Retail Cloud Market by Component (Solutions and Services), Service Model (SaaS, PaaS, and IaaS), Deployment Model (Public, Private, and Hybrid Cloud), Organization Size (SMEs and Large Enterprises) and Region - Global Forecast to 2028

Updated on : Nov 17, 2025

Overview

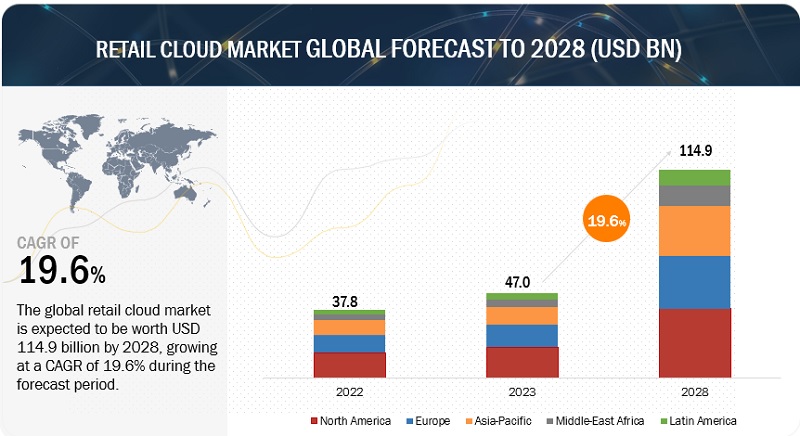

The global retail cloud market size was estimated at USD 47.0 billion in 2023 and is projected to reach USD 114.9 billion by 2028, growing at a CAGR of 19.6% from 2023 to 2028.

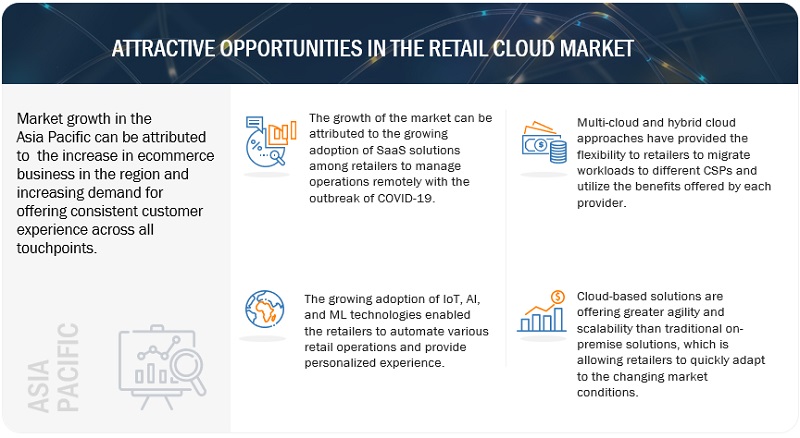

In recent years, cloud adoption in retail sector has evolved as many retailers began to adopt hybrid cloud solutions that combined public and private clouds. This allowed retailers to keep sensitive data on private clouds while using public clouds for less sensitive applications. Further, cloud-based POS systems began to gain traction in the retail industry. These systems allowed retailers to process transactions in real-time and access data from anywhere, making it easier to manage their operations. Many retailers are also integrating cloud-based solutions with other technologies such as AI and IoT. Retailers are utilizing cloud-based IoT platforms to collect and analyze data from sensors in stores and warehouses, while AI-powered chatbots are being utilized to offer personalized customer service through cloud-based platforms. The global recession caused by the COVID-19 pandemic has had a mixed impact on the retail cloud market. The pandemic has increased demand for retail cloud solutions and services with the growth in ecommerce. This trend is expected to continue post COVID-19 to manage the surge in demand and changing customer preferences.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Recession Impact on the Retail cloud market

The global recession caused by the COVID-19 pandemic has had a mixed impact on the retail cloud market. Factors like Russia-Ukraine war, the global pandemic, inflation, rising interest rates, and rising oil prices has resulted in recession across the various regions. These market uncertainties have resulted in reduced spending by organizations that may impact the demand for cloud solutions and services in the retail sector in the short term. Russia invasion of Ukraine has impacted the entire value chain of retail industry such as raw materials, manufacturing, transportation, and trading. This has significantly disrupted the global supply chain as well. In addition, Cloud providers and internet service providers are under constant pressure to not to service the clients in Russia. This is likely to impact the data center construction cost due to inflation, rising energy price, and supply chain disruptions for materials and semiconductor devices that are being produced in Russia and Ukraine.

While the recession has had a mixed impact on the retail cloud market, the long-term prospects for the industry remain positive. The continued growth in internet penetration, the increasing popularity of mobile devices, advent of technologies such as AI, IoT, cloud, and growth of ecommerce, are likely to drive continued growth in the market. However, the impact of the recession on the market is likely to be felt for some time, particularly in terms of investment and advertising revenue.

