Software-Defined Storage Market by Component [Platforms/Solutions (Software-Defined Server, Data Security & Compliance, Controller, Data Management, and Hypervisor), Services], Usage, Organization Size, Application Area - Global Forecast to 2021

[167 Pages Report] The Software Defined Storage market size is estimated to grow from USD 4.72 Billion in 2016 to USD 22.56 Billion by 2021, at a CAGR of 36.7%.

The SDS market has potential scope for growth in the years to come due to its advantages over traditional storage system both in terms of functionality and cost effectiveness. Exponential growth in volume of data across enterprises, rise in the software defined concept, and need for cost optimization in data management are some of the major driving factors for the market. The base year considered for the study is 2015 and the forecast period has been considered from 2016 to 2021. The objective of the study has been to define, describe, and forecast the global market on the basis of platform/solution, service, usage, organization size, application area, and region; analyze the opportunities in the market for the stakeholders, and detail the competitive landscape for the market leaders.

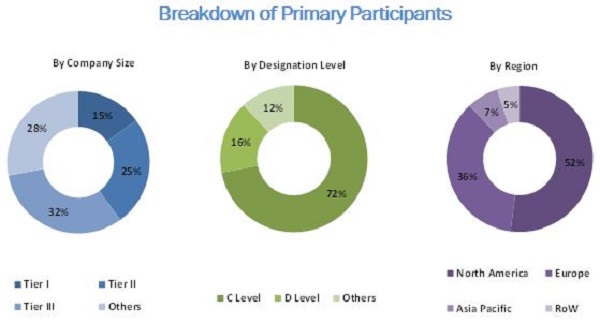

The research methodology used to estimate and forecast the Software Defined Storage market begins with the collection and analysis of data on key vendor revenues through secondary research such as Storage Network Industry Association (SNIA), Association for Computing Machinery (ACM), and Advanced Computing System Association (USENIX). The vendors software solution and service offerings are also analyzed to determine the market segmentation. The bottom-up procedure is used to arrive at the total market size of the global SDS market from the revenue of key players in the market. After estimating the total market size, it is split into segments and subsegments, which are then verified through primary research by conducting extensive interviews with key people, such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the accurate statistics for all segments and subsegments. The breakdown of profiles of primary is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The Software Defined Storage market ecosystem comprises standalone SDS providers with a server or platform such as VMware (California, U.S.), Fujitsu (Tokyo, Japan), and IBM (New York, U.S.); software technology vendors with server or platform such as Scality (California, U.S.), Nutanix (California, U.S.), and EMC (Massachusetts, U.S.); and hardware providers with server or platform such as Seagate (California, U.S.) and Intel (California, U.S.).

Target Audience

- IT service providers

- Hardware manufacturers

- System integrators

- Software providers

- Third-party suppliers

Scope of the Report

The research report segments the Software Defined Storage market into the following segments:

By Component:

- Platform/solution

- Service

By Software

- SDS server

- Data security and compliance software

- SDS controller software

- Data management

- Storage hypervisor

By Service:

- Consulting and training

- Support and maintenance

- Deployment and testing

- Training and consulting

- SDS service

By Usage

- Surveillance

- Data backup and disaster recovery

- Storage provisioning and high availability

- Others (DevOps)

By Organization Size:

- Small and Medium Businesses (SMBs)

- Large enterprises

By Industry Vertical:

- Education

- Telecom and ITES

- Logistics and warehouse

- Healthcare

- Media and entertainment

- Banking, Financial Services, and Insurance (BFSI)

- Others

By Region:

- North America

- Europe

- Asia-Pacific (APAC)

- Latin America

- Middle East And Africa (MEA)

Available Customizations

With the given Software Defined Storage market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the APAC market into Australia, India, and China

- Further breakdown of the North American market into the U.S. and others

- Further breakdown of the MEA market into Gulf Cooperation Council (GCC), Turkey, and others

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

The global Software Defined Storage market is expected to grow from USD 4.72 Billion in 2016 to USD 22.56 Billion by 2021, at a Compound Annual Growth Rate (CAGR) of 36.7%. The main driving factors for the growth of the market include exponentially growing data volume across enterprises, rise in the software defined concept, and need for cost optimization in data management.

