Rigid Plastic Packaging Market by Type, Application (Food, Beverages, Healthcare, Cosmetics, Industrial), Raw Material (Bioplastics, PE, PET, PS, PP, PVC, EPs, PC, Polyamide), Production Process, And Region - Global Forecast to 2027

Updated on : November 11, 2025

Rigid Plastic Packaging Market

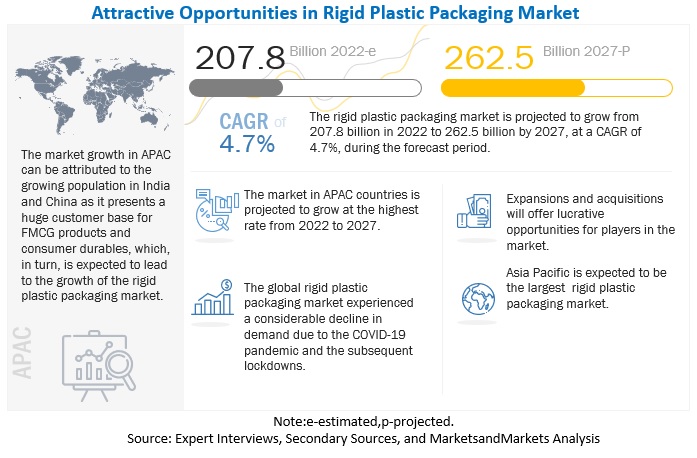

The global rigid plastic packaging market is projected to reach USD 262.5 billion by 2027, at a CAGR of 4.7%. The market is growing due to its multiple applications in end-use industries such as beverage, food, and healthcare. It is driven by factors such as strong demand in major APAC markets (mainly India and China) and increasing demand from food & beverage packaging industries.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on Rigid Plastic Packaging Market

The outbreak of COVID-19 affected the end-use industries of the rigid plastic packaging market across the globe. The impact can be felt on the economy with lockdowns and discontinuation of manufacturing operations due to social distancing norms. Decrease in the demand from end use industries impacted the rigid plastic packaging market across the globe.

Many companies have introduced short-term plans to keep their operations running amid the COVID-19 pandemic. The companies started selling their products through online platforms with contactless delivery.

Rigid Plastic Packaging Market Dynamics

Driver: Strong demand from the food & beverage packaging industry

The rigid plastic packaging market is witnessing an increase in demand from end-use industries such as food & beverages, cosmetics & toiletries, and healthcare. The food & beverage industry held a highest share in the packaging industry; growth in this industry highlights the growth potential for rigid plastics in packaging. The retail industry, which is currently witnessing a shift from unorganized to organized retail, will also stimulate the demand for rigid plastics in packaging material.

The beverage industry is a major consumer of rigid plastic packaging as it retains the quality and freshness of the product by sealing the contents within the container. Factors such as rising disposable income, change in consumer lifestyles, product presentation & differentiation, and rising demand for beverage products such as packed bottled water and alcoholic beverages will increase the consumption of rigid plastic packaging.

Restraint: Fierce competition from flexible plastic packaging

Flexible plastic packaging provides the biggest advantage for the manufacturer and retailer as it reduces the weight of packaging, which can result in reduced shipping and warehousing costs, thereby creating more space. For consumers, it provides convenience features such as single-serve portions, easy-open, easy-peel options, and the food tastes better in retort pouches than traditional tin cans. Flexible packaging is 40% less in terms of overall packaging cost, amounts to a 50% reduction in landfill waste and 62% reduction in Greenhouse Gas (GHG) emissions over rigid packaging. Hence, factors such as convenience, portability, cost savings, sustainability, and health benefits encourage product packaging manufacturers and packaging converters to move away from standard rigid materials to flexible materials.

Opportunity: Change in demographic trends

Demographic factors often have a much more complex effect on demand trends. In the packaging market, a great deal of attention has been devoted to ensuring that the demand from a particular demographic segment is met. Changing global demographic trends such as rising aging population as well as increasing middle-class population are also likely to support the demand for rigid plastic packaging. An increase in the global middle-class population will increase the consumption level of products such as beverages and packed food, which would directly drive the demand for rigid packaging in the coming years. According to the Asian Development Bank, “China’s middle-class population is estimated to increase by 83% in 2030.”

Challenge: Recycling and environmental concerns

According to the World Economic Forum, over 300 million tons of plastics are produced every year for use in a wide variety of applications. At least 8 million tons of plastics end up in our oceans every year and make up 80% of all marine debris from surface waters to deep-sea sediments. About 90% of all the trash in the ocean is from plastic. Estimates suggest that rigid plastic packaging represents the major share. According to the World Economic Forum, a study suggests that in Europe, around 53% of plastic packaging could be recycled economically and in an environmentally friendly manner.

