Security Assurance Market by Application (Business Applications, System & Network Infrastructure, and Mobility Solutions), Organization Size, Industry Verticals (BFSI, Telecommunications, Government, Healthcare), and Region - Global Forecast to 2023

[111 Pages Report] The global security assurance market was valued at USD 3.53 billion in 2017 and projected to reach USD 5.48 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 9.2% during the forecast period. The base year considered for the study is 2017, and the forecast period is, 20182023.

The report aims at estimating the market size and potential of the security assurance market across different segments, such as application, organization size, industry vertical, and region. The primary objectives of the report are to provide a detailed analysis of the major factors (drivers, restraints, opportunities, industry-specific challenges, and recent developments) influencing the growth of the market, analyze the market opportunities for stakeholders, and offer details of the competitive landscape to market leaders.

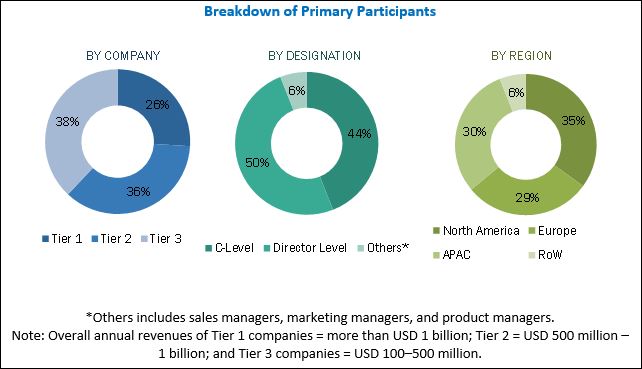

The research methodology used to estimate and forecast the Security Assurance Market began with capturing data about revenues of the key vendors through secondary sources, such as annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. This research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva. Other than these sources, analyses, and releases from industry trade associations, such as government regulatory bodies were considered during the research process. Vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global security assurance market from the revenues of the key market players. After arriving at the overall market size, the market was split into several segments and subsegments that were then verified through primary research by conducting extensive interviews with the key industry personnel, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primary participants is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The key and emerging security assurance market players include Accenture (Ireland), Avaya (US), IBM (US), Infosys (India), Micro Focus (UK), Microsoft (US), NETSCOUT (US), SAS (US), Sogeti (France), Aura (New Zealand), BizCarta (India), Cipher (US), CRITICAL Software (Portugal), Content Security (Australia), Happiest Minds (India), OpenText (Canada), Oracle (US), Telos (US), Tenable (US), Radix Security (US), Signature Consulting Group (US), Spirent (US), and Wipro (India).

Key Target Audience for Security Assurance Market

- Government Agencies

- Cloud Application Security Vendors

- Independent Software Vendors

- Consulting Firms

- System Integrators

- Value-Added Resellers (VARs)

- IT Security Agencies

- Managed Security Service Providers (MSSPs)

Scope of the Security Assurance Market Report

The research report categorizes the market to forecast revenues and analyze trends in each of the following subsegments:

By Application

- Business Applications

- System and Network Infrastructure

- Mobility Solutions

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Industry Vertical

- BFSI

- Telecommunications

- Government

- Healthcare

- Retail

- Manufacturing

- Others (Media, Energy and Utilities, Travel and Hospitality, Education, and ITES)

By Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific requirements. The following customization options are available for the report:

Product Analysis

- Product matrix provides detailed product information and comparisons

Geographic Analysis

- Further breakdown of the North American security assurance market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American market

Company Information

- Detailed analysis and profiles of additional market players

Security assurance empowers enterprises to timely identify, evaluate, and manage the security risks associated with business applications, mobile devices, and related technology environments. The scope of the report encompasses business applications, which include secure code review, architecture design review, testing, Intrusion Prevention Service/Intrusion Detection Service (IPS/IDS), and other related applications; system and network infrastructure which includes databases, secure network perimeters, and virtualized cloud; and mobility solutions which include endpoint devices and Internet of Things (IoT) devices.

The objective of the report is to define, describe, and forecast the security assurance market size by application, by organization size, by industry vertical, and region. Among Applications, the mobility solutions segment is expected to grow at the highest CAGR and account for the largest market share in the market during the forecast period. Rapid growth in the number of mobile devices across the globe is one of the driving factors for the growth of this market. Networks are more vulnerable to cyber-attacks, due to the increasing number of mobile devices. Hence it has become essential to assess organizations security.

The Banking, Financial Services, and Insurance (BFSI) industry vertical is estimated to account for the largest market size in 2018 and projected to grow at the highest CAGR during the forecast period. This industry vertical is continuously developing security products and services that could help protect the industry employees, customers, assets, offices, branches, and operations, and is thus expected to account for the largest share of the security assurance market. The healthcare industry vertical is expected to grow at the highest CAGR during the forecast period.

