Architectural Coatings Market by Resin Type (Acrylic, Alkyd, vinyl, Polyurethane), Technology (Waterborne, Solventborne), Coating Type (Interior and Exterior), User Type (DIY and Professional), Application, and Region - Global Forecast to 2028

Updated on : September 11, 2025

Architectural Coatings Market

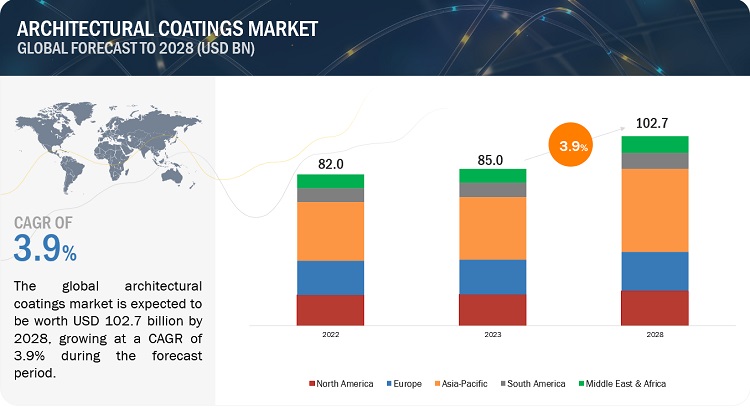

The Architectural Coatings Market was USD 85.0 billion in 2023 and is projected to reach USD 102.7 billion by 2028, growing at a cagr 3.9% from 2023 to 2028. Leading multinational corporations are relocating their manufacturing bases, opening sales offices, and expanding distribution networks to countries with high demand, such as Asia Pacific. The gradual relocation of manufacturing facilities to nations with high demand and cheaper production costs has a favorable impact on market growth. The top manufacturers control a sizable portion of the worldwide market. As a result, architectural coating companies are under intense competitive pressure to cut architectural coating prices in order to acquire market share at the expense of other rivals. Furthermore, regulatory standards for solvent usage and VOC emissions are critical parameters for architectural coating suppliers to consider.

Attractive Opportunities in Architectural Coatings Market

To know about the assumptions considered for the study, Request for Free Sample Report

Architectural Coatings Market Dynamics

Driver: One of the most significant developments observed in the coatings industry over the last ten years has been the growing need for environmentally friendly features, which was mainly driven by stringent EU regulations regarding the reduction of volatile organic compound (VOC) emissions in the coating life cycle. This has changed the market for ecologically benign goods such as aqueous and powder-based paints and coatings away from solvent-borne coatings. The European Commission and other federal government organisations establish new laws and regulations, such as the Eco-product Certification Scheme (ECS). These standards promote a green and sustainable environment by limiting or eliminating dangerous VOC emissions. In addition, after the Quality Council of India (QCI), Pollution Control Board Authorities, and the National Referral Centre for Lead Projects in India (NRCLPI) strongly advised the Government of India (GOI) to fix lead content below 90 ppm for all architectural and household paints, the regulations on lead control in household and architectural coatings were implemented in 2016. These laws encourage architectural coatings firms to invest in bio-based raw ingredients in paints and coatings, making architectural coatings more environmentally friendly. Furthermore, government laws in the United States and Western Europe, particularly those pertaining to air pollution, will continue to encourage the use of innovative, low-polluting coating technologies.

Restraints: The paints and coatings sector is heavily influenced by regulatory rules. Potential regulatory changes might cause uncertainty across the value chain. The time it takes for manufacturers at each node to accept the new rule and embrace new technology is referred to as uncertainty. Various time-consuming regulatory changes in various regions can have an impact on raw material producers, formulators, channel partners, and end users. As more governments enact severe regulatory standards, architectural coatings manufacturers must continually improve their processes in order to comply with the new policies and decrease VOC emissions. In the United Kingdom and the United States, for example, the Varnishes and Vehicle Refinishing Products Regulations 2005 demand a decrease in VOC emissions. In the United States, the Environmental Protection Agency (EPA) has also adopted measures in compliance with the 1977 Clean Air Act revisions. Products that do not fulfil regulatory standards are not sold in the Western European market.

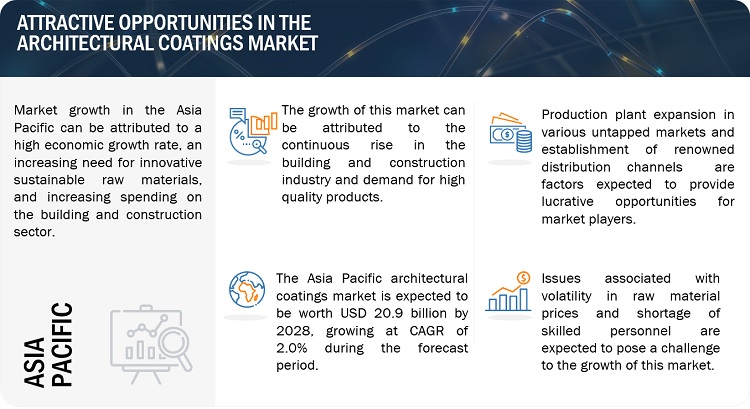

Opportunity: Major architectural coating manufacturers in North America and Europe have to follow stringent government rules and policies. However, the emerging regions have fewer or no rules for this segment. The market for architectural coatings in Asia Pacific and other emerging economies are growing rapidly. Over the last 15 years, emerging economies have accounted for nearly two-thirds of global GDP growth and more than half of new consumption. However, economic success differs significantly among countries. Over the last 30 years, more than two-thirds of GDP growth in outperforming nations has been attributed to a significant improvement in productivity associated with industrialization: an annual average productivity gain of 4.1 percent vs 0.8 percent for the other emerging economies. This rapid development starts the pro-growth cycle by creating wealth and increasing demand, which leads to more jobs.

