Aircraft Actuators Market by Type (Rotary, Linear), Installation Type (OEM & Aftermarket), Technology (Hydraulic, Electric Hybrid, Mechanical, Pneumatic, and Full Electric), Aircraft Type, System, Platform, and Region - Global Forecast to 2027

Update: 10/22/2024

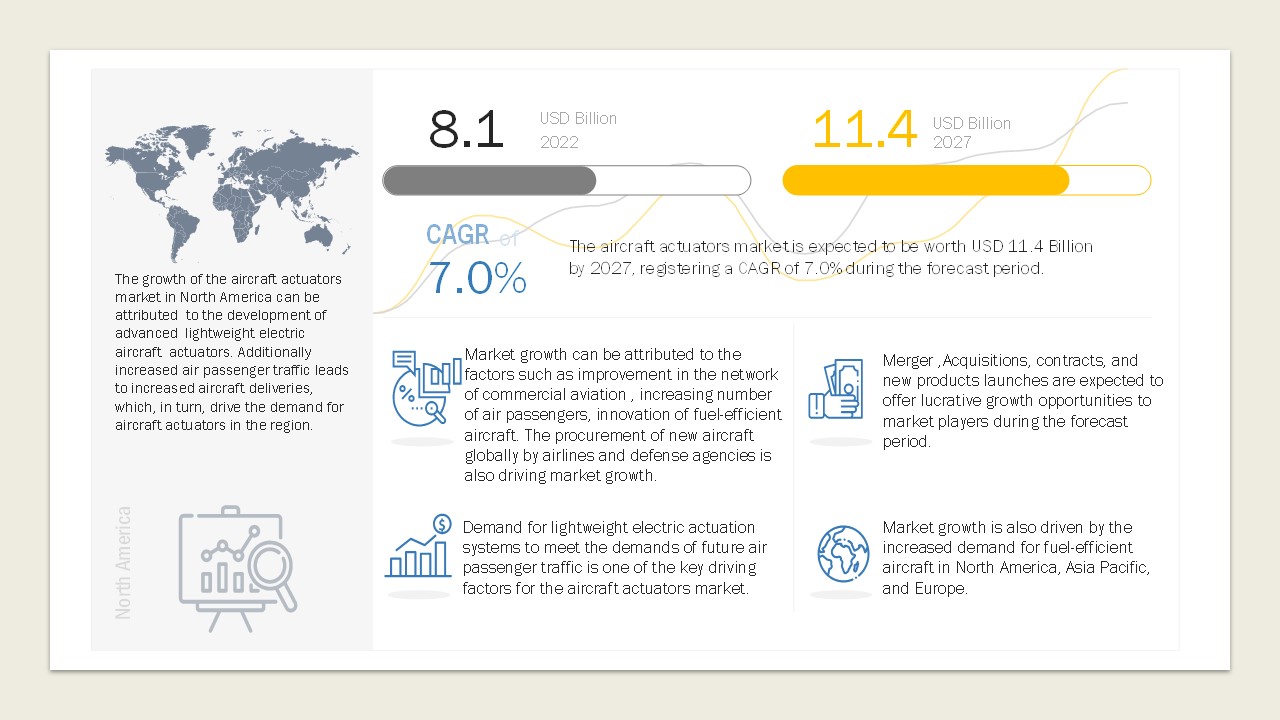

[256 Pages Report] The Aircraft Actuators Market size is projected to grow from USD 8.1 Billion in 2022 to USD 11.4 Billion by 2027, at a CAGR of 7.0% from 2022 to 2027. The Aircraft Actuators Industry is driven by various factors, such as the growing adoption of more electric aircraft concept and the expected increasing demand for commercial aircraft, globally.

To know about the assumptions considered for the study, Request for Free Sample Report

Aircraft Actuators Market Dynamics

Driver: Growing adoption of more electric aircraft concept

The increasing focus on the development of more electric aircraft (MEA) has encouraged aircraft OEMs to collaborate with suppliers to enable the design and development of new electric-intensive aircraft architecture within shorter timeframe. The concept of MEA acts as a critical enabler in the aviation industry and offers significant potential for aircraft weight reduction, fuel-efficient engines, reduction in operational costs by reducing maintenance costs, and increased aircraft reliability. While the non-propulsive systems are driven currently by hydraulic, pneumatic, and mechanical power sources, the concept of MEA provides an incentive for the utilization of electric power in such traditional systems.

There are several problems associated with conventional actuators powered by hydraulic, mechanical, or pneumatic technologies, such as cost, heating, fluid, and contamination, which are eliminated in electrical actuation solutions. Besides, electrical actuators have higher efficiency (around 80%) than their hydraulic counterparts, as they utilize a more efficient motor (without the issue of heating and lower risk of component damage). Electrical actuation systems are also environment-friendly and safer to use than conventional actuators, which consist of hydraulic fluids that can damage the skin and cause poisoning or infection due to the high temperature. Therefore, the demand for electrical actuation solutions has been continuously increasing, which, in turn, drives the aircraft actuators market.

Restraint: High power consumption and other associated issues

Pneumatic actuators convert energy generated from compressed air into mechanical motion and are an assembly of various systems, including compressors, air filters, lube tubes, dryers, and regulators. Thus, the systems are susceptible to faults such as excessive noise and air leaks, and the associated maintenance costs are quite high.

The high load factor offered by hydraulic actuators render them viable to be used in wheel brakes, landing gears, propellers, flight control surfaces, wing flaps, and spoilers. A hydraulic actuator uses a reservoir or electric pump that converts energy into mechanical motion, and are susceptible to fluid leakages, fire risks, and erosion of mechanical components due to hydraulic oil spills.

Electrical actuators, on the other hand, pose a different set of challenges. Since actuators consume more energy than sensors, a faulty electric actuator results in high consumption of electricity. The main challenge that manufacturers face is the designing of a circuit in electric actuators that consumes minimum energy. Due to the probability of defective circuit design, customers may not prefer pure electric actuators over other electromechanical and electrohydraulic actuators. Hence, high power consumption by faulty electric actuators is a major challenge for manufacturers in this market.

Opportunity: Ongoing digitization and adoption of Internet of Things (IoT) systems in the aviation industry

The Internet of Things (IoT) refers to the networking of physical objects with the help of devices, including sensors and actuators, enabling the transfer of information within the network. IoT in aviation offers multiple opportunities to enhance operational efficiency and automation in various aircraft operations. IoT enables multiple actuators with varied capabilities to be compiled together to form a network wherein the connected actuators are able communicate with one another to perform multiple tasks, which are otherwise not possible for each type of actuator individually.

