Regenerative Agriculture Market by Practice (Aquaculture, Agroecology, Agroforestry, Biochar & Terra Preta, Holistically Managed Grazing, No-Till & Pasture Cropping, Silvopasture), Application and Region - Global Forecast to 2027

With a compound annual growth rate (CAGR) of 14.0%, the global regenerative agriculture market is expected to rise from $8.7 billion in 2022 to $16.8 billion by 2027.

With the rising awareness of the environmental impact of conventional farming methods, regenerative agriculture is emerging as a sustainable solution that prioritizes soil health, biodiversity, and ecosystem resilience. The regenerative agriculture market presents a compelling opportunity for businesses to tap into the growing demand for sustainable food production systems and promote a more environmentally conscious approach to farming.

Several recent trends are driving the growth of the regenerative agriculture market. These include increasing consumer demand for sustainable and healthy food, corporate investment in regenerative farming practices, government policies and incentives, technological advancements, and increased collaboration and knowledge-sharing among stakeholders in the regenerative agriculture community. Together, these trends are fueling the adoption of regenerative practices by farmers and promoting sustainable agriculture practices worldwide.

To know about the assumptions considered for the study, Request for Free Sample Report

Regenerative Agriculture Market Growth Dynamics

Drivers: Rise in support from organizations, governments, and farmer welfare associations

To lower the carbon footprint produced by agricultural activities and, at the same time to increase agricultural production to meet the growing demand for food, the governments of different nations are switching to promote sustainable agricultural practices. In India, regenerative farming is promoted through the Paramparagat Krishi Vikas Yojana, a centrally sponsored program known as Bharatiya Prakritik Krishi Paddhati Program (BPKP) (PKVY). The BPKP aims to promote traditional indigenous techniques that use fewer inputs from outside sources. It is mostly predicated on the recycling of biomass inside the farm, with a focus on biomass mulching, the use of cow dung-urine formulations within the farm, periodic soil aeration, and the avoidance of any synthetic chemical inputs. Many of the farming methods regarded as regenerative in the US are supported by USDA conservation programs, such as the Environmental Quality Incentives Program. It is projected that the 2023 farm bill would accelerate the shift to a more resilient, just, and regenerative food and agricultural system.

Restraints: Lack of awareness among farmers about technical practices and benefits of regenerative agriculture

Farmers and ranchers run complicated enterprises in a dangerous, low-margin, and constantly evolving business climate, which keeps them very busy. Due to this reality, learning about and experimenting with new management strategies is a laborious and tedious process. Furthermore, there is a minimal possibility for innovation or deviation due to the unpredictable nature of the market. Based on their understanding of the land, collective wisdom, and experience, farmers manage their businesses. Extension rollout in support of regenerative practices may be slowed down by a lack of regional research combined with other obstacles. Extension agencies are not typical on a global scale. Instead, there are groups of farmers that work together to exchange expertise and an in-depth understanding of the land. Thus, retraining the growth of the market. Practices must be evaluated, and technical assistance must be provided to show the potential of regenerative agriculture to these farmers.

Opportunities: Growing research and development around the use of biologicals for carbon sequestration

There are growing research activities around the use of biologicals containing microbes, which, when used as a seed coating, can help to increase carbon sequestration. For instance, according to Soil Carbon Co., one of the most significant scientific endeavors of the twenty-first century is microbial carbon sequestration. It promises a simple answer for two of our biggest problems: climate change brought on by rising CO2 levels in the atmosphere, as well as declining soil fertility and resilience worldwide. Microbial activities are by far the most effective method of capturing carbon when compared to other carbon sequestration techniques. For the sequestration process, no additional tools, space, or energy are needed.

Challenges: Value chain and marketing challenges for products obtained from regenerative agriculture

Upstream demand is unpredictable, and consumers are hesitant to pay extra for products made using sustainable practices. The systemic infrastructure that surrounds large-scale agriculture and tends to support commodity systems and large-scale monoculture is said to be the biggest single problem across the majority of the country. Producers find themselves taking on several links or complete supply chains to get their products to market, from production, processing, and packaging to market development, sales, and distribution, without necessary local and regional infrastructure. There are numerous farmers trying to maximize revenue streams and/or achieve environmental goals and are also bringing several goods to market, adding to the complexity and quantity of processing partners they must manage.

Scope of the Regenerative Agriculture Market Report

|

Report Metric |

Details |

|

Market extent in 2022 |

USD 8.7 billion |

|

Financial outlook in 2027 |

USD 16.8 billion |

|

Progression rate |

CAGR of 14.0% |

|

Historical data |

2019-2027 |

|

Base year for estimation |

2021 |

|

Forecast period |

2022-2027 |

|

Quantitative units |

Value (USD Million) and Volume (Thousand Units) |

|

Market/Geography Specific Customization |

Available on Demand |

|

Report Coverage |

Revenue forecast, company ranking, driving factors, Competitive benchmarking, and analysis |

|

Segments covered |

Practice, Region, Application |

|

Regional Insight |

Europe, North America, South America, Asia Pacific |

|

Primary industry participants reviewed |

Nestle SA (Switzerland), Danone SA (France), General Mills, Inc (US), Cargill Incorporated (US), Unilever PLC (United Kingdom), Grounded (South Africa), Soil Capital Belgium SPRL (Belgium), Indigo Ag, Inc (US), and Serenity Kids (US) |

|

Research Coverage |

This report segments the regenerative agriculture market on the basis of practice, applications, and region. In terms of insights, this research report focuses on various levels of analyses—competitive landscape, pricing insights, end-use analysis, and company profiles—which together comprise and discuss the basic views on the emerging & high-growth segments of the regenerative agriculture market, high-growth regions, countries, industry trends, drivers, restraints, opportunities, and challenges. |

By practice, agroforestry is anticipated to grow at the highest CAGR during the study period

A resilient and sustainable agricultural practice, regenerative agroforestry, has the potential to help resolve the climate issue. This innovative farming method increases food security for expanding populations while recovering the environment, reducing climate change, safeguarding biodiversity, and enabling economically viable production. It is a cost-effective and nature-based practice that may be used anywhere in the world.

