Soil Amendments Market by Type (Organic, Inorganic), Soil Type (Sand, Loam, Clay, Slit), Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables), Form (Dry and Liquid), and Region (North America, Europe, APAC, RoW) - Global Forecast to 2027

Soil Amendments Market Analysis and Report Summary, 2027

The soil amendments market size is poised for tremendous growth, with a predicted value of USD 6.0 billion by 2027 and a CAGR of 11.0%. The global market was estimated at USD 3.6 billion in 2022, indicating a growing need for sustainable agricultural solutions and providing multiple chances for enterprises and stakeholders to innovate and have a positive effect.

With the right soil amendments, farmers can improve soil health and reduce the use of synthetic and conventional fertilizers, creating a more sustainable and environmentally conscious agricultural experience. This provides an opportunity for businesses and innovators to develop products and technologies that can help to address the growing need for eco-friendly farming practices.

The selection of soil amendments depends on the specific needs of the soil, such as its pH, nutrient levels, and physical structure. The growing market for soil amendments reflects the increasing awareness of the benefits of organic farming practices and sustainable agriculture, as well as the desire to reduce the environmental impact of traditional farming methods.By using soil amendments, farmers can help to improve soil health, reduce the use of synthetic and conventional fertilizers, and promote more sustainable and environmentally responsible agriculture. The growth of the market for soil amendments also represents an opportunity for businesses and innovators to develop new products and technologies that can help to address the growing need for sustainable and eco-friendly farming practices.

To know about the assumptions considered for the study, Request for Free Sample Report

Soil Amendments Market Dynamics

Drivers: Easier availability of humic substances as raw materials

Humic substances are widely distributed organic carbon-containing materials in terrestrial and aquatic environments. The availability of humic substances boosts the growth of the market. In terms of consumption of humic substances, Europe leads the market, followed by the Asia Pacific due to its easy and cheap availability in countries such as China and India. Asian countries account for a large agricultural area due to the greater availability of humic substances in this region.

Restraints: Supply of adulterated and low-quality products

The supply of counterfeit products is a major burning issue in the industry. The cost of production of spurious products is extremely low. Over the years, there has been an increase in incidents related to counterfeit products. Due to similar physical characteristics, farmers can not differentiate spurious organic soil amendments from the original ones. The chemical properties of both products are also identical. In the case of biofertilizers, poor microbial load, contaminated products, or improper strains are used to imitate the product, thus restraining the growth of the overall market.

Growth Opportunities: Strong growth in developing countries

The Asia Pacific is an important region in the global food chain, accounting for around 19% of global food and agriculture exports and 31% of total food and agriculture imports. The increasing population and the rise in disposable income are expected to help drive the demand for food & agriculture commodities and resources in the region. The rising population limited arable land, low farm yields, environmental and soil degradation, and infrastructure inadequacy lead to higher usage and implementation of soil conditioners.

Challenges: Lack of awareness among farmers

There is a lack of awareness among farmers regarding applying organic soil amendments, leading to low adoption rates. There is also a lack of training and knowledge about effectively handling soil amendments and organic fertilizers. Farmers prefer to use chemical fertilizers as they are readily available. Furthermore, there is a concentrated holding of companies offering various chemical fertilizers. In underdeveloped and developing nations, farmers are unaware of the basic nutrient requirements of the soil, which tends to be a challenge for the soil amendment market.

In 2021, Europe dominated the humic acid segment owing to the higher adoption of humic substances as soil amendment products

Humic acid performs a vital role in germination, microbial activity, chlorophyll synthesis, root vitality, and fertilizer retention and helps generate higher yields. The consumption of humic acid in Europe is majorly concentrated in Western countries. In terms of consumption of humic substances, Europe leads the market, followed by the Asia Pacific, due to its immense and cheap availability in countries such as China and India.

Ability to improve water infiltration and enhance acidic soils to drive the demand for gypsum as soil amendments

Gypsum is majorly used to remove excess sodium from the soil and add calcium to it. It is beneficial for clay soil in loosening the compact soil. Gypsum supports shifting the calcium and magnesium levels in soil and provides a readily available form of sulfate sulfur, an important secondary nutrient, which is advantageous to the crop as well as soil. Because of all these benefits, gypsum is widely used as soil amendments which are estimated to continue its higher demand in the years to come.

High demand for biofertilizers to drive the growth of the oilseeds & pulses segment

Oilseeds, like soybean, is widely utilized as feed in the different form of cakes and for producing renewable chemicals and biodiesel. It is one of the key factors enhancing soybean yield, raising the use of biofertilizers as soil amendments. Additionally, increasing demand for oilseed crops, specifically soybean, for application in the feed and food industries is one of the crucial elements that is predicted to drive the market growth of the oilseeds & pulses segment in the global market.