Rigid Plastic Packaging Market Ecosystem

The bottles & jars segment of accounted for the largest share of the rigid plastic packaging market during the forecast period

The rigid plastic bottles & jars market is projected to record moderate growth during the forecast period because of the flourishing retail industry, combined with the rise in disposable income of consumers. The increasing population, growing urbanization, and rising demand for beverages and home care products are fueling the market growth.

PET segment is the second largest market in rigid plastic packaging market by type of material

Polyethylene Terephthalate (PET) is a general-purpose thermoplastic polymer that belongs to the polyester family of polymers. Polyester resins are known for their excellent combination of properties such as mechanical, thermal, chemical resistance as well as dimensional stability.

The injection molding segment is projected to grow at the second-highest CAGR during the forecast period

Injection molding is a widely used process. Common injection molded packaging items include tubs, buckets, rigid tubes, screw caps, and fitments. An injection molder consists of a purpose-built extruder coupled with a clamping press that is fitted with an interchangeable mold. A common form of injection molder has a reciprocating screw extruder as the injection unit. The screw has a one-way valve or check ring at its tip.

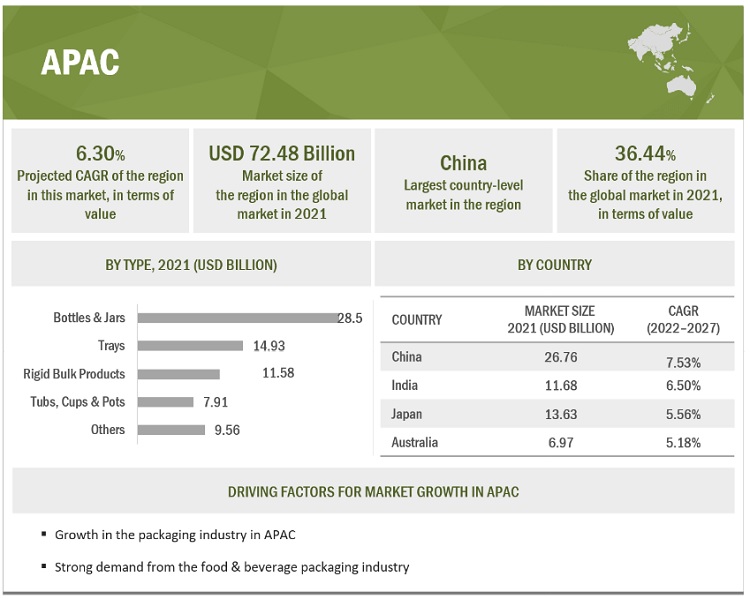

APAC accounted for the major share of the Rigid plastic packaging market

The rigid plastic packaging market in APAC is forecast to record its highest CAGR, in terms of value, between 2022 and 2027. Such growth is due to growing developmental activities and rapid economic expansion. In addition to this, the growing population in these countries presents a huge customer base for FMCG products and consumer durables, which, in turn, is expected to lead to the growth of the rigid plastic packaging market.

To know about the assumptions considered for the study, download the pdf brochure

Rigid Plastic Packaging Market Players

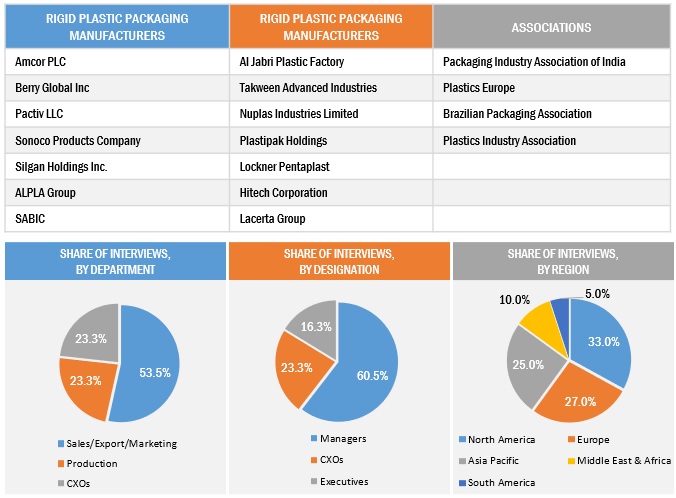

Berry Global Group Inc. (US), Amcor Plc (Switzerland), Takween Advanced Industries (Saudi Arabia), Silgan Holdings Inc. (US), Pactiv LLC (US), Sonoco Products (US), DS Smith Plc (UK), SABIC (Saudi Arabia), Al Jabri Plastic Factory (UAE) among others are some of the major players operating in the global market.

