Utility Drones Market by Services (End-to-End Solution and Point Solution), Type (Multi-Rotor and Fixed Wing), End-user (Power (T&D and Generation), and Renewable (Solar and Wind)), and Region - Global Forecast to 2023

[140 Report Pages] The global utility drones market was valued at USD 85.8 million in 2017 and is projected to reach USD 538.6 million by 2023, at a CAGR of 37.34% during the forecast period.

The years considered for the study are as follows:

- Base Year: 2017

- Estimated Year: 2018

- Projected Year: 2023

- Forecast Period: 2018–2023

The base year considered for company profiles is 2017. Whenever information was unavailable for the base year, the prior year has been considered.

Objectives of the Study

- To analyze and forecast the market size of utility drones in terms of value

- To provide detailed information about the major factors influencing the growth of the market such as drivers, restraints, opportunities, and industry-specific challenges of the market

- To define, describe, and forecast the market on the basis of type, services, and end-user

- To forecast the expansion of the market size with respect to main regions, namely, North America, South America, Europe, the Middle East & Africa, and Asia Pacific

- To strategically analyze the utility drone market with respect to individual growth trends, future expansions, and contribution to the market

- To analyze market opportunities for stakeholders and details of a competitive landscape for the market leaders

- To analyze competitive developments such as contracts & agreements, mergers & acquisitions, new product developments, investments & expansions, partnerships, and collaborations in the market

- To strategically identify and profile the key market players and analyze their core competencies in the market

Research Methodology

This research study involved the use of extensive secondary sources, directories, journals on power generation technologies, and other related rental markets; newsletters and databases such as Hoover’s, Bloomberg, Businessweek, and Factiva to identify and collect information useful for a technical, market-oriented, and commercial study of the global utility drone market. The primary sources include several industry experts from the core and related industries, vendors, preferred suppliers, technology developers, alliances, and organizations related to all the segments of this industry’s value chain. The research methodology has been explained below.

- Study of annual revenues and market developments of the major players providing utility drones

- Assessment of future trends and growth of types (multi-rotor and fixed wing)

- Assessment of the market with respect to the services mainly used (end-to-end solution and point solution)

- Assessment of the market with respect to the solutions used for different end-users (power and renewable)

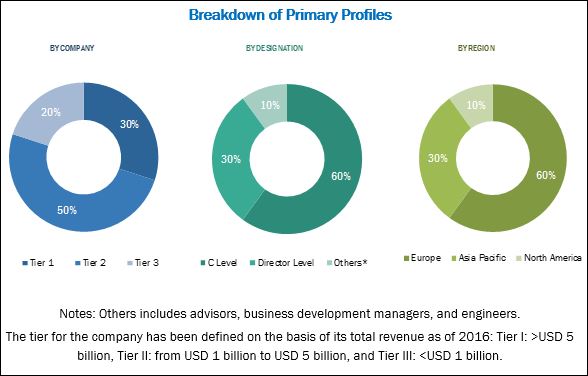

After arriving at the overall market size, the total market was split into several segments and subsegments. The figure given below illustrates the breakdown of primary interviews conducted during the research study based on company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Major players operating in the utility drones market include Cyberhawk (Scotland), Delair (France), HEMAV (Spain), PrecisionHawk (US), and Measure (US).

Target Audience:

- Manufacturers and suppliers of utility drones

- Service providers of utility drones

- Energy & environment associations

- End-user industries such as power industry, solar power, and wind power

- Government and research organizations

- State and national regulatory authorities

- Investment banks

- Manufacturers’ associations

- Institutional investors

- Environmental research institutes

Scope of the Report:

By Type

- Multi-rotor

- Fixed wing

By Services

- End-to-end solution

- Point solution

By End-user

- Power

- Generation

- Transmission & distribution

- Renewable

- Solar

- Wind

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Drivers

Growing global demand for minimizing outages related to transmission infrastructure

Power outages have been a severe global issue impacting the reliability of transmission systems. Reliability is a critical factor, especially for countries where energy prices are regulated. Power utilities face backlashes from regulatory authorities in terms of penalties, every time there is a power outage. A major cause of power outages has been the interference of tree branches with power lines. Drones have helped in minimizing such problems by acting as an asset management tool. Earlier, utility companies spent millions of dollars on inspecting difficult-to-reach infrastructures, from power lines to pipelines. Unmanned Aircraft Systems (UAS), or drones, have significantly solved these inspection issues by monitoring sensitive infrastructures better as well as minimizing the downtime.