Retail Cloud Market Dynamics

Driver: Accelerated adoption of multi-cloud architecture

Multi-cloud adoption has become a prevalent trend in retail as businesses seek to leverage the benefits of using multiple cloud service providers. The retail sector has specific requirements, including the need for scalable, flexible, and secure IT infrastructure to support both online and brick-and-mortar operations. Multi-cloud environments provide retailers with the ability to customize their IT infrastructure to meet their specific needs while also reducing the risk of downtime, data loss, and security breaches.

One of the trends in the retail industry is the use of multi-cloud environments for eCommerce operations. Retailers can leverage the scalability and redundancy of multi-cloud environments to ensure their eCommerce platforms are always available and can handle high volumes of traffic. By using multiple cloud providers, retailers can also ensure they have geographic redundancy, which helps to protect against outages and data loss. Retailers are also using multi-cloud environments for data analytics. Retailers generate vast amounts of data from various sources, including online sales, in-store transactions, and social media. By leveraging multiple cloud providers, retailers can ensure they have access to the tools and resources they need to manage their supply chain effectively. For instance, a retailer can use one cloud provider for inventory management and another for logistics management. Thus, multi-cloud adoption in the retail industry is expected to grow as retailers seek to leverage the benefits of multiple cloud providers to meet their unique requirements and improve their business operations. By adopting multi-cloud environments, retailers can gain a competitive advantage and improve their agility, scalability, and flexibility while reducing costs and improving their security posture.

Restraint: integration of cloud-based systems with legacy systems

Integrating cloud systems with legacy systems is one of the major hindrances to the adoption of cloud computing systems in the retail sector. Many retailers have invested in legacy systems over the years, and these systems often handle critical functions such as inventory management, order processing, and payment processing. Integrating these systems with cloud-based systems can be challenging, but it is essential to ensure that retailers can leverage the benefits of cloud computing while still maintaining their existing systems. Legacy systems are often built on older technologies that may not be compatible with newer cloud-based systems. This can result in issues with data migration and data exchange, which can impact the overall performance of the systems. To overcome this problem, retailers need to adopt a well-planned and structured approach to integrating cloud systems with legacy systems. This involves understanding the requirements of the business, assessing the compatibility of the legacy systems with cloud-based systems, and identifying the right integration tools and technologies. Retailers also need to ensure they have the necessary resources to manage the integration process effectively, including skilled personnel and adequate budgets.

Opportunity: adoption of new retail technologies to integrate online and offline shopping experiences

New retail adoption is driven by the increasing demand for a seamless and personalized shopping experience. Retailers are adopting new technologies to collect and analyze customer data to understand their preferences and shopping behavior, which can be used to provide personalized recommendations and improve customer engagement. This includes the use of technologies such as artificial intelligence, machine learning, big data analytics, augmented reality, and virtual reality, among others. New retail adoption is also helping retailers to optimize their operations by streamlining processes, reducing costs, and improving efficiency. For instance, automated inventory management systems can help retailers to keep track of stock levels and reorder products automatically, reducing the likelihood of stockouts and overstocking. Amazon, Apple, Alibaba, and Walmart are some top companies offering new retail stores. Amazon Go stores are a prime example of how new retail technology is being used to enhance the customer experience. With the use of computer vision, sensors, and machine learning algorithms, customers can simply walk in, pick up the items they need, and walk out without having to go through a checkout counter. The system automatically detects the items and charges the customer’s account. In addition, Apple and Alibaba have also been experimenting with cashier-less stores and leveraging AI for customer personalization. Apple’s “Today at Apple” sessions provide personalized learning experiences to customers based on their interests and skill levels. Alibaba’s Hema stores are another example of how new retail technology is being used to enhance the customer experience. These stores use a combination of mobile apps, AI-powered recommendation engines, and in-store robots to provide a seamless shopping experience. Thus, new retail will offer ample opportunities for retailers to enhance the customer experience, streamline processes, and gain a competitive edge.

Challenge: Concerns over data security in the cloud

Data security is a critical concern for any business, including those in the retail industry that use cloud solutions. When retailers store their data in the cloud, they must ensure it is protected from unauthorized access, data breaches, and other security threats. There are several practices that retailers can follow to ensure data security when migrating to the cloud, such as choosing a reputed cloud vendor, using strong passwords and authentication, monitoring access & usage, and developing a disaster recovery plan in the event of a natural disaster or cyber-attack. In addition, it is also important for retailers to stay up to date with the latest security threats and to continually evaluate and update their security measures as required.

