Renewable Drones Market by Drone Type (Multirotor and Fixed Wing), Solution (End-to-End Solution and Point Solution), End user (Solar (Photovoltaics and Concentrated Solar Power) and Wind), and Region - Global Forecast to 2025

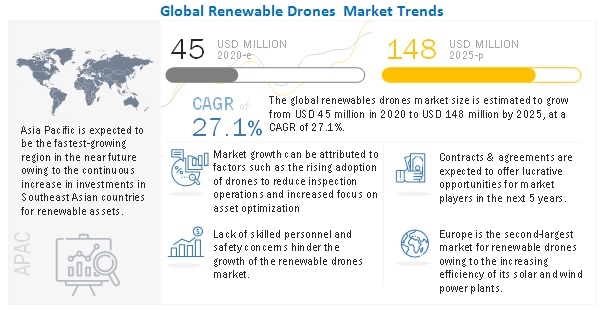

[295 Pages Report] The global renewable drones market size was valued at $45 million in 2020 and to reach $148 million by 2025, growing at a compound annual growth rate (CAGR) of 27.1% from 2020 to 2025. Increasing adoption of drones for reducing cost of inspection operation, focus on asset optimization and growing construction of solar and wind farm are expected to be the key factors driving the renewable drones market

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Renewable Drones Market

The COVID-19 outbreak has entire power industry negatively. According to IEA, the COVID-19 crisis has significantly impacted the growth of renewable power capacity. The net renewable capacity additions in 2020 are projected to decline by 13% as compared to 2019. The decline is caused mainly due to delay in construction activity and supply chain disruptions, as major countries imposed lockdown, social distancing measures for workers, and financial challenges.

In 2021, the renewable energy capacity is projected to increase with resumption of delayed projects. Supportive government polices for increasing renewable energy capacity is likely to help in improving the economic conditions. Adoption of drones for inspections in solar and wind farms will reduce risk associated with hazardous labour and help in boosting the production from the assets

Renewable Drones Market Dynamics

Driver: Rising adoption of drones to reduce cost of inspection operation

Drones collect data more than 50 times faster than traditional methods. Solar farms are typically very large installations, so a drone equipped with an appropriate thermal camera can scan the entire farm for defects faster than using a hand-held thermal camera on the ground. In the case of wind turbines, inspections are performed manually by climbing or using long-range photography. Manual inspections involving climbing introduce hazards that can be avoided with drone inspections. Ground-based data collection can be slow and lacks the detail and flexibility that a drone can provide. A drone can perform an inspection of 1 wind turbine (3 blades) in 40 minutes. Thus, drone inspections are faster, accurate, and economical solutions for solar and wind farm inspections.

Restraints:Legal regulations for performing drone operations

Drones are extremely instrumental to utilities for performing inspection operations. However, legal requirements have constrained advances in the drone market. The Federal Aviation Authority (FAA) is the regulatory body for drone operations. These regulations, in particular, exclude drone operations in some circumstances, such as Behind Visual Line of Sight (BVLOS), over a long distance, or at night. Considering, that the FAA has not maintained pace with rapidly advancing drone technologies, utility companies have not been able to utilize drones to the highest potential for improving the efficiency and effectiveness of inspection operations. The American Public Power Association on 21st June 2016 said that the FAA released the final rules for commercial businesses, non-profits, and government organizations to use drones for a variety of purposes; however, these rules do not allow users to operate beyond the visual line of sight and do not clarify whether drone usage by public power utilities is a governmental activity.

Opportunities: Growing construction of solar and wind farms

The renewable energy sector is among the fastest-growing sectors globally. Renewable energy plants are being developed at a rapid pace with advanced technologies, with the growing demand for clean and sustainable energy. Countries are shifting their focus from conventional energy sources toward increasing generation from renewable energy sources. According to a study by IRENA in 2018, between 2015 and 2050, the global economy would need average investments equivalent to some 2.0% of the global GDP per year in decarbonization solutions, including renewable energy, energy efficiency, and other technologies.

According to IRENA, in 2018, the global cumulative installed capacity of onshore wind power reached 542 GW. Wind power has increased at a CAGR of more than 21% since 2000. Further, it is expected that onshore wind power installations would reach 5,044 GW by 2050. This will create the demand for wind turbines for new installations as well as the replacement of old turbines. The development of wind power plants is capital intensive, and asset owners look for maximizing returns and minimizing expenditures. This is where drones come into the picture. Drones will help reduce the expenses for the inspection of wind turbines by at least 40% and will be able to provide data in 2–3 days as compared to 2–3 weeks in the case of traditional inspection methods.

Challenges: Scarcity of skilled personnel

A skilled drone pilot is essential to remotely control and operate commercial drones in various weather conditions and terrains. Many accidents happen due to poor control midflight. Efforts are taken to improve the efficiency of autonomous drone solutions to reduce the risk of accidents. Further, analyzing the inspection data also requires personnel who are well versed with the software and the technicalities of the assets being inspected. Various programs are being undertaken to train pilots for improving the drone operation. Hence, the lack of skilled personnel poses a challenge to the growth of the renewable drones market.