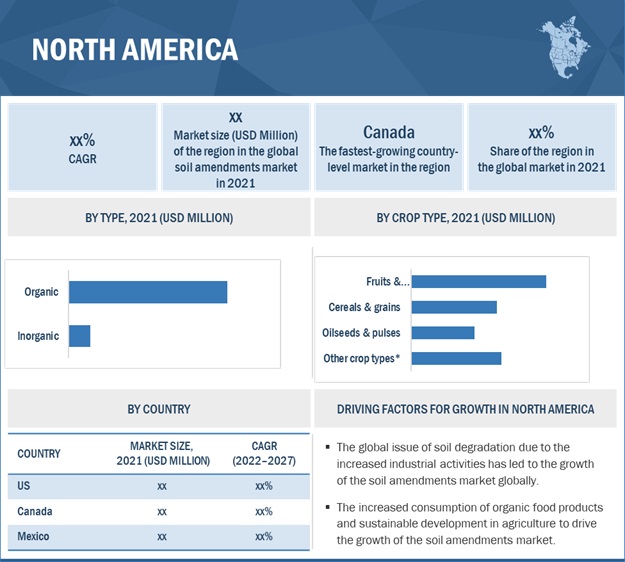

North America Soil Amendments Market Trends

To know about the assumptions considered for the study, download the pdf brochure

North America accounted for USD 912.1million in 2021, projected to reach USD 1,593.6 million by 2027, at a CAGR of 9.8 during the forecast period.

The US witnesses the presence of many mines, which are associated with hard rock mining, coal mining, smelting & refining sites, and construction & refining sites. Mines not only contribute to air pollution but also to land degradation and leave the soil less fertile and vulnerable to erosion. The abandoned mines are generally present in the forest areas, reducing the overall forest productivity and timber harvest potential. Some of these are also present in rural areas with rugged terrains and limited access.

Soil Amendments Market Key Players

The key players in this market include BASF SE (Germany), UPL Limited (India), FMC Corporation (US), Adama (Israel), Bayer (Germany), Novozymes (Denmark), Lallemand Inc (Canada), and T Stanes & Company, Evonik Industries (Germany), and Nufarm (Australia).

Scope of the Report

|

Report Metric |

Details |

|

Market magnitude in 2022 |

USD 3.6 billion |

|

Revenue estimate in 2027 |

USD 6.0 billion |

|

Growth rate |

CAGR of 11.0% |

|

Market size available for years |

2022-2027 |

|

Base year for estimation |

2021 |

|

Forecast period |

2022-2027 |

|

Quantitative units |

Value (USD Million) and Volume (Thousand Units) |

|

Report Coverage & Deliverables |

Revenue forecast, company ranking, driving factors, Competitive benchmarking, and analysis |

|

Segments covered |

Application, Region, Soil Type |

|

Regional Insight |

Europe, North America, South America, Asia Pacific |

|

Prominent firms featured |

BASF SE (Germany), UPL Limited (India), FMC Corporation (US), Adama (Israel), Bayer (Germany), Novozymes (Denmark), Lallemand Inc (Canada), and T Stanes & Company, Evonik Industries (Germany), and Nufarm (Australia)

|

|

Research coverage |

The report segments the soil amendments market on the basis of type, crop type, soil type, form, and region. In terms of insights, this report has focused on various levels of analyses - the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global soil amendments, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges. |

Target Audience:

- Fertilizer manufacturers, formulators, and blenders

- Agrochemical traders, suppliers, distributors, importers, and exporters

- Raw material suppliers and technology providers to soil amendment/soil conditioner manufacturers

- Agricultural co-operative societies

-

Fertilizer associations and industry bodies:

- Food and Agriculture Organization (FAO)

- International Fertilizer Industry Association (IFIA)

- International Fertilizer Association (IFA)

- European Consortium of the Organic-Based Fertilizer Industry (ECOFI)

-

Government agricultural departments and regulatory bodies:

- US Environmental Protection Agency (EPA)

- Canadian Food Inspection Agency (CFIA)

- US Department of Agriculture (USDA)

- European Food Safety Authority (EFSA)

This research report categorizes the soil amendments market based on soil type, crop type, form, and region.

|

Aspect |

Details |

|

By Type |

|

|

By Soil Type |

|

|

By Crop Type |

|

|

By Form |

|

|

By Region |

|

Recent Developments

- In May 2022, Evonik opened its new Applied Technology Center (ATC) in Sao Paulo, Brazil, including state-of-the-art laboratories and pilot plants. The company aims to expand local capabilities for producing biocompatible solutions.

