Routing Market by Type (Wired, Wireless), Placement (Edge, Core, Virtual), Application (Datacenter, Enterprise), Vertical (BFSI, Healthcare, Education, Residential, Media & Entertainment) and Region (2022-2027)

Updated on : Oct 23, 2024

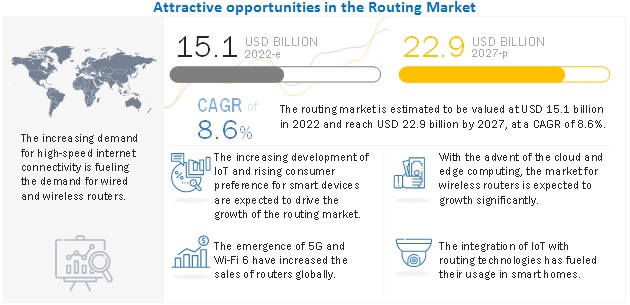

The routing market size is estimated to be valued at USD 15.1 billion in 2022 and reach USD 22.9 billion by 2027, at a CAGR of 8.6% from 2022–2027.

The growth of the routing industry is expected to be driven by the increase in demand for SDN and NFV, surge in the volume of multimedia content generated through the internet and web applications, and high demand for cloud services.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of Covid-19 on Routing Market

The pandemic was disruptive for every market, and the router market was no exception. The greatest hardships for nonresidential construction were witnessed in 2020, according to the data from the Associated Builders and Contractors (ABC). In the first quarter of 2020, the US economy dipped by 4.8% due to the adverse effects of the pandemic. Supply chain disruptions led to price increments of several networking products.

On the other hand, there has been a sharp increase in the demand for fiber-to-the-home (FTTH) due to the implementation of WFH policies by most companies across the globe. There has been a surge of 50–60% in data consumption after the outbreak of the pandemic. In April 2021, the Broadband Internet Technical Advisory Group (BITAG) released a report regarding network resiliency amidst the ongoing COVID-19 pandemic. According to the report, ISPs have witnessed a growth in internet traffic by 40% during peak business hours. Moreover, as per a study from the Hospital for Special Surgery (HSS), in July 2020, telehealth visits witnessed a “meteoric rise” as millions of Americans preferred to visit healthcare providers virtually amidst the continued impact of the COVID-19 pandemic. All these factors have fueled the growth of the routing market to a high extent.

Routing Market

The Routing market includes major Tier I and II players like Cisco (US), Huawei Technologies Co., Ltd. (China), Juniper Networks, Inc. (US), Hewlett Packard Enterprise Development LP (US), Arista Networks, Inc. (US), and others.

Router Market Dynamics

Driver: Surge in volume of multimedia content generated through internet and web applications

The increasing number of mobile subscribers, growing adoption and availability of affordable and high-speed wireless broadband services, such as hotspots and public Wi-Fi, and the rising number of laptop, tablet, and smartphone users have led to the generation of vast amounts of multimedia content on the Internet and mobile apps. As a result, content providers have started expanding their data centers. Thus, the surge of media-rich data would drive the growth of cloud computing, servers, and networks in data centers. Also, video on demand services require switches with increased bandwidth, pushing the limits from 10 Gbps to 100 Gbps and even more. The Ethernet switches are especially dominating the data center switch market, handling the massive amount of data among networked servers and storage units. This is likely to increase the spending on data centers and cloud infrastructure and result in a high adoption of data center switches for managing and routing the data traffic.

Restraint: Reluctance in moving from legacy systems to virtualized systems

Reluctance in moving from legacy systems to a virtualized environment can be one of the restraining factors in the router market. Internet service providers (ISPs) and telecom companies continue to maintain and operate legacy systems, which are complex to manage. Legacy systems incur high maintenance costs and lack compatibility with various platforms. The new, virtual router software solutions need to be customized for supporting the traditional architecture and infrastructure. These solutions must be properly integrated with the existing infrastructure to realize the benefits, and there is always a risk that this integration would be incomplete. Hence, when deploying a new virtual router application into operations, services providers are reluctant to convert old services to the new virtualized environment. Some telecom operators continue using the traditional systems, which are not capable of supporting new services for the increasing customer base. However, services providers worldwide have gradually started implementing virtual router solutions into their operations to accelerate time-to-market, reduce infrastructure maintenance costs, and increase returns on investment.

Opportunity: Growing requirement for bandwidth in data centers

In the era of the cloud, analytics could prove to be a huge growth opportunity for the router market. The high volume of sensitive data used in analytics demands servers with improved server connectivity and performance. The top-of-rack (ToR) connectivity architecture minimizes cabling complexity, as all servers are connected to the switch in the same rack. In addition, with the help of this architecture, in the future, the network that runs on 10 Gigabit Ethernet (GbE) bandwidth can be modified with minimum cost and changes to cabling. Many large-scale customers are deploying high-bandwidth switches to address the interconnectivity issue between thousands of servers. The overall volume of and workload in data centers are increasing for several applications such as cloud and data analytics. For such applications, a higher bandwidth is required to minimize delays and support higher speed and network. To fulfill this requirement, the network needs to accommodate a greater bandwidth at the access layer where the requirement is likely to increase from 1 GbE to 10 GbE or 25 GbE and in the core network where there will be a need for connectivity at 40 GbE or 100 GbE.

Challenge: Security concerns related to virtualized environment

With the development of technologies such as SDN and NFV, issues related to network threats are also growing. Though virtual routers offer various benefits, shared routing devices may create security-related concerns. With inadequate protection, an unauthorized user may access the virtual network. Hence, for any organization, the virtualized environment must offer safety against attacks and threats that may create security-related problems. Various vendors in the router market, such as Connectify and Juniper Networks, have incorporated various security protocols into router software solutions to provide network security.

Market for wireless routers to hold the highest market share during the forecast period

Wireless router is expected to be the leading segment, by type, in the routing market during the forecast period. The growing need for high-speed internet connectivity and the rising adoption of smart devices such as smartphones, tablets, and smart TVs are driving the demand for wireless routers with effective connectivity. The increasing demand for internet-based devices and expansion of cloud networking, coupled with the rising adoption of virtualized technologies, are expected to propel the growth of the global wireless router market during the forecast period.

Routing market for edge placement to hold the highest market share from 2022 to 2027

The edge router segment is expected to hold the largest share of the router market during the forecast period. As IoT development has progressed and 4K/8K videos have gained high popularity, the requirement for information communication technologies has increased significantly. The required quality and capabilities of communication vary widely from single high-speed sessions to numerous low-speed sessions, depending on use cases, applications, and devices. With the rising demand for network communication, the market for edge routers is expected to grow at a rapid rate in the coming years.