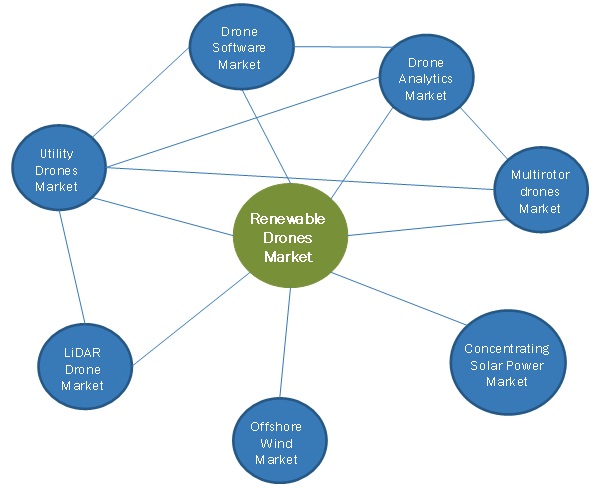

Market Interconnection

To know about the assumptions considered for the study, download the pdf brochure

By drone type, the multirotor segment is the largest contributor in the renewable drones market in 2019.

The multirotor segment led the renewable drones market, by drone type, in 2019. Multirotor drones have various advantages over Fixed wing drones; for instance, multi-rotor aircraft can perform vertical takeoffs and landings. They also require less space to take flight, can hover mid-flight, and maneuver around objects for easy inspection, mapping, and modeling. Further, multirotor drones use multiple propellers to maneuver; hence, they do not require a larger surface area or wingspan as compared to Fixed wing drones. Moreover, multirotor drones are designed to be folded down and packed up into smaller cases, which makes them easier to transport.

By solution, the end-to-end solution segment is expected to be the largest contributor during the forecast period.

The end-to-end solutions segment is expected to lead the renewable drones market from 2020 to 2025. End-to-end solution means that the service provider is supplying the drones and accessories, data analysis, and reports to the client in such a way that no other vendor is involved in meeting the demands. Overall, such a solution includes the provision of the drone, drone pilots, engineers, software, data management, processing, analytics, drone advisory services, and consulting. The use of drones for farm inspections is an intricate task and involves many complexities that require special expertise to deliver accurate results. Most utility companies use conventional technologies and do not possess this expertise. Thus, they opt for end-to-end solution that covers every aspect of the inspection process and obtain exactly what they require by being charged with respect to the area/lines being inspected. This helps utility companies in avoiding problems associated with the usage of forever-updating drone technology and related data processing.

By end user, the solar segment is expected to be the largest contributor during the forecast period.

The solar segment is estimated to grow at a faster rate from 2019 to 2025. To meet the growing demand for solar farm inspection and maintenance, asset owners, inspectors, and drone service providers (DSPs) must develop a deep understanding of thermography and flight operations to take full advantage of the benefits of drone-based solar inspection. Such factors drive the growth of solar segment in the renewable drones market.

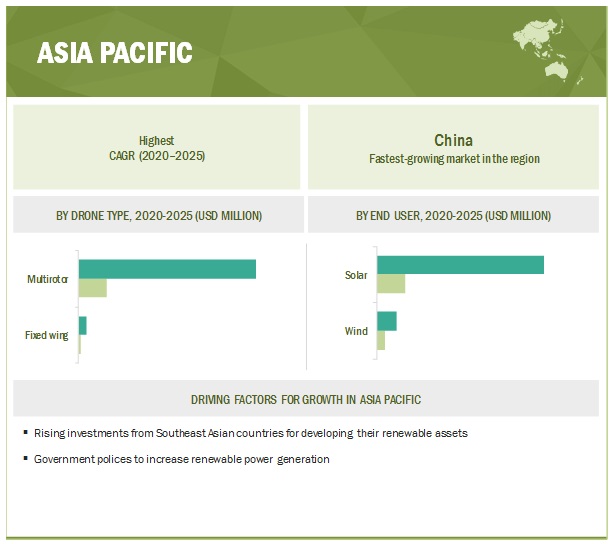

Asia Pacific is expected to account for the largest market size during the forecast period.

Asia Pacific is expected to be the largest renewable drones market during the forecast period. Asia Pacific comprises China, India, Japan, Australia, and Rest of Asia Pacific. The region has a high demand for electricity due to a rise in urbanization, industrialization, and population growth. The rapid increment in economic growth would lead to an increase in the demand for power. This would necessitate greater investments in the renewable power generation infrastructure. The region is expected to experience an increase in investments due to the rapidly declining prices of solar panels.

Key players in the renewable drones market

The prominent players in the global renewable drones market are DJI Enterprise (China), Terra Drone (Japan), Aerodyne Measure (US), and DroneDeploy (US).

