Sensor Fusion Market Size, Share & Industry Trends Analysis Report by Algorithms (Kalman Filter, Bayesian Filter, Central Limit Theorem, Convolutional Neural Networks), Technology (MEMS, Non-MEMS), Offering (Hardware, Software), End-Use Application and Region - Global Forecast to 2028

Updated on : Sep 18, 2024

Sensor Fusion Market Size & Share

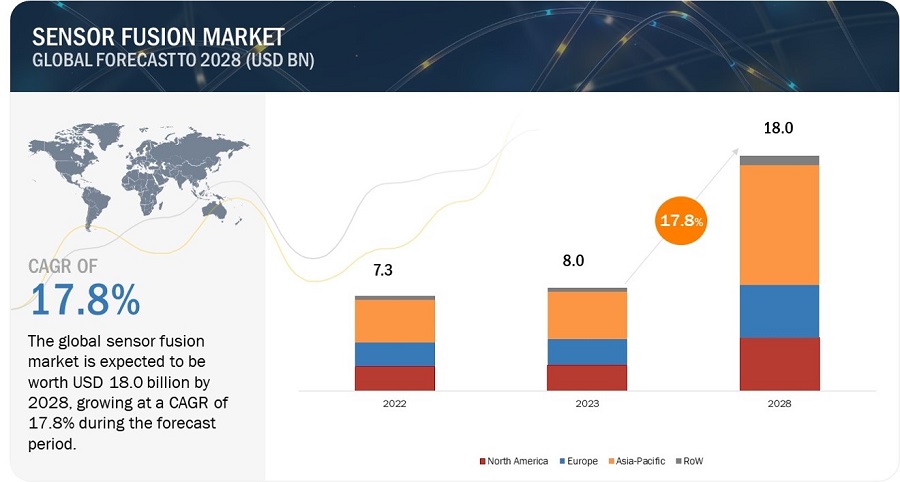

According to MarketsandMarkets, the global sensor fusion market size is projected to grow from USD 8.0 billion in 2023 to USD 18.0 billion by 2028, growing at a CAGR of 17.8% during the forecast period.

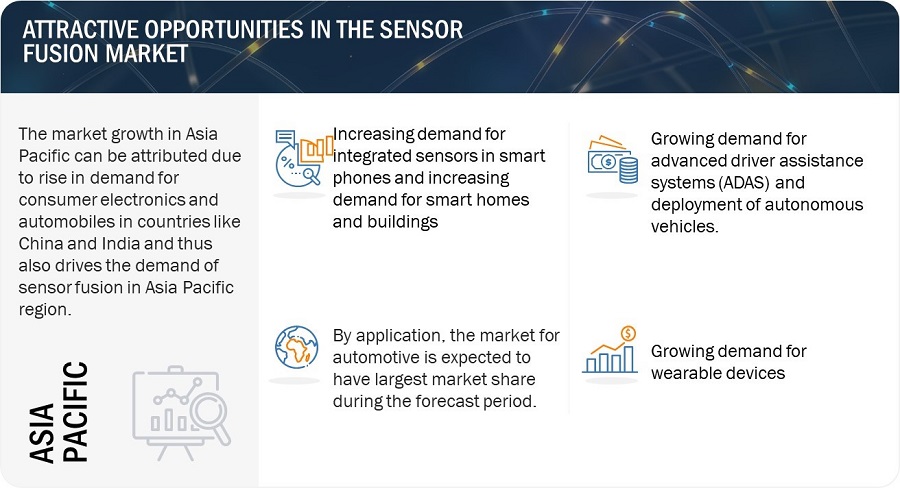

Growing demand for advanced driver assistance systems (ADAS) and deployment of autonomous vehicles, increasing demand for smart homes and buildings, growing trend of miniaturization in electronics, and increasing demand for integrated sensors in smartphones are expected to propel the market in the next five years. However, calibration across multiple sensors and security and safety concern are likely to pose challenges for the industry players.

The objective of the report is to define, describe, and forecast the sensor fusion industry based on algorithms, offering, technology, end-use application, and region.

Sensor Fusion Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Sensor Fusion Market Trends

Driver: Increasing demand for integrated sensors in smartphones

Consumer electronics is a rapidly changing and dynamic industry with increasing competitiveness among the market players and game-changing technological developments. Latest developments in mobile computing and sensor technologies are making smartphones and tablets popular worldwide.

In the present market scenario, smartphone manufacturers are under pressure to bring exclusive and differentiated products. Thus, if a manufacturer successfully offers a unique product to the customers, that product will gain popularity and tend to create a trend in the market. There is a growing trend of integrating various sensors in smartphones. Thus, innovation and development in the sensor fusion technology would assist the smartphones manufacturers in enhancing the features of their products. The 9-axis inertial sensor is one of the common sensor fusion solutions that are being integrated into smartphones for detecting the location of the user.

Moreover, manufacturers of smartphones like Apple Inc., Samsung Electronics Co., Ltd., and Huawei Technologies Co. are investing in R&D to create sensor-based applications that will set their products apart from the competitors. For instance, in 2022, Xiaomi and Leica launched a series of smartphones with advanced optical and imaging sensors. For example, Apple released iPhone X with a front-facing 3D sensor for face ID, a facial recognition technology that takes the place of a fingerprint sensor to unlock the device. This factor is expected to drive the market over the forecast periods.

Restraint: Calibration across multiple sensors

In order to ensure that the data from various sensors are reliable, precise, and consistent with one another, sensor calibration is a crucial stage in the sensor fusion process. Incorrect or inaccurate sensor fusion outcomes may emerge from sensor data that contains errors, noise, and inaccuracies as a result of improper sensor calibration.

The requirement for calibration across numerous sensors, each with its own unique characteristics and properties, is an important challenge in sensor fusion. Differences in the sensitivity, resolution, or noise levels of various sensors may impact the accuracy and consistency of the sensor data.

To address these challenges, sensor fusion systems need to incorporate sophisticated algorithms and techniques that can account for sensor variability and adapt to changes in sensor performance over time. This requires a deep understanding of sensor characteristics and properties, as well as expertise in signal processing, machine learning, and statistical analysis. Thus, the lack of proper calibration across multiple sensors is acting as a restrain for the market.

Opportunities: Growing demand for advanced driver assistance systems (ADAS) and deployment of autonomous vehicles

The advanced driver assistance systems depend on the sensing capabilities provided mainly by the combo inertial and image sensors. The MEMS inertial combo sensors are used for the detection of the state of motion in the vehicles.

The increasing use of the GPS-IMU (Inertial Measurement Unit) fusion principle and advancements in ADAS are assisting in resolving dead reckoning interval accumulation errors with absolute location measurements. Using information gathered from a forward-facing camera, Tesla's Autopilot automatic driving feature is an example of an ADAS that can carry out tasks like maintaining the vehicle's center in a highway lane and directing the vehicle accordingly. Since many of the functionalities introduced within the ADAS require sensor fusion systems, the growing deployment of ADAS is anticipated to have a positive impact on the sensor fusion market.

Further, the increasing deployment of autonomous vehicles also creates an opportunity for the market. Autonomous vehicles require sensors such as, camera, LiDAR, and radar to view and evaluate their surroundings. In addition, increasing collaboration between car manufacturers and sensor fusion platform developers is expected to boost the adoption of the sensor fusion technology. For instance, in December 2022, Baidu, a Chinese automobile manufacturer, and Pony.ai, a startup company backed by Toyota Motors, announced that they were granted their first license to test fully autonomous vehicles in Beijing.

Challenges: Security and safety concern

The sensor fusion market involves integrating data from multiple sensors to obtain a more accurate and comprehensive understanding of the environment. While this technology has many benefits, it also raises security and safety concerns, including: Privacy: Sensor fusion systems have the potential to gather private information that might be misused, such as location data, health status data, or biometric data. It is critical to ensure that users' privacy is maintained and that data is collected and stored securely.