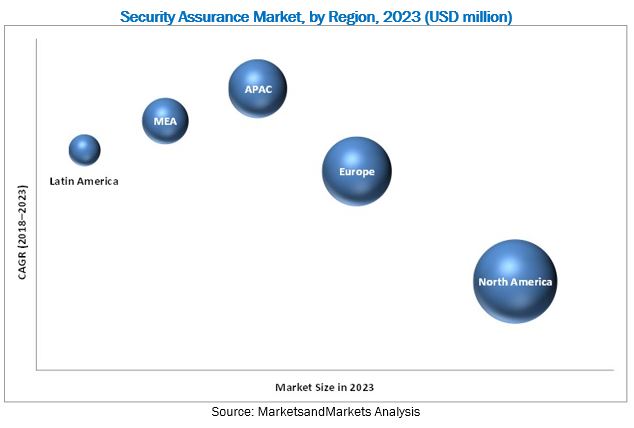

The geographic analysis of the security assurance market comprises 5 regions, namely, North America, APAC, Europe, MEA, and Latin America. North America is expected to account for the largest market size in the market during the forecast period, followed by Europe. North America has been extremely responsive towards adopting the latest technological advancements, such as artificial intelligence, cloud computing, and the IoT. Prevention of increasing security attacks and breaches act as a driving force for the growth of the market. The US and Canada are the major contributing countries in this region.

APAC is expected to grow at the highest CAGR during the forecast year. The need to mitigate IT security threats and the rise in the adoption of security assurance services among SMEs are the factors driving the security assurance market growth in this region. MEA and Latin America are expected to witness steady growth during the forecast period.

Stringent government regulations and compliance, and the growth in the deployment of third-party applications integrated with the core software are the major factors expected to drive the security assurance market. However, the lack of technical expertise to develop an agile and secure environment is expected to hinder the growth of the market, but for a limited period.

The key and emerging security assurance market players include Accenture (Ireland), Avaya (US), IBM (US), Infosys (India), Micro Focus (UK), Microsoft (US), NETSCOUT (US), SAS (US), Sogeti (France), Aura (New Zealand), BizCarta (India), Cipher (US), CRITICAL Software (Portugal), Content Security (Australia), Happiest Minds (India), OpenText (Canada), Oracle (US), Telos (US), Tenable (US), Radix Security (US), Signature Consulting Group (US), Spirent (US), and Wipro (India).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the Security Assurance Market

4.2 Market Share of Top 4 Industry Verticals and Regions, 2018

4.3 Market Investment Scenario

5 Market Overview (Page No. - 31)

5.1 Market Dynamics

5.1.1 Drivers

5.1.1.1 Stringent Government Regulations

5.1.1.2 Growing Deployment of Third-Party Applications Integrated With the Core Software

5.1.1.3 Rapid Adoption of Cloud-Based Services

5.1.2 Restraints

5.1.2.1 Difficulty in Providing Hybrid Cloud Security

5.1.3 Opportunities

5.1.3.1 Growing Adoption of IoT and Mobile Devices

5.1.3.1 Increase in the Adoption of Security Assurance in Cloud

5.1.4 Challenges

5.1.4.1 Limited Certified Security Experts

6 Security Assurance Market, By Application (Page No. - 34)

6.1 Introduction

6.2 Business Applications

6.3 System and Network Infrastructure

6.4 Mobility Solutions

7 Market By Organization Size (Page No. - 38)

7.1 Introduction

7.2 Large Enterprises

7.3 Small and Medium-Sized Enterprises

8 Security Assurance Market, By Industry Vertical (Page No. - 42)

8.1 Introduction

8.2 Banking, Financial Services, and Insurance

8.3 Telecommunications

8.4 Government

8.5 Healthcare

8.6 Retail

8.7 Manufacturing

8.8 Others

9 Security Assurance Market, By Region (Page No. - 50)

9.1 Introduction

9.2 North America

9.2.1 United States

9.2.2 Canada

9.3 Europe

9.3.1 United Kingdom

9.3.2 Germany

9.3.3 France

9.3.4 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.2 Japan

9.4.3 Australia and New Zealand

9.4.4 Rest of Asia Pacific

9.5 Middle East and Africa

9.5.1 Middle East

9.5.2 Africa

9.6 Latin America

9.6.1 Brazil

9.6.2 Mexico

9.6.3 Rest of Latin America

10 Competitive Landscape (Page No. - 68)

10.1 Overview

10.1.1 Partnerships, Agreements, and Collaborations

10.1.2 New Product/Service Launches and Product Enhancements

10.1.3 Mergers and Acquisitions

11 Company Profiles (Page No. - 70)

(Business Overview, Product/Solutions Offered, Recent Developments, MnM View)*

11.1 Introduction

11.2 Accenture

11.3 Avaya

11.4 IBM

11.5 Infosys

11.6 Micro Focus

11.7 Microsoft

11.8 Netscout

11.9 SAS Institute

11.10 Sogeti

11.11 Aura Information Security

11.12 Bizcarta

11.13 Cipher

11.14 Critical Software

11.15 Content Security

11.16 Happiest Minds

11.17 Opentext

11.18 Oracle

11.19 Telos Corporation

11.20 Tenable

11.21 Radix Security

11.22 Signature Consulting Group

11.23 Spirent Communications

11.24 Wipro

*Business Overview, Product/Solutions Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 106)