Among SDS software, the SDS controller software simplifies and automates storage, abstracts underlying complex storage infrastructures, enables monitoring of stored data, and optimization of the entire datacenter infrastructure. This software is expected to gain the maximum traction in the market during the forecast period. The function of controller software allows it to automate network management while making it easier to integrate and administer business applications. Therefore, the demand for SDS controller software solution is rising continuously.

In the SDS services segment, the security, and support & maintenance services are expected to grow at the highest CAGR, whereas training and consulting is the largest contributor among all the services. Security service is expected to grow rapidly as it is required to mitigate software-defined data center threats and ensure secure sharing of data between business units, partners, and customers, while alleviating lateral moving threats and advanced attacks.

Among application area segment, the telecom and ITES sector is expected to be the second largest contributor during the forecast period. This sector needs to store large volumes of data as every day new data is generated that needs to be stored and kept secured. The telecom and IT sector is hugely customer centric and customer service plays a significant role in retaining customers. These customer service centers need to have access to customer information and store the new generating data. SDS solution fulfills the storage and management need of the ever-increasing data volumes in the sector.

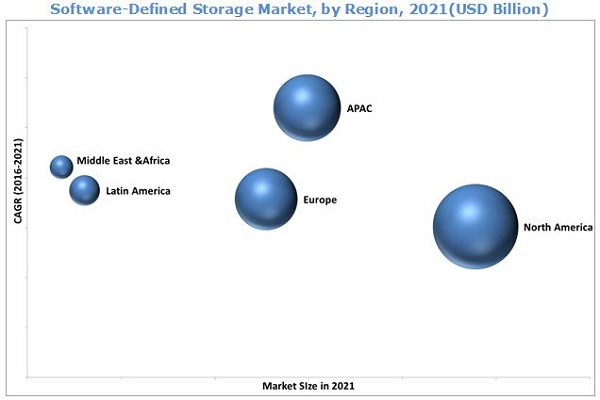

Asia-Pacific (APAC) is expected to be the fastest growing region during the forecast period, as the region is expecting technological advancement with the increasing IT number of companies. Also, the Small and Medium Enterprises (SMEs) in the region are keen on reducing their IT spending by seeking storage virtualization facilities. North America is expected to lead the Software Defined Storage market as the governments in the region have initiated many projects related to digitalization of their countries, which is making the region the largest adopter of SDS solutions.

The absence of skilled workforce for effective deployment of SDS infrastructure and security & reliability concerns in virtual cloud storage are the factors hindering the growth of the Software Defined Storage market. There is a need to educate the customers and define the actual importance of SDS. SDS vendors need to offer improved solutions that reduce the risk of storing the data on cloud.

Dell, EMC Corporation (Massachusetts, U.S.), Fujitsu (Tokyo, Japan), HPE (California, U.S.) , IBM (New York, U.S.), Citrix (Florida, U.S.), NetApp (California, U.S.), Scality (California, U.S.), VMware (California, U.S.), and Western Digital Corporation (California, U.S.) are identified as leaders in the Software Defined Storage market, whereas Atlantis (California, U.S.), DataCore (Florida, U.S.), Ericsson (Stockholm, Sweden), Intel (California, U.S.), Maxta (California, U.S.), Microsoft (Washington, U.S.), Nexenta (California, U.S.), Nutanix (California, U.S.) Pivot3 (Texas, U.S.), and SwiftStack (California, U.S.) are identified as key innovators in the market. The companies have majorly adopted the strategy of partnership, alliance, and collaboration to achieve growth in the Software Defined Storage market. The strategy of new product launches & enhancements and mergers & acquisitions accounted for 41% and 15%, respectively, of the total strategic developments, in the global SDS market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Software Defined Storage Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.1 Markets Covered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Attractive Market Opportunities in the Software Defined Storage Market

4.2 Market: Top Three Solution Segments

4.3 Market Analysis Across Top Three Regions and Verticals in 2016

4.4 Asia-Pacific is Expected to Showcase the Highest Growth Rate During the Forecast Period

4.5 Life Cycle Analysis, By Region

5 Software Defined Storage Market Overview (Page No. - 35)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 By Component

