

What are the upcoming trends in Signals Intelligence (SIGINT) Market?

- Increased Demand for Cyber SIGINT Solutions

- Use of Artificial Intelligence and Machine Learning

- Integration of Multiple Data Sources

- Growth in Commercial SIGINT Solutions

- Focus on Signal Interception

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 18)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 FACTORS IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLARS EXCHANGE RATE, 2014–2019

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 6 SIGNALS INTELLIGENCE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 SUPPLY-SIDE ANALYSIS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/SERVICES OF VENDORS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS AND SERVICES

2.3.2 DEMAND-SIDE ANALYSIS

2.3.3 DEMAND-SIDE INDICATORS

2.3.3.1 Increasing demand for unmanned systems

FIGURE 9 ESTIMATED TOTAL FUNDING OF THE US DEPARTMENT OF DEFENSE FOR UNMANNED SYSTEMS, FY 2014 TO FY 2018 (USD MILLION)

2.3.3.2 Modernization programs of military forces of major economies

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 10 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STUDY ASSUMPTIONS

2.7 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 37)

FIGURE 11 GLOBAL SIGNALS INTELLIGENCE MARKET TO WITNESS HIGH GROWTH DURING THE FORECAST PERIOD

FIGURE 12 LEADING SEGMENTS IN THE MARKET IN 2020

FIGURE 13 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 ATTRACTIVE OPPORTUNITIES IN THE SIGNALS INTELLIGENCE MARKET

FIGURE 14 NEED TO MODERNIZE AND REPLACE AGING DEFENSE SYSTEMS TO DRIVE THE MARKET GROWTH

4.2 MARKET, BY TYPE AND APPLICATION

FIGURE 15 ELINT AND AIRBORNE SEGMENTS TO HOLD HIGHER MARKET SHARES IN 2020

4.3 MARKET, BY REGION

FIGURE 16 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.4 MARKET: INVESTMENT SCENARIO

FIGURE 17 NORTH AMERICA AND ASIA PACIFIC TO EMERGE AS THE BEST MARKETS FOR INVESTMENTS OVER THE NEXT FIVE YEARS

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SIGNALS INTELLIGENCE MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing terrorism to remain a global threat

5.2.1.2 Growing defense budgets of major countries across the globe

TABLE 3 DEFENSE EXPENDITURE OF MAJOR COUNTRIES, 2018

5.2.1.3 Modernization or replacement of aging defense systems

5.2.2 RESTRAINTS

5.2.2.1 High cost involved in signals intelligence system deployment

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing presence of signals intelligence in the public domain

5.2.4 CHALLENGES

5.2.4.1 Incapability to address multiple threats

5.3 COVID-19-DRIVEN MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.3.3 CUMULATIVE GROWTH ANALYSIS

TABLE 4 COVID-19 IMPACT: SIGNALS INTELLIGENCE MARKET

5.4 SIGNALS INTELLIGENCE: COVID-19 IMPACT

5.5 VALUE CHAIN ANALYSIS OF THE MARKET

FIGURE 19 VALUE CHAIN ANALYSIS

5.6 TECHNOLOGICAL TRENDS

5.6.1 CYBER DEFENSE

5.6.2 COMBAT SYSTEMS AND C5ISR

5.6.3 NETWORK CENTRIC WARFARE

5.6.4 IMAGING SYSTEM FOR IMMERSIVE SURVEILLANCE

5.6.5 MORPHINATOR NETWORK TECHNOLOGY

5.6.6 WINDSHEAR SOFTWARE

5.6.7 NEAR-FIELD COMMUNICATION

5.6.8 ADVANCED EXTREMELY HIGH-FREQUENCY SATELLITES

5.6.9 IMPROVED MULTI-BAND TACTICAL COMMUNICATION AMPLIFIERS

5.6.10 HYPERSPECTRAL SENSORS

5.6.11 CLOUD COMPUTING

5.7 SIGNALS INTELLIGENCE: KEY VENDOR PRODUCT ANALYSIS

5.7.1 INDRA PRODUCTS OFFERED IN SIGINT MARKET

5.7.1.1 Elint Products

5.7.1.2 Comint products

5.7.2 HENSOLDT PRODUCTS OFFERED IN SIGINT MARKET

5.7.2.1 Airborne electronic support & sigint products

5.7.2.2 Airborne comint support & sigint products

5.7.2.3 Land based electronic support & sigint products

5.7.2.4 Maritime electronic support & sigint products

5.7.3 OTHERS KEY PLAYERS OFFERINGS IN SIGINT MARKET

5.8 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT FROM NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