Cybersecurity: Sensor fusion systems are susceptible to hacking or cyberattacks, which could compromise the system's accuracy and dependability. To defend against such attacks, strong cybersecurity measures like encryption and authentication must be put in place.

Safety: Sensor fusion systems can be in applications requiring high levels of safety, like driverless vehicles, where a system failure could lead to significant harm or even death. It is essential to confirm that the system has been developed and tested in accordance with safety requirements.

Market Map/Ecosystem

Sensor Fusion Market: Key Trends

The prominent players in the market are InvenSense Inc. (U.S.), NXP Semiconductors N.V. (Netherlands), and Bosch Sensortec GmbH (Germany), among others. These companies boast mixing trends with comprehensive product portfolio and strong geographic footprint.

Hardware offering to acquire significant share in sensor fusion market

The hardware offering is expected to hold the largest market share during the forecast period. The hardware segment comprises the physical components of sensor fusion systems, such as processors, communication modules, sensors, and microcontrollers. Development kits, evaluation boards, and reference designs are examples of hardware products. In addition, various product type has been taken into consideration such as inertial combo sensor, radar + image sensors+ lidar, environment sensors, IMU + GPS, and others.

Consumer electronics end-use application holds largest share in sensor fusion market in 2023

The consumer electronics segment accounted for the largest market share in 2023. The consumer electronics segment is an important market for sensor fusion. A wide range of consumer electronics devices use sensors, including smartphones, tablets, wearables, and gaming equipment. Sensor fusion technology is used in these devices to provide logically fused data from different sensors for various applications such as gesture recognition, image stabilization, navigation, and motion-based gaming.

The major players providing consumer electronics products are InvenSense Inc. (U.S.), NXP Semiconductors N.V. (Netherlands), and Bosch Sensortec GmbH (Germany). Bosch Sensortec is one of the major players for the development of smartphones by sensor fusion. For instance, December 2021, Bosch Sensortec partnered with Nextnav, a one of the leaders in next-generation GPS. Bosch Sensortec will make use of the partnership to assess measurement precision and provide original equipment manufacturers (OEMs) that utilise its sensors in widely available products like smartphones, tablets, and wearables with strict performance guarantees.

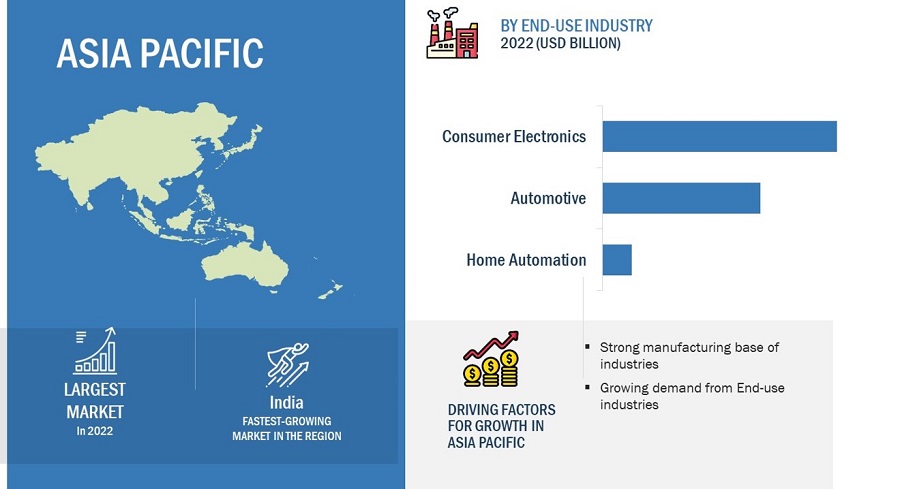

Sensor fusion market to witness highest demand from Asia Pacific

The governments in the Asia Pacific are also playing a crucial role in promoting the growth of the sensor fusion market through various initiatives and policies. For instance, the government of China has set targets to become a world leader in autonomous driving. It is investing heavily in the development of advanced sensor technologies such as LiDAR and radar. Thus, the above factor is driving the market growth in the region.

Further, China held the largest share of the sensor fusion market in the Asia Pacific in 2023 and is projected to dominate both markets during the forecast period. China is witnessing rapid economic development. It has been focusing on shifting from a manufacturing-driven to an innovation-driven economy. China is a global manufacturing hub for industries for semiconductor and consumer electronic devices, which produce smartphones, smart TVs, and wearables.

Considering the country's large population and growing economy, China is a high potential market for sensor fusion technology for consumer electronic devices. The country has seen considerable increase in sales for innovative devices in smartphones and wearable devices which use sensor fusion technology. This is helping the growth of the market for sensor fusion. According to Mobile Economy China 2021 published by GSM Association, the country's total number of smartphone connections is estimated to reach ~1.5 billion in 2025.

Sensor Fusion Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players in Sensor Fusion Maket Growth

Major vendors in the sensor fusion companies include include

- STMicroelectronics (Switzerland),

- InvenSense, Inc. (US),

- NXP Semiconductors N.V. (Netherlands),

- Infineon Technologies (Germany),

- Bosch Sensortec GmbH (Germany),

- Analog Devices, Inc. (US),

- Renesas Electronics Corporation. (Japan),

- Amphenol Corporation (US),

- Texas Instruments (US), and

- Qualcomm Technologies, Inc. (US), among others.

Sensor Fusion Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 8.0 billion in 2023 |

| Projected Market Size | USD 18.0 billion by 2028 |

| Growth Rate | CAGR of 17.8% |

|

Market Size Available for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Units |

Value (USD Million/USD Billion) |

|

Segments Covered |

Offering, Algorithms, Technology, End-Use Application, and Region |

|

Regions Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

include STMicroelectronics (Switzerland), InvenSense, Inc. (US), NXP Semiconductors N.V. (Netherlands), Infineon Technologies (Germany), Bosch Sensortec GmbH (Germany), Analog Devices, Inc. (US), Renesas Electronics Corporation. (Japan), Amphenol Corporation (US), Texas Instruments (US), and Qualcomm Technologies, Inc. (US), among others. |

Sensor Fusion Market Highlights

This report categorizes the sensor fusion market based on algorithms, offering, technology, end-use application, and region.

|

Segment |

Subsegment |

|

By Algorithms |

|

|

By Technology |

|

|

By Offering |

|

|

By End-Use Application |

|

|

By Region |

|

Recent Developments in Sensor Fusion Industry

- In February 2023, 221e srl, an innovator in embedded AI software, leader in intelligent precision sensing, and ST Authorized Partner, has extended its collaboration with STMicroelectronics, a global semiconductor leader serving customers across the spectrum of electronics applications, to include the latest offerings of both companies.

- In January 2023, Bosch Sensortec announced a new smart sensor system that delivers a best-in-class performance/power consumption ratio. . However, it is simple to integrate due to its small size and built-in, ready-to-use software algorithms.

- In June 2022, Infineon Technologies AG launched its battery-powered Smart Alarm System (SAS). The technology platform achieves high accuracy and very low-power operation using sensor fusion based on artificial intelligence/machine learning (AI/ML). This technology, combined with low-power wake-on acoustic event detection, provides remarkable performance.

Frequently Asked Questions (FAQ):

Which are the major companies in the sensor fusion market? What are their primary strategies to strengthen their market presence?

STMicroelectronics (Switzerland), InvenSense, Inc. (US), NXP Semiconductors N.V. (Netherlands), Infineon Technologies (Germany), Bosch Sensortec GmbH (Germany), Analog Devices, Inc. (US), are the leading players in the market. These companies have adopted organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to gain a competitive advantage in the market.

Which is the potential market for the end use application?

Consumer electronics is an end use application with high growth opportunities owing to advancements in the electronics devices.

What are the opportunities for new market entrants?