Time and cost efficiency

Drones help in providing a real-time image of a problem/damage in the utility asset, which ultimately expedites the correcting measures. Deploying manned helicopters, vehicle patrols, and foot patrols to inspect power lines and surrounding vegetation is extremely costly for utility companies. Use of drones for inspection has helped in significantly cutting down costs to nearly half, while providing high-quality, detailed images of the damage to overhead utility lines.

Restraints

Legal regulations

Legal regulations, across the globe, have constrained advances in the utility drones market. Although utility drones are extremely useful to utility companies, they have limited freedom owing to the regulations set by the Federal Aviation Administration (FAA). These regulations, in particular, exclude drone operations in some circumstances such as Beyond Visual Line-Of-Sight (BVLOS), over long distances, or at night. Considering that FAA has not maintained a pace with the fast-growing drone technologies, utility companies have not been able to utilize all the benefits of drones to improve the efficiency and effectiveness of infrastructure inspection and disaster recovery efforts. As quoted by the American Public Power Association, On June 21, 2016, the FAA released final rules for commercial operation of small unmanned aircraft systems (or drones). These rules, referred to collectively as Part 107, made it easier for businesses, nonprofits, and government agencies to use drones for a variety of purposes; however, these rules do not allow users to operate beyond visual line of sight and do not clarify that drone usage by public power utilities is a governmental activity.

Contracts & Agreements

|

Date |

Company Name |

Development |

|

June 2018 |

Delair |

Delair entered into an agreement with Cansel, a full-service provider of surveying and mapping solutions to the Canadian market. Cansel became the first Canadian reseller of Delair’s UX 11 long-range drone, and the 2 companies planned to rapidly expand the agreement to include the entire Delair product line. |

|

May 2018 |

Delair |

Delair signed an agreement with Sphere Drones, a UAV sales, consulting, and service provider in Australia. As a part of the agreement, Sphere Drones would be the first Delair UX11 reseller in the country, with the 2 companies set to rapidly expand the agreement to include the entire Delair product line. |

Partnerships

|

Date |

Company Name |

Product Name |

|

May 2018 |

PrecisionHawk |

HAZON and PrecisionHawk entered into a strategic partnership, where HAZON would serve as the preferred training partner for PrecisionHawk’s BVLOS waiver consulting program. |

|

January 2018 |

Sky Scape |

SUEZ partnered with Sky Scape to implement drone technology into water utility operations. The partnership was based on incorporating safe and efficient drone technology solutions into the maintenance and construction of one of the country’s most valuable utilities. |

New Product Launches

|

Date |

Company Name |

Product Name |

|

June 2018 |

HEMAV |

HEMAV released Hemav Planner. |

|

May 2018 |

PrecisionHawk |

PrecisionHawk released a Beyond Visual Line of Sight (BVLOS)-enabled, multi-rotor drone platform. |

Investments & Expansions

|

Date |

Company Name |

Product Name |

|

April 2018 |

Delair |

Delair announced the global availability of its UX11 fixed-wing UAV. The drone model passed its final testing phases and is available from Delair authorized distributors in more than 70 countries. |

|

March 2018 |

HEMAV |

HEMAV approved an international expansion plan in Brazil and Mexico, consolidating its presence in Peru, Ecuador, Colombia, Chile, Argentina, France, Portugal and Spain. |

The global utility drones market is estimated to be USD 110.2 million in 2018 and is projected to reach USD 538.6 million by 2023, at a CAGR of 37.34% from 2018 to 2023. Rising demand for minimizing outages related to transmission & distribution infrastructure, focus on time and cost efficiency, and reachability in hazardous locations are the major drivers of the utility drones market.

The report segments the utility drones market, by services, into end-to-end solution and point solutions. The end-to-end solution segment is expected to dominate the market in 2018 because of the availability of expertise required to obtain accurate data on utilities assets. This solution includes the provision of the drone; drone pilots; engineers; software; data management, processing, and analytics; drone advisory services; and consulting, among several other services.

Based on end-user, the utility drones market has been segmented into power and renewable. The power segment is expected to hold the largest market share in 2018. The advantages of using utility drones for the power industry include cutting down of operation and maintenance costs; boosting of worker safety considering their ability to fly in potentially dangerous areas; use of little or no fuel; and negligible environmental impact. All these are the key factors driving the power end-user segment of the utility drones market during the forecast period.