Read More: Rigid Plastic Packaging Companies

Rigid Plastic Packaging Market Report Scope

|

Report Metric |

Details |

|

Years Considered |

2020-2027 |

|

Base year |

2021 |

|

Forecast period |

2022-2027 |

|

Unit considered |

Value (USD Billion), and Volume (Tons) |

|

Segments |

Type, End Use Industry, Raw Material, Production Process and Region |

|

Regions |

North America, Europe, South America, APAC, Middle East & Africa. |

|

Companies |

The major players Amcor Ltd. (Switzerland), Berry Global Group Inc. (US), Pactiv LLC (US), Silgan Holdings Inc. (US), Sonoco Products Company (US), DS Smith Plc (UK), ALPLA (Austria), SABIC (Saudi Arabia), Al Jabri Plastic Factory (UAE), Takween Advanced Industries (Saudi Arabia) and others are covered in the Rigid plastic packaging market. |

This research report categorizes the global rigid plastic packaging market on the basis of Type, Application, and Region.

Rigid plastic packaging market, By Type

- Bottles & Jars

- Rigid Bulk Products

- Trays

- Tubs, Cups, and Pots

Rigid plastic packaging market, By End Use Industry

- Food

- Beverages

- Healthcare

- Cosmetics & Toiletries

- Industrial

Rigid plastic packaging market, By Raw Material

- Bioplastics

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Expanded Polystyrene (EPs)

- Others (PC, Polyamide)

Rigid plastic packaging market, By Production Process

- Extrusion

- Injection Molding

- Blow Molding

- Thermoforming

Rigid plastic packaging market, By Region

- North America

- Europe

- Asia Pacific (APAC)

- South America

- Middle East & Africa

The market has been further analyzed for the key countries in each of these regions.

Recent Developments in Rigid Plastic Packaging Market

- In 2022 Amcor Plc Amcor's New Lightweighting Technology Introduces in a Quantum Leap for the Future of Packaging. More than 50% of the material in the finish is eliminated by a new two-step lightweighting technology. Bottles assist businesses in meeting sustainability goals while maintaining a premium appearance and feel.

- In 2022, Pactiv Inc. announced that Fabri-Kal, a top producer of foodservice and consumer brand packaging solutions, had been acquired by its wholly-owned subsidiary, Pactiv Evergreen Group Holdings Inc. Fabri-Kal’s products include portion cups, lids, clamshells, drink cups and yogurt containers for the consumer packaged goods and industrial food markets. Approximately half of Fabri-Kal’s sales are generated from fully compostable packaging products or fully recyclable packaging products.

Frequently Asked Questions (FAQ):

Does this report covers the new applications of rigid plastic packaging?

Yes the report covers the new applications of rigid plastic packaging.

Does this report cover the volume tables in addition to value tables?

Yes the report covers the market both in terms of volume as well as value

What is the current competitive landscape in the rigid plastic packaging market in terms of new applications, production, and sales?

The market has various large, medium, and small-scale players operating across the globe. Many players are constantly innovating and developing new products and expanding to developing countries where the demand is constantly growing; thereby boosting sales.

Which all countries are considered in the report?

China, Japan, and India are major countries considered in the report. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growth of packaging industry in Asia Pacific- Strong demand from food and beverage packaging industriesRESTRAINTS- Stringent regulations- Intense competition from flexible plastic packagingOPPORTUNITIES- Changes in demographic trends- Changes in lifestyle patternsCHALLENGES- Increased and volatile input costs- Recycling and environmental concerns

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 PROMINENT COMPANIES

- 5.7 SMALL- & MEDIUM-SIZED ENTERPRISES

-

5.8 YC & YCC SHIFTREVENUE SHIFT & NEW REVENUE POCKETS FOR RIGID PLASTIC PACKAGING MANUFACTURERS

-

5.9 REGULATORY LANDSCAPECONTAINER COMPLIANCE OPTIONSCALCULATING COMPLIANCE

-

5.10 TECHNOLOGY ANALYSISNEW PET PREFORM MOLDING SOLUTIONPET-FREE OVENABLE TRAY SOLUTIONNEW TECHNOLOGY FOR PRODUCTION OF ULTRA-THIN-WALLED CONTAINERSNEW TECHNOLOGY TO HELP RECYCLE SMALL PLASTIC BOTTLES

-

5.11 CASE STUDY ANALYSISSIMULIA-AMCOR CASEPROJECT TO IDENTIFY AND SHOWCASE GOOD PRACTICES IN DESIGN FOR RECYCLABILITY OF RIGID PLASTIC PACKAGING IN UK MARKET.

