Saturated Polyester Resin Market by Type (Liquid SPR and Solid SPR), Application (Powder Coatings, Industrial Paints, Coil & Can Coatings, Automotive Paints, Flexible Packaging, and 2k PU Coatings), and by Region - Global Forecasts to 2021

[129 Pages Report] The global saturated polyester resin market is projected to reach USD 4.77 Billion by 2021, registering a CAGR of 5.83% from 2016 to 2021. The market is witnessing moderate growth owing to increasing applications, technological advancements, and growing demand for these resins in the Asia-Pacific and Europe. Saturated polyester resins are largely used in powder coating applications. The rapid growth of the market is driven by environmental concerns and increasingly stringent regulations.

Years considered for this report

2014 Historical Year

2015 Base Year

2016 Estimated Year

2021 Projected Year

Research Methodology

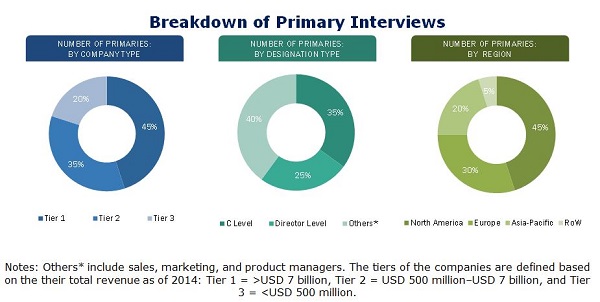

This study aims to estimate the market for saturated polyester resin for 2016, and project its demand by 2021. It provides a detailed qualitative and quantitative analysis of the market. Various secondary sources, such as directories, industry journals, and databases, have been used to identify and collect information useful for an extensive commercial study of the saturated polyester resin market. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information, as well as assess prospects of the saturated polyester resin market.

To know about the assumptions considered for the study, download the pdf brochure

The value chain of saturated polyester resin begins with raw material manufacturers, followed by saturated polyester resin manufacturers, paints & coatings manufacturers, and end-use industries. Maximum value is added during the coating manufacturing stage, as the coating process is proprietary, and protected by patents.

Target audience:

- Manufacturers of saturated polyester resin

- Manufacturers of resins, additives, pigments, and other feedstock chemical manufacturers

- Manufacturers of paints and coatings

- Manufacturers in end-use industries, such as powder coatings, industrial paints, coil & can coatings, automotive paints, flexible packaging, and 2k PU coatings, among others

- Traders, distributors, and suppliers of technology, chemicals, or components

- Regional chemical manufacturers associations and general radiation curable associations

- Government and regional agencies and research organizations

The study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments and the competitive landscape of the market.

Scope of the Report:

The saturated polyester resin market has been covered in detail in this report. The current market demand and forecasts have also been included to provide a complete picture. The saturated polyester resin market is segmented as follows:

On the basis of Type:

- Liquid saturated polyester resin

- Solid saturated polyester resin

- Solid carboxyl-terminated saturated polyester resin

- Solid hydroxyl-terminated saturated polyester resin

On the basis of Application:

- Powder Coatings

- Industrial Paints

- Coil & Can Coatings

- Automotive Paints

- Flexible Packaging

- 2k PU Coatings

- Other Applications

On the basis of Region:

- Asia-Pacific

- Europe

- North America

- RoW

The market is further analyzed according to key countries in each of these regions.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for this report:

Product Analysis

- A product matrix that provides a detailed comparison of the product portfolios of each company

Regional Analysis

- Further breakdown of the saturated polyester resin market in Rest of Asia-Pacific into Australia, New Zealand, and others

- Further breakdown of the RoW saturated polyester resin market into Latin America, the Middle East & Africa

The global saturated polyester resin market is projected to reach USD 4.77 Billion by 2021, growing at a CAGR of 5.83% from 2016 to 2021. The key drivers of the market are environmental concerns, growing awareness, stringent regulations for VOC emissions, and high performance of saturated polyester resin owing to its superior mechanical properties.