Retail Cloud Ecosystem

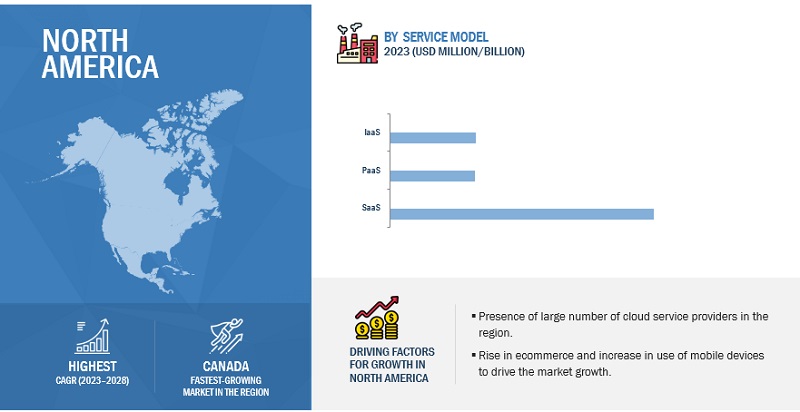

Based on service model, the SaaS segment is projected to hold the largest market share during the forecast period.

SaaS has become increasingly popular in the retail industry as a way to manage key functions such as inventory management, point of sale (POS), and customer relationship management (CRM). By using SaaS solutions, retailers can take advantage of the benefits of cloud computing, including lower costs, scalability, and accessibility from anywhere with an internet connection. One common use of SaaS in retail is for POS systems. Cloud-based POS systems offer several benefits over traditional POS systems, including faster implementation, easier upgrades, and the ability to access sales data and reports from anywhere. Additionally, cloud-based POS systems can be integrated with other SaaS solutions, such as inventory management and CRM, to provide a more complete retail management system.

Based on deployment model, the hybrid cloud segment is projected to witness the highest CAGR during the forecast period.

Hybrid cloud is increasingly being adopted by retailers as it offers the flexibility to integrate various retail applications and workloads across public and private cloud environments. Retailers are using hybrid cloud to support their critical retail functions such as supply chain management, inventory management, customer relationship management, and e-commerce. One of the main advantages of hybrid cloud in retail is that it provides a more cost-effective solution compared to running everything on-premises. Retailers can use public cloud services for non-sensitive workloads such as website hosting, data analytics, and application development, while keeping their sensitive data on-premises or in a private cloud environment. However, hybrid cloud in retail also presents some challenges. Retailers need to ensure that their data and applications are secure across both public and private cloud environments.

Based on Region, North America to hold the largest market share during the forecast period

North America is expected to lead the retail cloud market in 2023. The US is estimated to account for the largest market share in North America in 2023 in the retail cloud market, and the trend is expected to continue until 2028. The growth is mainly due to the growing adoption rate of cloud services across enterprises. In a survey by LogicMonitor, 87% of IT decision-makers in the US said that they plan to increase their use of cloud computing in the coming years. Also, According to Flexera, 97% of organizations in US are now using some form of cloud computing in 2020, up from 93% in 2019. Further, cloud service providers are focusing on launching cloud initiatives to drive the cloud adoption in retail sector. For instance, AWS launched its "AWS Retail Competency" program in 2019, which recognizes partners who have demonstrated technical proficiency and proven customer success in retail-specific categories.

Key Market Players

The retail cloud market is dominated by a few globally established players such as AWS (US), Microsoft (US), Google (US), Oracle (US), Salesforce (US), among others, are the key vendors that secured retail cloud contracts in last few years. These vendors can bring global processes and execution expertise to the table, the local players only have local expertise. Driven by increased disposable incomes, easy access to knowledge, and fast adoption of technological products, buyers are more willing to experiment/test new things in the market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

Component, Service Model, Deployment Model, Organization Size, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

AWS (US), Microsoft (US), Google (US), Oracle (US), Salesforce (US), SAP (Germany), Accenture (Ireland), Alibaba Cloud (China), IBM (US), Cisco (US), VMware (US), Fujitsu (Japan), Blue Yonder (US), Cognizant (US), Workday (US), Infor (US), Rackspace (US), SPS Commerce (US), Atos (France), Epicor (US), Nutanix (US), Lightspeed Commerce (Canada), Tekion (US), SymphonyAI Retail CPG and more. |

This research report categorizes the retail cloud market to forecast revenue and analyze trends in each of the following submarkets:

Based on Component:

-

Solutions

- Supply Chain Management

- Customer Management

- Merchandising

- Workforce Management

- Reporting & Analytics

- Data Security

- Omni-channel

- Other Solutions

-

Services

- Professional Services

- Managed Services

Based on Service Model:

- SaaS

- PaaS

- IaaS

Based on Deployment Model:

- Public Cloud

- Private Cloud

- Hybrid Cloud

Based on Organization Size:

- Large Enterprises

- SMEs

Based on Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East & Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In April 2023, AI Babtain Group, a trading business in Kuwait extended its use of Oracle Cloud by replacing its legacy applications with Oracle Retail Store Point of Service (POS) systems and Oracle Retail Customer Engagement Cloud Service to provide customers with personalized experience.

- In March 2023, Salesforce announced Einstein GPT for Commerce Cloud to offer personalized customer experience with AI.

- In February 2023, Google Cloud announced a collaboration with Accenture to support retailers in modernizing business, including new updates to Accenture’s ai.RETAIL platform, which integrated Google Cloud’s leading capabilities in data analytics, AI, and product discovery.