- 5.12 TRADE ANALYSIS

-

5.13 ECOSYSTEM MAPPING

- 5.14 PRICING ANALYSIS

-

5.15 PATENT ANALYSISINTRODUCTIONMETHODOLOGY

- 5.16 KEY CONFERENCES & EVENTS (2022–2023)

- 6.1 INTRODUCTION

-

6.2 EXTRUSIONLOWER PRODUCTION COSTS AND GREATER DESIGN FLEXIBILITY TO DRIVE GROWTH

-

6.3 INJECTION MOLDINGENABLES FASTER PRODUCTION COMPARED TO OTHER PROCESSES

-

6.4 BLOW MOLDINGRISING DEMAND FOR BOTTLES TO DRIVE MARKET

-

6.5 THERMOFORMINGLOW-COST PRODUCTION TO DRIVE GROWTH

- 6.6 OTHERS

- 7.1 INTRODUCTION

-

7.2 BIOPLASTICSECONOMICAL AND ENVIRONMENTALLY FRIENDLY PACKAGING TO DRIVE MARKET

-

7.3 POLYETHYLENE (PE)HIGH DURABILITY, VERSATILITY, RESISTANCE TO MOISTURE, AND LIGHTWEIGHT PROPERTIES TO DRIVE MARKET

-

7.4 POLYETHYLENE TEREPHTHALATE (PET)SUPERIOR TRANSPARENCY EQUAL TO GLASS AND HIGH MECHANICAL STRENGTH TO DRIVE MARKET

-

7.5 POLYSTYRENE (PS)PHARMACEUTICAL INDUSTRY TO DRIVE MARKET

-

7.6 POLYPROPYLENE (PP)WIDE USE IN FOOD PACKAGING TO DRIVE MARKET

-

7.7 POLYVINYL CHLORIDE (PVC)HIGH STIFFNESS PROPERTY TO DRIVE MARKET

-

7.8 EXPANDED POLYSTYRENE (EPS)DEMAND FOR FOOD PACKAGING TO DRIVE GROWTH

- 7.9 OTHERS (PC, POLYAMIDE)

- 8.1 INTRODUCTION

-

8.2 BOTTLES & JARSRISING DEMAND FOR BEVERAGES AND HOME CARE TO DRIVE MARKET

-

8.3 RIGID BULK PRODUCTSHIGH LOAD-HANDLING CAPACITY TO DRIVE GROWTH

-

8.4 TRAYSRISE IN GLOBAL FOOD DELIVERY AND TAKEAWAY MARKET TO DRIVE DEMAND

-

8.5 TUBS, CUPS, & POTSRISING DEMAND FOR SINGLE-SERVE PACKS TO DRIVE MARKET

- 8.6 OTHERS

- 9.1 INTRODUCTION

-

9.2 FOODINCREASING DEMAND FOR PACKED FOOD TO DRIVE MARKET

-

9.3 BEVERAGESCHANGING CONSUMPTION PATTERNS TO DRIVE MARKET

-

9.4 HEALTHCAREINCREASE IN CONSUMPTION OF MEDICATIONS TO DRIVE MARKET

-

9.5 COSMETICS & TOILETRIESRISING DEMAND TO DRIVE MARKET

-

9.6 INDUSTRIALRISING USE OF RIGID PLASTICS TO DRIVE MARKET

- 9.7 OTHERS

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICCHINA- Increasing demand for consumer goods to drive marketJAPAN- Rising disposable income and high urban population to drive marketINDIA- High demand from organized retail and e-commerce sectors to drive growthAUSTRALIA- Rising demand for ready-to-eat and processed food to drive marketREST OF ASIA PACIFIC

-

10.3 EUROPEGERMANY- High demand for industrial packaging to lead to market growthUK- Growth of healthcare industry to offer lucrative opportunitiesFRANCE- Demand from pharmaceutical industry to boost marketITALY- Retail, food, and healthcare industries to drive marketSPAIN- Demand from retail, home & personal care, pharmaceutical, and food & beverage industries to drive marketREST OF EUROPE

-

10.4 NORTH AMERICAUS- Demand for consumer durables to drive marketCANADA- Food & beverage and home & personal care industries to drive marketMEXICO- Growing beverage industry to boost market

-

10.5 MIDDLE EAST & AFRICASAUDI ARABIA- Higher spending on convenience packaging to drive demandSOUTH AFRICA- Growth of packaging industry to drive marketREST OF MIDDLE EAST & AFRICA

-

10.6 SOUTH AMERICABRAZIL- Exports of fruits, meat, and oils to drive marketARGENTINA- Growing demand for food packaging to drive marketREST OF SOUTH AMERICA

- 11.1 STRATEGIES ADOPTED BY PLAYERS

- 11.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2021

- 11.3 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

- 11.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

- 11.5 MARKET EVALUATION FRAMEWORK

-

11.6 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.7 SME MATRIX, 2021PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