5.3.1.1 By Platform/Solution

5.3.1.2 By Service

5.3.2 By Usage Type

5.3.3 By Organization Size

5.3.4 By Application Area

5.3.5 By Region

5.4 Market Dynamic

5.4.1 Drivers

5.4.1.1 Exponential Growth in the Volume of Data Across Enterprises

5.4.1.2 Rise of Software-Defined(Sd) Concept

5.4.1.3 Cost Optimization in Managing Hardware

5.4.2 Restraints

5.4.2.1 Absence of Skilled Workforce for Effective Deployment of SDS Infrastructure

5.4.2.2 Security and Reliability Concerns in Virtual Cloud Storage

5.4.3 Opportunities

5.4.3.1 Downtime Avoidance of Storage Infrastructure

5.4.3.2 Competitive Market Environment

5.4.4 Challenges

5.4.4.1 Avoiding Vendor Lock in

5.4.4.2 Data Management for Enterprises

6 Software Defined Storage Market: Industry Trends (Page No. - 46)

6.1 Introduction

6.2 Standards and Regulations

6.3 SDS Value Chain

6.3.1 Market Value-Chain Analysis

7 Market Analysis, By Component (Page No. - 51)

7.1 Introduction

7.2 Platforms/Solutions

7.2.1 Software-Defined Storage Server

7.2.2 Data Security and Compliance Software

7.2.3 Software-Defined Storage Controller Software

7.2.4 Data Management

7.2.5 Storage Hypervisor

7.3 Services

7.3.1 Support and Maintenance

7.3.2 Deployment and Testing

7.3.3 Training and Consulting

7.3.4 Security

7.3.5 Others

8 Software Defined Storage Market Analysis, By Usage (Page No. - 75)

8.1 Introduction

8.2 Surveillance

8.3 Data-Backup and Disaster-Recovery

8.4 Storage Provisioning and High Availability

8.5 Others

9 Market Analysis, By Organization Size (Page No. - 82)

9.1 Introduction

9.2 Small and Medium Enterprises (SMES)

9.3 Large Enterprises

10 Software Defined Storage Market Analysis, By Application Area (Page No. - 86)

10.1 Introduction

10.2 Education

10.3 Telecom and Ites

10.4 Logistics and Warehouse

10.5 Healthcare

10.6 Media and Entertainment

10.7 Banking, Financial Services, and Insurance (BFSI)

10.8 Others

11 Geographic Analysis (Page No. - 93)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia-Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Competitive Landscape (Page No. - 113)

12.1 Overview

12.2 Competitive Situation and Trends

12.2.1 New Product Launches and Enhancements

12.2.2 Partnerships, Agreements and Collaboration

12.2.3 Mergers and Acquisitions

12.2.4 Product Portfolio Comparison

13 Company Profiles (Page No. - 118)

13.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

13.2 Dell

13.3 EMC Corporation*

13.4 Fujitsu Ltd.

13.5 Hewlett Packard Enterprise Development LP

13.6 International Business Machines Corporation

13.7 Citrix Systems Inc.

13.8 Netapp, Inc.

13.9 Seagate Technology and Scality*

13.10 Vmware Inc.

13.11 Western Digital Corporation

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Key Innovators (Page No. - 146)

14.1 Atlantis Computing, Inc.

14.2 Datacore Software Corporation

14.3 Ericsson

14.4 Intel Corporation

14.5 Maxta, Inc.

14.6 Microsoft

14.7 Nexenta System

14.8 Nutanix

14.9 Pivot3

14.10 Swiftstack Inc.

15 Appendix (Page No. - 156)

15.1 Industry Excerpts

15.2 Additional Competitive Analysis

15.2.1 New Product Launches and Enhancements

15.2.2 Partnerships, Agreements, and Collaborations

15.3 Discussion Guide

15.4 Knowledge Store: Marketsandmarkets Subscription Portal

15.5 Introducing RT: Real Time Market Intelligence

15.6 Available Customizations

15.7 Related Reports

List of Tables (101 Tables)

Table 1 Global Software Defined Storage Market Size, 20162021 (USD Billion)

Table 2 Major Governance, Risk, and Compliance Standards and Regulations

Table 3 Market Size, By Component, 20142021 (USD Million)

Table 4 Market Size, By Platforms/Solutions, 20142021 (USD Million)

Table 5 Software-Defined Storage Server: Market Size, By Usage, 20142021 (USD Million)

Table 6 Software-Defined Storage Server: Market Size, By Organization Size, 20142021 (USD Million)

Table 7 Software-Defined Storage Server: Market Size, By Application Area, 20142021 (USD Million)

