Supply Chain Analytics Market Component, Software (Supplier Performance Analytics, Demand Analysis & Forecasting, and Spend & Procurement Analytics), Service, Deployment Mode, Organization Size, Vertical and Region - Global Forecast to 2027

Updated on : Nov 17, 2025

Supply Chain Analytics Market - Worldwide | Future Scope & Trends

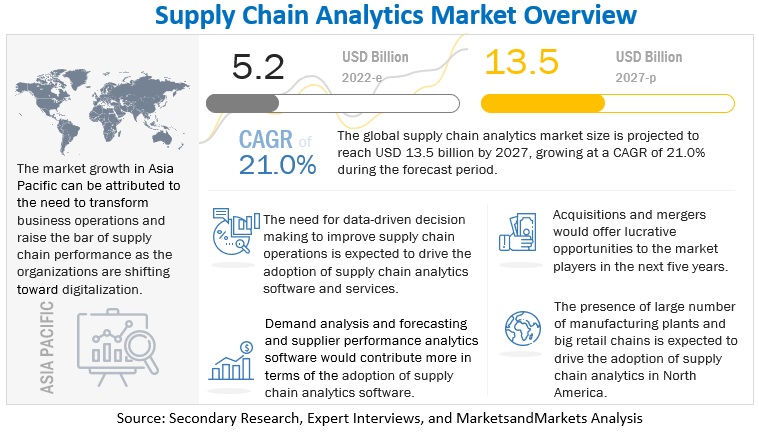

The supply chain analytics market is projected to grow significantly, increasing from USD 5.2 billion in 2022 to USD 13.5 billion by 2027, with a robust CAGR of 21.0%.

Growth is driven by increasing adoption of big data technologies, rising demand for cloud-based analytics, and the need for real-time supply chain visibility across industries.

Key Trends & Insights

- Big Data Adoption: Surge in IoT, social media, and multimedia data is fueling demand for analytics to process structured and unstructured datasets.

- Cloud-based Solutions: Growing use of cloud for supply chain analytics enables scalability, affordability, and real-time tracking of supply chain activities.

- Inventory Analytics Growth: Expected to record the highest CAGR, driven by demand for optimized stock control, shelf planning, and inventory level reduction.

- SME Segment Expansion: Small and medium enterprises are increasingly adopting analytics for efficiency, quality improvement, and cost reduction.

- North America Dominance: Region leads the market due to strong economy, AI-enabled infrastructure investments, and adoption across retail, e-commerce, healthcare, and manufacturing.

Supply Chain Analytics Market Size & Forecast

- 2022 Market Size: USD 5.2 Billion

- 2027 Projected Market Size: over USD 13.5 Billion

- CAGR (2022–2027): over 21.0%

- Largest Market in 2022: North America

To know about the assumptions considered for the study, Request for Free Sample Report

Supply Chain Analytics Market Growth Dynamics

Driver: Rising adoption of Big Data technologies

Organizations are continuously collecting significantly more data because of the expansion of the Internet of Things (IoT), social media, and multimedia, which has led to a prodigious flow of data. Data generated by robots and humans is growing at a rate 10 times faster than traditional business data. Additionally, it is predicted that by 2027, there will be about USD 41 billion worth of gadgets that collect, analyze, and exchange this data on the market globally. Several enterprises and individuals have adopted big data analytics because of the rising demand for huge amounts of structured and unstructured datasets to be stored, processed, and analyzed. This adoption is projected to drive market growth.

Restraint: Rising cyber threats hindering adoption of SCA solutions

Companies are analyzing data sets to make strategic choices due to the growth of big data across all business sectors. But data scientists across the world are concerned about data set inaccuracies. Unethical behavior and the rise in cyber threats may cause organizations to worry and, to some extent, hinder the adoption of SCA solutions. Despite the seeming promise of integrating technology into supply chain processes, industry executives continue to worry about possible security and data breaches. Data sets that contain errors, inconsistencies, or out-of-date information run the risk of undermining the company's efforts to develop a robust supply chain analytics project. According to IBM, the US economy loses a staggering USD 3.1 trillion yearly because of poor data, which includes inconsistent, out-of-date, and irrelevant data. Salesforce said that 70% of the data in a company's customer relationship management system (CRM) is outdated or useless every year and that 91% of that data is incomplete. Data modeling that is predictive and prescriptive is a part of the analytics workflows. Predictive and prescriptive analytics predict and prescribe future outcomes by examining historical data, events, and behaviors to produce significant insights that are essential to businesses for future usage. The patterns discovered by analytics models could not be linked with future trends due to the unreliability of the data sets. As a result, data set errors are a significant market restriction.

Opportunity: Growing use of supply chain analytics on cloud

Organizations are leaning toward the use of cloud-based supply chain analytics solutions due to the rising complexity and the growing demand for real-time analysis of data throughout the supply chain ecosystem. The usage of cloud-based analytics solutions primarily aids in tracking and evaluating the total supply chain activities throughout the ecosystems of the forward and backward supply chains. Additionally, the cloud's advantages over other supply chain management system providers, including its affordability, agility, simplicity of use and integration, planning, and scalability, are stimulating them. The substantial installations or adjustments required for the global supply chain systems add to the secondary expenses for businesses and raise the investment costs. Organizations adopt end-to-end supply chain visibility, such as a cloud-based supply system for transportation management, in response to the growth in complexity costs. Enterprises can connect, interact, and communicate with clients, partners, and suppliers due to cloud based SCA solutions in logistics and transportation. Additionally, it aids businesses in creating a safe, dependable, and integrated transportation management system that provides customers with real-time information. These advantages support the expansion of cloud-based supply chain analytics solutions in a variety of industry sectors, including the production of electronic equipment, automobiles, food and beverage products, machinery, and industrial equipment, as well as pharmaceutical, the public sector, energy, and utilities.