Based on type, the utility drones market has been segmented into multi-rotor and fixed wing. The multi-rotor segment is estimated to lead the market in 2018 and is expected to grow at the fastest rate during the forecast period, as multi-rotors are comparatively cheaper and readily available in the market.

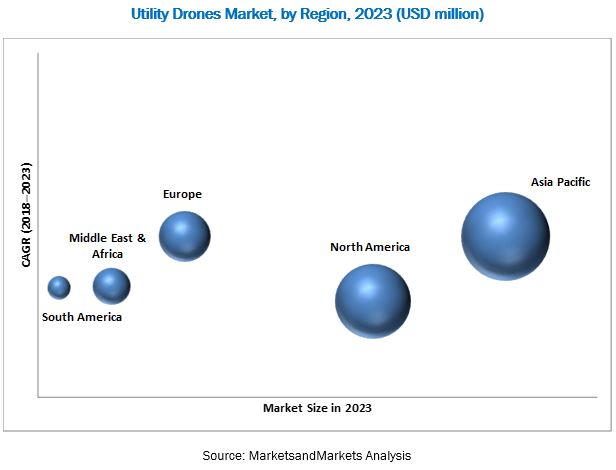

In this report, the utility drones market has been analyzed with respect to 5 regions, namely, Asia Pacific, Europe, North America, South America, and Middle East & Africa. The North American region is expected to hold the largest market share in 2018 and is the fastest growing market from 2018 to 2023. Factors such as increased investments in power infrastructure, rising power consumption, and increasing focus on renewable power generation in the energy mix are driving the utility drones market in the North American region.

Advancements in drone technology and amendments in drone regulations, permitting BVLOS flights can create opportunities in the utility drones market. However, legal regulations could restrain the growth of the market, leading to declining profits.

Some of the leading players in the utility drones market are Cyberhawk (Scotland), Delair (France), Measure (US), PrecisionHawk (US), and HEMAV (Spain). Contracts & agreements and partnerships were the most widely adopted strategies by players to ensure their dominance in the market.

Opportunities

Amendments in drone regulations, permitting BVLOS flights

BVLOS flights represent vast opportunities for the utility drone market. Considering the worldwide pressure by public utility companies on FAA for permitting or at least easing out regulations regarding BVLOS, there are high chances that the coming years would see more countries allowing BVLOS flights. Many countries have already started updating their regulatory frameworks regarding BVLOS flights, hence allowing them to utilize the full potential of the utility drones. Countries such as Australia, Czech Republic, Denmark, the UK, the US, Sri Lanka, and Brazil have initiated the testing of BVLOS flights with prior approvals. For instance, in Denmark, “BVLOS flights may only be performed with prior permission from the Danish Transportation Authority” as quoted by the Danish Transportation Authority; in Canada, “For BVLOS operations…specific weather requirements…are determined on a case-by-case basis. The minimum meteorological conditions must be suitable to allow the safe departure and arrival of the aircraft” – as quoted by Transport Canada.

Advancements in drone technology

Companies around the world have been consistently working on one prime issue faced with drones battery performance. Considering that drones can be operated only for a couple of minutes, their makers are trying to improvise on various parameters to allow longer flight durations, hence cutting down costs further. On the other hand, battery manufacturers have also been in the pursuit to come up with innovative solutions to enhance the battery life, and eventually the overall flight time of drones. For instance, a start-up from Massachusetts named SolidEnergy Systems has been working on lithium metal batteries, which are expected to provide twice as much power as opposed to the conventional lithium-ion batteries.

Challenges

Working safety

Adoption of drone technology, by the utilities and also other sectors, is growing at a very fast pace. This can lead to problems in tackling air traffic, increasing the risks related to collisions and other related aviation accidents. In case of malfunctioning, such as loss of power or loss of signal between the pilot and the drone, the incidents can pose major threats to the public. For utility companies, a minor malfunctioning can lead to drones crashing onto their assets (e.g., power lines) and can lead to a disruption in electricity supply while also severely damaging the equipment.