- In March 2022, Haifa Group acquired Ecuador-based Horticoop Andina, a wholesaler specializing in marketing nutritional products for agriculture. The company aims to broaden its presence in Ecuador and the Latin market.

- In June 2021, UPL launched the NPP – Natural Plant Protection business unit comprising a natural and biologically derived agricultural inputs and technologies portfolio. NPP will act as a stand-alone brand, consolidating UPL’s existing biosolutions portfolio, a network of R&D laboratories, and facilities globally.

Frequently Asked Questions (FAQ):

What is the expected market size for the global soil amendments market in the coming years?

The soil amendments market is poised for significant expansion, with an expected value of USD 6.0 Billion by 2027 and a CAGR of 11.0%.

What is the estimated growth rate (CAGR) of the global soil amendments market for the next five years?

The global soil amendments market is set for significant growth, with a projected surge at a CAGR of 11.0% during 2022-2027.

What are the major revenue pockets in the soil amendments market currently?

North America accounted for USD 912.1million in 2021, projected to reach USD 1,593.6 million by 2027, at a CAGR of 9.8 during the forecast period.

What was the size of the global soil amendments market in 2022?

In 2022, the soil amendments market was valued at USD 3.6 billion, signaling a growing demand for sustainable solutions in agriculture and offering numerous opportunities for businesses and stakeholders to innovate and make a positive impact.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

FIGURE 2 REGIONS COVERED

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2021

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 7 MARKET FOR SOIL AMENDMENTS, BY CROP TYPE, 2022 VS. 2027

FIGURE 8 MARKET SIZE, BY TYPE, 2022 VS. 2027

FIGURE 9 MARKET FOR SOIL AMENDMENTS, BY FORM, 2021

FIGURE 10 SOIL AMENDMENTS MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 OVERVIEW OF THE MARKET

FIGURE 11 GROWING RISK OF SOIL DEGRADATION AND DESERTIFICATION OF LAND TO DRIVE THE GROWTH OF THE MARKET

4.2 SOIL AMENDMENTS MARKET, BY TYPE

FIGURE 12 ORGANIC SEGMENT OCCUPIED THE LARGEST SHARE IN THE SOIL AMENDMENT MARKET IN 2021

4.3 NORTH AMERICA: SOIL AMENDMENTS MARKET, BY CROP TYPE AND KEY COUNTRIES

FIGURE 13 UNITED STATES WAS THE MAJOR CONSUMER OF SOIL AMENDMENTS IN THE NORTH AMERICAN REGION, 2021

4.4 MARKET FOR SOIL AMENDMENTS, BY SOIL TYPE AND REGION

FIGURE 14 NORTH AMERICA HELD THE LARGEST MARKET SHARE FOR SILT IN 2021

4.5 MARKET FOR SOIL AMENDMENTS, BY KEY COUNTRY

FIGURE 15 GERMANY TO GROW AT THE HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 RISE IN ORGANIC FARM AREA

FIGURE 16 ORGANIC FARM AREA GROWTH TREND, BY KEY COUNTRY, 2017–2019 (THOUSAND HA)

5.2.2 DECLINE IN ARABLE LAND

FIGURE 17 ARABLE LAND AREA PER CAPITA, 1960–2050 (HA)

5.3 MARKET DYNAMICS

FIGURE 18 SOIL AMENDMENTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.3.1 DRIVERS

5.3.1.1 Easier availability of humic substances as raw materials

5.3.1.2 Strong market demand for organic food products and high-value crops

FIGURE 19 AREA HARVESTED UNDER FRUITS & VEGETABLES, 2013–2017 (MILLION HA)