The next generation of aircraft are to be IoT-enabled, hence, big data analytics is expected to play a major role in aircraft design, manufacturing, and maintenance during the forecast period. Currently, Pratt & Whitney (a United Technologies Group) has deployed IoT technology in aircraft engines to improve their efficiency. Nevertheless, IoT can be used in electric devices (such as actuators) to enable them to communicate and move together with ease. IoT is an opportunity for flight control and landing gear system applications in aviation to enhance automation in these areas; hence, the increasing application scope of actuators in IoT for these applications is expected to boost the demand for actuators during the forecast period.

Challenge: Stringent regulatory framework

The aviation industry is marred by a multitude of bilateral, national, and international regulations and standards that bind the actions of airports and aircraft operators. The International Civil Aviation Organization (ICAO) is tasked with formulating global standards for the commercial aviation sector to ensure the safe operation of aircraft and controlling the risks associated with it to an acceptable level.

The ongoing globalization and liberalization of aviation business have exerted significant pressure on aviation incumbents to succeed commercially in an increasingly competitive environment. Nevertheless, the prime focus of the industry players have been the development of advanced systems and components with reduced failure rates, lower material cost, and shorter R&D phase. Thus, components and systems for aircraft undergo stringent quality checks and rigorous testing to increase safety levels. The increasing complexity of aircraft architecture necessitates the use of electronic components, which makes aircraft OEMs struggle with their delivery commitments. Moreover, with rapid technological advancements and new technologies and products replacing the old ones every five to seven years, it becomes a challenge for the component and system manufacturers to adhere to the regulatory environment.

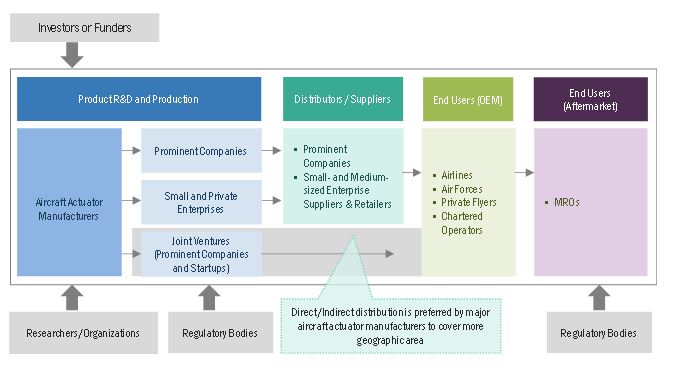

Aircraft Actuators Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of aircraft actuators. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies include Raytheon Technologies Corporation (US), Curtiss-Wright Corporation (US), Honeywell International Inc. (US), Safran SA (France), Liebherr-International Duetschland GmbH (Germany), Moog Inc. (US), and Eaton Corporation plc (Ireland). Airlines, global air forces, business jet users, private flyers, MROs, and chartered operators are some of the leading consumers of aircraft actuators.

Flight control systems to dominate market share during the forecast period

Based on system, the aircraft actuators market has been segmented into flight control system, landing & braking system, thrust reverser actuation system, power generation system, fuel distribution system, payload management system, cabin actuation system, and fuel management system. The growing emphasis on safer and lighter aircraft control systems is expected to drive demand for actuators inflight control systems.

Fixed wing aircraft to witness higher demand for aircraft actuators during the forecast period

Based on aircraft type, the aircraft actuators market has been segmented into fixed wing and rotary wing. Some of the main factors propelling the fixed wing aircraft market include rapid urbanization and the increasing focus of aircraft OEMs to manufacture high-performance aircraft with lower weight profile. Besides, the rapid growth in global passenger traffic is also expected to drive the demand for fixed wing aircraft in the commercial and general aviation sectors, thereby creating a parallel demand for aircraft actuators for integration into the different systems onboard the aircraft.

Hydraulic actuators to witness higher demand during the forecast period

Based on technology, the aircraft actuators market has been classified into hydraulic, electric hybrid, pneumatic, full electric and mechanical actuators. The inherent benefits of using hydraulic actuators for high-force applications drives the use of such systems in an aircraft. However, the electric actuators are expected to replace hydraulic and pneumatic actuators due to their high efficiency and level of control.

Rotary actuators to witness higher demand during the forecast period

Based on type, the aircraft actuators market has been classified into rotary and linear actuators. There are inherent benefits of using rotary actuators primarily in automation applications, such as gates and valves. For instance, their high efficiency, ranging from 85% to 92% in single rack models and from 92% to 97% in double rack models, and their ease of compatibility with automated control systems in the form of synchronous actuation systems, drive their demand for integration into modern aircraft platforms.

The Commercial Aviation segment projected to lead Aircraft Actuators market during the forecast period

Based on Platform, the commercial aviation segment is projected to lead the aircraft actuators market during the forecast period. The demand for commercial aircraft is fueled by the expansion of the aircraft fleet, market demand for fuel-efficient aircraft, and an increase in the number of airline passengers.

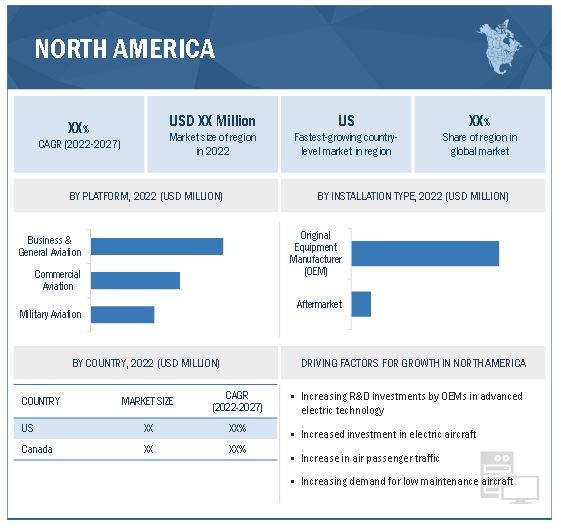

North America is projected to witness the highest market share during the forecast period

North America leads the aircraft actuators market due to the presence of several large aircraft actuator manufacturers in the region. Prominent market players based in this region include Honeywell International Inc. (US), Collins Aerospace (US), Moog (US), AMETEK (US), and Woodward Inc. (US). These major market players continuously invest in R&D to develop aircraft actuators with improved efficiency and reliability. They are also focused on developing aircraft actuators suitable for state-of-the-art technologies, such as more electric aircraft systems or digital fly-by-wire, rather than using conventional technology in aircraft.

