Robotics and Automation Actuators Market by Type (Linear Actuators, Rotary Actuators), Actuation (Electric, Pneumatic, Hydraulic), Application (Process Automation, Robotics), Vertical, Design Characteristic, and Region - Global Forecast to 2027

Update: 11/22/2024

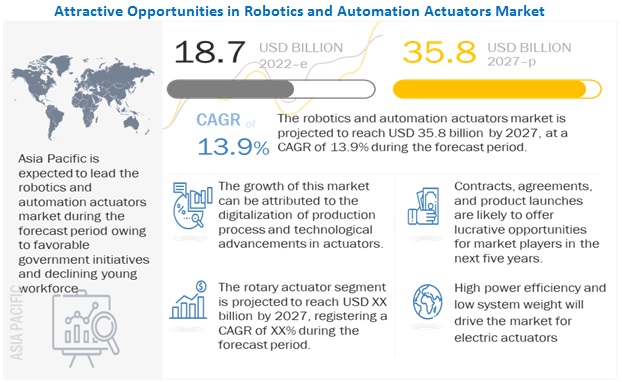

The Global Robotics and Automation Actuators Market Size was valued at USD 18.7 billion in 2022 and is estimated to reach USD 35.8 billion by 2027, growing at a CAGR of 13.9% during the forecast period. Industries across all the regions are expected to adopt robotics and automation actuators that have simple designs, are easy to operate, and are cost-effective.

To know about the assumptions considered for the study, Request for Free Sample Report

Robotics and Automation Actuators Market Dynamics:

Driver: Ongoing technological advancements in Robotics and automation actuators

The demand for improved performance Robotics and automation actuators for use in various industries has led to the development of new and advanced actuators such as electrical actuators, compact pneumatic actuators, and explosion- proof actuators. Electrical actuators are the most advanced actuators in terms of technology. They are increasingly used in the mining, automation, aerospace & defense, and chemical industries as they are silent, clean, non-toxic, and energy competent. These actuators are more efficient than pneumatic and hydraulic actuators. Electrical actuators can be integrated with critical systems using data bus communication. They offer instant feedback of movements of end effectors and provide accurate variable control over motor speed acceleration and velocity. They are also easy to install. Electrical actuators have a long shelf life and require low maintenance, leading to low total functional costs as compared to other actuators.

Moreover, several other types of actuators, such as mini-electrical actuators, digital linear actuators, and idle speed controllers, have also been developed and introduced in the market. Thus, continuous technological advancements in actuators are expected to lead to their increased application in various industries, thereby fueling their demand across the globe. This increased demand for different types of actuators is expected to contribute to the growth of the Robotics and Automation Actuators Industry during the forecast period.

Restraint: Continuous upheavals in the oil & gas industry and volatility in the price of crude oil

Actuators are used in the petrochemicals industry for automation at different stages of the oil & gas supply chain. Continuous upheavals in the oil & gas industry in the form of reduced oil prices have affected oil & gas exploration activities across the globe. Several oil-producing countries are focusing on the optimum utilization of their current oil wells. Exploration and development activities of new oil & gas fields are taking place at a very slow pace. This has adversely affected the overall growth of the actuators market. The price of crude oil has fallen drastically over the last few years, affecting the overall market for various components used in the oil & gas supply chain, including Robotics and automation actuators.

Opportunity: Development of smart cities across the globe

Due to the ongoing rapid urbanization across the globe, there is an increase in the development of smart cities across the globe. Smart cities adopt instrumentation and actuation technologies to manage and interconnect thousands of scattered sensors and actuators, which use the Internet of Things (IoT).

Smart cities use electronically-driven solutions for logistics applications. Smart electrical actuators equipped with inbuilt location feedback and power systems as well as bus communication act as cost-effective solutions for the transformation of control logic into smart motion. These actuators cater to service robots such as cleaning robots, automated guided vehicles, automated parking systems, surveillance robots, etc.

There is an increase in the number of smart cities being planned across the globe, as several existing cities are facing housing shortages, overstretched infrastructures, and uncertain water and energy supplies. This has led to the requirement for smart cities that use the Internet of Things as a networking technology and smart data as a forecasting technology. Thus, the development of smart cities using these technologies is expected to lead to decentralized management, the merger of heating and electricity facilities, and the integration of industrial facilities, buildings, and vehicles as energy suppliers.