Challenge: Reluctance to switch from manual methods to advanced reporting processes

The emergence of big data, smart cities, and IoT has rapidly boosted the volume of data and data sources. Company leaders now have the chance to obtain more pertinent customer- and supply chain operations-focused insights, as well as develop business plans based on them, due to this vast data creation. Companies are still having a difficult time implementing supply chain analytics systems, however, for a variety of reasons. Most of the data created is unstructured. The management of this unstructured data and converting it to a structured manner is a significant issue for organizations. To make the data more extrapolative for greater insights, it is crucial to obtain it in an organized way. According to research by Accenture, 97% of the executives polled found it difficult to integrate a supply chain program into their operations. The poll went on to point out that just 17% of respondents used supply chain technology in all their operations. It is also seen that firms are reluctant to switch from manual methods to advanced reporting and dashboard processes, which is why the adoption of supply chain analytics systems is not accelerating. Most businesses have a relaxed attitude toward new technologies and rely more on their gut than they do on cutting-edge technologies to make wise business decisions. Due to the conventional corporate culture of basing business choices on past company data and occurrences, most of the advanced analytics technologies are experiencing low adoption rates.

By component, Inventory analytics segment to register at the highest CAGR during the forecast period

The supply chain analytics market by component is segmented into: demand analysis and forecasting, supplier performance analytics, spend and procurement analytics, inventory analytics, and distribution analytics. The Inventory analytics to grow at a highest CAGR during the forecast period. The supply chain analytics market is witnessing increased growth opportunities in the Inventory analytics vertical.

Inventory management deals with raw materials, finished/for-sale commodities, MRO (maintenance, repair, and operations) goods, etc. The key challenge handled by inventory analytics is to precisely have the correct number of necessary products in the right place at precisely the right moment. Inventory analytics keeps a tab on various parameters that include Stock Control, Channel Performance Evaluation, Shelf Planning, and Reducing Inventory Levels.

SMEs segments to register to register at the highest CAGR during the forecast period

Due to its innovative business approach and competitive advantage, supply chain management (SCM) has seen a sharp increase in attention. Small and medium-sized businesses (SMEs) are lagging in understanding how an integrated supply chain generates notable changes in company processes and works with good outcomes in improved quality services, cost savings, and efficiency.

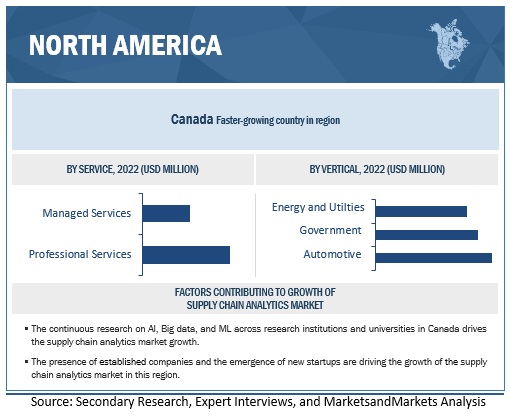

North America to account for the largest market size during the forecast period

North America is expected to have the largest market share in the supply chain analytics market. One of the other key factors driving market development is the growing need for fast analytics solutions for monitoring and managing the regional distribution chain. The area also has a strong economy and has seen significant investments in infrastructure that is Al-enabled; as a result, established businesses as well as startups are placing increasing emphasis on creating cutting-edge analytical solutions that can serve a variety of industrial verticals. The major users of supply chain analytics systems in North America are business sectors including retail and e-commerce, healthcare, automotive, transportation & logistics, food & beverage, and manufacturing.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The supply chain analytics vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global supply chain analytics market include SAP (Germany), Oracle (US), IBM (US), SAS Institute (US), Software AG (Germany), MicroStrategy (US), Tableau (US), Qlik (US), TIBCO (US), Cloudera (US), Logility (US), Savi Technology (US), Infor (US), RELEX Solutions (Finland), TARGIT(Denmark), Voxware (US), The AnyLogic Company (US), Antuit (US), Axway (US), AIMMS (Netherlands), BRIDGEi2i (India), Domo (US), Datameer (US), 1010data(US), Rosslyn Analytics(UK), Manhattan Associates (US), Salesforce (US), Zebra Technologies (US), Dataiku (US), Intugine Technologies (India), Lumachain (Australia), Hum Industrial Technology (US), Pafaxe (UK), SS Supply Chain Solutions (US), and DataFactZ (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market Size Value in 2022 |

US$ 5.2 billion |

|

Revenue Forecast Size Value in 2027 |

US$ 13.5 billion |

|

Growth Rate |

21.0% CAGR from 2022 to 2027 |

|

Largest Market |

North America |

|

Key Market Drivers |

Rising adoption of Big Data technologies |

|

Key Market Opportunities |

Growing use of supply chain analytics on cloud |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2022 |

|

Forecast period |

2022–2027 |

|

Forecast units |

USD Billion |

|

Segments covered |

Component, Service, Deployment Mode, Organization Size, Industry Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

SAP (Germany), Oracle (US), IBM (US), SAS Institute (US), Software AG (Germany), MicroStrategy (US), Tableau (US), Qlik (US), TIBCO (US), Cloudera (US), Logility (US), Savi Technology (US), Infor (US), RELEX Solutions (Finland), TARGIT(Denmark), Voxware (US), The AnyLogic Company (US), Antuit (US), Axway (US), AIMMS (Netherlands), BRIDGEi2i (India), Domo (US), Datameer (US), 1010data(US), Rosslyn Analytics(UK), Manhattan Associates (US), Salesforce (US), Zebra Technologies (US), Dataiku (US), Intugine Technologies (India), Lumachain (Australia), Hum Industrial Technology (US), Pafaxe (UK), SS Supply Chain Solutions (US), and DataFactZ (US). |

This research report categorizes the supply chain analytics market based on components, solutions, application, deployment mode, organization size, vertical, and regions.