To know about the assumptions considered for the study, download the pdf brochure

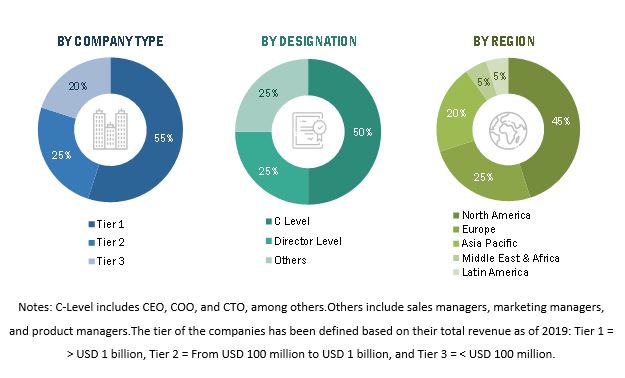

The break-up of profile of primary participants in the aircraft actuators market:

- By Company Type: Tier 1 – 55%, Tier 2 – 25%, and Tier 3 – 20%

- By Designation: C Level – 50%, Director Level – 25%, Others-25%

- By Region: North America – 45%, Europe – 25%, Asia Pacific – 20%, Middle East – 5%, and Latin America – 5%

Aircraft Actuators Industry Companies: Top Key Market Players

The Aircraft Actuators Companies is dominated by globally established players such as Raytheon Technologies Corporation (US), Curtiss-Wright Corporation (US), Honeywell International Inc. (US), Safran SA (France), Liebherr-International Duetschland GmbH (Germany), Moog Inc. (US), and Eaton Corporation plc (Ireland).

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Installation Type, Technology, Type, Platform, Aircraft Type, and By Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and Latin America |

|

Companies covered |

Raytheon Technologies Corporation (US), Curtiss-Wright Corporation (US), Honeywell International Inc. (US), Safran SA (France), Liebherr-International Duetschland GmbH (Germany), Moog Inc. (US), and Eaton Corporation plc (Ireland), among others |

This research report categorizes the Aircraft Actuators Market based on System, Platform, Fit, and Region.

Aircraft Actuators Market, By Installation Type

- Original Equipment Manufacturer (OEM)

- Retrofit

Aircraft Actuators Market, By System

- Flight Control System

- Landing & Braking System

- Thrust Reverser Actuation System

- Power Generation System

- Fuel Distribution System

- Payload Management System

- Cabin Actuation System

- Fuel Storage System

Aircraft Actuators Market, By Technology

- Full-Electric

- Hydraulic

- Electric Hybrid

- Mechanical

- Pneumatic

Aircraft Actuators Market, By Type

- Linear

- Rotary

Aircraft Actuators Market, By Platform

- Commercial Aviation

- Military Aviation

- Business & General Aviation

Aircraft Actuators Market, By Aircraft Type

- Fixed-wing

- Rotary-wing

Aircraft Actuators Market, By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In July 2022, Safran SA launched a new line of electro-hydrostatic actuators (EHA) for the nose landing gear of different aircraft platforms served by the company.

- In January 2020, Honeywell International Inc. announced the development of its new line of electromechanical actuators specifically designed for urban air mobility (UAM).

Frequently Asked Questions (FAQs):

What are your views on the growth prospect of the aircraft actuators market?

The aircraft actuators market is expected to grow substantially owing to the growing trend of more electric aircraft and the expected increasing demand for commercial aircraft, globally.

What are the key sustainability strategies adopted by leading players operating in the aircraft actuators market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the aircraft actuators market. The major players include Raytheon Technologies Corporation (US), Curtiss-Wright Corporation (US), Honeywell International Inc. (US), Safran SA (France), Liebherr-International Duetschland GmbH (Germany), Moog Inc. (US), and Eaton Corporation plc (Ireland). These players have adopted various strategies, such as acquisitions, contracts, expansions, new product launches, and partnerships & agreements, to expand their presence in the market.

What are the new emerging technologies and use cases disrupting the Aircraft actuators market?

Some of the major emerging technologies and use cases disrupting the market include more electric technology, digital fly-by-wire, and use of fully electric architecture in aviation applications.

Who are the key players and innovators in the ecosystem of the aircraft actuators market?

The key players in the Aircraft actuators market include Raytheon Technologies Corporation (US), Curtiss-Wright Corporation (US), Honeywell International Inc. (US), Safran SA (France), Liebherr-International Duetschland GmbH (Germany), Moog Inc. (US), and Eaton Corporation plc (Ireland).

Which region is expected to hold the highest market share in the aircraft actuators market?

Aircraft actuators market in North America is projected to hold the highest market share during the forecast period due to the presence of several large aircraft actuator manufacturers in the region.

Which technology, such as hydraulic, pneumatic, electric, and mechanical, is expected to drive the growth of the market in the coming years?

For the aircraft actuators market, electric technology is projected to grow at the highest CAGR during the forecast period from 2022 to 2027. Significant advancements in electric aircraft architecture is expected to drive the market.

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES

1.5 INCLUSIONS AND EXCLUSIONS

TABLE 2 AIRCRAFT ACTUATORS MARKET: INCLUSIONS AND EXCLUSIONS

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH PROCESS FLOW

FIGURE 2 AIRCRAFT ACTUATORS MARKET: RESEARCH DESIGN

2.2 SECONDARY DATA

2.2.1 SECONDARY SOURCES

2.3 PRIMARY DATA

2.3.1 PRIMARY SOURCES

2.3.1.1 Key data from primary sources

2.3.2 BREAKDOWN OF PRIMARIES

2.3.2.1 Breakdown of Primary Interviews: By Company Type, Designation, and Region

2.4 FACTOR ANALYSIS

2.4.1 INTRODUCTION

2.4.2 DEMAND-SIDE INDICATORS

2.4.2.1 Increasing demand for aftermarket services

2.4.3 SUPPLY-SIDE INDICATORS

2.4.3.1 Need for minimizing operational limitations

2.5 RESEARCH APPROACH AND METHODOLOGY

TABLE 3 SEGMENTS AND SUBSEGMENTS

2.6 MARKET SIZE ESTIMATION

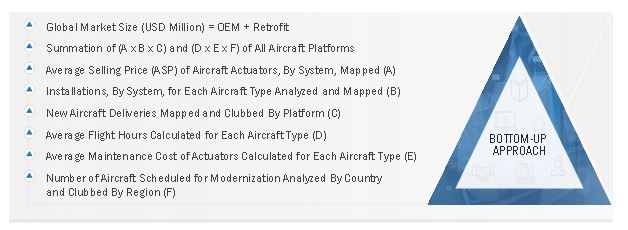

2.6.1 BOTTOM-UP APPROACH

2.6.1.1 Evaluation of aircraft actuators market

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (DEMAND-SIDE)

2.6.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH (SUPPLY-SIDE)

2.7 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.8 GROWTH RATE ASSUMPTIONS