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Drone type, solution, end user and region |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

DJI Enterprise (China), Terra Drone (Japan), Aerodyne Measure (US), and DroneDeploy (US), Parrot Group (France), ABJ Drones (US), DRONE VOLT Group (France), Airpix (India), Sitemark (Belgium), Skylark Drones (India), PrecisionXYZ (US), Flyability (Switzerland), FORCE Technology (Denmark), Droneflight (UK), Above Surveying (US), Siemens (Germany), SPH Engineering (Latvia), Raptor Maps (US), SkySpecs (US), Cognite (Norway), Singulair (France), NanoNet Technologies (US), GarudaUAV (India), ARBOREA INTELLBIRD (Spain), Sulzer Schmid Laboratories (Switzerland), AirProbe (India), Measure Australia (Australia), CSP Services (Germany), Helvetis (Switzerland), ideaForge (India), Cyberhawk (US), Balmore Group (Scotland), ROBUR Industry Service Group (Germany), and Aerospec Technologies(US) |

This research report categorizes the Renewable Drones market-based on drone type, solution, end user, and region

Based on drone type, the Renewable Drones market has been segmented as follows:

- Multirotor

- Fixed wing

Based on solution, the Renewable Drones market has been segmented as follows:

- End-to-end solution

- Point solution

Based on end user, the Renewable Drones market has been segmented as follows:

-

Solar

- Solar PV

- Solar CSP

- Wind

Based on the region, the Renewable Drones market has been segmented as follows:

- North America

- Asia Pacific

- South America

- Europe

- Middle East & Africa

Recent Developments

- In June 2020, Siemens Gamesa won a contract from Trianel Windkraftwerk Borkum II GmbH & Co. KG for a 5-year full scope offshore service and maintenance of Trianel Windpark Borkum II. The installation of the 32 Senvion 6.33-MW turbines was completed in May 2020. TWB II has a total output capacity of 200 MW and produces clean energy for around 200,000 households per year.

- In June 2020, Terra Drone opened a new base, named Terra Drone Technology Malaysia Sdn Bhd (TDMY), in Kuala Lumpur, Malaysia. TDMY will be providing drone survey, inspection, and industrial services for multiple industries, such as oil & gas, telecommunications, power, construction, agriculture, and government agencies.

- In December 2019, Aerodyne Group acquired a controlling interest in the services business of Measure to create a new, combined business entity named Aerodyne Measure. Aerodyne Measure will serve enterprise clients in North America with aerial inspections and data analysis services. This agreement also provides Measure with additional funding as it grows its stand-alone SaaS offering and Measure Ground Control, an end-to-end software solution for enterprise drone programs.

- In February 2019, Terra Drone entered the Indian market with the establishment of Terra Drone India. Terra Drone India’s core areas of specialization include agriculture, energy, urban development and management, defense, water, security, mining, infrastructure, forest, utilities, and disaster management. Its customer-centric industrial drone solutions use a multitude of sensors, such as visual, multispectral, thermal, LiDAR, and hyperspectral, and offer a complete UAV ecosystem to help clients plan, collect, and process the data. With an in-house drone research and development-cum-manufacturing unit, Terra Drone India supports the Government of India’s ‘Make in India’ initiative as well.

Frequently Asked Questions (FAQ):

What is the current size of the Renewable Drones market?

The current market size of global Renewable Drones market is USD 44.6 million in 2019.

What is the major drivers for Renewable Drones market?

Rising adoption of drones to reduce cost of inspection operation and increasing focus on asset optimization are major drivers driving the market of Renewable Drones .

Which is the fastest growing region during the forecasted period in Renewable Drones market?

Asia Pacific is the fastest growing region during the forecasted period owing to increasing investments for development of renewable power plants

Which is the fastest growing segment, by technology during the forecasted period in Renewable Drones market?

The solar segment , by end user is the fastest growing segment during the forecasted period owing to rapid development of solar PV and CSP farms across geographies. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.2.1 RENEWABLE DRONES MARKET, BY SOLUTION: INCLUSIONS VS. EXCLUSIONS

1.2.2 MARKET, BY END USER: INCLUSIONS VS. EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.4 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 RENEWABLE DRONES MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

2.3 SCOPE

FIGURE 3 MAIN METRICS CONSIDERED IN ASSESSING DEMAND FOR MARKET

2.4 MARKET SIZE ESTIMATION

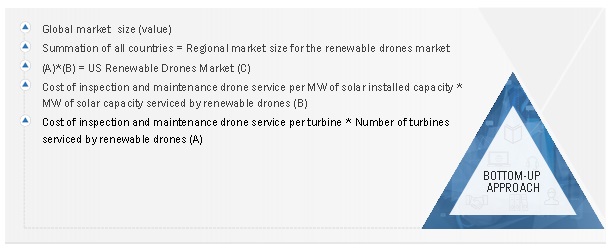

2.4.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4.3 DEMAND-SIDE ANALYSIS