- In January 2023, Google Cloud announced four new and updated AI tools to offer a smoother online shopping experience to retail customers and assist retailers in inventory management in the stores.

- In November 2022, AWS launched AWS Supply Chain, a cloud application which will improve supply chain visibility and provides actionable insights and overcome risk related to supply chain risks, lower costs, and improve customer experiences.

- In August 2022, Accenture acquired The Stable, a commerce company to help consumer companies operate and build their digital channels and drive sales across the North American region.

- In February 2022, Best Buy, a consumer electronics retailer, partnered with AWS for cloud infrastructure services and its strategic partner for developing cloud engineering talent.

- In February 2021, Virgin Megastore was an international retailing chain partnered with SAP to implement SAP Commerce Cloud to provide an omni-channel experience.

Frequently Asked Questions (FAQ):

How big is the Retail Cloud Market?

What is growth rate of the Retail Cloud Market?

What are the key trends affecting the global Retail Cloud Market?

Who are the key players in Retail Cloud Market?

Who will be the leading hub for Retail Cloud Market?

What is Retail Cloud?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Need to enhance online shopping experience- Growth in adoption of SaaS solutions to meet changing customer preferences- Accelerated adoption of multi-cloud architectureRESTRAINTS- Integration of cloud-based systems with legacy systemsOPPORTUNITIES- Advent of IoT in retail to improve retail management- Adoption of new retail technologies to integrate online and offline shopping experiencesCHALLENGES- Difficulty in switching IT workloads to other cloud vendors- Concerns over data security in cloud

-

5.3 CASE STUDY ANALYSISGRUPO NAZAN CREATED SEAMLESS SHOPPING EXPERIENCE WITH ORACLE CLOUD SOLUTIONSFLEXI MET GROWING DEMAND FOR ONLINE SHOPPING WITH SAP COMMERCE CLOUD SOLUTIONSALIANSCE SONAE SHOPPING CENTERS BUILT BETTER RETAIL EXPERIENCE WITH NUTANIXGIBSON BRANDS STREAMLINED ITS BUSINESS AND CREATED IMMERSIVE CUSTOMER EXPERIENCE WITH MICROSOFT DYNAMICS 3651-800-FLOWERS.COM, INC. MIGRATED TO IBM COMMERCE ON CLOUD PLATFORM ENVIRONMENT TO INTEGRATE ORDER MANAGEMENT SYSTEMS

- 5.4 SUPPLY CHAIN ANALYSIS

-

5.5 ECOSYSTEM

-

5.6 TECHNOLOGICAL ANALYSISMACHINE LEARNINGINTERNET OF THINGSBLOCKCHAINARTIFICIAL INTELLIGENCE

- 5.7 PRICING ANALYSIS

-

5.8 PATENT ANALYSIS

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY CONFERENCES AND EVENTS

-

5.11 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONS- North America- Europe- Asia Pacific- Middle East & Africa- Latin America

-

5.12 TRENDS/DISRUPTIONS IMPACTING BUYERS

-

5.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.1 INTRODUCTIONCOMPONENT: MARKET DRIVERS

-

6.2 SOLUTIONSSUPPLY CHAIN MANAGEMENTCUSTOMER MANAGEMENTMERCHANDISINGWORKFORCE MANAGEMENTREPORTING & ANALYTICSDATA SECURITYOMNI-CHANNELOTHER SOLUTIONS

-

6.3 SERVICESPROFESSIONAL SERVICESMANAGED SERVICES

-

7.1 INTRODUCTIONSERVICE MODEL: MARKET DRIVERS

- 7.2 SOFTWARE AS A SERVICE

- 7.3 PLATFORM AS A SERVICE

- 7.4 INFRASTRUCTURE AS A SERVICE

-

8.1 INTRODUCTIONDEPLOYMENT MODEL: MARKET DRIVERS

- 8.2 PUBLIC CLOUD

- 8.3 PRIVATE CLOUD

- 8.4 HYBRID CLOUD

-

9.1 INTRODUCTIONORGANIZATION SIZE: MARKET DRIVERS

- 9.2 SMALL & MEDIUM ENTERPRISES

- 9.3 LARGE ENTERPRISES

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Rise in adoption rate of cloud servicesCANADA- Technological developments and government initiatives

-

10.3 EUROPEEUROPE: MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Early adopter in European technology spaceGERMANY- Increase in emphasis on data privacy and securityFRANCE- Accelerated digital transformation with COVID-19 outbreakREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Rapid technological developments facilitate growth of eCommerceJAPAN- Growth in eCommerce to drive adoption of cloudINDIA- Rapid growth and digitalization of Indian retail sectorREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTSAUDI ARABIA- Growth in technological advancements with rise in eCommerce activityUAE- Smart Dubai initiative and other government initiativesREST OF MIDDLE EAST & AFRICA