Challenges: Titanium dioxide (TiO2) is an essential ingredient in the manufacturing of architectural coatings. TiO2 comprises 20–30% of the total expenditure on raw materials. There are many global suppliers of TiO2, and there is no substitute available for this ingredient. TiO2 pigments are traded internationally; however, the fluctuations in the price of TiO2 have increased in both amplitude and frequency in the last decade. These frequent changes in the prices make it difficult for customers to plan their spending and affect their profit margin. In the US market, the TiO2 price has shown conflicting market emotions. The prices fell precipitously in October 2022 as a result of weak demand fundamentals. Prices rose somewhat in November before falling again in late Q4. According to industry participants, the construction sector has been mediocre, causing no meaningful change in TiO2 demand dynamics. Furthermore, rising interest rates and inflationary pressures have hindered manufacturing across the country. The market was operating at low levels, and ocean shipments were also down. As a consequence, at the conclusion of the fourth quarter, TiO2 98% CFR USGC prices were estimated at USD 3118 per ton.

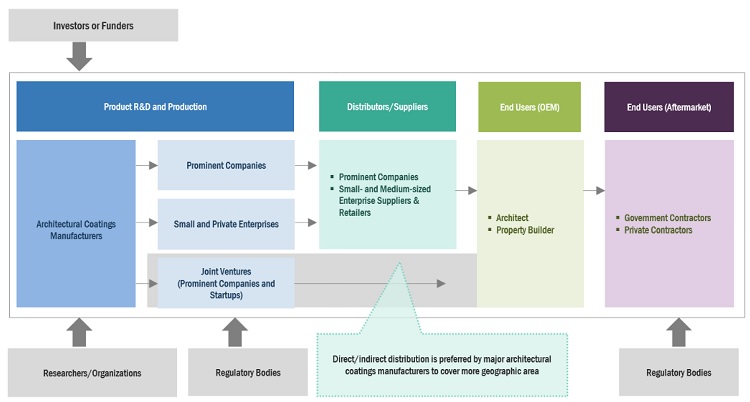

Architectural Coatings Market Ecosystem

Based on user type, professional segment is estimated to account for the largest market share of the architectural coatings market

Another alternative for a paint job is to hire painters or painting contractors. One of the main reasons to hire a professional is to assure a high-quality finish and to prevent damage furniture or flooring. Such paint jobs also finish faster, which might assist end users if time is of the essence. Furthermore, the shift towards professional or Do-it-yourself services is becoming more visible as the number of elderly people and young people who have not learned how to do DIY grows. Professional painting is chosen over a DIY project when a house is placed up for sale in residential construction or when a homeowner wishes to paint/repaint the home for aesthetic grounds.

Based on coating type, interior segment is anticipated to dominate the market

Interior paint coatings provide stain repellency, improved concealing properties, durability, and long-lasting performance with application diversity. Low-VOC, low-odor paints are currently favored above other paints. These paints enable experts to paint in inhabited areas while causing minimal disturbance to the end user's daily operations. There is currently a trend towards utilising expensive paints. While any standard paint can give a home a facelift, premium paint transforms interior surfaces to make them last longer. Consumers examine various factors when selecting interior paints, such as stain resistance, film durability, and low odor. Interior coatings with durability and long-lasting performance are sought after by homeowners and professionals. Consumers choose goods that need less time to apply, such as paint-and-primer-in-one.

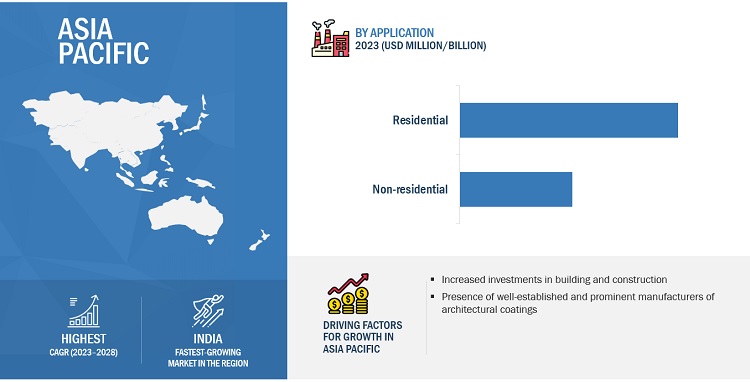

By application, the residential segment of the architectural coatings market is projected to witness the highest CAGR during the forecast period.

Economic expansion and better salaries in recent years have resulted in the construction of various new residences and the remodeling of existing ones. New paint and repainting are examples of architectural coatings for residential construction applications. Paints, stains, lacquers, primers, and cleansers are examples of architectural and utilitarian coatings. Architectural coatings are utilised in both interior and exterior home applications. Repainting is the process of imparting a fresh look to an old or worn-out interior or exterior of a structure.

The Asia Pacific market is projected to contribute the largest share of the architectural coatings market.

Asia Pacific is a fast-rising market with numerous possibilities for industry participants. The vast majority of large corporations in North America and Europe aim to transfer their manufacturing operations to this area because of the availability of low-cost raw materials, cheap production costs, and a desire to better serve local consumers. As the region's middle-class population grows, so does its hunger for luxury goods. Government measures are also assisting the growth of the building and construction industry. These characteristics are projected to have a significant impact on the architectural coatings industry.

According to the IMF, the Russia-Ukraine conflict has had a broad impact on the Asian economy in terms of trade and financial market instability, as well as inflation, and the danger of regional fragmentation is significant. One of the most severe repercussions on Asia is a drop in international demand. The second focuses on food and commodity prices, which have skyrocketed since the crisis. The pandemic has already hurt the Asian economy, which has been compounded by the fighting and has produced economic instability. Prior to the epidemic and war, many nations had commercial conflicts, particularly China and the United States. As a result, trade fears have skyrocketed.

To know about the assumptions considered for the study, download the pdf brochure

Architectural Coatings Market Players

The Sherwin-Williams Company (US), PPG Industries, Inc (US), AkzoNobel N.V. (The Netherlands), BASF Coating GMBH (Germany), Jotun A/s (Norway), Asian Paints Limited (India), Kansai Paint Co., Ltd (Japan), Nippon Paint Holding Co., Ltd (Japan), RPM International, Inc (US), Masco Corporation (US) are the key players operating in the global market.