Solid saturated polyester resins are used for manufacturing powder coatings for the automotive industry, home appliances, industrial machineries, and OEMs, and are being widely used in the European powder coatings industry and witnessing rapid growth in Asia-Pacific.

The powder coating segment will continue to account for the highest demand for saturated polyester resin because powder coatings based on saturated polyester resin have good weather resistance, excellent impact strength, and adhesion to metals (even under humid conditions), and are therefore suitable for uses, such as in exterior and interior architectural applications, coating machinery, domestic appliances, steel furniture, and garden tools.

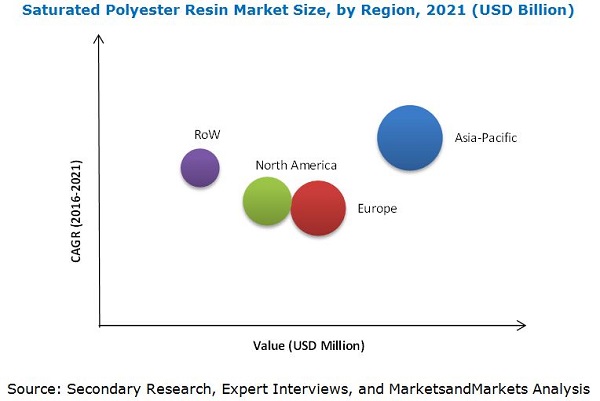

Asia-Pacific is the largest market for saturated polyester resin, followed by Europe and North America. The market in Asia-Pacific is estimated to record high growth owing to increasing demand from powder coatings and coil & can coating applications.

Factors restraining market growth include the inability of saturated polyester resin to achieve cost competitiveness with other substitute resins such as acrylic, vinyl-ester resin, and unsaturated polyester resin. Moreover, the saturated polyester resin market is moderately consolidated and competitive, with a number of small- to medium-scale players, especially in China.

The market is dominated by various players, depending on their core competencies. The key players in this market are Royal DSM N.V. (Netherlands), Allnex Belgium SA/NV (Belgium), Arkema S.A. (France), Nuplex Industries (New Zealand), Stepan Company (U.S.), Evonik Industries (Germany), Nippon Gohsei (Japan), Covestro AG (Germany), and Megara Resins (Anastassios Fanis S.A.) (Greece).

Stepan Company has established partnerships with a network of leading chemical distributors to effectively serve its customers worldwide. Expertise in chemical manufacturing and global reach are its driving factors that aid it to build long-term relationship with customers. The companys global chemical manufacturing capabilities include sulfonation, neutralization, and blends; esterification; amidation; quaternization; alkoxylation; and oxidation.

In 2013, Stepan acquired Bayer MaterialSciences North American polyester resins business. This acquisition provides a significant line extension to its core business. The acquired Columbus, Georgia facility provides 20 thousand tons of capacity to the company. The acquired business has been integrated into Stepans existing polymer business, which complements its three existing innovation research centers and four polyester polyol manufacturing facilities.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Stakeholder

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Key Data From Secondary Sources

2.1.2 Key Data From Primary Sources

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Saturated Polyester Resin Market

4.2 Saturated Polyester Resin Market, By Type

4.3 Saturated Polyester Resin Market in Asia-Pacific

4.4 Saturated Polyester Resin Market Share, By Region

4.5 Saturated Polyester Resin Market: Major Country Markets

4.6 Saturated Polyester Resin Market Attractiveness, By Application (2021)

4.7 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Types of Saturated Polyester Resins and Their Applications

