Self-healing Networks Market by Component (Solutions, Services), Network Type (Public, Private, & Hybrid), Application (Network Provisioning, Network Traffic Management), Vertical (Telecom, Healthcare & Life Sciences) and Region - Global Forecast to 2027

Updated on : Jan 27, 2026

Self-Healing Networks Market - Worldwide | Future Scope & Trends

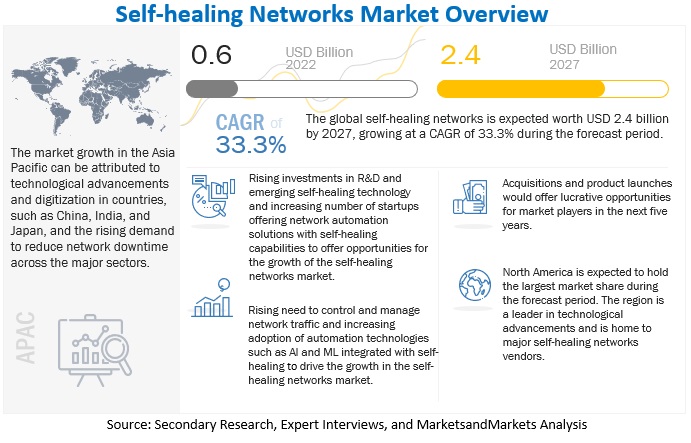

The global Self-Healing Networks Market size was valued $0.6 billion in 2022 and is anticipated to reach over $2.4 billion by the end of 2027, projecting a effective CAGR of 33.3% during the forecast period.

Few of the factors such as rising investments in R&D and emerging self-healing technology coupled with increasing number of startups offering network automation solutions with self-healing capabilities would create immense potential opportunities for self-healing networks vendors across the globe.

To know about the assumptions considered for the study, Request for Free Sample Report

Self-healing Networks Market Dynamics

Driver: Increasing adoption of automation technologies such as AI and ML integrated with self-healing

The growing complexity of network infrastructure, combined with the low latency and determinism associated with next-generation services, makes it difficult to deploy and manage networks based on traditional network management methods and static policies. Therefore, the importance and value of innovative technologies, such as AI and Machine Learning (ML), has increased. These disruptive technologies play a very crucial role in protecting highly data-driven, software-defined, and virtualized network components. AI technology is applied in the network to improve various operations, including closed-loop automation and encrypted traffic analytics. AI and ML technology innovations have made closed-loop automation possible with NFV, which is essential to the remote monitoring and management of various network edge locations and billions of connected devices. For instance, Cisco offers Cisco AI network analytics, which drives network intelligence and allows the easy management of all devices and services, prioritizes and resolves network issues, and ensures better user experience across the network. Hence the increasing advancements of such disruptive technologies such as AI and ML will drive the growth of self-healing networks in the market.

Restraints: Rising security threats across the networks

Ever-more complex cyberattacks involves malware, phishing, and cryptocurrency have placed the data and assets of corporations, governments and individuals at continual threat. Also, networks are the key enabler for the enterprise, they are also a source of complete hazard. However, increasing connected devices leads to greater risk which affectIoT networks more vulnerable to cyber attacks.. IoT devices which is controlled by hackers can be used to create disaster, overload networks and lock down essential equipment for financial gain. . According to the Cisco Annual Internet Report, 2018-2023, there were a total of 1,272 breaches, with a total of nearly 163 million records exposed as of November 2019. Further, not all network engineers are completely trained in defending these attacks due to which they may pose threats in securing networks and may restraints the self-healing market.

Opportunity: Rising investments in R&D and emerging self-healing technology

Networking companies are heavily investing in the R&D of networking solutions with self-healing capabilities, with a focus on long-term value creation. Based on the fluctuations in short-term business performance and financial results, leading networking companies have not reduced their investment for the innovation and testing of self-healing networks solutions. For instance, Forta offers Intermapper's network monitoring software helps users create a network map, giving the user a live view of what's happening on the network. This tool will be able to find and fix technology issues before users or customers are impacted. Networking companies are also coming up with “Ethernet fabrics.” Ethernet fabric is a network topology that enhances the performance, utilization, availability, and simplicity required to meet the networking requirement of modern virtual data centers. These continuous investments and positive outcomes are expected to further fuel the growth of the self-healing networks in the market.

Challenge: Lack of awareness among network administrators

Self-healing networks solutions, with varied features and functionalities, are being offered by numerous vendors across the globe. Network admins need to understand their requirements to manage the network infrastructure and chose the appropriate solution. In the world of convergence, technology has been changing rapidly in the business system. Most of the network administrators are reluctant to modify the SOPs and are hesitant in automating their networks and upgrade self-healing capabilities. Therefore, solution providers need to offer updated training and education services to network admins, so that they can gain more insights from unstructured network data. Many organizations, especially SMEs, do not have enough skilled workforce to manage the network infrastructure. Hence, the lack of awareness among network admins to distinguish between precise self-healing networks solutions pose a key challenge for the growth of the self-healing networks market.

Services segment to register the higher growth rate during the forecast period

Based on services, the self-healing networks market is segmented into managed and professional services. Increasing adoption of self-healing networks services by enterprises to help deploy a proper platform to run and support their applications rather than investing in the software leads to a higher demands for services. Managed services are completely provided by the third-party vendor and offer clients on-time conveyance.