5.3.1.3 Initiatives by government agencies to promote the use of organic amendments

5.3.1.4 Growing awareness about soil health management

5.3.2 RESTRAINTS

5.3.2.1 Supply of adulterated and low-quality products

5.3.2.2 Short shelf life of soil amendments

5.3.3 OPPORTUNITIES

5.3.3.1 Incorporation of soil amendments into fertilizer formulations

5.3.3.2 Strong growth in developing countries

5.3.4 CHALLENGES

5.3.4.1 Lack of awareness among farmers

5.4 PATENT ANALYSIS

FIGURE 20 NUMBER OF PATENTS APPROVED FOR HUMIC SUBSTANCES IN THE GLOBAL MARKET, 2017–2022

FIGURE 21 NUMBER OF PATENTS APPROVED FOR BIOFERTILIZER STRAINS IN THE GLOBAL MARKET, 2017–2022

FIGURE 22 NUMBER OF PATENTS APPROVED FOR SEAWEED IN THE GLOBAL MARKET, 2017–2022

FIGURE 23 NUMBER OF PATENTS APPROVED FOR POLYSACCHARIDE DERIVATIVES IN THE GLOBAL MARKET, 2017–2022

FIGURE 24 NUMBER OF PATENTS APPROVED FOR GYPSUM IN THE GLOBAL MARKET, 2017–2022

FIGURE 25 NUMBER OF PATENTS APPROVED FOR LIME IN THE GLOBAL MARKET, 2017–2022

TABLE 2 LIST OF IMPORTANT PATENTS FOR SOIL AMENDMENTS, 2017–2022

6 SOIL AMENDMENTS MARKET, BY TYPE (Page No. - 70)

6.1 INTRODUCTION

FIGURE 26 ORGANIC SEGMENT IS PROJECTED TO DOMINATE THE SOIL AMENDMENTS MARKET DURING THE FORECAST PERIOD

TABLE 3 SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 4 MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

6.2 ORGANIC

TABLE 5 ORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 6 ORGANIC SOIL AMENDMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 7 ORGANIC SOIL AMENDMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 8 ORGANIC SOIL AMENDMENTS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

6.2.1 BIOFERTILIZERS

6.2.1.1 Rise in soil pollution and soil degradation drives the market

TABLE 9 BIOFERTILIZERS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 10 BIOFERTILIZERS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

6.2.2 SEAWEED EXTRACTS

6.2.2.1 Increase in global seaweed production to drive the seaweed extract market for soil amendments

TABLE 11 SEAWEED EXTRACTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 12 SEAWEED EXTRACTS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

6.2.3 HUMIC ACID

6.2.3.1 Cheaper source of humic acid reduces the cost of soil amendments

TABLE 13 HUMIC ACID MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 14 HUMIC ACID MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

6.2.4 POLYSACCHARIDE DERIVATIVES

6.2.4.1 Europe dominated the polysaccharide derivatives segment

TABLE 15 POLYSACCHARIDE DERIVATIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 16 POLYSACCHARIDE DERIVATIVES MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

6.3 INORGANIC SOIL AMENDMENTS

TABLE 17 INORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 18 INORGANIC SOIL AMENDMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 19 INORGANIC SOIL AMENDMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 20 INORGANIC SOIL AMENDMENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

6.3.1 GYPSUM

6.3.1.1 Ability to improve water infiltration and enhance acidic soils to drive the demand for gypsum as soil amendments

TABLE 21 GYPSUM MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 22 GYPSUM MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

6.3.2 LIME

6.3.2.1 Lime helps to raise the pH of the soil

TABLE 23 LIME MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 24 LIME MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7 SOIL AMENDMENTS MARKET, BY CROP TYPE (Page No. - 82)

7.1 INTRODUCTION

FIGURE 27 SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 25 SOIL AMENDMENT MARKET SIZE, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 26 SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021–2027 (USD MILLION)

7.2 FRUITS & VEGETABLES

7.2.1 ORGANIC SOIL AMENDMENTS ARE HIGHLY PREFERRED FOR THE CULTIVATION OF FRUITS & VEGETABLES

TABLE 27 APPLICATION EFFECTS OF SOIL AMENDMENTS ON FRUIT & VEGETABLE CROPS

TABLE 28 SOIL AMENDMENTS MARKET SIZE IN FRUITS & VEGETABLES, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 SOIL AMENDMENT MARKET SIZE IN FRUITS & VEGETABLES, BY REGION, 2021–2027 (USD MILLION)

7.3 CEREALS & GRAINS

7.3.1 APPLICATION OF SOIL AMENDMENTS ON CEREAL CROPS TO IMPROVE THEIR PRODUCTIVITY BY ENHANCING SOIL PROPERTIES

TABLE 30 SOIL AMENDMENTS MARKET SIZE IN CEREALS & GRAINS, BY REGION, 2017–2020 (USD MILLION)

TABLE 31 SOIL AMENDMENT MARKET SIZE IN CEREALS & GRAINS, BY REGION, 2021–2027 (USD MILLION)

7.4 OILSEEDS & PULSES

7.4.1 HIGH DEMAND FOR BIOFERTILIZERS TO DRIVE THE GROWTH OF THE OILSEEDS & PULSES SEGMENT

TABLE 32 SOIL AMENDMENT MARKET SIZE IN OILSEEDS & PULSES, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 SOIL AMENDMENT MARKET SIZE IN OILSEEDS & PULSES, BY REGION, 2021–2027 (USD MILLION)

