Digital Assurance Market by Testing Mode (Manual Testing and Test Automation), Testing Type (API, Functional, Network, Performance, Security, and Usability Testing), Technology (SMAC), Organization Size, Vertical, and Region - Global Forecast to 2022

[146 Pages Report] The digital assurance market was valued at USD 2.63 Billion in 2016 and projected to reach USD 5.47 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 13.5% during the forecast period. The base year considered for the study is 2016, and the forecast period is 2017–2022.

Objectives of the Study

- To determine and forecast the global digital assurance market by testing mode, testing type, technology, organization size, vertical, and region from 2017 to 2022, and analyze various macro and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to the 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA)

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the digital assurance market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key market players, provide comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities in the market

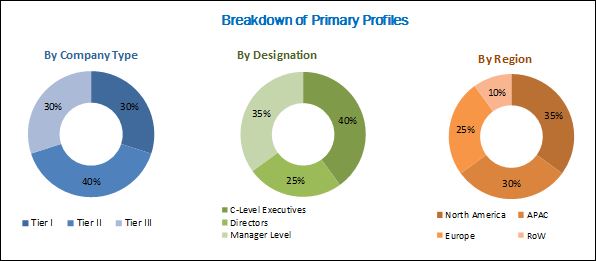

The research methodology used to estimate and forecast the digital assurance market begins with capturing data on key vendor revenues and the market size of individual segments through secondary sources, such as industry associations and trade journals. The vendor offerings are also taken into consideration to determine market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the market from the individual services segment. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key industry personnel, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

The breakdown of the profiles of the primary discussion participants is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The digital assurance market ecosystem includes players, such as Accenture (Dublin), Micro Focus (UK), Wipro (India), Cognizant (US), Cigniti (India), Capgemini (France), Hexaware (India), SQS (Germany), TCS (India), and Maveric Systems (India).

Key Target Audience

- Independent testing service providers

- Test organizations

- Integrated testing service providers

- Managed testing service providers

- Test automation tools providers

- Quality Assurance (QA) and testing managers

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2022 |

|

Base year considered |

2016 |

|

Forecast period |

2017–2022 |

|

Forecast unit |

Value (USD Billion) |

|

Segments covered |

Testing Mode, Testing Type, Technology, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA) |

|

Companies covered |

Capgemini (France), Micro Focus (UK), Accenture (Republic of Ireland), Cognizant (US), Cigniti (India), Hexaware (India), SQS (Germany), TCS (India), Wipro (India), and Maveric Systems (India) |

The digital assurance market takes into account the expenditure on various digital application testing services across testing modes, testing types, technologies, verticals, organization sizes, and regions.

By Testing Mode

- Manual testing

- Test automation

By Testing Type

- Application Programming Interface (API) testing

- Functional testing

- Network testing

- Performance testing

- Security testing

- Usability testing

By Technology

- Social media

- Mobile

- Analytics

- Cloud

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

By Vertical

- Government and public sector

- Banking, Financial Services, and Insurance (BFSI)

- Telecom, and media and entertainment

- Healthcare and life sciences

- Retail and eCommerce

- Manufacturing

- Transportation and logistics

- Others (education, and energy and utilities)

By Region

- North America

- Europe

- APAC

- MEA

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customization as per the company’s specific requirements. The following customization options are available for the report:

Geographic Analysis

- Further country-level breakdown of the European digital assurance market

- Further country-level breakdown of the APAC market

- Further country-level breakdown of the MEA market

- Further country-level breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

The digital assurance market size is expected to grow from USD 2.90 Billion in 2017 to USD 5.47 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 13.5% during the forecast period. The major drivers of the market include increasing digital transformation initiatives, increasing use of DevOps and agile application development methodologies, increasing test automation for lower operational costs and enhanced quality assurance, and increasing Application Programming Interface (API) monitoring in the digital economy.

The scope of the report covers the digital assurance market analysis by testing mode, testing type, technology, organization size, vertical, and region. The functional testing type is expected to have the largest market share during the forecast period, owing to the increased requirement of validating and assuring the performance of software or application that operates in conformance with the requirement specifications. The security testing segment is expected to grow at the highest CAGR during the forecast period, as vulnerabilities have become more complex and sophisticated, which are expected to further increase the demand for security testing, to cater to the challenges posed by threats.