By Component:

- Software

- Services

By Solutions:

- Includes Demand Analysis and Forecasting

- Supplier Performance Analytics

- Spend and Procurement Analytics

- Inventory Analytics

- Distribution Analytics

By Services:

- Professional Services

- Managed Services

By Deployment Mode:

- Cloud

- On-premises

By Organization Size:

- Large Enterprises

- SMEs

By Vertical:

- Automotive

- Retail & Consumer Goods

- F&B Manufacturing

- Machinery & Industrial Equipment Manufacturing

- Pharmaceutical

- Government

- Energy & Utilities

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- ASEAN

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- Kingdom of Saudi Arabia

- Israel

- Turkey

- Qatar

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In January 2023, the partnership between project44 and SAS combines the largest global real-time transportation data repository with the most intelligent supply chain planning tools available, enabling accuracy and visibility in E2E global supply chains.

- In November 2022, IBM (introduced IBM Business Analytics Enterprise to assist businesses in rapidly making data-driven choices and dealing with unanticipated disruptions.

- In October 2022, Oracle announced a partnership with WellSpan Health to streamline operations and increase business visibility.

- In May 2021, by allowing the deployment of its TrendMiner analytics software on SAP's S/4HANA Cloud, Software AG expanded its partnership with SAP into the field of digital supply chains.

- In February 2021, to enhance product quality, Software AG and SAP have partnered to better surface supply chain management data.

Frequently Asked Questions (FAQ):

What is the projected market value of Supply Chain Analytics Market?

What is the estimated growth rate (CAGR) of the global Market?

What are the major key players in the global Supply Chain Analytics Market?

What are the major revenue pockets in the global Supply Chain Analytics Market currently?

Which are the key drivers supporting the Supply Chain Analytics Market growth?

Which are the key Opportunities supporting the Supply Chain Analytics Market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing need for greater supply-chain and operational efficiency- Growing adoption of IoT in supply chains- Rising adoption of big data technologies- Growing use of analytics technologiesRESTRAINTS- Increasing concerns of businesses regarding data security- Rising cyber threats hindering adoption of SCA solutionsOPPORTUNITIES- Growing use of supply chain analytics on cloud- Rising awareness of benefits of supply chain management- Increasing benefits of using supply chain analytics softwareCHALLENGES- Lack of qualified employees- Reluctance to switch from manual methods to advanced reporting processes- Integration and analysis of all data

-

5.3 SUPPLY CHAIN ANALYTICS MARKET: ECOSYSTEM

-

5.4 STUDY ANALYSISAUTOMOTIVE- Case study 1: Mazda Motor Logistics speeds visibility across supply chainMANUFACTURING- Case study 1: Titan International’s Journey with Oracle Cloud and Internet of Things- Case study 2: Electrolux improved customer service and reduced inventory management cost by using Demand planning & Optimization solution of SAS with Oracle Cloud and Internet of ThingsBFSI- Case study 1: Improved distribution of products to target audiencesHEALTHCARE AND LIFE SCIENCES- Case study 1: EmblemHealth modernizes operations in Oracle CloudDISTRIBUTION ANALYTICS- Case study 1: Cloud automation helps FedEx respond to changes 2X faster

-

5.5 TECHNOLOGY ANALYSISARTIFICIAL INTELLIGENCEBIG DATAIOTBLOCKCHAIN

- 5.6 SUPPLY/VALUE CHAIN ANALYSIS

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.8 PRICING MODEL ANALYSIS

-

5.9 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPEINNOVATION AND PATENT APPLICATIONS- Top applicants

- 5.10 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.11 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSNORTH AMERICA: REGULATIONS- Personal Information Protection and Electronic Documents Act (PIPEDA)- Gramm-Leach-Bliley (GLB) Act- Health Insurance Portability and Accountability Act (HIPAA) of 1996- Federal Information Security Management Act (FISMA)- Federal Information Processing Standards (FIPS)- California Consumer Privacy Act (CSPA)EUROPE: TARIFFS AND REGULATIONS- GDPR 2016/679- General Data Protection Regulation- European Committee for Standardization (CEN)- European Technical Standards Institute (ETSI)

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.13 KEY STAGES IN SUPPLY CHAINPLANNINGMANAGEMENT AND CONTROLEXECUTION

-

6.1 INTRODUCTIONCOMPONENT: SUPPLY CHAIN ANALYTICS MARKET DRIVERS

- 6.2 SOFTWARE

-

6.3 DEMAND ANALYSIS AND FORECASTINGGROWING NEED FOR FORECASTING CUSTOMER DEMAND TO PROPEL MARKET

-

6.4 DEMAND AND SUPPLY PLANNINGS&OP PROCESS MANAGEMENTSUPPLY CHAIN RISK MANAGEMENTSUPPLY CHAIN EVENT MANAGEMENT

-

6.5 SUPPLIER PERFORMANCE ANALYTICSRISING DEMAND FOR SUPPLIER PERFORMANCE ANALYTICS PLATFORMS TO MANAGE DELIVERY CONCERNS AND QUALITY CONTROL TO FUEL MARKET