Routing market for enterprise application to hold the highest market during the forecast period

The enterprise application segment is expected to hold the largest share (62%) of the routing market during the forecast period. Routers play a vital role in enterprises by connecting computer networks and the internet. Traditional routers offer bandwidths of several Mbit/s but are susceptible to network congestion. By leveraging flexible and efficient application-based traffic steering, Software-Defined WAN (SD-WAN) is the best choice for enterprise WAN interconnection in the cloud era. However, when traditional enterprise routers intersect with SD-WAN, their forwarding performance decreases by about 80% on average. The demand for IT peripherals, including wired and wireless routers, in enterprises has witnessed a sharp rise between 2019 and 2021 due to the outbreak of COVID-19 and the implementation of work from home (WFH) policies by several companies across the globe.

Routing market for BFSI vertical to hold the highest share from 2022 to 2027

BFSI is expected to be the leading vertical in the router market during the forecast period. Financial organizations rely on technology to enhance the working of processes such as transfers, lending, investments, and receiving of payments. Digital and mobile banking services increase the level of customer convenience and accessibility. High-speed networks ensure that traders and investors have real-time access to market information. Thus, financial organizations need a high-speed, low-latency, and secure network to meet the challenges of fintech. The growing use of advanced routing solutions in the fintech industry is expected to boost the growth of the router market for the BFSI vertical.

Routing market in APAC to hold the highest market share from 2022 to 2027

The market in APAC is expected to grow at the highest rate during the forecast period. Countries in APAC, especially China, are at the forefront of technological developments such 5G and Wi-Fi 6. In June 2021, Chinese state-owned telecommunication company China Telecom and ZTE Corporation successfully deployed ZTE's core router ZXR10 T8000 in China Telecom’s IP MAN in Hunan, a mountainous province in southern China. Additionally, in June 2020, China Mobile launched the first deeply customized Wi-Fi 6 AX3000 router, which was jointly developed with HiSilicon (Shanghai). This router works in tandem with China Mobile's smart home services and features 160 MHz bandwidth, triple anti-interference, hardware acceleration, and chip-level security.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Routing companies is dominated by players such as Cisco (US), Huawei Technologies Co., Ltd. (China), Juniper Networks, Inc. (US), Hewlett Packard Enterprise Development LP (US), and Arista Networks, Inc. (US).

Routing Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 15.1 billion in 2022 |

|

Projected Market Size |

USD 22.9 billion by 2027 |

|

Growth Rate |

CAGR of 8.6% |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2018 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Type, Placement, Route, Application, and Vertical |

|

Geographies covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

The major market players Cisco (US), Huawei Technologies Co., Ltd. (China), Juniper Networks, Inc. (US), Hewlett Packard Enterprise Development LP (US), Arista Networks, Inc. (US), ASUSTeK Computer Inc. (Taiwan), New H3C Technologies Co., Ltd. (Taiwan), NETGEAR (US), Nokia (Finland), and Xiaomi (China) (Total 25 players are profiled) |

The study categorizes the routing market based on Type, Placement, Route, Application, and Vertical at the regional and global levels.

Routing Market, By Type

- Wired router

- Wireless router

Router Market, By Placement

- Edge

- Core

- Virtual

Routing Market, By Route

- Static routing

- Default routing

- Dynamic routing

Router Market, By Application

- Datacenter

- Enterprise

Routing Market, By Vertical

- BFSI

- Healthcare

- Education

- Residential

- Media & Entertainment

- Others

Routing Market, By Region

- North America

- Europe

- APAC

- RoW

Recent Developments in Router Market

- In December 2021, Aruba, a Hewlett Packard Enterprise company, introduced its new EdgeConnect Microbranch solution, an industry-leading home office and small office networking solution for hybrid work environments that securely provides remote personnel all of the traditional services workers receive in-office via a single Wi-Fi access point (AP), with no gateway, agent, or additional hardware required at the remote site.

- In December 2021, Aston Martin Cognizant Formula One Team announced a new partnership with Juniper Networks, which became the team’s Official Networking Equipment Vendor. As part of the partnership, Juniper would supply an agile and highly automated network platform across the team’s new technology campus, currently due for completion in early 2023.

- In December 2021, Juniper Networks announced that it was selected by Bharti Airtel (Airtel), India’s premier communications solutions provider, to deliver network upgrades to expand Airtel’s nationwide broadband coverage across India. As part of the deal, Juniper Networks would supply, install, and provide support for upgrades to the MX Series routers and line cards as part of its market-leading broadband network gateway (BNG) to manage its subscribers and services, as well as carrier-grade NAT (CGNAT) solutions to ensure secure encryption across the network respectively.

- In December 2021, Datagroup, a leading Ukrainian telecom operator for business and home users, launched a large-scale national project to modernize its backbone network with Cisco. The new Datagroup network is based on Cisco Routed Optical Networking and Converged SDN Transport solutions, which helped service providers build high-speed networks with greater security and reliability.

- In November 2021, H3C comprehensively showed its capabilities to facilitate the application of 5G networks, and digital and intelligent transformation at the China Mobile Global Partners Conference 2021 concluded recently in Guangzhou, Guangdong province, further solidifying its close ties with China Mobile. As an important supplier of 5G-related products and services for China Mobile, H3C engaged in the construction of China Mobile’s 5G special cloud network, helping the carrier build top-ranking new infrastructure facilities with industry-leading high-end routers.

- In November 2021, Juniper announced two new 6 GHz access points that leverage Mist AI to maximize Wi-Fi performance and capacity while simplifying IT operations. In addition, Juniper introduced a new IoT Assurance service that streamlines and scales the onboarding and securing of IoT devices without Network Access Control (NAC). These enhancements to the Juniper, wireless access portfolio, furthered the company’s experience-first networking mission.

- In November 2021, Nokia announced the supply of its 400GE IP edge routing platforms for LINX, the UK’s leading interconnection and peering community, to provide high-speed connectivity for LINX’s 950+ membership. LINX members would benefit from significantly higher speed interconnection with low latency and high reliability at main LINX locations.

- In November 2021, DISH Wireless and Cisco announced a multi-layered agreement to accelerate 5G services in the US. The partnership was designed to enable businesses to capitalize on DISH’s 5G network and application infrastructure to support new hybrid work models.