The cloud technology segment is estimated to have the largest market share in 2017, owing to the need to provide extremely scalable IT-enabled capabilities to several clients who are using internet technologies. The cloud technology is widely adopted by various enterprises across the globe, as cloud-based software and applications are cost-efficient and can be deployed even in a basic IT infrastructure. The mobile technology segment is expected to grow at the highest rate, owing to increased usage of mobile devices to access the internet, enterprise data, communication, and personalized information. The mobile technology has been revolutionized over the years and is widely used to streamline the business flow.

The manufacturing vertical is expected to have the largest market share during the forecast period, as digital testing in the manufacturing vertical enables highly efficient and automated manufacturing tests that choose a wireless communication tester for sophisticated manufacturing devices to perform non-signaling tests on connected devices and support cellular and non-cellular standards. The retail and eCommerce vertical is expected to grow at the highest rate, owing to the boom in eCommerce and its numerous applications posing the requirement of digital assurance.

As per the geographic analysis, North America is expected to hold the largest market share, as North America has reached the maturity curve in terms of adopting digital technologies, and agile and DevOps for Quality Assurance (QA) and testing activities in the region. Asia Pacific (APAC) is expected to witness the highest growth rate in the digital assurance market during the forecast period, as the digital assurance vendors are expanding their presence in this region to capitalize growth opportunities.

The major factor that is expected to limit the growth of the digital assurance market is the threat of shadow IT, which is being deployed without an organization’s approval. The major vendors profiled in the report include Accenture (Dublin), Micro Focus (UK), Wipro (India), Cognizant (US), Cigniti (India), Capgemini (France), Hexaware (India), SQS (Germany), TCS (India), and Maveric Systems (India).

Frequently Asked Questions (FAQ):

How big is the Digital Assurance Market?

What is growth rate of the Digital Assurance Market?

What are the top trends in Digital Assurance Market?

Who are the key players in Digital Assurance Market?

Who will be the leading hub for Digital Assurance Market?

Who are the key target audience in Digital Assurance Market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Attractive Market Opportunities in the Digital Assurance Market

4.2 Market By Testing Mode

4.3 Market By Testing Type

4.4 Market By Technology

4.5 Market By Organization Size

4.6 Market By Vertical

4.7 Market By Region

4.8 Market Investment Scenario

5 Market Overview and Industry Trends (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Digital Transformation is Paving the Way for Digital Assurance

5.2.1.2 The Increasing Use of Agile and Devops Methodologies in Sdlc

5.2.1.3 The Increasing Use of Test Automation Leads to Lower the Operational Costs and Enhance the QA

5.2.1.4 Growing Need of Api Monitoring in the Digital Economy

5.2.2 Restraints

5.2.2.1 Shadow IT is A Major Risk Area for Organizations

5.2.3 Opportunities

5.2.3.1 Advancements in Testing With the Infusion of Ai and Machine Learning Technologies

5.2.3.2 Service Virtualization Offers A Safe Testing Environment

5.2.3.3 Open Source Testing Tools Explore Untapped Potential

5.2.4 Challenges

5.2.4.1 Lack of Expertise and Reluctance to Adopting New Testing Methods

5.2.4.2 Lack of Complete Test Coverage, Ranging From Testing Every Possible Input to Every Possible Variable

5.2.4.3 Operational Challenges

5.3 Use Cases

6 Digital Assurance Market, By Testing Mode (Page No. - 45)

6.1 Introduction

6.2 Manual Testing

6.3 Test Automation

7 Market By Testing Type (Page No. - 49)

7.1 Introduction

7.2 Application Programming Interface Testing

7.3 Functional Testing

7.4 Network Testing

7.5 Performance Testing

7.6 Security Testing

7.7 Usability Testing

8 Market By Technology (Page No. - 57)

8.1 Introduction

8.2 Social Media

8.3 Mobile

8.4 Analytics

8.5 Cloud

9 Digital Assurance Market, By Organization Size (Page No. - 63)

9.1 Introduction

9.2 Small and Medium-Sized Enterprises

9.3 Large Enterprises

10 Market By Vertical (Page No. - 67)

10.1 Introduction

10.2 Government and Public Sector

10.3 Banking, Financial Services, and Insurance

10.4 Telecom, and Media and Entertainment

10.5 Healthcare and Life Sciences

10.6 Retail and Ecommerce

10.7 Manufacturing

10.8 Transportation and Logistics

10.9 Others

11 Digital Assurance Market, By Region (Page No. - 77)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia Pacific

11.5 Latin America

11.6 Middle East and Africa

12 Competitive Landscape (Page No. - 102)

12.1 Overview

12.2 Market Ranking Analysis

12.3 Competitive Scenario

12.3.1 New Product/Service/Solution Launches

12.3.2 Business Expansions

12.3.3 Mergers and Acquisitions

12.3.4 Agreements and Partnerships

13 Company Profiles (Page No. - 107)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

13.1 Capgemini

13.2 Micro Focus

13.3 Accenture

13.4 Cognizant

13.5 Cigniti

13.6 Hexaware

13.7 SQS

13.8 TCS

13.9 Wipro

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 138)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Available Customization