Table 8 Software-Defined Storage Server: Market Size, By Region, 20142021 (USD Million)

Table 9 Data Security and Compliance Software: Market Size, By Usage, 20142021 (USD Million)

Table 10 Data Security and Compliance Software: Market Size, By Organization Size, 20142021 (USD Million)

Table 11 Data Security and Compliance Software: Market Size, By Application Area, 20142021 (USD Million)

Table 12 Data Security and Compliance Software: Market Size, By Region, 20142021 (USD Million)

Table 13 Software-Defined Storage Controller Software: Market Size, By Usage, 20142021 (USD Million)

Table 14 Software-Defined Storage Controller Software: Market Size, By Organization Size, 20142021 (USD Million)

Table 15 Software-Defined Storage Controller Software: Market Size, By Application Area, 20142021 (USD Million)

Table 16 Software-Defined Storage Controller Software: Market Size, By Region, 20142021 (USD Million)

Table 17 Data Management: Market Size, By Usage, 20142021 (USD Million)

Table 18 Data Management: Market Size, By Organization Size, 20142021 (USD Million)

Table 19 Data Management: Market Size, By Application Area, 20142021 (USD Million)

Table 20 Data Management: Market Size, By Region, 20142021 (USD Million)

Table 21 Storage Hypervisor: Market Size, By Usage, 20142021 (USD Million)

Table 22 Storage Hypervisor: Market Size, By Organization Size, 20142021 (USD Million)

Table 23 Storage Hypervisor: Market Size, By Application Area, 20142021 (USD Million)

Table 24 Storage Hypervisor: Market Size, By Region, 20142021 (USD Million)

Table 25 Software Defined Storage Market Size, By Service, 20142021 (USD Million)

Table 26 Support and Maintenance: Market Size, By Usage, 20142021 (USD Million)

Table 27 Support and Maintenance: Market Size, By Organization Size, 20142021 (USD Million)

Table 28 Support and Maintenance: Market Size, By Application Area, 20142021 (USD Million)

Table 29 Support and Maintenance: Market Size, By Region, 20142021 (USD Million)

Table 30 Deployment and Testing: Market Size, By Usage, 20142021 (USD Million)

Table 31 Deployment and Testing: Market Size, By Organization Size, 20142021 (USD Million)

Table 32 Deployment and Testing: Market Size, By Application Area, 20142021 (USD Million)

Table 33 Deployment and Testing: Market Size, By Region, 20142021 (USD Million)

Table 34 Training and Consulting: Market Size, By Usage, 20142021 (USD Million)

Table 35 Training and Consulting: Market Size, By Organization Size, 20142021 (USD Million)

Table 36 Training and Consulting: Market Size, By Application Area, 20142021 (USD Million)

Table 37 Training and Consulting: Market Size, By Region, 20142021 (USD Million)

Table 38 Security: Market Size, By Usage, 20142021 (USD Million)

Table 39 Security: Market Size, By Organization Size, 20142021 (USD Million)

Table 40 Security: Market Size, By Application Area, 20142021 (USD Million)

Table 41 Security: Market Size, By Region, 20142021 (USD Million)

Table 42 Others: Market Size, By Usage, 20142021 (USD Million)

Table 43 Others: Market Size, By Organization Size, 20142021 (USD Million)

Table 44 Others: Market Size, By Application Area, 20142021 (USD Million)

Table 45 Others: Market Size, By Region, 20142021 (USD Million)

Table 46 Software Defined Storage Market Size, By Usage, 20142021 (USD Million)

Table 47 Surveillance: Market Size, By Organization Size, 20142021 (USD Million)

Table 48 Surveillance: Market Size, By Application Area, 20142021 (USD Million)

Table 49 Data-Backup and Disaster-Recovery: Market Size, By Organization Size, 20142021 (USD Million)

Table 50 Data-Backup and Disaster-Recovery: Market Size, By Application Area, 20142021 (USD Million)

Table 51 Storage Provisioning and High Availability: Market Size, By Organization Size, 20142021 (USD Million)

Table 52 Storage Provisioning and High Availability: Market Size, By Application Area, 20142021 (USD Million)

Table 53 Others: Market Size, By Organization Size, 20142021 (USD Million)

Table 54 Others: Market Size, By Application Area, 20142021 (USD Million)