Data protection and security

Since drones capture enormous amount of data, for utilities in this case, there are concerns regarding the protection and safety of confidential data from potential hackers. Cybersecurity is of utmost importance to drones and the related software industry. Although data hacking from drones has not been a big issue, there are still chances of data vulnerability if drones are connected to the internet. Such cyber issues have been overcome by some companies, such as Sharper Shape, which use cloud technology to process and maintain sensitive data. However, there are utility companies that still rely on old-school methods of data protection and have not adopted modern day cloud-based solutions.

Mergers & Acquisitions

|

Date |

Company Name |

Development |

|

March 2018 |

Aerodyne |

Aerodyne bought a 60% controlling stake in wind turbine blade inspection company AtSite for Euros 2.2 million. |

|

February 2018 |

PrecisionHawk |

PrecisionHawk acquired Droners.io and AirVid. The acquisition was aimed at launching the nation’s largest network of commercially licensed drone pilots. |

Collaborations & Alliances

|

Date |

Company Name |

Development |

|

September 2017 |

Sharper Shape |

Sharper Shape and SkySkopes, in cooperation with an investor-owned utility, utilized Sock pulling for power-line construction. The mission used the Sharper A6 UAS to string sock lines for a 675-kV line construction project. |

|

September 2017 |

PrecisionHawk |

McCarthy collaborated with PrecisionHawk to develop customized tools and services aimed at expanding the use of drones across field solutions, BIM, survey, and risk management. |

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regional Segmentation

1.4 Years Considered in the Report

1.5 Currency & Pricing

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the Utility Drones Market During the Forecast Period

4.2 Utility Drone Market, By Type

4.3 End-To-End Solution, Drone Market, By Service

4.4 Utility Drone Market, By End-User

4.5 Utility Drone Market, By Region

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Global Demand for Minimizing Outages Related to Transmission Infrastructure

5.2.1.2 Time and Cost Efficiency

5.2.1.3 Reachability in Hazardous Locations

5.2.2 Restraints

5.2.2.1 Legal Regulations

5.2.3 Opportunities

5.2.3.1 Amendments in Drone Regulations, Permitting Bvlos Flights

5.2.3.2 Advancements in Drone Technology

5.2.4 Challenges

5.2.4.1 Working Safety

5.2.4.2 Data Protection and Security

6 Utility Drones Market, By Type (Page No. - 34)

6.1 Introduction

6.2 Multi-Rotor

6.3 Fixed Wing

7 Utility Drones Market, By Services (Page No. - 38)

7.1 Introduction

7.2 End-To-End Solution

7.3 Point Solution

8 Utility Drones Market, By End-User (Page No. - 42)

8.1 Introduction

8.2 Power

8.2.1 Generation

8.2.2 Transmission

8.3 Renewable

8.3.1 Solar

8.3.2 Wind

9 Utility Drones Market, By Region (Page No. - 47)

9.1 Introduction

9.2 North America

9.2.1 By Type

9.2.2 By Services

9.2.3 By End-User

9.2.4 By Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3 Asia Pacific

9.3.1 By Type

9.3.2 By Services

9.3.3 By End-User

9.3.4 By Country

9.3.4.1 China

9.3.4.2 Japan

9.3.4.3 India

9.3.4.4 Australia

9.3.4.5 Rest of Asia Pacific

9.4 Europe

9.4.1 By Type

9.4.2 By Services

9.4.3 By End-User

9.4.4 By Country

9.4.4.1 Germany

9.4.4.2 Russia

9.4.4.3 UK

9.4.4.4 France

9.4.4.5 Rest of Europe

9.5 Middle East & Africa

9.5.1 By Type

9.5.2 By Services

9.5.3 By End-User

9.5.4 By Country

9.5.4.1 Saudi Arabia

9.5.4.2 UAE

9.5.4.3 South Africa

9.5.4.4 Rest of the Middle East & Africa

9.6 South America

9.6.1 By Type

9.6.2 By Services

9.6.3 By End-User

9.6.4 By Country

9.6.4.1 Brazil

9.6.4.2 Argentina

9.6.4.3 Rest of South America

10 Competitive Landscape (Page No. - 82)

10.1 Introduction

10.2 Ranking of Players and Market Structure

10.3 Competitive Scenario

10.3.1 Contracts & Agreements

10.3.2 Partnerships

10.3.3 New Product Launches

10.3.4 Investments & Expansions

10.3.5 Mergers & Acquisitions

10.3.6 Collaborations & Alliances

11 Competitive Benchmarking (Page No. - 87)

12 Company Profiles (Page No. - 88)

(Business Overview, Products Offered, Recent Developments, and MnM View)*

12.1 Aerodyne

12.2 Asset Drone

12.3 ABJ Drones

12.4 Cyberhawk

12.5 Delair

12.6 Hemav

12.7 Measure

12.8 Terra Drone

12.9 Sky-Futures

12.10 Precisionhawk

12.11 Sharper Shape

12.12 Sky Scape

12.13 ULC Robotics

*Details on Business Overview, Products Offered, Recent Developments, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 119)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (80 Tables)

