Security Inks Market Type (Invisible, Biometric, Fluorescent, Thermochromic), Printing Method (Offset, Intaglio, Flexographic, Silk Screen, Letterpress), Application (Banknotes, Tax Banderoles, Security Labels), and Region - Global Forecast to 2027

Security Inks Market

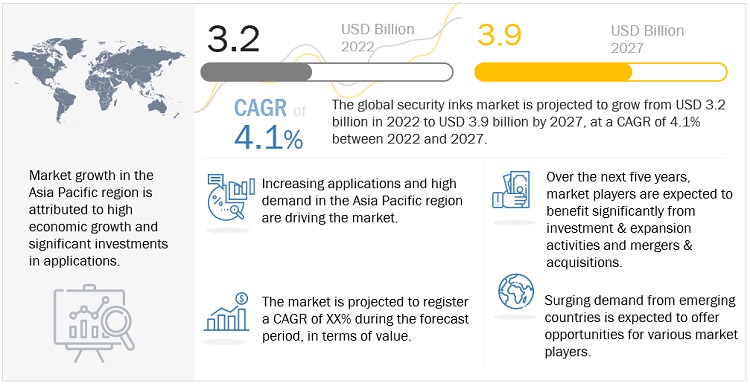

Security Inks Market was valued at USD 3.2 billion in 2022 and is projected to reach USD 3.9 billion by 2027, growing at a cagr 4.1% from 2022 to 2027. The reprinting of banknotes is a continuous process to ensure proper circulation. This is the main driving factor for the market. On the other hand, factors such as stringent government regulations and digitalization hinder the growth of the market.

Global Security Inks Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Security Inks Market Dynamics

DRIVER: Need for security inks for consumer safety

Security inks offer consumers and manufacturers greater confidence by protecting them from theft or product tampering. Governments can fight counterfeiting and fraud by incorporating security inks into currency, official travel documents, and labels and tax stamps. These inks provide different security features with a range of applications. They are widely used for industrial printing on porous and many non-porous substrates for documents, tax stamps, anti-counterfeiting of designer products, consumer goods, etc. The need for printing with invisible and fluorescent inks (types of security inks) to prevent fraud and conform with regulations for consumer safety is driving increasing interest in these inks.

RESTRAINT: Growth in digitization

The security inks industry acts as a restraining factor from digitization and technological convergence of content. The compelling reason for technological convergence is the speedy digitization of all types of content and converting content into computer-readable digital code. The catalyst for the transformation toward a digital age is likely to come from governments, consumers, and businesses. From 2022 to 2026, governments and businesses will continue investing in new digital technologies, accelerating the trend toward fully digital societies and also adopting greater digitalization in many types of security documentation. Hence, growing digitization and technological convergence can be considered restraints for the security inks market. However, these factors may also generate new opportunities for security printing organizations to invest in new product developments to overcome the threat.

OPPORTUNITIES: Increased identity theft

An increase in the number of identity thefts acts as a significant market opportunity for security inks. Fraudsters use forged documents for illegal purposes such as trafficking commodities and migrants, human smuggling across borders illegally, committing violent crimes, extremism, and terrorist acts, and getting privileges and money. Scammers use another personality to evade economic duties and responsibilities and commit illicit crimes without being held accountable and by transferring blame to the genuine person. This complex problem of identity fraud is continuously growing.

CHALLENGES: Stringent environmental regulations in North American and European countries

Europe and North America are strictly regulated by environmental laws regarding the production of chemical and petro-based products. This is affecting the production capacities of manufacturers in Europe and North America. Solvents used in the printing industry are frequently not or only partially retrieved from exhaust air streams generated by dryer systems. Hence, vapors from solvents pollute the air in printing buildings as well as outside. High-boiling mineral oils, glycol ethers, and other solvents often used in embossed steel dye printing are considered harmful to human health. As a result, regulations act as a major restraint to the overall growth of the market.

Security labels is the fastest growing application segment of the security inks market in the forecast period

Security labels is the fastest growing segment in the applications of security inks market for the forecast period between 2022 and 2027, in terms of both value and volume. Manufacturers of security labels are expanding their operational capacities and investing heavily in advanced technologies to provide the best products to brands for the protection of actual products from counterfeit ones, which, in turn, provides a much-needed boost to the global security labels market's expansion.

Asia Pacific is expected to be the largest regional market during the forecast period.