7.5 OTHER CROP TYPES

TABLE 34 SOIL AMENDMENT MARKET SIZE IN OTHER CROP TYPES, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 SOIL AMENDMENT MARKET SIZE IN OTHER CROP TYPES, BY REGION, 2021–2027 (USD MILLION)

8 SOIL AMENDMENTS MARKET, BY SOIL TYPE (Page No. - 90)

8.1 INTRODUCTION

FIGURE 28 SOIL AMENDMENTS MARKET SIZE, BY SOIL TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 36 MARKET SIZE FOR SOIL AMENDMENTS, BY SOIL TYPE, 2017–2020 (USD MILLION)

TABLE 37 MARKET SIZE FOR SOIL AMENDMENTS, BY SOIL TYPE, 2021–2027 (USD MILLION)

8.2 SAND

8.2.1 COMPOST ARE HIGHLY PREFERRED FOR APPLICATION IN SANDY SOILS

TABLE 38 SOIL AMENDMENT MARKET SIZE FOR SAND, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 SOIL AMENDMENT MARKET SIZE FOR SAND, BY REGION, 2021–2027 (USD MILLION)

8.3 CLAY

8.3.1 ORGANIC SOIL AMENDMENTS ARE USED ON CLAY SOILS TO LOOSEN THE SOIL TEXTURE AND IMPROVE DRAINAGE

TABLE 40 SOIL AMENDMENT MARKET SIZE FOR CLAY, BY REGION, 2017–2020 (USD MILLION)

TABLE 41 SOIL AMENDMENT MARKET SIZE FOR CLAY, BY REGION, 2021–2027 (USD MILLION)

8.4 SILT

8.4.1 APPLICATION OF LIMESTONE BALANCES THE PH OF SILT SOIL

TABLE 42 SOIL AMENDMENTS MARKET SIZE FOR SILT, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 SOIL AMENDMENT MARKET SIZE FOR SILT, BY REGION, 2021–2027 (USD MILLION)

8.5 LOAM

8.5.1 HIGH FERTILITY OF LOAMY SOIL TO INCREASE THE CULTIVATION OF HIGH-VALUE CROPS

TABLE 44 SOIL AMENDMENT MARKET SIZE FOR LOAM, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 SOIL AMENDMENT MARKET SIZE FOR LOAM, BY REGION, 2021–2027 (USD MILLION)

9 SOIL AMENDMENTS MARKET, BY FORM (Page No. - 97)

9.1 INTRODUCTION

FIGURE 29 SOIL AMENDMENT MARKET SIZE, BY FORM, 2022 VS. 2027 (USD BILLION)

TABLE 46 MARKET SIZE FOR SOIL AMENDMENTS, BY FORM, 2017–2020 (USD MILLION)

TABLE 47 MARKET SIZE FOR SOIL AMENDMENTS, BY FORM, 2021–2027 (USD MILLION)

9.2 LIQUID

9.2.1 HIGH EFFICACY RATE TO DRIVE THE DEMAND FOR LIQUID SOIL AMENDMENTS

TABLE 48 LIQUID SOIL AMENDMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 49 LIQUID SOIL AMENDMENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.3 DRY

9.3.1 IMPROVED SHELF LIFE TO PROVIDE BETTER OPPORTUNITIES FOR DRY SOIL AMENDMENTS

TABLE 50 DRY SOIL AMENDMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 51 DRY SOIL AMENDMENT MARKET, BY REGION, 2021–2027 (USD MILLION)

10 SOIL AMENDMENTS MARKET, BY REGION (Page No. - 102)

10.1 INTRODUCTION

FIGURE 30 US: MAJOR SOIL AMENDMENT MARKET IN 2021

TABLE 52 MARKET SIZE FOR SOIL AMENDMENTS, BY REGION, 2017–2020 (USD MILLION)

TABLE 53 MARKET SIZE FOR SOIL AMENDMENTS, BY REGION, 2021–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 31 NORTH AMERICA: SOIL AMENDMENTS MARKET SNAPSHOT, 2021

TABLE 54 NORTH AMERICA: MARKET SIZE FOR SOIL AMENDMENTS, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET SIZE FOR SOIL AMENDMENTS, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 58 NORTH AMERICA: ORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 59 NORTH AMERICA: ORGANIC SOIL AMENDMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 60 NORTH AMERICA: INORGANIC SOIL AMENDMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 61 NORTH AMERICA: INORGANIC SOIL AMENDMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 62 NORTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2021–2027 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET SIZE FOR SOIL AMENDMENTS, BY SOIL TYPE, 2017–2020 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET SIZE FOR SOIL AMENDMENTS, BY SOIL TYPE, 2021–2027 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE FOR SOIL AMENDMENTS, BY FORM, 2017–2020 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE FOR SOIL AMENDMENTS, BY FORM, 2021–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Reclamation of abandoned mines land to drive the market for soil amendments in the US