-

6.6 SUPPLIER PERFORMANCE METRICS ANALYSISDELIVERY PERFORMANCE ANALYSISPRICE AND PROFIT MARGIN ANALYSIS

-

6.7 SPEND AND PROCUREMENT ANALYTICSABILITY TO MAKE DATA-DRIVEN DECISIONS TO REDUCE RISK AND DISCOVER COST-SAVING OPPORTUNITIES TO DRIVE MARKET

-

6.8 TYPES OF SPEND AND PROCUREMENT ANALYSISTAIL SPEND ANALYSISSUPPLIER SPEND ANALYSISCATEGORY SPEND ANALYSISCONTRACT SPEND ANALYSISSTRATEGIC SOURCING ANALYSISSOURCE-TO-PAY ANALYSIS

-

6.9 INVENTORY ANALYTICSINCREASING NEED FOR INVENTORY ANALYTICS TO FUEL MARKETABC ANALYSISHML ANALYSISVED ANALYSISSDE ANALYSISSAFETY STOCK ANALYSIS

-

6.10 DISTRIBUTION ANALYTICSGROWING USE OF ANALYTICS IN DISTRIBUTION MANAGEMENT TO ACCELERATE MARKET GROWTHPERFORMANCE MANAGEMENTROUTE OPTIMIZATIONOUTBOUND LOGISTICS MANAGEMENT

-

7.1 INTRODUCTIONSERVICES: MARKET DRIVERS

-

7.2 MANAGED SERVICESGROWING DEMAND FOR ON-TIME DELIVERY BY CLIENTS TO PROPEL MARKET

-

7.3 PROFESSIONAL SERVICESCONSULTING SERVICES- Rising demand for lowering risks, reducing complexities, and increasing RoI to drive marketSUPPORT AND MAINTENANCE SERVICES- Increasing demand for data management to fuel marketDEPLOYMENT AND INTEGRATION SERVICES- Growing need for integrating IoT devices and solutions with existing IT infrastructure to boost

-

8.1 INTRODUCTIONDEPLOYMENT MODE: SUPPLY CHAIN ANALYTICS MARKET DRIVERS

-

8.2 ON-PREMISESREDUCED COMPLEXITIES OVER AI APPLICATIONS TO PROPEL MARKET

-

8.3 CLOUDGROWING NEED FOR ADOPTION OF DIGITAL SOLUTIONS FOR FLEXIBLE AND SCALED PRODUCTIVITY TO FUEL MARKET

-

9.1 INTRODUCTIONORGANIZATION SIZE: MARKET DRIVERS

-

9.2 SMALL AND MEDIUM-SIZED ENTERPRISESRISE IN INNOVATIVE BUSINESS APPROACH IN SUPPLY CHAIN MANAGEMENT TO DRIVE MARKET

-

9.3 LARGE ENTERPRISESGROWING INVESTMENTS BY LARGE ENTERPRISES TO IMPLEMENT SUITABLE SUPPLY CHAIN ANALYTICS SOLUTIONS AND SERVICES TO FUEL MARKET

-

10.1 INTRODUCTIONVERTICAL: MARKET DRIVERS

-

10.2 RETAIL AND CONSUMER GOODSRISING DEMAND FOR BETTER CUSTOMER EXPERIENCE TO PROPEL MARKET

-

10.3 AUTOMOTIVEGROWING NEED TO IMPROVE BUSINESS PERFORMANCE, OPERATIONAL EFFICIENCY, AND BOOST VISIBILITY WITH SUPPLY CHAIN ANALYTICS SOLUTIONS TO DRIVE MARKET

-

10.4 PHARMACEUTICALINCREASING COMPETITION TO FORECAST LIFECYCLE OF SPECIFIC DRUGS TO FUEL MARKET

-

10.5 FOOD & BEVERAGE MANUFACTURINGINCREASING NEED TO MINIMIZE WASTE WITH BETTER UNDERSTANDING OF INVENTORY LEVELS TO BOOST MARKET

-

10.6 MACHINERY AND INDUSTRIAL EQUIPMENT MANUFACTURINGRISING DEMAND FOR CAPACITY PLANNING TO HELP BUSINESSES ADOPT SUPPLY CHAIN ANALYTICS SOLUTIONS

-

10.7 ENERGY AND UTILITIESGROWING NEED FOR OPERATIONAL EXPENSES AND PROJECT DELAYS TO GENERATE DEMAND FOR SUPPLY CHAIN ANALYTICS

-

10.8 GOVERNMENTGROWING GOVERNMENT INITIATIVES TO DRIVE ADOPTION OF SUPPLY CHAIN ANALYTICS SOFTWARE

-

11.1 INTRODUCTIONSUPPLY CHAIN ANALYTICS MARKET: IMPACT OF RECESSION

-

11.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSUS- Advanced infrastructure, innovation, and initiatives to drive marketCANADA- Huge investment share of Canadian companies to strengthen supply chain operations