The Asia Pacific market is expected to be the largest regional segment for the security ink market due to increasing cases of forgery and counterfeiting. According to research by PwC on fraud in 2018 which focused on Vietnam and discovered that 51% of the 7,000 respondents in 123 areas had experienced economic fraud in the previous two years. Moreover, the Government of India declared demonetization without warning, which has raised the need for security inks in this region.

To know about the assumptions considered for the study, download the pdf brochure

The security inks market is dominated by a few globally established players such as SICPA Holding SA (Switzerland), DIC Corporation (Sun Chemical) (Japan), Kao Collins Corporation (US), Chromatic Technologies Inc. (US), Ink Tec Inc. (US), among others.

Security Inks Market Report Scope

|

Report Metric |

Details |

|

Years Considered for the study |

2020-2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

By Type |

|

Regions covered |

Asia Pacific, Europe, North America, Middle East & Africa, South America |

|

Companies profiled |

SICPA Holding SA (Switzerland), DIC Corporation (Sun Chemical) (Japan), Kao Collins Corporation (US), Chromatic Technologies Inc. (US), and Ink Tec Inc. (US). A total of 20 players have been covered. |

This research report categorizes the security inks market based on Type, Printing Method, Application, and Region.

By Type:

- Invisible

- Biometric

- Fluorescent

- Thermochromic

- Optically Variable

- Magnetic

- Reactive

- Erasable

- Infrared

- Others

By Printing Method:

- Offset

- Intaglio

- Flexographic

- Silk Screen

- Letterpress

- Others

By Application:

- Banknotes

- Tax Banderoles

- Security Labels

- Official Identity Documents

- Others

By Region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In December 2022, Fujifilm has entered into an asset purchase agreement with Inspirata, Inc. to acquire the company's Digital Pathology Business.

- In July 2022, DIC corporation acquired Guangdong TOD New Materials Co., Ltd. Coating and resin business. This acquisition will help DIC to expand its Asian market coating resins capacity, focused particularly on China—the world's largest coating resins market.

- In June 2022, SICPA Morocco inaugurated today its new regional coding centre for highly secure tax stamps in the industrial zone of Sidi Bernoussi in Casablanca.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the security inks market during 2022-2027?

Security inks market registered a CAGR of 4.1% during the forecast period 2022-2027.

What are the driving factors for the security inks?

Need for security inks for consumer safety, increased occurrences of forgery and counterfeiting practices, and growth in banking and financial sectors to drive the security inks market.

Which are the significant players operating in the security inks market?

SICPA Holding SA (Switzerland), DIC Corporation (Sun Chemical) (Japan), Kao Collins Corporation (US), Chromatic Technologies Inc. (US), Ink Tec Inc. (US), among others are the significant players operating in security inks market.

Which region will lead the security inks market in the future?

Asia Pacific will lead the security inks market in future. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

- 5.2 VALUE CHAIN ANALYSIS

-

5.3 MARKET DYNAMICSDRIVERS- Need for security inks for consumer safety- Increasing occurrences of forgery and counterfeiting practices- Growth in banking & financial sectorRESTRAINTS- Growth in digitizationOPPORTUNITIES- Rise in number of identity theftsCHALLENGES- Stringent environmental regulations in North American and European countries

-

5.4 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.5 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.6 MACROECONOMIC INDICATOR ANALYSISINTRODUCTIONGDP TRENDS AND FORECASTTRENDS AND FORECASTS FOR GLOBAL FINTECH INDUSTRY

- 5.7 TECHNOLOGY ANALYSIS

- 5.8 CASE STUDY ANALYSIS

-

5.9 PRICING ANALYSISAVERAGE SELLING PRICE, BY APPLICATIONAVERAGE SELLING PRICE, BY TYPEAVERAGE SELLING PRICE, BY PRINTING METHOD

- 5.10 TRADE DATA STATISTICS

-

5.11 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTHCHINA- China’s debt problem- Australia-China trade war- Environmental commitmentsEUROPE- Political instability in Germany- Energy crisis in Europe