2.9 ASSUMPTIONS

FIGURE 6 PARAMETRIC ASSUMPTIONS FOR MARKET FORECAST

2.10 RISKS

3 EXECUTIVE SUMMARY (Page No. - 54)

FIGURE 7 FLIGHT CONTROL SYSTEM PROJECTED TO LEAD MARKET FROM 2022 TO 2027

FIGURE 8 HYDRAULIC SEGMENT TO DOMINATE AIRCRAFT ACTUATORS MARKET IN 2022

FIGURE 9 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AIRCRAFT ACTUATORS MARKET

FIGURE 10 INCREASING DEMAND FOR LIGHTWEIGHT COMPONENTS IN AIRCRAFT TO DRIVE MARKET DURING FORECAST PERIOD

4.2 AIRCRAFT ACTUATORS MARKET, BY SYSTEM

FIGURE 11 FLIGHT CONTROL SYSTEM TO HOLD DOMINANT SHARE DURING FORECAST PERIOD

4.3 AIRCRAFT ACTUATORS MARKET, BY TYPE

FIGURE 12 COMMERCIAL AVIATION SEGMENT TO LEAD MARKET FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 AIRCRAFT ACTUATORS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing use of electric aircraft

TABLE 4 MORE ELECTRIC AIRCRAFT PROGRAMS, BY CATEGORY

5.2.1.2 Large fleets of commercial and military aircraft

TABLE 5 REGIONAL OUTLOOK OF AIR TRAFFIC GROWTH, FLEET GROWTH, AND AIRCRAFT DELIVERIES

FIGURE 14 AIRCRAFT DELIVERIES, BY AIRCRAFT TYPE

FIGURE 15 AIRCRAFT FLEET SIZE, BY REGION (2021)

5.2.1.3 Advancements in electric actuators for all-electric platforms and light aircraft

5.2.2 RESTRAINTS

5.2.2.1 High power consumption and other associated issues

5.2.2.2 Design challenges

5.2.3 OPPORTUNITIES

5.2.3.1 Ongoing digitization and Internet of Things (IoT)

5.2.4 CHALLENGES

5.2.4.1 Stringent regulatory framework

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AIRCRAFT ACTUATOR MANUFACTURERS

FIGURE 16 REVENUE SHIFT IN AIRCRAFT ACTUATORS MARKET

5.4 TRADE ANALYSIS

TABLE 6 IMPORTED VALUE OF AIRCRAFT AND SPACECRAFT PARTS, USD MILLION (2017–2021)

TABLE 7 EXPORTED VALUE OF AIRCRAFT AND SPACECRAFT PARTS, USD MILLION (2017–2021)

5.5 PRICING ANALYSIS

TABLE 8 AVERAGE SELLING PRICE RANGE: AIRCRAFT ACTUATORS MARKET (BY SYSTEM)

5.6 MARKET ECOSYSTEM

5.6.1 PROMINENT COMPANIES

5.6.2 PRIVATE AND SMALL ENTERPRISES

5.6.3 END USERS

FIGURE 17 MARKET ECOSYSTEM MAP: AIRCRAFT ACTUATORS

TABLE 9 AIRCRAFT ACTUATORS MARKET ECOSYSTEM

5.7 VALUE CHAIN ANALYSIS

FIGURE 18 VALUE CHAIN ANALYSIS: AIRCRAFT ACTUATORS MARKET

5.8 TECHNOLOGY ANALYSIS

5.8.1 ELECTRIC ACTUATORS

5.8.2 SHAPE-CHANGING WING FOR NEXT-GENERATION AVIATION

5.8.3 SWEEPING JET ACTUATORS

5.8.4 PLASMA WING ACTUATORS

5.9 PORTER’S FIVE FORCES MODEL

TABLE 10 AIRCRAFT ACTUATORS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AIRCRAFT ACTUATOR TECHNOLOGIES

TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AIRCRAFT ACTUATOR TECHNOLOGIES (%)

5.10.2 BUYING CRITERIA

FIGURE 20 KEY BUYING CRITERIA FOR AIRCRAFT ACTUATOR TECHNOLOGIES

TABLE 12 KEY BUYING CRITERIA FOR AIRCRAFT ACTUATOR TECHNOLOGIES

5.11 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 13 AIRCRAFT ACTUATORS MARKET: CONFERENCES AND EVENTS

5.12 TARIFF REGULATORY LANDSCAPE FOR AEROSPACE INDUSTRY

TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 INDUSTRY TRENDS (Page No. - 80)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 21 SUPPLY CHAIN ANALYSIS OF AIRCRAFT ACTUATORS MARKET

6.3 TECHNOLOGY TRENDS

6.3.1 SMART ACTUATORS

6.3.2 EVOLUTION OF FLY-BY-WIRE SYSTEMS

6.3.3 FLY-BY-WIRE RUDDERS

6.3.4 MORPHING WINGS

6.3.5 FLOW CONTROL ACTUATORS

6.3.6 NO-BLEED SYSTEM AIRCRAFT ARCHITECTURE

6.3.7 ELECTRIC ACTUATION SYSTEM

6.4 IMPACT OF MEGATRENDS

6.4.1 IMPLEMENTATION OF INDUSTRY 4.0

6.4.2 GLOBALIZATION OF SUPPLY CHAIN FOR AIRCRAFT ACTUATOR MANUFACTURING

6.5 AIRCRAFT ACTUATORS MARKET: PATENT ANALYSIS

TABLE 18 KEY PATENTS, 2018–2022

7 AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE (Page No. - 85)

7.1 INTRODUCTION

FIGURE 22 OEM SEGMENT TO LEAD AIRCRAFT ACTUATORS MARKET FROM 2022 TO 2027

TABLE 19 AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 20 AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

7.2 ORIGINAL EQUIPMENT MANUFACTURER (OEM)

7.2.1 AIRCRAFT DELIVERIES EXPECTED TO DRIVE SEGMENT

7.3 AFTERMARKET

7.3.1 RISE IN AIRCRAFT FLEET SIZE FOR MAINTENANCE TO BOOST GROWTH

8 AIRCRAFT ACTUATORS MARKET, BY SYSTEM (Page No. - 88)

8.1 INTRODUCTION

FIGURE 23 FLIGHT CONTROL SYSTEM TO LEAD AIRCRAFT ACTUATORS MARKET DURING FORECAST PERIOD

TABLE 21 AIRCRAFT ACTUATORS MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 22 AIRCRAFT ACTUATORS MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