14.5 Related Reports

14.6 Author Details

List of Tables (72 Tables)

Table 1 United States Dollar Exchange Rate, 2014–2017

Table 2 Digital Assurance Market: Assumptions

Table 3 Digital Assurance Market: Use Cases

Table 4 Market Size By Testing Mode, 2015–2022 (USD Million)

Table 5 Manual Testing: Market Size By Region, 2015–2022 (USD Million)

Table 6 Test Automation: Market Size By Region, 2015–2022 (USD Million)

Table 7 Market Size By Testing Type, 2015–2022 (USD Million)

Table 8 Application Programming Interface Testing: Market Size By Region, 2015–2022 (USD Million)

Table 9 Functional Testing: Market Size By Region, 2015–2022 (USD Million)

Table 10 Network Testing: Digital Assurance Size, By Region, 2015–2022 (USD Million)

Table 11 Performance Testing: Digital Assurance Size, By Region, 2015–2022 (USD Million)

Table 12 Security Testing: Digital Assurance Size, By Region, 2015–2022 (USD Million)

Table 13 Usability Testing: Digital Assurance Size, By Region, 2015–2022 (USD Million)

Table 14 Digital Assurance Market Size, By Technology, 2015–2022 (USD Million)

Table 15 Social Media: Digital Assurance Size, By Region, 2015–2022 (USD Million)

Table 16 Mobile: Market Size By Region, 2015–2022 (USD Million)

Table 17 Analytics: Market Size By Region, 2015–2022 (USD Million)

Table 18 Cloud: Market Size By Region, 2015–2022 (USD Million)

Table 19 Market Size By Organization Size, 2015–2022 (USD Million)

Table 20 Small and Medium-Sized Enterprises: Market Size By Region, 2015–2022 (USD Million)

Table 21 Large Enterprises: Market Size By Region, 2015–2022 (USD Million)

Table 22 Digital Assurance Market Size, By Vertical, 2015–2022 (USD Million)

Table 23 Government and Public Sector: Market Size By Region, 2015–2022 (USD Million)

Table 24 Banking, Financial Services, and Insurance: Market Size By Region, 2015–2022 (USD Million)

Table 25 Telecom, and Media and Entertainment: Market Size By Region, 2015–2022 (USD Million)

Table 26 Healthcare and Life Sciences: Market Size By Region, 2015–2022 (USD Million)

Table 27 Retail and Ecommerce: Market Size By Region, 2015–2022 (USD Million)

Table 28 Manufacturing: Market Size By Region, 2015–2022 (USD Million)

Table 29 Transportation and Logistics: Market Size By Region, 2015–2022 (USD Million)

Table 30 Others: Market Size, By Region, 2015–2022 (USD Million)

Table 31 Digital Assurance Market Size, By Region, 2015–2022 (USD Million)

Table 32 North America: Market Size By Country, 2015–2022 (USD Million)

Table 33 North America: Market Size By Testing Mode, 2015–2022 (USD Million)

Table 34 North America: Market Size By Testing Type, 2015–2022 (USD Million)

Table 35 North America: Market Size By Technology, 2015–2022 (USD Million)

Table 36 North America: Market Size By Organization Size, 2015–2022 (USD Million)

Table 37 North America: Market Size By Vertical, 2015–2022 (USD Million)

Table 38 United States: Digital Assurance Market Size, By Testing Mode, 2015–2022 (USD Million)

Table 39 United States: Market Size By Testing Type, 2015–2022 (USD Million)

Table 40 United States: Market Size By Technology, 2015–2022 (USD Million)

Table 41 United States: Market Size By Organization Size, 2015–2022 (USD Million)

Table 42 United States: Market Size By Vertical, 2015–2022 (USD Million)

Table 43 Canada: Digital Assurance Market Size, By Testing Mode, 2015–2022 (USD Million)

Table 44 Canada: Market Size By Testing Type, 2015–2022 (USD Million)

Table 45 Canada: Market Size By Technology, 2015–2022 (USD Million)

Table 46 Canada: Market Size By Organization Size, 2015–2022 (USD Million)

Table 47 Canada: Market Size By Vertical, 2015–2022 (USD Million)