TABLE 68 US: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 69 US: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 70 US: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 71 US: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2021–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Degrading soil quality of prairies in Canada to increase the demand for organic soil amendments

TABLE 72 CANADA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 73 CANADA: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 74 CANADA: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 75 CANADA: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2021–2027 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Soil degradation due to metal contamination drives the soil amendment market in Mexico

TABLE 76 MEXICO: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 77 MEXICO: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021– 2027 (USD MILLION)

TABLE 78 MEXICO: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 79 MEXICO: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2021–2027 (USD MILLION)

10.3 EUROPE

FIGURE 32 EUROPE: SOIL AMENDMENTS MARKET SNAPSHOT, 2021

TABLE 80 EUROPE: MARKET SIZE FOR SOIL AMENDMENTS, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 81 EUROPE: MARKET SIZE FOR SOIL AMENDMENTS, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 83 EUROPE: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 84 EUROPE: ORGANIC SOIL AMENDMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 85 EUROPE: ORGANIC SOIL AMENDMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 86 EUROPE: INORGANIC SOIL AMENDMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 87 EUROPE: INORGANIC SOIL AMENDMENTSMARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 88 EUROPE: SOIL AMENDMENTS MARKET SIZE, BY SOIL TYPE, 2017–2020 (USD MILLION)

TABLE 89 EUROPE: MARKET SIZE FOR SOIL AMENDMENTS, BY SOIL TYPE, 2021–2027 (USD MILLION)

TABLE 90 EUROPE: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 91 EUROPE: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2021–2027 (USD MILLION)

TABLE 92 EUROPE: MARKET SIZE FOR SOIL AMENDMENTS, BY FORM, 2017–2020 (USD MILLION)

TABLE 93 EUROPE: MARKET SIZE FOR SOIL AMENDMENTS, BY FORM, 2021–2027 (USD MILLION)

10.3.1 FRANCE

10.3.1.1 Adoption of organic farming practices to drive the market growth for soil amendments

TABLE 94 FRANCE: SOIL AMENDMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 95 FRANCE: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 96 FRANCE: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 97 FRANCE: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2021–2027 (USD MILLION)

10.3.2 GERMANY

10.3.2.1 Increase in awareness about soil health management to drive the growth of the soil amendments market

TABLE 98 GERMANY: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 99 GERMANY: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 100 GERMANY:MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 101 GERMANY: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2021–2027 (USD MILLION)

10.3.3 RUSSIA

10.3.3.1 Increase in the degradation of soil quality to drive the growth of the soil amendments market

TABLE 102 RUSSIA: SOIL AMENDMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 103 RUSSIA: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 104 RUSSIA: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 105 RUSSIA: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2021–2027 (USD MILLION)

10.3.4 SPAIN

10.3.4.1 Poor structural conditions of soils encourage the demand for soil amendments

TABLE 106 SPAIN: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 107 SPAIN: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 108 SPAIN: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 109 SPAIN: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2021–2027 (USD MILLION)

10.3.5 UK

10.3.5.1 Adoption of intensive farming has led to higher usage of soil amendments

TABLE 110 UK: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 111 UK: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 112 UK: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 113 UK: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2021–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 114 REST OF EUROPE: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 115 REST OF EUROPE: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 116 REST OF EUROPE: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 117 REST OF EUROPE: MARKET SIZE FOR SOIL AMENDMENTS, BY COUNTRY, 2021–2027 (USD MILLION)

10.4 ASIA PACIFIC

TABLE 118 ASIA PACIFIC: SOIL AMENDMENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET SIZE FOR SOIL AMENDMENTS, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 122 ASIA PACIFIC: ORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 123 ASIA PACIFIC: ORGANIC SOIL AMENDMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 124 ASIA PACIFIC: INORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 125 ASIA PACIFIC: INORGANIC SOIL AMENDMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 126 ASIA PACIFIC: SOIL AMENDMENTS MARKET SIZE, BY SOIL TYPE, 2017–2020 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET SIZE FOR SOIL AMENDMENTS, BY SOIL TYPE, 2021–2027 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2021–2027 (USD MILLION)