-

5.12 SECURITY INKS ECOSYSTEM AND INTERCONNECTED MARKET

-

5.13 TARIFFS AND REGULATIONSISO 14298:2021GRAPHIC TECHNOLOGY—MANAGEMENT OF SECURITY PRINTING PROCESSESISO 14298 MANAGEMENT OF SECURITY PRINTING PROCESSES: INTERGRAF CERTIFICATION REQUIREMENTSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.14 PATENT ANALYSISMETHODOLOGYPUBLICATION TRENDSTOP JURISDICTIONTOP APPLICANTS

- 5.15 KEY CONFERENCES AND EVENTS IN 2023

- 6.1 INTRODUCTION

-

6.2 INVISIBLEUSED INCREASINGLY IN VARIOUS END-USER APPLICATIONS

-

6.3 BIOMETRICHIGH LEVEL OF SECURITY AND ACCURACY IN THUMB IMPRESSIONS

-

6.4 FLUORESCENTUTILIZED FOR SECURE PRINTING ON POSTAL STAMPS AND MAIL IDENTIFICATION

-

6.5 THERMOCHROMICUSED FOR HIGH SECURITY OF DOCUMENTS

-

6.6 OPTICALLY VARIABLEIMPLEMENTED MAJORLY IN MODERN BANKNOTES AND OFFICIAL DOCUMENTS

-

6.7 MAGNETICDEMAND FROM FINANCIAL INSTITUTIONS

-

6.8 REACTIVEUTILIZED IN DIGITAL TEXTILE PRINTING

-

6.9 ERASABLEAPPLICATION IN CERTIFICATE AND PANTOGRAPH DESIGNS

-

6.10 INFRAREDUSEFUL IN HIGH-SECURITY APPLICATIONS

- 6.11 OTHERS

- 7.1 INTRODUCTION

-

7.2 OFFSETOFFERS SUPERIOR PERFORMANCE AND MASS PRINTING

-

7.3 INTAGLIOPROVIDES EXCELLENT AND VARIOUS PRINTING EFFECTS

-

7.4 FLEXOGRAPHICOFFERS RAPID AND HIGH-QUALITY PRINTING

-

7.5 SILK SCREENOFFERS AFFORDABLE AND HIGH-QUALITY PRINTING

-

7.6 LETTERPRESSSLOW GROWTH DUE TO HIGH TIME TO SET PRESS

- 7.7 OTHERS

- 8.1 INTRODUCTION

-

8.2 BANKNOTESINCREASE IN SPENDING ON PRINTING BANKNOTES TO DRIVE MARKET

-

8.3 TAX BANDEROLESECONOMIC GROWTH TO DRIVE DEMAND

-

8.4 SECURITY LABELSBRAND VALUE PROTECTION FROM FAKE PRODUCTS TO DRIVE MARKET

-

8.5 OFFICIAL IDENTITY DOCUMENTSPROTECTION AGAINST FRAUD AND IDENTITY THEFT TO INCREASE DEMAND

-

8.6 OFFICIAL/LEGAL GOVERNMENT DOCUMENTSINCREASE IN AUTHENTICATION OF OFFICIAL/LEGAL GOVERNMENT DOCUMENTS TO BOOST MARKET

- 8.7 OTHERS

-

9.1 INTRODUCTIONGLOBAL RECESSION OVERVIEW

-

9.2 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICCHINA- Presence of strong printing, packaging, and labeling industries to propel marketINDIA- Fastest-growing market in Asia PacificJAPAN- Growing tourism industry to drive demand for security paper in visas and passportsSOUTH KOREA- Increasing demand for banknotes to be market driverREST OF ASIA PACIFIC

-

9.3 EUROPEIMPACT OF RECESSION ON EUROPEGERMANY- Increasing use of digital printing technology to drive marketITALY- Growth of tourism industry to support marketSPAIN- Banking sector to favor market growthFRANCE- Increasing demand for secure and tamper-proof products to drive marketUK- Increase in frauds and counterfeiting to drive demandREST OF EUROPE

-

9.4 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICAUS- Largest market in North AmericaCANADA- Rise in counterfeit banknotes to boost demand for high-security featuresMEXICO- Printing, circulation, and reprinting of banknotes to drive security paper demand

-

9.5 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON MIDDLE EAST & AFRICASAUDI ARABIA- Growing tourism industry to drive marketSOUTH AFRICA- Increasing cases of fraud and counterfeiting to augment demandREST OF MIDDLE EAST & AFRICA