5.2.1 Types of Saturated Polyester Resins and Their Applications

5.3 Evolution of Saturated Polyester Resin Market

5.4 Market Segmentation

5.4.1 By Type

5.4.2 By Application

5.5 Market Dynamics

5.5.1 Drivers

5.5.1.1 Environmental Concerns, Growing Awareness, and Stringent Regulations

5.5.1.2 High Performance Due to Superior Mechanical Properties

5.5.2 Restraints

5.5.2.1 Relatively Expensive Than Other Competitive Resins

5.5.3 Opportunities

5.5.3.1 Southeast Asia Presents Opportunities for Saturated Polyester Resin Manufacturers

5.5.3.2 Trend Toward Epoxy-Free Non-Bpa Can Coatings

5.5.4 Challenges

5.5.4.1 Growing Price Cutting Measures

6 Industry Trends (Page No. - 42)

6.1 Introduction

6.2 Value-Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Saturated Polyester Resin Market, By Type (Page No. - 46)

7.1 Introduction

7.2 Saturated Polyester Resin Market, By Type

7.3 Liquid Saturated Polyester Resin

7.4 Solid Saturated Polyester Resin

7.4.1 Solid Carboxyl-Terminated Saturated Polyester Resin

7.4.2 Solid Hydroxyl-Terminated Saturated Polyester Resin

8 Saturated Polyester Resin Market, By Application (Page No. - 53)

8.1 Introduction

8.1.1 Powder Coatings

8.1.2 Industrial Paints

8.1.3 Coil & Can Coatings

8.1.4 Automotive Paints

8.1.5 Flexible Packaging

8.1.6 2k Pu Coatings

8.1.7 Other Applications

9 Saturated Polyester Resin Market, By Region (Page No. - 64)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 India

9.2.3 Japan

9.2.4 South Korea

9.2.5 Thailand

9.2.6 Indonesia

9.2.7 Malaysia

9.2.8 Rest of Asia-Pacific

9.3 Europe

9.3.1 Germany

9.3.2 Italy

9.3.3 France

9.3.4 Turkey

9.3.5 U.K.

9.3.6 Rest of Europe

9.4 North America

9.4.1 U.S.

9.4.2 Canada

9.4.3 Mexico

9.5 RoW

9.5.1 The Middle East

9.5.2 Russia

9.5.3 Brazil

9.5.4 Others

10 Competitive Landscape (Page No. - 97)

10.1 Overview

10.2 Competitive Situations and Trends

10.3 New Product Launches

10.4 Mergers & Acquisitions

10.5 Investment & Expansions

10.6 Joint Venture

11 Company Profiles (Page No. - 102)

11.1 Introduction

11.2 Royal DSM N.V.

11.2.1 Business Overview

11.2.2 Products and Services

11.2.3 SWOT Analysis

11.2.4 MnM View

11.3 Allnex Belgium SA/NV (Formerly Cytec)

11.3.1 Business Overview

11.3.2 Products and Services

11.3.3 Recent Developments

11.3.4 SWOT Analysis

11.3.5 MnM View

11.4 Arkema S.A.

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 Recent Developments

11.4.4 SWOT Analysis

11.4.5 MnM View

11.5 Nuplex Industries Ltd.

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 SWOT Analysis

11.5.4 MnM View

11.6 Stepan Company

11.6.1 Business Overview

11.6.2 Products and Services

11.6.3 Recent Developments

11.6.4 SWOT Analysis

11.6.5 MnM View

11.7 Evonik Industries

11.7.1 Business Overview

11.7.2 Products and Services

11.7.3 Recent Developments

11.7.4 SWOT Analysis

11.7.5 MnM View

11.8 Nippon Gohsei

11.8.1 Business Overview

11.8.2 Products and Services

11.8.3 SWOT Analysis

11.9 Covestro AG (Formerly Bayer Materialscience)

11.9.1 Business Overview

11.9.2 Products and Services

11.9.3 SWOT Analysis

11.10 Megara Resins (Anastassios Fanis S.A.)

11.10.1 Business Overview

11.10.2 Products and Services

11.10.3 Recent Development

12 Appendix (Page No. - 123)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables (77 Tables)

Table 1 Saturated Polyester Resin Market to Register Moderate Growth Between 2016 and 2021

Table 2 Saturated Polyester Resin Market Size, By Type, 20142021 (USD Million)