8.2 FLIGHT CONTROL SYSTEM

8.2.1 GROWING EMPHASIS ON SAFER AND LIGHTER AIRCRAFT CONTROL SYSTEMS

8.3 LANDING & BRAKING SYSTEM

8.3.1 ENSURES SAFETY OF AIRCRAFT AND PASSENGERS

8.4 THRUST REVERSER ACTUATION SYSTEM

8.4.1 SUPPORTS SMALLER AIRPORTS WITH SHORTER RUNWAYS

8.5 POWER GENERATION SYSTEM

8.5.1 POWERS AIRCRAFT EFFICIENTLY

8.6 FUEL DISTRIBUTION SYSTEM

8.6.1 ENSURES EFFECTIVE CONTROL OF FUEL FLOW

8.7 PAYLOAD MANAGEMENT SYSTEM

8.7.1 DEMAND FOR MILITARY AIRCRAFT BOOSTS SEGMENT GROWTH

8.8 CABIN ACTUATION SYSTEM

8.8.1 DRIVEN BY GROWING PREFERENCE FOR COMFORT INSIDE AIRCRAFT CABIN

8.9 FUEL STORAGE SYSTEM

8.9.1 GROWING EMPHASIS ON INCREASING OPERATIONAL EFFICIENCY

9 AIRCRAFT ACTUATORS MARKET, BY TECHNOLOGY (Page No. - 93)

9.1 INTRODUCTION

FIGURE 24 FULL ELECTRIC SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 23 AIRCRAFT ACTUATORS MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 24 AIRCRAFT ACTUATORS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

9.2 HYDRAULIC

9.2.1 USED FOR HIGH-FORCE APPLICATIONS

9.3 ELECTRIC HYBRID

TABLE 25 AIRCRAFT ACTUATORS MARKET, BY ELECTRIC HYBRID TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 26 AIRCRAFT ACTUATORS MARKET, BY ELECTRIC HYBRID TECHNOLOGY, 2022–2027 (USD MILLION)

9.3.1 ELECTROMECHANICAL ACTUATORS

9.3.2 ELECTROHYDRAULIC ACTUATORS

9.3.3 ELECTRO-HYDROSTATIC ACTUATORS

9.4 PNEUMATIC

9.4.1 AIRCRAFT MODERNIZATION PLAN TO FUEL SEGMENT

9.5 FULL ELECTRIC

9.5.1 PROVIDES EFFICIENT CONTROL AT HIGH SPEED

9.6 MECHANICAL

9.6.1 ACTUATION SYSTEM FOR HIGH-LOAD APPLICATIONS

10 AIRCRAFT ACTUATORS MARKET, BY TYPE (Page No. - 98)

10.1 INTRODUCTION

FIGURE 25 ROTARY SEGMENT TO LEAD AIRCRAFT ACTUATORS MARKET DURING FORECAST PERIOD

TABLE 27 AIRCRAFT ACTUATORS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 28 AIRCRAFT ACTUATORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.2 ROTARY

TABLE 29 ROTARY ACTUATORS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 30 ROTARY ACTUATORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.2.1 PISTON TYPE ROTARY

10.2.1.1 Precision control applications

10.2.2 BLADDER & VANE ROTARY

10.2.2.1 Utilized in gates and valves

10.2.3 MOTOR ROTARY

10.2.3.1 Controls crucial equipment

10.3 LINEAR

TABLE 31 LINEAR ACTUATORS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 32 LINEAR ACTUATORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.3.1 ROD TYPE LINEAR

10.3.1.1 Increasing use in aircraft structures to carry loads

10.3.2 SCREW TYPE LINEAR

10.3.2.1 Available with servomotors to drive and control hardware

11 AIRCRAFT ACTUATORS MARKET, BY PLATFORM (Page No. - 103)

11.1 INTRODUCTION

FIGURE 26 COMMERCIAL AVIATION PROJECTED FOR LARGEST MARKET SHARE

TABLE 33 AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 34 AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

11.2 COMMERCIAL AVIATION

FIGURE 27 NARROW-BODY AIRCRAFT TO HOLD DOMINANT MARKET SHARE DURING FORECAST PERIOD

TABLE 35 COMMERCIAL AVIATION MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 36 COMMERCIAL AVIATION MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

11.2.1 NARROW-BODY AIRCRAFT

11.2.1.1 Advancements in hydraulic and pneumatic aircraft systems

11.2.2 WIDE-BODY AIRCRAFT

11.2.2.1 Increase in passenger travel leads to more demand

11.2.3 REGIONAL JETS

11.2.3.1 Fly-by-wire technology fuels demand

11.3 BUSINESS & GENERAL AVIATION

FIGURE 28 BUSINESS JETS TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 37 BUSINESS & GENERAL MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 38 BUSINESS & GENERAL AVIATION MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

11.3.1 BUSINESS JETS

11.3.1.1 Growth of private aviation companies to fuel demand

11.3.2 COMMERCIAL HELICOPTERS

11.3.2.1 Increasing corporate and civil applications to drive demand

11.3.3 UNMANNED AERIAL MOBILITY

11.3.3.1 Used for aerial remote sensing operations and cargo deliveries

11.3.4 LIGHT AIRCRAFT

11.3.4.1 Low maintenance and operation costs

11.4 MILITARY AVIATION

FIGURE 29 COMBAT AIRCRAFT TO ACCOUNT FOR LARGEST MARKET SHARE

TABLE 39 MILITARY AVIATION MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 40 MILITARY AVIATION MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

11.4.1 COMBAT AIRCRAFT

11.4.1.1 Growing procurement due to increasing geopolitical rift

11.4.2 TRAINING AIRCRAFT

11.4.2.1 Focus on reducing expenses with state-of-the-art technology to train military pilots

11.4.3 MILITARY DRONES

11.4.3.1 Proliferation of drones for ISR missions

11.4.4 TRANSPORT AIRCRAFT

11.4.4.1 Increasing use in military operations

11.4.5 MILITARY HELICOPTERS

11.4.5.1 Utilized in combat and search & rescue operations

11.4.6 SPECIAL MISSION AIRCRAFT

11.4.6.1 Growing investment to enhance defense capabilities

12 AIRCRAFT ACTUATORS MARKET, BY AIRCRAFT TYPE (Page No. - 112)

12.1 INTRODUCTION

FIGURE 30 FIXED-WING SEGMENT TO HOLD MAJOR MARKET SHARE DURING FORECAST PERIOD

TABLE 41 AIRCRAFT ACTUATORS MARKET SIZE, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 42 AIRCRAFT ACTUATORS MARKET SIZE, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

