Remote Towers Market by Operation Type (Single, Multiple, Contingency), System Type (Airport Equipment, Remote Tower Modules, Solutions & Software), Application (Communication, Information & Control, Surveillance) and Region - Global Forecast to 2027

Update: 11/22/2024

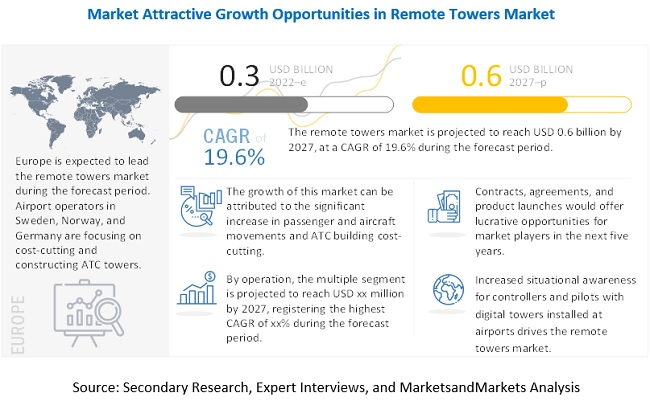

The Global Remote Towers Market Size was valued at USD 0.3 Billion in 2022 and is estimated to reach USD 0.6 Billion by 2027, growing at a CAGR of 19.6% during the forecast period.

Remote tower is a innovative concept where the air traffic service (ATS) at an airport is performed somewhere other than in the local control tower. Although it was originally developed for airports with low traffic levels, in 2021 it was implemented at a major international airports in London, Norway and few other places. Also, this report dicusses the digital tower concept. To capture the increasing demand for integration of a wide range of ATM systems and data in support of advanced air traffic operations, the digital towers concept was launched.

This market report covers various applications and systems related to remote towers that are used in commercial and military airports. Remote towers are evolving rapidly in terms of technology, with the development of new, advanced, and high-speed cameras, remote modules, and communication systems. Increased cost saving, efficiency, and safety fuel the demand for Remote Towers Industry.

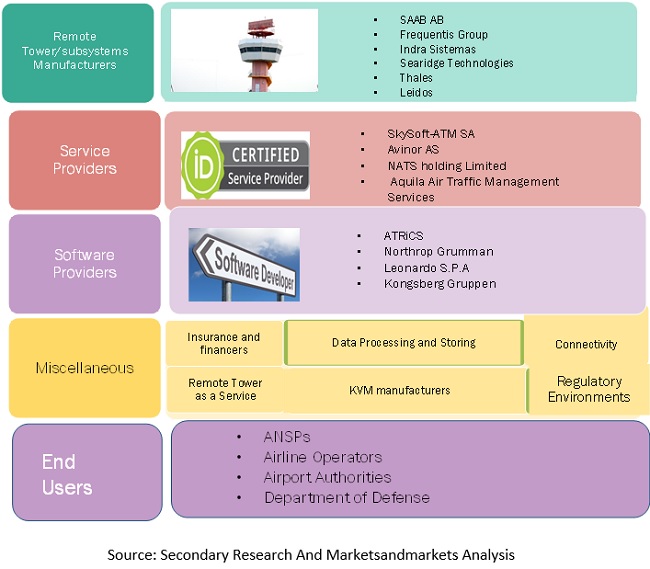

Saab (Sweden), Thales Group (France), Frequentis Group (Austria), Indra Sistemas (Spain), and L3Harris Technologies (US) are some of the leading players operating in the remote towers market. A general overview of these companies, an analysis of their financials, products, and services, and the key developments undertaken by them are covered in this report.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Remote Towers Market

The COVID pandemic has had and will linger to have for some time a devastating impact on air traffic, which indirectly would hit the remote towers market negatively. Airports of all sizes have been impacted, but smaller and regional airports are predominantly vulnerable. Due to COVID-19 crisis, the research & development (R&D) in numerous remote towers system has been hindered due to the declared lockdowns and government restrictions on public gatherings. Due to COVID-19 crisis worldwide, the major airports have been non-operational, which has deferred ongoing upgradation of airports with multiple remote tower systems. Maintaining production has become a challenge for every category of remote tower manufacturers as businesses and supply chains observed temporary shutdowns or disruption due to the financial losses sustained owing to strict lockdowns, closures of international borders, and a fall in import and export activities. Start-ups faced a financial crunch as these factors discouraged investor funding. The financial impact of COVID-19 on airlines and the aviation supply chain pushed many businesses and organizations to execute cost cutting measures. Most of these measures consist of reduction in staff, whether in the form of staff furlough or early retirements. In addition to this having a negative impact on staff morale, it has changed the working environment for crews, ATCOs, and dispatchers in the aviation sector.