2.4.3.1 Calculation

2.4.3.2 Assumptions

2.4.4 SUPPLY-SIDE ANALYSIS

FIGURE 6 MAIN METRICS CONSIDERED IN ASSESSING SUPPLY FOR MARKET

2.4.4.1 Calculation

2.4.4.2 Assumptions

FIGURE 7 INDUSTRY CONCENTRATION, 2019

2.4.5 FORECAST

2.4.5.1 Forecast assumptions

2.5 PRIMARY INSIGHTS

FIGURE 8 KEY SERVICE PROVIDERS’ POINTS OF VIEW

3 EXECUTIVE SUMMARY (Page No. - 46)

3.1 SCENARIO ANALYSIS

FIGURE 9 SCENARIO ANALYSIS: MARKET, 2017–2025

3.1.1 OPTIMISTIC SCENARIO

3.1.2 REALISTIC SCENARIO

3.1.3 PESSIMISTIC SCENARIO

TABLE 1 MARKET SNAPSHOT

FIGURE 10 ASIA PACIFIC TO GROW AT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

FIGURE 11 MULTIROTOR SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 12 END-TO-END SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 13 SOLAR SEGMENT TO WITNESS FASTEST GROWTH IN MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE OPPORTUNITIES IN RENEWABLE DRONES MARKET

FIGURE 14 RISING ADOPTION OF DRONES TO REDUCE INSPECTION OPERATION TO DRIVE MARKET DURING FORECAST PERIOD

4.2 MARKET, BY DRONE TYPE

FIGURE 15 MULTIROTOR SEGMENT TO DOMINATE MARKET, BY DRONE TYPE, DURING FORECAST PERIOD

4.3 MARKET, BY SOLUTION

FIGURE 16 END-TO-END SOLUTION SEGMENT DOMINATED MARKET, BY SOLUTION, 2019

4.4 MARKET, BY END USER

FIGURE 17 SOLAR SEGMENT DOMINATED MARKET, BY END USER, IN 2019

4.5 MARKET, BY REGION

FIGURE 18 ASIA PACIFIC MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.6 ASIA PACIFIC MARKET, BY END USER & COUNTRY

FIGURE 19 SOLAR SEGMENT AND CHINA DOMINATED ASIA PACIFIC MARKET IN 2019

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.1.1 YC SHIFT

FIGURE 20 YC SHIFT

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 21 COVID-19: GLOBAL PROPAGATION

FIGURE 22 COVID-19 PROPAGATION IN SELECT COUNTRIES

5.3 ROAD TO RECOVERY

FIGURE 23 RECOVERY ROAD FOR 2020

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 24 REVISED GDP FORECAST FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 25 RENEWABLE DRONES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Rising adoption of drones to reduce cost of inspection operation

5.5.1.2 Increasing focus on asset optimization

5.5.2 RESTRAINTS

5.5.2.1 Legal regulations for performing drone operations

5.5.2.2 Safety and security concerns

5.5.3 OPPORTUNITIES

5.5.3.1 Growing construction of solar and wind farms

5.5.3.2 Technological advances in drone data analytics

5.5.4 CHALLENGES

5.5.4.1 Scarcity of skilled personnel

5.6 SUPPLY CHAIN OVERVIEW

FIGURE 26 MARKET SUPPPLY CHAIN

5.6.1 KEY INFLUCENERS

5.6.1.1 Equipment manufacturer

5.6.1.2 Service provider

5.6.1.3 End users

5.7 AVERAGE PRICE TREND

TABLE 2 MARKET, BY AVERAGE PRICE TREND, 2018–2025

5.8 CASE STUDY ANALYSIS

5.8.1 PACE POWER SYSTEMS PVT. LTD. USES DRONES FOR 10-MW SOLAR PLANT INSTALLATION

TABLE 3 PACE POWER SYSTEMS PVT LTD PROJECT STATISTICS

5.8.2 LARGE-SCALE UTILITY USES DRONES FOR 199-MW SOLAR PLANT INSPECTION

TABLE 4 RAPTOR MAPS’ 199-MW SOLAR FARM INSPECTION PROJECT STATISTICS

5.9 MARKET MAP

FIGURE 27 RENEWABLE DRONES MARKET: MARKET MAP

6 IMPACT OF COVID-19 ON MARKET, SCENARIO ANALYSIS, BY REGION (Page No. - 68)

6.1 INTRODUCTION

6.1.1 IMPACT OF COVID-19 ON GDP

TABLE 5 GDP ANALYSIS (IN PERCENTAGE)

6.1.2 SCENARIO ANALYSIS OF RENEWABLE INDUSTRY

6.1.3 OPTIMISTIC SCENARIO

TABLE 6 OPTIMISTIC SCENARIO: MARKET, BY REGION, 2018–2025 (USD THOUSAND)

6.1.4 REALISTIC SCENARIO

TABLE 7 REALISTIC SCENARIO: MARKET, BY REGION, 2018–2025 (USD THOUSAND)

6.1.5 PESSIMISTIC SCENARIO

TABLE 8 PESSIMISTIC SCENARIO: MARKET, BY REGION, 2018–2025 (USD THOUSAND)