By application, biodiversity is forecasted to grow at the highest CAGR during the research period

Various regenerative agricultural practices such as no-tillage, planting cover crops, and planting buffer strips, among others, helps in increasing biodiversity. Some other benefits of biodiversity include a safe and clean water supply, protection of the soil, nutrient recovery, the provision of feed and fertilizer, the availability of wood products, a greater variety of wildlife, resources of the future and their protection, and help in maintaining appropriate climatic conditions.

To know about the assumptions considered for the study, download the pdf brochure

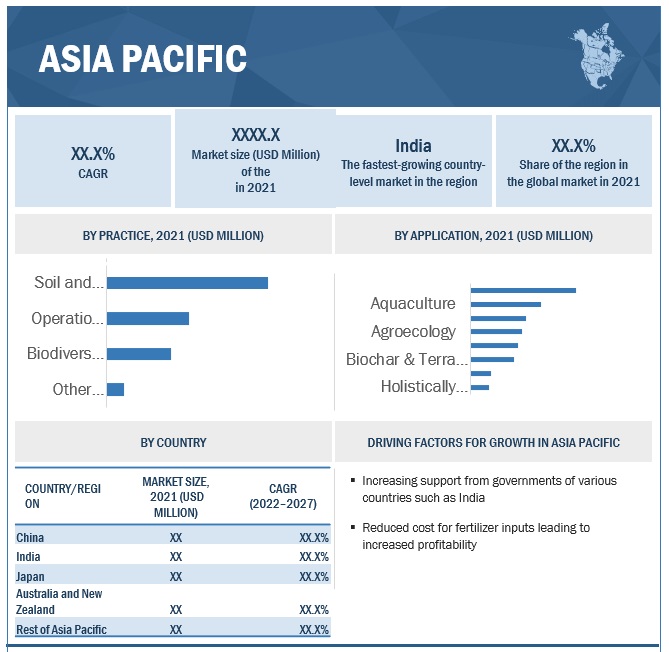

Asia Pacific is expected to grow at the highest CAGR in the global regenerative market during the forecast period. Due to vast agricultural land and a large population engaged in low-budget farming, Asia Pacific is expected to grow rapidly throughout the forecast period. Furthermore, rising government initiatives to promote innovative agricultural techniques, combined with increased awareness about soil improvement, are expected to create lucrative opportunities in the market in the coming years.

Key Market Players:

Key players in this market include Nestle SA (Switzerland), Danone SA (France), General Mills, Inc (US), Cargill Incorporated (US), Unilever PLC (United Kingdom), Grounded (South Africa), Soil Capital Belgium SPRL (Belgium), Indigo Ag, Inc (US), and Serenity Kids (US).

Target Audience:

- Food & beverages manufacturers

- Government and research organizations

- Suppliers and distributors of products based on regenerative produce

- Marketing directors

- Key executives from various key companies and organizations in the regenerative agriculture market

This research report categorizes the regenerative agriculture market based on practice, application, and region.

|

Aspect |

Details |

|

By Practice |

|

|

By Application |

|

|

By Region |

|

Recent Developments in Regenerative Agriculture Market (Revenue, USD Billion, 2022- 2027)

- In October 2022, Nestle SA (Switzerland) launched NESCAFÉ Plan 2030 to help drive regenerative agriculture, reduce greenhouse gas emissions and improve farmers' livelihoods. The brand is investing over one billion Swiss francs by 2030 in the NESCAFÉ Plan 2030. This investment builds on the existing NESCAFÉ Plan as the brand expands its sustainability work. It is supported by Nestlé's regenerative agriculture financing following the Group's commitment to accelerate the transition to a regenerative food system and ambition to achieve zero net greenhouse gas emissions.

- In June 2022, General Mills (US) partnered up with Regrow Agriculture (Australia) to monitor agricultural practices and their environmental impacts across 175 million acres of farmland in North America, Latin America, and Europe. Regrow Agriculture is also supporting General Mills’ commitment towards regenerative agriculture on 1 million acres of farmland by 2030.

- In February 2022, Indigo AG, Inc. (US) announced a partnership with Landus Cooperative (US) to develop Market+ Merchandise that helps streamline grain merchandising. This would help the company to strengthen its position in the market.

Frequently Asked Questions (FAQ):

How big is the regenerative agriculture market?

At a CAGR of 14.0% from 2022 to 2027, the global regenerative agriculture market is estimated to be worth $8.7 billion in 2022 and $16.8 billion by the end of 2027.

Which players are involved in the regenerative agriculture market?

Nestle SA (Switzerland), Danone SA (France), General Mills, Inc (US), Cargill Incorporated (US), Unilever PLC (United Kingdom), Grounded (South Africa), Soil Capital Belgium SPRL (Belgium), Indigo Ag, Inc (US), and Serenity Kids (US).

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for the regenerative agriculture market?

On request, We will provide details on market size, key players, growth rate of this industry in the Oceania region. Also, you can let us know if there are any other countries of your interest.

What is the future growth potential of regenerative agriculture market?