Cloud segment to register the larger market size during the forecast period

Vendors in the self-healing networks market offer on-premises and cloud-based deployment mode. The deployment mode is primarily dependent on the financial stability and IT infrastructure of the organizations deploying self-healing networks solution. Cloud deployment mode to hold the larger market size in the market. Cloud as a service is not only enabling organizations to manage their costs but also support businesses in ensuring improved business agility. Cloud-based solutions enables fast and secure network configuration by leveraging cloud computing capabilities. Moreover, the cloud deployment model scales a solution’s capacity to handle enormous network application traffic.

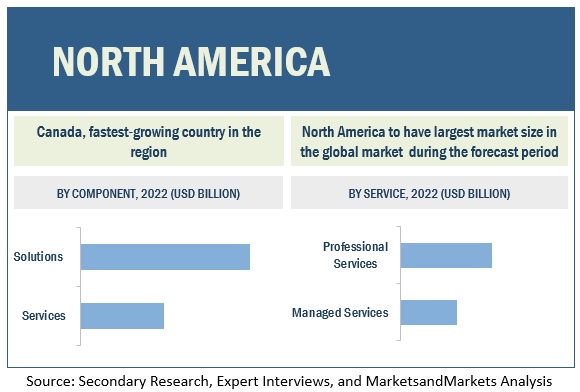

North America to have the largest self-healing networks market size during the forecast period

The major countries covered in North America are the US and Canada. The North American region, being the primary adopter of self-healing networks technology, is the major revenue-generating region in the global self-healing networks market. Moreover, it is a well-established economy, witnessing large-scale investments in digitalized IT infrastructure. The North American region has been extremely open toward adopting new and innovative technologies and is expected to provide market growth opportunities to self-healing networks vendors, as it is expected to witness an exponential growth of IT and network device-based generated data and stringent laws and policies for safeguarding the network data. Investment in various technologies such as AI, IoT, ML and big data would boost the growth of the self-healing networks in the market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The self-healing networks solution and service providers have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Some major players in the Self-healing networks market include Fortra (US), VMWare (US), IBM (US), CommScope (US), SolarWinds (US), ManageEngine (US), BMC Software (US), Elisa Polystar (Sweden), HPE (US), Cisco (US), Ivanti (US), Easyvista (France), Huawei (China), ACT (India), Ericsson (Sweden), Nokia (US), Anuta Networks (US), Juniper (US), Bluecat (Canada), Park Place Technologies (US), Appnomic (India), Versa Networks (US), Parallel Wireless (US), Itential (US), Kentik (US), Domotz (US), and Beegol (Brazil).

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 0.6 Billion |

|

Revenue forecast by 2027 |

USD 2.4 Billion |

|

Growth Rate (CAGR) |

CAGR of 33.3% from 2022 to 2027 |

|

Market size available for years |

2019-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

USD (Million/Billion) |

|

Segments covered |

Component, Network Type, Organization Size, Deployment Mode, Application, Vertical and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

Fortra (US), VMWare (US), IBM (US), CommScope (US), SolarWinds (US), ManageEngine (US), BMC Software (US), Elisa Polystar (Sweden), HPE (US), Cisco (US), Ivanti (US), Easyvista (France), Huawei (China), ACT (India), Ericsson (Sweden), Nokia (US), Anuta Networks (US), Juniper (US), Bluecat (Canada), Park Place Technologies (US), Appnomic (India), Versa Networks (US), Parallel Wireless (US), Itential (US), Kentik (US), Domotz (US), and Beegol (Brazil). |

Self-healing Networks Market Highlights

This research report categorizes the Self-healing Networks Market to forecast revenues and analyze trends in each of the following submarkets:

|

Segment |

Subsegment |

|

By Component: |

|

|

By Network Type: |

|

|

By Organization Size: |

|

|

By Deployment Mode: |

|

|

By Applications: |

|

|

By Verticals: |

|

|

By Region: |

|

Recent Developments:

- In November 2022, SolarWinds Corporation, a leading provider of simple, powerful, and secure IT management software, and DRYiCE, a division of HCL Software focused on humanizing enterprise application of AI, announced its intended expansion of their partnership aimed at revolutionizing IT operations for enterprises. The expanded partnership will focus on bringing together the best-in-class advanced AIOps, end-to-end observability, and service management platform from both companies.

- In October 2022, IBM Cloud Pak for Network Automation, in collaboration with Pliant.io, helps organizations increase their efficiency, lower overall operational costs, normalize configuration and management across many vendors and ensure network stability and security. By tapping IBM Cloud Pak for Network Automation with Pliant’s workflow engine and API gateway capabilities, enterprises can improve service delivery speed, prevent vendor lock-in and extend and expand an organization's integration capability—all while ensuring network remains in its desired state.

- In June 2022, Elisa Polystar acquires Cardinality Ltd, a UK-based supplier of cloud-native data management (DataOps), service assurance and customer experience analytics for communications service providers (CSPs) globally. By combining with Cardinality, Elisa Polystar will have stronger data management, AI-driven analytics and automation portfolio with comprehensive data ingestion and cloud-native capabilities enabling simultaneous top-and bottom-line improvements for network operators.

- In January 2021, Fortra acquired FileCatalyst, a leader in enterprise file transfer acceleration to continue expansion of Cybersecurity and Automation Portfolio. FileCatalyst enables organizations working with extremely large files to optimize and transfer information swiftly and securely across global networks. This can be particularly beneficial in industries such as broadcast media and live sports.

- In October 2020, VMware announced its acquisition of SaltStack, a pioneer in building intelligent, event-driven automation software, that helps customers to automate ITOps, DevOps, NetOps or SecOps functions. With the acquisition of SaltStack, VMware has broadened its automation capabilities including software configuration management, network automation, and infrastructure automation.