-

9.6 SOUTH AMERICAIMPACT OF RECESSION ON SOUTH AMERICABRAZIL- Dominant market in South AmericaREST OF SOUTH AMERICA

- 10.1 OVERVIEW

-

10.2 COMPANY EVALUATION QUADRANT MATRIX FOR TIER-1 PLAYERS, 2021STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.3 STRENGTH OF PRODUCT PORTFOLIO

-

10.4 COMPANY EVALUATION QUADRANT MATRIX FOR START-UPS/SMES, 2021PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 10.5 MARKET RANKING ANALYSIS

- 10.6 COMPETITIVE BENCHMARKING

-

10.7 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKMARKET EVALUATION MATRIXCOMPETITIVE SITUATIONS AND TRENDS

-

11.1 KEY PLAYERSSICPA HOLDING SA- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewDIC CORPORATION (SUN CHEMICAL)- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewKAO COLLINS CORPORATION- Business overview- Products/Services/Solutions offered- MnM viewCHROMATIC TECHNOLOGIES INC.- Business overview- Products/Services/Solutions offered- MnM viewINK TEC INC.- Business overview- Products/Services/Solutions offered- MnM viewGLEITSMANN SECURITY INKS GMBH- Business overview- Products/Services/Solutions offered- MnM viewCHROMA INKS USA- Business overview- Products/Services/Solutions offered- MnM viewSHRIRAM VERITECH SOLUTIONS PVT. LTD.- Business overview- Products/Services/Solutions offered- MnM viewFLINT GROUP- Business overview- Products/Services/Solutions offered- MnM viewFUJIFILM HOLDINGS AMERICA CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM view

-

11.2 OTHER PLAYERSYIP’S CHEMICAL HOLDINGS LIMITED- Products/Services/Solutions offeredTOYO INK SC HOLDINGS CO., LTD.- Products/Services/Solutions offeredDAINICHISEIKA COLOR & CHEMICALS MFG. CO., LTD.- Products/Services/Solutions offeredSIEGWERK DRUCKFARBEN AG & CO. KGAA- Products/Services/Solutions offeredT&K TOKA CORPORATION- Products/Services/Solutions offeredWIKOFF COLOR CORPORATION- Products/Services/Solutions offeredKAO CHIMIGRAF SI.- Products/Services/Solutions offeredMARABU GMBH & CO. KG- Products/Services/Solutions offeredGANS INK & SUPPLY- Products/Services/Solutions offeredPETREL- Products/Services/Solutions offered

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 SECURITY INKS MARKET SNAPSHOT, 2022 VS. 2027

- TABLE 2 SECURITY INKS MARKET: ROLE IN ECOSYSTEM

- TABLE 3 SECURITY INKS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS (%)

- TABLE 5 KEY BUYING CRITERIA FOR SECURITY INKS

- TABLE 6 TRENDS AND FORECAST OF GDP, PERCENTAGE CHANGE, 2016–2027

- TABLE 7 COUNTRY-WISE IMPORT DATA FOR PRINTING INKS, WHETHER OR NOT CONCENTRATED OR SOLID (EXCLUDING BLACK INK), 2021

- TABLE 8 COUNTRY-WISE EXPORT DATA FOR PRINTING INK, WHETHER OR NOT CONCENTRATED OR SOLID (EXCLUDING BLACK INK), 2021

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 SECURITY INKS MARKET: KEY CONFERENCES AND EVENTS

- TABLE 13 SECURITY INKS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 14 SECURITY INKS MARKET, BY TYPE, 2020–2027 (TON)

- TABLE 15 INVISIBLE: SECURITY INKS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 16 INVISIBLE: SECURITY INKS MARKET, BY REGION, 2020–2027 (TON)

- TABLE 17 BIOMETRIC: SECURITY INKS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 18 BIOMETRIC: SECURITY INKS MARKET, BY REGION, 2020–2027 (TON)

- TABLE 19 FLUORESCENT: SECURITY INKS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 20 FLUORESCENT: SECURITY INKS MARKET, BY REGION, 2020–2027 (TON)

- TABLE 21 THERMOCHROMIC: SECURITY INKS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 22 THERMOCHROMIC: SECURITY INKS MARKET, BY REGION, 2020–2027 (TON)

- TABLE 23 OPTICALLY VARIABLE: SECURITY INKS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 24 OPTICALLY VARIABLE: SECURITY INKS MARKET, BY REGION, 2020–2027 (TON)