Table 1 Utility Drones Market Snapshot

Table 2 Market, By Type, 2016–2023 (USD Million)

Table 3 Multi-Rotor: Market Size, By Region, 2016–2023 (USD Million)

Table 4 Fixed Wing: Market Size, By Region, 2016–2023 (USD Million)

Table 5 Market, By Services, 2016–2023 (USD Million)

Table 6 End-To-End Solution: Market Size, By Region, 2016–2023 (USD Million)

Table 7 Point Solution: Market Size, By Region, 2016–2023 (USD Million)

Table 8 Market, By End-User, 2016–2023 (USD Billion)

Table 9 Power: Market Size, By Region, 2016–2023 (USD Million)

Table 10 Power: Market, By Type, 2016-2023 (USD Million)

Table 11 Renewable: Market Size, By Region, 2016–2023 (USD Million)

Table 12 Renewable Market, By Type, 2016–2023 (USD Million)

Table 13 Utility Drones Market Size, By Region, 2016–2023 (USD Million)

Table 14 North America: Utility Drone Market Size, By Type, 2016–2023 (USD Billion)

Table 15 North America: Market Size, By Services, 2016–2023 (USD Million)

Table 16 North America: Market Size, By End-User, 2016–2023 (USD Million)

Table 17 North America: Market Size, By Country, 2016–2023 (USD Million)

Table 18 US: Market Size, By Type, 2016–2023 (USD Million)

Table 19 US: Utility Drones Market Size, By End-User, 2016–2023 (USD Million)

Table 20 Canada: Market Size, By Type, 2016–2023 (USD Million)

Table 21 Canada: Market Size, By End-User, 2016–2023 (USD Million)

Table 22 Mexico: Market Size, By Type, 2016–2023 (USD Million)

Table 23 Mexico: Market Size, By End-User, 2016–2023 (USD Million)

Table 24 Asia Pacific: Utility Drones Market Size, By Type, 2016–2023 (USD Million)

Table 25 Asia Pacific: Market Size, By Services, 2016–2023 (USD Million)

Table 26 Asia Pacific: Market Size, By End-User, 2016–2023 (USD Million)

Table 27 Asia Pacific: Market Size, By Country, 2016–2023 (USD Million)

Table 28 China: Market Size, By Type, 2016–2023 (USD Million)

Table 29 China: Market Size, By End-User, 2016–2023 (USD Million)

Table 30 Japan: Market Size, By Type, 2016–2023 (USD Million)

Table 31 Japan: Utility Drone Market Size, By End-User, 2016–2023 (USD Million)

Table 32 India: Market Size, By Type, 2016–2023 (USD Million)

Table 33 India: Market Size, By End-User, 2016–2023 (USD Million)

Table 34 Australia: Market Size, By Type, 2016–2023 (USD Million)

Table 35 Australia: Market Size, By End-User, 2016–2023 (USD Million)

Table 36 Rest of Asia Pacific: Market Size, By Type, 2016–2023 (USD Million)

Table 37 Rest of Asia Pacific: Market Size, By End-User, 2016–2023 (USD Million)

Table 38 Europe: Utility Drones Market Size, By Type, 2016–2023 (USD Billion)

Table 39 Europe: Market Size, By Services, 2016–2023 (USD Million)

Table 40 Europe: Market Size, By End-User, 2016–2023 (USD Million)

Table 41 Europe: Market Size, By Country, 2016–2023 (USD Million)

Table 42 Germany: Market Size, By Type, 2016–2023 (USD Million)

Table 43 Germany: Market Size, By End-User, 2016–2023 (USD Million)

Table 44 Russia: Utility Drone Market Size, By Type, 2016–2023 (USD Million)

Table 45 Russia: Market Size, By End-User, 2016–2023 (USD Million)