Table 3 Saturated Polyester Resin Market Size, By Type, 20142021 (Thousand Ton)

Table 4 Liquid Saturated Polyester Resin Market Size, By Region, 20142021 (USD Million)

Table 5 Liquid Saturated Polyester Resin Market Size, By Region, 20142021 (Thousand Ton)

Table 6 Solid Saturated Polyester Resins Market Size, By Type, 20142021 (USD Million)

Table 7 Solid Saturated Polyester Resins Market Size, By Type, 20142021 (Thousand Ton)

Table 8 Solid Saturated Polyester Resins Market Size, By Region, 20142021 (USD Million)

Table 9 Solid Saturated Polyester Resins Market Size, By Region, 20142021 (Thousand Ton)

Table 10 Solid Carboxyl-Terminated Saturated Polyester Resins Market Size, By Region, 20142021 (USD Million)

Table 11 Solid Carboxyl-Terminated Saturated Polyester Resin Market Size, By Region, 20142021 (Thousand Ton)

Table 12 Solid Hydroxyl-Terminated Saturated Polyester Resins Market Size, By Region, 20142021 (USD Million)

Table 13 Solid Hydroxyl-Terminated Saturated Polyester Resin Market Size, By Region, 20142021 (Thousand Ton)

Table 14 Saturated Polyester Resin Market Size, By Application, 20142021 (USD Million)

Table 15 Saturated Polyester Resin Market Size, By Application, 20142021 (Thousand Ton)

Table 16 Saturated Polyester Resin Market Size in Powder Coating Application, By Region, 20142021 (USD Million)

Table 17 Saturated Polyester Resin Market Size in Powder Coating Application, By Region, 20142021 (Thousand Ton)

Table 18 Saturated Polyester Resin Market Size in Industrial Paints Application, By Region, 20142021 (USD Million)

Table 19 Saturated Polyester Resin Market Size in Industrial Paints Application, By Region, 20142021 (Thousand Ton)

Table 20 Saturated Polyester Resin Market Size in Coil & Can Coatings Application, By Region, 20142021 (USD Million)

Table 21 Saturated Polyester Resin Market Size in Coil & Can Coatings Application, By Region, 20142021 (Thousand Ton)

Table 22 Saturated Polyester Resin Market Size in Automotive Paints Application, By Region, 20142021 (USD Million)

Table 23 Saturated Polyester Resin Market Size in Coil & Can Coatings Application, By Region, 20142021 (Thousand Ton)

Table 24 Saturated Polyester Resin Market Size in Flexible Packaging Application, By Region, 20142021 (USD Million)

Table 25 Saturated Polyester Resin Market Size in Flexible Packaging Application, By Region, 20142021 (Thousand Ton)

Table 26 Saturated Polyester Resin Market Size in Two-Component Polyurethane Coatings Application, By Region, 20142021 (USD Million)

Table 27 Saturated Polyester Resin Market Size in Two-Component Polyurethane Coatings Application, By Region, 20142021 (Thousand Ton)

Table 28 Saturated Polyester Resin Market Size in Other Applications, By Region, 20142021 (USD Million)

Table 29 Saturated Polyester Resin Market Size in Other Applications, By Region, 20142021 (Thousand Ton)

Table 30 Saturated Polyester Resin Market Size, By Region, 20142021 (USD Million)

Table 31 Saturated Polyester Resin Market Size, By Region, 20142021 (Thousand Ton)

Table 32 Asia-Pacific: Saturated Polyester Resin Market Size, By Country, 20142021 (USD Million)

Table 33 Asia-Pacific: Saturated Polyester Resin Market Size, By Country, 20142021 (Thousand Ton)

Table 34 Asia-Pacific: Saturated Polyester Resin Market Size, By Type, 20142021 (USD Million)

Table 35 Asia-Pacific: Saturated Polyester Resin Market Size, By Type, 20142021 (Thousand Ton)

Table 36 Asia-Pacific: Saturated Polyester Resin Market Size, By Application, 20142021 (USD Million)