- TABLE 25 MAGNETIC: SECURITY INKS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 26 MAGNETIC: SECURITY INKS MARKET, BY REGION, 2020–2027 (TON)

- TABLE 27 REACTIVE: SECURITY INKS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 28 REACTIVE: SECURITY INKS MARKET, BY REGION, 2020–2027 (TON)

- TABLE 29 ERASABLE: SECURITY INKS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 30 ERASABLE: SECURITY INKS MARKET, BY REGION, 2020–2027 (TON)

- TABLE 31 INFRARED: SECURITY INKS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 32 INFRARED: SECURITY INKS MARKET, BY REGION, 2020–2027 (TON)

- TABLE 33 OTHERS: SECURITY INKS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 34 OTHERS: SECURITY INKS MARKET, BY REGION, 2020–2027 (TON)

- TABLE 35 SECURITY INKS MARKET, BY PRINTING METHOD, 2020–2027 (USD MILLION)

- TABLE 36 SECURITY INKS MARKET, BY PRINTING METHOD, 2020–2027 (TON)

- TABLE 37 OFFSET: SECURITY INKS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 38 OFFSET: SECURITY INKS MARKET, BY REGION, 2020–2027 (TON)

- TABLE 39 INTAGLIO: SECURITY INKS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 40 INTAGLIO: SECURITY INKS MARKET, BY REGION, 2020–2027 (TON)

- TABLE 41 FLEXOGRAPHIC: SECURITY INKS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 42 FLEXOGRAPHIC: SECURITY INKS MARKET, BY REGION, 2020–2027 (TON)

- TABLE 43 SILK SCREEN: SECURITY INKS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 44 SILK SCREEN: SECURITY INKS MARKET, BY REGION, 2020–2027 (TON)

- TABLE 45 LETTERPRESS: SECURITY INKS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 46 LETTERPRESS: SECURITY INKS MARKET, BY REGION, 2020–2027 (TON)

- TABLE 47 OTHERS: SECURITY INKS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 48 OTHERS: SECURITY INKS MARKET, BY REGION, 2020–2027 (TON)

- TABLE 49 SECURITY INKS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 50 SECURITY INKS MARKET, BY APPLICATION, 2020–2027 (TON)

- TABLE 51 SECURITY INKS MARKET IN BANKNOTES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 52 SECURITY INKS MARKET IN BANKNOTES, BY REGION 2020–2027 (TON)

- TABLE 53 SECURITY INKS MARKET IN TAX BANDEROLES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 54 SECURITY INKS MARKET IN TAX BANDEROLES, BY REGION, 2020–2027 (TON)

- TABLE 55 SECURITY INKS MARKET IN SECURITY LABELS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 56 SECURITY INKS MARKET IN SECURITY LABELS, BY REGION, 2020–2027 (TON)

- TABLE 57 SECURITY INKS MARKET IN OFFICIAL IDENTITY DOCUMENTS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 58 SECURITY INKS MARKET IN OFFICIAL IDENTITY DOCUMENTS, BY REGION, 2020–2027 (TON)

- TABLE 59 SECURITY INKS MARKET IN OFFICIAL/LEGAL GOVERNMENT DOCUMENTS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 60 SECURITY INKS MARKET IN OFFICIAL/LEGAL GOVERNMENT DOCUMENTS, BY REGION, 2020–2027 (TON)

- TABLE 61 SECURITY INKS MARKET IN OTHER APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 62 SECURITY INKS MARKET IN OTHER APPLICATIONS, BY REGION, 2020–2027 (TON)

- TABLE 63 SECURITY INKS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 64 SECURITY INKS MARKET, BY REGION, 2020–2027 (TON)

- TABLE 65 ASIA PACIFIC: SECURITY INKS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 66 ASIA PACIFIC: SECURITY INKS MARKET, BY TYPE, 2020–2027 (TON)

- TABLE 67 ASIA PACIFIC: SECURITY INKS MARKET, BY PRINTING METHOD, 2020–2027 (USD MILLION)

- TABLE 68 ASIA PACIFIC: SECURITY INKS MARKET, BY PRINTING METHOD, 2020–2027 (TON)

- TABLE 69 ASIA PACIFIC: SECURITY INKS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 70 ASIA PACIFIC: SECURITY INKS MARKET, BY APPLICATION, 2020–2027 (TON)