Factors such as increase in commercial spaces across growing demand for advanced driver assistance systems (ADAS) and deployment of autonomous vehicles and growing demand for wearable devices are creating opportunities for the players in the market.

Which offering is expected to drive market growth in the next six years?

Software is expected to remain the major offering driving sensor fusion demand.

What are the major strategies adopted by sensor fusion companies?

The sensor fusion companies have adopted product launches, acquisitions, expansions and contracts to strengthen their position in the automated material handling equipment market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing development and adoption of autonomous vehicles- Growing adherence to safety regulations for vehicles- Increasing advancements in ADAS technology- Rising need to ensure data accuracy in all weather conditionsRESTRAINTS- High cost of installing and maintaining multiple sensors- Data privacy concernsOPPORTUNITIES- Rising demand for safer and sustainable transportation solutions- Increasing adoption of ADAS in modern vehicles- Growing consumer acceptance of L3 and L4 autonomous vehiclesCHALLENGES- Complex management of high volume of sensor data- High operational cost of cybersecurity measures- Compatibility and integration challenges in hardware and software components

-

5.3 OEM ADAS/AD ADOPTION PROGRESSGENERAL MOTORSFORD MOTOR COMPANYHYUNDAI MOTOR COMPANYVOLKSWAGEN AGTOYOTA MOTOR CORPORATIONMERCEDES-BENZRENAULT-NISSANSTELLANTIS NVACURABMWVOLVO

-

5.4 TECH PLAYERS PROVIDING SENSOR FUSION SOLUTIONSMOBILEYE GLOBAL INC.- Analysis of company developments- Future plans for sensor fusionNVIDIA CORPORATION- Analysis of company developments- Future plans for sensor fusionQUALCOMM INCORPORATED- Analysis of company developments- Future plans for sensor fusionHUAWEI TECHNOLOGIES CO., LTD.- Analysis of company developments- Future plans for sensor fusionAMBARELLA, INC.- Analysis of company developments- Future plans for sensor fusionTESLA, INC.- Analysis of company developments- Future plans for sensor fusionRENESAS ELECTRONICS CORPORATION- Analysis of company developments- Future plans for sensor fusionHORIZON ROBOTICS- Analysis of company developments- Future plans for sensor fusionXILINX, INC.- Analysis of company developments- Future plans for sensor fusion

-

5.5 ECOSYSTEM MAPPINGSENSOR FUSION PROVIDERSSYSTEM-ON-CHIP PROVIDERSSENSOR PROVIDERSOEMS

- 5.6 TOOLS AND BUILDING BLOCKS OF SOFTWARE-DEFINED VEHICLES

- 5.7 SUPPLY CHAIN ANALYSIS

-

5.8 KEY STAKEHOLDERS AND BUYING CRITERIAPASSENGER CARSCOMMERCIAL VEHICLESKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.9 PRICING ANALYSIS

- 5.10 KEY CONFERENCES AND EVENTS IN 2023–2024

-

5.11 TECHNOLOGY ANALYSISDEEP LEARNING-BASED SENSOR FUSIONARTIFICIAL INTELLIGENCE FOR SENSOR FUSIONEDGE COMPUTING FOR SENSOR FUSIONBLOCKCHAIN FOR SENSOR FUSION DATASENSOR FUSION WITH KALMAN FILTER

-

5.12 PATENT ANALYSISINTRODUCTION

-

5.13 CASE STUDY ANALYSISSOC SOLUTIONS SUPPORTING CAMERA AND RADAR SYSTEMSENHANCED DRIVING CAPABILITIES BY UTILIZING WAYMO DRIVERSELF-DRIVING DELIVERY VEHICLE WITH IMPROVED SAFETYMULTI-DOMAIN COMPUTING CAPABILITIES USING DRIVE THORNAVIGATING COMPLEX URBAN LOCALITIES WITH DRIVE4U

-

5.14 REGULATORY OVERVIEWREGULATIONS ON AUTONOMOUS VEHICLES USAGE, BY COUNTRYREGULATIONS AND INITIATIVES ON ADAS, BY COUNTRYREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.16 SENSOR FUSION MARKET FOR AUTOMOTIVE SCENARIOS, 2023–2030MOST LIKELY SCENARIOOPTIMISTIC SCENARIOPESSIMISTIC SCENARIO

