Sensor Hub Market by Processor Type (Application Sensor, Discrete Sensor, Sensor Integrated Microcontroller), End-Use Application (Consumer Electronics, Automotive, Industrial, Military, Healthcare), and Geography - Global Forecast to 2023

[149 Pages Report] The global sensor hub market was valued at USD 9.87 Billion in 2016 and is expected to grow at a CAGR of 18.9% during the forecast period. The factors such as the significantly growing need for low power generating solutions, steady growth in the number of integrated sensors in smartphones, and increasing use of 6-axis and 9-axis sensor solutions or use of sensor fusion within devices are expected to drive the growth of the sensor hub market. The base year considered for the study is 2016 and the forecast period is between 2018 and 2023. The objective of the report is to provide a detailed analysis of the sensor hub market, based on processor type, end-use application, and region. The report provides detailed information on the major factors influencing the growth of the sensor hub market.

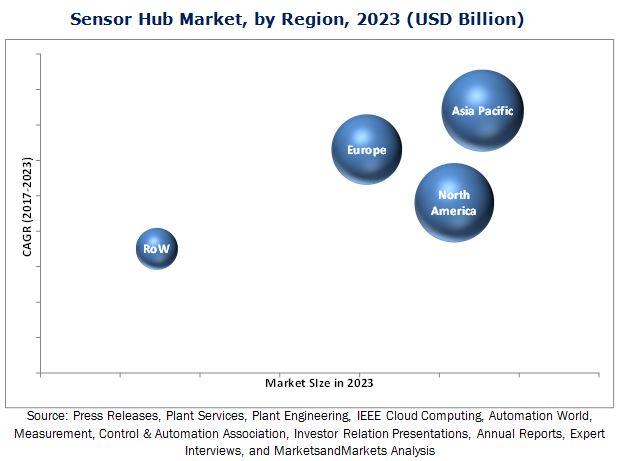

The sensor hub market is expected to reach USD 32.53 Billion by 2023, at a CAGR of 18.9% between 2017 and 2023. The growth of this market is propelled by the steady growth in the number of integrated sensors in smartphones, the need for a low-power solution, and the use of sensor fusion in devices.

The discrete sensor processor dominated the sensor hub market in 2016. This dominance is attributed to the use of discrete sensor processor hubs in wearable devices as well as the higher power saving advantages offered by this processor type. The application sensor processor is expected to hold the largest size of the sensor hub market during the forecast period as it is being deployed by a large number of smartphone manufacturers such as Apple, Inc. (US).

The consumer electronics end-use application is the largest market for sensor hubs. This growth is attributed to the extensive use of sensor hubs in smartphones, tablets, smart TVs, wearables, and gaming consoles. All these devices use sensors for different activities such as gesture recognition, image stabilization, navigation, motion-based gaming, and health monitoring.

North America dominated the overall sensor hub market in 2016. Owing to the rising awareness for driver's safety and influence of regulations and safety ratings for original equipment manufacturers (OEMs), the system such as advanced driver-assistance systems (ADAS) is highly adopted by automobile manufacturers, thereby driving the growth of the sensor hub market in this region. The US is an important market in North America that provides sensor hub solutions to OEMs of consumer electronics and automobiles. North America is an important hub for consumer electronics products, especially for smartphones and wearable devices, which prominently use the sensor hub technology. This region has the highest number of end users for healthcare wearable devices.

Technical complexity in sensor hub deployment is one of the major challenge witnessed by the sensor hub market. There is a need for advanced technical expertise for the effective deployment of sensor hubs in products. Thus, emphasis needs to be given on the ease of integration of sensors with microcontrollers as well as complete sensor hub systems for the growth of the sensor hub market.

Market players such as Microchip Technology, Inc. (US), Inc., NXP Semiconductors N.V. (Netherland), STMicroelectronics N.V.(Switzerland), Robert Bosch GmbH (Germany), and Intel Corp (US) are focusing on product launches and developments, mergers, acquisitions, and collaborations to enhance their product offerings and expand their business.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Analysis

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data Points From Primary Sources