12.1 Discussion Guide

12.2 Knowledge Store: MarketsandMarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (39 Tables)

Table 1 Security Assurance Market Size, By Application, 20162023 (USD Million)

Table 2 Business Applications: Market Size By Region, 20162023 (USD Million)

Table 3 System and Network Infrastructure: Market Size By Region, 20162023 (USD Million)

Table 4 Mobility Solutions: Market Size By Region, 20162023 (USD Million)

Table 5 Market Size, By Organization Size, 20162023 (USD Million)

Table 6 Large Enterprises: Market Size By Region, 20162023 (USD Million)

Table 7 Small and Medium-Sized Enterprises: Market Size By Region, 20162023 (USD Million)

Table 8 Security Assurance Market Size, By Industry Vertical, 20162023 (USD Million)

Table 9 Banking, Financial Services, and Insurance: Market Size By Region, 20162023 (USD Million)

Table 10 Telecommunications: Market Size By Region, 20162023 (USD Million)

Table 11 Government: Market Size By Region, 20162023 (USD Million)

Table 12 Healthcare: Market Size By Region, 20162023 (USD Million)

Table 13 Retail: Market Size By Region, 20162023 (USD Million)

Table 14 Manufacturing: Market Size By Region, 20162023 (USD Million)

Table 15 Others: Market Size By Region, 20162023 (USD Million)

Table 16 Security Assurance Market Size, By Region, 20162023 (USD Million)

Table 17 North America: Market Size By Application, 20162023 (USD Million)

Table 18 North America: Market Size By Organization Size, 20162023 (USD Million)

Table 19 North America: Market Size By Industry Vertical, 20162023 (USD Million)

Table 20 North America: Market Size By Country, 20162023 (USD Million)

Table 21 Europe: Market Size, By Application, 20162023 (USD Million)

Table 22 Europe: Market Size By Organization Size, 20162023 (USD Million)

Table 23 Europe: Market Size By Industry Vertical, 20162023 (USD Million)

Table 24 Europe: Market Size By Country, 20162023 (USD Million)

Table 25 Asia Pacific: Security Assurance Market Size, By Application, 20162023 (USD Million)

Table 26 Asia Pacific: Market Size By Organization Size, 20162023 (USD Million)

Table 27 Asia Pacific: Market Size By Industry Vertical, 20162023 (USD Million)

Table 28 Asia Pacific: Market Size By Country, 20162023 (USD Million)

Table 29 Middle East and Africa: Market Size, By Application, 20162023 (USD Million)

Table 30 Middle East and Africa: Market Size By Organization Size, 20162023 (USD Million)

Table 31 Middle East and Africa: Market Size By Industry Vertical, 20162023 (USD Million)

Table 32 Middle East and Africa: Market Size By Sub-Region, 20162023 (USD Million)

Table 33 Latin America: Security Assurance Market Size, By Application, 20162023 (USD Million)

Table 34 Latin America: Market Size By Organization Size, 20162023 (USD Million)

Table 35 Latin America: Market Size By Industry Vertical, 20162023 (USD Million)

Table 36 Latin America: Market Size By Country, 20162023 (USD Million)

Table 37 Partnerships, Agreements, and Collaborations, 2018

Table 38 New Product/Service Launches and Product Enhancements, 2018

Table 39 Mergers and Acquisitions, 2018

List of Figures (36 Figures)

Figure 1 Security Assurance Market Segmentation

Figure 2 Market Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Security Assurance Market: Assumptions

Figure 8 Market Share Top 3 Industry Verticals, 2018

Figure 9 Market Share By Application, 2018

Figure 10 Market Share By Organization Size, 2018

Figure 11 Market Regional Snapshot

Figure 12 Growing Need to Secure Business-Critical Data and Processes is Expected to Fuel the Growth of the Market During the Forecast Period

Figure 13 BFSI and North America are Estimated to Have the Largest Market Shares in 2018

Figure 14 Asia Pacific is Expected to Emerge as the Best Market for Investments in the Next 5 Years

Figure 15 Security Assurance Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Mobility Solutions Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 17 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 18 Healthcare Industry Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 19 Asia Pacific is Expected to Be an Attractive Destination for the Security Assurance Market During the Forecast Period

Figure 20 North America: Market Snapshot

Figure 21 Asia Pacific: Market Snapshot

Figure 22 Accenture: Company Snapshot

Figure 23 Avaya: Company Snapshot

Figure 24 IBM: Company Snapshot

Figure 25 Infosys: Company Snapshot

Figure 26 Micro Focus: Company Snapshot

Figure 27 Microsoft: Company Snapshot

Figure 28 Netscout: Company Snapshot

Figure 29 SAS: Company Snapshot

Figure 30 Sogeti: Company Snapshot

Figure 31 Opentext: Company Snapshot

Figure 32 Oracle: Company Snapshot

Figure 33 Telos Corporation: Company Snapshot

Figure 34 Tenable: Company Snapshot

Figure 35 Spirent: Company Snapshot

Figure 36 Wipro: Company Snapshot

Growth opportunities and latent adjacency in Security Assurance Market