12.1 KEY PLAYERSAMCOR- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBERRY GLOBAL GROUP INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPACTIV LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSILGAN HOLDINGS INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSONOCO PRODUCTS COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDS SMITH PLC- Business overview- Products/Solutions/Services offered- MnM viewALPLA- Business overview- Products/Solutions/Services offered- Recent developmentsSABIC- Business overview- Products/Solutions/Services offeredAL JABRI PLASTIC FACTORY- Business overview- Products/Solutions/Services offeredTAKWEEN ADVANCED INDUSTRIES- Business overview- Products/Solutions/Services offeredNUPLAS INDUSTRIES LTD- Business overview- Products/Solutions/Services offered

-

12.2 OTHER PLAYERSALTIUM PACKAGING LPPLASTIPAK HOLDINGS, INC.KLÖCKNER PENTAPLASTHITECH CORPORATIONLACERTA GROUP INC.WINPAK LTDUS PACK GROUPREGENT PLAST PVT. LTD.MPACT

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 RIGID PLASTIC PACKAGING MARKET SIZE, INCLUSIONS & EXCLUSIONS

- TABLE 2 PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 RIGID PLASTIC PACKAGING MARKET VALUE CHAIN

- TABLE 4 PLASTIC CONTAINER IMPORT DATA, 2021 (USD BILLION)

- TABLE 5 PLASTIC CONTAINER EXPORT DATA, 2021 (USD BILLION)

- TABLE 6 DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 7 RIGID PLASTIC PACKAGING MARKET SIZE, BY PRODUCTION PROCESS, 2020–2027 (MILLION METRIC TONS)

- TABLE 8 RIGID PLASTIC PACKAGING MARKET SIZE, BY RAW MATERIAL, 2020–2027 (USD BILLION)

- TABLE 9 RIGID PLASTIC PACKAGING MARKET SIZE, BY RAW MATERIAL, 2020–2027 (MILLION METRIC TONS)

- TABLE 10 RIGID PLASTIC PACKAGING MARKET SIZE, HISTORIC TABLE, BY TYPE, 2016–2019 (USD BILLION)

- TABLE 11 RIGID PLASTIC PACKAGING MARKET SIZE, HISTORIC TABLE, BY TYPE, 2016–2019 (MILLION METRIC TONS)

- TABLE 12 RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 13 RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 14 RIGID PLASTIC PACKAGING MARKET SIZE, HISTORIC TABLE, BY APPLICATION, 2016–2019 (USD BILLION)

- TABLE 15 RIGID PLASTIC PACKAGING MARKET SIZE, HISTORIC TABLE, BY APPLICATION, 2016–2019 (MILLION METRIC TONS)

- TABLE 16 RIGID PLASTIC PACKAGING MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 17 RIGID PLASTIC PACKAGING MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 18 RIGID PLASTIC PACKAGING MARKET SIZE, BY REGION, 2020–2027 (USD BILLION)

- TABLE 19 RIGID PLASTIC PACKAGING MARKET SIZE, BY REGION, 2020–2027 (MILLION METRIC TONS)

- TABLE 20 RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 21 RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 22 HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2016–2019 (USD BILLION)

- TABLE 23 HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2016–2019 (MILLION METRIC TONS)

- TABLE 24 RIGID PLASTIC PACKAGING MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 25 RIGID PLASTIC PACKAGING MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 26 HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY APPLICATION, 2016–2019 (USD BILLION)

- TABLE 27 HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION METRIC TONS)

- TABLE 28 RIGID PLASTIC PACKAGING MARKET SIZE, BY RAW MATERIAL, 2020–2027 (USD BILLION)

- TABLE 29 RIGID PLASTIC PACKAGING MARKET SIZE, BY RAW MATERIAL, 2020–2027 (MILLION METRIC TONS)

- TABLE 30 RIGID PLASTIC PACKAGING MARKET SIZE, BY PRODUCTION PROCESS, 2020–2027 (MILLION METRIC TONS)

- TABLE 31 ASIA PACIFIC: RIGID PLASTIC PACKAGING MARKET SIZE, BY COUNTRY, 2020–2027 (USD BILLION)

- TABLE 32 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2027 (MILLION METRIC TONS)

- TABLE 33 ASIA PACIFIC: HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2016–2019 (USD BILLION)

- TABLE 34 ASIA PACIFIC: HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2016–2019 (MILLION METRIC TONS)

- TABLE 35 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 36 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 37 ASIA PACIFIC: HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY APPLICATION, 2016–2019 (USD BILLION)

- TABLE 38 ASIA PACIFIC: HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION METRIC TONS)

- TABLE 39 ASIA PACIFIC: RIGID PACKAGING MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 40 ASIA PACIFIC: RIGID PACKAGING MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 41 ASIA PACIFIC: MARKET SIZE, BY RAW MATERIAL, 2020–2027 (USD BILLION)