12.2 FIXED-WING

12.2.1 GROWTH IN PASSENGER TRAFFIC TO DRIVE DEMAND

12.3 ROTARY-WING

12.3.1 GROWING APPLICATION IN MILITARY AND COMMERCIAL AVIATION

13 COMPONENTS OF AIRCRAFT ACTUATION SYSTEMS (Page No. - 115)

13.1 INTRODUCTION

13.2 FRONT/REAR CLEVIS

13.3 OUTER TUBE

13.4 INNER TUBE

13.5 SPINDLE

13.6 WIPER

13.7 DRIVE NUT

13.8 LIMIT SWITCHES

13.9 GEAR

13.1 MOTOR AND MOTOR HOUSING

13.11 OUTPUT/FEEDBACK SENSORS

14 REGIONAL ANALYSIS (Page No. - 117)

14.1 INTRODUCTION

FIGURE 31 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

TABLE 43 AIRCRAFT ACTUATORS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 AIRCRAFT ACTUATORS MARKET, BY REGION, 2022–2027 (USD MILLION)

14.2 NORTH AMERICA

14.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 32 NORTH AMERICA: AIRCRAFT ACTUATORS MARKET SNAPSHOT

TABLE 45 NORTH AMERICA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 46 NORTH AMERICA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 47 NORTH AMERICA: AIRCRAFT ACTUATORS MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 48 NORTH AMERICA: AIRCRAFT ACTUATORS MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 49 NORTH AMERICA: AIRCRAFT ACTUATORS MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 50 NORTH AMERICA: AIRCRAFT ACTUATORS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 51 NORTH AMERICA: AIRCRAFT ACTUATORS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 52 NORTH AMERICA: AIRCRAFT ACTUATORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 53 NORTH AMERICA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 54 NORTH AMERICA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 55 NORTH AMERICA: AIRCRAFT ACTUATORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 56 NORTH AMERICA: AIRCRAFT ACTUATORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 57 NORTH AMERICA: AIRCRAFT ACTUATORS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 58 NORTH AMERICA: AIRCRAFT ACTUATORS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.2.2 US

14.2.2.1 Increased investment in electric-powered aircraft

TABLE 59 US: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 60 US: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 61 US: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 62 US: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

14.2.3 CANADA

14.2.3.1 Increased focus on developing modern electronic aircraft

TABLE 63 CANADA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 64 CANADA: AIRCRAFT ACTUATORS MARKET, INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 65 CANADA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 66 CANADA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

14.3 EUROPE

14.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 33 EUROPE: AIRCRAFT ACTUATORS MARKET SNAPSHOT

TABLE 67 EUROPE: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 68 EUROPE: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 69 EUROPE: AIRCRAFT ACTUATORS MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 70 EUROPE: AIRCRAFT ACTUATORS MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 71 EUROPE: AIRCRAFT ACTUATORS MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 72 EUROPE: AIRCRAFT ACTUATORS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 73 EUROPE: AIRCRAFT ACTUATORS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 74 EUROPE: AIRCRAFT ACTUATORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 75 EUROPE: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 76 EUROPE: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 77 EUROPE: AIRCRAFT ACTUATORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 78 EUROPE: AIRCRAFT ACTUATORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 79 EUROPE: AIRCRAFT ACTUATORS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 80 EUROPE: AIRCRAFT ACTUATORS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.3.2 UK

14.3.2.1 Ongoing development of advanced aircraft architecture technology for zero carbon footprint

TABLE 81 UK: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 82 UK: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 83 UK: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 84 UK: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

14.3.3 FRANCE

14.3.3.1 Increased demand for aircraft post-pandemic

TABLE 85 FRANCE: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 86 FRANCE: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 87 FRANCE: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 88 FRANCE: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

14.3.4 GERMANY

14.3.4.1 Procurement of advanced fighter jets

TABLE 89 GERMANY: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 90 GERMANY: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 91 GERMANY: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 92 GERMANY: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

14.3.5 ITALY

14.3.5.1 Growing developments in aviation industry

TABLE 93 ITALY: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 94 ITALY: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 95 ITALY: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 96 ITALY: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

14.3.6 RUSSIA

14.3.6.1 Increased emphasis on commercial aircraft

TABLE 97 RUSSIA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 98 RUSSIA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 99 RUSSIA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 100 RUSSIA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

14.3.7 REST OF EUROPE

14.3.7.1 Growing air passenger traffic

TABLE 101 REST OF EUROPE: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 102 REST OF EUROPE: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 103 REST OF EUROPE: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 104 REST OF EUROPE: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

14.4 ASIA PACIFIC

14.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 34 ASIA PACIFIC: AIRCRAFT ACTUATORS SNAPSHOT

TABLE 105 ASIA PACIFIC: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 106 ASIA PACIFIC: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 107 ASIA PACIFIC: AIRCRAFT ACTUATORS MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 108 ASIA PACIFIC: AIRCRAFT ACTUATORS MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 109 ASIA PACIFIC: AIRCRAFT ACTUATORS MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 110 ASIA PACIFIC: AIRCRAFT ACTUATORS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 111 ASIA PACIFIC: AIRCRAFT ACTUATORS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 112 ASIA PACIFIC: AIRCRAFT ACTUATORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 113 ASIA PACIFIC: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 114 ASIA PACIFIC: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 115 ASIA PACIFIC: AIRCRAFT ACTUATORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 116 ASIA PACIFIC: AIRCRAFT ACTUATORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 117 ASIA PACIFIC: AIRCRAFT ACTUATORS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 118 ASIA PACIFIC: AIRCRAFT ACTUATORS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.4.2 CHINA

14.4.2.1 Increased investment in development of lightweight aircraft

TABLE 119 CHINA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 120 CHINA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 121 CHINA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 122 CHINA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

14.4.3 INDIA

14.4.3.1 Improved domestic connectivity under UDAN scheme

TABLE 123 INDIA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 124 INDIA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 125 INDIA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 126 INDIA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

14.4.4 JAPAN

14.4.4.1 Investments in electric-powered aircraft

TABLE 127 JAPAN: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 128 JAPAN: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 129 JAPAN: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 130 JAPAN: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

14.4.5 AUSTRALIA

14.4.5.1 Procurement of aircraft to meet air travel demand

TABLE 131 AUSTRALIA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 132 AUSTRALIA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 133 AUSTRALIA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 134 AUSTRALIA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

14.4.6 SOUTH KOREA

14.4.6.1 Increased demand for electromechanical actuators

TABLE 135 SOUTH KOREA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 136 SOUTH KOREA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 137 SOUTH KOREA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 138 SOUTH KOREA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

14.4.7 REST OF ASIA PACIFIC

14.4.7.1 Increased air passenger footprint

TABLE 139 REST OF ASIA PACIFIC: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 140 REST OF ASIA PACIFIC: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 141 REST OF ASIA PACIFIC: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 142 REST OF ASIA PACIFIC: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