Please visit 360Quadrants to see the vendor listing of Top paint and coating companies

Architectural Coatings Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 85.0 billion |

|

Revenue Forecast in 2028 |

USD 102.7 billion |

|

CAGR |

3.9% |

|

Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast Period |

2023-2028 |

|

Forecast Units |

Value (USD Billion) |

|

Segments Covered |

By Resin Type, By Technology, By Coating Type, By User Type, By Application, By Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Companies covered |

The Sherwin-Williams Company (US), PPG Industries, Inc (US), AkzoNobel N.V. (The Netherlands), BASF Coating GMBH (Germany), Jotun A/s (Norway), Asian Paints Limited (India), Kansai Paint Co., Ltd (Japan), Nippon Paint Holding Co., Ltd (Japan), RPM International, Inc (US) |

Based on resin type, the architectural coatings industry has been segmented as follows:

- Acrylic

- Alkyd

- Vinyl

- Polyurethane

- Others

Based on technology, the architectural coatings industry has been segmented as follows:

- Waterborne

- Solventborne

- Powder coatings

Based on application, the architectural coatings industry has been segmented as follows:

-

Residential

- New construction

- Remodel and repaint

-

Non-residential

- Commercial

- Industrial

- Infrastructure

Based on coating type, the architectural coatings market has been segmented as follows:

- Interior

- Exterior

Based on user type, the architectural coatings market has been segmented as follows:

- DIY

- Professional

Based on the region, the architectural coatings market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- After negotiating a deal to buy Colombia-based paints and coatings manufacturer Grupo Orbis, AkzoNobel N.V. plans to grow its operations in South and Central America in June 2021. Grupo Orbis operates in ten countries in South America, Central America, and the Antilles. This is a plan for growth and delivery.

- Tikkurila was bought by PPG in June 2021. This is aimed at helping the firm extend its paint and coating selections, which will now include Tikkurila's environmentally friendly ornamental products as well as high-quality industrial coatings.

Frequently Asked Questions (FAQ):

What is the current competitive landscape in the architectural coatings market in terms of new applications, production, and sales?

Various major, medium-sized, and small-scale business firms operate in the industry on a global basis. Numerous companies are always inventing and producing new items, as well as moving into developing regions where demand is increasing, resulting in increased sales.

Which countries contribute more to the architectural coatings market?

India, China, Japan, Germany, and Italy are major countries considered in the report.

What is the total CAGR expected to be recorded for the architectural coatings market during 2023-2028?

The CAGR is expected to record 3.9% from 2023-2028

Does this report cover the different resin types of architectural coatings market?

Yes, the report covers the different resin types of architectural coatings.

Does this report cover different application of architectural coatings?

Yes, the report covers different application of architectural coatings. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growth of construction sector- Eco-friendly coating systems- Durable coatings with better performance and estheticsRESTRAINTS- Stringent regulatory policiesOPPORTUNITIES- Investments in emerging economiesCHALLENGES- Adoption of new technologies- Volatile prices of titanium dioxide

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.5 MACROECONOMIC INDICATORSINTRODUCTIONGDP TRENDS AND FORECASTFORECAST OF GLOBAL CONSTRUCTION INDUSTRY

-

5.6 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTHRUSSIA–UKRAINE WARCHINA- China’s debt problem- Australia–China trade war- Environmental commitmentsEUROPE- Energy crisis in Europe

- 5.7 VALUE CHAIN ANALYSIS

- 5.8 PRICING ANALYSIS

-

5.9 ECOSYSTEM

- 5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.11 TRADE ANALYSIS

-

5.12 PATENT ANALYSISMETHODOLOGYPUBLICATION TRENDSTOP JURISDICTIONTOP APPLICANTS

- 5.13 CASE STUDY ANALYSIS

- 5.14 TECHNOLOGY ANALYSIS

- 5.15 KEY CONFERENCES AND EVENTS, 2023

-

5.16 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.1 INTRODUCTION

-

6.2 WATERBORNE COATINGSDEMAND FOR ECO-FRIENDLY CLEARCOAT TO DRIVE MARKET

-

6.3 SOLVENTBORNE COATINGSHIGH DURABILITY AND COST-EFFECTIVENESS TO DRIVE MARKET

-

6.4 POWDER COATINGSABRASION AND CORROSION RESISTANCE TO FUEL DEMAND FOR POWDER COATINGS

- 7.1 INTRODUCTION

-

7.2 ACRYLIC RESINRESISTANCE TO WATER AND ALKALI TO FUEL DEMAND FOR ACRYLIC RESINS

-

7.3 ALKYD RESINCOMPATIBILITY WITH COATING POLYMERS TO INCREASE DEMAND FOR ALKYD RESINS

-

7.4 POLYURETHANE RESINUSE OF POLYURETHANE IN ARCHITECTURAL COATINGS TO DRIVE MARKET

-

7.5 VINYL RESINRESISTANCE TO WATER AND CHEMICALS TO FUEL DEMAND FOR VINYL RESIN

-

7.6 OTHER RESINSEPOXY RESINUNSATURATED POLYESTER RESINSATURATED POLYESTER RESIN

- 8.1 INTRODUCTION

-

8.2 DIYINCREASE IN DIY PAINTING TO DRIVE MARKET

-

8.3 PROFESSIONALINCREASE IN SPENDING POWER OF CONSUMERS TO SUPPORT MARKET GROWTH

- 9.1 INTRODUCTION

-

9.2 INTERIORINCREASING RENOVATION ACTIVITIES TO FUEL DEMAND FOR PREMIUM COATINGS

-

9.3 EXTERIORHIGH DURABILITY TO INCREASE DEMAND FOR ARCHITECTURAL COATINGS

- 10.1 INTRODUCTION

-

10.2 RESIDENTIALNEW CONSTRUCTION- Energy efficiency and low maintenance costs to increase demand for architectural coatingsREMODEL AND REPAINT- Surge in renovation activities to fuel demand for architectural coatings

-

10.3 NONRESIDENTIALCOMMERCIAL- Rise in private sector investments and increasing commercial office spaces to drive marketINDUSTRIAL- Growth of industrial sector to fuel demand for architectural coatingsINFRASTRUCTURE- Infrastructure development in emerging economies to drive market