-

11.3 EUROPEEUROPE: SUPPLY CHAIN ANALYTICS MARKET DRIVERSUK- Disruptions in supply chain to drive marketGERMANY- Industrial developments and advancements to fuel marketFRANCE- Initiatives by government to position France as tech-giant to propel marketITALY- Technological developments to boost marketSPAIN- Cloud adoption to drive investments in data centersREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: SUPPLY CHAIN ANALYTICS MARKET DRIVERSCHINA- Increasing adoption of AI and IoT to fuel supply chain analytics adoptionJAPAN- Rising demand for process automation among enterprises to drive marketINDIA- Growing adoption of supply chain 4.0 to boost marketASEAN- Increasing adoption of digital tools and real-time data to propel marketREST OF ASIA PACIFIC

-

11.5 MIDDLE EAST AND AFRICAMIDDLE EAST AND AFRICA: MARKET DRIVERSUAE- Government’s focus on adopting various strategies to drive marketKINGDOM OF SAUDI ARABIA- Rising digitization and growing partnership strategies in KSA to boost demand for supply chain analyticsISRAEL- Increasing use of cutting-edge solutions to analyze and gain better insights from data to fuel marketTURKEY- Growing need for smart devices and analytics to fuel market growthQATAR- Increasing focus of government on enhancing logistics infrastructure to drive marketSOUTH AFRICA- Rising number of initiatives to increase infrastructure expenditure to propel marketREST OF MIDDLE EAST AND AFRICA

-

11.6 LATIN AMERICALATIN AMERICA: SUPPLY CHAIN ANALYTICS MARKET DRIVERSBRAZIL- Increasing sales and operational planning in Brazil owing to big data analytics to boost marketMEXICO- Growing digitalization of supply chain to drive marketARGENTINA- Increasing use of cutting-edge technologies to fuel marketREST OF LATIN AMERICA

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

-

12.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.6 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 12.7 COMPETITIVE BENCHMARKING

-

12.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

13.1 MAJOR PLAYERSIBM- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewORACLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSAP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSALESFORCE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSOFTWARE AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROSTRATEGY- Business overview- Products/Solutions/Services offeredSAS INSTITUTE- Business overview- Products/Solutions/Services offeredCLOUDERA- Business overview- Products/Solutions/Services offeredDOMO- Business overview- Products/Solutions/Services offeredAXWAY- Business overview- Products/Solutions/Services offeredROSSLYN ANALYTICS- Business overview- Products/Solutions/Services offered- Recent developments1010DATA- Business overview- Products/Solutions/Services offeredQLIK- Business overview- Products/Solutions/Services offered- Recent developmentsLOGILITY- Business overview- Products/Solutions/Services offered- Recent developmentsINFOR- Business overview- Products/Solutions/Services offeredVOXWARE- Business overview- Products/Solutions/Services offered

-

13.2 OTHER PLAYERSMANHATTAN ASSOCIATESDATAFACTZDATAIKURELEX SOLUTIONSAIMMSTARGITTIBCO SOFTWAREZEBRA TECHNOLOGIESTHE ANYLOGIC COMPANYINTUGINE TECHNOLOGIESLUMACHAINHUM INDUSTRIAL TECHNOLOGYPAFAXESS SUPPLY CHAIN SOLUTIONS (3SC)

-

14.1 BLOCKCHAIN SUPPLY CHAIN MARKETMARKET DEFINITIONMARKET OVERVIEWBLOCKCHAIN SUPPLY CHAIN MARKET, BY OFFERINGBLOCKCHAIN SUPPLY CHAIN MARKET, BY TYPEBLOCKCHAIN SUPPLY CHAIN MARKET, BY PROVIDER TYPEBLOCKCHAIN SUPPLY CHAIN MARKET, BY APPLICATIONBLOCKCHAIN SUPPLY CHAIN MARKET, BY ORGANIZATION SIZEBLOCKCHAIN SUPPLY CHAIN MARKET, BY END-USERBLOCKCHAIN SUPPLY CHAIN MARKET, BY REGION

-

14.2 BIG DATA MARKETMARKET DEFINITIONMARKET OVERVIEW- Big data market, by component- Big data market, by deployment mode- Big data market, by organization size- Big data market, by business function- Big data market, by industry vertical- Big data market, by region

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2020–2022

- TABLE 2 GLOBAL SUPPLY CHAIN ANALYTICS MARKET SIZE AND GROWTH RATE, 2016–2021 (USD MILLION, Y-O-Y%)

- TABLE 3 GLOBAL MARKET SIZE AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y%)

- TABLE 4 MARKET: ECOSYSTEM

- TABLE 5 PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 MARKET: PRICING LEVELS

- TABLE 7 PATENTS FILED, 2019–2022

- TABLE 8 TOP TEN PATENT OWNERS, 2019–2022

- TABLE 9 DETAILED LIST OF CONFERENCES AND EVENTS, 2023–2024

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST AND AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 16 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 17 SUPPLY CHAIN ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 18 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 19 MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 20 MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 21 SOFTWARE: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 22 SOFTWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 23 DEMAND ANALYSIS AND FORECASTING: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 24 DEMAND ANALYSIS AND FORECASTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 25 SUPPLIER PERFORMANCE ANALYTICS: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 26 SUPPLIER PERFORMANCE ANALYTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 27 SPEND AND PROCUREMENT ANALYTICS: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 28 SPEND AND PROCUREMENT ANALYTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 29 INVENTORY ANALYTICS: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 30 INVENTORY ANALYTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 31 DISTRIBUTION ANALYTICS: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 32 DISTRIBUTION AND LOGISTICS ANALYTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 33 MARKET, BY SERVICE, 2016–2021 (USD MILLION)

- TABLE 34 MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 35 SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 36 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 37 MANAGED SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 38 MANAGED SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 39 SUPPLY CHAIN ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2016–2021 (USD MILLION)