- TABLE 71 ASIA PACIFIC: SECURITY INKS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 72 ASIA PACIFIC: SECURITY INKS MARKET, BY COUNTRY, 2020–2027 (TON)

- TABLE 73 EUROPE: SECURITY INKS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 74 EUROPE: SECURITY INKS MARKET, BY TYPE, 2020–2027 (TON)

- TABLE 75 EUROPE: SECURITY INKS MARKET, BY PRINTING METHOD, 2020–2027 (USD MILLION)

- TABLE 76 EUROPE: SECURITY INKS MARKET, BY PRINTING METHOD, 2020–2027 (TON)

- TABLE 77 EUROPE: SECURITY INKS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 78 EUROPE: SECURITY INKS MARKET, BY APPLICATION, 2020–2027 (TON)

- TABLE 79 EUROPE: SECURITY INKS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 80 EUROPE: SECURITY INKS MARKET, BY COUNTRY, 2020–2027 (TON)

- TABLE 81 NORTH AMERICA: SECURITY INKS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 82 NORTH AMERICA: SECURITY INKS MARKET, BY TYPE, 2020–2027 (TON)

- TABLE 83 NORTH AMERICA: SECURITY INKS MARKET, BY PRINTING METHOD, 2020–2027 (USD MILLION)

- TABLE 84 NORTH AMERICA: SECURITY INKS MARKET, BY PRINTING METHOD, 2020–2027 (TON)

- TABLE 85 NORTH AMERICA: SECURITY INKS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 86 NORTH AMERICA: SECURITY INKS MARKET, BY APPLICATION, 2020–2027 (TON)

- TABLE 87 NORTH AMERICA: SECURITY INKS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 88 NORTH AMERICA: SECURITY INKS MARKET, BY COUNTRY, 2020–2027 (TON)

- TABLE 89 MIDDLE EAST & AFRICA: SECURITY INKS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 90 MIDDLE EAST & AFRICA: SECURITY INKS MARKET, BY TYPE, 2020–2027 (TON)

- TABLE 91 MIDDLE EAST & AFRICA: SECURITY INKS MARKET, BY PRINTING METHOD, 2020–2027 (USD MILLION)

- TABLE 92 MIDDLE EAST & AFRICA: SECURITY INKS MARKET, BY PRINTING METHOD, 2020–2027 (TON)

- TABLE 93 MIDDLE EAST & AFRICA: SECURITY INKS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 94 MIDDLE EAST & AFRICA: SECURITY INKS MARKET, BY APPLICATION, 2020–2027 (TON)

- TABLE 95 MIDDLE EAST & AFRICA: SECURITY INKS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 96 MIDDLE EAST & AFRICA: SECURITY INKS MARKET, BY COUNTRY, 2020–2027 (TON)

- TABLE 97 SOUTH AMERICA: SECURITY INKS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 98 SOUTH AMERICA: SECURITY INKS MARKET, BY TYPE, 2020–2027 (TON)

- TABLE 99 SOUTH AMERICA: SECURITY INKS MARKET, BY PRINTING METHOD, 2020–2027 (USD MILLION)

- TABLE 100 SOUTH AMERICA: SECURITY INKS MARKET, BY PRINTING METHOD, 2020–2027 (TON)

- TABLE 101 SOUTH AMERICA: SECURITY INKS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 102 SOUTH AMERICA: SECURITY INKS MARKET, BY APPLICATION, 2020–2027 (TON)

- TABLE 103 SOUTH AMERICA: SECURITY INKS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 104 SOUTH AMERICA: SECURITY INKS MARKET, BY COUNTRY, 2020–2027 (TON)

- TABLE 105 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN SECURITY INKS MARKET (JANUARY 2018–DECEMBER 2022)

- TABLE 106 SECURITY INKS MARKET: LIST OF KEY START-UPS/SMES

- TABLE 107 SECURITY INKS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 108 SECURITY INKS MARKET: LIST OF KEY PLAYERS