- In July 2020, HPE announced its acquisition of Silver Peak, a software-defined wide area network (SD-WAN) platform provider, which got incorporated into its Aruba Networks subsidiary.

Frequently Asked Questions (FAQ):

How big is the Self-Healing Networks Market?

What is growth rate of the Self-Healing Networks Market?

What are the key trends affecting the Self-Healing Networks Market?

- Network Provisioning

- Security Compliance Management

- Network Traffic Management

Who are the key players in Self-Healing Networks Market?

Who will be the leading hub for Self-Healing Networks Market?

What are the opportunities in Self-Healing Networks Market?

- IT and ITES

- Media and Entertainment

- Healthcare and Life Sciences

- Telecom

- Education

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising need to control and manage network traffic- Increasing adoption of automation technologies such as AI and ML- Surge in human error rates in manual systems to cause network downtimeRESTRAINTS- Rising security threats across networksOPPORTUNITIES- Rising investments in R&D and emerging self-healing technologies- Increasing number of startups to offer networking solutions with self-healing capabilitiesCHALLENGES- Lack of awareness among network administrators

- 5.3 EVOLUTION

- 5.4 SELF-HEALING NETWORKS MARKET: ECOSYSTEM

-

5.5 CASE STUDY ANALYSISMEDIA AND ENTERTAINMENT- Juniper offers AI-driven proactive automation and self-healing capabilities to JoongAng- SolarWinds enables Springer Nature to unify monitoring solutionsTELECOM- Anuta Networks helps Tata Communication Ltd. to improveself-service capabilities- Elisa Polystar enables Deri to automate operations for radio access networkENERGY AND UTILITY- IBM helps Austin Energy to develop Intelligent Utility NetworkMANUFACTURING- Entuity Analytics Network helps Grundfos Pumps to streamline and automate configuration management processesBFSI- BMC software helped Sichuan Rural Credit Union and Cooperative Bank to replace manual IT service management processesHEALTHCARE AND LIFE SCIENCES- VMware helps Northeast Georgia Health System to deliver prompt and effective patient care

-

5.6 TECHNOLOGY ANALYSISSELF-HEALING NETWORKS AND 5G LANSELF-HEALING NETWORKS, ARTIFICIAL INTELLIGENCE (AI), AND MACHINE LEARNING (ML)SELF-HEALING NETWORKS AND CLOUD COMPUTINGSELF-HEALING NETWORKS AND BLOCKCHAINSELF-HEALING NETWORKS AND INTERNET OF THINGS (IOT)

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.8 REGULATORY LANDSCAPEHEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)GENERAL DATA PROTECTION REGULATION (GDPR)GRAMM–LEACH–BLILEY ACT (GLBA)INTERNATIONAL ORGANIZATION FOR STANDARDIZATION STANDARD 27001HEALTH LEVEL SEVEN INTERNATIONAL (HL7)COMMUNICATIONS DECENCY ACT

- 5.9 PRICING MODEL ANALYSIS

-

5.10 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPEINNOVATION AND PATENT APPLICATIONS- Top applicants

- 5.11 KEY CONFERENCES AND EVENTS, 2022–2023

-

5.12 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS OF SELF-HEALING NETWORKS MARKET

-

5.14 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.1 INTRODUCTIONCOMPONENT: SELF-HEALING NETWORKS MARKET DRIVERS

-

6.2 SOLUTIONSNETWORK MONITORING TOOLS- Tools to enable network administrators to monitor and diagnose problemsNETWORK AUTOMATION SOFTWARE- Software to reduce cost of network maintenanceINTENT-BASED NETWORKING SOFTWARE- Networking software to increase operational efficiencyOTHER SOLUTIONS

-

6.3 SERVICESPROFESSIONAL SERVICES- Training and Consulting- Support and Maintenance- System Integration and TestingMANAGED SERVICES- Services to fulfill pre- and post-deployment needs

-

7.1 INTRODUCTIONNETWORK TYPE: SELF-HEALING NETWORKS MARKET DRIVERS

-

7.2 PHYSICALPHYSICAL NETWORK TO PROVIDE ACCESS TO CENTRALIZED MODEL

-

7.3 VIRTUALCLOUD-BASED SERVICES ENABLE BUSINESSES TO MANAGE AND CONFIGURE VIRTUAL NETWORKS

-

7.4 HYBRIDHYBRID NETWORK TO COMBINE VIRTUAL AND PHYSICAL NETWORK INFRASTRUCTURE

-

8.1 INTRODUCTIONDEPLOYMENT MODE: SELF-HEALING NETWORKS MARKET DRIVERS

-

8.2 ON-PREMISESBUSINESSES TO EMBRACE ON-PREMISES SELF-HEALING NETWORKS SOLUTIONS DUE TO SECURITY CONCERNS

-

8.3 CLOUDQUICK AND SECURE NETWORK CONFIGURATION TO OFFER BUSINESS AGILITY AND COST MANAGEMENT

-

9.1 INTRODUCTIONORGANIZATION SIZE: SELF-HEALING NETWORKS SYSTEM MARKET DRIVERS

-

9.2 LARGE ENTERPRISESBENEFITS OF NETWORK INFRASTRUCTURE OPTIMIZATION AND LOW OPERATIONAL COSTS

-

9.3 SMALL AND MEDIUM-SIZED ENTERPRISESINTEGRATION OF CUTTING-EDGE TECHNOLOGIES TO DRIVE ADOPTION OF SELF-HEALING NETWORKS