7 RENEWABLE DRONES MARKET, BY DRONE TYPE (Page No. - 72)

7.1 INTRODUCTION

FIGURE 28 MULTIROTOR DRONE TYPE TO LEAD MARKET DURING FORECAST PERIOD

TABLE 9 MARKET SIZE, BY DRONE TYPE, 2018–2025 (USD THOUSAND)

7.2 MULTIROTOR

7.2.1 GEATER MANEUVERABILITY AND LOWER PRICE OF MULTIROTOR DRONES DRIVING MARKET

TABLE 10 MULTIROTOR: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

7.3 FIXED WING

7.3.1 LONGER FLIGHT TIME AND BETTER STABILITY DRIVING FIXED WING MARKET

TABLE 11 FIXED WING: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

8 RENEWABLE DRONES MARKET, BY SOLUTION (Page No. - 76)

8.1 INTRODUCTION

FIGURE 29 END-TO-END SOLUTION SEGMENT DOMINATED MARKET IN 2019

TABLE 12 MARKET, BY SOLUTION, 2018–2025 (USD THOUSAND)

8.2 END-TO-END SOLUTION

8.2.1 INCREASING NEED FOR TURNKEY SOLUTIONS DRIVE MARKET GROWTH

TABLE 13 END-TO-END SOLUTION: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

8.3 POINT SOLUTION

8.3.1 FOCUS ON SPECIFIC OFFERING DRIVES MARKET GROWTH

TABLE 14 POINT SOLUTION: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

9 RENEWABLE DRONES MARKET, BY END USER (Page No. - 79)

9.1 INTRODUCTION

FIGURE 30 SOLAR SEGMENT TO LEAD MARKET FROM 2020 TO 2025

TABLE 15 MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

9.2 SOLAR

TABLE 16 SOLAR: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 17 SOLAR: MARKET SIZE, BY TYPE, 2018–2025 (USD THOUSAND)

9.2.1 SOLAR PV

9.2.1.1 Need for thermographic drone inspections driving market

TABLE 18 SOLAR PV: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

9.2.2 SOLAR CSP

9.2.2.1 Need for shape assessment and thermal performance testing drives market growth

TABLE 19 SOLAR CSP: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

9.3 WIND

9.3.1 INCREASING FOCUS ON ASSET OPTIMIZATION DRIVE MARKET GROWTH

TABLE 20 WIND: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

10 RENEWABLE DRONES MARKET, BY REGION (Page No. - 85)

10.1 INTRODUCTION

FIGURE 32 MARKET IN ASIA PACIFIC IS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 33 ASIA PACIFIC DOMINATED MARKET IN 2019

TABLE 21 MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

10.2 ASIA PACIFIC

FIGURE 34 ASIA PACIFIC: REGIONAL SNAPSHOT

10.2.1 RENEWABLE ENERGY OUTLOOK

TABLE 22 ASIA PACIFIC: RENEWABLE ENERGY OUTLOOK, BY COUNTRY

10.2.2 LIST OF KEY SUPPLIERS AND THEIR PRESENCE

TABLE 23 ASIA PACIFIC: LIST OF KEY SUPPLIERS AND THEIR PRESENCE

10.2.3 EXISTING OPERATING MODELS

TABLE 24 ASIA PACIFIC: LIST OF KEY SUPPLIERS, BY OPERATING MODEL

10.2.4 KEY TARGET SEGMENTS

TABLE 25 ASIA PACIFIC: LIST OF KEY SUPPLIERS, BY KEY TARGET SEGMENTS

10.2.5 PRODUCT & SERVICE PORTFOLIO

TABLE 26 ASIA PACIFIC: LIST OF KEY SUPPLIERS, BY KEY PRODUCTS & SERVICES

10.2.6 BY DRONE TYPE

TABLE 27 ASIA PACIFIC: MARKET SIZE, BY DRONE TYPE, 2018–2025 (USD THOUSAND)

10.2.7 BY SOLUTION

TABLE 28 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2018–2025 (USD THOUSAND)

10.2.8 BY END USER

TABLE 29 ASIA PACIFIC: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.2.8.1 Solar, by type

TABLE 30 SOLAR: ASIA PACIFIC MARKET SIZE, BY TYPE, 2018–2025 (USD THOUSAND)

10.2.9 BY COUNTRY

TABLE 31 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

10.2.9.1 China

10.2.9.1.1 Increasing investments in renewables for grid stabilization are driving Chinese renewable drones market

10.2.9.1.2 By end user

TABLE 32 CHINA: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.2.9.2 India

10.2.9.2.1 Rising number of solar parks and supporting government plans on renewable energy generation will bring opportunities for renewable drones

10.2.9.2.2 By end user

TABLE 33 INDIA: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.2.9.3 Japan

10.2.9.3.1 Increasing emphasis on renewable energy and plans to phase out nuclear power plants is driving Japanese renewable drones market

10.2.9.3.2 By end user

TABLE 34 JAPAN: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.2.9.4 Australia