Remote Towers Market Dynamics:

Driver: Increased cost savings

Remote towers can operate both, a single airport as well as multiple airports simultaneously from a remote location. This leads to cost savings in civil infrastructure and ATM systems. Small- and medium-sized airports that have low traffic operate in loss due to heavy ATC tower costs that cannot be balanced out with the volume of air traffic. Multiple such airports can be controlled from one location through remote towers simultaneously as well as sequentially based on a schedule. The cost of having independent towers at such airports is far too high as compared to installing a high-end camera system that relays the video footage to a remote tower for ATC operations. The first tower in Norway to be run through the remote tower technology was rolled out in 2019, while three more towers are being implemented by Avinor AS in partnership with SESAR 2020 programme in 2020. The remote towers technology will be rolled out at a total of 15 airports in Norway by the end of 2022, which will be run from the centre in Bodø. This is expected to be significantly cheaper than installing independent towers at each of these airports. The remote towers will cater to this increasing passenger traffic at a cost that will be significantly less than upgrading and developing traditional air traffic control towers. The need to reduce the ATM costs is expected to spur the demand for remote towers.

Opportunity: Digitalization in air traffic management

The aviation industry is undergoing a digital transformation. Digital MRO, autonomous aircraft and drones, and digital airport technologies, among others, are driving the industry toward digitalization. Remote towers are at the forefront of airport digitalization. They replace human OTW view with digital equipment that functions using highly automated systems. Besides the digital displays, the aeronautical data received by remote towers and the automated algorithms creating terrain mapping as well as anti-collision mapping for the controllers are digital. For instance, ENAIRE (Spain) aims in development of its Digital Control Tower project, Along with Indra Sistemas (Spain)as the technological partner,in a project that goes well beyond the mere remote provision of Tower Control Traffic Services. This advanced solution integrates the current ATS surveillance data, Air Traffic Control and Communications systems with a panoramic visualization system furnished with innovative information and alert functionalities, based on the application of Augmented Reality and Artificial Intelligence. This progress of “remote concept” to a new “digital concept” is based on the objective to expand the human and ATMS system cooperation, moving from the “visual” concept of operations of the exiting Towers to a new concept of operations based on the amalgamation of a new digitalized visual together with ATM system information.

Challenge: Rise in cyber threats to air traffic management

The use of Information and Communications Technology (ICT) in remote towers systems to create a network between the airport and CWPs could expose the ATC operations to cyber hacking. Digitalization of such complex instrumentation has introduced considerable issues related to cybersecurity. Traditional ATC towers work in an isolated environment, which is protected against cyber threats. However, remote towers and their components are connected to the internet or a network, thus making them vulnerable to hacking. Due to this interface and interdependence inherent to ICT, the threat to remote towers has increased.

The most direct threat to ATM systems is posed by non-state actors, including terrorists, hacktivists, and cybercriminals. The major impact of such threats can involve information theft, general disruption in aviation, and potential loss of life. Some of the recent instances of cyberattacks on the ATM system include the December 2014 coordinated attack by Iranian hackers against computer systems of over 16 countries, including attacks on systems of Pakistan, South Korea, Saudi Arabia, and the US. In June 2015, a cyberattack on the network of Polskie Linie Lotnicze (Polish National Airline) grounded ten flights to Poland, Germany, and Denmark, and caused delays for another ten by compromising the system that creates flight plans.