Table 37 Asia-Pacific: Saturated Polyester Resin Market Size, By Application, 20142021 (Thousand Ton)

Table 38 Europe: Saturated Polyester Resin Market Size, By Country, 20142021 (USD Million)

Table 39 Europe: Saturated Polyester Resin Market Size, By Country, 20142021 (Thousand Ton)

Table 40 Europe: Saturated Polyester Resin Market Size, By Type, 20142021 (USD Million)

Table 41 Europe: Saturated Polyester Resin Market Size, By Type, 20142021 (Thousand Ton)

Table 42 Europe: Saturated Polyester Resin Market Size, By Application, 20142021 (USD Million)

Table 43 Europe: Saturated Polyester Resin Market Size, By Application, 20142021 (Thousand Ton)

Table 44 Germany: Saturated Polyester Resin Market Size, By Application, 20142021 (USD Million)

Table 45 Germany: Saturated Polyester Resin Market Size, By Application,20142021 (Thousand Ton)

Table 46 Italy: Saturated Polyester Resin Market Size, By Application, 20142021 (USD Million)

Table 47 Italy: Saturated Polyester Resin Market Size, By Application, 20142021 (Thousand Ton)

Table 48 France: Saturated Polyester Resin Market Size, By Application, 20142021 (USD Million)

Table 49 France: Saturated Polyester Resin Market Size, By Application, 20142021 (Thousand Ton)

Table 50 Turkey: Saturated Polyester Resin Market Size, By Application, 20142021 (USD Million)

Table 51 Turkey: Saturated Polyester Resin Market Size, By Application, 20142021 (Thousand Ton)

Table 52 U.K.: Saturated Polyester Resin Market Size, By Application, 20142021 (USD Million)

Table 53 U.K.: Saturated Polyester Resin Market Size, By Application, 20142021 (Thousand Ton)

Table 54 Rest of Europe: Saturated Polyester Resin Market Size, By Application, 20142021 (USD Million)

Table 55 Rest of Europe: Saturated Polyester Resin Market Size, By Application, 20142021 (Thousand Ton)

Table 56 North America: Saturated Polyester Resin Market Size, By Country, 20142021 (USD Million)

Table 57 North America: Saturated Polyester Resin Market Size, By Country, 20142021 (Thousand Ton)

Table 58 North America: Saturated Polyester Resin Market Size, By Type, 20142021 (USD Million)

Table 59 North America: Saturated Polyester Resin Market Size, By Type, 20142021 (Thousand Ton)

Table 60 North America: Saturated Polyester Resin Market Size, By Application, 20142021 (USD Million)

Table 61 North America: Saturated Polyester Resin Market Size, By Application, 20142021 (Thousand Ton)

Table 62 U.S.: Saturated Polyester Resin Market Size, By Application, 20142021 (USD Million)

Table 63 U.S.: Saturated Polyester Resin Market Size, By Application,20142021 (Thousand Ton)

Table 64 Canada: Saturated Polyester Resin Market Size, By Application, 20142021 (USD Million)

Table 65 Canada: Saturated Polyester Resin Market Size, By Application, 20142021 (Thousand Ton)

Table 66 Mexico: Saturated Polyester Resin Market Size, By Application, 20142021 (USD Million)

Table 67 Mexico: Saturated Polyester Resin Market Size, By Application, 20142021 (Thousand Ton)

Table 68 RoW: Saturated Polyester Resin Market Size, By Country, 20142021 (USD Million)

Table 69 RoW: Saturated Polyester Resin Market Size, By Country, 20142021 (Thousand Ton)

Table 70 RoW: Saturated Polyester Resin Market Size, By Type, 20142021 (USD Million)

Table 71 RoW: Saturated Polyester Resin Market Size, By Type, 20142021 (Thousand Ton)

Table 72 RoW: Saturated Polyester Resin Market Size, By Application, 20142021 (USD Million)

Table 73 RoW: Saturated Polyester Resin Market Size, By Application, 20142021 (Thousand Ton)