10.2.9.4.1 High potential of solar PV and CSP plants is driving market for renewable drones

10.2.9.4.2 By end user

TABLE 35 AUSTRALIA: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.2.9.5 Rest of Asia Pacific

10.2.9.5.1 By end user

TABLE 36 REST OF ASIA PACIFIC: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.3 EUROPE

FIGURE 35 EUROPE: REGIONAL SNAPSHOT

10.3.1 RENEWABLE ENERGY OUTLOOK

TABLE 37 EUROPE: RENEWABLE ENERGY OUTLOOK, BY COUNTRY

10.3.2 LIST OF KEY SUPPLIERS AND THEIR PRESENCE

TABLE 38 EUROPE: LIST OF KEY SUPPLIERS AND THEIR PRESENCE

10.3.3 EXISTING OPERATING MODELS

TABLE 39 EUROPE: LIST OF KEY SUPPLIERS, BY OPERATING MODEL

10.3.4 KEY TARGET SEGMENTS

TABLE 40 EUROPE: LIST OF KEY SUPPLIERS, BY KEY TARGET SEGMENTS

10.3.5 PRODUCT & SERVICE PORTFOLIO

TABLE 41 EUROPE: LIST OF KEY SUPPLIERS, BY PRODUCTS & SERVICES

10.3.6 BY DRONE TYPE

TABLE 42 EUROPE: RENEWABLE DRONES MARKET SIZE, BY DRONE TYPE, 2018–2025 (USD THOUSAND)

10.3.7 BY SOLUTION

TABLE 43 EUROPE: MARKET SIZE, BY SOLUTION, 2018–2025 (USD THOUSAND)

10.3.8 BY END USER

TABLE 44 EUROPE: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.3.8.1 Solar, by type

TABLE 45 SOLAR: EUROPE MARKET SIZE, BY TYPE, 2018–2025 (USD THOUSAND)

10.3.9 BY COUNTRY

TABLE 46 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

10.3.9.1 UK

10.3.9.1.1 Availability of large wind farms and increasing investments in solar & onshore wind capacities

10.3.9.1.2 By end user

TABLE 47 UK: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.3.9.2 Germany

10.3.9.2.1 High focus on generating total electricity through renewables is likely to drive market for renewable drones in Germany

10.3.9.2.2 By end user

TABLE 48 GERMANY: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.3.9.3 France

10.3.9.3.1 Increasing number of PV projects are fueling the market in France

10.3.9.3.2 By end user

TABLE 49 FRANCE: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.3.9.4 Russia

10.3.9.4.1 Potential for increasing solar PV and wind energy capacity for power generation

10.3.9.4.2 By end user

TABLE 50 RUSSIA: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.3.9.5 Rest of Europe

10.3.9.5.1 By end user

TABLE 51 REST OF EUROPE: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.4 NORTH AMERICA

10.4.1 RENEWABLE ENERGY OUTLOOK

TABLE 52 NORTH AMERICA: RENEWABLE ENERGY OUTLOOK, BY COUNTRY

10.4.2 LIST OF KEY SUPPLIERS AND THEIR PRESENCE

TABLE 53 NORTH AMERICA: LIST OF KEY SUPPLIERS AND THEIR PRESENCE

10.4.3 EXISTING OPERATING MODELS

TABLE 54 NORTH AMERICA: LIST OF KEY SUPPLIERS, BY OPERATING MODEL

10.4.4 KEY TARGET SEGMENTS

TABLE 55 NORTH AMERICA: LIST OF KEY SUPPLIERS, BY KEY TARGET SEGMENTS

10.4.5 PRODUCT & SERVICE PORTFOLIO

TABLE 56 NORTH AMERICA: LIST OF KEY SUPPLIERS, BY PRODUCTS & SERVICES

10.4.6 BY DRONE TYPE

TABLE 57 NORTH AMERICA: MARKET SIZE, BY DRONE TYPE, 2018–2025 (USD THOUSAND)

10.4.7 BY SOLUTION

TABLE 58 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2018–2025 (USD THOUSAND)

10.4.8 BY END USER

TABLE 59 NORTH AMERICA: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.4.8.1 Solar, by type

TABLE 60 SOLAR: NORTH AMERICA MARKET SIZE, BY TYPE, 2018–2025 (USD THOUSAND)

10.4.9 BY COUNTRY

TABLE 61 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

10.4.9.1 US

10.4.9.1.1 Increasing number of solar projects are driving renewable drones market

10.4.9.1.2 By end user

TABLE 62 US: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.4.9.2 Canada

10.4.9.2.1 Growing investments in wind and solar photovoltaic energy projects

10.4.9.2.2 By end user

TABLE 63 CANADA: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.4.9.3 Mexico

10.4.9.3.1 Government initiatives to expand solar industry are driving the market for renewable drones

10.4.9.3.2 By end user

TABLE 64 MEXICO: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.5 MIDDLE EAST & AFRICA