-

10.6 LATIN AMERICALATIN AMERICA: RETAIL CLOUD MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Retailers adopting SaaS solutions to manage CRM, eCommerce, and PoS systemsMEXICO- Adoption of cloud-based PoS systems in retail applicationsREST OF LATIN AMERICA

- 11.1 OVERVIEW

- 11.2 MARKET EVALUATION FRAMEWORK

- 11.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.4 REVENUE ANALYSIS

- 11.5 COMPANY FINANCIAL METRICS

- 11.6 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- 11.7 MARKET SHARE ANALYSIS

-

11.8 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY PRODUCT FOOTPRINT ANALYSIS

-

11.9 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

11.10 KEY MARKET DEVELOPMENTSPRODUCT LAUNCHES & ENHANCEMENTSDEALS

- 12.1 INTRODUCTION

-

12.2 KEY PLAYERSAWS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGOOGLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewORACLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSALESFORCE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSAP- Business overview- Products/Solutions/Services offered- Recent developmentsACCENTURE- Business overview- Products/Solutions/Services offered- Recent developmentsALIBABA CLOUD- Business overview- Products/Solutions/Services offered- Recent developmentsIBM- Business overview- Products/Solutions/Services offered- Recent developmentsCISCO- Business overview- Products/Solutions/Services offered- Recent developmentsVMWAREFUJITSUBLUE YONDERCOGNIZANTWORKDAYINFORRACKSPACESPS COMMERCEATOSEPICORNUTANIXLIGHTSPEED COMMERCETEKIONSYMPHONYAI RETAIL CPG

-

12.3 SMES/STARTUPSCLOVER NETWORKRAPIDSCALERETAILCLOUDRETAIL SOLUTIONSBRIGHTPEARLKLIGER-WEISS INFOSYSTEMSOPENBRAVOIVEND RETAIL BY CITIXSYSIQMETRIXONE STEP RETAIL SOLUTIONSRETAILOPS

- 13.1 INTRODUCTION

- 13.2 RETAIL POINT OF SALE MARKET

- 13.3 CLOUD COMPUTING MARKET

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2015–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 RETAILCOULD: PRICING ANALYSIS OF VENDORS IN RETAIL CLOUD MARKET

- TABLE 4 SHOPIFY: PRICING ANALYSIS OF VENDORS IN RETAIL CLOUD MARKET

- TABLE 5 VYAPAR: PRICING ANALYSIS OF VENDORS IN RETAIL CLOUD MARKET

- TABLE 6 US: TOP TEN PATENT APPLICANTS, 2022

- TABLE 7 PATENTS IN RETAIL CLOUD MARKET

- TABLE 8 PORTER’S FIVE FORCES ANALYSIS

- TABLE 9 KEY CONFERENCES AND EVENTS IN 2023 & 2024

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- TABLE 15 KEY BUYING CRITERIA FOR END USERS

- TABLE 16 MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 17 RETAIL CLOUD MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 18 MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 19 RETAIL CLOUD MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 20 SOLUTIONS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 21 SOLUTIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 SUPPLY CHAIN MANAGEMENT: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 23 SUPPLY CHAIN MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 CUSTOMER MANAGEMENT: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 25 CUSTOMER MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 MERCHANDISING: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 27 MERCHANDISING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 WORKFORCE MANAGEMENT: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 WORKFORCE MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 REPORTING & ANALYTICS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 31 REPORTING & ANALYTICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 DATA SECURITY: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 33 DATA SECURITY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 OMNI-CHANNEL SOLUTIONS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 35 OMNI-CHANNEL SOLUTIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 OTHER SOLUTIONS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 37 OTHER SOLUTIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 39 RETAIL CLOUD MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 40 SERVICES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 41 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 PROFESSIONAL SERVICES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 43 PROFESSIONAL SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 MANAGED SERVICES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 45 MANAGED SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 47 RETAIL CLOUD MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 48 SOFTWARE AS A SERVICE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 49 SOFTWARE AS A SERVICE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 PLATFORM AS A SERVICE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 51 PLATFORM AS A SERVICE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 INFRASTRUCTURE AS A SERVICE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 INFRASTRUCTURE AS A SERVICE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 55 RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 56 PUBLIC CLOUD: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 57 PUBLIC CLOUD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 PRIVATE CLOUD: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 59 PRIVATE CLOUD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 HYBRID CLOUD: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 61 HYBRID CLOUD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 63 RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 64 SMALL & MEDIUM ENTERPRISES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 65 SMALL & MEDIUM ENTERPRISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 LARGE ENTERPRISES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 LARGE ENTERPRISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 69 RETAIL CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: PESTLE ANALYSIS

- TABLE 71 NORTH AMERICA: MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 72 NORTH AMERICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: RETAIL CLOUD MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 85 US: MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 86 US: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 87 US: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 88 US: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 89 CANADA: MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 90 CANADA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 91 CANADA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 92 CANADA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 93 EUROPE: PESTLE ANALYSIS