The regenerative agriculture market holds considerable promise for substantial growth in the future, driven by a convergence of factors addressing pressing environmental and agricultural challenges. With mounting concerns over sustainability and climate change, there's a growing recognition of the need for agricultural practices that prioritize soil health, biodiversity, and carbon sequestration. Regenerative agriculture offers a holistic approach to farming that not only improves soil quality and resilience but also mitigates climate impacts by sequestering carbon. As consumers increasingly demand sustainably produced food and fiber, and policymakers enact measures to support environmentally friendly practices, the adoption of regenerative agriculture is expected to accelerate.

What are the types of regenerative agriculture?

Regenerative agriculture is an approach to farming and land management that aims to improve soil health, increase biodiversity, and enhance ecosystem resilience. While there are various practices and techniques involved in regenerative agriculture, here are the types commonly implemented: Cover Cropping, Rotational Grazing, Agroforestry.

What is regenerative agriculture?

Regenerative agriculture is a sustainable farming approach focused on improving soil health, enhancing biodiversity, and increasing ecosystem resilience while producing nutrient-dense food. It emphasizes practices such as cover cropping, minimal tillage, composting, and rotational grazing.

Why is regenerative agriculture important?

Regenerative agriculture is crucial because it helps combat climate change by sequestering carbon in the soil, improves water retention, reduces soil erosion, and enhances biodiversity. It also supports long-term farm productivity and food security.

What are the key market trends in regenerative agriculture?

Key trends include the adoption of advanced technologies such as precision farming, the use of natural fertilizers and bio-stimulants, and increased investment in regenerative farming practices by major agricultural companies.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 REGENERATIVE AGRICULTURE MARKET SEGMENTATION

1.3.1 GEOGRAPHIC SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNITS CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2021

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

FIGURE 3 EXPERT INSIGHTS

2.1.2.2 Breakdown of primary interviews

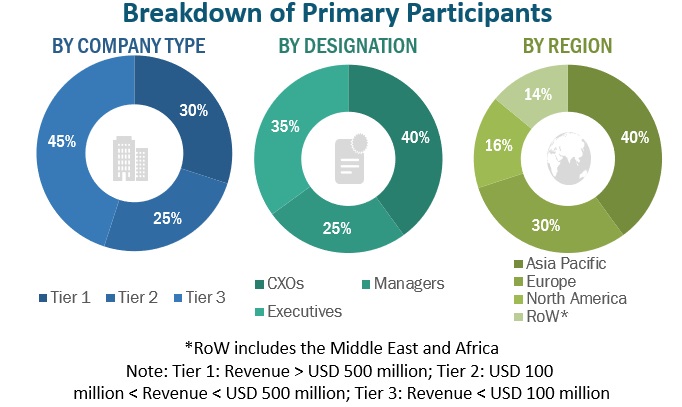

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY VALUE CHAIN, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 REGENERATIVE AGRICULTURE MARKET SIZE ESTIMATION: SUPPLY SIDE

FIGURE 6 REGENERATIVE AGRICULTURE MARKET SIZE ESTIMATION: DEMAND SIDE

2.2.1 BOTTOM-UP APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 GROWTH RATE FORECAST ASSUMPTION

2.4 DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.5 STUDY ASSUMPTIONS

2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 45)

TABLE 2 REGENERATIVE AGRICULTURE MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 10 REGENERATIVE AGRICULTURE MARKET, BY PRACTICE, 2022 VS. 2027 (USD MILLION)

FIGURE 11 REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 12 REGENERATIVE AGRICULTURE MARKET SHARE AND GROWTH RATE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN REGENERATIVE AGRICULTURE MARKET

FIGURE 13 INCREASING DEMAND FOR SUSTAINABLY SOURCED FOOD & BEVERAGE PRODUCTS TO PROPEL MARKET

4.2 ASIA PACIFIC: REGENERATIVE AGRICULTURE MARKET, BY PRACTICE AND COUNTRY, 2021

FIGURE 14 AGROFORESTRY AND CHINA ACCOUNTED FOR LARGEST SHARES IN ASIA PACIFIC IN 2021

4.3 REGENERATIVE AGRICULTURE MARKET, BY PRACTICE

FIGURE 15 AGROFORESTRY TO DOMINATE MARKET DURING FORECAST PERIOD

4.4 REGENERATIVE AGRICULTURE MARKET, BY APPLICATION AND REGION

FIGURE 16 SOIL AND CROP MANAGEMENT AND NORTH AMERICA TO DOMINATE DURING FORECAST PERIOD

4.5 REGENERATIVE AGRICULTURE MARKET, BY APPLICATION

FIGURE 17 SOIL AND CROP MANAGEMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.6 REGENERATIVE AGRICULTURE MARKET SHARE, BY COUNTRY, 2021

FIGURE 18 US TO DOMINATE GLOBAL MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 INCREASING SUPPORT FROM GOVERNMENTS, ORGANIZATIONS, AND FARMER WELFARE ASSOCIATIONS TO DRIVE MARKET