2.1.2.2 Key Industry Insights

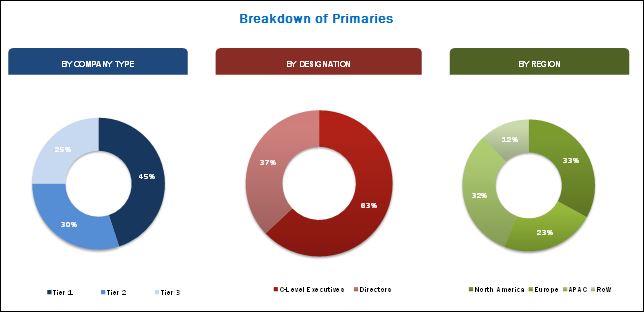

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing the Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing the Market Share By Top-Down Analysis (Supply Side)

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Sensor Hub Market

4.2 Market, By Processor Type (2017–2023)

4.3 Market, By End-Use Application (2017–2023)

4.4 Market, By End-Use Application and Region (2017)

4.5 Market, By Region

4.6 Market, By Geography (2017)

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Processor Type

5.2.2 By End-Use Application

5.2.3 By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growing Need for Low Power Generating Solutions

5.3.1.2 Steady Growth in the Number of Integrated Sensors in Smartphones

5.3.1.3 Increasing Use of 6-Axis and 9-Axis Sensor Solutions Or Use of Sensor Fusion Within Devices

5.3.2 Restraints

5.3.2.1 Complicated Debugging Field Issues as There is No Direct Interface Between the Sensor Hub and the Application Processor (Ap)

5.3.3 Opportunities

5.3.3.1 Advancements in Consumer Electronics End-Use Applications and Wearable Devices

5.3.3.2 Application Processor-Based Sensor Hubs to Attract Future Market Growth

5.3.4 Challenges

5.3.4.1 Technical Complexity in Sensor Hub Deployment

6 Sensor Hub Market, By Processor Type (Page No. - 41)

6.1 Introduction

6.2 Application Sensor Processor

6.3 Discrete Sensor Processor

6.4 Sensor Integrated Microcontroller

7 Sensor Hub Market, By End-Use Application (Page No. - 46)

7.1 Introduction

7.2 Consumer Electronics

7.3 Automotive

7.4 Industrial

7.5 Telecommunications

7.6 Military

7.7 Healthcare

8 Geographic Analysis (Page No. - 57)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Canada

8.2.3 Mexico

8.3 Europe

8.3.1 UK

8.3.2 Germany

8.3.3 France

8.3.4 Rest of Europe

8.4 Asia Pacific (APAC)

8.4.1 China

8.4.2 Japan

8.4.3 South Korea

8.4.4 Rest of APAC (RoAPAC)

8.5 Rest of the World (RoW)

8.5.1 South America

8.5.2 Middle East

8.5.3 Africa

9 Competitive Landscape (Page No. - 99)

9.1 Overview

9.2 Market Ranking Analysis

9.3 Vendor Dive Overview

9.3.1 Vanguards (Leaders)

9.3.2 Dynamic

9.3.3 Innovator

9.3.4 Emerging

9.4 Product Offering

9.5 Business Strategy

Top 25 Companies Analyzed for This Study are - Broadcom Limited; Intel Corporation; Microchip Corp.; NXP Semiconductors N.V.; Qualcomm Incorporated; Robert Bosch GmbH; Rohm Co. Ltd.; Stmicroelectronics N.V.; Analog Devices, Inc.; HiLLCrest Laboratories, Inc.; Maxim Integrated; Marvell Technology Group Ltd.; Renesas Electronics Corp.; Te Connectivity Corporation; Imagination Technologies Group PLC; Infineon Technologies Ag; Invensense, Inc.; Lapis Semiconductor Co., Ltd.; Memsic, Inc.; Quicklogic Inc; Texas Instruments Inc.; Ineda Systems Inc.; Mediatek Inc.; Standing Egg Inc.,; Megachips Corporation;

9.6 Competitive Scenario

9.6.1 Product Launches

9.6.2 Acquisitions and Agreements

10 Company Profiles (Page No. - 107)

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View)*

10.1 Introduction

10.2 Analog Devices, Inc.

10.3 Robert Bosch GmbH

10.4 Microchip Technology Inc.

10.5 Texas Instruments Incorporated

10.6 Stmicroelectronics N.V.

10.7 NXP Semiconductors N.V.

10.8 Invensense, Inc.

10.9 Rohm Co., Ltd.

10.10 Intel Corporation

10.11 Infineon Technologies AG

10.12 Memsic, Inc.

10.13 Key Innovators

10.13.1 Broadcom Limited

10.13.2 Qualcomm Technologies, Inc.

10.13.3 Quicklogic Corp

10.13.4 HiLLCrest Labs, Inc.

*Details on Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 143)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Introducing RT: Real-Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (95 Tables)