Market Ecosystem Map

The key stakeholders in the Remote Towers Market ecosystem are Airport Developers, Software Developers, Research Bodies, Governmental Bodies, Remote Tower Systems Manufacturers, Government Agencies, Regulators and Investors and Financial Community Professionals

Market ecosystem map: remote towers market

“By operation type, the multiple segment is projected to grow at the highest CAGR during the forecast period”

By operation type, the multiple segment is projected to grow at the highest CAGR during the forecast period. SESAR 2020 and PJ.05, an innovative programme for researching the future of air traffic management in Europe, plans to further develop the Multiple Remote Tower Concept and an efficient Remote Tower Centre.Also, in the simultaneous configuration, the module and CWP enable Air traffic Service (ATS) to operate for two or more airports at the same time. In order to operate airport safely and to save build cost, equipment and manpower, major airport operators and Ain Navigation Service together are working towards connecting various small airport with low traffic and making centralized to manage.

“Based on investment, the expansion & modernization segment is projected to lead the remote towers market during the forecast period”

Based on investment, the expansion & modernization segment is projected to lead the remote towers market during the forecast period. Various European and American airports, including London City Airport (UK), Heathrow Airport (UK), Saarbrücken (Germany), Erfurt (Germany), and Dresden (Germany) are operating through expansion and modernization programs. The key priority of airport operators and air navigation service providers is to centralize 2-3 airports with low and medium air traffic with remote towers infrastructure.

“By application, the communication segment is estimated to lead the market during the forecast period”

Communication segment would lead based on application, because it is a crucial component for air traffic management. Communication between air traffic controllers and aircraft is in the form of voice and text. Remote towers are equipped with specific systems that process and display communication data. These systems collect and relay communications between control working positions (CWPs) and the aircraft.

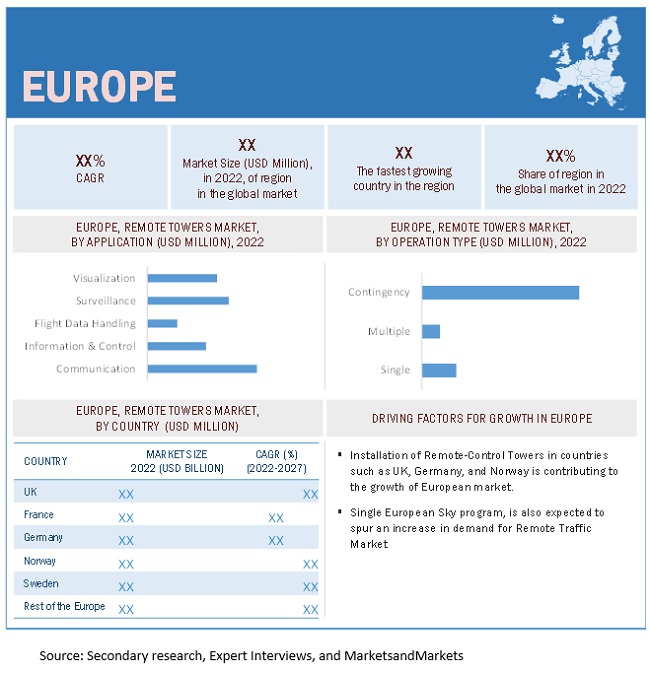

“Europe to lead the remote tower market in 2022”

Europe to lead the remote tower market in 2022, with the UK, and Sweden accounting for the significant share of the regional market. The growing demand for remote towers in the European rgion with yhe development of new and technologically advanced remote towers component such as high resolution cameras, and panaromic display and communication systems are the key factors driving the market in Europe.

Europe is Projected to have the Highest Market Share for Remote Towers Market in 2021

To know about the assumptions considered for the study, download the pdf brochure

Key players operating

The Remote Towers Companies are dominated by a few globally established players such as Saab (Sweden), Thales Group (France), Frequentis Group (Austria), Indra Sistemas (Spain), and L3Harris Technologies (US).

Scope of the Report

|

Report Metric |

Details |

|

Estimated Value

|

USD 0.3 Billion in 2022 |

| Projected Value | USD 0.6 Billion by 2027 |

| Growth Rate | CAGR of 19.6% |

|

Market size available for years |

2017-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

by end user, operation type, system type, application, investment and regions |

|

Geographies covered |

North America, Asia Pacific, Europe, RoW (Rest of the World) |

|

Companies covered |

Saab (Sweden), Thales Group (France), Frequentis Group (Austria), Indra Sistemas (Spain), and L3Harris Technologies (US) are among others. |

This research report categorizes the remote towers market based on end user, operation type, system type, application, investment and regions.