- 11.1 INTRODUCTION

-

11.2 ASIA PACIFICRECESSION IMPACT ON ASIA PACIFICCHINA- Foreign investments to drive marketINDIA- Boom in real estate industry to propel marketJAPAN- Investments in commercial and reconstruction sector to boost demand for architectural coatingsINDONESIA- Foreign investments in infrastructure and residential construction to drive marketTHAILAND- Increasing awareness about esthetics and functionalities of architectural coating products to drive marketREST OF ASIA PACIFIC

-

11.3 NORTH AMERICARECESSION IMPACT ON NORTH AMERICAUS- Growth of private residential and nonresidential construction industry to boost marketCANADA- Foreign trade to fuel demand for premium coatingsMEXICO- Growth of tourism industry to drive market

-

11.4 EUROPERECESSION IMPACT ON EUROPEGERMANY- Stringent environmental regulations to increase production of architectural coatingsRUSSIA- Growing population to fuel demand for architectural coatings in residential constructionUK- Growth of construction sector to propel marketFRANCE- Increasing demand for tourism infrastructure to drive marketITALY- Growth of small and medium-sized enterprises to drive marketSPAIN- Adoption of advanced technology to fuel demand for architectural coatingsTURKEY- Rapid urbanization to drive marketREST OF EUROPE

-

11.5 MIDDLE EAST & AFRICARECESSION IMPACT ON MIDDLE EASTSAUDI ARABIA- Mega housing projects to boost demand for architectural coatingsSOUTH AFRICA- Regional alliances and strategic acquisitions to drive marketEGYPT- New residential projects to fuel demand for premium coatingsREST OF MIDDLE EAST & AFRICA

-

11.6 SOUTH AMERICARECESSION IMPACT ON SOUTH AMERICABRAZIL- Rising living standards and easier credit availability to fuel demand for architectural coatingsARGENTINA- Improved economic conditions to drive marketREST OF SOUTH AMERICA

- 12.1 OVERVIEW

-

12.2 COMPETITIVE LEADERSHIP MAPPING, 2022STARSEMERGING LEADERSPARTICIPANTSPERVASIVE PLAYERS

-

12.3 STARTUP/SME EVALUATION QUADRANT, 2022RESPONSIVE COMPANIESPROGRESSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

- 12.4 STRENGTH OF PRODUCT PORTFOLIO

- 12.5 COMPETITIVE BENCHMARKING

- 12.6 MARKET SHARE ANALYSIS

- 12.7 MARKET RANKING ANALYSIS

- 12.8 REVENUE ANALYSIS

-

12.9 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKMARKET EVALUATION MATRIX

- 12.10 STRATEGIC DEVELOPMENTS

-

13.1 KEY PLAYERSSHERWIN-WILLIAMS COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPPG INDUSTRIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAKZONOBEL N.V.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBASF COATING GMBH- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewJOTUN A/S- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewASIAN PAINTS LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKANSAI PAINTS CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNIPPON PAINT HOLDINGS CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRPM INTERNATIONAL, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMASCO CORPORATION- Business overview- Products/Solutions/Services offered- MnM view

-

13.2 OTHER PLAYERSHEMPEL A/S- Company overview- Products/Solutions/Services offered- Recent developmentsDAW SE- Company overview- Products/Solutions/Services offered- Recent developmentsINDIGO PAINTS PVT. LTD.- Company overview- Products/Solutions/Services offeredDIAMOND VOGEL PAINT COMPANY- Company overview- Products/Solutions/Services offeredKELLY-MOORE PAINTS- Company overview- Products/Solutions/Services offeredBERGER PAINTS INDIA LIMITED- Company overview- Products/Solutions/Services offeredSHALIMAR PAINTS- Company overview- Products/Solutions/Services offeredBENJAMIN MOORE & CO- Company overview- Products/Solutions/Services offeredBRILLUX GMBH & CO. KG- Company overview- Products/Solutions/Services offeredCARPOLY CHEMICAL GROUP CO., LTD.- Company overview- Products/Solutions/Services offeredCLOVERDALE PAINT INC.- Company overview- Products/Solutions/Services offeredSTO CORP.- Company overview- Products/Solutions/Services offeredLANCO PAINTS- Company overview- Products/Solutions/Services offeredGUANGDONG MAYDOS BUILDING MATERIALS CO., LTD.- Company overview- Products/Solutions/Services offeredFUJIKURA KASEI CO., LTD.- Company overview- Products/Solutions/Services offered

- 14.1 INTRODUCTION

- 14.2 PAINTS & COATINGS MARKET: LIMITATIONS

- 14.3 PAINTS & COATINGS MARKET: DEFINITION

- 14.4 PAINTS & COATINGS MARKET: OVERVIEW

- 14.5 PAINTS & COATINGS MARKET, BY TECHNOLOGY

- 14.6 PAINTS & COATINGS MARKET, BY RESIN TYPE

- 14.7 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY

- 14.8 PAINTS & COATINGS MARKET, BY REGION

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 ARCHITECTURAL COATINGS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 2 ARCHITECTURAL COATINGS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS (%)

- TABLE 4 KEY BUYING CRITERIA FOR ARCHITECTURAL COATINGS

- TABLE 5 TRENDS AND FORECAST OF GDP, PERCENTAGE CHANGE, 2020–2027

- TABLE 6 ARCHITECTURAL COATINGS MARKET: SUPPLY CHAIN ANALYSIS

- TABLE 7 COUNTRY-WISE EXPORT DATA, 2019–2021 (USD THOUSAND)

- TABLE 8 COUNTRY-WISE IMPORT DATA, 2019–2021 (USD THOUSAND)