Frequently Asked Questions (FAQ):

What is the market size for the Routing market?

The routing market size is estimated to be valued at USD 15.1 billion in 2022 and reach USD 22.9 billion by 2027, at a CAGR of 8.6% from 2022–2027.

What are the major driving factors and opportunities in the routing market?

The growth of the routing market is expected to be driven by the increase in demand for SDN and NFV, surge in the volume of multimedia content generated through the internet and web applications, and high demand for cloud services. The growing requirement for bandwidth in data centers and rising adoption of connected devices in the healthcare and education sectors are projected to create lucrative opportunities for the market players during the review period.

Who are the leading players in the global routing market?

Companies such as Cisco (US), Huawei Technologies Co., Ltd. (China), Juniper Networks, Inc. (US), Hewlett Packard Enterprise Development LP (US), and Arista Networks, Inc. (US) are the leading players in the market. Moreover, these companies rely on strategies that include new product launches and developments, partnerships and collaborations, and acquisitions. Such advantages give these companies an edge over other companies in the market.

What is the COVID-19 impact on the Routing market?

According to discussions with various primary respondents, the impact of COVID-19 on the routing market has been considered to be for a short-to-medium term; hence, it has been assumed that COVID-19 prevailed from the first quarter of 2020 to its fourth quarter.

What are some of the technological advancements in the market?

Software-based routing or virtual router software is a distinct code sold separately from underlying hardware -- typically on x86 or Broadcom white boxes. This offers a working model different from traditional, box-based routers with integrated hardware and software from vendors such as Cisco or Juniper Networks. Enterprises, service providers, and other organizations are increasingly deploying software-based routing for a variety of network locations, including branch offices, data centers, network edge, cell sites, and network core. Software-based routing uses the increased price and performance of commercial silicon and white box pricing, and its performance is expected to continue improving with software innovation, as new routing software suppliers and hardware improvements such as Intel and Broadcom introduce new, faster silicon platforms. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 INTRODUCTION

2.2 RESEARCH DESIGN

FIGURE 1 ROUTING MARKET: RESEARCH DESIGN

2.2.1 SECONDARY DATA

2.2.1.1 List of major secondary sources

2.2.1.2 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

2.2.3 SECONDARY AND PRIMARY RESEARCH

2.2.3.1 Key industry insights

2.3 MARKET SIZE ESTIMATION

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY SIDE ANALYSIS

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE)—IDENTIFICATION OF REVENUE GENERATED BY COMPANIES FROM ROUTING MARKET

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach for arriving at market size using bottom-up analysis

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH FOR ESTIMATING SIZE OF ROUTING MARKET

2.3.2 TOP-DOWN APPROACH

2.3.2.1 Approach for arriving at market size using top-down analysis

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 MARKET BREAKDOWN AND DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

FIGURE 8 ASSUMPTIONS FOR RESEARCH STUDY

2.6 LIMITATIONS

2.7 RISK ASSESSMENT

TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 9 GLOBAL PROPAGATION OF COVID-19

FIGURE 10 RECOVERY SCENARIOS FOR GLOBAL ECONOMY

3.1 REALISTIC SCENARIO

3.2 OPTIMISTIC SCENARIO

3.3 PESSIMISTIC SCENARIO

FIGURE 11 GROWTH PROJECTIONS OF ROUTING MARKET IN REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

FIGURE 12 ROUTING MARKET FOR WIRELESS ROUTER TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 13 EDGE PLACEMENT SEGMENT TO HOLD LARGEST SHARE OF ROUTING MARKET IN 2027

FIGURE 14 ENTERPRISE APPLICATION SEGMENT TO HOLD LARGER SHARE OF ROUTING MARKET IN 2027

FIGURE 15 BFSI VERTICAL TO HOLD LARGEST SHARE OF ROUTING MARKET IN 2027

FIGURE 16 ROUTING MARKET IN APAC TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN ROUTING MARKET

FIGURE 17 INCREASING IOT DEVELOPMENT TO BOOST GROWTH OF ROUTING MARKET

4.2 ROUTING MARKET IN NORTH AMERICA, BY COUNTRY AND TYPE

FIGURE 18 US AND WIRELSS ROUTER SEGMENT HELD LARGEST SHARES OF NORTH AMERICAN ROUTING MARKET IN 2021

4.3 ROUTING MARKET IN APAC, BY VERTICAL

FIGURE 19 BFSI VERTICAL TO HOLD LARGEST SHARE OF APAC ROUTING MARKET DURING FORECAST PERIOD

4.4 ROUTING MARKET, BY COUNTRY

FIGURE 20 ROUTING MARKET IN INDIA TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 ROUTING MARKET DYNAMICS

FIGURE 22 DRIVERS AND THEIR IMPACT ON ROUTING MARKET

FIGURE 23 OPPORTUNITIES AND THEIR IMPACT ON ROUTING MARKET

FIGURE 24 RESTRAINTS AND THREATS AND THEIR IMPACT ON ROUTING MARKET

5.2.1 DRIVERS

5.2.1.1 Increase in demand for SDN and NFV

5.2.1.2 Surge in volume of multimedia content generated through internet and web applications

5.2.1.3 High demand for cloud services

5.2.1.4 Emergence and adoption of smart homes

5.2.2 RESTRAINTS

5.2.2.1 Reluctance in moving from legacy systems to virtualized systems

5.2.3 OPPORTUNITIES

5.2.3.1 Growing requirement for bandwidth in data centers

5.2.3.2 Rising adoption of connected devices in healthcare and education sectors

5.2.4 CHALLENGES

5.2.4.1 Security concerns related to virtualized environment

5.3 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS: ROUTING MARKET

5.4 ECOSYSTEM

FIGURE 26 ROUTING MARKET: ECOSYSTEM

TABLE 2 KEY PLAYERS AND THEIR ROLE IN ROUTING ECOSYSTEM

5.5 PORTER’S FIVE FORCES ANALYSIS

TABLE 3 ROUTING MARKET: PORTER’S FIVE FORCES ANALYSIS

5.5.1 DEGREE OF COMPETITION

5.5.2 BARGAINING POWER OF SUPPLIERS

5.5.3 BARGAINING POWER OF BUYERS

5.5.4 THREAT OF SUBSTITUTES

5.5.5 THREAT OF NEW ENTRANTS

5.6 CASE STUDIES

5.6.1 TELDAT’S ATLAS-60 DECREASED MAINTENANCE COSTS THROUGH ONE DEVICE WITHIN EACH BRANCH FOR DATA AND VOICE CONNECTIONS

5.6.2 INHAND NETWORKS OFFERED SOLUTION USING ITS INROUTER900 INDUSTRIAL LTE M2M ROUTER, DELIVERING FAST AND RELIABLE CONNECTIVITY WITH GE’S CT SCANNERS