-

10.1 INTRODUCTIONAPPLICATION: SELF-HEALING NETWORKS MARKET DRIVERS

-

10.2 NETWORK PROVISIONINGSELF-HEALING NETWORKS TOOLS TO MONITOR AND ENHANCENETWORK OPTIMIZATION

-

10.3 NETWORK BANDWIDTH MONITORINGBANDWIDTH MONITOR TO SUPPORT REAL-TIME BANDWIDTH ANALYSIS AND DATA COLLECTION

-

10.4 POLICY MANAGEMENTSELF-HEALING NETWORKS TO REDUCE SECURITY RISKS

-

10.5 SECURITY COMPLIANCE MANAGEMENTSELF-HEALING NETWORKS TO DETECT ANOMALOUS BEHAVIOR IN APPLICATION PERFORMANCE AND SECURITY

-

10.6 ROOT CAUSE ANALYSISSELF-HEALING NETWORKS TO MAXIMIZE RETURN ON INVESTMENT (ROI)

-

10.7 NETWORK TRAFFIC MANAGEMENTSELF-HEALING NETWORKS TO MONITOR TRAFFIC PATTERNS TO DETECT AND PREVENT BOTTLENECKS

-

10.8 NETWORK ACCESS CONTROLNETWORK ACCESS CONTROL TO PREVENT UNAUTHORIZED ACCESS TO DATA

- 10.9 OTHER APPLICATIONS

-

11.1 INTRODUCTIONVERTICAL: SELF-HEALING NETWORKS MARKET DRIVERS

-

11.2 IT AND ITESSELF-HEALING CAPABILITIES MAKE IT ECOSYSTEMS MORE RELIABLE

-

11.3 BFSINEW GENERATION NETWORKS TO IMPROVE DIGITAL BUSINESS RESILIENCY

-

11.4 HEALTHCARE AND LIFE SCIENCESSELF-HEALING NETWORKS TO DELIVER ACCURATE AND LOGICAL DIAGNOSIS

-

11.5 MEDIA AND ENTERTAINMENTSELF-HEALING NETWORKS SOLUTION REDUCE OPEX AND INCREASE BANDWIDTH

-

11.6 TELECOMSELF-HEALING NETWORKS TO IDENTIFY AND RECTIFY POTENTIAL FAULTS

-

11.7 RETAIL AND CONSUMER GOODSSELF-HEALING NETWORKS TO PROVIDE RETAILERS GREAT IN-STORE USER EXPERIENCE

-

11.8 EDUCATIONSELF-HEALING NETWORKS TO ENHANCE ASSESSMENTS AND IMPROVE STUDENT ENGAGEMENT

- 11.9 OTHER VERTICALS

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTNORTH AMERICA: SELF-HEALING NETWORKS MARKET DRIVERSUS- Technological awareness and presence of several network providers to drive marketCANADA- Threats against network infrastructure to drive adoption of self-healing networks

-

12.3 EUROPEEUROPE: RECESSION IMPACTEUROPE: SELF-HEALING NETWORKS MARKET DRIVERSUK- Growing demand for comprehensive technologies to manage network infrastructureGERMANY- Positive business environment to boost adoption of self-healing networksFRANCE- Technically competent end consumers to utilize self-healing networksREST OF EUROPE

-

12.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: SELF-HEALING NETWORKS MARKET DRIVERSCHINA- Initiatives taken by government and private players to raise demand for self-healing networksJAPAN- Presence of highly efficient and competitive companies to drive demand for self-healing networksINDIA- Growing penetration of cutting-edge technologies to drive market growthREST OF ASIA PACIFIC

-

12.5 MIDDLE EAST AND AFRICAMIDDLE EAST AND AFRICA: RECESSION IMPACTMIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET DRIVERSUAE- Adoption of cutting-edge technologies to drive adoption of self-healing networksSAUDI ARABIA- Government initiatives to fuel adoption of self-healing networksSOUTH AFRICA- Presence of global players and technological development to create opportunitiesREST OF MIDDLE EAST AND AFRICA

-

12.6 LATIN AMERICALATIN AMERICA: RECESSION IMPACTLATIN AMERICA: SELF-HEALING NETWORKS MARKET DRIVERSBRAZIL- Investments by private players to drive marketMEXICO- Growing integration of technologies to boost adoption of advanced network infrastructureREST OF LATIN AMERICA

- 13.1 OVERVIEW

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

13.3 REVENUE ANALYSISHISTORICAL REVENUE ANALYSIS

- 13.4 MARKET SHARE ANALYSIS

- 13.5 MARKET EVALUATION FRAMEWORK

-

13.6 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.7 COMPETITIVE BENCHMARKINGCOMPANY PRODUCT FOOTPRINT

-

13.8 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

13.9 STARTUP/SME COMPETITIVE BENCHMARKINGCOMPANY PRODUCT FOOTPRINT

-

13.10 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALS

- 14.1 INTRODUCTION

-

14.2 KEY PLAYERSVMWARE- Business overview- Solutions/Services offered- Recent developments- MnM viewIBM- Business overview- Solutions/Services offered- Recent developments- MnM viewCOMMSCOPE- Business overview- Solutions/Services offered- Recent developments- MnM viewBMC SOFTWARE- Business overview- Solutions/Services offered- Recent developments- MnM viewFORTRA- Business overview- Solutions/Services offered- Recent developments- MnM viewSOLARWINDS- Business overview- Solutions/Services offered- Recent developmentsMANAGEENGINE- Business overview- Solutions/Services offered- Recent developmentsELISA POLYSTAR- Business overview- Solutions/Services offered- Recent developmentsHPE- Business overview- Solutions/Services offered- Recent developmentsCISCO- Business overview- Solutions/Services offered- Recent developments