6 SIGNALS INTELLIGENCE MARKET, BY TYPE (Page No. - 67)

6.1 INTRODUCTION

6.1.1 TYPE: MARKET DRIVERS

6.1.2 TYPE: SIGNALS INTELLIGENCE VENDOR INITIATIVES AND DEVELOPMENTS

FIGURE 21 COMMUNICATION INTELLIGENCE TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 5 MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 6 MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

6.2 ELECTRONIC INTELLIGENCE

TABLE 7 ELECTRONIC INTELLIGENCE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 8 ELECTRONIC INTELLIGENCE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.3 COMMUNICATION INTELLIGENCE

TABLE 9 COMMUNICATION INTELLIGENCE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 10 COMMUNICATION INTELLIGENCE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7 SIGNALS INTELLIGENCE MARKET, BY APPLICATION (Page No. - 72)

7.1 INTRODUCTION

7.1.1 APPLICATION: MARKET DRIVERS

7.1.2 APPLICATION: SIGNALS INTELLIGENCE VENDOR INITIATIVES AND DEVELOPMENTS

FIGURE 22 AIRBORNE SEGMENT TO HOLD THE HIGHEST MARKET SHARE IN 2020

TABLE 11 MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 12 MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

7.2 AIRBORNE

TABLE 13 AIRBORNE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 14 AIRBORNE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 15 AIRBORNE: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 16 AIRBORNE: SIGNALS INTELLIGENCE MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

7.2.1 FIGHTER JETS

TABLE 17 FIGHTER JETS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 18 FIGHTER JETS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.2.2 SPECIAL MISSION AIRCRAFTS

TABLE 19 SPECIAL MISSION AIRCRAFTS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 20 SPECIAL MISSION AIRCRAFTS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.2.3 TRANSPORT AIRCRAFTS

TABLE 21 TRANSPORT AIRCRAFTS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 22 TRANSPORT AIRCRAFTS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.2.4 UNMANNED AERIAL VEHICLES

TABLE 23 UNMANNED AERIAL VEHICLES MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 24 UNMANNED AERIAL VEHICLES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3 GROUND

TABLE 25 GROUND: SIGNALS INTELLIGENCE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 26 GROUND: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 27 GROUND: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 28 GROUND: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

7.3.1 VEHICLE-MOUNTED

TABLE 29 VEHICLE-MOUNTED MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 30 VEHICLE-MOUNTED MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3.2 SOLDIERS

TABLE 31 SOLDIERS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 32 SOLDIERS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3.3 BASE STATIONS

TABLE 33 BASE STATIONS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 34 BASE STATIONS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.4 NAVAL

TABLE 35 NAVAL: SIGNALS INTELLIGENCE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 36 NAVAL: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 37 NAVAL: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 38 NAVAL: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

7.4.1 SHIPS

TABLE 39 SHIPS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 40 SHIPS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.4.2 SUBMARINES

TABLE 41 SUBMARINES MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 42 SUBMARINES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.4.3 UNMANNED MARINE VEHICLES

TABLE 43 UNMANNED MARINE VEHICLES MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 44 UNMANNED MARINE VEHICLES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.5 SPACE

TABLE 45 SPACE: SIGNALS INTELLIGENCE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 46 SPACE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.6 CYBER

TABLE 47 CYBER: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 48 CYBER: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8 SIGNALS INTELLIGENCE MARKET, BY REGION (Page No. - 91)