5.6.3 TP-LINK HELPED CHASE GRAMMAR SCHOOL WITH WIRELESS OPTIMIZATION FOR INTERNET CONNECTIVITY

5.6.4 NTTPC COMMUNICATIONS INC. DEPLOYS CISCO INTEGRATED SERVICE ROUTERS WITH IOS EMBEDDED EVENT MANAGER TO REDUCE OVERALL OPERATIONS COST OF

5.6.5 D-LINK HELPS FOOD PROCESSING COMPANY IN WASHINGTON ELIMINATE NETWORK DOWNTIME AND ENABLE ROUND-THE-CLOCK EFFICIENCY

5.7 TECHNOLOGY ANALYSIS

5.7.1 SOFTWARE-BASED ROUTING

5.7.2 WI-FI 6

5.8 AVERAGE SELLING PRICE (ASP) TREND ANALYSIS

FIGURE 27 AVERAGE SELLING PRICES OF ROUTERS, BY TYPE

FIGURE 28 AVERAGE SELLING PRICES OF WIRELESS ROUTERS

5.9 TRADE ANALYSIS

5.9.1 EXPORT SCENARIO

TABLE 4 EXPORT SCENARIO FOR HS CODE: 851762, BY COUNTRY, 2016–2020 (USD THOUSAND)

FIGURE 29 EXPORT SCENARIO FOR HS CODE: 851762 FOR TOP FIVE COUNTRIES, 2016–2020 (USD BILLION)

5.9.2 IMPORT SCENARIO

TABLE 5 IMPORT SCENARIO FOR HS CODE: 851762, BY COUNTRY, 2016–2020 (USD THOUSAND)

FIGURE 30 IMPORT SCENARIO FOR HS CODE: 851762 FOR TOP FIVE COUNTRIES, 2016–2020 (USD BILLION)

5.10 PATENTS ANALYSIS

TABLE 6 PATENTS PERTAINING TO ROUTING MARKET FILED DURING 2019–2021

5.11 TARIFFS AND REGULATIONS

5.11.1 TARIFFS RELATED TO ROUTING MARKET

TABLE 7 TARIFF IMPOSED BY US ON HS CODE 851762, BY COUNTRY, 2020

TABLE 8 TARIFF IMPOSED BY INDIA ON HS CODE 851762, BY COUNTRY, 2020

TABLE 9 TARIFF IMPOSED BY CHINA ON HS CODE 851762, BY COUNTRY, 2020

5.12 STANDARDS AND REGULATIONS RELATED TO ROUTING MARKET

TABLE 10 HISTORY OF WIRELESS STANDARDS

5.12.1 IEEE 802.11

5.12.2 IEEE 802.11A

5.12.3 IEEE 802.11B

5.12.4 IEEE 802.11G

5.12.5 IEEE 802.11N

5.12.6 IEEE 802.11AC

5.12.7 IEEE 802.11AX

5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 31 REVENUE SHIFT FOR ROUTING MARKET

6 ROUTING MARKET, BY TYPE (Page No. - 69)

6.1 INTRODUCTION

FIGURE 32 ROUTING MARKET, BY TYPE

FIGURE 33 ROUTING MARKET FOR WIRELESS ROUTERS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 11 ROUTING MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 12 ROUTING MARKET, BY TYPE, 2022–2027 (USD BILLION)

6.2 WIRED ROUTER

6.2.1 INCREASED DEMAND FOR WIRED ROUTERS DUE TO THEIR EXCELLENT FEATURES

TABLE 13 ROUTING MARKET FOR WIRED ROUTER, BY PLACEMENT, 2018–2021 (USD BILLION)

TABLE 14 ROUTING MARKET FOR WIRED ROUTER, BY PLACEMENT, 2022–2027 (USD BILLION)

TABLE 15 ROUTING MARKET FOR WIRED ROUTER, BY APPLICATION, 2018–2021 (USD BILLION)

TABLE 16 ROUTING MARKET FOR WIRED ROUTER, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 17 ROUTING MARKET FOR WIRED ROUTER, BY VERTICAL, 2018–2021 (USD BILLION)

TABLE 18 ROUTING MARKET FOR WIRED ROUTER, BY VERTICAL, 2022–2027 (USD BILLION)

TABLE 19 ROUTING MARKET FOR WIRED ROUTER, BY REGION, 2018–2021 (USD BILLION)

TABLE 20 ROUTING MARKET FOR WIRED ROUTER, BY REGION, 2022–2027 (USD BILLION)

6.3 WIRELESS ROUTER

6.3.1 GROWING DEMAND FOR WIRELESS ROUTERS DUE TO EMERGENCE OF WI-FI6

6.3.1.1 Single-band wireless router

6.3.1.2 Dual-band wireless router

6.3.1.3 Tri-band wireless router

FIGURE 34 DUAL-BAND SUB-SEGMENT TO GROW AT HIGHEST CAGR IN ROUTING MARKET FOR WIRELESS ROUTERS DURING FORECAST PERIOD

TABLE 21 ROUTING MARKET FOR WIRELESS ROUTER, BY TYPE, 2018–2021 (USD BILLION)

TABLE 22 ROUTING MARKET FOR WIRELESS ROUTER, BY TYPE, 2022–2027 (USD BILLION)

TABLE 23 ROUTING MARKET FOR WIRELESS ROUTER, BY PLACEMENT, 2018–2021 (USD BILLION)

TABLE 24 ROUTING MARKET FOR WIRELESS ROUTER, BY PLACEMENT, 2022–2027 (USD BILLION)

TABLE 25 ROUTING MARKET FOR WIRELESS ROUTER, BY APPLICATION, 2018–2021 (USD BILLION)

TABLE 26 ROUTING MARKET FOR WIRELESS ROUTER, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 27 ROUTING MARKET FOR WIRELESS ROUTER, BY VERTICAL, 2018–2021 (USD BILLION)

TABLE 28 ROUTING MARKET FOR WIRELESS ROUTER, BY VERTICAL, 2022–2027 (USD BILLION)

TABLE 29 ROUTING MARKET FOR WIRELESS ROUTER, BY REGION, 2018–2021 (USD BILLION)