Challenge: Power consumption, noise, and leakage issues

The most challenging stage in the manufacturing of actuators is the designing of a circuit that consumes less energy. Actuators consume more energy than sensors, and a single faulty actuator can result in increased electricity consumption. The power, capacity, and weight of electrical actuators are the main reasons for their increased demand in various applications. However, due to the probability of defective circuit designs, customers may not prefer purchasing actuators. Hence, power consumption issues, especially in faulty actuators, act as a challenge for the manufacturers of Robotics and automation actuators.

In addition, the lack of maintenance of actuators may lead to excessive noise and air leakage. These systems are also known to fail over long periods of time, owing to the dampening of the inside edges of their tubes. Moreover, the noise level during the operation of actuators is significantly high, and as such, these systems are sometimes placed in a separate room to limit the sound pollution. In some cases, hazardous chemicals are used in actuators that can lead to the accidental release of chemicals into the air. This can result in an adverse impact on the surrounding environment.

Robotics And Automation Actuators Market Ecosystem

Prominent companies providing Robotics and Automation Actuator Product and solutions private and small enterprises, distributors/suppliers/retailers, and end customers are key stakeholders in the Robotics and Automation Actuator market ecosystem. Investors, funders, academic researchers, distributors, service providers, and industries serve as major influencers in the market.

To know about the assumptions considered for the study, download the pdf brochure

The electric actuation segment of the robotics and automation actuators market is projected to lead the market.

By actuation, the electric segment is estimated to lead the robotics and automation actuators market in 2022. The growth of this segment can be attributed to the high power efficiency, lower system weight and increasing power output.

The Robotics application segment of the robotics and automation actuators market is projected to grow at the highest CAGR during the forecasted period.

By application, the robotics segment is projected to grow at the highest CAGR in the robotics and automation actuators market in 2022. The robotics segment of the market has been further classified into industrial robots and service robots. The growth of this segment is increasing the demand from large-scale enterprises to use industrial robots in their manufacturing plants, while service robots are used for professional as well as personal applications.

The Rotary actuator segment of the robotics and automation actuators market is estimated to have the highest CAGR during the forecasted period

By type, the rotary is estimated to grow at a highest CAGR during the forecast period. . They are used to convert electric energy into rotational motion. These actuators are primarily used in automation applications such as gates, valves, etc., and in industries where accurate positioning of end effectors, such as movement of valves in a pipeline, is required and are fueling the growth of the market inturn.

Asia Pacific is estimated to lead the robotics and automation actuators market

Asia Pacific is estimated to lead the robotics and automation actuators market by 2027.Countries here are upgrading various capabilities by undertaking developments in the field of actuators. China and Japan are primarily investing in robotics and automation to enhance and gain a tactical edge in process automation. This provides an excellent opportunity for actuators manufacturers to strengthen their businesses in the Asia Pacific region

Key Market Players

ABB (Switzerland), Rockwell Automation (US), Altra Industrial Motion (US). Moog (US), SMC (Japan), Curtis Wright (Exlar) (US), and MISUMI (Japan) are some of the leading players covered in the Robotics and Automation Actuators Companies report.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 18.7 billion |

|

Projected Market Size |

USD 35.8 billion |

|

Growth Rate |

13.9% |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By type, vertical, application, actuation and design characteristics |

|

Geographies covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies covered |

|

This research report categorizes the Robotics and automation actuators Market based on on type, vertical, application and actuation and region.

Robotics and automation actuators Market, By Application

- Robotics

- Process Automation

Robotics and automation actuators Market, By Type

- Linear Actuators

- Rotary Actuators

Robotics and automation actuators Market, By Vertical

- Food & Beverages

- Oil & Gas

- Metal Mining & Machinery

- Power Generation

- Chemicals, Paper & plastics

- Pharmaceutical & Healthcare

- Automotive

- Aerospace & Defense

- Marine

- Electronics & Electricals

- Logistics

- Inspection, Maintenance & Cleaning

- Agriculture & Forestry

- Others

Robotics and automation actuators Market, By Characteristics

- Load

- Torque

Robotics and automation actuators Market, By Actuation

- Electric

- Pneumatic

- Hydraulic

- Others

Robotics and automation actuators Market, By Design Characteristics

- Load

- Torque

Robotics and automation actuators Market, By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Recent Developments

- In February 2022, ABB successfully completes installation and remote commissioning of new actuators for India’s largest paper and paperboard business. . As a result of the upgrade to Slice xP, which is easy to install and maintain, ITC will benefit from reduced CD profile variability and advanced diagnostics through the built-in monitoring of each actuator.

- In April 2021, Rockwell Automation entered into a partnership with Comau to simplify robot integration for manufacturers.