Table 55 Software Defined Storage Market Size, By Organization Size, 20142021 (USD Million)

Table 56 Small and Medium Businesses: Market Size, By Region, 20142021 (USD Million)

Table 57 Large Enterprises: Market Size, By Region, 20142020 (USD Million)

Table 58 Software Defined Storage Market Size, By Application Area, 20142021 (USD Million)

Table 59 Education: Market Size, By Region, 20142021 (USD Million)

Table 60 Telecom and Ites: Market Size, By Region, 20142021 (USD Million)

Table 61 Logistics and Warehouse: Market Size, By Region, 20142021 (USD Million)

Table 62 Healthcare: Market Size, By Region, 20142021 (USD Million)

Table 63 Media and Entertainment: Market Size, By Region, 20142021 (USD Million)

Table 64 Banking, Financial Services, and Insurance : Market Size, By Region, 20142021 (USD Million)

Table 65 Others: Market Size, By Region, 20142021 (USD Million)

Table 66 Software Defined Storage Market Size, By Region, 2014-2021 (USD Million)

Table 67 North America: Market Size, By Component, 2014-2021 (USD Million)

Table 68 North America: Market Size, By Platform/Solution, 2014-2021 (USD Million)

Table 69 North America: Market Size, By Service, 2014-2021 (USD Million)

Table 70 North America: Market Size, By Usage, 2014-2021 (USD Million)

Table 71 North America: Market Size, By Organization Size, 2014-2021 (USD Million)

Table 72 North America: Market Size, By Application Area, 2014-2021 (USD Million)

Table 73 Europe: Software Defined Storage Market Size, By Component, 2014-2021 (USD Million)

Table 74 Europe: Market Size, By Platform/Solution, 2014-2021 (USD Million)

Table 75 Europe: Market Size, By Service, 2014-2021 (USD Million)

Table 76 Europe: Market Size, By Usage, 2014-2021 (USD Million)

Table 77 Europe: Market Size, By Organization Size, 2014-2021 (USD Million)

Table 78 Europe: Market Size, By Application Area, 2014-2021 (USD Million)

Table 79 Asia-Pacific: Software Defined Storage Market Size, By Component, 2014-2021 (USD Million)

Table 80 Asia-Pacific: Market Size, By Platform/Solution, 2014-2021 (USD Million)

Table 81 Asia-Pacific: Market Size, By Service, 2014-2021 (USD Million)

Table 82 Asia-Pacific: Market Size, By Usage, 2014-2021 (USD Million)

Table 83 Asia-Pacific: Market Size, By Organization Size, 2014-2021 (USD Million)

Table 84 Asia-Pacific: Market Size, By Application Area, 2014-2021 (USD Million)

Table 85 Middle East and Africa: Software Defined Storage Market Size, By Component, 2014-2021 (USD Million)

Table 86 Middle East and Africa: Market Size, By Platform/Solution, 2014-2021 (USD Million)

Table 87 Middle East and Africa: Market Size, By Service, 2014-2021 (USD Million)

Table 88 Middle East and Africa: Market Size, By Usage, 2014-2021 (USD Million)

Table 89 Middle East and Africa: Market Size, By Organization Size, 2014-2021 (USD Million)

Table 90 Middle East and Africa: Market Size, By Application Area, 2014-2021 (USD Million)

Table 91 Latin America: Software Defined Storage Market Size, By Component, 2014-2021 (USD Million)

Table 92 Latin America: Market Size, By Platform/Solution, 2014-2021 (USD Million)

Table 93 Latin America: Market Size, By Service, 2014-2021 (USD Million)

Table 94 Latin America: Market Size, By Usage, 2014-2021 (USD Million)

Table 95 Latin America: Market Size, By Organization Size, 2014-2021 (USD Million)

Table 96 Latin America: Software Defined Storage Market Size, By Application Area, 2014-2021 (USD Million)

Table 97 New Product Launches and Enhancements, 20142016

Table 98 Partnerships, Agreements, and Collaborations, 20142016

Table 99 Mergers and Acquisitions, 20142016

Table 100 New Product Launches and Enhancements, 20142016

Table 101 Partnerships, Agreements, and Collaborations, 20142016

List of Figures (58 Figures)

Figure 1 Global Software Defined Storage Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Market Breakdown and Data Triangulation