-

14.3 OTHER KEY PLAYERSIVANTIEASYVISTAHUAWEINOKIAACTERICSSONANUTA NETWORKSJUNIPERBLUECATPARK PLACE TECHNOLOGIESAPPNOMIC

-

14.4 STARTUP/SME PROFILESPARALLEL WIRELESSITENTIALVERSA NETWORKSKENTIKDOMOTZBEEGOL

- 15.1 INTRODUCTION

-

15.2 NETWORK MANAGEMENT SYSTEM MARKET - GLOBAL FORECAST TO 2027MARKET DEFINITIONMARKET OVERVIEW- Network management system market, by component- Network management system market, by deployment type- Network management system market, by organization size- Network management system market, by end user- Network management system market, by region

-

15.3 IT OPERATIONS ANALYTICS MARKET - GLOBAL FORECAST TO 2026MARKET DEFINITIONMARKET OVERVIEW- IT Operations Analytics market, by component- IT Operations Analytics market, by deployment mode- IT Operations Analytics market, by organization size- IT Operations Analytics market, by end user- IT Operations Analytics market, by region

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- 16.6 FACTOR ANALYSIS

- TABLE 1 FACTOR ANALYSIS

- TABLE 2 GLOBAL SELF-HEALING NETWORKS MARKET AND GROWTH RATE, 2019–2021 (USD MILLION, Y-O-Y %)

- TABLE 3 GLOBAL SELF-HEALING NETWORKS MARKET AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y %)

- TABLE 4 SELF-HEALING NETWORKS MARKET: ECOSYSTEM

- TABLE 5 SELF-HEALING NETWORKS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 PRICING ANALYSIS

- TABLE 7 PATENTS FILED, 2019–2021

- TABLE 8 TOP 10 PATENT OWNERS (US) IN SELF-HEALING NETWORKS MARKET, 2019–2021

- TABLE 9 SELF-HEALING NETWORKS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2022–2023

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST AND AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 16 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 17 SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 18 SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 19 SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 20 SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 21 SELF-HEALING NETWORKS SOLUTIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 22 SELF-HEALING NETWORKS SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 23 NETWORK MONITORING TOOLS: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 24 NETWORK MONITORING TOOLS: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 25 NETWORK AUTOMATION SOFTWARE: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 26 NETWORK AUTOMATION SOFTWARE: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 27 INTENT-BASED NETWORKING SOFTWARE: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 28 INTENT-BASED NETWORKING SOFTWARE: SELF-HEALING NETWORKS MARKET,BY REGION, 2022–2027 (USD MILLION)

- TABLE 29 OTHER SOLUTIONS: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 30 OTHER SOLUTIONS: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 31 SELF-HEALING NETWORKS MARKET, BY SERVICE, 2019–2021 (USD MILLION)

- TABLE 32 SELF-HEALING NETWORKS MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 33 SELF-HEALING NETWORKS SERVICE MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 34 SELF-HEALING NETWORKS SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 35 SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2019–2021 (USD MILLION)

- TABLE 36 SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 37 PROFESSIONAL SERVICE: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 38 PROFESSIONAL SERVICE: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 39 TRAINING AND CONSULTING: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 40 TRAINING AND CONSULTING: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 41 SUPPORT AND MAINTENANCE: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 42 SUPPORT AND MAINTENANCE: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 43 SYSTEM INTEGRATION AND TESTING: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 44 SYSTEM INTEGRATION AND TESTING: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 45 MANAGED SERVICES: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 46 MANAGED SERVICES: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 47 SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2019–2021 (USD MILLION)

- TABLE 48 SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2022–2027 (USD MILLION)

- TABLE 49 PHYSICAL: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 50 PHYSICAL: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 51 VIRTUAL: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 52 VIRTUAL: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 53 HYBRID: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 54 HYBRID: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 55 SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2019–2021 (USD MILLION)

- TABLE 56 SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 57 ON-PREMISES: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 58 ON-PREMISES: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 59 CLOUD: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 60 CLOUD: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 61 SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2019–2021 (USD MILLION)

- TABLE 62 SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 63 SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 64 SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 65 SMALL AND MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 66 SMALL AND MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 67 SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 68 SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 69 NETWORK PROVISIONING: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 70 NETWORK PROVISIONING: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 71 NETWORK BANDWIDTH MONITORING: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 72 NETWORK BANDWIDTH MONITORING: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 73 POLICY MANAGEMENT: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 74 POLICY MANAGEMENT: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 75 SECURITY COMPLIANCE MANAGEMENT: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 76 SECURITY COMPLIANCE MANAGEMENT: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 77 ROOT CAUSE ANALYSIS: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 78 ROOT CAUSE ANALYSIS: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 79 NETWORK TRAFFIC MANAGEMENT: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 80 NETWORK TRAFFIC MANAGEMENT: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 81 NETWORK ACCESS CONTROL: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 82 NETWORK ACCESS CONTROL: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 83 OTHER APPLICATIONS: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 84 OTHER APPLICATIONS: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 85 SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2019–2021 (USD MILLION)