- In March 2021, Federal Equipment Company has awarded Curtiss-Wright a contract to supply Exlar Electro-Mechanical Actuators in support of its weapons elevator systems for the Ford-class aircraft carrier programme. On the Ford-class ships, Exlar actuators are employed in the Jet Blast Defector, Integrated Catapult Control Station, and LSO actuation systems, among other mission-critical areas.

Frequently Asked Questions (FAQ):

How will the drivers, challenges, and future opportunities for the robotics and automation actuators market affect its dynamics and the subsequent market analysis of the associated trends?

The robotics and automation actuators market is growing at a significant rate, and this trend is expected to continue during the forecast period. This growth can be attributed to the development of advanced actuators, such as pneumatic muscle arm actuators, shape memory alloy actuators, and compact electric actuators. However, stringent regulations regarding safety and power consumption, noise, and leak issues are some of the restraints impacting the growth of the market.

What are the key sustainability strategies adopted by leading players operating in the robotics and automation actuators market?

A benchmarking of the growth strategies adopted by key players were undertaken which offers a comprehensive analysis of new product launches, contracts, partnerships, collaborations, expansions, agreements, new product developments, and acquisitions.

Who are the key players and innovators in the partnership ecosystem?

ABB (Switzerland), Rockwell Automation (US), Altra Industrial Motion (US). Moog (US), SMC (Japan), Curtis Wright (Exlar) (US), and MISUMI (Japan) are some of the key companies. These key companies are all strong in their home regions and are exploring geographic diversification alternatives to grow their businesses. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

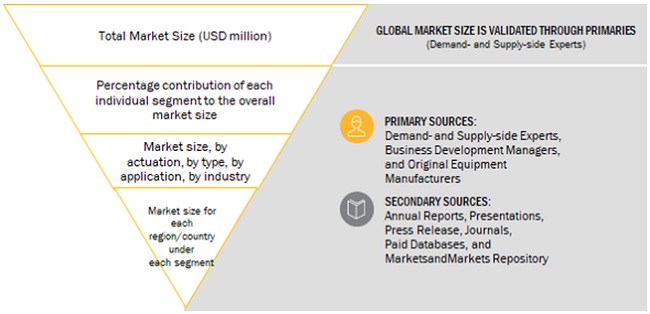

Exhaustive secondary research was undertaken to collect information on the robotics and automation actuators market, its peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, the top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg, BusinessWeek, and Drones Journals & Magazines were referred to, to identify and collect information for this study. Secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

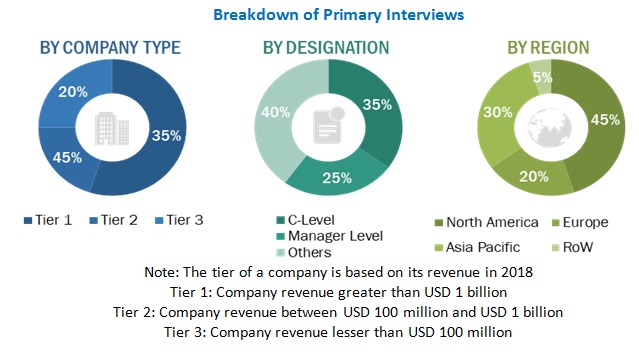

Primary Research

Substantial primary research was conducted after obtaining information on the robotics and automation actuators market scenario through secondary research. Various primary interviews were conducted with market experts from both, the demand and supply sides across major regions, namely, North America, Europe, and Asia Pacific (APAC). The primary data was collected through questionnaires, mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, the top-down and bottom-up approaches were used to estimate and validate the size of the robotics and automation actuators market. These methods were also used extensively to estimate the sizes of various subsegments in the market. The research methodology used to estimate the market size included the following.

- Key players in the market were identified through secondary research, and their market ranking determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, and analyzed by MarketsandMarkets and presented in this report.