- TABLE 94 EUROPE: MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 95 EUROPE: RETAIL CLOUD MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 96 EUROPE: MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 97 EUROPE: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 98 EUROPE: MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 99 EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 100 EUROPE: MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 101 EUROPE: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 102 EUROPE: MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 103 EUROPE: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 104 EUROPE: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 105 EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 106 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 107 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 108 UK: MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 109 UK: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 110 UK: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 111 UK: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 112 GERMANY: MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 113 GERMANY: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 114 GERMANY: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 115 GERMANY: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 116 FRANCE: MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 117 FRANCE: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 118 FRANCE: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 119 FRANCE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 120 REST OF EUROPE: MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 121 REST OF EUROPE: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 122 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 123 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: PESTLE ANALYSIS

- TABLE 125 ASIA PACIFIC: MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 126 ASIA PACIFIC: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 127 ASIA PACIFIC: MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 128 ASIA PACIFIC: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 129 ASIA PACIFIC: MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 130 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 131 ASIA PACIFIC: MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 132 ASIA PACIFIC: RETAIL CLOUD MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 134 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 136 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 137 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 138 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 139 CHINA: MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 140 CHINA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 141 CHINA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 142 CHINA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 143 JAPAN: MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 144 JAPAN: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 145 JAPAN: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 146 JAPAN: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 147 INDIA: MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 148 INDIA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 149 INDIA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 150 INDIA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: PESTLE ANALYSIS

- TABLE 156 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: RETAIL CLOUD MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 170 SAUDI ARABIA: MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 171 SAUDI ARABIA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 172 SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 173 SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 174 UAE: MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 175 UAE: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 176 UAE: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 177 UAE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 178 REST OF THE MIDDLE EAST & AFRICA: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 179 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 180 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 181 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 182 LATIN AMERICA: PESTLE ANALYSIS

- TABLE 183 LATIN AMERICA: MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 184 LATIN AMERICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 185 LATIN AMERICA: MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 186 LATIN AMERICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 187 LATIN AMERICA: MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 188 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 189 LATIN AMERICA: MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 190 LATIN AMERICA: RETAIL CLOUD MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 191 LATIN AMERICA: MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 192 LATIN AMERICA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 193 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 194 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 195 LATIN AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 196 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 197 BRAZIL: MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 198 BRAZIL: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 199 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 200 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 201 MEXICO: MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 202 MEXICO: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 203 MEXICO: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 204 MEXICO: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 205 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 206 REST OF LATIN AMERICA: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 207 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 208 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 209 OVERVIEW OF STRATEGIES ADOPTED BY KEY RETAIL CLOUD VENDORS

- TABLE 210 MARKET: DEGREE OF COMPETITION

- TABLE 211 KEY COMPANY PRODUCT FOOTPRINT

- TABLE 212 RETAIL CLOUD MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 213 STARTUP/SME PRODUCT FOOTPRINT

- TABLE 214 PRODUCT LAUNCHES & ENHANCEMENTS, 2021–2023

- TABLE 215 DEALS, 2021–2023

- TABLE 216 AWS: BUSINESS OVERVIEW

- TABLE 217 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 219 AWS: DEALS

- TABLE 220 MICROSOFT: BUSINESS OVERVIEW

- TABLE 221 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 223 MICROSOFT: DEALS

- TABLE 224 GOOGLE: BUSINESS OVERVIEW

- TABLE 225 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 227 GOOGLE: DEALS

- TABLE 228 ORACLE: BUSINESS OVERVIEW

- TABLE 229 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 231 ORACLE: DEALS

- TABLE 232 SALESFORCE: BUSINESS OVERVIEW

- TABLE 233 SALESFORCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 SALESFORCE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 235 SALESFORCE: DEALS

- TABLE 236 SAP: BUSINESS OVERVIEW

- TABLE 237 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 239 SAP: DEALS

- TABLE 240 ACCENTURE: BUSINESS OVERVIEW

- TABLE 241 ACCENTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 ACCENTURE: DEALS

- TABLE 243 ALIBABA CLOUD: BUSINESS OVERVIEW

- TABLE 244 ALIBABA CLOUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 ALIBABA CLOUD: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 246 ALIBABA CLOUD: DEALS

- TABLE 247 IBM: BUSINESS OVERVIEW

- TABLE 248 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 250 IBM: DEALS

- TABLE 251 CISCO: BUSINESS OVERVIEW

- TABLE 252 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 CISCO: DEALS

- TABLE 254 RELATED MARKETS

- TABLE 255 RETAIL POS MARKET, BY PRODUCT, 2014–2019 (USD MILLION)

- TABLE 256 RETAIL POS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

- TABLE 257 RETAIL POS MARKET, BY COMPONENT, 2014–2019 (USD MILLION)

- TABLE 258 RETAIL POS MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

- TABLE 259 RETAIL POS MARKET, BY END USER, 2014–2019 (USD MILLION)

- TABLE 260 RETAIL POS MARKET, BY END USER, 2019–2026 (USD MILLION)

- TABLE 261 RETAIL POS MARKET, BY REGION, 2014–2019 (USD MILLION)