- TABLE 86 SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 87 IT AND ITES: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 88 IT AND ITES: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 89 BFSI: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 90 BFSI: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 91 HEALTHCARE AND LIFE SCIENCES: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 92 HEALTHCARE AND LIFE SCIENCES: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 93 MEDIA AND ENTERTAINMENT: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 94 MEDIA AND ENTERTAINMENT: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 95 TELECOM: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 96 TELECOM: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 97 RETAIL AND CONSUMER GOODS: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 98 RETAIL AND CONSUMER GOODS: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 99 EDUCATION: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 100 EDUCATION: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 101 OTHER VERTICALS: SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 102 OTHER VERTICALS: SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 103 SELF-HEALING NETWORKS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 104 SELF-HEALING NETWORKS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 105 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 106 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 107 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY SERVICE, 2019–2021 (USD MILLION)

- TABLE 108 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 109 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2019–2021 (USD MILLION)

- TABLE 110 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 111 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 112 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 113 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2019–2021 (USD MILLION)

- TABLE 114 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2022–2027 (USD MILLION)

- TABLE 115 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2019–2021 (USD MILLION)

- TABLE 116 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 117 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2019–2021 (USD MILLION)

- TABLE 118 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 119 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2019–2021 (USD MILLION)

- TABLE 120 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 121 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 122 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 123 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 124 NORTH AMERICA: SELF-HEALING NETWORKS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 125 EUROPE: SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 126 EUROPE: SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 127 EUROPE: SELF-HEALING NETWORKS MARKET, BY SERVICE, 2019–2021 (USD MILLION)

- TABLE 128 EUROPE: SELF-HEALING NETWORKS MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 129 EUROPE: SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2019–2021 (USD MILLION)

- TABLE 130 EUROPE: SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 131 EUROPE: SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 132 EUROPE: SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 133 EUROPE: SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2019–2021 (USD MILLION)

- TABLE 134 EUROPE: SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2022–2027 (USD MILLION)

- TABLE 135 EUROPE: SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2019–2021 (USD MILLION)

- TABLE 136 EUROPE: SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 137 EUROPE: SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2019–2021 (USD MILLION)

- TABLE 138 EUROPE: SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 139 EUROPE: SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2019–2021 (USD MILLION)

- TABLE 140 EUROPE: SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 141 EUROPE: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 142 EUROPE: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 143 EUROPE: SELF-HEALING NETWORKS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 144 EUROPE: SELF-HEALING NETWORKS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 145 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 146 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 147 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY SERVICE, 2019–2021 (USD MILLION)

- TABLE 148 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 149 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2019–2021 (USD MILLION)

- TABLE 150 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 151 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 152 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 153 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2019–2021 (USD MILLION)

- TABLE 154 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2022–2027 (USD MILLION)

- TABLE 155 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2019–2021 (USD MILLION)

- TABLE 156 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 157 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2019–2021 (USD MILLION)

- TABLE 158 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 159 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2019–2021 (USD MILLION)

- TABLE 160 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 161 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 162 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 163 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 164 ASIA PACIFIC: SELF-HEALING NETWORKS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 165 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 166 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 167 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY SERVICE, 2019–2021 (USD MILLION)

- TABLE 168 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 169 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2019–2021 (USD MILLION)

- TABLE 170 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 171 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 172 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 173 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2019–2021 (USD MILLION)

- TABLE 174 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2022–2027 (USD MILLION)

- TABLE 175 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2019–2021 (USD MILLION)

- TABLE 176 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 177 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2019–2021 (USD MILLION)

- TABLE 178 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 179 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2019–2021 (USD MILLION)

- TABLE 180 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 181 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 182 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 183 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 184 MIDDLE EAST AND AFRICA: SELF-HEALING NETWORKS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 185 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 186 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 187 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY SERVICE, 2019–2021 (USD MILLION)

- TABLE 188 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 189 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2019–2021 (USD MILLION)

- TABLE 190 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 191 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 192 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 193 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2019–2021 (USD MILLION)

- TABLE 194 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2022–2027 (USD MILLION)

- TABLE 195 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2019–2021 (USD MILLION)

- TABLE 196 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 197 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2019–2021 (USD MILLION)

- TABLE 198 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 199 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2019–2021 (USD MILLION)

- TABLE 200 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 201 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 202 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 203 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 204 LATIN AMERICA: SELF-HEALING NETWORKS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 205 OVERVIEW OF STRATEGIES ADOPTED BY KEY SELF-HEALING NETWORKS VENDORS

- TABLE 206 SELF-HEALING NETWORKS MARKET: DEGREE OF COMPETITION

- TABLE 207 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, 2021

- TABLE 208 SELF-HEALING NETWORKS MARKET: COMPETITIVE BENCHMARKING OF STARTUP/SMES

- TABLE 209 SELF-HEALING NETWORKS MARKET: DETAILED LIST OF KEY STARTUP/SMES

- TABLE 210 SERVICE/PRODUCT LAUNCHES, 2019–2022

- TABLE 211 DEALS, 2019–2022

- TABLE 212 VMWARE: BUSINESS OVERVIEW

- TABLE 213 VMWARE: SOLUTIONS/SERVICES OFFERED

- TABLE 214 VMWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 215 VMWARE: DEALS

- TABLE 216 IBM: BUSINESS OVERVIEW

- TABLE 217 IBM: SOLUTIONS/SERVICES OFFERED

- TABLE 218 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 219 IBM: DEALS

- TABLE 220 COMMSCOPE: BUSINESS OVERVIEW

- TABLE 221 COMMSCOPE: SOLUTIONS/SERVICES OFFERED

- TABLE 222 COMMSCOPE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 223 COMMSCOPE: DEALS