- TABLE 40 MARKET, BY PROFESSIONAL SERVICE TYPE, 2022–2027 (USD MILLION)

- TABLE 41 PROFESSIONAL SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 42 PROFESSIONAL SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 43 CONSULTING SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 44 CONSULTING SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 45 SUPPORT AND MAINTENANCE SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 46 SUPPORT AND MAINTENANCE SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 47 DEPLOYMENT AND INTEGRATION SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 48 DEPLOYMENT AND INTEGRATION SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 49 SUPPLY CHAIN ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 50 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 51 ON-PREMISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 52 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 53 CLOUD: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 54 CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 55 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 56 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 57 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 58 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 59 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 60 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 61 MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 62 SUPPLY CHAIN ANALYTICS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 63 RETAIL AND CONSUMER GOODS: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 64 RETAIL AND CONSUMER GOODS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 65 AUTOMOTIVE: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 66 AUTOMOTIVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 67 PHARMACEUTICAL: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 68 PHARMACEUTICAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 69 F&B MANUFACTURING: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 70 F&B MANUFACTURING: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 71 MACHINERY AND INDUSTRIAL EQUIPMENT MANUFACTURING: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 72 MACHINERY AND INDUSTRIAL EQUIPMENT MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 73 ENERGY AND UTILITIES: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 74 ENERGY AND UTILITIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 75 GOVERNMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 76 GOVERNMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 77 MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 78 MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 79 NORTH AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 80 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 81 NORTH AMERICA: MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 82 NORTH AMERICA: MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 83 NORTH AMERICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

- TABLE 84 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 85 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 86 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 87 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 88 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 89 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 90 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 91 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 92 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 93 EUROPE: SUPPLY CHAIN ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 94 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 95 EUROPE: MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 96 EUROPE: MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 97 EUROPE: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

- TABLE 98 EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 99 EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 100 EUROPE: SUPPLY CHAIN ANALYTICS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 101 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 102 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 103 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 104 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 105 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 106 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 107 ASIA PACIFIC: SUPPLY CHAIN ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 108 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 109 ASIA PACIFIC: MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 110 ASIA PACIFIC: MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

- TABLE 112 ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 113 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 116 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 117 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 118 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 119 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 120 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 121 MIDDLE EAST AND AFRICA: SUPPLY CHAIN ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 122 MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 123 MIDDLE EAST AND AFRICA: MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 124 MIDDLE EAST AND AFRICA: MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 125 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

- TABLE 126 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 127 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 128 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 129 MIDDLE EAST AND AFRICA: SUPPLY CHAIN ANALYTICS MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 130 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 131 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 132 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 133 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 134 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 135 LATIN AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 136 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 137 LATIN AMERICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

- TABLE 138 LATIN AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 139 LATIN AMERICA: MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 140 LATIN AMERICA: MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 141 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 142 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 143 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 144 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 145 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 146 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 147 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 148 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 149 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN MARKET

- TABLE 150 SUPPLY CHAIN ANALYTICS MARKET: DEGREE OF COMPETITION

- TABLE 151 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, 2022

- TABLE 152 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 153 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (STARTUPS/SMES)

- TABLE 154 PRODUCT LAUNCHES, 2021–2022

- TABLE 155 DEALS, 2019–2022

- TABLE 156 OTHERS, 2019–2021

- TABLE 157 IBM: BUSINESS OVERVIEW

- TABLE 158 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 IBM: PRODUCT LAUNCHES

- TABLE 160 IBM: DEALS

- TABLE 161 ORACLE: BUSINESS OVERVIEW

- TABLE 162 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 ORACLE: PRODUCT LAUNCHES

- TABLE 164 ORACLE: DEALS

- TABLE 165 SAP: BUSINESS OVERVIEW

- TABLE 166 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 SAP: PRODUCT LAUNCHES

- TABLE 168 SAP: DEALS

- TABLE 169 SALESFORCE: BUSINESS OVERVIEW

- TABLE 170 SALESFORCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 SALESFORCE: PRODUCT LAUNCHES

- TABLE 172 SALESFORCE: DEALS

- TABLE 173 SOFTWARE AG: BUSINESS OVERVIEW

- TABLE 174 SOFTWARE AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 SOFTWARE AG: PRODUCT LAUNCHES

- TABLE 176 SOFTWARE AG: DEALS

- TABLE 177 MICROSTRATEGY: BUSINESS OVERVIEW

- TABLE 178 MICROSTRATEGY: PRODUCTS OFFERED

- TABLE 179 MICROSTRATEGY: DEALS

- TABLE 180 SAS INSTITUTE: BUSINESS OVERVIEW

- TABLE 181 SAS INSTITUTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 SAS INSTITUTE: DEALS

- TABLE 183 CLOUDERA: BUSINESS OVERVIEW

- TABLE 184 CLOUDERA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 DOMO: BUSINESS OVERVIEW

- TABLE 186 DOMO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 DOMO: DEALS

- TABLE 188 AXWAY: BUSINESS OVERVIEW

- TABLE 189 AXWAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 AXWAY: DEALS

- TABLE 191 ROSSLYN ANALYTICS: BUSINESS OVERVIEW

- TABLE 192 ROSSLYN ANALYTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 ROSSLYN ANALYTICS: PRODUCT LAUNCHES

- TABLE 194 ROSSLYN ANALYTICS: DEALS

- TABLE 195 1010DATA: BUSINESS OVERVIEW

- TABLE 196 1010DATA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 1010DATA: PRODUCT LAUNCHES