5.2.1 DRIVERS

5.2.1.1 Increased farm profitability and crop yield in long run

5.2.1.2 Increasing support from governments, organizations, and farmer welfare associations

5.2.1.3 Rising demand for organically-produced and sustainably-sourced food & beverage products

TABLE 3 US ORGANIC FOOD VS TOTAL FOOD SALES, GROWTH, AND PENETRATION, 2015−2019

5.2.2 RESTRAINTS

5.2.2.1 Lack of awareness among farmers about technical practices and benefits of regenerative agriculture

5.2.3 OPPORTUNITIES

5.2.3.1 Increased R&D around use of biologicals for carbon sequestration

5.2.3.2 Rise in use of technology to support regenerative agricultural practices

5.2.3.3 Growing investments and support from various companies

5.2.4 CHALLENGES

5.2.4.1 Red tape for obtaining certificates in carbon credit program

5.2.4.2 Value chain and marketing challenges for regenerative agricultural products

6 INDUSTRY TRENDS (Page No. - 63)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS

6.2.1 ADOPTION OF REGENERATIVE AGRICULTURE BY FARMERS

6.2.2 TRAINING, ADVISORY, FINANCIAL SUPPORT, AND REWARDS FOR FARMERS

6.2.3 PROCUREMENT OF REGENERATIVE AGRICULTURAL PRODUCE

6.2.4 PROCESSING

6.2.5 MARKETING AND RETAILING OF REGENERATIVE AGRICULTURE-BASED PRODUCTS

6.3 PRICING ANALYSIS

FIGURE 21 BREAK-EVEN ANALYSIS OF REGENERATIVE FARMS

6.4 ECOSYSTEM ANALYSIS

6.4.1 REGENERATIVE AGRICULTURE MARKET MAP

TABLE 4 REGENERATIVE AGRICULTURE MARKET ECOSYSTEM

6.5 TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 22 REVENUE SHIFT FOR REGENERATIVE AGRICULTURE MARKET

6.6 TECHNOLOGY ANALYSIS

6.7 PATENT ANALYSIS

FIGURE 23 PATENTS GRANTED FOR REGENERATIVE AGRICULTURE MARKET, 2011–2021

FIGURE 24 REGIONAL ANALYSIS OF PATENTS GRANTED, 2011–2021

TABLE 5 KEY PATENTS PERTAINING TO REGENERATIVE AGRICULTURE MARKET, 2011–2022

6.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 REGENERATIVE AGRICULTURE MARKET: PORTER’S FIVE FORCES ANALYSIS

6.8.1 DEGREE OF COMPETITION

6.8.2 BARGAINING POWER OF SUPPLIERS

6.8.3 BARGAINING POWER OF BUYERS

6.8.4 THREAT OF SUBSTITUTES

6.8.5 THREAT OF NEW ENTRANTS

6.9 CASE STUDIES

6.9.1 SOIL CAPITAL LAUNCHES CARBON REMUNERATION

6.9.2 PIVOT BIO PROVIDES NITROGEN-CREATING MICROBES

6.10 KEY CONFERENCES AND EVENTS IN 2022−2023

TABLE 7 DETAILED LIST OF CONFERENCES AND EVENTS, 2022–2023

7 KEY REGULATIONS FOR REGENERATIVE AGRICULTURE (Page No. - 78)

7.1 NORTH AMERICA

7.1.1 CANADA

7.1.2 US

7.2 EUROPE

7.2.1 GERMANY

7.2.2 UK

7.3 ASIA PACIFIC

7.3.1 CHINA

7.3.2 INDIA

7.3.3 AUSTRALIA AND NEW ZEALAND

7.4 TARIFF AND REGULATORY LANDSCAPE

7.4.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

8 REGENERATIVE AGRICULTURE MARKET, BY PRACTICE (Page No. - 85)

8.1 INTRODUCTION

FIGURE 25 AGROFORESTRY SEGMENT TO HOLD HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 11 REGENERATIVE AGRICULTURE MARKET, BY PRACTICE, 2019–2021 (USD MILLION)

TABLE 12 REGENERATIVE AGRICULTURE MARKET, BY PRACTICE, 2022–2027 (USD MILLION)

8.2 AQUACULTURE

8.2.1 REGENERATIVE AQUACULTURE TO PRODUCE PROTEIN ON LARGE SCALE WITH MINIMUM INPUT COST

TABLE 13 AQUACULTURE: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 14 AQUACULTURE: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 AGROECOLOGY

8.3.1 ADOPTION OF AGROECOLOGY BY FARMERS TO PROMOTE USE OF SUSTAINABLE RESOURCES FOR CROP PRODUCTION

TABLE 15 AGROECOLOGY: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 16 AGROECOLOGY: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 AGROFORESTRY

8.4.1 INCREASING ADOPTION OF AGROFORESTRY BY VARIOUS COMMUNITIES TO SUPPORT LIVELIHOOD

TABLE 17 AGROFORESTRY: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 18 AGROFORESTRY: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 BIO CHAR & TERRA PRETA

8.5.1 ENCOURAGEMENT BY GOVERNMENTS AND AGRO-WELFARE ORGANIZATIONS TO HELP IN CARBON SEQUESTRATION

TABLE 19 BIOCHAR & TERRA PRETA: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 20 BIOCHAR & TERRA PRETA: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 HOLISTICALLY MANAGED GRAZING

8.6.1 HOLISTICALLY MANAGED GRAZING TO INCREASE MICROBIAL ACTIVITY IN SOIL

TABLE 21 HOLISTICALLY MANAGED GRAZING: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 22 HOLISTICALLY MANAGED GRAZING: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2022–2027 (USD MILLION)

8.7 NO-TILL & PASTURE CROPPING

8.7.1 NO-TILL & PASTURE CROPPING TO HELP IN CARBON SEQUESTRATION

TABLE 23 NO-TILL & PASTURE CROPPING: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 24 NO-TILL & PASTURE CROPPING: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2022–2027 (USD MILLION)

8.8 SILVOPASTURE

8.8.1 ECONOMIC BENEFITS OF GROWING TREES AND RAISING LIVESTOCK WITH NATURAL INPUTS TO DRIVE MARKET

TABLE 25 SILVOPASTURE: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 26 SILVOPASTURE: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2022–2027 (USD MILLION)