14.5 MIDDLE EAST & AFRICA

14.5.1 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

FIGURE 35 MIDDLE EAST & AFRICA: AIRCRAFT ACTUATORS MARKET SNAPSHOT

TABLE 143 MIDDLE EAST & AFRICA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 144 MIDDLE EAST & AFRICA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 145 MIDDLE EAST & AFRICA: AIRCRAFT ACTUATORS MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 146 MIDDLE EAST & AFRICA: AIRCRAFT ACTUATORS MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 147 MIDDLE EAST & AFRICA: AIRCRAFT ACTUATORS MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 148 MIDDLE EAST & AFRICA: AIRCRAFT ACTUATORS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 149 MIDDLE EAST & AFRICA: AIRCRAFT ACTUATORS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 150 MIDDLE EAST & AFRICA: AIRCRAFT ACTUATORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 151 MIDDLE EAST & AFRICA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 152 MIDDLE EAST & AFRICA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 153 MIDDLE EAST & AFRICA: AIRCRAFT ACTUATORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 154 MIDDLE EAST & AFRICA: AIRCRAFT ACTUATORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 155 MIDDLE EAST & AFRICA: AIRCRAFT ACTUATORS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 156 MIDDLE EAST & AFRICA: AIRCRAFT ACTUATORS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.5.2 SAUDI ARABIA

14.5.2.1 Aviation sector modernization program – Vision 2030

TABLE 157 SAUDI ARABIA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 158 SAUDI ARABIA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 159 SAUDI ARABIA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 160 SAUDI ARABIA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

14.5.3 UAE

14.5.3.1 Modern aircraft and helicopters for national security

TABLE 161 UAE: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 162 UAE: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 163 UAE: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 164 UAE: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

14.5.4 ISRAEL

14.5.4.1 Modernization of Israeli Air Force aircraft fleet

TABLE 165 ISRAEL: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 166 ISRAEL: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 167 ISRAEL: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 168 ISRAEL: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

14.5.5 SOUTH AFRICA

14.5.5.1 Rising demand for commercial aircraft

TABLE 169 SOUTH AFRICA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 170 SOUTH AFRICA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 171 SOUTH AFRICA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 172 SOUTH AFRICA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

14.5.6 NIGERIA

14.5.6.1 Upgrading outdated aircraft actuators

TABLE 173 NIGERIA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 174 NIGERIA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 175 NIGERIA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 176 NIGERIA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

14.5.7 REST OF MIDDLE EAST & AFRICA

14.5.7.1 Rising need for modern commercial aircraft

TABLE 177 REST OF MIDDLE & AFRICA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 178 REST OF MIDDLE & AFRICA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 179 REST OF MIDDLE & AFRICA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 180 REST OF MIDDLE & AFRICA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

14.6 LATIN AMERICA

14.6.1 PESTLE ANALYSIS: LATIN AMERICA

FIGURE 36 LATIN AMERICA: AIRCRAFT ACTUATORS MARKET SNAPSHOT

TABLE 181 LATIN AMERICA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 182 LATIN AMERICA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 183 LATIN AMERICA: AIRCRAFT ACTUATORS MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 184 LATIN AMERICA: AIRCRAFT ACTUATORS MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 185 LATIN AMERICA: AIRCRAFT ACTUATORS MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 186 LATIN AMERICA: AIRCRAFT ACTUATORS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 187 LATIN AMERICA: AIRCRAFT ACTUATORS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 188 LATIN AMERICA: AIRCRAFT ACTUATORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 189 LATIN AMERICA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 190 LATIN AMERICA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 191 LATIN AMERICA: AIRCRAFT ACTUATORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 192 LATIN AMERICA: AIRCRAFT ACTUATORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 193 LATIN AMERICA: AIRCRAFT ACTUATORS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 194 LATIN AMERICA: AIRCRAFT ACTUATORS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.6.2 BRAZIL

14.6.2.1 High demand for modern narrow-body aircraft

TABLE 195 BRAZIL: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 196 BRAZIL: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 197 BRAZIL: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 198 BRAZIL: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

14.6.3 MEXICO

14.6.3.1 Domestic airline demand for commercial aircraft

TABLE 199 MEXICO: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 200 MEXICO: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 201 MEXICO: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 202 MEXICO: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

14.6.4 REST OF LATIN AMERICA

14.6.4.1 Modernization of aircraft equipment of existing aircraft fleet

TABLE 203 REST OF LATIN AMERICA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 204 REST OF LATIN AMERICA: AIRCRAFT ACTUATORS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 205 REST OF LATIN AMERICA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 206 REST OF LATIN AMERICA: AIRCRAFT ACTUATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

15 COMPETITIVE LANDSCAPE (Page No. - 181)

15.1 INTRODUCTION

15.2 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2021

TABLE 207 AIRCRAFT ACTUATORS MARKET: DEGREE OF COMPETITION

FIGURE 37 SHARE OF TOP PLAYERS IN AIRCRAFT ACTUATORS MARKET, 2021

TABLE 208 KEY DEVELOPMENTS BY LEADING PLAYERS IN AIRCRAFT ACTUATORS MARKET, 2016–2022

15.3 TOP 5 PLAYERS RANKING ANALYSIS, 2021

FIGURE 38 MARKET RANKING OF LEADING PLAYERS IN AIRCRAFT ACTUATORS MARKET, 2021

FIGURE 39 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2021

15.4 COMPETITIVE BENCHMARKING

TABLE 209 COMPANY PRODUCT FOOTPRINT

TABLE 210 COMPANY SOLUTION TYPE FOOTPRINT

TABLE 211 COMPANY REGION FOOTPRINT

15.5 COMPANY EVALUATION QUADRANT

15.5.1 STARS

15.5.2 EMERGING LEADERS

15.5.3 PERVASIVE PLAYERS

15.5.4 PARTICIPANTS

FIGURE 40 MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

15.5.5 STARTUP/SME EVALUATION QUADRANT

15.5.5.1 PROGRESSIVE COMPANIES

15.5.5.2 RESPONSIVE COMPANIES

15.5.5.3 STARTING BLOCKS

15.5.5.4 DYNAMIC COMPANIES

TABLE 212 AIRCRAFT ACTUATORS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

FIGURE 41 AIRCRAFT ACTUATORS MARKET (STARTUPS) COMPETITIVE LEADERSHIP MAPPING, 2021

15.6 COMPETITIVE SCENARIO

15.6.1 MARKET EVALUATION FRAMEWORK

15.6.2 NEW PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 213 NEW PRODUCT LAUNCHES AND DEVELOPMENTS, 2018–2022

15.6.3 DEALS

TABLE 214 CONTRACTS, 2018–2022

15.6.4 VENTURES/AGREEMENTS/EXPANSIONS

TABLE 215 ACQUISITIONS/PARTNERSHIPS/JOINT VENTURES/AGREEMENTS/EXPANSIONS, 2018–2022

16 COMPANY PROFILES (Page No. - 198)

16.1 INTRODUCTION

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)*

16.2 KEY PLAYERS

16.2.1 HONEYWELL INTERNATIONAL INC.

TABLE 216 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 42 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 217 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