- TABLE 42 ASIA PACIFIC: RIGID PACKAGING MARKET SIZE, BY RAW MATERIAL, 2020–2027 (MILLION METRIC TONS)

- TABLE 43 CHINA: RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 44 CHINA: RIGID PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 45 CHINA: RIGID PLASTIC PACKAGING MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 46 CHINA: RIGID PACKAGING MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 47 JAPAN: RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 48 JAPAN: MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 49 JAPAN: MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 50 JAPAN: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 51 INDIA: RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 52 INDIA: RIGID PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 53 INDIA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 54 INDIA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 55 AUSTRALIA: RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 56 AUSTRALIA: RIGID PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 57 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 58 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 59 REST OF ASIA PACIFIC: RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 60 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 61 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 62 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 63 EUROPE: RIGID PLASTIC PACKAGING MARKET SIZE, BY COUNTRY, 2020–2027 (USD BILLION)

- TABLE 64 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2027 (MILLION METRIC TONS)

- TABLE 65 EUROPE: HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2016–2019 (USD BILLION)

- TABLE 66 EUROPE: HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2016–2019 (MILLION METRIC TONS)

- TABLE 67 EUROPE: MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 68 EUROPE: MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 69 EUROPE: HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY APPLICATION, 2016–2019 (USD BILLION)

- TABLE 70 EUROPE: HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION METRIC TONS)

- TABLE 71 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 72 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 73 EUROPE: MARKET SIZE, BY RAW MATERIAL, 2020–2027 (USD BILLION)

- TABLE 74 EUROPE: MARKET SIZE, BY RAW MATERIAL, 2020–2027 (MILLION METRIC TONS)

- TABLE 75 GERMANY: RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 76 GERMANY: RIGID PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 77 GERMANY: RIGID PLASTIC PACKAGING MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 78 GERMANY: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 79 UK: RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 80 UK: MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 81 UK: MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 82 UK: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 83 FRANCE: RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 84 FRANCE: RIGID PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 85 FRANCE: RIGID PLASTIC PACKAGING MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 86 FRANCE: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 87 ITALY: RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 88 ITALY: MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 89 ITALY: MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 90 ITALY: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 91 SPAIN: RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 92 SPAIN: RIGID PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 93 SPAIN: MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 94 SPAIN: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 95 REST OF EUROPE: RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 96 REST OF EUROPE: MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 97 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 98 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 99 NORTH AMERICA: RIGID PLASTIC PACKAGING MARKET SIZE, BY COUNTRY, 2020–2027 (USD BILLION)

- TABLE 100 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2027 (MILLION METRIC TONS)

- TABLE 101 NORTH AMERICA: RIGID PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 102 NORTH AMERICA: RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 103 NORTH AMERICA: HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2016–2019 (USD BILLION)

- TABLE 104 NORTH AMERICA: HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2016–2019 (MILLION METRIC TONS)

- TABLE 105 NORTH AMERICA: RIGID PACKAGING MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 106 NORTH AMERICA: RIGID PLASTIC PACKAGING MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 107 NORTH AMERICA: HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY APPLICATION, 2016–2019 (USD BILLION)

- TABLE 108 NORTH AMERICA: HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION METRIC TONS)

- TABLE 109 NORTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2020–2027 (USD BILLION)

- TABLE 110 NORTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2020–2027 (MILLION METRIC TONS)

- TABLE 111 US: RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 112 US: RIGID PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 113 US: MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 114 US: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 115 CANADA: RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 116 CANADA: RIGID PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 117 CANADA: RIGID PLASTIC PACKAGING MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 118 CANADA: RIGID PACKAGING MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 119 MEXICO: RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 120 MEXICO: MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 121 MEXICO: MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 122 MEXICO: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 123 MIDDLE EAST & AFRICA: RIGID PLASTIC PACKAGING MARKET SIZE, BY COUNTRY, 2020–2027 (USD BILLION)

- TABLE 124 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2027 (MILLION METRIC TONS)

- TABLE 125 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 126 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 127 MIDDLE EAST & AFRICA: HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2016–2019 (USD BILLION)

- TABLE 128 MIDDLE EAST & AFRICA: HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2016–2019 (MILLION METRIC TONS)

- TABLE 129 MIDDLE EAST & AFRICA: HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY APPLICATION, 2016–2019 (USD BILLION)

- TABLE 130 MIDDLE EAST & AFRICA: HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION METRIC TONS)

- TABLE 131 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 132 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 133 MIDDLE EAST & AFRICA: MARKET SIZE, BY RAW MATERIAL, 2020–2027 (USD BILLION)

- TABLE 134 MIDDLE EAST & AFRICA: MARKET SIZE, BY RAW MATERIAL, 2020–2027 (MILLION METRIC TONS)