- TABLE 9 TOP PATENT OWNERS

- TABLE 10 ARCHITECTURAL COATINGS MARKET: KEY CONFERENCES AND EVENTS

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ARCHITECTURAL COATINGS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 16 ARCHITECTURAL COATING MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 17 ARCHITECTURAL COATINGS MARKET, BY TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 18 ARCHITECTURAL COATING MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 19 WATERBORNE: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 20 WATERBORNE: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 WATERBORNE: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 22 WATERBORNE: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 23 SOLVENTBORNE: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 24 SOLVENTBORNE: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 SOLVENTBORNE: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 26 SOLVENTBORNE: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 27 POWDER COATINGS: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 28 POWDER COATINGS: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 POWDER COATINGS: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 30 POWDER COATINGS: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 31 ARCHITECTURAL COATINGS MARKET, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 32 ARCHITECTURAL COATING MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 33 ARCHITECTURAL COATINGS MARKET, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 34 ARCHITECTURAL COATING MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 35 PROPERTIES AND APPLICATIONS OF ACRYLIC PAINTS & COATINGS

- TABLE 36 ACRYLIC RESIN: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 37 ACRYLIC RESIN: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 ACRYLIC RESIN: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 39 ACRYLIC RESIN: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 40 ALKYD RESIN: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 41 ALKYD RESIN: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 ALKYD RESIN: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 43 ALKYD RESIN: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 44 POLYURETHANE RESIN: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 45 POLYURETHANE RESIN: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 POLYURETHANE RESIN: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 47 POLYURETHANE RESIN: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 48 VINYL RESIN: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 49 VINYL RESIN: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 VINYL RESIN: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 51 VINYL RESIN: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 52 OTHERS: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 OTHERS: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 OTHERS: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 55 OTHERS: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 56 ARCHITECTURAL COATINGS MARKET, BY USER TYPE, 2019–2022 (USD MILLION)

- TABLE 57 ARCHITECTURAL COATING MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 58 ARCHITECTURAL COATINGS MARKET, BY USER TYPE, 2019–2022 (KILOTON)

- TABLE 59 ARCHITECTURAL COATING MARKET, BY USER TYPE, 2023–2028 (KILOTON)

- TABLE 60 DIY: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 61 DIY: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 DIY: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 63 DIY: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 64 PROFESSIONAL: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 65 PROFESSIONAL: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 PROFESSIONAL: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 67 PROFESSIONAL: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 68 ARCHITECTURAL COATINGS MARKET, BY COATING TYPE, 2019–2022 (USD MILLION)

- TABLE 69 ARCHITECTURAL COATING MARKET, BY COATING TYPE, 2023–2028 (USD MILLION)

- TABLE 70 ARCHITECTURAL COATINGS MARKET, BY COATING TYPE, 2019–2022 (KILOTON)

- TABLE 71 ARCHITECTURAL COATING MARKET, BY COATING TYPE, 2023–2028 (KILOTON)

- TABLE 72 INTERIOR: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 73 INTERIOR: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 INTERIOR: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 75 INTERIOR: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 76 EXTERIOR: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 77 EXTERIOR: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 EXTERIOR: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 79 EXTERIOR: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 80 ARCHITECTURAL COATINGS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 81 ARCHITECTURAL COATING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 82 ARCHITECTURAL COATINGS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 83 ARCHITECTURAL COATING MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 84 RESIDENTIAL: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 85 RESIDENTIAL: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 86 RESIDENTIAL: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 87 RESIDENTIAL: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 88 RESIDENTIAL (NEW CONSTRUCTION): ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 89 RESIDENTIAL (NEW CONSTRUCTION): ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 RESIDENTIAL (NEW CONSTRUCTION): ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 91 RESIDENTIAL (NEW CONSTRUCTION): ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 92 RESIDENTIAL (REMODEL AND REPAINT): ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 93 RESIDENTIAL (REMODEL AND REPAINT): ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 RESIDENTIAL (REMODEL AND REPAINT): ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 95 RESIDENTIAL (REMODEL AND REPAINT): ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 96 NONRESIDENTIAL: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 97 NONRESIDENTIAL: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 98 NONRESIDENTIAL: ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 99 NONRESIDENTIAL: ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 100 NONRESIDENTIAL (COMMERCIAL): ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 101 NONRESIDENTIAL (COMMERCIAL): ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 102 NONRESIDENTIAL (COMMERCIAL): ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 103 NONRESIDENTIAL (COMMERCIAL): ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 104 NONRESIDENTIAL (INDUSTRIAL): ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 105 NONRESIDENTIAL (INDUSTRIAL): ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 106 NONRESIDENTIAL (INDUSTRIAL): ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 107 NONRESIDENTIAL (INDUSTRIAL): ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 108 NONRESIDENTIAL (INFRASTRUCTURE): ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 109 NONRESIDENTIAL (INFRASTRUCTURE): ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 110 NONRESIDENTIAL (INFRASTRUCTURE): ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 111 NONRESIDENTIAL (INFRASTRUCTURE): ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 112 ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 113 ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 114 ARCHITECTURAL COATINGS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 115 ARCHITECTURAL COATING MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 116 ASIA PACIFIC: ARCHITECTURAL COATINGS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 117 ASIA PACIFIC: ARCHITECTURAL COATING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 119 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 120 ASIA PACIFIC: MARKET, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 121 ASIA PACIFIC: MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: MARKET, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 123 ASIA PACIFIC: ARCHITECTURAL COATINGS MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 124 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 127 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 128 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 131 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 132 ASIA PACIFIC: MARKET, BY COATING TYPE, 2019–2022 (USD MILLION)

- TABLE 133 ASIA PACIFIC: MARKET, BY COATING TYPE, 2023–2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: MARKET, BY COATING TYPE, 2019–2022 (KILOTON)

- TABLE 135 ASIA PACIFIC: MARKET, BY COATING TYPE, 2023–2028 (KILOTON)

- TABLE 136 ASIA PACIFIC: MARKET, BY USER TYPE, 2019–2022 (USD MILLION)

- TABLE 137 ASIA PACIFIC: MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 138 ASIA PACIFIC: MARKET, BY USER TYPE, 2019–2022 (KILOTON)

- TABLE 139 ASIA PACIFIC: MARKET, BY USER TYPE, 2023–2028 (KILOTON)