TABLE 130 ASIA PACIFIC: MARKET SIZE FOR SOIL AMENDMENTS, BY FORM, 2017–2020 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET SIZE FOR SOIL AMENDMENTS, BY FORM, 2021–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Growing need to reduce soil erosion drives the demand for organic soil amendments in the Chinese market

TABLE 132 CHINA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 133 CHINA: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 134 CHINA: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 135 CHINA: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2021–2027 (USD MILLION)

10.4.2 INDIA

10.4.2.1 Rise in demand for high-value crops to encourage the utilization of soil amendments

TABLE 136 INDIA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 137 INDIA: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 138 INDIA: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 139 INDIA: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2021–2027 (USD MILLION)

10.4.3 JAPAN

10.4.3.1 Adoption of sustainable agricultural practices to drive the growth of the Japanese soil amendments market

TABLE 140 JAPAN: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 141 JAPAN: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 142 JAPAN: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 143 JAPAN: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2021–2027 (USD MILLION)

10.4.4 AUSTRALIA

10.4.4.1 Increase in preference for organic food has encouraged the adoption of organic soil amendments

TABLE 144 AUSTRALIA: SOIL AMENDMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 145 AUSTRALIA: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 146 AUSTRALIA: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 147 AUSTRALIA: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2021–2027 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

TABLE 148 REST OF ASIA PACIFIC: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 149 REST OF ASIA PACIFIC: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 150 REST OF ASIA PACIFIC: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 151 REST OF ASIA PACIFIC: MARKET SIZE FOR SOIL AMENDMENTS, BY COUNTRY, 2021–2027 (USD MILLION)

10.5 SOUTH AMERICA

TABLE 152 SOUTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 153 SOUTH AMERICA: MARKET SIZE FOR SOIL AMENDMENTS, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 154 SOUTH AMERICA: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 155 SOUTH AMERICA: MARKET SIZE FOR SOIL AMENDMENTS, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 156 SOUTH AMERICA: ORGANIC SOIL AMENDMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 157 SOUTH AMERICA: ORGANIC SOIL AMENDMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 158 SOUTH AMERICA: INORGANIC SOIL AMENDMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 159 SOUTH AMERICA: INORGANIC SOIL AMENDMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 160 SOUTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY SOIL TYPE, 2017–2020 (USD MILLION)

TABLE 161 NORTH AMERICA: MARKET SIZE FOR SOIL AMENDMENTS, BY SOIL TYPE, 2021–2027 (USD MILLION)

TABLE 162 SOUTH AMERICA: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 163 SOUTH AMERICA: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2021–2027 (USD MILLION)

TABLE 164 SOUTH AMERICA: MARKET SIZE FOR SOIL AMENDMENTS, BY FORM, 2017–2020 (USD MILLION)

TABLE 165 SOUTH AMERICA: MARKET SIZE FOR SOIL AMENDMENTS, BY FORM, 2021–2027 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 Reduction in organic matter in soils to increase the demand for organic soil amendment products in Brazil

TABLE 166 BRAZIL: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 167 BRAZIL: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 168 BRAZIL: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 169 BRAZIL: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2021–2027 (USD MILLION)

10.5.2 ARGENTINA

10.5.2.1 Organic amendments dominated the market in Argentina

TABLE 170 ARGENTINA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 171 ARGENTINA: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 172 ARGENTINA: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 173 ARGENTINA: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2021–2027 (USD MILLION)

10.5.3 REST OF SOUTH AMERICA

TABLE 174 REST OF SOUTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 175 REST OF SOUTH AMERICA: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 176 REST OF SOUTH AMERICA: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 177 REST OF SOUTH AMERICA: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2021–2027 (USD MILLION)

10.6 REST OF THE WORLD (ROW)

TABLE 178 ROW: SOIL AMENDMENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 179 ROW: MARKET SIZE FOR SOIL AMENDMENTS, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 180 ROW: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 181 ROW: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 182 ROW: ORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 183 ROW: ORGANIC SOIL AMENDMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 184 ROW: INORGANIC SOIL AMENDMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 185 ROW: INORGANIC SOIL AMENDMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 186 ROW: SOIL AMENDMENT MARKET SIZE, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 187 ROW: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2021–2027 (USD MILLION)

TABLE 188 ROW: MARKET SIZE FOR SOIL AMENDMENTS, BY SOIL TYPE, 2017–2020 (USD MILLION)

TABLE 189 ROW: MARKET SIZE FOR SOIL AMENDMENTS, BY SOIL TYPE, 2021–2027 (USD MILLION)