Table 46 UK: Market Size, By Type, 2016–2023 (USD Million)

Table 47 UK: Market Size, By End-User, 2016–2023 (USD Million)

Table 48 France: Market Size, By Type, 2016–2023 (USD Million)

Table 49 France: Market Size, By End-User, 2016–2023 (USD Million)

Table 50 Rest of Europe: Market Size, By Type, 2016–2023 (USD Million)

Table 51 Rest of Europe: Market Size, By End-User, 2016–2023 (USD Million)

Table 52 Middle East & Africa: Utility Drones Market Size, By Type, 2016–2023 (USD Million)

Table 53 Middle East & Africa: Market Size, By Services, 2016–2023 (USD Million)

Table 54 Middle East & Africa: Market Size, By End-User, 2016–2023 (USD Million)

Table 55 Middle East & Africa: Market Size, By Country, 2016–2023 (USD Million)

Table 56 Saudi Arabia: Market Size, By Type, 2016–2023 (USD Million)

Table 57 Saudi Arabia: Market Size, By End-User, 2016–2023 (USD Million)

Table 58 UAE: Utility Drone Market Size, By Type, 2016–2023 (USD Million)

Table 59 UAE: Market Size, By End-User, 2016–2023 (USD Million)

Table 60 South Africa: Market Size, By Type, 2016–2023 (USD Million)

Table 61 South Africa: Market Size, By End-User, 2016–2023 (USD Million)

Table 62 Rest of the Middle East & Africa: Market Size, By Type, 2016–2023 (USD Million)

Table 63 Rest of the Middle East & Africa: Market Size, By End-User, 2016–2023 (USD Million)

Table 64 South America: Utility Drones Market Size, By Type, 2016–2023 (USD Million)

Table 65 South America: Market Size, By Services, 2016–2023 (USD Million)

Table 66 South America: Market Size, By End-User, 2016–2023 (USD Million)

Table 67 South America: Market Size, By Country, 2016–2023 (USD Million)

Table 68 Brazil: Utility Drone Market Size, By Type, 2016–2023 (USD Million)

Table 69 Brazil: Market Size, By End-User, 2016–2023 (USD Million)

Table 70 Argentina: Market Size, By Type, 2016–2023 (USD Million)

Table 71 Argentina: Market Size, By End-User, 2016–2023 (USD Million)

Table 72 Rest of South America: Market Size, By Type, 2016–2023 (USD Million)

Table 73 Rest of South America: Market Size, By End-User, 2016–2023 (USD Million)

Table 74 Cyberhawk, the Most Active Player in the Market Between 2015 and 2018

Table 75 Contracts & Agreements

Table 76 Partnerships

Table 77 New Product Launches

Table 78 Investments & Expansions

Table 79 Mergers & Acquisitions

Table 80 Collaborations & Alliances

List of Figures (24 Figures)

Figure 1 Utility Drone Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 3 Utility Drones Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Utility Drones Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions

Figure 7 Power Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 8 End-To-End Segment is Expected to Have the Maximum Market Share During the Forecast Period

Figure 9 Multi-Rotor Segment is Expected to Lead the Utility Drone System Market in 2018

Figure 10 North America is Expected to Dominate the Utility Drone System Market During the Forecast Period

Figure 11 Amendment in Drone Regulation Creates Opportunity for the Utility Drone Market, 2018–2023

Figure 12 Multi-Rotor Segment is Leading the Utility Drone Market, 2018–2023

Figure 13 End-To-End Solution Segment Led the Utility Drone Market in 2018

Figure 14 Power is Expected to Lead the Utility Drone Market During the Forecast Period

Figure 15 Asia Pacific Region is Expected to Grow at the Fastest CAGR During the Forecast Period

Figure 16 Utility Drone Market: Drivers, Restraints, Opportunities, & Challenges

Figure 17 Multi-Rotor Segment Dominated the Utility Drone Market in 2017

Figure 18 End-To-End Solution Segment Dominated the Utility Drone Market in 2017

Figure 19 Power Segment Dominated the Utility Drone Market in 2017

Figure 20 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 21 North America Led the Utility Drone Market in 2017

Figure 22 North America: Market Snapshot

Figure 23 Asia Pacific: Market Snapshot

Figure 24 Recent Key Developments in the Utility Drone Market

Growth opportunities and latent adjacency in Utility Drones Market