16.2.2 RAYTHEON TECHNOLOGIES CORPORATION

TABLE 218 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

FIGURE 43 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

TABLE 219 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

16.2.3 CURTISS-WRIGHT CORPORATION

TABLE 220 CURTISS-WRIGHT CORPORATION: BUSINESS OVERVIEW

FIGURE 44 CURTIS-WRIGHT CORPORATION: COMPANY SNAPSHOT

TABLE 221 CURTISS-WRIGHT CORPORATION: DEALS

16.2.4 LIEBHERR GROUP

TABLE 222 LIEBHERR GROUP: BUSINESS OVERVIEW

TABLE 223 LIEBHERR GROUP.: DEALS

16.2.5 MOOG INC.

TABLE 224 MOOG INC.: BUSINESS OVERVIEW

FIGURE 45 MOOG INC.: COMPANY SNAPSHOT

TABLE 225 MOOG INC.: DEALS

16.2.6 SAFRAN SA

TABLE 226 SAFRAN SA: BUSINESS OVERVIEW

FIGURE 46 SAFRAN SA: COMPANY SNAPSHOT

TABLE 227 SAFRAN SA: PRODUCT LAUNCHES

TABLE 228 SAFRAN SA: DEALS

16.2.7 AMETEK, INC.

TABLE 229 AMETEK, INC.: BUSINESS OVERVIEW

FIGURE 47 AMETEK, INC.: COMPANY SNAPSHOT

TABLE 230 AMETEK, INC.: DEALS

16.2.8 ASTRONICS CORPORATION

TABLE 231 ASTRONICS CORPORATION: BUSINESS OVERVIEW

FIGURE 48 ASTRONICS CORPORATION: COMPANY SNAPSHOT

TABLE 232 ASTRONICS CORPORATION: DEALS

16.2.9 NABTESCO CORPORATION

TABLE 233 NABTESCO CORPORATION: BUSINESS OVERVIEW

FIGURE 49 NABTESCO CORPORATION: COMPANY SNAPSHOT

16.2.10 EATON CORPORATION PLC

TABLE 234 EATON CORPORATION PLC: BUSINESS OVERVIEW

FIGURE 50 EATON CORPORATION PLC: COMPANY SNAPSHOT

16.2.11 SAAB AB

TABLE 235 SAAB AB: BUSINESS OVERVIEW

FIGURE 51 SAAB AB: COMPANY SNAPSHOT

16.2.12 WOODWARD INC.

TABLE 236 WOODWARD INC.: BUSINESS OVERVIEW

FIGURE 52 WOODWARD INC.: COMPANY SNAPSHOT

16.2.13 ITT INC.

TABLE 237 ITT INC.: BUSINESS OVERVIEW

FIGURE 53 ITT INC.: COMPANY SNAPSHOT

16.2.14 SITEC AEROSPACE GMBH

TABLE 238 SITEC AEROSPACE GMBH: BUSINESS OVERVIEW

16.2.15 ARKWIN INDUSTRIES INC.

TABLE 239 ARKWIN INDUSTRIES INC.: BUSINESS OVERVIEW

16.2.16 TAMAGAWA SEIKO CO. LTD.

TABLE 240 TAMAGAWA SEIKO CO. LTD: BUSINESS OVERVIEW

16.2.17 PARKER HANNIFIN CORP.

TABLE 241 PARKER HANNIFIN CORP.: BUSINESS OVERVIEW

FIGURE 54 PARKER HANNIFIN CORP.: COMPANY SNAPSHOT

TABLE 242 PARKER HANNIFIN CORP.: DEALS

16.2.18 ELEKTRO-METALL EXPORT

TABLE 243 ELEKTRO-METALL EXPORT: BUSINESS OVERVIEW

16.2.19 PEGASUS ACTUATORS GMBH

TABLE 244 PEGASUS ACTUATORS GMBH.: BUSINESS OVERVIEW

16.2.20 BEAVER AEROSPACE & DEFENSE INC.

TABLE 245 BEAVER AEROSPACE & DEFENSE INC.: COMPANY OVERVIEW

16.2.21 MEGGITT PLC

TABLE 246 MEGGITT PLC: BUSINESS OVERVIEW

FIGURE 55 MEGGITT PLC: COMPANY SNAPSHOT

16.3 OTHER PLAYERS

16.3.1 NOOK INDUSTRIES, INC.

TABLE 247 NOOK INDUSTRIES, INC.: BUSINESS OVERVIEW

16.3.2 ELECTROMECH TECHNOLOGIES

TABLE 248 ELECTROMECH TECHNOLOGIES: COMPANY OVERVIEW

16.3.3 WHIPPANY ACTUATION SYSTEMS LLC

TABLE 249 WHIPPANY ACTUATION SYSTEMS LLC: COMPANY OVERVIEW

16.3.4 PHT AEROSPACE LLC

TABLE 250 PHT AEROSPACE LLC: BUSINESS OVERVIEW

16.3.5 TRIUMPH GROUP

TABLE 251 TRIUMPH GROUP: COMPANY OVERVIEW

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)* might not be captured in case of unlisted companies.

17 APPENDIX (Page No. - 249)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 CUSTOMIZATION OPTIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

The study involved four major activities in estimating the current market size for the aircraft actuators market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulators databases.

Primary Research

The aircraft actuators market comprises several stakeholders, such as raw material providers, Aircraft Actuators manufacturers and suppliers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in actuator technologies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the aircraft actuators market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market size estimation methodology: Bottom-up approach

The bottom-up approach was employed to arrive at the overall size of the aircraft actuators market from the demand for aircraft actuators by end users in each country. The average cost of integration for line fit and retrofit installation was multiplied by the new aircraft deliveries and MRO fleet, respectively. These calculations led to the estimation of the overall market size.

Market size estimation methodology: Top-down approach

In the top-down approach, the overall market size was used to estimate the size of the individual markets (mentioned in market segmentation) through percentage splits obtained from secondary and primary research.

The most appropriate and immediate parent market size was used to calculate the specific market segments to implement the top-down approach. The bottom-up approach was also implemented to validate the market segment revenues obtained.

A market share was then estimated for each company to verify the revenue share used earlier in the bottom-up approach. With data triangulation procedures and validation through primaries, the overall parent market size and each market size were determined and confirmed in this study. The data triangulation procedure used for this study is explained in the market breakdown and triangulation section.

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the aircraft actuators market.

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the aircraft actuators market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for five regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, along with major countries in each of these regions

- To strategically analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, expansions, and new product developments

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 6)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aircraft Actuators Market