- 6.1 INTRODUCTION

-

6.2 L2LANE KEEPING ASSIST, 360-DEGREE SURROUND VIEW, AND ADAPTIVE CRUISE CONTROL CAPABILITIES TO DRIVE MARKET

-

6.3 L3RISING DEMAND FOR ROAD SAFETY TO DRIVE MARKET

-

6.4 L4GROWING SHIFT TOWARD FULL AUTOMATION TO DRIVE MARKET

- 6.5 KEY INDUSTRY INSIGHTS

- 7.1 INTRODUCTION

-

7.2 PASSENGER CARINCREASING DEMAND FOR SAFER, COMFORTABLE, AND LUXURY VEHICLES TO DRIVE MARKET

-

7.3 LIGHT COMMERCIAL VEHICLERISING DEMAND FOR IMPROVED NAVIGATION AND OBSTACLE DETECTION TO DRIVE MARKET

-

7.4 HEAVY COMMERCIAL VEHICLEGROWING UTILIZATION FOR COST-EFFECTIVE COMMERCIAL TRANSPORTATION TO DRIVE MARKET

- 7.5 KEY INDUSTRY INSIGHTS

- 8.1 INTRODUCTION

- 8.2 OPERATIONAL DATA

-

8.3 BATTERY ELECTRIC VEHICLERISING INCLINATION TOWARD SENSOR FUSION EQUIPPED MODELS TO DRIVE MARKET

-

8.4 PLUG-IN ELECTRIC VEHICLELARGER BATTERY PACKS AND ABILITY TO TRAVEL LONGER DISTANCES TO DRIVE MARKET

-

8.5 FUEL CELL ELECTRIC VEHICLEINCREASING ADOPTION OF L2 ADAS SYSTEMS IN ELECTRIC VEHICLES TO DRIVE MARKET

- 8.6 KEY INDUSTRY INSIGHTS

- 9.1 INTRODUCTION

-

9.2 HIGH-LEVEL FUSIONINCREASING DEMAND FOR IMPROVED DRIVING EXPERIENCE IN AUTONOMOUS VEHICLES TO DRIVE MARKET

-

9.3 MID-LEVEL FUSIONBETTER TRACKING AND OBJECT DETECTION CAPABILITIES TO DRIVE MARKET

-

9.4 LOW-LEVEL FUSIONGROWING ADOPTION IN AUTONOMOUS VEHICLES, INDUSTRIAL AUTOMATION, AND ROBOTICS TO DRIVE MARKET

- 9.5 KEY INDUSTRY INSIGHTS

- 10.1 INTRODUCTION

-

10.2 DATA FUSIONRISING FOCUS ON DECISION MAKING IN DYNAMIC DRIVING SITUATIONS TO DRIVE MARKET

-

10.3 FEATURE FUSIONINCREASED USE IN L2+ AND L4 VEHICLES TO DRIVE MARKET

-

10.4 DECISION FUSIONLOWER PROCESSING CAPACITY AND REAL-TIME DRIVING DECISION CAPABILITIES TO DRIVE MARKET

- 10.5 KEY INDUSTRY INSIGHTS

- 11.1 INTRODUCTION

-

11.2 KALMAN FILTERGROWING ADOPTION IN SEMI-AUTOMATED VEHICLES, UNMANNED VEHICLES, AND SELF-DRIVING CARS TO DRIVE MARKET

-

11.3 BAYESIAN FILTERINCREASING USE OF NOISE SENSORS TO DRIVE MARKET

-

11.4 CENTRAL LIMIT THEOREMLOW COMPUTATIONAL COMPLEXITY TO DRIVE MARKET

-

11.5 CONVOLUTIONAL NEURAL NETWORKFAULT FEATURE DETECTION CAPABILITIES TO DRIVE MARKET

- 12.1 INTRODUCTION

-

12.2 HOMOGENEOUSINCREASING DEMAND FOR REDUCING DATA OVERLOAD TO DRIVE MARKET

-

12.3 HETEROGENEOUSGROWING REQUIREMENT FOR ENHANCED SYSTEM PERFORMANCE IN AUTONOMOUS VEHICLES TO DRIVE MARKET

- 13.1 INTRODUCTION

-

13.2 ADASGROWING INVESTMENTS BY AUTOMAKERS TO DRIVE MARKET

-

13.3 AUTONOMOUS DRIVINGRISING NEED TO REPLACE MANUAL CONTROL WITH AUTOMATED FUNCTIONS TO DRIVE MARKET

- 13.4 KEY INDUSTRY INSIGHTS

- 14.1 INTRODUCTION

-

14.2 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Increasing domestic vehicle production and adoption of cloud infrastructure for autonomous driving applications to drive marketJAPAN- Rising incorporation of sensor fusion technology in mid-range automobiles to drive marketSOUTH KOREA- Future Vehicle Industry Development Strategy to drive marketINDIA- Growing shift to emission-friendly vehicles and better safety regulations to drive market

-

14.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- Autonomous Driving Act and implementation of L4 automated parking to drive marketFRANCE- Growing government mandates for road safety and acceptance of automated vehicles to drive marketITALY- Rising demand for luxury cars with advanced safety features and testing of sensor fusion-enabled L3 passenger cars to drive marketSPAIN- Evolving consumer preference and regulatory changes to drive marketUK- Increasing demand and export of luxury and sports cars to drive market

-

14.4 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Growing demand for sensor fusion in ADAS-enabled vehicles and increasing investments by automakers to drive marketCANADA- Favorable startup ecosystem and growing investments by government to develop and test autonomous vehicles to drive market

- 15.1 OVERVIEW

- 15.2 RANKING ANALYSIS

- 15.3 KEY PLAYERS’ STRATEGIES, 2020–2023

- 15.4 REVENUE ANALYSIS

-

15.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

15.6 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

15.7 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSEXPANSIONSOTHER DEALS/DEVELOPMENTS

-

16.1 KEY PLAYERSMOBILEYE GLOBAL INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNVIDIA CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewQUALCOMM INCORPORATED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTESLA, INC.- Business overview- Products/Solutions/Services offered- MnM viewHUAWEI TECHNOLOGIES CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewWAYMO LLC- Business overview- Products/Solutions/Services offered- Recent developmentsDATASPEED INC.- Business overview- Products/Solutions/Services offered- Recent developmentsLEDDARTECH- Business overview- Products/Solutions/Services offered- Recent developmentsVECTOR INFORMATIK- Business overview- Products/Solutions/Services offered- Recent developmentsBAIDU, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsRENESAS ELECTRONICS CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsMICROCHIP TECHNOLOGY- Business overview- Products/Solutions/Services offered- Recent developments

-

16.2 HARDWARE PROVIDERSROBERT BOSCH GMBH- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCONTINENTAL AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewZF FRIEDRICHSHAFEN AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDENSO CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNXP SEMICONDUCTORS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewALLEGRO MICROSYSTEMS- Business overview- Products/Solutions/Services offered- Recent developmentsSTMICROELECTRONICS- Business overview- Products/Solutions/Services offered- Recent developmentsAPTIV PLC- Business overview- Products/Solutions/Services offered- Recent developmentsINFINEON TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developments

-

16.3 OTHER PLAYERSZOOX, INC.AURORA INNOVATION INC.CTS CORPORATIONMEMSIC SEMICONDUCTOR (TIANJIN) CO., LTD.KIONIX, INC.TDK CORPORATIONMONOLITHIC POWER SYSTEMS, INC.IBEO AUTOMOTIVE SYSTEMS GMBHMAGNA INTERNATIONALANALOG DEVICESVISTEON CORPORATIONPHANTOM AINEOUSYS TECHNOLOGYTE CONNECTIVITY LTD.MICRON TECHNOLOGYXILINX, INC.AMBARELLA, INC.

- 17.1 ASIA PACIFIC TO BE MOST LUCRATIVE SENSOR FUSION MARKET FOR AUTOMOTIVE

- 17.2 TECHNOLOGICAL ADVANCEMENTS TO LEAD TO MARKET DEVELOPMENT

- 17.3 LEVEL 3 AND LEVEL 4 AUTONOMOUS VEHICLES TO GROW EXPONENTIALLY IN FUTURE

- 17.4 CONCLUSION

- 18.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 18.2 DISCUSSION GUIDE

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 18.4 CUSTOMIZATION OPTIONS

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS

- TABLE 1 MARKET DEFINITION: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY TECHNOLOGY

- TABLE 2 MARKET DEFINITION: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY

- TABLE 3 MARKET DEFINITION: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY DATA FUSION TYPE

- TABLE 4 MARKET DEFINITION: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY VEHICLE TYPE

- TABLE 5 MARKET DEFINITION: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY ELECTRIC VEHICLE TYPE

- TABLE 6 MARKET DEFINITION: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY SENSOR PLATFORM APPROACH

- TABLE 7 MARKET DEFINITION: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY FUSION LEVEL

- TABLE 8 MARKET DEFINITION: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY SENSOR TYPE

- TABLE 9 MARKET DEFINITION: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY ALGORITHM

- TABLE 10 INCLUSIONS AND EXCLUSIONS

- TABLE 11 CURRENCY EXCHANGE RATES

- TABLE 12 COST ANALYSIS OF AUTOMOTIVE SENSORS

- TABLE 13 IMPACT OF MARKET DYNAMICS

- TABLE 14 MOBILEYE GLOBAL INC.: SOC OFFERINGS

- TABLE 15 MOBILEYE GLOBAL INC.: SOC COMPARISON

- TABLE 16 MOBILEYE GLOBAL INC.: TIER I PARTNERSHIPS

- TABLE 17 MOBILEYE GLOBAL INC.: OEM PARTNERSHIPS

- TABLE 18 NVIDIA CORPORATION: SOC COMPARISON

- TABLE 19 NVIDIA CORPORATION: TIER I PARTNERSHIPS

- TABLE 20 NVIDIA CORPORATION: OEM PARTNERSHIPS

- TABLE 21 QUALCOMM INCORPORATED: SOC COMPARISON

- TABLE 22 QUALCOMM INCORPORATED: TIER I PARTNERSHIPS

- TABLE 23 QUALCOMM INCORPORATED: OEM PARTNERSHIPS

- TABLE 24 HUAWEI TECHNOLOGIES CO., LTD.: SOC COMPARISON

- TABLE 25 HUAWEI TECHNOLOGIES CO., LTD.: OEM PARTNERSHIPS

- TABLE 26 AMBARELLA, INC.: SOC COMPARISON

- TABLE 27 AMBARELLA, INC.: TIER I PARTNERSHIPS

- TABLE 28 TESLA, INC.: SOC COMPARISON

- TABLE 29 RENESAS ELECTRONICS CORPORATION: SOC COMPARISON

- TABLE 30 RENESAS ELECTRONICS CORPORATION: OEM PARTNERSHIPS

- TABLE 31 HORIZON ROBOTICS: SOC COMPARISON

- TABLE 32 HORIZON ROBOTICS: OEM PARTNERSHIPS

- TABLE 33 XILINX, INC.: SOC COMPARISON

- TABLE 34 XILINX, INC.: OEM PARTNERSHIPS

- TABLE 35 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 37 KEY BUYING CRITERIA FOR AUTONOMOUS VEHICLES

- TABLE 38 AVERAGE SELLING PRICE ANALYSIS, BY REGION, 2022

- TABLE 39 AVERAGE SELLING PRICE ANALYSIS, BY REGION, 2030

- TABLE 40 L2+/L3 AD SOFTWARE SUITE PRICE BY LEADING OEMS, 2022

- TABLE 41 LIST OF CONFERENCES AND EVENTS, 2023–2024

- TABLE 42 INNOVATIONS AND PATENT REGISTRATIONS, 2018–2023

- TABLE 43 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 44 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 45 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 46 SENSOR FUSION MARKET FOR AUTOMOTIVE (MOST LIKELY), BY REGION, 2023–2030 (USD MILLION)