- TABLE 224 BMC SOFTWARE: BUSINESS OVERVIEW

- TABLE 225 BMC SOFTWARE: SOLUTIONS/SERVICES OFFERED

- TABLE 226 BMC SOFTWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 227 BMC SOFTWARE: DEALS

- TABLE 228 FORTRA: BUSINESS OVERVIEW

- TABLE 229 FORTRA: SOLUTIONS/SERVICES OFFERED

- TABLE 230 FORTRA: DEALS

- TABLE 231 SOLARWINDS: BUSINESS OVERVIEW

- TABLE 232 SOLARWINDS: SOLUTIONS/SERVICES OFFERED

- TABLE 233 SOLARWINDS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 234 SOLARWINDS: DEALS

- TABLE 235 MANAGEENGINE: BUSINESS OVERVIEW

- TABLE 236 MANAGEENGINE: SOLUTIONS/SERVICES OFFERED

- TABLE 237 MANAGEENGINE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 238 ELISA POLYSTAR: BUSINESS OVERVIEW

- TABLE 239 ELISA POLYSTAR: SOLUTIONS/SERVICES OFFERED

- TABLE 240 ELISA POLYSTAR: DEALS

- TABLE 241 HPE: BUSINESS OVERVIEW

- TABLE 242 HPE: SOLUTIONS/SERVICES OFFERED

- TABLE 243 HPE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 244 HPE: DEALS

- TABLE 245 CISCO: BUSINESS OVERVIEW

- TABLE 246 CISCO: SOLUTIONS/SERVICES OFFERED

- TABLE 247 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 248 CISCO: DEALS

- TABLE 249 NETWORK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 250 NETWORK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 251 NETWORK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD MILLION)

- TABLE 252 NETWORK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 253 NETWORK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 254 NETWORK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 255 NETWORK MANAGEMENT SYSTEM MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 256 NETWORK MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 257 NETWORK MANAGEMENT SYSTEM MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 258 NETWORK MANAGEMENT SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 259 IT OPERATIONS ANALYTICS MARKET, BY COMPONENT, 2014–2019 (USD MILLION)

- TABLE 260 IT OPERATIONS ANALYTICS MARKET, BY COMPONENT, 2019–2025 (USD MILLION)

- TABLE 261 IT OPERATIONS ANALYTICS MARKET, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

- TABLE 262 IT OPERATIONS ANALYTICS MARKET, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

- TABLE 263 IT OPERATIONS ANALYTICS MARKET, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

- TABLE 264 IT OPERATIONS ANALYTICS MARKET, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

- TABLE 265 IT OPERATIONS ANALYTICS MARKET, BY END USER, 2014–2019 (USD MILLION)

- TABLE 266 IT OPERATIONS ANALYTICS MARKET, BY END USER, 2019–2025 (USD MILLION)

- TABLE 267 IT OPERATIONS ANALYTICS MARKET, BY REGION, 2014–2019 (USD MILLION)

- TABLE 268 IT OPERATIONS ANALYTICS MARKET, BY REGION, 2019–2025 (USD MILLION)

- FIGURE 1 SELF-HEALING NETWORKS MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 SELF-HEALING NETWORKS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/SERVICES OF SELF-HEALING NETWORKS MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2, BOTTOM UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM SOLUTIONS/SERVICES OF SELF-HEALING NETWORKS MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM SOLUTIONS/SERVICES OF SELF-HEALING NETWORKS MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 4, BOTTOM UP (DEMAND SIDE): SHARE OF SELF-HEALING NETWORKS THROUGH OVERALL SELF-HEALING NETWORKS SPENDING

- FIGURE 8 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

- FIGURE 9 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- FIGURE 10 SOLUTIONS SEGMENT TO DOMINATE MARKET IN 2022

- FIGURE 11 PROFESSIONAL SERVICES TO HOLD LARGER MARKET SHARE IN 2022

- FIGURE 12 TRAINING & CONSULTING SEGMENT TO LEAD MARKET IN 2022

- FIGURE 13 NETWORK AUTOMATION SOFTWARE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2022

- FIGURE 14 NETWORK PROVISIONING TO DOMINATE APPLICATION SEGMENT IN 2022

- FIGURE 15 PHYSICAL NETWORK TYPE SEGMENT TO DOMINATE MARKET IN 2022

- FIGURE 16 LARGE ENTERPRISES TO DOMINATE MARKET IN 2022

- FIGURE 17 CLOUD SEGMENT TO HOLD LARGEST MARKET IN 2022

- FIGURE 18 HEALTHCARE AND LIFE SCIENCES SEGMENT TO GROW AT HIGHEST CAGR IN 2022

- FIGURE 19 NORTH AMERICA TO HOLD LARGEST MARKET SHARE AND ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST YEAR

- FIGURE 20 RISING NEED TO MANAGE NETWORK TRAFFIC TO REDUCE NETWORK DOWNTIME

- FIGURE 21 NETWORK TRAFFIC MANAGEMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 22 SOLUTIONS SEGMENT AND TELECOM SEGMENT TO HOLD LARGEST MARKET SHARE IN NORTH AMERICA IN 2022

- FIGURE 23 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2022

- FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SELF-HEALING NETWORKS MARKET

- FIGURE 25 EVOLUTION: SELF-HEALING NETWORKS MARKET

- FIGURE 26 SELF-HEALING NETWORKS: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 27 TOTAL NUMBER OF PATENTS GRANTED, 2019–2021