8.1 INTRODUCTION

8.1.1 REGION: MARKET DRIVERS

8.1.2 REGION: SIGNALS INTELLIGENCE VENDOR INITIATIVES AND DEVELOPMENTS

8.1.3 REGION: COVID-19 IMPACT

FIGURE 23 NORTH AMERICA TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 49 MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 50 MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 24 NORTH AMERICA: MARKET SNAPSHOT

TABLE 51 NORTH AMERICA: SIGNALS INTELLIGENCE MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET SIZE, BY AIRBORNE TYPE, 2014–2019 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY AIRBORNE TYPE, 2019–2025 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET SIZE, BY GROUND TYPE, 2014–2019 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET SIZE, BY GROUND TYPE, 2019–2025 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET SIZE, BY NAVAL TYPE, 2014–2019 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET SIZE, BY NAVAL TYPE, 2019–2025 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.2.1 UNITED STATES

TABLE 63 UNITED STATES: SIGNALS INTELLIGENCE MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 64 UNITED STATES: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 65 UNITED STATES: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 66 UNITED STATES: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 67 UNITED STATES: MARKET SIZE, BY AIRBORNE TYPE, 2014–2019 (USD MILLION)

TABLE 68 UNITED STATES: MARKET SIZE, BY AIRBORNE TYPE, 2019–2025 (USD MILLION)

TABLE 69 UNITED STATES: MARKET SIZE, BY GROUND TYPE, 2014–2019 (USD MILLION)

TABLE 70 UNITED STATES: MARKET SIZE, BY GROUND TYPE, 2019–2025 (USD MILLION)

TABLE 71 UNITED STATES: MARKET SIZE, BY NAVAL TYPE, 2014–2019 (USD MILLION)

TABLE 72 UNITED STATES: MARKET SIZE, BY NAVAL TYPE, 2019–2025 (USD MILLION)

8.2.2 CANADA

8.3 EUROPE

TABLE 73 EUROPE: SIGNALS INTELLIGENCE MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 74 EUROPE: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 75 EUROPE: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 76 EUROPE: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE, BY AIRBORNE TYPE, 2014–2019 (USD MILLION)

TABLE 78 EUROPE: MARKET SIZE, BY AIRBORNE TYPE, 2019–2025 (USD MILLION)

TABLE 79 EUROPE: MARKET SIZE, BY GROUND TYPE, 2014–2019 (USD MILLION)

TABLE 80 EUROPE: MARKET SIZE, BY GROUND TYPE, 2019–2025 (USD MILLION)

TABLE 81 EUROPE: MARKET SIZE, BY NAVAL TYPE, 2014–2019 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE, BY NAVAL TYPE, 2019–2025 (USD MILLION)

TABLE 83 EUROPE: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 84 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.3.1 UNITED KINGDOM

TABLE 85 UNITED KINGDOM: SIGNALS INTELLIGENCE MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 86 UNITED KINGDOM: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 87 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 88 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 89 UNITED KINGDOM: MARKET SIZE, BY AIRBORNE TYPE, 2014–2019 (USD MILLION)

TABLE 90 UNITED KINGDOM: MARKET SIZE, BY AIRBORNE TYPE, 2019–2025 (USD MILLION)

TABLE 91 UNITED KINGDOM: MARKET SIZE, BY GROUND TYPE, 2014–2019 (USD MILLION)

TABLE 92 UNITED KINGDOM: MARKET SIZE, BY GROUND TYPE, 2019–2025 (USD MILLION)

TABLE 93 UNITED KINGDOM: MARKET SIZE, BY NAVAL TYPE, 2014–2019 (USD MILLION)

TABLE 94 UNITED KINGDOM: MARKET SIZE, BY NAVAL TYPE, 2019–2025 (USD MILLION)

8.3.2 FRANCE

8.3.3 GERMANY

8.3.4 RUSSIA

8.3.5 REST OF EUROPE

8.4 ASIA PACIFIC

FIGURE 25 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 95 ASIA PACIFIC: SIGNALS INTELLIGENCE MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET SIZE, BY AIRBORNE TYPE, 2014–2019 (USD MILLION)