Table 74 New Product Launches, 20112015

Table 75 Mergers & Acquisitions, 20112015

Table 76 Investments & Expansions, 20132016

Table 77 Joint Venture, 2014

List of Figures (42 Figures)

Figure 1 Saturated Polyester Resin: Research Design

Figure 2 Bottom-Up Approach

Figure 3 Top-Down Approach

Figure 4 Research Methodology: Data Triangulation

Figure 5 Solid Saturated Polyester Resin to Register the Highest Growth

Figure 6 Saturated Polyester Resin Market for Coil & Can Coatings to Register the Highest Growth

Figure 7 Asia-Pacific Dominated the Saturated Polyester Resin Market in 2015

Figure 8 Saturated Polyester Resin Market to Register High CAGR Between 2016 and 2021

Figure 9 Solid Saturated Polyester Resin to Register the Fastest Growth Rate Between 2016 and 2021

Figure 10 Powder Coatings Accounts for the Highest Demand for Saturated Polyester Resin in Asia-Pacific

Figure 11 Asia-Pacific Accounted for the Largest Share in the Saturated Polyester Resin Market in 2015

Figure 12 Emerging Countries in Asia-Pacific to Drive the Saturated Polyester Resin Market Between 2016 and 2021

Figure 13 Saturated Polyester Resin Market in Powder Coating Application Will Continue to Be the Most Attractive Market Between 2016 and 2021

Figure 14 Asia-Pacific Witnessed the Highest Growth Rate in 2015

Figure 15 Drivers, Restraints, Opportunities, and Challenges in the Saturated Polyester Resin Market

Figure 16 Fluctuations in the Price of Crude Oil, 2011Jan 2015

Figure 17 Price Trend of Ethylene and Benzene Jan 2014 Jan 2015

Figure 18 Saturated Polyester Resin: Value-Chain Analysis

Figure 19 Liquid Saturated Polyester Resin to Continue Dominating the Market Till 2021

Figure 20 Market Projections for End-Use Applications of Saturated Polyester Resin

Figure 21 Regional Snapshot: India, Thailand, Indonesia, and Mexico are Emerging as New Hotspots (20162021)

Figure 22 Asia-Pacific Market Snapshot: Increasing Consumption of Powder Coatings and Coil & Can Coatings to Drive the Demand for Saturated Polyester Resin

Figure 23 North American Market Snapshot: Increasing Consumption for Powder Coatings & Coil & Can Coatings Drive the Demand of Saturated Polyester Resin

Figure 24 Companies Adopted New Product Launches as the Key Growth Strategy Between 2011 and 2016

Figure 25 Market Evaluation Framework: Significant New Product Launches Have Fueled Growth and Innovation, 20112016

Figure 26 New Product Launches Was the Key Strategy Between 20112016

Figure 27 Regional Revenue Mix of Top Five Market Players

Figure 28 Royal DSM N.V.: Company Snapshot

Figure 29 Royal DSM N.V.: SWOT Analysis

Figure 30 Allnex Belgium SA/NV: SWOT Analysis

Figure 31 Arkema S.A.: Company Snapshot

Figure 32 Arkema S.A.: SWOT Analysis

Figure 33 Nuplex Industries Ltd.: Company Snapshot

Figure 34 Nuplex Industries Ltd.: SWOT Analysis

Figure 35 Stepan Company: Company Snapshot

Figure 36 Stepan Company: SWOT Analysis

Figure 37 Evonik Industries: Company Snapshot

Figure 38 Evonik Industries: SWOT Analysis

Figure 39 Nippon Gohsei: Company Snapshot

Figure 40 Nippon Gohsei: SWOT Analysis

Figure 41 Covestro AG: Company Snapshot

Figure 42 Covestro AG: SWOT Analysis

Growth opportunities and latent adjacency in Saturated Polyester Resin Market

Require Powder polyolefin market report

Informaiton on resins demand and related machinery for powder coatings, in the MEA.