- TABLE 135 SAUDI ARABIA: RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 136 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 137 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 138 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 139 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 140 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 141 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 142 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 143 REST OF MIDDLE EAST & AFRICA: RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 144 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 145 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 146 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 147 SOUTH AMERICA: RIGID PLASTIC PACKAGING MARKET SIZE, BY COUNTRY, 2020–2027 (USD BILLION)

- TABLE 148 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2027 (MILLION METRIC TONS)

- TABLE 149 SOUTH AMERICA: HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2016–2019 (USD BILLION)

- TABLE 150 SOUTH AMERICA: HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2016–2019 (MILLION METRIC TONS)

- TABLE 151 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 152 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 153 SOUTH AMERICA: HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY APPLICATION, 2016–2019 (USD BILLION)

- TABLE 154 SOUTH AMERICA: HISTORIC RIGID PLASTIC PACKAGING MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION METRIC TONS)

- TABLE 155 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 156 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 157 SOUTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2020–2027 (USD BILLION)

- TABLE 158 SOUTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2020–2027 (MILLION METRIC TONS)

- TABLE 159 BRAZIL: RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 160 BRAZIL: MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 161 BRAZIL: MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 162 BRAZIL: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 163 ARGENTINA: RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 164 ARGENTINA: MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 165 ARGENTINA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 166 ARGENTINA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 167 REST OF SOUTH AMERICA: RIGID PLASTIC PACKAGING MARKET SIZE, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 168 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2020–2027 (MILLION METRIC TONS)

- TABLE 169 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD BILLION)

- TABLE 170 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION METRIC TONS)

- TABLE 171 DEGREE OF COMPETITION

- TABLE 172 MARKET EVALUATION FRAMEWORK

- TABLE 173 COMPANY PRODUCT FOOTPRINT BY TYPE

- TABLE 174 COMPANY PRODUCT FOOTPRINT BY PRODUCTION PROCESS

- TABLE 175 COMPANY PRODUCT FOOTPRINT BY APPLICATION

- TABLE 176 COMPANY REGION FOOTPRINT

- TABLE 177 SME MATRIX: COMPANY PRODUCT FOOTPRINT BY TYPE

- TABLE 178 SME MATRIX: COMPANY PRODUCT FOOTPRINT BY PRODUCTION PROCESS

- TABLE 179 SME MATRIX: COMPANY PRODUCT FOOTPRINT BY APPLICATION

- TABLE 180 SME MATRIX: COMPANY REGION FOOTPRINT

- TABLE 181 PRODUCT LAUNCHES, 2018–2022

- TABLE 182 DEALS, 2018–2022

- TABLE 183 AMCOR PLC: COMPANY OVERVIEW

- TABLE 184 AMCOR PLC: PRODUCT LAUNCHES

- TABLE 185 AMCOR PLC: DEALS

- TABLE 186 AMCOR PLC: OTHERS

- TABLE 187 BERRY GLOBAL GROUP INC.: COMPANY OVERVIEW

- TABLE 188 BERRY GLOBAL GROUP INC.: OTHERS

- TABLE 189 PACTIV LLC: COMPANY OVERVIEW

- TABLE 190 PACTIV LLC: DEALS

- TABLE 191 SILGAN HOLDINGS INC.: COMPANY OVERVIEW

- TABLE 192 SILGAN HOLDINGS INC.: DEALS

- TABLE 193 SONOCO PRODUCTS COMPANY: COMPANY OVERVIEW

- TABLE 194 SONOCO PRODUCTS COMPANY: PRODUCT LAUNCHES

- TABLE 195 SONOCO PRODUCTS COMPANY: DEALS

- TABLE 196 SONOCO PRODUCTS COMPANY: DS SMITH PLC: COMPANY OVERVIEW

- TABLE 197 ALPLA: COMPANY OVERVIEW

- TABLE 198 ALPLA: DEALS

- TABLE 199 ALPLA: OTHERS

- TABLE 200 SABIC: COMPANY OVERVIEW

- TABLE 201 AL JABRI PLASTIC FACTORY: COMPANY OVERVIEW

- TABLE 202 TAKWEEN ADVANCED INDUSTRIES: COMPANY OVERVIEW

- TABLE 203 NUPLAS INDUSTRIES LTD: COMPANY OVERVIEW

- FIGURE 1 RIGID PLASTIC PACKAGING MARKET SEGMENTATION

- FIGURE 2 APPROACH (BOTTOM-UP)

- FIGURE 3 APPROACH (TOP-DOWN)

- FIGURE 4 APPROACH (SUPPLY SIDE)

- FIGURE 5 VOLUME APPROACH

- FIGURE 6 RIGID PLASTIC PACKAGING MARKET: DATA TRIANGULATION

- FIGURE 7 KEY MARKET INSIGHTS

- FIGURE 8 LIST OF STAKEHOLDERS AND BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 9 PE RAW MATERIAL SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 10 BOTTLES & JARS SEGMENT TO LEAD MARKET BETWEEN 2022 AND 2027