- TABLE 140 NORTH AMERICA: ARCHITECTURAL COATINGS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 141 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 142 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 143 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 144 NORTH AMERICA: MARKET, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 145 NORTH AMERICA: MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 146 NORTH AMERICA: MARKET, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 147 NORTH AMERICA: MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 148 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 149 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 150 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 151 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 152 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 153 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 154 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 155 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 156 NORTH AMERICA: MARKET, BY COATING TYPE, 2019–2022 (USD MILLION)

- TABLE 157 NORTH AMERICA: MARKET, BY COATING TYPE, 2023–2028 (USD MILLION)

- TABLE 158 NORTH AMERICA: MARKET, BY COATING TYPE, 2019–2022 (KILOTON)

- TABLE 159 NORTH AMERICA: MARKET, BY COATING TYPE, 2023–2028 (KILOTON)

- TABLE 160 NORTH AMERICA: MARKET, BY USER TYPE, 2019–2022 (USD MILLION)

- TABLE 161 NORTH AMERICA: MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 162 NORTH AMERICA: MARKET, BY USER TYPE, 2019–2022 (KILOTON)

- TABLE 163 NORTH AMERICA: MARKET, BY USER TYPE, 2023–2028 (KILOTON)

- TABLE 164 EUROPE: ARCHITECTURAL COATINGS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 165 EUROPE: ARCHITECTURAL COATING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 166 EUROPE: MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 167 EUROPE: MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 168 EUROPE: MARKET, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 169 EUROPE: MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 170 EUROPE: MARKET, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 171 EUROPE: MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 172 EUROPE: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 173 EUROPE: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 174 EUROPE: MARKET, BY TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 175 EUROPE: MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 176 EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 177 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 178 EUROPE: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 179 EUROPE: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 180 EUROPE: MARKET, BY COATING TYPE, 2019–2022 (USD MILLION)

- TABLE 181 EUROPE: MARKET, BY COATING TYPE, 2023–2028 (USD MILLION)

- TABLE 182 EUROPE: MARKET, BY COATING TYPE, 2019–2022 (KILOTON)

- TABLE 183 EUROPE: MARKET, BY COATING TYPE, 2023–2028 (KILOTON)

- TABLE 184 EUROPE: MARKET, BY USER TYPE, 2019–2022 (USD MILLION)

- TABLE 185 EUROPE: MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 186 EUROPE: MARKET, BY USER TYPE, 2019–2022 (KILOTON)

- TABLE 187 EUROPE: MARKET, BY USER TYPE, 2023–2028 (KILOTON)

- TABLE 188 MIDDLE EAST & AFRICA: ARCHITECTURAL COATINGS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: ARCHITECTURAL COATING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 191 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 192 MIDDLE EAST & AFRICA: MARKET, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: MARKET, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 195 MIDDLE EAST & AFRICA: MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 196 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 199 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 200 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 203 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 204 MIDDLE EAST & AFRICA: MARKET, BY COATING TYPE, 2019–2022 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: MARKET, BY COATING TYPE, 2023–2028 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: MARKET, BY COATING TYPE, 2019–2022 (KILOTON)

- TABLE 207 MIDDLE EAST & AFRICA: MARKET, BY COATING TYPE, 2023–2028 (KILOTON)

- TABLE 208 MIDDLE EAST & AFRICA: MARKET, BY USER TYPE, 2019–2022 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: MARKET, BY USER TYPE, 2019–2022 (KILOTON)

- TABLE 211 MIDDLE EAST & AFRICA: MARKET, BY USER TYPE, 2023–2028 (KILOTON)

- TABLE 212 SOUTH AMERICA: ARCHITECTURAL COATINGS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 213 SOUTH AMERICA: ARCHITECTURAL COATING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 214 SOUTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 215 SOUTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 216 SOUTH AMERICA: MARKET, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 217 SOUTH AMERICA: MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 218 SOUTH AMERICA: MARKET, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 219 SOUTH AMERICA: MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 220 SOUTH AMERICA: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 221 SOUTH AMERICA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 222 SOUTH AMERICA: MARKET, BY TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 223 SOUTH AMERICA: MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 224 SOUTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 225 SOUTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 226 SOUTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 227 SOUTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 228 SOUTH AMERICA: MARKET, BY COATING TYPE, 2019–2022 (USD MILLION)

- TABLE 229 SOUTH AMERICA: MARKET, BY COATING TYPE, 2023–2028 (USD MILLION)

- TABLE 230 SOUTH AMERICA: MARKET, BY COATING TYPE, 2019–2022 (KILOTON)

- TABLE 231 SOUTH AMERICA: MARKET, BY COATING TYPE, 2023–2028 (KILOTON)

- TABLE 232 SOUTH AMERICA: MARKET, BY USER TYPE, 2019–2022 (USD MILLION)

- TABLE 233 SOUTH AMERICA: MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 234 SOUTH AMERICA: MARKET, BY USER TYPE, 2019–2022 (KILOTON)

- TABLE 235 SOUTH AMERICA: MARKET, BY USER TYPE, 2023–2028 (KILOTON)

- TABLE 236 STRATEGIES ADOPTED BY KEY ARCHITECTURAL COATINGS PLAYERS (2016–2023)

- TABLE 237 ARCHITECTURAL COATINGS MARKET: KEY STARTUPS/SMES

- TABLE 238 ARCHITECTURAL COATING MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

- TABLE 239 COMPANY EVALUATION MATRIX: ARCHITECTURAL COATINGS MARKET

- TABLE 240 ARCHITECTURAL COATINGS MARKET: INTENSITY OF COMPETITIVE RIVALRY, 2022

- TABLE 241 STRATEGIC DEVELOPMENTS, BY COMPANY

- TABLE 242 WIDELY ADOPTED STRATEGIES

- TABLE 243 GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

- TABLE 244 COMPANY INDUSTRY FOOTPRINT

- TABLE 245 COMPANY REGION FOOTPRINT

- TABLE 246 COMPANY FOOTPRINT

- TABLE 247 ARCHITECTURAL COATINGS MARKET: PRODUCT LAUNCHES, 2016–2023

- TABLE 248 ARCHITECTURAL COATING MARKET: DEALS, 2016–2023

- TABLE 249 ARCHITECTURAL COATINGS MARKET: OTHERS, 2016–2023

- TABLE 250 SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

- TABLE 251 SHERWIN-WILLIAMS COMPANY: PRODUCT LAUNCHES

- TABLE 252 SHERWIN-WILLIAMS COMPANY: DEALS

- TABLE 253 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 254 PPG INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 255 PPG INDUSTRIES, INC.: DEALS