- TABLE 47 SENSOR FUSION MARKET FOR AUTOMOTIVE (OPTIMISTIC), BY REGION, 2023–2030 (USD MILLION)

- TABLE 48 SENSOR FUSION MARKET FOR AUTOMOTIVE (PESSIMISTIC), BY REGION, 2023–2030 (USD MILLION)

- TABLE 49 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (THOUSAND UNITS)

- TABLE 50 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (THOUSAND UNITS)

- TABLE 51 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (USD MILLION)

- TABLE 52 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (USD MILLION)

- TABLE 53 OEM OFFERINGS, BY LEVEL OF AUTONOMY

- TABLE 54 L2: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 55 L2: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 56 L2: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 57 L2: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (USD MILLION)

- TABLE 58 L3: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 59 L3: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 60 L3: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 61 L3: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (USD MILLION)

- TABLE 62 L4: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 63 L4: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (USD MILLION)

- TABLE 64 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY VEHICLE TYPE, 2019–2022 (THOUSAND UNITS)

- TABLE 65 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY VEHICLE TYPE, 2023–2030 (THOUSAND UNITS)

- TABLE 66 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 67 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 68 UPCOMING AND OPERATIONAL SENSOR FUSION-ENABLED PASSENGER CAR MODELS

- TABLE 69 PASSENGER CAR: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 70 PASSENGER CAR: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 71 PASSENGER CAR: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 72 PASSENGER CAR: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (USD MILLION)

- TABLE 73 UPCOMING AND OPERATIONAL SENSOR FUSION-ENABLED LIGHT COMMERCIAL VEHICLES

- TABLE 74 LIGHT COMMERCIAL VEHICLE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 75 LIGHT COMMERCIAL VEHICLE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 76 LIGHT COMMERCIAL VEHICLE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 77 LIGHT COMMERCIAL VEHICLE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (USD MILLION)

- TABLE 78 HEAVY COMMERCIAL VEHICLE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 79 HEAVY COMMERCIAL VEHICLE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 80 HEAVY COMMERCIAL VEHICLE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 81 HEAVY COMMERCIAL VEHICLE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (USD MILLION)

- TABLE 82 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY ELECTRIC VEHICLE TYPE, 2019–2022 (THOUSAND UNITS)

- TABLE 83 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY ELECTRIC VEHICLE TYPE, 2023–2030 (THOUSAND UNITS)

- TABLE 84 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY ELECTRIC VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 85 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY ELECTRIC VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 86 SENSOR FUSION ENABLED L2 ELECTRIC VEHICLES BY LEADING OEMS

- TABLE 87 BATTERY ELECTRIC VEHICLE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 88 BATTERY ELECTRIC VEHICLE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 89 BATTERY ELECTRIC VEHICLE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 90 BATTERY ELECTRIC VEHICLE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (USD MILLION)

- TABLE 91 PLUG-IN ELECTRIC VEHICLE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 92 PLUG-IN ELECTRIC VEHICLE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 93 PLUG-IN ELECTRIC VEHICLE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 94 PLUG-IN ELECTRIC VEHICLE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (USD MILLION)

- TABLE 95 FUEL CELL ELECTRIC VEHICLE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 96 FUEL CELL ELECTRIC VEHICLE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 97 FUEL CELL ELECTRIC VEHICLE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 98 FUEL CELL ELECTRIC VEHICLE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (USD MILLION)

- TABLE 99 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY SENSOR PLATFORM APPROACH, 2019–2022 (USD MILLION)

- TABLE 100 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY SENSOR PLATFORM APPROACH, 2023–2030 (USD MILLION)

- TABLE 101 SENSOR FUSION LEVEL COMPARISON

- TABLE 102 HIGH-LEVEL FUSION: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 103 HIGH-LEVEL FUSION: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (USD MILLION)

- TABLE 104 MID-LEVEL FUSION: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 105 MID-LEVEL FUSION: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (USD MILLION)

- TABLE 106 LOW-LEVEL FUSION: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 107 LOW-LEVEL FUSION: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (USD MILLION)

- TABLE 108 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY FUSION LEVEL, 2019–2022 (USD MILLION)

- TABLE 109 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY FUSION LEVEL, 2023–2030 (USD MILLION)

- TABLE 110 DATA FUSION: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 111 DATA FUSION: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (USD MILLION)

- TABLE 112 FEATURE FUSION: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 113 FEATURE FUSION: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (USD MILLION)

- TABLE 114 DECISION FUSION: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 115 DECISION FUSION: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (USD MILLION)

- TABLE 116 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY TECHNOLOGY, 2019–2022 (THOUSAND UNITS)

- TABLE 117 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 118 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 119 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 120 OEM OFFERINGS WITH ADAS FEATURES

- TABLE 121 ADAS: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 122 ADAS: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 123 ADAS: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 124 ADAS: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (USD MILLION)

- TABLE 125 AUTONOMOUS DRIVING: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 126 AUTONOMOUS DRIVING: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 127 AUTONOMOUS DRIVING: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 128 AUTONOMOUS DRIVING: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (USD MILLION)

- TABLE 129 PHASES IN DEVELOPMENT OF AUTONOMOUS VEHICLES AND THEIR IMPACT ON MARKET

- TABLE 130 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 131 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 132 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 133 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (USD MILLION)

- TABLE 134 ASIA PACIFIC: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY COUNTRY, 2019–2022 (THOUSAND UNITS)

- TABLE 135 ASIA PACIFIC: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY COUNTRY, 2023–2030 (THOUSAND UNITS)

- TABLE 136 ASIA PACIFIC: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 137 ASIA PACIFIC: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 138 KEY COMPANIES AND PARTNERS IN CHINA FOR AUTONOMOUS VEHICLE TECHNOLOGY

- TABLE 139 AUTOMOTIVE SENSOR FUSION STARTUPS IN CHINA

- TABLE 140 CHINA: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (THOUSAND UNITS)

- TABLE 141 CHINA: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (THOUSAND UNITS)

- TABLE 142 CHINA: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (USD MILLION)

- TABLE 143 CHINA: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (USD MILLION)

- TABLE 144 AUTOMOTIVE SENSOR FUSION STARTUPS IN JAPAN

- TABLE 145 JAPAN: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (THOUSAND UNITS)

- TABLE 146 JAPAN: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (THOUSAND UNITS)

- TABLE 147 JAPAN: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (USD MILLION)

- TABLE 148 JAPAN: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (USD MILLION)

- TABLE 149 AUTOMOTIVE SENSOR FUSION STARTUPS IN SOUTH KOREA

- TABLE 150 SOUTH KOREA: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (THOUSAND UNITS)

- TABLE 151 SOUTH KOREA: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (THOUSAND UNITS)

- TABLE 152 SOUTH KOREA: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (USD MILLION)

- TABLE 153 SOUTH KOREA: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (USD MILLION)

- TABLE 154 AUTOMOTIVE SENSOR FUSION STARTUPS IN INDIA

- TABLE 155 INDIA: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (THOUSAND UNITS)

- TABLE 156 INDIA: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (THOUSAND UNITS)

- TABLE 157 INDIA: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (USD MILLION)

- TABLE 158 INDIA: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (USD MILLION)

- TABLE 159 EUROPE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY COUNTRY, 2019–2022 (THOUSAND UNITS)

- TABLE 160 EUROPE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY COUNTRY, 2023–2030 (THOUSAND UNITS)