TABLE 30 ROUTING MARKET FOR WIRELESS ROUTER, BY REGION, 2022–2027 (USD BILLION)

7 ROUTING MARKET, BY PLACEMENT (Page No. - 79)

7.1 INTRODUCTION

FIGURE 35 EDGE PLACEMENT SEGMENT TO HOLD LARGEST SHARE OF ROUTING MARKET IN 2027

TABLE 31 ROUTING MARKET, BY PLACEMENT, 2018–2021 (USD BILLION)

TABLE 32 ROUTING MARKET, BY PLACEMENT, 2022–2027 (USD BILLION)

7.2 EDGE ROUTER

7.2.1 EDGE ROUTERS OFFER NETWORKING, SECURITY, AND OTHER IT SERVICES IN COMPACT FORM FACTOR

7.2.1.1 Aggregation edge platform

7.2.1.2 Branch edge platform

7.2.1.3 Virtual edge platform

TABLE 33 ROUTING MARKET FOR EDGE ROUTER, BY TYPE, 2018–2021 (USD BILLION)

TABLE 34 ROUTING MARKET FOR EDGE ROUTER, BY TYPE, 2022–2027 (USD BILLION)

7.3 CORE ROUTER

7.3.1 SINGLE CORE ROUTER IS CAPABLE OF PROCESSING MILLIONS OF PACKETS EVERY SECOND

TABLE 35 ROUTING MARKET FOR CORE ROUTER, BY TYPE, 2018–2021 (USD BILLION)

TABLE 36 ROUTING MARKET FOR CORE ROUTER, BY TYPE, 2022–2027 (USD BILLION)

7.4 VIRTUAL ROUTER

7.4.1 VIRTUAL ROUTER ENABLES HIGH HARDWARE INTEROPERABILITY

TABLE 37 ROUTING MARKET FOR VIRTUAL ROUTER, BY TYPE, 2018–2021 (USD BILLION)

TABLE 38 ROUTING MARKET FOR VIRTUAL ROUTER, BY TYPE, 2022–2027 (USD BILLION)

8 ROUTING MARKET, BY ROUTE (Page No. - 85)

8.1 INTRODUCTION

8.2 STATIC ROUTING

8.2.1 STATIC ROUTES ARE HIGHLY PREFERRED OVER DYNAMIC ROUTES

8.3 DEFAULT ROUTING

8.3.1 ROUTER IN DEFAULT ROUTING IS CONFIGURED TO SEND ALL PACKETS TOWARD SINGLE ROUTER

8.4 DYNAMIC ROUTING

8.4.1 DYNAMIC ROUTING USES COMPLEX ROUTING ALGORITHMS AND DOES NOT PROVIDE HIGH SECURITY LIKE STATIC ROUTING

9 ROUTED OPTICAL NETWORKING MARKET (Page No. - 86)

9.1 INTRODUCTION

9.2 ROUTED OPTICAL NETWORKING (RON)

9.2.1 RISING DATA TRAFFIC TO DRIVE DEMAND FOR ROUTED OPTICAL NETWORKING (RON)

FIGURE 36 GROWTH RATE OF ROUTED OPTICAL NETWORKING MARKET, 2022–2027

TABLE 39 ROUTED OPTICAL NETWORKING MARKET, 2022–2027 (USD MILLION)

TABLE 40 ROUTED OPTICAL NETWORKING MARKET, BY REGION, 2022–2027 (USD MILLION)

FIGURE 37 ROUTED OPTICAL NETWORK ARCHITECTURE FEATURES

9.3 RECENT DEVELOPMENTS

9.3.1 DATAGROUP HAS TAKEN INTERNET SPEEDS TO NEW HEIGHTS ACROSS UKRAINE WITH CISCO’S ROUTED OPTICAL NETWORKING

9.3.2 COLT HAS TAKEN NETWORK INNOVATION TO NEW HEIGHTS WITH 400G-CAPABLE ROUTED OPTICAL NETWORKING SOLUTION

10 ROUTING MARKET, BY APPLICATION (Page No. - 89)

10.1 INTRODUCTION

FIGURE 38 ENTERPRISE APPLICATION SEGMENT TO HOLD LARGER SHARE OF ROUTING MARKET IN 2027

TABLE 41 ROUTING MARKET, BY APPLICATION, 2018–2021 (USD BILLION)

TABLE 42 ROUTING MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

10.2 DATA CENTER

10.2.1 EDGE ROUTERS ARE WIDELY USED IN EDGE DATA CENTERS

TABLE 43 ROUTING MARKET FOR DATA CENTER APPLICATION, BY TYPE, 2018–2021 (USD BILLION)

TABLE 44 ROUTING MARKET FOR DATA CENTER APPLICATION, BY TYPE, 2022–2027 (USD BILLION)

10.3 ENTERPRISE

10.3.1 ENTERPRISE ROUTERS ARE HIGHLY PREFERRED IN ENTERPRISES

TABLE 45 ROUTING MARKET FOR ENTERPRISE APPLICATION, BY TYPE, 2018–2021 (USD BILLION)

TABLE 46 ROUTING MARKET FOR ENTERPRISE APPLICATION, BY TYPE, 2022–2027 (USD BILLION)

11 ROUTING MARKET, BY VERTICAL (Page No. - 93)

11.1 INTRODUCTION

FIGURE 39 BFSI VERTICAL TO HOLD LARGEST SHARE OF ROUTING MARKET IN 2027

TABLE 47 ROUTING MARKET, BY VERTICAL, 2018–2021 (USD BILLION)

TABLE 48 ROUTING MARKET, BY VERTICAL, 2022–2027 (USD BILLION)

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

11.2.1 INCREASING IMPLEMENTATION OF IOT IN BFSI VERTICAL TO FUEL GROWTH OF ROUTING MARKET

TABLE 49 ROUTING MARKET FOR BFSI VERTICAL, BY TYPE, 2018–2021 (USD BILLION)

TABLE 50 ROUTING MARKET FOR BFSI VERTICAL, BY TYPE, 2022–2027 (USD BILLION)

FIGURE 40 BFSI VERTICAL TO HOLD LARGEST SIZE OF NORTH AMERICAN ROUTING MARKET IN 2027

TABLE 51 ROUTING MARKET FOR BFSI VERTICAL, BY REGION, 2018–2021 (USD BILLION)

TABLE 52 ROUTING MARKET FOR BFSI VERTICAL, BY REGION, 2022–2027 (USD BILLION)