- TABLE 256 PPG INDUSTRIES, INC.: OTHERS

- TABLE 257 AKZONOBEL N.V.: COMPANY OVERVIEW

- TABLE 258 AKZONOBEL N.V.: PRODUCT LAUNCHES

- TABLE 259 AKZONOBEL N.V.: DEALS

- TABLE 260 BASF COATING GMBH: COMPANY OVERVIEW

- TABLE 261 BASF COATINGS GMBH: PRODUCT LAUNCHES

- TABLE 262 BASF SE: OTHERS

- TABLE 263 JOTUN A/S: COMPANY OVERVIEW

- TABLE 264 JOTUN A/S: DEALS

- TABLE 265 ASIAN PAINTS LIMITED: COMPANY OVERVIEW

- TABLE 266 ASIAN PAINTS LIMITED: PRODUCT LAUNCHES

- TABLE 267 ASIAN PAINTS LIMITED: DEALS

- TABLE 268 KANSAI PAINTS CO., LTD.: COMPANY OVERVIEW

- TABLE 269 KANSAI PAINTS CO., LTD.: PRODUCT LAUNCHES

- TABLE 270 KANSAI PAINTS CO., LTD.: DEALS

- TABLE 271 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 272 NIPPON PAINT HOLDINGS CO., LTD.: PRODUCT LAUNCHES

- TABLE 273 NIPPON PAINT HOLDINGS CO., LTD.: DEALS

- TABLE 274 RPM INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 275 RPM INTERNATIONAL, INC.: DEALS

- TABLE 276 MASCO CORPORATION: COMPANY OVERVIEW

- TABLE 277 HEMPEL A/S: DEALS

- TABLE 278 DAW SE: DEALS

- TABLE 279 ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

- TABLE 280 ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

- TABLE 281 ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (KILOTON)

- TABLE 282 ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2021–2026 (KILOTON)

- TABLE 283 INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

- TABLE 284 INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

- TABLE 285 INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (KILOTON)

- TABLE 286 INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2021–2026 (KILOTON)

- TABLE 287 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2017–2020 (USD MILLION)

- TABLE 288 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2021–2026 (USD MILLION)

- TABLE 289 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2017–2020 (KILOTON)

- TABLE 290 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2021–2026 (KILOTON)

- TABLE 291 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2017–2020 (USD MILLION)

- TABLE 292 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2021–2026 (USD MILLION)

- TABLE 293 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2017–2020 (KILOTON)

- TABLE 294 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2021–2026 (KILOTON)

- TABLE 295 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 296 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

- TABLE 297 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 298 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

- TABLE 299 PAINTS & COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 300 PAINTS & COATINGS MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 301 PAINTS & COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 302 PAINTS & COATINGS MARKET, BY REGION, 2021–2026 (KILOTON)

- FIGURE 1 ARCHITECTURAL COATINGS MARKET SEGMENTATION

- FIGURE 2 ARCHITECTURAL COATINGS MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARIES

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION, BY REGION

- FIGURE 7 MARKET SIZE ESTIMATION, BY RESIN TYPE

- FIGURE 8 ARCHITECTURAL COATINGS MARKET: SUPPLY-SIDE FORECAST

- FIGURE 9 METHODOLOGY FOR SUPPLY-SIDE SIZING OF ARCHITECTURAL COATINGS MARKET

- FIGURE 10 MAJOR FACTORS RESPONSIBLE FOR GLOBAL RECESSION AND THEIR IMPACT ON ARCHITECTURAL COATINGS MARKET

- FIGURE 11 ARCHITECTURAL COATINGS MARKET: DATA TRIANGULATION

- FIGURE 12 ACRYLIC RESIN SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 WATERBORNE TECHNOLOGY TO CAPTURE LARGEST MARKET SHARE

- FIGURE 14 RESIDENTIAL SEGMENT TO BE LARGER APPLICATION OF ARCHITECTURAL COATINGS

- FIGURE 15 ASIA PACIFIC TO DOMINATE ARCHITECTURAL COATINGS MARKET DURING FORECAST PERIOD

- FIGURE 16 ARCHITECTURAL COATINGS MARKET TO WITNESS MODERATE GROWTH DURING FORECAST PERIOD

- FIGURE 17 POLYURETHANE TO BE FASTEST-GROWING SEGMENT BETWEEN 2023 AND 2028

- FIGURE 18 EMERGING ECONOMIES TO WITNESS HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 19 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 20 INDIA TO EMERGE AS LUCRATIVE MARKET FOR ARCHITECTURAL COATINGS

- FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ARCHITECTURAL COATINGS MARKET

- FIGURE 22 PORTER’S FIVE FORCES ANALYSIS: ARCHITECTURAL COATINGS MARKET

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 24 KEY BUYING CRITERIA FOR ARCHITECTURAL COATINGS

- FIGURE 25 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2014–2035

- FIGURE 26 ARCHITECTURAL COATINGS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 AVERAGE PRICE OF ARCHITECTURAL COATINGS, BY REGION (2022)

- FIGURE 28 AVERAGE PRICE OF ARCHITECTURAL COATINGS, BY TECHNOLOGY (2022)

- FIGURE 29 AVERAGE PRICE OF ARCHITECTURAL COATINGS, BY RESIN TYPE (2022)

- FIGURE 30 AVERAGE PRICE OF ARCHITECTURAL COATINGS, BY COATING TYPE (2022)

- FIGURE 31 AVERAGE PRICE OF ARCHITECTURAL COATINGS, BY KEY COMPANY (2023)