- TABLE 161 EUROPE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 162 EUROPE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 163 AUTOMOTIVE SENSOR FUSION STARTUPS IN GERMANY

- TABLE 164 GERMANY: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (THOUSAND UNITS)

- TABLE 165 GERMANY: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (THOUSAND UNITS)

- TABLE 166 GERMANY: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (USD MILLION)

- TABLE 167 GERMANY: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (USD MILLION)

- TABLE 168 AUTOMOTIVE SENSOR FUSION STARTUPS IN FRANCE

- TABLE 169 FRANCE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (THOUSAND UNITS)

- TABLE 170 FRANCE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (THOUSAND UNITS)

- TABLE 171 FRANCE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (USD MILLION)

- TABLE 172 FRANCE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (USD MILLION)

- TABLE 173 ITALY: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (THOUSAND UNITS)

- TABLE 174 ITALY: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (THOUSAND UNITS)

- TABLE 175 ITALY: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (USD MILLION)

- TABLE 176 ITALY: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (USD MILLION)

- TABLE 177 AUTOMOTIVE SENSOR FUSION STARTUPS IN SPAIN

- TABLE 178 SPAIN: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (THOUSAND UNITS)

- TABLE 179 SPAIN: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (THOUSAND UNITS)

- TABLE 180 SPAIN: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (USD MILLION)

- TABLE 181 SPAIN: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (USD MILLION)

- TABLE 182 AUTOMOTIVE SENSOR FUSION STARTUPS IN UK

- TABLE 183 UK: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (THOUSAND UNITS)

- TABLE 184 UK: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (THOUSAND UNITS)

- TABLE 185 UK: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (USD MILLION)

- TABLE 186 UK: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (USD MILLION)

- TABLE 187 NORTH AMERICA: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY COUNTRY, 2019–2022 (THOUSAND UNITS)

- TABLE 188 NORTH AMERICA: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY COUNTRY, 2023–2030 (THOUSAND UNITS)

- TABLE 189 NORTH AMERICA: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 190 NORTH AMERICA: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 191 AUTOMOTIVE SENSOR FUSION STARTUPS IN US

- TABLE 192 US: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (THOUSAND UNITS)

- TABLE 193 US: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (THOUSAND UNITS)

- TABLE 194 US: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (USD MILLION)

- TABLE 195 US: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (USD MILLION)

- TABLE 196 AUTOMOTIVE SENSOR FUSION STARTUPS IN CANADA

- TABLE 197 CANADA: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (THOUSAND UNITS)

- TABLE 198 CANADA: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (THOUSAND UNITS)

- TABLE 199 CANADA: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2019–2022 (USD MILLION)

- TABLE 200 CANADA: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (USD MILLION)

- TABLE 201 KEY PLAYERS’ STRATEGIES, 2020–2023

- TABLE 202 COMPANY FOOTPRINT, 2023

- TABLE 203 COMPANY FOOTPRINT, BY VEHICLE TYPE, 2023

- TABLE 204 COMPANY FOOTPRINT, BY REGION, 2023

- TABLE 205 LIST OF KEY STARTUPS/SMES

- TABLE 206 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 207 SENSOR FUSION MARKET: PRODUCT LAUNCHES, JANUARY 2023– SEPTEMBER 2023

- TABLE 208 SENSOR FUSION MARKET: DEALS, JANUARY 2023–SEPTEMBER 2023

- TABLE 209 SENSOR FUSION MARKET: EXPANSIONS, JUNE 2021–AUGUST 2023

- TABLE 210 SENSOR FUSION MARKET: OTHER DEALS/DEVELOPMENTS, JUNE 2021– AUGUST 2023

- TABLE 211 MOBILEYE GLOBAL INC.: COMPANY OVERVIEW

- TABLE 212 MOBILEYE GLOBAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 MOBILEYE GLOBAL INC.: PRODUCT DEVELOPMENTS

- TABLE 214 MOBILEYE GLOBAL INC.: DEALS

- TABLE 215 NVIDIA CORPORATION: COMPANY OVERVIEW

- TABLE 216 NVIDIA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 NVIDIA CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 218 NVIDIA CORPORATION: DEALS

- TABLE 219 QUALCOMM INCORPORATED: COMPANY OVERVIEW

- TABLE 220 QUALCOMM INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 QUALCOMM INCORPORATED: PRODUCT DEVELOPMENTS

- TABLE 222 QUALCOMM INCORPORATED: DEALS

- TABLE 223 TESLA, INC.: COMPANY OVERVIEW

- TABLE 224 TESLA, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 TESLA, INC.: DEALS

- TABLE 226 TESLA, INC.: OTHERS

- TABLE 227 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 228 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCT DEVELOPMENTS

- TABLE 230 HUAWEI TECHNOLOGIES CO., LTD.: DEALS

- TABLE 231 HUAWEI TECHNOLOGIES CO., LTD.: OTHERS

- TABLE 232 WAYMO LLC: COMPANY OVERVIEW

- TABLE 233 WAYMO LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 WAYMO LLC: PRODUCT DEVELOPMENTS

- TABLE 235 WAYMO LLC: DEALS

- TABLE 236 DATASPEED INC.: COMPANY OVERVIEW

- TABLE 237 DATASPEED INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 DATASPEED INC.: PRODUCT DEVELOPMENTS

- TABLE 239 DATASPEED INC.: DEALS

- TABLE 240 LEDDARTECH: COMPANY OVERVIEW

- TABLE 241 LEDDARTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 LEDDARTECH: PRODUCT DEVELOPMENTS

- TABLE 243 LEDDARTECH: DEALS

- TABLE 244 LEDDARTECH: OTHERS

- TABLE 245 VECTOR INFORMATIK: COMPANY OVERVIEW

- TABLE 246 VECTOR INFORMATIK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 VECTOR INFORMATIK: PRODUCT DEVELOPMENTS

- TABLE 248 VECTOR INFORMATIK: DEALS

- TABLE 249 BAIDU, INC.: COMPANY OVERVIEW

- TABLE 250 BAIDU, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 BAIDU, INC.: PRODUCT DEVELOPMENTS

- TABLE 252 BAIDU, INC.: DEALS

- TABLE 253 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 254 RENESAS ELECTRONICS CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 255 RENESAS ELECTRONICS CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 256 RENESAS ELECTRONICS CORPORATION: DEALS

- TABLE 257 MICROCHIP TECHNOLOGY: COMPANY OVERVIEW

- TABLE 258 MICROCHIP TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 MICROCHIP TECHNOLOGY: PRODUCT DEVELOPMENTS

- TABLE 260 MICROCHIP TECHNOLOGY: DEALS

- TABLE 261 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 262 ROBERT BOSCH GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 ROBERT BOSCH GMBH: PRODUCT DEVELOPMENTS

- TABLE 264 ROBERT BOSCH GMBH: DEALS

- TABLE 265 ROBERT BOSCH GMBH: OTHERS

- TABLE 266 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 267 CONTINENTAL AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 CONTINENTAL AG: PRODUCT DEVELOPMENTS

- TABLE 269 CONTINENTAL AG: DEALS

- TABLE 270 CONTINENTAL AG: OTHERS

- TABLE 271 ZF FRIEDRICHSHAFEN AG: COMPANY OVERVIEW

- TABLE 272 ZF FRIEDRICHSHAFEN AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 ZF FRIEDRICHSHAFEN AG: PRODUCT DEVELOPMENTS

- TABLE 274 ZF FRIEDRICHSHAFEN AG: DEALS

- TABLE 275 DENSO CORPORATION: COMPANY OVERVIEW

- TABLE 276 DENSO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 DENSO CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 278 DENSO CORPORATION: DEALS

- TABLE 279 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 280 NXP SEMICONDUCTORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 NXP SEMICONDUCTORS: PRODUCT DEVELOPMENTS