- TABLE 109 STRATEGIC DEVELOPMENTS, BY COMPANY

- TABLE 110 HIGHEST ADOPTED STRATEGIES

- TABLE 111 NUMBER OF GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

- TABLE 112 COMPANY APPLICATION FOOTPRINT

- TABLE 113 COMPANY REGION FOOTPRINT

- TABLE 114 COMPANY OVERALL FOOTPRINT

- TABLE 115 SECURITY INKS MARKET: DEALS, 2019–2022

- TABLE 116 SECURITY INKS MARKET: OTHER DEVELOPMENTS, 2019–2022

- TABLE 117 SICPA HOLDING SA: COMPANY OVERVIEW

- TABLE 118 SICPA HOLDING SA: DEALS

- TABLE 119 SICPA HOLDING SA: OTHER DEVELOPMENTS

- TABLE 120 DIC CORPORATION (SUN CHEMICAL): COMPANY OVERVIEW

- TABLE 121 DIC CORPORATION (SUN CHEMICAL): DEALS

- TABLE 122 KAO COLLINS CORPORATION: COMPANY OVERVIEW

- TABLE 123 CHROMATIC TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 124 INK TEC INC.: COMPANY OVERVIEW

- TABLE 125 GLEITSMANN SECURITY INK GMBH: COMPANY OVERVIEW

- TABLE 126 CHROMA INKS USA: COMPANY OVERVIEW

- TABLE 127 SHRIRAM VERITECH SOLUTIONS PVT. LTD.: COMPANY OVERVIEW

- TABLE 128 FLINT GROUP: COMPANY OVERVIEW

- TABLE 129 FUJIFILM HOLDINGS AMERICA CORPORATION: COMPANY OVERVIEW

- TABLE 130 FUJIFILM HOLDINGS AMERICA CORPORATION: DEALS

- TABLE 131 YIP’S CHEMICAL HOLDINGS LIMITED: COMPANY OVERVIEW

- TABLE 132 TOYO INK SC HOLDINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 133 DAINICHISEIKA COLOR & CHEMICALS MFG. CO., LTD.: COMPANY OVERVIEW

- TABLE 134 SIEGWERK DRUCKFARBEN AG & CO. KGAA: COMPANY OVERVIEW

- TABLE 135 T&K TOKA CORPORATION: COMPANY OVERVIEW

- TABLE 136 WIKOFF COLOR CORPORATION: COMPANY OVERVIEW

- TABLE 137 KAO CHIMIGRAF SI.: COMPANY OVERVIEW

- TABLE 138 MARABU GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 139 GANS INK & SUPPLY: COMPANY OVERVIEW

- TABLE 140 PETREL: COMPANY OVERVIEW

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 SECURITY INKS MARKET: RESEARCH DESIGN

- FIGURE 3 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION

- FIGURE 5 SECURITY INKS MARKET, BY REGION

- FIGURE 6 SECURITY INKS MARKET, BY APPLICATION

- FIGURE 7 BOTTOM-UP APPROACH, BY APPLICATION

- FIGURE 8 MAJOR FACTORS RESPONSIBLE FOR GLOBAL RECESSION AND THEIR IMPACT ON SECURITY INKS MARKET

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 INVISIBLE SECURITY INKS TO BE LARGEST TYPE SEGMENT DURING FORECAST PERIOD

- FIGURE 11 OFFSET PRINTING METHOD TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 BANKNOTES APPLICATION TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- FIGURE 14 PRINTING, REPRINTING, AND CIRCULATION OF BANKNOTES TO DRIVE SECURITY INKS MARKET

- FIGURE 15 INVISIBLE SEGMENT TO BE LARGEST SECURITY INK TYPE DURING FORECAST PERIOD

- FIGURE 16 BANKNOTES TO BE LARGEST APPLICATION DURING FORECAST PERIOD

- FIGURE 17 CHINA TO DOMINATE GLOBAL MARKET DURING FORECAST PERIOD

- FIGURE 18 SECURITY INKS MARKET IN INDIA TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

- FIGURE 19 SECURITY INKS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 SECURITY INKS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 SECURITY INKS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 23 KEY BUYING CRITERIA FOR SECURITY INKS