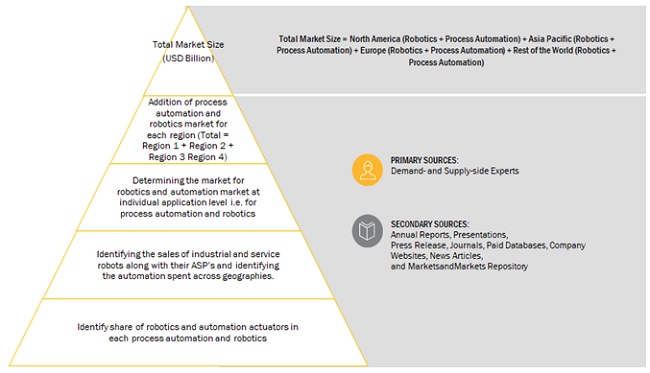

Bottom- Up Approach

The bottom-up approach was employed to arrive at the overall size of the robotics and automation actuators market. The bottom-up approach has also been implemented to extract data from secondary research to validate revenues of various segments of the market. Market share has then been estimated for each company to verify revenue shares used earlier in the bottom-up approach. With the data triangulation procedure and validation of data through primaries, sizes of the parent market and each individual market have been determined and confirmed in this study.

Steps involved in the bottom-up approach:

- The bottom-up approach was used to arrive at the regional splits of the robotics and automation actuators market.

- The regional split of the global market was carried out based on the number of actuators used by each country. This approach was followed to arrive at the market size for robotics and automation actuators and was validated through various primary interviews

- Market size of the robotics and automation actuators = {(spent on process automation) *(share of actuators in process automation)} + {(totals sales of robotics) *(share of actuators in process automation)}

- Electric actuator = {(% share in robotics*market size for robotics) + (% share in process automation*market size for process automation)}

- Linear actuator = {(% share in robotics*market size for robotics) + (% share in process automation*market size for process automation)}

- Total market = {market for process automation + market for robotics}

Market Size Estimation Methodology: Bottom-Up Approach

Top-Down Approach

In the top-down approach, the overall market size was used to estimate the size of individual subsegments (mentioned in the market segmentation) through percentage splits in secondary and primary research. For the calculation of specific market segments, the most appropriate immediate market size was used to implement the top-down approach. The bottom-up approach has also been implemented to validate revenues obtained for various market segments.

Market Size Estimation Methodology: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated numbers for robotics and automation actuators market segments and subsegments. The data was triangulated by studying various factors and trends from, both demand- and supply-sides. Along with this, the market size was validated using both, top-down and bottom-up approaches.

The Growing Significance of Robotics in the Automation Actuators Market

Robotics is playing a significant role in the automation actuators market. Its applications are diverse and can be found in various industries. One of the primary applications of robotics in this market is in the manufacturing industry, where it is used to automate processes such as assembly, welding, painting, and material handling. This results in increased efficiency, reduced errors, and improved quality and consistency of products.

Another industry that has benefited from the use of robotics in automation actuators is the automotive industry. Here, robots are used for tasks such as welding, painting, and assembly of parts, which results in increased production efficiency, reduced costs, and improved safety by eliminating the need for workers to perform hazardous tasks. Similarly, in the aerospace industry, robotics is used to automate various tasks such as drilling, riveting, and painting of aircraft components, leading to improved accuracy, consistency, and production efficiency.

The use of robotics in automation actuators is becoming increasingly common as technology continues to advance and the demand for automation increases. Its impact on various industries is significant, and the benefits it provides, such as increased efficiency, reduced costs, and improved safety, make it a valuable tool for businesses looking to improve their operations.

The Role of Robotics and Automation in Actuator Production Processes

Robotics and automation are the primary growth factors in the actuators industry. Automation and robotics are transforming the way actuators are produced, tested, and installed, resulting in increased production efficiency, reduced costs, and improved safety.

Robotics and automation are allowing manufacturers to automate the production process, reducing the need for manual labor and increasing production efficiency. The use of robots in the production of actuators reduces errors and improves consistency, leading to improved quality and lower costs. Additionally, robotics allows for more efficient testing of actuators, ensuring that they meet industry standards and are safe for use in a variety of applications.

Automation is also allowing for improved efficiency in the installation of actuators. By automating the installation process, manufacturers can reduce the time and cost associated with manual labor, while also ensuring that the installation is accurate and consistent. This results in improved quality and reduced costs for end-users.

Robotics and automation are driving growth in the actuators industry by improving production efficiency, reducing costs, and improving safety. As technology continues to advance, the use of robotics and automation in the production, testing, and installation of actuators is expected to become even more widespread, leading to further growth and innovation in the industry.

Report Objectives

- To define, describe, and forecast the size of the market based on type, vertical, application and actuation along with a regional analysis.

- To understand the structure of the Robotics and automation actuators market by identifying the subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, challenges, and industry-specific challenges)

- To analyze micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the five regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze competitive developments such as new product launches, contracts, agreements, acquisition, collaboration, and joint ventures in the Robotics and automation actuators market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Robotics and Automation Actuators Market