- TABLE 282 NXP SEMICONDUCTORS: DEALS

- TABLE 283 ALLEGRO MICROSYSTEMS: COMPANY OVERVIEW

- TABLE 284 ALLEGRO MICROSYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 ALLEGRO MICROSYSTEMS: PRODUCT DEVELOPMENTS

- TABLE 286 ALLEGRO MICROSYSTEMS: DEALS

- TABLE 287 STMICROELECTRONICS: COMPANY OVERVIEW

- TABLE 288 STMICROELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 STMICROELECTRONICS: PRODUCT DEVELOPMENTS

- TABLE 290 STMICROELECTRONICS: DEALS

- TABLE 291 APTIV PLC: COMPANY OVERVIEW

- TABLE 292 APTIV PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 APTIV PLC: PRODUCT DEVELOPMENTS

- TABLE 294 APTIV PLC: DEALS

- TABLE 295 APTIV PLC: OTHERS

- TABLE 296 INFINEON TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 297 INFINEON TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 298 INFINEON TECHNOLOGIES: PRODUCT DEVELOPMENTS

- TABLE 299 INFINEON TECHNOLOGIES: DEALS

- TABLE 300 ZOOX, INC.: COMPANY OVERVIEW

- TABLE 301 AURORA INNOVATION INC.: COMPANY OVERVIEW

- TABLE 302 CTS CORPORATION: COMPANY OVERVIEW

- TABLE 303 MEMSIC SEMICONDUCTOR (TIANJIN) CO., LTD.: COMPANY OVERVIEW

- TABLE 304 KIONIX, INC.: COMPANY OVERVIEW

- TABLE 305 TDK CORPORATION: COMPANY OVERVIEW

- TABLE 306 MONOLITHIC POWER SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 307 IBEO AUTOMOTIVE SYSTEMS GMBH: COMPANY OVERVIEW

- TABLE 308 MAGNA INTERNATIONAL: COMPANY OVERVIEW

- TABLE 309 ANALOG DEVICES: COMPANY OVERVIEW

- TABLE 310 VISTEON CORPORATION: COMPANY OVERVIEW

- TABLE 311 PHANTOM AI: COMPANY OVERVIEW

- TABLE 312 NEOUSYS TECHNOLOGY: COMPANY OVERVIEW

- TABLE 313 TE CONNECTIVITY LTD.: COMPANY OVERVIEW

- TABLE 314 MICRON TECHNOLOGY: COMPANY OVERVIEW

- TABLE 315 XILINX, INC.: COMPANY OVERVIEW

- TABLE 316 AMBARELLA, INC.: COMPANY OVERVIEW

- FIGURE 1 MARKETS COVERED

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH PROCESS FLOW

- FIGURE 4 KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 7 BOTTOM-UP APPROACH

- FIGURE 8 TOP-DOWN APPROACH

- FIGURE 9 MARKET SIZE ESTIMATION NOTES

- FIGURE 10 DATA TRIANGULATION

- FIGURE 11 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS

- FIGURE 12 SENSOR FUSION MARKET FOR AUTOMOTIVE: MARKET OVERVIEW

- FIGURE 13 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (USD MILLION)

- FIGURE 14 HISTORICAL ROADMAP FOR SENSOR FUSION MARKET FOR AUTOMOTIVE

- FIGURE 15 L3 TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 16 TECHNOLOGICAL DEVELOPMENTS AND FAVORABLE GOVERNMENT REGULATIONS TO DRIVE MARKET

- FIGURE 17 ASIA PACIFIC TO LEAD MARKET AT HIGHEST GROWTH RATE BY 2030

- FIGURE 18 L3 VEHICLES TO DRIVE LEVEL OF AUTONOMY SEGMENT (2023–2030)

- FIGURE 19 PASSENGER CAR SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 20 BATTERY ELECTRIC VEHICLE SEGMENT TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD (2023–2030)

- FIGURE 21 MID-LEVEL FUSION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 22 DATA FUSION SEGMENT TO HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 23 AUTONOMOUS DRIVING SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 24 DIFFERENT SENSORS IN ADAS SYSTEMS

- FIGURE 25 SENSOR FUSION MARKET FOR AUTOMOTIVE: MARKET DYNAMICS

- FIGURE 26 SAFETY FEATURES IN SELF-DRIVING, AUTOMATED, AND CONNECTED VEHICLES

- FIGURE 27 REGULATORY SAFETY FEATURES BY EUROPEAN COMMISSION IN 2022

- FIGURE 28 ADAS FUNCTIONS PROVIDED BY OEMS

- FIGURE 29 EVOLUTION OF ADAS FUNCTIONS

- FIGURE 30 IMPACT OF WEATHER ON SENSOR-ENABLED VEHICLES

- FIGURE 31 SENSORS USED FOR AUTONOMOUS FUNCTIONS

- FIGURE 32 VEHICLE ATTACK VECTORS

- FIGURE 33 FUEL ECONOMY IMPROVEMENTS USING ADAS SYSTEMS

- FIGURE 34 GROWING SALES OF ADAS EQUIPPED CARS, 2019–2022 (THOUSAND UNITS)

- FIGURE 35 AUTONOMOUS VEHICLES READINESS INDEX

- FIGURE 36 DATA GENERATED BY CONNECTED VEHICLES

- FIGURE 37 COMMON ATTACK VECTORS IN CONNECTING VEHICLES, 2010–2022

- FIGURE 38 DIFFERENT TYPES OF SENSORS

- FIGURE 39 AUTONOMOUS DRIVING MILESTONE

- FIGURE 40 GENERAL MOTORS: FUTURE PLANS FOR SENSOR FUSION

- FIGURE 41 FORD MOTOR COMPANY: FUTURE PLANS FOR SENSOR FUSION

- FIGURE 42 HYUNDAI MOTOR COMPANY: FUTURE PLANS FOR SENSOR FUSION

- FIGURE 43 VOLKSWAGEN AG: FUTURE PLANS FOR SENSOR FUSION

- FIGURE 44 TOYOTA MOTOR CORPORATION: FUTURE PLANS FOR SENSOR FUSION

- FIGURE 45 MERCEDES-BENZ: FUTURE PLANS FOR SENSOR FUSION

- FIGURE 46 RENAULT-NISSAN: FUTURE PLANS FOR SENSOR FUSION

- FIGURE 47 STELLANTIS NV: FUTURE PLANS FOR SENSOR FUSION

- FIGURE 48 ECOSYSTEM ANALYSIS

- FIGURE 49 SUPPLY CHAIN ANALYSIS

- FIGURE 50 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 51 KEY BUYING CRITERIA FOR AUTONOMOUS VEHICLES

- FIGURE 52 RENESAS ELECTRONICS CORPORATION: SENSOR FUSION WITH DEEP LEARNING

- FIGURE 53 RENESAS ELECTRONICS CORPORATION: AI-BASED SENSOR FUSION

- FIGURE 54 EDGE COMPUTING SYSTEM ARCHITECTURE

- FIGURE 55 BLOCKCHAIN IN AUTONOMOUS VEHICLES

- FIGURE 56 KALMAN FILTER FOR SENSOR FUSION IN AUTONOMOUS VEHICLES

- FIGURE 57 NUMBER OF PATENTS GRANTED, 2013–2022

- FIGURE 58 PUBLICATION TRENDS

- FIGURE 59 REVENUE SHIFT AND NEW REVENUE POCKETS FOR SENSOR FUSION MARKET FOR AUTOMOTIVE

- FIGURE 60 FUTURE TRENDS AND SCENARIOS, 2023–2030 (USD MILLION)

- FIGURE 61 AUTOMATION LEVELS IN AUTONOMOUS CARS

- FIGURE 62 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY LEVEL OF AUTONOMY, 2023–2030 (USD MILLION)

- FIGURE 63 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- FIGURE 64 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY ELECTRIC VEHICLE TYPE, 2023–2030 (USD MILLION)