- TABLE 262 RETAIL POS MARKET, BY REGION, 2020–2026 (USD MILLION)

- TABLE 263 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2017–2021 (USD BILLION)

- TABLE 264 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2022–2027 (USD BILLION)

- TABLE 265 CLOUD COMPUTING MARKET, BY IAAS, 2017–2021 (USD BILLION)

- TABLE 266 CLOUD COMPUTING MARKET, BY IAAS, 2022–2027 (USD BILLION)

- TABLE 267 CLOUD COMPUTING MARKET, BY PAAS, 2017–2021 (USD BILLION)

- TABLE 268 CLOUD COMPUTING MARKET, BY PAAS, 2022–2027 (USD BILLION)

- TABLE 269 CLOUD COMPUTING MARKET, BY SAAS, 2017–2021 (USD BILLION)

- TABLE 270 CLOUD COMPUTING MARKET, BY SAAS, 2022–2027 (USD BILLION)

- TABLE 271 CLOUD COMPUTING MARKET, BY VERTICAL, 2017–2021 (USD BILLION)

- TABLE 272 CLOUD COMPUTING MARKET, BY VERTICAL, 2022–2027 (USD BILLION)

- TABLE 273 CLOUD COMPUTING MARKET, BY REGION, 2017–2021 (USD BILLION)

- TABLE 274 CLOUD COMPUTING MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 275 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2017–2021 (USD BILLION)

- TABLE 276 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2022–2027 (USD BILLION)

- TABLE 277 CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 278 CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- FIGURE 1 RETAIL CLOUD MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 RETAIL CLOUD MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 APPROACH 1 (SUPPLY SIDE): REVENUE OF SERVICES FROM RETAIL CLOUD VENDORS

- FIGURE 5 BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF RETAIL CLOUD VENDORS

- FIGURE 6 SUPPLY SIDE: CAGR PROJECTIONS

- FIGURE 7 APPROACH 2 (BOTTOM-UP): REVENUE GENERATED BY RETAIL CLOUD VENDORS FROM EACH SERVICE TYPE

- FIGURE 8 APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM DIFFERENT APPLICATIONS

- FIGURE 9 FASTEST-GROWING SEGMENTS IN RETAIL CLOUD MARKET, 2023–2028

- FIGURE 10 SOLUTIONS TO ACCOUNT FOR LARGER MARKET THAN SERVICES DURING FORECAST PERIOD

- FIGURE 11 SAAS TO BE LARGEST SERVICE MODEL DURING FORECAST PERIOD

- FIGURE 12 PUBLIC CLOUD TO ACCOUNT FOR LARGEST DEPLOYMENT MODEL DURING FORECAST PERIOD

- FIGURE 13 LARGE ENTERPRISES TO BE LARGER ADOPTERS OF RETAIL CLOUD DURING FORECAST PERIOD

- FIGURE 14 RETAIL CLOUD MARKET: REGIONAL SNAPSHOT

- FIGURE 15 NEED TO ENHANCE CUSTOMER EXPERIENCES ACROSS ALL CHANNELS TO BOOST MARKET GROWTH

- FIGURE 16 SOLUTIONS TO ACCOUNT FOR LARGER MARKET SHARE

- FIGURE 17 SUPPLY CHAIN MANAGEMENT SOLUTION TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 18 PROFESSIONAL SERVICES TO ACCOUNT FOR LARGER MARKET SHARE

- FIGURE 19 SAAS SERVICE MODEL TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 20 PUBLIC CLOUD TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 21 LARGE ENTERPRISES TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 22 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 23 MARKET DYNAMICS: RETAIL CLOUD MARKET

- FIGURE 24 RETAIL CLOUD MARKET: SUPPLY CHAIN

- FIGURE 25 RETAIL CLOUD MARKET: ECOSYSTEM

- FIGURE 26 NUMBER OF PATENTS PUBLISHED, 2012–2022

- FIGURE 27 TOP FIVE PATENT OWNERS (GLOBAL), 2022

- FIGURE 28 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 29 RETAIL CLOUD MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- FIGURE 31 KEY BUYING CRITERIA FOR END USERS

- FIGURE 32 RETAIL CLOUD SOLUTIONS TO EDGE OVER SERVICES DURING FORECAST PERIOD

- FIGURE 33 SUPPLY CHAIN MANAGEMENT TO BE LARGEST SOLUTION MARKET DURING FORECAST PERIOD

- FIGURE 34 SOFTWARE AS A SERVICE TO BE LARGEST SERVICE MODEL FOR RETAIL CLOUD DURING FORECAST PERIOD

- FIGURE 35 PUBLIC CLOUD TO BE DEPLOYED MORE THAN OTHER MODELS DURING FORECAST PERIOD

- FIGURE 36 LARGE ENTERPRISES TO BE LARGER MARKET DURING FORECAST PERIOD

- FIGURE 37 NORTH AMERICA TO BE LARGEST REGIONAL MARKET DURING FORECAST PERIOD

- FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 40 HISTORICAL FOUR-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2018–2022 (USD MILLION)