Remote Tower Market , By Operation Type

- Single / Sequential

- Multiple/ Simultaneous

- Contigency

- Supplementary Remote Tower

Remote Tower Market , By System Type

-

Airport Equipment

- Cameras (180/360/Pan).

- Display

- Vhf/Uhf Radios

- Nav Aids

- Met Sensors

-

Remote Tower Module

- Heads-Up Display (Hud)

- Heads-Down-Display (Hdd)

-

Solutions & Software

- Wide Area Network (Wan)

- High Speed Ip Network

Remote Tower Market , By Application

- Communication

- Information & Control

- Flight Data Handling

- Surveillance

- Visualization

Remote Tower Market , By End User

- Military Airport

-

Commercial Airport

- Class A (>20 Million)

- Class B (10-20 Milion)

- Class C (1-10million)

- Class D (<1 Million)

Remote Tower Market , By Investment

- New Construction

- Expansion & Modernization

Remote Tower Market , By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Recent Developments

- In November 2021, China Southern signed a purchase agreement with Thales Group for their selection of the NXT-800 Automatic Dependent Surveillance – Broadcast (ADS-B) Transponder from ACSS, an L3Harris Technologies and Thales company, during the fourth China International Import Expo (CIIE).

- In October 2021, The Korean Airport Corporation (KAC) has conferred Indra Sistemas (Spain) a contract for the supply and installation of Indra Sistemas’s Normarc Instrument Landing Systems (ILS) and Distance Measuring Equipment (DME) with a total value of roughly USD 7 million.

- In January 2021, Frequentis Group (Austria) acquired parts of the ATM product segment from L3Harris Technologies (US)

Frequently Asked Questions (FAQ):

What is the current size of the remote towers market?

The global remote towers market is projected to grow from USD 259 million in 2022 to USD 644 million by 2027, at a CAGR of 20.0% from 2022 to 2027. Asia Pacific is expected to be the fastest-growing market, anticipated to register a CAGR of 29.30% during the forecast period.

Who are the winners in the remote towers market?

Key players operating in remote towers market are Saab (Sweden), Thales Group (France), Frequentis Group (Austria), Indra Sistemas (Spain), and L3Harris Technologies (US).

What is the COVID-19 impact on remote towers market?

The COVID pandemic has had and will linger to have for some time a devastating impact on air traffic, which indirectly would hit the remote towers market negatively. Airports of all sizes have been impacted, but smaller and regional airports are predominantly vulnerable. Due to COVID-19 crisis, the research & development (R&D) in numerous remote towers system has been hindered due to the declared lockdowns and government restrictions on public gatherings. Due to COVID-19 crisis worldwide, the major airports have been non-operational, which has deferred ongoing upgradation of airports with multiple remote tower systems. Production rate of many remote tower components such as several equipment, remote tower modules or KVM products are down due to COVID-19, which has negatively affected global remote towers market. Business development possibility of multiple remote tower firms has been severely affected due to the overall shortage in demand of remote tower systems due to COVID-19 pandemic.

What are some of the technological advancements in the market?

Due to increased air traffic, airports face various challenges by way of increased ground movements and surface traffic across runways, aprons, and taxiways. As part of Advanced Surface Movement Guidance and Control Systems (A-SMGCS) activities, new generation automation systems have been included in simulations to demonstrate how various tools can operate together to provide integrated airport safety nets. The introduction of electronic flight strips in remote control towers provides a link between instructions given by a controller which are available electronically and can be integrated with other data, such as flight plan, surveillance, routing, and published rules and procedures. The integration of this data enables the system to monitor the information and alert the controller when inconsistencies are detected. Electronic strips can be customized to implement the workflow of any remote tower. It easily integrates with other ATM systems, airport systems, and surveillance systems.

What are the factors driving the growth of the market?