8.9 OTHER PRACTICES

8.9.1 COVER CROPS TO HELP IN CARBON SEQUESTRATION

TABLE 27 OTHER PRACTICES: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 28 OTHER PRACTICES: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2022–2027 (USD MILLION)

9 REGENERATIVE AGRICULTURE MARKET, BY APPLICATION (Page No. - 101)

9.1 INTRODUCTION

FIGURE 26 BIODIVERSITY SEGMENT TO HOLD HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 29 REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 30 REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 SOIL AND CROP MANAGEMENT

TABLE 31 SOIL AND CROP MANAGEMENT: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 32 SOIL AND CROP MANAGEMENT: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 33 SOIL AND CROP MANAGEMENT: REGENERATIVE AGRICULTURE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 34 SOIL AND CROP MANAGEMENT: REGENERATIVE AGRICULTURE MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.2.1 NITROGEN FIXATION

9.2.1.1 Reduction in synthetic nitrogen fertilizer usage to propel segment

9.2.2 WATER RETENTION

9.2.2.1 Improving soil quality and making crops resilient towards draught to drive segment

9.2.3 NUTRIENT CYCLE

9.2.3.1 Nutrient cycling to help in efficient utilization of organic matter

9.3 OPERATIONS MANAGEMENT

TABLE 35 OPERATIONS MANAGEMENT: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 36 OPERATIONS MANAGEMENT: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 37 OPERATIONS MANAGEMENT: REGENERATIVE AGRICULTURE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 38 OPERATIONS MANAGEMENT: REGENERATIVE AGRICULTURE MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.3.1 CARBON SEQUESTRATION

9.3.1.1 Increasing focus on carbon sequestration by different governments to reduce carbon emission

9.3.2 ECOSYSTEM SERVICES

9.3.2.1 Increasing efforts by FAO to safeguard ecosystem support and food chain

9.4 BIODIVERSITY

9.4.1 REDUCING FINANCIAL RISK BY INCREASING BIODIVERSITY TO AUGMENT MARKET

TABLE 39 BIODIVERSITY: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 40 BIODIVERSITY: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 OTHER APPLICATIONS

9.5.1 SUSTAINABLE INCOME BY FARMERS THROUGH ADOPTION OF REGENERATIVE PRACTICES TO PROPEL MARKET

TABLE 41 OTHER APPLICATIONS: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 42 OTHER APPLICATIONS: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2022–2027 (USD MILLION)

10 REGENERATIVE AGRICULTURE MARKET, BY REGION (Page No. - 112)

10.1 INTRODUCTION

FIGURE 27 REGENERATIVE AGRICULTURE MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

FIGURE 28 GEOGRAPHIC SNAPSHOT: REGENERATIVE AGRICULTURE MARKET

TABLE 43 REGENERATIVE AGRICULTURE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 44 REGENERATIVE AGRICULTURE MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA: REGENERATIVE AGRICULTURE MARKET SNAPSHOT

TABLE 45 NORTH AMERICA: REGENERATIVE AGRICULTURE MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 46 NORTH AMERICA: REGENERATIVE AGRICULTURE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 47 NORTH AMERICA: REGENERATIVE AGRICULTURE MARKET, BY PRACTICE, 2019–2021 (USD MILLION)

TABLE 48 NORTH AMERICA: REGENERATIVE AGRICULTURE MARKET, BY PRACTICE, 2022–2027 (USD MILLION)

TABLE 49 NORTH AMERICA: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 50 NORTH AMERICA: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 51 NORTH AMERICA: REGENERATIVE AGRICULTURE MARKET FOR SOIL AND CROP MANAGEMENT, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 52 NORTH AMERICA: REGENERATIVE AGRICULTURE MARKET FOR SOIL AND CROP MANAGEMENT, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 53 NORTH AMERICA: REGENERATIVE AGRICULTURE MARKET FOR OPERATIONS MANAGEMENT, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 54 NORTH AMERICA: REGENERATIVE AGRICULTURE MARKET FOR OPERATIONS MANAGEMENT, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 55 NORTH AMERICA: REGENERATIVE AGRICULTURE MARKET FOR BIODIVERSITY, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 56 NORTH AMERICA: REGENERATIVE AGRICULTURE MARKET FOR BIODIVERSITY, BY COUNTRY 2022–2027 (USD MILLION)

TABLE 57 NORTH AMERICA: REGENERATIVE AGRICULTURE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 58 NORTH AMERICA: REGENERATIVE AGRICULTURE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Increased environmental concerns among consumers to drive market

TABLE 59 US: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 60 US: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Federal government encouraging adoption of regenerative farming practices to augment market

TABLE 61 CANADA: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 62 CANADA: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Increasing focus on restoring biodiversity on farmlands to propel market

TABLE 63 MEXICO: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 64 MEXICO: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3 EUROPE

TABLE 65 EUROPE: REGENERATIVE AGRICULTURE MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 66 EUROPE: REGENERATIVE AGRICULTURE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 67 EUROPE: REGENERATIVE AGRICULTURE MARKET, BY PRACTICE, 2019–2021 (USD MILLION)

TABLE 68 EUROPE: REGENERATIVE AGRICULTURE MARKET, BY PRACTICE, 2022–2027 (USD MILLION)