- FIGURE 65 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY SENSOR PLATFORM APPROACH, 2023–2030 (USD MILLION)

- FIGURE 66 DIFFERENT FUSION LEVELS FOR SENSOR INFORMATION

- FIGURE 67 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY FUSION LEVEL, 2023–2030 (USD MILLION)

- FIGURE 68 KALMAN FILTER FOR SENSOR FUSION IN AUTOMOTIVE

- FIGURE 69 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- FIGURE 70 SENSOR FUSION MARKET FOR AUTOMOTIVE, BY REGION, 2023–2030 (USD MILLION)

- FIGURE 71 ASIA PACIFIC: SENSOR FUSION MARKET FOR AUTOMOTIVE SNAPSHOT

- FIGURE 72 EUROPE: SENSOR FUSION MARKET FOR AUTOMOTIVE, BY COUNTRY, 2023–2030 (USD MILLION)

- FIGURE 73 NORTH AMERICA: SENSOR FUSION MARKET FOR AUTOMOTIVE SNAPSHOT

- FIGURE 74 RANKING ANALYSIS, 2023

- FIGURE 75 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2022

- FIGURE 76 KEY PLAYERS: COMPANY EVALUATION MATRIX, 2023

- FIGURE 77 HARDWARE PROVIDERS: COMPANY EVALUATION MATRIX, 2023

- FIGURE 78 STARTUP/SME EVALUATION MATRIX, 2023

- FIGURE 79 MOBILEYE GLOBAL INC.: COMPANY SNAPSHOT

- FIGURE 80 MOBILEYE EYEQ 6 HIGH PLATFORM

- FIGURE 81 MOBILEYE EYEQ 6 LIGHT PLATFORM

- FIGURE 82 NVIDIA CORPORATION: COMPANY SNAPSHOT

- FIGURE 83 NVIDIA DRIVE PLATFORM

- FIGURE 84 NVIDIA DRIVE THOR PLATFORM

- FIGURE 85 QUALCOMM INCORPORATED: COMPANY SNAPSHOT

- FIGURE 86 QUALCOMM SNAPDRAGON RIDE SOFTWARE PLATFORM FOR AUTONOMOUS VEHICLES

- FIGURE 87 QUALCOMM SNAPDRAGON RIDE VISION SOC

- FIGURE 88 QUALCOMM SNAPDRAGON RIDE VISION PLATFORM

- FIGURE 89 TESLA, INC.: COMPANY SNAPSHOT

- FIGURE 90 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

- FIGURE 91 HUAWEI ADS 2.0 VS. TESLA AUTOPILOT

- FIGURE 92 WAYMO DRIVER SETUP

- FIGURE 93 LEDDARVISION ENVIRONMENTAL PERCEPTION FRAMEWORK FOR AUTONOMOUS VEHICLES

- FIGURE 94 BASELABS DATA FUSION TECHNOLOGY

- FIGURE 95 BAIDU, INC.: COMPANY SNAPSHOT

- FIGURE 96 BAIDU APOLLO PLATFORM

- FIGURE 97 BAIDU APOLLO PLATFORM APPLICATIONS

- FIGURE 98 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 99 MICROCHIP TECHNOLOGY: COMPANY SNAPSHOT

- FIGURE 100 MICROCHIP’S DIGITAL COCKPIT

- FIGURE 101 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 102 BOSCH ADAS SYSTEMS

- FIGURE 103 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 104 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

- FIGURE 105 ZF FRIEDRICHSHAFEN AG ADAS SYSTEMS FOR AUTONOMOUS VEHICLES

- FIGURE 106 DENSO CORPORATION: COMPANY SNAPSHOT

- FIGURE 107 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- FIGURE 108 ALLEGRO MICROSYSTEMS: COMPANY SNAPSHOT

- FIGURE 109 STMICROELECTRONICS: COMPANY SNAPSHOT

- FIGURE 110 APTIV PLC: COMPANY SNAPSHOT

- FIGURE 111 APTIV PLC: AUTONOMOUS VEHICLE ARCHITECTURE

- FIGURE 112 INFINEON TECHNOLOGIES: COMPANY SNAPSHOT

The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the sensor fusion market. This process involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for the comprehensive, technical, market-oriented, and commercial study of the sensor fusion market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects. Key players in the sensor fusion market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information important for this study. Secondary sources included corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; white papers, sensor fusion products related journals, certified publications; articles by recognized authors; directories; and databases.

Secondary research was conducted to obtain key information about the industry supply chain, market value chain, key players, market classification and segmentation as per industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to determine the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology & innovation directors, and key executives from major companies in the sensor fusion market.

After going through market engineering (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers obtained. Primary research was conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by players operating in the market.

To know about the assumptions considered for the study, download the pdf brochure

Market size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out on the complete market engineering process to list the key information/insights pertaining to the sensor fusion market.

The key players in the market were identified through secondary research, and their rankings in the respective regions were determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, as well as interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Sensor Fusion Market: Bottom-up Approach

Sensor Fusion Market: Top-Down Approach

Data Triangulation

After arriving at the overall size of the sensor fusion market from the market size estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the market breakdown and data triangulation procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using top-down and bottom-up approaches.

Market Definition

Sensor fusion is a process of combining the outputs from various sensors to provide an integrated and more refined sensor output than individual sensors. The most common type of sensor fusion is inertial combo sensors. In general, sensor fusion entails combining data from various sensors to produce a more precise and comprehensive picture of the environment or system under observation.

Sensor fusion is crucial in the context of autonomous vehicles since it enables the car to sense its surroundings much more accurately and consistently. For instance, a self-driving car may employ a variety of sensors, including cameras, lidar, radar, and others, to identify obstacles, pedestrians, and other moving vehicles. The car can build a complete 3D map of its surroundings and make better navigational judgements by combining the data from all these sensors.

Stakeholders

- Semiconductor product designers and fabricators

- Application providers

- Business providers

- Professional services/solutions providers

- Research organizations

- Technology standard organizations, forums, alliances, and associations

- Technology investors

Report Objectives

- To describe and forecast the sensor fusion market, in terms of value, based on algorithms, offering, technology, and end-use application

- To describe and forecast the sensor fusion market size, in terms of value, with respect to four regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information about the drivers, restraints, opportunities, and challenges influencing the growth of the sensor fusion market

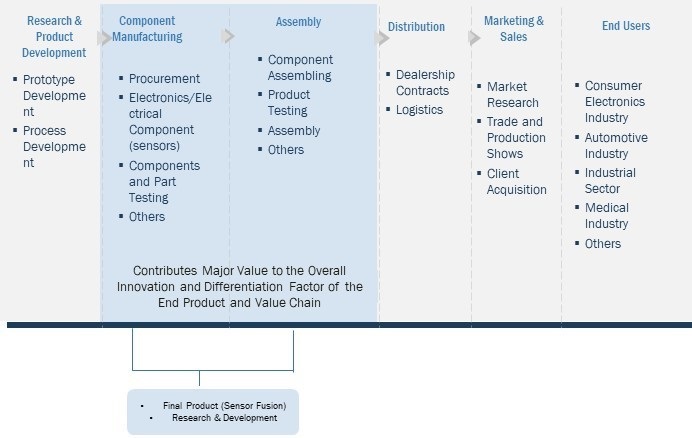

- To provide a detailed overview of the supply chain of the sensor fusion ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of business strategy excellence and strength of product portfolios

- To strategically profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with a detailed competitive landscape of the market

- To analyze competitive developments in the sensor fusion market, such as acquisitions, product launches, partnerships, expansions, and collaborations

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product Analysis

- Detailed analysis and profiling of additional market players

The following customization options are available for the report:

- Market sizing and forecast for additional countries

- Additional five companies profiling

Growth opportunities and latent adjacency in Sensor Fusion Market