TABLE 100 ASIA PACIFIC: MARKET SIZE, BY AIRBORNE TYPE, 2019–2025 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET SIZE, BY GROUND TYPE, 2014–2019 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET SIZE, BY GROUND TYPE, 2019–2025 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET SIZE, BY NAVAL TYPE, 2014–2019 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET SIZE, BY NAVAL TYPE, 2019–2025 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.4.1 CHINA

TABLE 107 CHINA: SIGNALS INTELLIGENCE MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 108 CHINA: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 109 CHINA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 110 CHINA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 111 CHINA: MARKET SIZE, BY AIRBORNE TYPE, 2014–2019 (USD MILLION)

TABLE 112 CHINA: MARKET SIZE, BY AIRBORNE TYPE, 2019–2025 (USD MILLION)

TABLE 113 CHINA: MARKET SIZE, BY GROUND TYPE, 2014–2019 (USD MILLION)

TABLE 114 CHINA: MARKET SIZE, BY GROUND TYPE, 2019–2025 (USD MILLION)

TABLE 115 CHINA: MARKET SIZE, BY NAVAL TYPE, 2014–2019 (USD MILLION)

TABLE 116 CHINA: MARKET SIZE, BY NAVAL TYPE, 2019–2025 (USD MILLION)

8.4.2 JAPAN

8.4.3 INDIA

8.4.4 AUSTRALIA

8.4.5 REST OF ASIA PACIFIC

8.5 MIDDLE EAST AND AFRICA

TABLE 117 MIDDLE EAST AND AFRICA: SIGNALS INTELLIGENCE MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 118 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 119 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 120 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 121 MIDDLE EAST AND AFRICA: MARKET SIZE, BY AIRBORNE TYPE, 2014–2019 (USD MILLION)

TABLE 122 MIDDLE EAST AND AFRICA: MARKET SIZE, BY AIRBORNE TYPE, 2019–2025 (USD MILLION)

TABLE 123 MIDDLE EAST AND AFRICA: MARKET SIZE, BY GROUND TYPE, 2014–2019 (USD MILLION)

TABLE 124 MIDDLE EAST AND AFRICA: MARKET SIZE, BY GROUND TYPE, 2019–2025 (USD MILLION)

TABLE 125 MIDDLE EAST AND AFRICA: MARKET SIZE, BY NAVAL TYPE, 2014–2019 (USD MILLION)

TABLE 126 MIDDLE EAST AND AFRICA: MARKET SIZE, BY NAVAL TYPE, 2019–2025 (USD MILLION)

TABLE 127 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 128 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.5.1 KINGDOM OF SAUDI ARABIA

8.5.2 UNITED ARAB EMIRATES

8.5.3 ISRAEL

8.5.4 TURKEY

8.5.5 REST OF MIDDLE EAST AND AFRICA

8.6 LATIN AMERICA

TABLE 129 LATIN AMERICA: SIGNALS INTELLIGENCE MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 130 LATIN AMERICA: SIGNALS INTELLIGENCE MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 131 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 132 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 133 LATIN AMERICA: MARKET SIZE, BY AIRBORNE TYPE, 2014–2019 (USD MILLION)

TABLE 134 LATIN AMERICA: MARKET SIZE, BY AIRBORNE TYPE, 2019–2025 (USD MILLION)

TABLE 135 LATIN AMERICA: MARKET SIZE, BY GROUND TYPE, 2014–2019 (USD MILLION)

TABLE 136 LATIN AMERICA: MARKET SIZE, BY GROUND TYPE, 2019–2025 (USD MILLION)

TABLE 137 LATIN AMERICA: MARKET SIZE, BY NAVAL TYPE, 2014–2019 (USD MILLION)

TABLE 138 LATIN AMERICA: MARKET SIZE, BY NAVAL TYPE, 2019–2025 (USD MILLION)

TABLE 139 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 140 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.6.1 BRAZIL