TABLE 69 EUROPE: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 70 EUROPE: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 71 EUROPE: REGENERATIVE AGRICULTURE MARKET FOR SOIL AND CROP MANAGEMENT, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 72 EUROPE: REGENERATIVE AGRICULTURE MARKET FOR SOIL AND CROP MANAGEMENT, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 73 EUROPE: REGENERATIVE AGRICULTURE MARKET FOR OPERATIONS MANAGEMENT, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 74 EUROPE: REGENERATIVE AGRICULTURE MARKET FOR OPERATIONS MANAGEMENT, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 75 EUROPE: REGENERATIVE AGRICULTURE MARKET FOR BIODIVERSITY, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 76 EUROPE: REGENERATIVE AGRICULTURE MARKET FOR BIODIVERSITY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 77 EUROPE: REGENERATIVE AGRICULTURE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 78 EUROPE: REGENERATIVE AGRICULTURE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Efforts by government to achieve self-sufficiency in agro-inputs and lower use of synthetic fertilizers to aid market

TABLE 79 GERMANY: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 80 GERMANY: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 Constant degradation of soil and farmland to support market

TABLE 81 UK: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 82 UK: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Decline in agricultural productivity due to heavy usage of synthetic fertilizers to restrain market

TABLE 83 FRANCE: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 84 FRANCE: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.4 SPAIN

10.3.4.1 Increased resistance to soil erosion and adverse climatic conditions offered by regenerative practices to fuel market

TABLE 85 SPAIN: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 86 SPAIN: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.5 REST OF EUROPE

10.3.5.1 Efforts taken by various organizations to reduce emissions from agriculture industry to aid market

TABLE 87 REST OF EUROPE: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 88 REST OF EUROPE: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 30 ASIA PACIFIC: REGENERATIVE AGRICULTURE MARKET SNAPSHOT

TABLE 89 ASIA PACIFIC: REGENERATIVE AGRICULTURE MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 90 ASIA PACIFIC: REGENERATIVE AGRICULTURE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 91 ASIA PACIFIC: REGENERATIVE AGRICULTURE MARKET, BY PRACTICE, 2019–2021 (USD MILLION)

TABLE 92 ASIA PACIFIC: REGENERATIVE AGRICULTURE MARKET, BY PRACTICE, 2022–2027 (USD MILLION)

TABLE 93 ASIA PACIFIC: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 94 ASIA PACIFIC: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 95 ASIA PACIFIC: REGENERATIVE AGRICULTURE MARKET FOR SOIL AND CROP MANAGEMENT, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 96 ASIA PACIFIC: REGENERATIVE AGRICULTURE MARKET FOR SOIL AND CROP MANAGEMENT, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 97 ASIA PACIFIC: REGENERATIVE AGRICULTURE MARKET FOR OPERATIONS MANAGEMENT, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 98 ASIA PACIFIC: REGENERATIVE AGRICULTURE MARKET FOR OPERATIONS MANAGEMENT, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 99 ASIA PACIFIC: REGENERATIVE AGRICULTURE MARKET FOR BIODIVERSITY, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 100 ASIA PACIFIC: REGENERATIVE AGRICULTURE MARKET FOR BIODIVERSITY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 101 ASIA PACIFIC: REGENERATIVE AGRICULTURE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 102 ASIA PACIFIC: REGENERATIVE AGRICULTURE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Support by government to reverse soil degradation and improve farm productivity to drive market

TABLE 103 CHINA: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 104 CHINA: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Government efforts to reduce emissions from agricultural sector to augment market

TABLE 105 JAPAN: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 106 JAPAN: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Increased adoption of regenerative farming techniques by farmers for higher income to aid market

TABLE 107 INDIA: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 108 INDIA: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.4 AUSTRALIA AND NEW ZEALAND

10.4.4.1 Increased demand for sustainably sourced food products to drive market

TABLE 109 AUSTRALIA AND NEW ZEALAND: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 110 AUSTRALIA AND NEW ZEALAND: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

10.4.5.1 Increased focus on agroforestry to reduce loss of income due to dependency on single crop

TABLE 111 REST OF ASIA PACIFIC: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 112 REST OF ASIA PACIFIC: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.5 SOUTH AMERICA

TABLE 113 SOUTH AMERICA: REGENERATIVE AGRICULTURE MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 114 SOUTH AMERICA: REGENERATIVE AGRICULTURE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 115 SOUTH AMERICA: REGENERATIVE AGRICULTURE MARKET, BY PRACTICE, 2019–2021 (USD MILLION)

TABLE 116 SOUTH AMERICA: REGENERATIVE AGRICULTURE MARKET, BY PRACTICE, 2022–2027 (USD MILLION)

TABLE 117 SOUTH AMERICA: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 118 SOUTH AMERICA: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 119 SOUTH AMERICA: REGENERATIVE AGRICULTURE MARKET FOR SOIL AND CROP MANAGEMENT, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 120 SOUTH AMERICA: REGENERATIVE AGRICULTURE MARKET FOR SOIL AND CROP MANAGEMENT, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 121 SOUTH AMERICA: REGENERATIVE AGRICULTURE MARKET FOR OPERATIONS MANAGEMENT, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 122 SOUTH AMERICA: REGENERATIVE AGRICULTURE MARKET FOR OPERATIONS MANAGEMENT, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 123 SOUTH AMERICA: REGENERATIVE AGRICULTURE MARKET FOR BIODIVERSITY, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 124 SOUTH AMERICA: REGENERATIVE AGRICULTURE MARKET FOR BIODIVERSITY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 125 SOUTH AMERICA: REGENERATIVE AGRICULTURE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 126 SOUTH AMERICA: REGENERATIVE AGRICULTURE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 Stringent rules and regulations promoting regenerative agricultural practices to boost market

TABLE 127 BRAZIL: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 128 BRAZIL: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.5.2 ARGENTINA

10.5.2.1 Increased focus on lowering emissions from livestock farming to support market

TABLE 129 ARGENTINA: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 130 ARGENTINA: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.5.3 REST OF SOUTH AMERICA