Table 1 Sensor Hub Market, in Terms of Value and Volume, 2014–2023

Table 2 Market for Consumer Electronics End-Use Application, in Terms of Value and Volume, 2014–2023

Table 3 Market, By Processor Type, 2014–2023 (USD Million)

Table 4 Market for Application Sensor Processor, By Region, 2014–2023 (USD Million)

Table 5 Market for Discrete Sensor Processor, By Region, 2014–2023 (USD Million)

Table 6 Market for Sensor Integrated Microcontroller, By Region, 2014–2023 (USD Million)

Table 7 Sensor Hub Market, By End-Use Application, 2014–2023 (USD Million)

Table 8 Market, By End-Use Application, 2014–2023 (Million Units)

Table 9 Market for Consumer Electronics, By Type, 2014–2023 (USD Million)

Table 10 Market for Healthcare, By Type, 2014–2023 (USD Million)

Table 11 Sensor Hub Market for Consumer Electronics, By Region, 2014–2023 (USD Million)

Table 12 Market for Consumer Electronics, By Region, 2014–2023 (Million Units)

Table 13 Market for Automotive, By Region, 2014–2023 (USD Million)

Table 14 Market for Automotive, By Region, 2014–2023 (Million Units)

Table 15 Market for Industrial, By Region, 2014–2023 (USD Million)

Table 16 Market for Industrial, By Region, 2014–2023 (Million Units)

Table 17 Market for Telecommunications, By Region, 2014–2023 (USD Million)

Table 18 Sensor Hub Market for Telecommunications, By Region, 2014–2023 (Million Units)

Table 19 Market for Military, By Region, 2014–2023 (USD Million)

Table 20 Market for Military, By Region, 2014–2023 (Million Units)

Table 21 Market for Healthcare, By Region, 2014–2023 (USD Million)

Table 22 Market for Healthcare, By Region, 2014–2023 (Million Units)

Table 23 Sensor Hub Market, By Region, 2014–2023 (USD Million)

Table 24 Market, By Region, 2014–2023 (Million Units)

Table 25 Market in North America, By Processor Type, 2014–2023 (USD Million)

Table 26 Sensor Hub Market in North America, By End-Use Application, 2014–2023 (USD Million)

Table 27 Market in North America, By End-Use Application, 2014–2023 (Million Units)

Table 28 Market for Consumer Electronics in North America, By Type, 2014–2023 (Million Units)

Table 29 Market for Healthcare in North America, By Type, 2014–2023 (USD Million)

Table 30 Market in North America, By Country, 2014–2023 (Million Units)

Table 31 Sensor Hub Market in US, By Processor Type, 2014–2023 (USD Million)

Table 32 Market in US, By End-Use Application, 2014–2023 (USD Million)

Table 33 Market for Consumer Electronics in Us, By Type, 2014–2023 (USD Million)

Table 34 Market for Healthcare in Us, By Type, 2014–2023 (USD Million)

Table 35 Market in Canada, By Processor Type, 2014–2023 (USD Million)

Table 36 Market in Canada, By End-Use Application, 2014–2023 (USD Million)

Table 37 Market for Consumer Electronics in Canada, By Type, 2014–2023 (USD Million)

Table 38 Market for Healthcare in Canada, By Type, 2014–2023 (USD Million)

Table 39 Market in Mexico, By Processor Type, 2014–2023 (USD Million)

Table 40 Market in Mexico, By End-Use Application, 2014–2023 (USD Million)

Table 41 Market for Consumer Electronics in Mexico, By Type, 2014–2023 (USD Million)

Table 42 Sensor Hub Market for Healthcare in Mexico, By Type, 2014–2023 (USD Million)

Table 43 Market in Europe, By Processor Type, 2014–2023 (USD Million)

Table 44 Market in Europe, By End-Use Application, 2014–2023 (USD Million)

Table 45 Market in Europe, By End-Use Application, 2014–2023 (Million Units)

Table 46 Market for Consumer Electronics in Europe, By Type, 2014–2023 (USD Million)

Table 47 Market for Healthcare in Europe, By Type, 2014–2023 (USD Million)

Table 48 Sensor Hub Market in Europe, By Country, 2014–2023 (USD Million)