- FIGURE 24 GLOBAL DIGITAL PAYMENT TRENDS AND FORECAST

- FIGURE 25 AVERAGE PRICE OF SECURITY INKS, BY REGION

- FIGURE 26 AVERAGE SELLING PRICE, BY APPLICATION

- FIGURE 27 AVERAGE SELLING PRICE, BY TYPE

- FIGURE 28 AVERAGE SELLING PRICE, BY PRINTING METHOD

- FIGURE 29 SECURITY INKS MARKET: ECOSYSTEM MAPPING

- FIGURE 30 NUMBER OF PATENTS PUBLISHED, 2018–2022

- FIGURE 31 PATENTS PUBLISHED, BY JURISDICTION, 2018–2022

- FIGURE 32 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2018–2022

- FIGURE 33 INVISIBLE INK TYPE HOLDS LARGEST SHARE OF SECURITY INKS MARKET

- FIGURE 34 OFFSET PRINTING METHOD TO DOMINATE DURING FORECAST PERIOD

- FIGURE 35 BANKNOTES TO LEAD SECURITY INKS MARKET DURING FORECAST PERIOD

- FIGURE 36 ASIA PACIFIC TO BE FASTEST-GROWING SECURITY INKS MARKET

- FIGURE 37 ASIA PACIFIC: SECURITY INKS MARKET SNAPSHOT

- FIGURE 38 EUROPE: SECURITY INKS MARKET SNAPSHOT

- FIGURE 39 NORTH AMERICA: SECURITY INKS MARKET SNAPSHOT

- FIGURE 40 MIDDLE EAST & AFRICA: SECURITY INKS MARKET SNAPSHOT

- FIGURE 41 SOUTH AMERICA: SECURITY INKS MARKET SNAPSHOT

- FIGURE 42 SECURITY INKS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 43 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN SECURITY INKS MARKET

- FIGURE 44 SECURITY INKS MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES, 2020

- FIGURE 45 RANKING OF KEY PLAYERS IN SECURITY INKS MARKET

- FIGURE 46 DIC CORPORATION (SUN CHEMICAL): COMPANY SNAPSHOT

- FIGURE 47 FUJIFILM HOLDINGS AMERICA CORPORATION: COMPANY SNAPSHOT

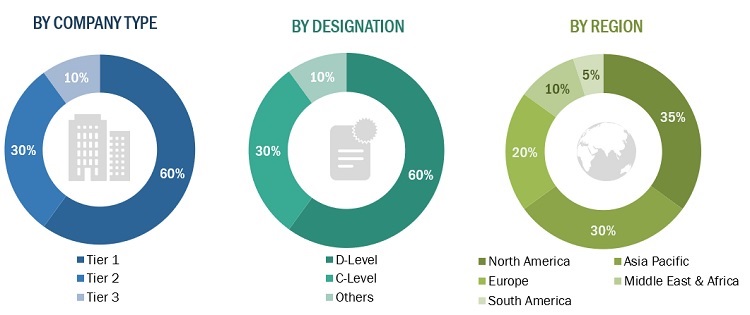

The study involves four major activities in estimating the current market size of security inks. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to for identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The security inks industry comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in application areas, such as banknotes, tax banderoles, security labels, official identity documents, and others. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

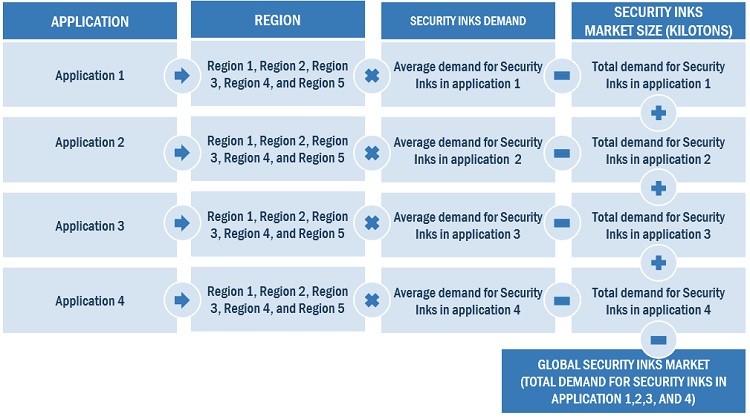

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the security inks market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Security Inks Market Size: Bottom-up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the security inks market size in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To define, describe, and forecast the market by type, printing method, application, and region

- To forecast the market size with respect to five main regions, namely, Asia Pacific, the Middle East & Africa, Europe, North America, and South America

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments such as investments, expansions, new product developments, partnerships, collaborations, and mergers & acquisitions in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2.

Note: 1. Micromarkets refer to further segments and subsegments of the security inks market included in the report.

2. Core competencies of companies were captured in terms of key developments and key strategies adopted by them to sustain their position in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the security inks market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Security Inks Market