Table 48 Europe: Market Size By Testing Mode, 2015–2022 (USD Million)

Table 49 Europe: Market Size By Testing Type, 2015–2022 (USD Million)

Table 50 Europe: Market Size By Technology, 2015–2022 (USD Million)

Table 51 Europe: Market Size By Organization Size, 2015–2022 (USD Million)

Table 52 Europe: Market Size By Vertical, 2015–2022 (USD Million)

Table 53 Asia Pacific: Digital Assurance Market Size, By Testing Mode, 2015–2022 (USD Million)

Table 54 Asia Pacific: Market Size By Testing Type, 2015–2022 (USD Million)

Table 55 Asia Pacific: Market Size By Technology, 2015–2022 (USD Million)

Table 56 Asia Pacific: Market Size By Organization Size, 2015–2022 (USD Million)

Table 57 Asia Pacific: Market Size By Vertical, 2015–2022 (USD Million)

Table 58 Latin America: Digital Assurance Market Size, By Testing Mode, 2015–2022 (USD Million)

Table 59 Latin America: Market Size By Testing Type, 2015–2022 (USD Million)

Table 60 Latin America: Market Size By Technology, 2015–2022 (USD Million)

Table 61 Latin America: Market Size By Organization Size, 2015–2022 (USD Million)

Table 62 Latin America: Market Size By Vertical, 2015–2022 (USD Million)

Table 63 Middle East and Africa: Digital Assurance Market Size, By Testing Mode, 2015–2022 (USD Million)

Table 64 Middle East and Africa: Market Size By Testing Type, 2015–2022 (USD Million)

Table 65 Middle East and Africa: Market Size By Technology, 2015–2022 (USD Million)

Table 66 Middle East and Africa: Market Size By Organization Size, 2015–2022 (USD Million)

Table 67 Middle East and Africa: Market Size By Vertical, 2015–2022 (USD Million)

Table 68 Market Ranking, 2017

Table 69 New Product/Service/Solution Launches, 2015–2017

Table 70 Business Expansions, 2017

Table 71 Mergers and Acquisitions, 2017

Table 72 Agreements and Partnerships, 2015–2017

List of Figures (44 Figures)

Figure 1 Digital Assurance Market Segmentation

Figure 2 Market Research Design

Figure 3 Breakdown of Primaries: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Digital Assurance Market, 2015–2022

Figure 8 Market Top 3 Segments

Figure 9 Market By Technology

Figure 10 Market Top 3 Verticals in Each Region

Figure 11 Market By Region

Figure 12 Growing Trend of Digital Transformation is Expected to Be Driving the Growth of the Market

Figure 13 Test Automation Segment is Estimated to Hold A Larger Market Share During the Forecast Period

Figure 14 Functional Testing Type is Estimated to Hold the Largest Market Share During the Forecast Period

Figure 15 Cloud and Analytics Technologies are Estimated to Hold the Largest Market Shares in 2017 and 2022, Respectively

Figure 16 Large Enterprises Segment is Expected to Hold A Larger Market Share During the Forecast Period

Figure 17 Retail and Ecommerce Vertical is Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 18 North America is Expected to Hold the Largest Market Share During the Forecast Period

Figure 19 Asia Pacific is Expected to Be the Hotspot Market to Invest in During the Forecast Period

Figure 20 Digital Assurance Market: Drivers, Restraints, Opportunities, and Challenges

Figure 21 Test Automation Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 22 Security Testing Type is Expected to Grow at the Highest CAGR During Forecast Period

Figure 23 Mobile Technology is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 24 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 25 Retail and Ecommerce Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 26 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 27 North America: Market Snapshot

Figure 28 Asia Pacific: Market Snapshot

Figure 29 Key Developments By Leading Players in the Digital Assurance Market During 2015–2017

Figure 30 Market Evaluation Framework

Figure 31 Capgemini: Company Snapshot

Figure 32 Capgemini: SWOT Analysis

Figure 33 Micro Focus: Company Snapshot

Figure 34 Micro Focus: SWOT Analysis

Figure 35 Accenture: Company Snapshot

Figure 36 Accenture: SWOT Analysis

Figure 37 Cognizant: Company Snapshot

Figure 38 Cognizant: SWOT Analysis

Figure 39 Cigniti: Company Snapshot

Figure 40 Cigniti: SWOT Analysis

Figure 41 Hexaware: Company Snapshot

Figure 42 SQS: Company Snapshot

Figure 43 TCS: Company Snapshot

Figure 44 Wipro: Company Snapshot

Growth opportunities and latent adjacency in Digital Assurance Market