Table 49 Market in UK, By Processor Type, 2014–2023 (USD Million)

Table 50 Market in UK, By End-Use Application, 2014–2023 (USD Million)

Table 51 Market for Consumer Electronics in UK, By Type, 2014–2023 (USD Million)

Table 52 Market for Healthcare in UK, By Type, 2014–2023 (USD Million)

Table 53 Market in Germany, By Processor Type, 2014–2023 (USD Million)

Table 54 Market in Germany, By End-Use Application, 2014–2023 (USD Million)

Table 55 Sensor Hub Market for Consumer Electronics in Germany, By Type, 2014–2023 (USD Million)

Table 56 Market for Healthcare in Germany, By Type, 2014–2023 (USD Million)

Table 57 Market in France, By Processor Type, 2014–2023 (USD Million)

Table 58 Market in France, By End-Use Application, 2014–2023 (USD Million)

Table 59 Sensor Hub Market for Consumer Electronics in France, By Type, 2014–2023 (USD Million)

Table 60 Market for Healthcare in France, By Type, 2014–2023 (USD Million)

Table 61 Market in RoE, By Processor Type, 2014–2023 (USD Million)

Table 62 Market in RoE, By End-Use Application, 2014–2023 (USD Million)

Table 63 Market for Consumer Electronics in RoE, By Type, 2014–2023 (USD Million)

Table 64 Sensor Hub Market for Healthcare in RoE, By Type, 2014–2023 (USD Million)

Table 65 Market in APAC, By Processor Type, 2014–2023 (Million Units)

Table 66 Market in APAC, By End-Use Application, 2014–2023 (USD Million)

Table 67 Market in APAC, By End-Use Application, 2014–2023 (Million Units)

Table 68 Market for Consumer Electronics in APAC, By Type, 2014–2023 (USD Million)

Table 69 Market for Healthcare in APAC, By Type, 2014–2023 (USD Million)

Table 70 Market in APAC, By Country, 2014–2023 (Million Units)

Table 71 Market in China, By Processor Type, 2014–2023 (USD Million)

Table 72 Sensor Hub Market in China, By End-Use Application, 2014–2023 (USD Million)

Table 73 Market for Consumer Electronics in China, By Type, 2014–2023 (USD Million)

Table 74 Market for Healthcare in China, By Type, 2014–2023 (USD Million)

Table 75 Sensor Hub Market in Japan, By Processor Type, 2014–2023 (USD Million)

Table 76 Market in Japan, By End-Use Application, 2014–2023 (USD Million)

Table 77 Market for Consumer Electronics in Japan, By Type, 2014–2023 (USD Million)

Table 78 Market for Healthcare in Japan, By Type, 2014–2023 (USD Million)

Table 79 Market in South Korea, By Processor Type, 2014–2023 (USD Million)

Table 80 Sensor Hub Market in South Korea, By End-Use Application, 2014–2023 (USD Million)

Table 81 Market for Consumer Electronics in South Korea, By Type, 2014–2023 (USD Million)

Table 82 Market for Healthcare in South Korea, By Type, 2014–2023 (USD Million)

Table 83 Market in RoAPAC, By Processor Type, 2014–2023 (USD Million)

Table 84 Market in RoAPAC, By End-Use Application, 2014–2023 (USD Million)

Table 85 Market for Consumer Electronics in RoAPAC, By Type, 2014–2023 (USD Million)

Table 86 Market for Healthcare in RoAPAC, By Type, 2014–2023 (USD Million)

Table 87 Market in RoW, By Processor Type, 2014–2023 (USD Million)

Table 88 Market in RoW, By End-Use Application, 2014–2023 (USD Million)

Table 89 Market in RoW, By End-Use Application, 2014–2023 (Million Units)

Table 90 Market for Consumer Electronics in RoW, By Type, 2014–2023 (USD Million)

Table 91 Market for Healthcare in RoW, By Type, 2014–2023 (USD Million)

Table 92 Market in RoW, By Region, 2014–2023 (USD Million)

Table 93 Market Ranking of Top 10 Players in the Sensor Hub Market, 2016

Table 94 Recent Product Launches in the Market

Table 95 Acquisitions and Agreements in the Market

List of Figures (39 Figures)

Figure 1 Market Segmentation

Figure 2 Sensor Hub Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Assumptions of the Research Study

Figure 7 Sensor Hub Market, in Terms of Value and Volume, 2014–2023

Figure 8 Market, By Processor Type, 2014–2023 (USD Million)