11.3 HEALTHCARE

11.3.1 HIGH NEED FOR SECURE DATA TRANSMISSION IN HEALTHCARE VERTICAL TO BOOST GROWTH OF ROUTING MARKET

TABLE 53 ROUTING MARKET FOR HEALTHCARE VERTICAL, BY TYPE, 2018–2021 (USD BILLION)

TABLE 54 ROUTING MARKET FOR HEALTHCARE VERTICAL, BY TYPE, 2022–2027 (USD BILLION)

TABLE 55 ROUTING MARKET FOR HEALTHCARE VERTICAL, BY REGION, 2018–2021 (USD BILLION)

TABLE 56 ROUTING MARKET FOR HEALTHCARE VERTICAL, BY REGION, 2022–2027 (USD BILLION)

11.4 EDUCATION

11.4.1 INCREASED PROMOTION OF E-LEARNING ON GLOBAL LEVEL DURING COVID-19 PANDEMIC PERIOD HAS FUELED DEMAND FOR ROUTERS

TABLE 57 ROUTING MARKET FOR EDUCATION VERTICAL, BY TYPE, 2018–2021 (USD BILLION)

TABLE 58 ROUTING MARKET FOR EDUCATION VERTICAL, BY TYPE, 2022–2027 (USD BILLION)

TABLE 59 ROUTING MARKET FOR EDUCATION VERTICAL, BY REGION, 2018–2021 (USD BILLION)

TABLE 60 ROUTING MARKET FOR EDUCATION VERTICAL, BY REGION, 2022–2027 (USD BILLION)

11.5 RESIDENTIAL

11.5.1 GROWING USE OF SMART DEVICES IN HOMES AND OFFICES TO DRIVE MARKET GROWTH

TABLE 61 ROUTING MARKET FOR RESIDENTIAL VERTICAL, BY TYPE, 2018–2021 (USD BILLION)

TABLE 62 ROUTING MARKET FOR RESIDENTIAL VERTICAL, BY TYPE, 2022–2027 (USD BILLION)

TABLE 63 ROUTING MARKET FOR RESIDENTIAL VERTICAL, BY REGION, 2018–2021 (USD BILLION)

TABLE 64 ROUTING MARKET FOR RESIDENTIAL VERTICAL, BY REGION, 2022–2027 (USD BILLION)

11.6 MEDIA & ENTERTAINMENT

11.6.1 EMERGENCE OF 5G TECHNOLOGY TO BOOST GROWTH OF ROUTING MARKET FOR MEDIA & ENTERTAINMENT (M&E) VERTICAL

TABLE 65 ROUTING MARKET FOR MEDIA & ENTERTAINMENT VERTICAL, BY TYPE, 2018–2021 (USD BILLION)

TABLE 66 ROUTING MARKET FOR MEDIA & ENTERTAINMENT VERTICAL, BY TYPE, 2022–2027 (USD BILLION)

TABLE 67 ROUTING MARKET FOR MEDIA & ENTERTAINMENT VERTICAL, BY REGION, 2018–2021 (USD BILLION)

TABLE 68 ROUTING MARKET FOR MEDIA & ENTERTAINMENT VERTICAL, BY REGION, 2022–2027 (USD BILLION)

11.7 OTHERS

TABLE 69 ROUTING MARKET FOR OTHERS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 70 ROUTING MARKET FOR OTHERS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 71 ROUTING MARKET FOR OTHERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 ROUTING MARKET FOR OTHERS, BY REGION, 2022–2027 (USD MILLION)

12 ROUTING MARKET, BY REGION (Page No. - 105)

12.1 INTRODUCTION

FIGURE 41 NORTH AMERICA TO HOLD LARGEST SIZE OF ROUTING MARKET IN 2027

TABLE 73 ROUTING MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 74 ROUTING MARKET, BY REGION, 2022–2027 (USD BILLION)

12.2 NORTH AMERICA

FIGURE 42 SNAPSHOT: ROUTING MARKET IN NORTH AMERICA

TABLE 75 ROUTING MARKET IN NORTH AMERICA, BY TYPE, 2018–2021 (USD BILLION)

TABLE 76 ROUTING MARKET IN NORTH AMERICA, BY TYPE, 2022–2027 (USD BILLION)

TABLE 77 ROUTING MARKET IN NORTH AMERICA, BY VERTICAL, 2018–2021 (USD BILLION)

TABLE 78 ROUTING MARKET IN NORTH AMERICA, BY VERTICAL, 2022–2027 (USD BILLION)

TABLE 79 ROUTING MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 80 ROUTING MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD BILLION)

12.2.1 US

12.2.1.1 Presence of key routing solutions providers to underpin market growth in US

12.2.2 CANADA

12.2.2.1 Government support for installation of data centers to provide opportunities for deployment of routing solutions in Canada

12.2.3 MEXICO

12.2.3.1 Growing number of data centers in Mexico to provide opportunities for routing market growth

12.3 EUROPE

FIGURE 43 SNAPSHOT: ROUTING MARKET IN EUROPE

TABLE 81 ROUTING MARKET IN EUROPE, BY TYPE, 2018–2021 (USD BILLION)

TABLE 82 ROUTING MARKET IN EUROPE, BY TYPE, 2022–2027 (USD BILLION)

TABLE 83 ROUTING MARKET IN EUROPE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 84 ROUTING MARKET IN EUROPE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 85 ROUTING MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 86 ROUTING MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD BILLION)

12.3.1 UK

12.3.1.1 Higher adoption of cloud-based services in BFSI and telecommunications industries is driving routing market in UK

12.3.2 GERMANY

12.3.2.1 Investments in upgrade of traditional IT infrastructure to boost demand for routing solutions in Germany

12.3.3 FRANCE

12.3.3.1 Presence of data centers and high-speed communication infrastructure to favor market growth in France

12.3.4 REST OF EUROPE

12.4 ASIA PACIFIC

FIGURE 44 SNAPSHOT: ROUTING MARKET IN ASIA PACIFIC

TABLE 87 ROUTING MARKET IN APAC, BY TYPE, 2018–2021 (USD BILLION)

TABLE 88 ROUTING MARKET IN APAC, BY TYPE, 2022–2027 (USD BILLION)

TABLE 89 ROUTING MARKET IN APAC, BY VERTICAL, 2018–2021 (USD BILLION)

TABLE 90 ROUTING MARKET IN APAC, BY VERTICAL, 2022–2027 (USD BILLION)