10.5.1 RENEWABLE ENERGY OUTLOOK

TABLE 65 MIDDLE EAST & AFRICA: RENEWABLE ENERGY OUTLOOK, BY COUNTRY

10.5.2 LIST OF KEY SUPPLIERS AND THEIR PRESENCE

TABLE 66 MIDDLE EAST & AFRICA: LIST OF KEY SUPPLIERS AND THEIR PRESENCE

10.5.3 EXISTING OPERATING MODELS

TABLE 67 MIDDLE EAST & AFRICA: LIST OF KEY SUPPLIERS, BY OPERATING MODEL

10.5.4 KEY TARGET SEGMENTS

TABLE 68 MIDDLE EAST & AFRICA: LIST OF KEY SUPPLIERS, BY KEY TARGET SEGMENTS

10.5.5 PRODUCT & SERVICE PORTFOLIO

TABLE 69 MIDDLE EAST & AFRICA: LIST OF KEY SUPPLIERS, BY PRODUCTS & SERVICES

10.5.6 BY DRONE TYPE

TABLE 70 MIDDLE EAST & AFRICA: MARKET SIZE, BY DRONE TYPE, 2018–2025 (USD THOUSAND)

10.5.7 BY SOLUTION

TABLE 71 MIDDLE EAST & AFRICA: MARKET SIZE, BY SOLUTION, 2018–2025 (USD THOUSAND)

10.5.8 BY END USER

TABLE 72 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.5.8.1 Solar, by type

TABLE 73 SOLAR: MIDDLE EAST & AFRICA MARKET SIZE, BY TYPE, 2018–2025 (USD THOUSAND)

10.5.9 BY COUNTRY

TABLE 74 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

10.5.9.1 Saudi Arabia

10.5.9.1.1 Focus on transition from oil-based economy towards clean energy economy is driving renewable drones market

10.5.9.1.2 By end user

TABLE 75 SAUDI ARABIA: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.5.9.2 UAE

10.5.9.2.1 Investments in solar energy are expected to drive market in the UAE

10.5.9.2.2 By end user

TABLE 76 UAE: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.5.9.3 Oman

10.5.9.3.1 Focus on expanding renewable energy sources for meeting domestic electricity demands is driving Oman’s market

10.5.9.3.2 By End User

TABLE 77 OMAN: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.5.9.4 South Africa

10.5.9.4.1 Reducing share of fossil fuels and expanding solar reserves are driving South African renewable drones market

10.5.9.4.2 By end user

TABLE 78 SOUTH AFRICA: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.5.9.5 Morocco

10.5.9.5.1 Growing number of solar projects and supportive legislature are driving the market

10.5.9.5.2 By end user

TABLE 79 MOROCCO: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.5.9.6 Egypt

10.5.9.6.1 Increasing renewable energy targets and investments are driving the market

10.5.9.6.2 By end user

TABLE 80 EGYPT: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.5.9.7 Bahrain

10.5.9.7.1 Policy support from government to enable adoption of solar technologies

10.5.9.7.2 By end user

TABLE 81 BAHRAIN: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.5.9.8 Rest of Middle East & Africa

10.5.9.8.1 By end user

TABLE 82 REST OF MIDDLE EAST & AFRICA: RENEWABLE DRONES MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.6 SOUTH AMERICA

10.6.1 RENEWABLE ENERGY OUTLOOK

TABLE 83 SOUTH AMERICA: RENEWABLE ENERGY OUTLOOK, BY COUNTRY

10.6.2 LIST OF KEY SUPPLIERS AND THEIR PRESENCE

TABLE 84 SOUTH AMERICA: LIST OF KEY SUPPLIERS AND THEIR PRESENCE

10.6.3 EXISTING OPERATING MODELS

TABLE 85 SOUTH AMERICA: LIST OF KEY SUPPLIERS, BY OPERATING MODEL

10.6.4 KEY TARGET SEGMENTS

TABLE 86 SOUTH AMERICA: LIST OF KEY SUPPLIERS, BY KEY TARGET SEGMENTS

10.6.5 PRODUCT & SERVICE PORTFOLIO

TABLE 87 SOUTH AMERICA: LIST OF KEY SUPPLIERS, BY PRODUCT & SERVICES

10.6.6 BY DRONE TYPE

TABLE 88 SOUTH AMERICA: MARKET SIZE, BY DRONE TYPE, 2018–2025 (USD THOUSAND)

10.6.7 BY SOLUTION

TABLE 89 SOUTH AMERICA: MARKET SIZE, BY SOLUTION, 2018–2025 (USD THOUSAND)

10.6.8 BY END USER

TABLE 90 SOUTH AMERICA: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.6.8.1 Solar, by type

TABLE 91 SOLAR: SOUTH AMERICA MARKET SIZE, BY TYPE, 2018–2025 (USD THOUSAND)

10.6.9 BY COUNTRY

TABLE 92 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

10.6.9.1 Brazil

10.6.9.1.1 Increase in investments for renewable energy is expected to drive the market

10.6.9.1.2 By end user

TABLE 93 BRAZIL: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.6.9.2 Argentina