Figure 9 Consumer Electronics to Hold Largest Size of Market By 2023

Figure 10 Market in APAC to Grow at the Highest Rate During the Forecast Period

Figure 11 Demand in Consumer Electronics End-Use Application Expected to Create Attractive Growth Opportunities in Sensor Hub Market

Figure 12 Sensor Integrated Microcontroller Processor to Hold Largest Share of Market During Forecast Period

Figure 13 Market for Consumer Electronics End-Use Application Expected to Grow at Highest Rate Between 2017 and 2023

Figure 14 North America Expected to Hold Largest Share of Sensor Hub Market in 2017

Figure 15 Market in APAC Expected to Grow at Highest CAGR During Forecast Period

Figure 16 US to Hold Largest Share of Market in 2017

Figure 17 Market, By Geography

Figure 18 Growing Need for Low Power Generating Solutions Drive the Growth of the Market

Figure 19 Application Sensor Processor is Expected to Dominate the Market During the Forecast Period

Figure 20 Consumer Electronics End-Use Application Dominated the Market in 2017

Figure 21 Market for Wearable Devices Expected to Grow at the Highest Rate During the Forecast Period

Figure 22 Market, Geographic Snapshot, 2017–2023

Figure 23 Snapshot: Market in North America

Figure 24 Snapshot: Sensor Hub Market in Europe

Figure 25 Snapshot: Market in APAC

Figure 26 Snapshot: Market in RoW

Figure 27 Companies in the Market Adopted Product Launches as the Key Growth Strategy Between January 2014 and March 2017

Figure 28 Dive Chart

Figure 29 Battle for Market Share

Figure 30 Analog Devices, Inc.: Company Snapshot

Figure 31 Robert Bosch GmbH: Company Snapshot

Figure 32 Microchip Technology Inc.: Company Snapshot

Figure 33 Texas Instruments Incorporated: Company Snapshot

Figure 34 Stmicroelectronics N.V.: Company Snapshot

Figure 35 NXP Semiconductors N.V.: Company Snapshot

Figure 36 Invensense, Inc.: Company Snapshot

Figure 37 Rohm Co., Ltd.: Company Snapshot

Figure 38 Intel Corporation: Company Snapshot

Figure 39 Infineon Technologies AG: Company Snapshot

The research methodology used to estimate and forecast the sensor hub market begins with capturing data on key vendor revenue through government association-based secondary research such as International Journal of Research in Computer and Communication Technology (JIRCCT) Sensors & Transducers Journal, and the leading players’ newsletters. The vendor offerings are also considered to determine the market segmentation. The bottom-up procedure is employed to arrive at the overall size of the global sensor hub market from the revenue of the key players. After arriving at the overall market size, the total market is split into several segments and subsegments, which are verified through primary research by conducting extensive interviews with industry experts such as CEOs, VPs, directors, and executives. Market breakdown and data triangulation procedures are employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of the profiles of the primaries is depicted in the following figure:

To know about the assumptions considered for the study, download the pdf brochure

The sensor hub market ecosystem comprises interface manufacturers, system integrators, and distributors. Players involved in the development of sensor hub include Microchip Technology Inc. (US),, STMicroelectronics N.V. (Switzerland), Robert Bosch GmbH (Germany), NXP Semiconductors N.V.(Netherland), RoHM Co. Ltd. (Japan), Analog Devices, Inc.(US), InvenSense, Inc. (US), Infineon Technologies AG (Germany), and Memsic, Inc. (US).

Target Audience of the Report:

- Raw material and manufacturing equipment suppliers

- Sensor hub instrument original equipment manufacturers (OEMs)

- Asset management consultants who specialize in physical asset management

- Research institutes and organizations

- Associations and regulatory authorities related to plant maintenance

- Government bodies, venture capitalists, and private equity firms

“This study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.”

Scope of the Report:

This research report categorizes the overall sensor hub market by processor type, end-use application, and region.

Sensor Hub Market, by Processor Type:

- Application Sensor Processor

- Discrete Sensor Processor

- Sensor Integrated Microcontroller

- Others

Sensor Hub Market, by End-Use Application:

- Consumer Electronics

- Automotive

- Industrial

- Military

- Healthcare

- Telecommunications

- Others

Sensor Hub Market, by Region:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

Company Information:

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Sensor Hub Market