- TABLE 198 1010DATA: DEALS

- TABLE 199 QLIK: BUSINESS OVERVIEW

- TABLE 200 QLIK: PRODUCTS OFFERED

- TABLE 201 QLIK: PRODUCT LAUNCHES

- TABLE 202 QLIK: DEALS

- TABLE 203 QLIK: OTHERS

- TABLE 204 LOGILITY: BUSINESS OVERVIEW

- TABLE 205 LOGILITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 LOGILITY: PRODUCT LAUNCHES

- TABLE 207 LOGILITY: DEALS

- TABLE 208 INFOR: BUSINESS OVERVIEW

- TABLE 209 INFOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 INFOR: DEALS

- TABLE 211 VOXWARE: BUSINESS OVERVIEW

- TABLE 212 VOXWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 VOXWARE: OTHERS

- TABLE 214 BLOCKCHAIN SUPPLY CHAIN MARKET, BY OFFERING, 2014–2019 (USD MILLION)

- TABLE 215 BLOCKCHAIN SUPPLY CHAIN MARKET, BY OFFERING, 2019–2026 (USD MILLION)

- TABLE 216 BLOCKCHAIN SUPPLY CHAIN MARKET, BY TYPE, 2014–2019 (USD MILLION)

- TABLE 217 BLOCKCHAIN SUPPLY CHAIN MARKET, BY TYPE, 2019–2026 (USD MILLION)

- TABLE 218 BLOCKCHAIN SUPPLY CHAIN MARKET, BY PROVIDER TYPE, 2014–2019 (USD MILLION)

- TABLE 219 BLOCKCHAIN SUPPLY CHAIN MARKET, BY PROVIDER TYPE, 2019–2026 (USD MILLION)

- TABLE 220 BLOCKCHAIN SUPPLY CHAIN MARKET, BY APPLICATION, 2014–2019 (USD MILLION)

- TABLE 221 BLOCKCHAIN SUPPLY CHAIN MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

- TABLE 222 BLOCKCHAIN SUPPLY CHAIN MARKET, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

- TABLE 223 BLOCKCHAIN SUPPLY CHAIN MARKET, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

- TABLE 224 BLOCKCHAIN SUPPLY CHAIN MARKET, BY END-USER, 2014–2019 (USD MILLION)

- TABLE 225 BLOCKCHAIN SUPPLY CHAIN MARKET, BY END-USER, 2019–2026 (USD MILLION)

- TABLE 226 BLOCKCHAIN SUPPLY CHAIN MARKET, BY REGION, 2014–2019 (USD MILLION)

- TABLE 227 BLOCKCHAIN SUPPLY CHAIN MARKET, BY REGION, 2019–2026 (USD MILLION)

- TABLE 228 BIG DATA MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

- TABLE 229 BIG DATA MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

- TABLE 230 BIG DATA MARKET, BY SOLUTION TYPE, 2016–2020 (USD MILLION)

- TABLE 231 BIG DATA MARKET, BY SOLUTION TYPE, 2021–2026 (USD MILLION)

- TABLE 232 BIG DATA MARKET, BY SERVICE TYPE, 2016–2020 (USD MILLION)

- TABLE 233 BIG DATA MARKET, BY SERVICE TYPE, 2021–2026 (USD MILLION)

- TABLE 234 PROFESSIONAL SERVICES: BIG DATA MARKET, BY TYPE, 2016–2020 (USD MILLION)

- TABLE 235 PROFESSIONAL SERVICES: BIG DATA MARKET, BY TYPE, 2021–2026 (USD MILLION)

- TABLE 236 BIG DATA MARKET, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

- TABLE 237 BIG DATA MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

- TABLE 238 CLOUD DEPLOYMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

- TABLE 239 CLOUD DEPLOYMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

- TABLE 240 BIG DATA MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

- TABLE 241 BIG DATA MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

- TABLE 242 BIG DATA MARKET, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

- TABLE 243 BIG DATA MARKET, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

- TABLE 244 BIG DATA MARKET, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

- TABLE 245 BIG DATA MARKET, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

- TABLE 246 BIG DATA MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 247 BIG DATA MARKET, BY REGION, 2021–2026 (USD MILLION)

- FIGURE 1 MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/SERVICES OF SUPPLY CHAIN ANALYTICS MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM SOFTWARE/SERVICES OF MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM SOFTWARE/SERVICES OF MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 4, BOTTOM-UP (DEMAND SIDE): SHARE OF SUPPLY CHAIN ANALYTICS THROUGH OVERALL SUPPLY CHAIN ANALYTICS SPENDING

- FIGURE 7 FACTOR ANALYSIS

- FIGURE 8 SOFTWARE HELD LARGER MARKET SIZE IN 2022

- FIGURE 9 PROFESSIONAL SERVICES HELD LARGER MARKET SHARE IN 2022

- FIGURE 10 CONSULTING SERVICES HELD LARGEST MARKET SIZE IN 2022

- FIGURE 11 DEMAND ANALYSIS & FORECASTING HELD LARGEST MARKET SIZE IN 2022

- FIGURE 12 CLOUD DEPLOYMENT MODE HELD LARGER MARKET SIZE IN 2022

- FIGURE 13 LARGE ENTERPRISES HELD LARGER MARKET SHARE IN 2022

- FIGURE 14 RETAIL AND CONSUMER GOODS VERTICAL HELD LARGEST MARKET SIZE IN 2022

- FIGURE 15 NORTH AMERICA HELD LARGEST MARKET SHARE IN 2022

- FIGURE 16 RISING NEED FOR DATA-DRIVEN DECISION-MAKING ACROSS SUPPLY CHAIN OPERATIONS TO DRIVE MARKET

- FIGURE 17 RETAIL AND CONSUMER GOODS VERTICAL TO CONTINUE TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 18 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2027