- FIGURE 28 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2019–2021

- FIGURE 29 SELF-HEALING NETWORKS MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 32 SERVICES SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 33 NETWORK MONITORING TOOLS SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 MANAGED SERVICES SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 35 SYSTEM INTEGRATION & TESTING SERVICES SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 VIRTUAL SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 ON-PREMISES SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 38 SMALL AND MEDIUM-SIZED ENTERPRISES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 39 NETWORK TRAFFIC MANAGEMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 HEALTHCARE AND LIFE SCIENCES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 INDIA TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 ASIA PACIFIC TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 45 HISTORICAL REVENUE ANALYSIS OF TOP FIVE LEADING PLAYERS, 2019–2021 (USD MILLION)

- FIGURE 46 MARKET SHARE ANALYSIS FOR KEY COMPANIES, 2021

- FIGURE 47 MARKET EVALUATION FRAMEWORK: EXPANSIONS AND CONSOLIDATIONS IN SELF-HEALING NETWORKS MARKET BETWEEN 2019-2022

- FIGURE 48 KEY SELF-HEALING NETWORKS MARKET PLAYERS, COMPANY EVALUATION QUADRANT, 2022

- FIGURE 49 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS

- FIGURE 50 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS

- FIGURE 51 STARTUPS/SMES SELF-HEALING NETWORKS PLAYERS, COMPANY EVALUATION QUADRANT, 2022

- FIGURE 52 PRODUCT PORTFOLIO ANALYSIS OF STARTUPS/SMES

- FIGURE 53 BUSINESS STRATEGY EXCELLENCE OF STARTUPS/SMES

- FIGURE 54 VMWARE: COMPANY SNAPSHOT

- FIGURE 55 IBM: COMPANY SNAPSHOT

- FIGURE 56 COMMSCOPE: COMPANY SNAPSHOT

- FIGURE 57 SOLARWINDS: COMPANY SNAPSHOT

- FIGURE 58 HPE: COMPANY SNAPSHOT

- FIGURE 59 CISCO: COMPANY SNAPSHOT

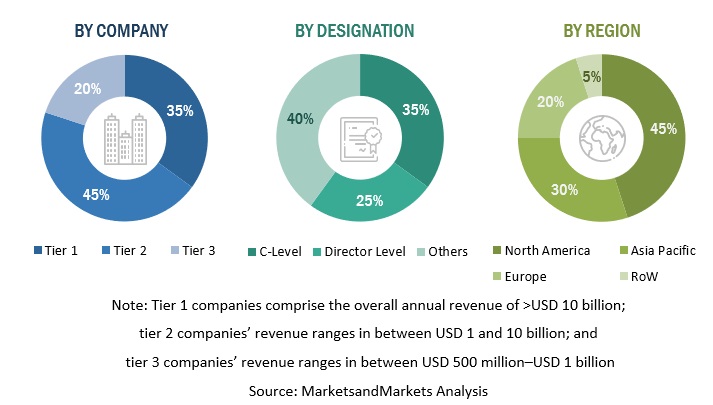

The research study for the self-healing networks market involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred self-healing networks providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

The market size of companies offering self-healing networks solutions and services was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to, for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors websites. Additionally, self-healing networks spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to solutions, services, deployment modes, applications, network types, organization sizes, verticals, and regions, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and self-healing networks expertise; related key executives from self-healing networks solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to adjacent technologies, applications, deployment modes, network types, verticals and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using self-healing networks, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of self-healing networks solutions and services, which would impact the overall self-healing networks market.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For market estimation, key self-healing networks solutions and service vendors, such as Fortra (US), VMWare (US), IBM (US), CommScope (US), SolarWinds (US), ManageEngine (US), BMC Software (US), Elisa Polystar (Sweden), HPE (US), Cisco (US), Ivanti (US), Easyvista (France), Huawei (China), ACT (India), Ericsson (Sweden), Nokia (US), Anuta Networks (US), Juniper (US), Bluecat (Canada), Park Place Technologies (US), Appnomic (India), Versa Networks (US), Parallel Wireless (US), Itential (US), Kentik (US), Domotz (US), and Beegol (Brazil) were identified. These vendors contribute nearly 45%–55% to the global self-healing networks market.

The market is competitive due to the presence of several vendors. After confirming these companies through primary interviews with industry experts, their total revenue through annual reports, Securities and Exchange Commission (SEC) filings, and paid databases was estimated. The revenue pertaining to Business Units (BUs) that offer self-healing networks solutions was identified through similar sources. Then, through primaries, the data of revenue generated from specific self-healing networks solutions was collected. The collective revenue of key companies that offer self-healing networks solutions comprises 40%–50% of the market, which was again confirmed through primary interviews with industry experts.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For converting various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency, the USD, remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on self-healing networks based on some of the key use cases. These factors for the self-healing networks industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, start-up ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the self-healing networks market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major self-healing networks providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall self-healing networks market size and segments’ size were determined and confirmed using the study.

Report Objectives

- To define, describe, and predict the self-healing networks market in terms of component (solutions and services), deployment mode, network type, application, organization size, vertical, and region.

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the self-healing networks market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the self-healing networks market

- To analyze the impact of the recession across all the regions in the self-healing networks market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American self-healing networks market

- Further breakup of the European self-healing networks market

- Further breakup of the Asia Pacific self-healing networks market

- Further breakup of the Middle East and Africa self-healing networks market

- Further breakup of the Latin America self-healing networks market

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Self-healing Networks Market