10.5.3.1 Initiatives by various organizations for regenerative agricultural practices to drive market

TABLE 131 REST OF SOUTH AMERICA: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 132 REST OF SOUTH AMERICA: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.6 REST OF THE WORLD

TABLE 133 REST OF THE WORLD: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 134 REST OF THE WORLD: REGENERATIVE AGRICULTURE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 135 REST OF THE WORLD: REGENERATIVE AGRICULTURE MARKET, BY PRACTICE, 2019–2021 (USD MILLION)

TABLE 136 REST OF THE WORLD: REGENERATIVE AGRICULTURE MARKET, BY PRACTICE, 2022–2027 (USD MILLION)

TABLE 137 REST OF THE WORLD: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 138 REST OF THE WORLD: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 139 REST OF THE WORLD: REGENERATIVE AGRICULTURE MARKET FOR SOIL AND CROP MANAGEMENT, BY REGION, 2019–2021 (USD MILLION)

TABLE 140 REST OF THE WORLD: REGENERATIVE AGRICULTURE MARKET FOR SOIL AND CROP MANAGEMENT, BY REGION, 2022–2027 (USD MILLION)

TABLE 141 REST OF THE WORLD: REGENERATIVE AGRICULTURE MARKET FOR OPERATIONS MANAGEMENT, BY REGION, 2019–2021 (USD MILLION)

TABLE 142 REST OF THE WORLD: REGENERATIVE AGRICULTURE MARKET FOR OPERATIONS MANAGEMENT, BY REGION, 2022–2027 (USD MILLION)

TABLE 143 REST OF THE WORLD: REGENERATIVE AGRICULTURE MARKET FOR BIODIVERSITY, BY REGION, 2019–2021 (USD MILLION)

TABLE 144 REST OF THE WORLD: REGENERATIVE AGRICULTURE MARKET FOR BIODIVERSITY, BY REGION, 2022–2027 (USD MILLION)

TABLE 145 REST OF THE WORLD: REGENERATIVE AGRICULTURE MARKET FOR OTHER APPLICATIONS, BY REGION, 2019–2021 (USD MILLION)

TABLE 146 REST OF THE WORLD: REGENERATIVE AGRICULTURE MARKET FOR OTHER APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

10.6.1 MIDDLE EAST

10.6.1.1 Increasing adoption of regenerative farming by small farmers to drive market

TABLE 147 MIDDLE EAST: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 148 MIDDLE EAST: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.6.2 AFRICA

10.6.2.1 Growing adoption of regenerative practices by farmers to increase farm profitability

TABLE 149 AFRICA: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 150 AFRICA: REGENERATIVE AGRICULTURE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 162)

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS, 2O21

FIGURE 31 REGENERATIVE AGRICULTURE MARKET SHARE, 2021

11.3 STRATEGIES ADOPTED BY KEY PLAYERS

11.4 REVENUE SHARE ANALYSIS OF KEY PLAYERS

FIGURE 32 TOTAL REVENUE ANALYSIS OF KEY PLAYERS, 2019–2022 (USD BILLION)

11.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 33 REGENERATIVE AGRICULTURE MARKET: COMPANY EVALUATION QUADRANT, 2020 (KEY PLAYERS)

11.6 COMPANY FOOTPRINT

TABLE 151 KEY PLAYERS: COMPANY FOOTPRINT, BY APPLICATION

TABLE 152 KEY PLAYERS: COMPANY FOOTPRINT, BY REGION

TABLE 153 KEY PLAYERS: COMPANY FOOTPRINT, OVERALL FOOTPRINT

11.7 START-UPS/SMES EVALUATION QUADRANT (OTHER PLAYERS)

11.7.1 PROGRESSIVE COMPANIES

11.7.2 STARTING BLOCKS

11.7.3 RESPONSIVE COMPANIES

11.7.4 DYNAMIC COMPANIES

TABLE 154 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

FIGURE 34 REGENERATIVE AGRICULTURE MARKET: COMPANY EVALUATION QUADRANT, 2020 (START-UPS/SMES)