10.6.9.2.1 Development of renewable energy projects is expected to drive the market

10.6.9.2.2 By end user

TABLE 94 ARGENTINA: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.6.9.3 Rest of South America

10.6.9.3.1 By end user

TABLE 95 REST OF SOUTH AMERICA: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

11 COMPETITIVE LANDSCAPE (Page No. - 139)

11.1 OVERVIEW

FIGURE 36 KEY DEVELOPMENTS IN GLOBAL MARKET, 2017–JULY 2020

11.2 INDUSTRY CONCENTRATION, 2019

FIGURE 37 INDUSTRY CONCENTRATION, 2019

11.3 COMPETITIVE SCENARIO

TABLE 96 DEVELOPMENTS OF KEY PLAYERS IN MARKET, 2017–2020

11.3.1 CONTRACTS & AGREEMENTS

11.3.2 INVESTMENTS & EXPANSIONS

11.3.3 MERGERS & ACQUISITIONS

11.4 WINNERS VS. TAIL ENDERS

11.4.1 WINNERS

11.4.2 TAIL ENDERS

11.5 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

11.5.1 STAR

11.5.2 EMERGING LEADER

11.5.3 PERVASIVE

11.5.4 PARTICIPANT

FIGURE 38 RENEWABLE DRONES MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 39 PRODUCT OFFERING COMPARISION

FIGURE 40 BUSINESS STRATEGY COMPARISION

12 COMPANY PROFILES (Page No. - 151)

(Business overview, Products/Solutions/Services Offered, Recent developments, SWOT Analysis, MNM view)*

12.1 SITEMARK

12.2 ABJ DRONES

12.3 PARROT GROUP

FIGURE 41 PARROT GROUP: COMPANY SNAPSHOT

FIGURE 42 PARROT GROUP: SWOT ANALYSIS

12.4 DRONE VOLT GROUP

FIGURE 43 DRONE VOLT GROUP: COMPANY SNAPSHOT

FIGURE 44 DRONE VOLT GROUP: SWOT ANALYSIS

12.5 SIEMENS

FIGURE 46 SIEMENS: SWOT ANALYSIS

12.6 MEASURE AUSTRALIA

12.7 ADVANCED VISION ANALYTICS

12.8 PRECISIONHAWK

12.9 AERODYNE MEASURE

12.10 SKYLARK DRONES

12.11 GARUDAUAV

12.12 DRONEDEPLOY

12.13 IDEAFORGE

12.14 PRECISIONXYZ

12.15 RAPTOR MAPS

12.16 DRONEFLIGHT

12.17 SPH ENGINEERING

12.18 AIRPROBE

12.19 DJI ENTERPRISE

12.20 AEROSPEC TECHNOLOGIES

12.21 COGNITE

12.22 CSP SERVICES

12.23 FORCE TECHNOLOGY

12.24 ARBOREA INTELLBIRD

12.25 BALAMORE GROUP

12.26 CYBERHAWK

12.27 AIRPIX

12.28 SKYSPECS

12.29 ABOVE SURVEYING

12.30 SULZER & SCHMID LABORATORIES

12.31 SINGULAIR

12.32 ROBUR INDUSTRY SERVICE GROUP

12.33 NANONET TECHNOLOGIES

12.34 FLYABILITY

12.35 TERRA DRONE

12.36 HELVETIS

*Details on Business overview, Products/Solutions/Services Offered, Recent developments, SWOT Analysis, MNM view might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 285)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

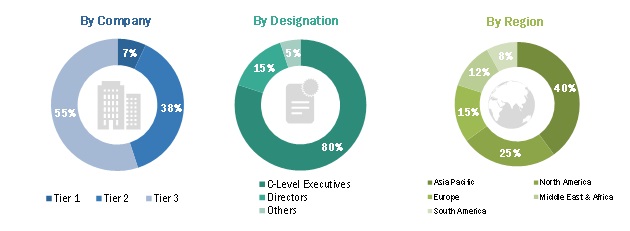

This study involved four major activities in estimating the current size of the renewable drones market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global renewable drones market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The renewable drones market comprises several stakeholders, such as end-product manufacturers, service providers, and end-users in the supply chain. The demand-side of this market is characterized by its end-users, such as utilities/asset owners, and others. The supply-side is characterized by renewable drones service providers, tool providers, integrators, and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global renewable drones market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Renewable drones Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the oil & gas upstream sector.

Report Objectives

- To define and describe the global renewable drones market by drone type, solution, end user and region.

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges).

- To strategically analyze the global market with respect to individual growth trends, future expansions, and the contribution of each segment to the market.

- The impact of the COVID-19 pandemic on the market has been analyzed for the estimation of the market size.

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders.

- To forecast the growth of the global market with respect to the main regions (North America, Asia Pacific, Europe, South America, and the Middle East & Africa).

- To profile and rank key players and comprehensively analyze their market share.

- To analyze competitive developments such as contracts & agreements, expansions & investments, and mergers & acquisitions in the renewable drones market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Renewable Drones Market