Figure 5 Market Size, 20142021 (USD Million)

Figure 6 Software-Defined Storage Platforms/Solutions Market Snapshot (2016 vs 2021)

Figure 7 Software-Defined Storage Service Market Snapshot (2016 vs 2021)

Figure 8 Global Market Analysis By Platforms/Solutions, 2016

Figure 9 North America is Expected to Showcase the Highest Adoption in the Market

Figure 10 North American Enterprises are Investing Substantial Share of Their Revenue in Software-Defined Storage Platforms/Solutions and Services

Figure 11 Global Software Defined Storage Market is Expected to Grow Significantly During the Forecast Period

Figure 12 Data Security and Compliance Software, Storage Hypervisor, and Storage-Defined Controller Software are the Most Crucial Segments in Terms of Revenue Generation for SDS Vendors

Figure 13 BFSI, Healthcare, and Energy & Utility Sectors are Expected to Be the Major Areas of Investment Across North America, Europe, and Asia-Pacific

Figure 14 Software-Defined Storage Adoption in Asia-Pacific Driven By Rapid Digitalization and Advancements in It Infrastructure

Figure 15 North America and Europe Have Been the Major Contributors in Adoption and Developments of the Market

Figure 16 Software-Defined Storage Evolution From 1920 to 2015

Figure 17 Market Segmentation: By Component

Figure 18 Market Segmentation: By Platforms/Solutions

Figure 19 Market Segmentation: By Service

Figure 20 Market Segmentation: By Usage Type

Figure 21 Market Segmentation: By Organization Size

Figure 22 Market Segmentation: By Vertical

Figure 23 Market Segmentation: By Region

Figure 24 Market Drivers, Restraints, Opportunities, and Challenges

Figure 25 Market Value Chain Analysis

Figure 26 Software-Defined Storage Software and Service Types

Figure 27 Global Software-Defined Storage Platforms/Solutions and Service Adoption Trend

Figure 28 SDS Controller Software is Essentially the Most Critical Solution Component of Software-Defined Storage Offering

Figure 29 Support and Maintenance Services Segment is Expected to Lead the Software Defined Storage Market With Increase in Adoption of Software-Defined Storage Solutions

Figure 30 Storage Provisioning and High Availability is Expected to Showcase the Highest CAGR

Figure 31 Large Enterprises are Expected to Showcase the Highest Software Defined Storage Adoption, While SMES are Projected to Highest Growth Rate

Figure 32 Telecom & ITs and Healthcare Application Areas are Expected to Have the Highest CAGR During the Forecast Period

Figure 33 Asia-Pacific is Projected to Exhibit the Highest Growth in the Software Defined Storage Market

Figure 34 North America and Europe are the Most Attractive Markets for Investments, 2016-2021

Figure 35 Asia-Pacific Expected to Grow at the Highest CAGR, 2016-2021

Figure 36 North America Market Snapshot

Figure 37 Europe Market Snapshot

Figure 38 Asia-Pacific Market Snapshot

Figure 39 Companies Adopted Partnership and Agreement as the Key Growth Strategy Over the Last Three Years

Figure 40 Market Evaluation Framework

Figure 41 Battle for Market Share: Partnerships and Collaboration Was the Key Strategy for the Growth of the SDS Market

Figure 42 Product Portfolio Comparison, 20142016

Figure 43 Geographic Revenue Mix of Top 4 Players

Figure 44 Dell: SWOT Analysis

Figure 45 EMC Corporation: Company Snapshot

Figure 46 EMC Corporation: SWOT Analysis

Figure 47 Fujitsu Ltd.: Company Snapshot

Figure 48 Fujitsu: SWOT Analysis

Figure 49 Hewlett Packard Enterprise Development LP: Company Snapshot

Figure 50 Hewlett Packard Enterprise: SWOT Analysis

Figure 51 International Business Machines Corporation: Company Snapshot

Figure 52 IBM: SWOT Analysis

Figure 53 Citrix Systems Inc.: Company Snapshot

Figure 54 Netapp, Inc.: Company Snapshot

Figure 55 Seagate Technologies: Company Snapshot

Figure 56 Scality: Company Snapshot

Figure 57 Vmware: Company Snapshot

Figure 58 Western Digital Corporation: Company Snapshot

Growth opportunities and latent adjacency in Software-Defined Storage Market