11.8 COMPANY FOOTPRINT

TABLE 155 OTHER PLAYERS: COMPANY FOOTPRINT, BY APPLICATION

TABLE 156 OTHER PLAYERS: COMPANY FOOTPRINT, BY REGION

TABLE 157 OTHER PLAYERS: COMPANY FOOTPRINT, OVERALL FOOTPRINT

11.9 COMPETITIVE SCENARIO

11.9.1 PRODUCT LAUNCHES

TABLE 158 REGENERATIVE AGRICULTURE MARKET: PRODUCT LAUNCHES, 2019–2022

11.9.2 DEALS

TABLE 159 REGENERATIVE AGRICULTURE MARKET: DEALS, 2019–2022

11.9.3 OTHERS

TABLE 160 REGENERATIVE AGRICULTURE MARKET: EXPANSIONS, 2019 - 2022

12 COMPANY PROFILES (Page No. - 181)

(Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)*

12.1 PLANS, PROGRAMS, AND PROJECTS-BASED COMPANIES

12.1.1 NESTLE SA

TABLE 161 NESTLE SA: COMPANY OVERVIEW

FIGURE 35 NESTLE S.A.: COMPANY SNAPSHOT

TABLE 162 NESTLE SA: OTHERS

12.1.2 DANONE S.A.

TABLE 163 DANONE S.A.: COMPANY OVERVIEW

FIGURE 36 DANONE S.A.: COMPANY SNAPSHOT

TABLE 164 DANONE S.A.: PRODUCT LAUNCHES

12.1.3 GENERAL MILLS, INC.

TABLE 165 GENERAL MILLS, INC.: COMPANY OVERVIEW

FIGURE 37 GENERAL MILLS, INC.: COMPANY SNAPSHOT

TABLE 166 GENERAL MILLS, INC.: DEALS

12.1.4 CARGILL INCORPORATED

TABLE 167 CARGILL INCORPORATED: COMPANY OVERVIEW

FIGURE 38 CARGILL INCORPORATED: COMPANY SNAPSHOT

TABLE 168 CARGILL INCORPORATED: PRODUCT LAUNCHES

TABLE 169 CARGILL INCORPORATED: DEALS

12.1.5 UNILEVER PLC

TABLE 170 UNILEVER PLC: COMPANY OVERVIEW

FIGURE 39 UNILEVER PLC: COMPANY SNAPSHOT

TABLE 171 UNILEVER PLC: PRODUCT LAUNCHES

TABLE 172 UNILEVER PLC: DEALS

12.1.6 GROUNDED

TABLE 173 GROUNDED: COMPANY OVERVIEW

TABLE 174 GROUNDED: OTHERS

12.1.7 SOIL CAPITAL BELGIUM SPRL

TABLE 175 SOIL CAPITAL BELGIUM SPRL: COMPANY OVERVIEW

TABLE 176 SOIL CAPITAL BELGIUM SPRL: OTHERS

12.1.8 LA DELIA VERDE

TABLE 177 LA DELIA VERDE: COMPANY OVERVIEW

TABLE 178 LA DELIA VERDE: PRODUCTS OFFERED

12.1.9 INDIGO AG, INC.

TABLE 179 INDIGO AG, INC.: COMPANY OVERVIEW

TABLE 180 INDIGO AG, INC.: PRODUCT LAUNCHES

TABLE 181 INDIGO AG, INC.: DEALS

12.1.10 RENATURE

TABLE 182 RENATURE: COMPANY OVERVIEW

12.1.11 PIVOT BIO

TABLE 183 PIVOT BIO: COMPANY OVERVIEW

12.1.12 AGREENA APS

12.1.13 LOAM BIO PTY LTD.

12.1.14 ROOTS OF NATURE

12.1.15 AMIHA

12.1.16 ARANYA

12.2 PRODUCT-BASED COMPANIES

12.2.1 SERENITY KIDS

TABLE 184 SERENITY KIDS: COMPANY OVERVIEW

TABLE 185 SERENITY KIDS: PRODUCTS OFFERED

12.2.2 BLUEBIRD GRAIN FARMS

TABLE 186 BLUEBIRD GRAIN FARMS: COMPANY OVERVIEW

TABLE 187 BLUEBIRD GRAIN FARMS: PRODUCT LAUNCHES

12.2.3 AKUA

TABLE 188 AKUA: COMPANY OVERVIEW

TABLE 189 AKUA: PRODUCTS OFFERED

12.2.4 ALTER ECO

TABLE 190 ALTER ECO: COMPANY OVERVIEW

TABLE 191 ALTER ECO: OTHERS

*Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS (Page No. - 220)

13.1 INTRODUCTION

TABLE 192 ADJACENT MARKETS TO REGENERATIVE AGRICULTURE MARKET

13.2 LIMITATIONS

13.3 SOIL AMENDMENTS MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

TABLE 193 SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 194 SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021–2027 (USD MILLION)

13.4 BIOFERTILIZERS MARKET

13.4.1 MARKET DEFINITION

13.4.2 MARKET OVERVIEW

TABLE 195 BIOFERTILIZERS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 196 BIOFERTILIZERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.5 AGRICULTURAL BIOLOGICALS MARKET

13.5.1 MARKET DEFINITION

13.5.2 MARKET OVERVIEW

TABLE 197 AGRICULTURAL BIOLOGICALS MARKET SIZE, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 198 AGRICULTURAL BIOLOGICALS MARKET SIZE, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

14 APPENDIX (Page No. - 225)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study on regenerative agriculture market size comprised of four primary activities:

- exhaustive secondary research to gather data on the market, peer market, and parent market.

- primary research with industry experts to validate findings, assumptions, and sizing across the value chain

- utilization of top-down and bottom-up approaches to estimate the entire market size

- market breakdown and data triangulation to determine the sizes of segments and sub-segments within the market.

Regenerative Agriculture Market Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Regenerative Agriculture Market Primary Research

The market comprises several stakeholders in the supply chain, including food & beverage manufacturers, suppliers, farmers/growers, importers and exporters, and intermediary suppliers such as traders and distributors of regenerative agriculture products. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply side include suppliers, farmers/growers, importers, and exporters. The primary sources from the demand side include players manufacturing food and beverage products, intermediary suppliers such as traders, and distributors of regenerative agriculture products.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Regenerative Agriculture Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the regenerative agriculture market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the regenerative agriculture market, in terms of value, were determined through primary and secondary research.

- All percentage shares splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points matches, the data is assumed to be correct.

Regenerative Agriculture Market Report Objectives

- To describe and forecast the regenerative agriculture market in terms of practice, application, and region

- To describe and forecast the regenerative agriculture market, in terms of value, by region–North America, Europe, Asia Pacific, South America, and the rest of the world—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the regenerative agriculture market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the regenerative agriculture market

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

- To analyze strategic approaches, such as expansions & investments, product launches & approvals, mergers & acquisitions, and agreements in the regenerative agriculture market

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe regenerative agriculture market into Greece and Eastern European countries

- Further breakdown of the Rest of Asia Pacific regenerative agriculture market into the Philippines, Singapore, Thailand, and Papua New Guinea.

- Further breakdown of other countries in the Rest of the World regenerative agriculture market by key countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Regenerative Agriculture Market