- FIGURE 41 TRADING COMPARABLES, 2023 (EV/EBITDA)

- FIGURE 42 GLOBAL SNAPSHOT OF KEY RETAIL CLOUD MARKET PARTICIPANTS, 2022

- FIGURE 43 RETAIL CLOUD MARKET: MARKET SHARE ANALYSIS, 2022

- FIGURE 44 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

- FIGURE 45 RETAIL CLOUD MARKET: KEY COMPANY EVALUATION QUADRANT, 2022

- FIGURE 46 RANKING OF KEY PLAYERS IN RETAIL CLOUD MARKET, 2022

- FIGURE 47 STARTUP/SME EVALUATION QUADRANT: CRITERIA WEIGHTAGE

- FIGURE 48 RETAIL CLOUD MARKET: STARTUP/SME COMPANY EVALUATION QUADRANT, 2022

- FIGURE 49 AWS: COMPANY SNAPSHOT

- FIGURE 50 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 51 GOOGLE: COMPANY SNAPSHOT

- FIGURE 52 ORACLE: COMPANY SNAPSHOT

- FIGURE 53 SALESFORCE: COMPANY SNAPSHOT

- FIGURE 54 SAP: COMPANY SNAPSHOT

- FIGURE 55 ACCENTURE: COMPANY SNAPSHOT

- FIGURE 56 ALIBABA CLOUD: COMPANY SNAPSHOT

- FIGURE 57 IBM: COMPANY SNAPSHOT

- FIGURE 58 CISCO: COMPANY SNAPSHOT

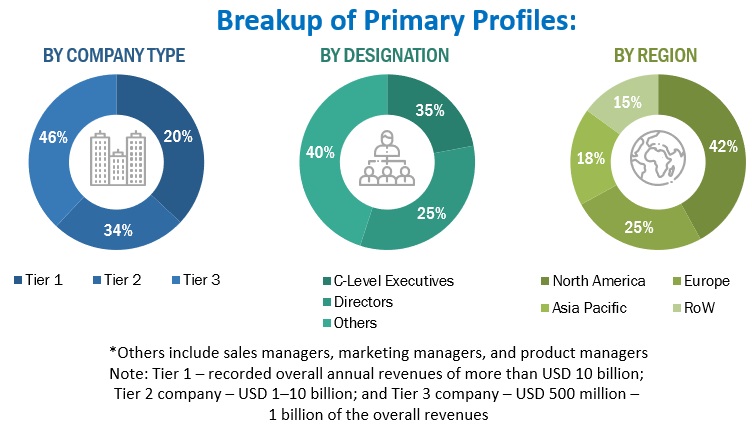

The study involved four major activities in estimating the current market size of the retail cloud market. Extensive secondary research was done to collect information on the market, the competitive market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the various segments in the retail cloud industry.

Secondary Research

This research study used extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, vendor data sheets, product demos, Cloud Computing Association (CCA), Vendor Surveys, Asia Cloud Computing Association, and The Software Alliance. All these sources were referred to for identifying and collecting information useful for this technical, market-oriented, and commercial study of the retail cloud market.

Primary Research

Primary sources were several industry experts from the core and related industries, preferred software providers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, segmentation types, industry trends, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs); the installation teams of governments/end users using Retail Cloud; and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use of services, which would affect the overall retail cloud market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and forecast the retail cloud market and other dependent submarkets. The bottom-up procedure was deployed to arrive at the overall market size using the revenues and offerings of key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply sides in the retail cloud market.

Market Definition

Retail cloud is the implementation of cloud computing in retail sectors such as food, clothing & textiles, consumer durables, footwear, jewelry, books-music-gift articles, and fuel to handle the entire back-end process of retail operation, including order processing, inventory management, fulfillment and shipping. In addition to cost savings, improved security, flexibility, scalability, and disaster management, retail cloud solutions help create new products based on consumer reviews and feedback, provide personalized customer experience, and manage inventory more efficiently.

Key Stakeholders

- Technology service providers

- Cloud service providers (CSPs)

- Colocation providers

- Government organizations

- Networking companies

- Consultants/consultancies/advisory firms

- Support and maintenance service providers

- Telecom service providers

- Information Technology (IT) infrastructure providers

- System Integrators (SIs)

- Regional associations

- Independent software vendors (ISVs)

- Value-added resellers and distributors

Report Objectives

- To define, describe, and forecast the global retail cloud market based on component (solutions and services), service model (SaaS, PaaS, IaaS), deployment model (public cloud, private cloud, hybrid cloud), organization size, and region.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the market with respect to individual growth trends, prospects, and contributions to the overall market

- To forecast the market size of main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the retail cloud market and comprehensively analyze their core competencies in each subsegment.

- To track and analyze competitive developments, such as mergers and acquisitions, new product launches, and partnerships and collaborations, in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Retail Cloud Market