FIGURE 45 CHINA TO HOLD LARGEST SIZE OF ROUTING MARKET IN APAC IN 2027

TABLE 91 ROUTING MARKET IN APAC, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 92 ROUTING MARKET IN APAC, BY COUNTRY, 2022–2027 (USD BILLION)

12.4.1 CHINA

12.4.1.1 Expanding telecom industry to favor growth of routing market in China

12.4.2 JAPAN

12.4.2.1 Presence of several networking companies to support market growth in Japan

12.4.3 INDIA

12.4.3.1 Booming IT sector and rise in number of large data centers in India are fueling demand for routers

12.4.4 REST OF APAC

12.4.5 REST OF THE WORLD

TABLE 93 ROUTING MARKET IN ROW, BY TYPE, 2018–2021 (USD BILLION)

TABLE 94 ROUTING MARKET FOR ROW, BY TYPE, 2022–2027 (USD BILLION)

TABLE 95 ROUTING MARKET IN ROW, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 96 ROUTING MARKET IN ROW, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 97 ROUTING MARKET IN ROW, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 98 ROUTING MARKET FOR ROW, BY COUNTRY, 2022–2027 (USD BILLION)

12.4.6 SOUTH AMERICA

12.4.6.1 Emerging trends of high-quality video streaming to drive the market growth in South America

12.4.7 MIDDLE EAST & AFRICA

12.4.7.1 Focus on enhancing network capabilities to achieve network efficiency and coverage to augment demand for routers in MEA

13 COMPETITIVE LANDSCAPE (Page No. - 123)

13.1 OVERVIEW

13.2 MARKET EVALUATION FRAMEWORK

TABLE 99 OVERVIEW OF STRATEGIES ADOPTED BY KEY MARKET PLAYERS

13.2.1 PRODUCT PORTFOLIO

13.2.2 REGIONAL FOCUS

13.2.3 MANUFACTURING FOOTPRINT

13.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

13.3 REVENUE ANALYSIS OF LEADING PLAYERS (2016–2020)

FIGURE 46 5-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN ROUTING MARKET

13.4 MARKET SHARE ANALYSIS: ROUTING MARKET, 2020

TABLE 100 DEGREE OF COMPETITION

13.5 COMPANY EVALUATION MATRIX

13.5.1 STAR

13.5.2 EMERGING LEADER

13.5.3 PERVASIVE

13.5.4 PARTICIPANT

FIGURE 47 COMPANY EVALUATION MATRIX, 2021

13.6 START-UP EVALUATION MATRIX

13.6.1 PROGRESSIVE COMPANY

13.6.2 RESPONSIVE COMPANY

13.6.3 DYNAMIC COMPANY

13.6.4 STARTING BLOCK

FIGURE 48 STARTUP (SME) EVALUATION MATRIX, 2021

13.7 COMPANY PRODUCT FOOTPRINT

TABLE 101 COMPANY PRODUCT FOOTPRINT

TABLE 102 FOOTPRINT OF DIFFERENT TYPES OF ROUTERS USED BY DIFFERENT COMPANIES

TABLE 103 FOOTPRINT OF DIFFERENT COMPANIES ACROSS VARIOUS VERTICALS

TABLE 104 REGIONAL FOOTPRINT OF DIFFERENT COMPANIES

13.8 COMPETITIVE SITUATIONS AND TRENDS

13.8.1 PRODUCT LAUNCHES

TABLE 105 PRODUCT LAUNCHES, FEBRUARY 2020–DECEMBER 2021

13.8.2 DEALS

TABLE 106 DEALS, FEBRUARY 2020–DECEMBER 2021

13.8.2.1 Others

TABLE 107 OTHERS, 2021

14 COMPANY PROFILES (Page No. - 141)

14.1 INTRODUCTION

14.2 KEY PLAYERS

(Business Overview, Products/Solutions/Services offered, Recent Developments, and MnM View)*

14.2.1 CISCO

TABLE 108 CISCO: BUSINESS OVERVIEW

FIGURE 49 CISCO: COMPANY SNAPSHOT

TABLE 109 CISCO: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 110 CISCO: PRODUCT LAUNCHES

TABLE 111 CISCO: DEALS

14.2.2 HUAWEI

TABLE 112 HUAWEI: BUSINESS OVERVIEW

FIGURE 50 HUAWEI: COMPANY SNAPSHOT

TABLE 113 HUAWEI: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 114 HUAWEI: PRODUCT LAUNCHES

TABLE 115 HUAWEI: OTHERS

14.2.3 JUNIPER NETWORKS

TABLE 116 JUNIPER NETWORKS: BUSINESS OVERVIEW

FIGURE 51 JUNIPER NETWORKS: COMPANY SNAPSHOT

TABLE 117 JUNIPER NETWORKS: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 118 JUNIPER NETWORKS: PRODUCT LAUNCHES

TABLE 119 JUNIPER NETWORKS: DEALS

14.2.4 HP ENTERPRISE

TABLE 120 HP ENTERPRISE: BUSINESS OVERVIEW

FIGURE 52 HP ENTERPRISE: COMPANY SNAPSHOT

TABLE 121 HP ENTERPRISE: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 122 HP ENTERPRISE: PRODUCT LAUNCHES

TABLE 123 HP ENTERPRISE: DEALS

14.2.5 ARISTA NETWORKS

TABLE 124 ARISTA NETWORKS: BUSINESS OVERVIEW

FIGURE 53 ARISTA NETWORKS: COMPANY SNAPSHOT

TABLE 125 ARISTA NETWORKS: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 126 ARISTA NETWORKS: PRODUCT LAUNCHES

TABLE 127 ARISTA NETWORKS: DEALS

14.2.6 ASUSTEK COMPUTER

TABLE 128 ASUSTEK COMPUTER: BUSINESS OVERVIEW

FIGURE 54 ASUSTEK COMPUTER: COMPANY SNAPSHOT

TABLE 129 ASUSTEK COMPUTER: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 130 ASUSTEK COMPUTER: PRODUCT LAUNCHES

14.2.7 H3C

TABLE 131 H3C: BUSINESS OVERVIEW

TABLE 132 H3C: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 133 H3C: PRODUCT LAUNCHES

TABLE 134 H3C: OTHERS

14.2.8 NETGEAR

TABLE 135 NETGEAR: BUSINESS OVERVIEW

FIGURE 55 NETGEAR: COMPANY SNAPSHOT

TABLE 136 NETGEAR: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 137 NETGEAR: PRODUCT LAUNCHES