Government initiatives such as NextGen (US), SES Europe (Single European Sky), and OneSKY (Australia), among others, are driving the growth of the ATM industry. These initiatives have laid the foundation for remote towers. Remote towers can contribute to the growth and create opportunities for modernization initiatives as well as the installation of new equipment in upcoming greenfield projects. A significant chunk of ATM growth can be attributed to remote towers that are being proposed in countries such as Norway, Germany, the UK, Sweden, the US, and India, among others. Europe is working on the installation of remote towers. According to International Airport Review, Norway has already started working towards implementing remote towers for 15 airports by end 2022. In 2019 The Royal Norwegian Air Force and Avinor AS started a partnership for testing the Remote Towers solution for military usage in Norway. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

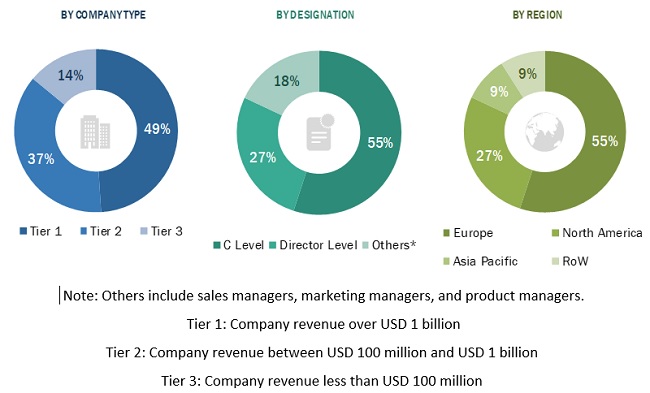

The research study conducted on the remote towers market involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information relevant to the market. Primary sources considered include industry experts from the market as well as suppliers, manufacturers, solution providers, technology developers, and organizations related to all segments of the value chain of the remote towers market. In-depth interviews of various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the market as well as to assess the prospects.

Secondary Research

Secondary sources referred for this research study included financial statements of companies offering remote towers technology and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the remote towers market, which was validated by primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- The top-down and bottom-up approaches were used to estimate and validate the size of the remote towers market. The research methodology used to estimate the market size also included the following details.

- The key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders, including chief executive officers (CEO), directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by representatives in MarketsandMarkets, and presented in this report.

bottom-up approach

The bottom-up approach was employed to arrive at the overall size of the remote towers market. Airport investments (brownfield and greenfield), list of current airports, and network connectivity were considered to calculate the total number of possible remote towers in each country. For the cost of remote towers in each country, ASP was identified based on % of the average cost of an air traffic control tower for regional and large international airports. This data was segmented based on application and system type.

Regional remote towers market

- The bottom-up approach was used to arrive at the regional value of the remote towers market.

- The global market size was arrived at by totaling the market size of each country considered for the study.

- Factors such as airport investments, number of regional & international airports, and network connectivity of each country were evaluated against the current stage of remote towers technology development to arrive at the estimated number of remote towers in each country.

Remote towers market, by operation type

A country-level analysis was done for each operation type, namely, single, multiple, and contingency. Single and multiple operations of remote towers were considered for small regional airports with passenger footprints less than 1 million/year as of 2018. For contingency operations, large airports with passenger footprints more than 5 million/year as of 2018 were considered. The segmental market value for by operation types was arrived through the bottom-up approach.

To know about the assumptions considered for the study, Request for Free Sample Report

Data triangulation

After arriving at the overall size of the remote towers market from the market size estimation process explained above, the total market was split into several segments and subsegments.

Report Objectives

- To define, describe, segment, and forecast the size of the remote towers market based on operation type, application, end user, system type, investment, and region

- To analyze the degree of competition in the remote towers market by identifying key market players

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the remote towers market

- To analyze macro and micro indicators of the market and provide a factor analysis for them

- To forecast the market size of various segments of the remote tower market, with respect to 4 major regions: North America, Europe, Asia Pacific, and the Rest of the World, along with major countries in each region

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market rankings and core competencies2

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, and new product launches & developments of key players in the remote towers market

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the remote towers market

- To identify industry trends, market trends, and technology trends currently prevailing in the remote towers market

1. Micromarkets are defined as the further segments and subsegments of the remote towers market included in the report.

2. Core competencies of companies are captured in terms of their key developments and strategies adopted to sustain their position in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Remote Towers Market