8.6.2 MEXICO

8.6.3 REST OF LATIN AMERICA

9 COMPETITIVE LANDSCAPE (Page No. - 131)

9.1 INTRODUCTION

9.2 MARKET EVALUATION FRAMEWORK

FIGURE 26 MARKET EVALUATION FRAMEWORK: SIGNALS INTELLIGENCE FRAMEWORK

9.3 REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 27 SIGNALS INTELLIGENCE MARKET: REVENUE ANALYSIS

9.4 HISTORICAL REVENUE ANALYSIS

FIGURE 28 REVENUE ANALYSIS OF THE TOP FIVE MARKET PLAYERS

TABLE 141 FIVE YEAR REVENUE ANALYSIS OF TOP PLAYER

9.5 RANKING OF KEY PLAYERS IN THE MARKET, 2020

FIGURE 29 SIGNALS INTELLIGENCE KEY PLAYER RANKING

10 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 135)

10.1 COMPANY EVALUATION MATRIX

10.1.1 COMPETITIVE EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

TABLE 142 EVALUATION CRITERIA

10.1.2 STAR

10.1.3 PERVASIVE

10.1.4 EMERGING LEADERS

10.1.5 PARTICIPANTS

FIGURE 30 SIGNALS INTELLIGENCE MARKET (GLOBAL), COMPETITIVE EVALUATION MATRIX, 2020

10.2 COMPANY PROFILES

(Business Overview, Products, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

10.2.1 BAE SYSTEMS

FIGURE 31 BAE SYSTEMS: COMPANY SNAPSHOT

FIGURE 32 SWOT ANALYSIS: BAE SYSTEMS

10.2.2 LOCKHEED MARTIN

FIGURE 33 LOCKHEED MARTIN: COMPANY SNAPSHOT

FIGURE 34 SWOT ANALYSIS: LOCKHEED MARTIN

10.2.3 NORTHROP GRUMMAN

FIGURE 35 NORTHROP GRUMMAN: COMPANY SNAPSHOT

FIGURE 36 SWOT ANALYSIS: NORTHROP GRUMMAN

10.2.4 THALES

FIGURE 37 THALES: COMPANY SNAPSHOT

FIGURE 38 SWOT ANALYSIS: THALES

10.2.5 RAYTHEON

FIGURE 39 RAYTHEON: COMPANY SNAPSHOT

FIGURE 40 SWOT ANALYSIS: RAYTHEON

10.2.6 ELBIT SYSTEMS

FIGURE 41 ELBIT SYSTEMS: COMPANY SNAPSHOT

10.2.7 GENERAL DYNAMICS

FIGURE 42 GENERAL DYNAMICS: COMPANY SNAPSHOT

10.2.8 SAAB

FIGURE 43 SAAB: COMPANY SNAPSHOT

10.2.9 HENSOLDT

10.2.10 INDRA

10.2.11 MERCURY SYSTEMS

10.2.12 ISRAEL AEROSPACE INDUSTRIES

10.2.13 ROLTA INDIA

10.2.14 RHEINMETALL

10.2.15 SYSTEMATIC

10.2.16 L3HARRIS

10.2.17 COBHAM

10.2.18 LEONARDO

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

11 ADJACENT/RELATED MARKETS (Page No. - 177)

11.1 INTRODUCTION

11.2 C4ISR MARKET

11.2.1 MARKET DEFINITION

TABLE 143 C4ISR MARKET SIZE, BY PLATFORM, 2015–2022 (USD BILLION)

TABLE 144 C4ISR MARKET FOR LAND, BY REGION, 2015–2022 (USD BILLION)

TABLE 145 C4ISR MARKET FOR NAVAL, BY REGION, 2015–2022 (USD BILLION)

TABLE 146 C4ISR MARKET FOR AIRBORNE, BY REGION, 2015–2022 (USD BILLION)

TABLE 147 C4ISR MARKET FOR SPACE, BY REGION, 2015–2022 (USD BILLION)

11.3 MILITARY COMMUNICATION MARKET

11.3.1 MARKET DEFINITION

TABLE 148 MILITARY COMMUNICATIONS MARKET SIZE, BY COMMUNICATION TYPE, 2016–2023 (USD BILLION)