TABLE 138 NETGEAR: OTHERS

14.2.9 NOKIA

TABLE 139 NOKIA: BUSINESS OVERVIEW

FIGURE 56 NOKIA: COMPANY SNAPSHOT

TABLE 140 NOKIA: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 141 NOKIA: PRODUCT LAUNCHES

TABLE 142 NOKIA: DEALS

TABLE 143 NOKIA: OTHERS

14.2.10 XIAOMI

TABLE 144 XIAOMI: BUSINESS OVERVIEW

FIGURE 57 XIAOMI: COMPANY SNAPSHOT

TABLE 145 XIAOMI: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 146 XIAOMI: PRODUCT LAUNCHES

* Business Overview, Products/Solutions/Services offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

14.3 OTHER KEY PLAYERS

14.3.1 ACELINK TECHNOLOGY

14.3.2 ADTRAN

14.3.3 ALLIED TELESIS

14.3.4 BELKIN INTERNATIONAL

14.3.5 D-LINK

14.3.6 EERO LLC

14.3.7 EKINOPS

14.3.8 EXTREME NETWORKS

14.3.9 LINKSYS

14.3.10 MIKROTIK

14.3.11 PEPLINK

14.3.12 RAYMAR INFORMATION TECHNOLOGY

14.3.13 SIERRA WIRELESS

14.3.14 SYNOLOGY

14.3.15 TP-LINK

15 APPENDIX (Page No. - 186)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

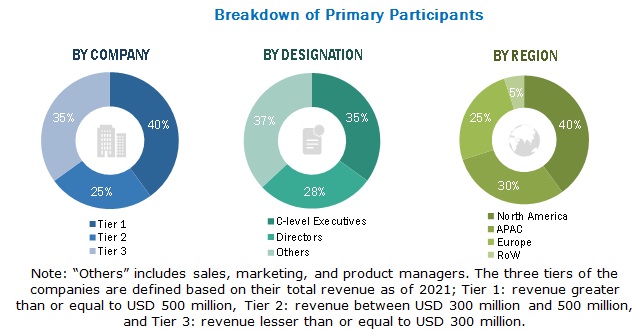

This research study involved extensive use of secondary sources, directories, and databases (e.g., Hoovers, Bloomberg Business, Factiva, and OneSource) to identify and collect information useful for this technical, market-oriented, and commercial study of the routing market. Primary sources include several industry experts from the core and related industries and suppliers, manufacturers, distributors, technology developers, IP vendors, and standards organizations related to all the segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information, as well as to assess the prospects of the market.

Secondary Research

Secondary sources referred to for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

List of major secondary sources

|

SOURCE |

WEB LINK |

|

Organization for Economic Co-operation and Development (OECD) |

https://www.oecd.org/digital/broadband-statistics-update.htm |

|

Government of Singapore |

https://data.gov.sg/dataset/mobile-penetration-rate |

|

Cybersecurity & Infrastructure Security Agency (CISA) |

https://www.cisa.gov/publication/5g-strategy |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the routing market through secondary research. Several primary interviews were conducted with experts from both demand and supply sides across 4 major regions—North America, Europe, APAC, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the routing market and its various dependent submarkets. The key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure involved the study of annual and financial reports of top players and extensive interviews with industry leaders such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

The bottom-up approach was used to arrive at the overall size of the routing market from the revenues of key players and their shares in the market. The overall market size was calculated based on the revenues of key players identified in the market. The research methodology used to estimate the market size by the bottom-up approach includes the following:

- Initially, the companies offering different types of routers with various placements were identified, and their product mappings with respect to different parameters such as application and vertical were carried out.

- The size of the routing market was estimated based on demand for routers in different applications and verticals and the revenue of the companies operating in the routing ecosystem.

- Primary interviews were conducted with a few major players operating in the routing market for validating the global market size.

- For calculating the CAGR of the routing market, the historical and future market trend analyses were carried out by understanding the penetration rate of routers, and their demand and supply in different applications and verticals.

- The estimates at every level were verified and cross-checked through discussions with key opinion leaders such as corporate executives (CXOs), directors, and sales heads, as well as with the domain experts in MarketsandMarkets.

- Various paid and unpaid information sources, such as annual reports, press releases, white papers, and databases, were also studied

In the top-down approach, the overall size of the routing market that was derived through percentage splits obtained from secondary and primary research was used to estimate the size of the individual markets (mentioned in the market segmentation).

For the calculation of the size of specific market segments, the overall size of the routing market was considered to implement the top-down approach. The bottom-up approach was also implemented for the data extracted from secondary research to validate the obtained market size of different segments.

The market share of each company was estimated to verify the revenue share used earlier in the bottom-up approach. With the data triangulation procedure and validation of data through primaries, the sizes of the overall parent market and each individual market were determined and confirmed in this study.

The research methodology used to estimate the market size by the top-down approach includes the following:

- Information related to the revenues of key manufacturers and providers of routers was studied and analyzed to estimate the global size of the routing market.

- The routing market is expected to witness a linear growth trend during the forecast period as it is a mature market with a large number of well-established players serving various verticals.

- Placements, geographic presence, and key verticals, as well as different types of offerings of all identified players in the routing market, were studied to estimate and arrive at the percentage split of different segments of the market.

- All major players in each category (type and application) of the routing market were identified through secondary research and verified through brief discussions with the industry experts.

- Multiple discussions with key opinion leaders of all major companies involved in the development of the routers were conducted to validate the market split based on type, placement, application, vertical, and geography.

- Geographic splits were estimated using secondary sources, based on various factors such as the number of players offering routers in a specific country or region and the type of router offered by these players.

Data Triangulation

After arriving at the overall size of the routing market from the market size estimation process explained above, the total market was split into several segments and subsegments. The market breakdown and data triangulation procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both, demand and supply sides. In addition to this, the market size was validated using top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the routing market, in terms of value, based on type, placement, route, application, vertical, and region

- To forecast the market size based on type, in terms of volume

- To describe and forecast the market size, in terms of value, for 4 major regions—North America, Europe, APAC, and RoW

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the value chain of the routing ecosystem

- To strategically analyze micromarkets1 with respect to individual market trends, growth prospects, and contributions to the overall market

- To strategically profile key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with a detailed competitive landscape for the market leaders

- To analyze major growth strategies such as product launches, expansions, joint ventures, agreements, and acquisitions adopted by the key market players to boost their position in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Routing Market