- FIGURE 32 PAINTS & COATINGS ECOSYSTEM

- FIGURE 33 NUMBER OF PATENTS PUBLISHED, 2018–2023

- FIGURE 34 PATENTS PUBLISHED BY JURISDICTION, 2018–2023

- FIGURE 35 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2018–2023

- FIGURE 36 WATERBORNE COATINGS TO DOMINATE DURING FORECAST PERIOD

- FIGURE 37 ACRYLIC TO BE LARGEST RESIN TYPE FOR ARCHITECTURAL COATINGS DURING FORECAST PERIOD

- FIGURE 38 PROFESSIONAL SEGMENT TO ACCOUNT FOR LARGER SHARE OF ARCHITECTURAL COATINGS MARKET

- FIGURE 39 INTERIOR SEGMENT TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

- FIGURE 40 RESIDENTIAL SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 42 ASIA PACIFIC: ARCHITECTURAL COATINGS MARKET SNAPSHOT

- FIGURE 43 NORTH AMERICA: ARCHITECTURAL COATINGS MARKET SNAPSHOT

- FIGURE 44 EUROPE: ARCHITECTURAL COATINGS MARKET SNAPSHOT

- FIGURE 45 SAUDI ARABIA TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 46 BRAZIL TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 47 ARCHITECTURAL COATINGS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 48 ARCHITECTURAL COATINGS MARKET: SME MATRIX, 2022

- FIGURE 49 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN ARCHITECTURAL COATINGS MARKET

- FIGURE 50 MARKET SHARE, BY KEY PLAYER (2022)

- FIGURE 51 MARKET RANKING ANALYSIS, 2022

- FIGURE 52 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018–2022

- FIGURE 53 SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

- FIGURE 54 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 55 AKZONOBEL N.V.: COMPANY SNAPSHOT

- FIGURE 56 BASF COATING GMBH: COMPANY SNAPSHOT

- FIGURE 57 JOTUN A/S: COMPANY SNAPSHOT

- FIGURE 58 ASIAN PAINTS LIMITED: COMPANY SNAPSHOT

- FIGURE 59 KANSAI PAINTS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 60 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 61 RPM INTERNATIONAL, INC.: COMPANY SNAPSHOT

- FIGURE 62 MASCO CORPORATION: COMPANY SNAPSHOT

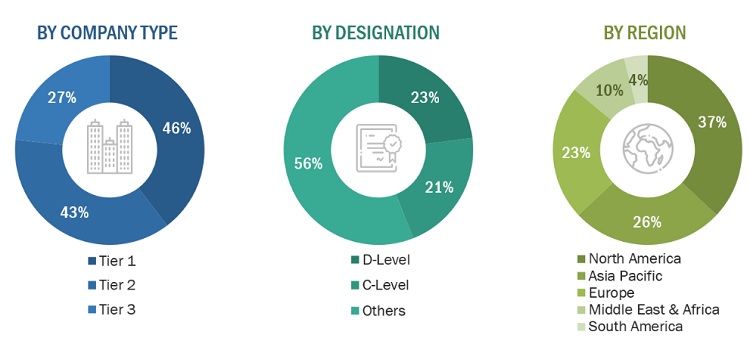

The study involved four major activities in estimating the current size of the architectural coatings market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering architectural coatings information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the architectural coatings market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the architectural coatings market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from architectural coatings vendors; raw material suppliers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to resin type, technology, application, industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using architectural coatings were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of architectural coatings and future outlook of their business which will affect the overall market.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

|

CoMPANY NAME |

DESIGNATION

|

|

The Sherwin-Williams Company |

Director |

|

PPG Industries Inc. |

Project Manager |

|

AkzoNobel N.V. |

Individual Industry Expert |

|

BASF SE |

Director |

Market Size Estimation

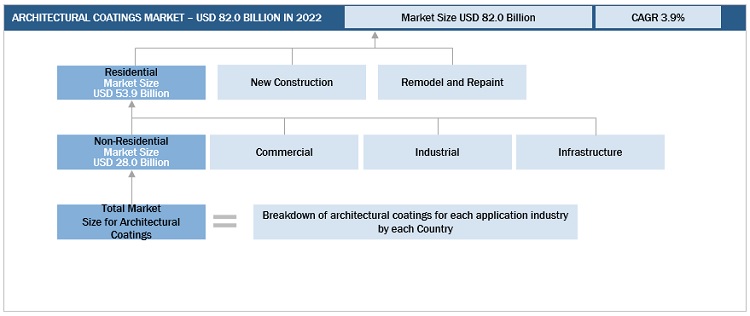

The research methodology used to estimate the size of the architectural coatings market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in the residential and non-residential at a regional level. Such procurements provide information on the demand aspects of architectural coatings.

Global Architectural Coatings Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

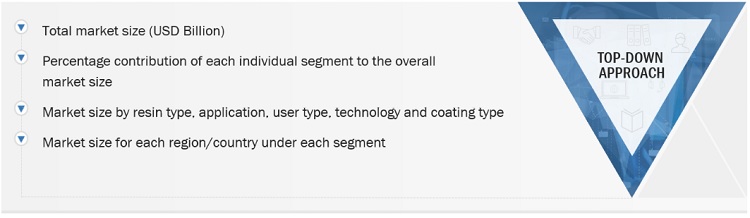

Global Architectural coatings Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Architectural coatings are used by end users on the interior or exterior surfaces of residential, commercial, institutional, or industrial buildings, and applied at room temperature. These coatings can be categorized based on their usage for aesthetics and protective purposes. They include surface preparatory products, such as putties, primers, and aesthetics and protective products, namely topcoats, and base coat. Weather resistance, washability, low VOC, anti-fungal, and anti-dampening are certain properties that the topcoat and base coat impart to the surface.

Key Stakeholders

- End User

- Raw Material Suppliers

- Senior Management

- Procurement Department

Report Objectives

- To define, describe, segment, and forecast the size of the architectural coatings market based on resin type, technology, coating type, application, user type, and region.

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, South America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the architectural coatings market

- To analyze technological advancements and product launches in the market

- To strategically analyze micro markets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the architectural coatings market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the architectural coatings Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Architectural Coatings Market