- FIGURE 11 FOOD SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 GROWING DEMAND FROM FOOD & BEVERAGE INDUSTRY TO DRIVE MARKET

- FIGURE 14 ASIA PACIFIC REGION AND BOTTLES & JARS SEGMENT LED MARKET IN 2021

- FIGURE 15 PE AND BEVERAGES SEGMENTS LED MARKET IN 2021

- FIGURE 16 EXTRUSION PRODUCTION PROCESS ACCOUNTED FOR LARGEST SHARE IN 2021

- FIGURE 17 MARKET IN CHINA PROJECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES:

- FIGURE 19 E-COMMERCE INDUSTRY IN INDIA (USD BILLION)

- FIGURE 20 BEER PRODUCTION IN EUROPE, 2014–2021

- FIGURE 21 AVERAGE PRICE OF PER BARREL CRUDE OIL (USD)

- FIGURE 22 GLOBAL GROWTH IN PLASTIC CONSUMPTION, 2019-2060

- FIGURE 23 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 VALUE CHAIN

- FIGURE 25 SUPPLY CHAIN OF RIGID PLASTIC PACKAGING INDUSTRY

- FIGURE 26 REVENUE SHIFT FOR RIGID PLASTIC PACKAGING MANUFACTURERS

- FIGURE 27 ECOSYSTEM OF RIGID PLASTIC PACKAGING MARKET

- FIGURE 28 COST INCURRED FOR MANUFACTURING SINGLE PLASTIC BOTTLE

- FIGURE 29 GRANTED PATENTS 47% OF TOTAL COUNT DURING LAST FIVE YEARS

- FIGURE 30 PUBLICATION TRENDS - LAST FIVE YEARS

- FIGURE 31 JURISDICTION ANALYSIS

- FIGURE 32 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 33 EXTRUSION TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 34 PE TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 35 BOTTLES & JARS SEGMENT TO COMMAND LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 36 BEVERAGES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 37 CHINA TO BE FASTEST-GROWING MARKET FROM 2022 TO 2027

- FIGURE 38 ASIA PACIFIC: RIGID PLASTIC PACKAGING MARKET SNAPSHOT

- FIGURE 39 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2018–2022

- FIGURE 40 REVENUE & RANKING ANALYSIS OF TOP FIVE PLAYERS IN RIGID PLASTIC PACKAGING MARKET, 2021

- FIGURE 41 SHARE OF KEY PLAYERS IN RIGID PLASTIC PACKAGING MARKET, 2021

- FIGURE 42 TOP FIVE PLAYERS DOMINATED MARKET DURING LAST FIVE YEARS

- FIGURE 43 COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 44 SME MATRIX, 2021

- FIGURE 45 AMCOR PLC: COMPANY SNAPSHOT

- FIGURE 46 BERRY GLOBAL GROUP INC.: COMPANY SNAPSHOT

- FIGURE 47 PACTIV LLC: COMPANY SNAPSHOT

- FIGURE 48 SILGAN HOLDINGS INC.: COMPANY SNAPSHOT

- FIGURE 49 SONOCO PRODUCTS COMPANY: COMPANY SNAPSHOT

- FIGURE 50 DS SMITH PLC: COMPANY SNAPSHOT

- FIGURE 51 SABIC: COMPANY SNAPSHOT

- FIGURE 52 TAKWEEN ADVANCED INDUSTRIES: COMPANY SNAPSHOT

This research involved the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the rigid plastic packaging market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Rigid Plastic Packaging Market Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Rigid Plastic Packaging Market Primary Research

The rigid packaging market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the rigid plastic packaging market. Primary sources from the supply side include associations and institutions involved in the rigid plastic packaging industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Rigid Plastic Packaging Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global rigid plastic packaging market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Bottom-Up Approach and Top-Down Approach

Rigid Plastic Packaging Market Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Rigid Plastic Packaging Market Report Objectives

- To define, describe, and forecast the global rigid plastic packaging market in terms of value

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on type, region, and end-use application.

- To forecast the market size, in terms of value, with respect to five main regions: North America, Europe, South America, APAC, Middle East & Africa.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape

- To strategically profile key players in the market

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions

- To strategically profile the leading players and comprehensively analyze their key developments in the market

Rigid Plastic Packaging Market Report Available Customizations

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Rigid Plastic Packaging Market Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Rigid Plastic Packaging Market Regional Analysis

- Further breakdown of the Rest of the APAC Rigid plastic packaging market

- Further breakdown of the Rest of Europe’s Rigid plastic packaging market

Rigid Plastic Packaging Market Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Rigid Plastic Packaging Market