- FIGURE 19 DEMAND ANALYSIS & FORECASTING AND RETAIL AND CONSUMER GOODS TO BE LARGEST SHAREHOLDERS IN MARKET IN 2027

- FIGURE 20 SUPPLY CHAIN ANALYTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 SUPPLY/VALUE CHAIN ANALYSIS

- FIGURE 22 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 23 TOTAL NUMBER OF PATENTS GRANTED, 2019–2022

- FIGURE 24 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2019–2022

- FIGURE 25 SERVICES TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 26 INVENTORY ANALYTICS SOFTWARE TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 27 MANAGED SERVICES TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 28 CONSULTING SERVICES TO HOLD LARGEST MARKET SIZE IN 2027

- FIGURE 29 CLOUD DEPLOYMENT MODE TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 30 SMALL AND MEDIUM-SIZED ENTERPRISES TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 31 RETAIL AND CONSUMER GOODS VERTICAL TO HOLD LARGEST MARKET SIZE IN 2027

- FIGURE 32 ASIA PACIFIC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 UNITED ARAB EMIRATES TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 36 REVENUE ANALYSIS FOR KEY COMPANIES, 2017–2021 (USD MILLION)

- FIGURE 37 MARKET SHARE ANALYSIS FOR KEY PLAYERS, 2021

- FIGURE 38 KEY MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2022

- FIGURE 39 STARTUP/SME MARKET EVALUATION MATRIX, 2022

- FIGURE 40 IBM: FINANCIAL OVERVIEW

- FIGURE 41 ORACLE: FINANCIAL OVERVIEW

- FIGURE 42 SAP: FINANCIAL OVERVIEW

- FIGURE 43 SALESFORCE: FINANCIAL OVERVIEW

- FIGURE 44 SOFTWARE AG: FINANCIAL OVERVIEW

- FIGURE 45 MICROSTRATEGY: FINANCIAL OVERVIEW

- FIGURE 46 SAS INSTITUTE: FINANCIAL OVERVIEW

- FIGURE 47 CLOUDERA: FINANCIAL OVERVIEW

- FIGURE 48 DOMO: FINANCIAL OVERVIEW

- FIGURE 49 AXWAY: FINANCIAL OVERVIEW

- FIGURE 50 ROSSLYN ANALYTICS: FINANCIAL OVERVIEW

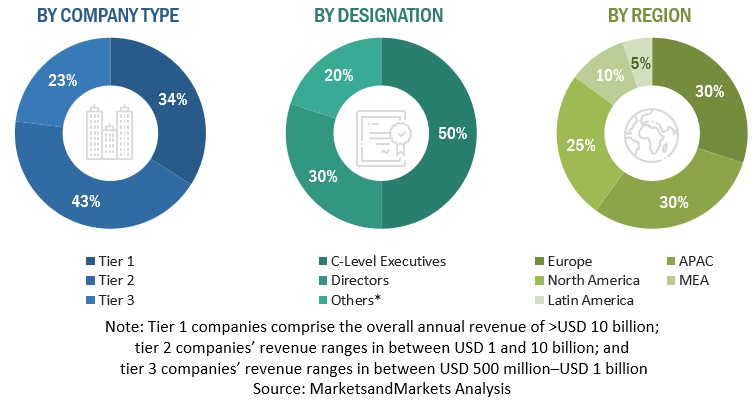

The research methodology for the global supply chain analytics market report involved the use of extensive secondary sources and directories, as well as various reputed opensource databases to identify and collect information useful for this technical and market-oriented study. In-depth interviews were conducted with various primary respondents, including the key opinion leaders, subject matter experts, high-level executives of various companies offering supply chain analytics software and services, and industry consultants to obtain and verify critical qualitative and quantitative information, as well as assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources.

The secondary research was mainly used to obtain the key information about the industry’s value chain, market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides of the supply chain analytics market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing supply chain analytics software; associated service providers; and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify and validate the segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

In the complete market engineering process, both the top-down and bottom-up approaches were extensively used, along with several data triangulation methods to perform the market estimation and market forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to record the key information/insights throughout the report.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the supply chain analytics market and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global market, using the revenue from the key companies and their offerings in the market. With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the supply chain analytics market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on the breadth of software and services, deployment modes, organization size, and verticals. The aggregate of all the revenues of the companies was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

In the bottom-up approach, the adoption rate of supply chain analytics software and services among different end-users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of supply chain analytics software and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency USD remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

- Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on supply chain analytics solutions based on some of the key use cases. These factors for the supply chain analytics tool industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the supply chain analytics market based on software, service, deployment model, organization size, industry verticals, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide the competitive landscape of the market

- To forecast the revenue of the market segments with respect to all the five major regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East and Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze the recent developments and their positioning related to the market

- To analyze competitive developments, such as mergers and acquisitions, product developments, and research and development (R&D) activities, in the market

- To analyze the impact of recession across all the regions across the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American supply chain analytics market

- Further breakup of the European supply chain analytics market

- Further breakup of the Asia Pacific supply chain analytics market

- Further breakup of the Latin American supply chain analytics market

- Further breakup of the Middle East & Africa supply chain analytics market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Supply Chain Analytics Market