TABLE 149 AIRBORNE COMMUNICATION: MILITARY COMMUNICATIONS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 150 AIR-GROUND COMMUNICATION: MILITARY COMMUNICATIONS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 151 UNDERWATER COMMUNICATION: MILITARY COMMUNICATIONS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 152 GROUND-BASED COMMUNICATION: MILITARY COMMUNICATIONS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 153 SHIPBORNE COMMUNICATION: MILITARY COMMUNICATIONS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

11.4 ELECTRONIC WARFARE MARKET

11.4.1 MARKET DEFINITION

TABLE 154 ELECTRONIC WARFARE MARKET SIZE, BY CAPABILITY, 2015-2022 (USD MILLION)

TABLE 155 ELECTRONIC SUPPORT MARKET SIZE, BY REGION, 2015-2022 (USD MILLION)

TABLE 156 ELECTRONIC SUPPORT MARKET SIZE, BY CATEGORY, 2015-2022 (USD MILLION)

TABLE 157 SIGINT MARKET SIZE, BY SUBCATEGORY, 2015-2022 (USD MILLION)

TABLE 158 ELECTRONIC ATTACK MARKET SIZE, BY REGION, 2015-2022 (USD MILLION)

TABLE 159 ELECTRONIC ATTACK MARKET SIZE, BY TYPE, 2015-2022 (USD MILLION)

TABLE 160 ELECTRONIC PROTECTION MARKET SIZE, BY REGION, 2015-2022 (USD MILLION)

TABLE 161 ELECTRONIC PROTECTION MARKET SIZE, BY TYPE, 2015-2022 (USD MILLION)

12 APPENDIX (Page No. - 184)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the SIGINT. Exhaustive secondary research was done to collect information on the SIGINT. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the size of the segments and subsegments of the market.

Secondary Research

In secondary research, various sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. Data was also collected from secondary sources such as the Stockholm International Peace Research Institute (SIPRI), Our World in Data, and AFCEA International. Secondary research was mainly used to obtain key information about the industry’s value chain and supply chain to identify key players according to their offerings and industry trends related to technologies, applications, and regions and key developments from both market- and technology-oriented perspectives.

Primary Research

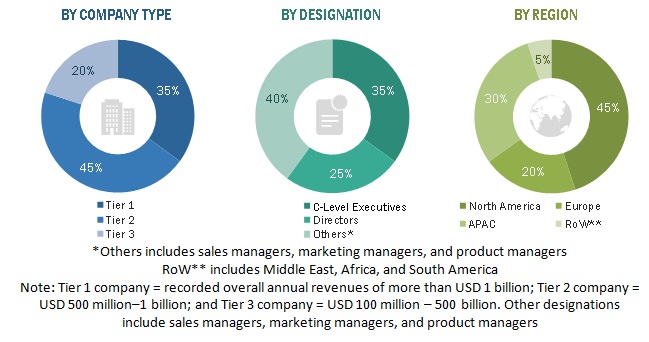

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs), Vice Presidents (VPs), and directors from business development, marketing, and product development/innovation teams, related key executives from SIGINT vendors, SIGINT solution providers, industry associations, independent SIGINT consultants, and key opinion leaders.

Following is the breakup of the primary respondent:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the SIGINT. These methods were also used extensively to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global SIGINT by type, application, and region from 2020 to 2025, and analyze the various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), MEA, and Latin America.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall SIGINT

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the SIGINT

Key Questions addressed by the report:

- Define, describe, and forecast the SIGINT market based on type, application, and regions.

- Detailed analysis of the market’s sub-segments with respect to individual growth trends, prospects, and contributors to the total market.

- Revenue forecast of the market’s segments with respect to five major regions, namely, North America, Europe, Asia Pacific (APAC), Latin America, and MEA.

- Detailed analysis of the competitive developments, such as mergers and acquisitions, new product developments, and business expansion activities, in the market.

- Analysis of major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the European market, which includes the rest of Europe countries

- Further breakup of the APAC market, which includes the rest of APAC countries

- Further breakup of the Rest of Latin America]

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Signals Intelligence (SIGINT) Market