TABLE 190 ROW: MARKET SIZE FOR SOIL AMENDMENTS, BY FORM, 2017–2020 (USD MILLION)

TABLE 191 ROW: MARKET SIZE FOR SOIL AMENDMENTS, BY FORM, 2021–2027 (USD MILLION)

10.6.1 SOUTH AFRICA

10.6.1.1 Increasing risk of soil erosion and a decrease in agricultural land to drive the market growth

TABLE 192 SOUTH AFRICA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 193 SOUTH AFRICA: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 194 SOUTH AFRICA: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 195 SOUTH AFRICA: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2021–2027 (USD MILLION)

10.6.2 TURKEY

10.6.2.1 Overgrazing and soil erosion drive the soil amendments market in Turkey

TABLE 196 TURKEY: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 197 TURKEY: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 198 TURKEY: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 199 TURKEY: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2021–2027 (USD MILLION)

10.6.3 OTHERS IN ROW

TABLE 200 OTHERS IN ROW: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 201 OTHERS IN ROW: MARKET SIZE FOR SOIL AMENDMENTS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 202 OTHERS IN ROW: MARKET SIZE FOR SOIL AMENDMENTS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 203 OTHERS IN ROW: MARKET SIZE FOR SOIL AMENDMENTS, BY COUNTRY, 2021–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 156)

11.1 OVERVIEW

11.2 REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 33 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2018–2020 (USD BILLION)

11.3 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

11.3.1 STARS

11.3.2 PERVASIVE PLAYERS

11.3.3 EMERGING LEADERS

11.3.4 PARTICIPANTS

FIGURE 34 SOIL AMENDMENT MARKET, COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

11.3.5 PRODUCT FOOTPRINT

TABLE 204 COMPANY FOOTPRINT, BY FORM

TABLE 205 COMPANY FOOTPRINT, BY CROP TYPE

TABLE 206 COMPANY FOOTPRINT, BY REGION

11.4 SOIL AMENDMENTS MARKET, OTHER PLAYERS EVALUATION QUADRANT, 2021

11.4.1 PROGRESSIVE COMPANIES

11.4.2 STARTING BLOCKS

11.4.3 RESPONSIVE COMPANIES

11.4.4 DYNAMIC COMPANIES

FIGURE 35 SOIL AMENDMENT MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

TABLE 207 MARKET SIZE FOR SOIL AMENDMENTS: DETAILED LIST OF KEY STARTUP/SMES

11.5 COMPETITIVE SCENARIO

11.5.1 NEW PRODUCT LAUNCHES

TABLE 208 NEW PRODUCT LAUNCHES, 2018–2022

11.5.2 EXPANSIONS

TABLE 209 EXPANSIONS, 2018–2022

11.5.3 MERGERS & ACQUISITIONS

TABLE 210 MERGERS & ACQUISITIONS, 2018–2022

11.5.4 PARTNERSHIPS & AGREEMENTS

TABLE 211 PARTNERSHIPS & AGREEMENTS, 2018–2022

12 COMPANY PROFILES (Page No. - 167)

(Business overview, Products offered, Recent Developments, MNM view)*

12.1 BASF SE

TABLE 212 BASF SE: BUSINESS OVERVIEW

FIGURE 36 BASF SE: COMPANY SNAPSHOT

12.2 UPL

TABLE 213 UPL: BUSINESS OVERVIEW

FIGURE 37 UPL: COMPANY SNAPSHOT

12.3 FMC CORPORATION

TABLE 214 FMC CORPORATION: BUSINESS OVERVIEW

FIGURE 38 FMC CORPORATION: COMPANY SNAPSHOT

12.4 NUFARM

TABLE 215 NUFARM: BUSINESS OVERVIEW

FIGURE 39 NUFARM: COMPANY SNAPSHOT

12.5 ADAMA

TABLE 216 ADAMA: BUSINESS OVERVIEW

FIGURE 40 ADAMA: COMPANY SNAPSHOT

12.6 EVONIK INDUSTRIES AG

TABLE 217 EVONIK INDUSTRIES AG: BUSINESS OVERVIEW

FIGURE 41 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

12.7 BAYER

TABLE 218 BAYER: BUSINESS OVERVIEW

FIGURE 42 BAYER: COMPANY SNAPSHOT

12.8 NOVOZYMES A/S

TABLE 219 NOVOZYMES: BUSINESS OVERVIEW

FIGURE 43 NOVOZYMES: COMPANY SNAPSHOT

12.9 AGRINOS

TABLE 220 AGRINOS: BUSINESS OVERVIEW

12.10 T.STANES & COMPANY

TABLE 221 T.STANES & COMPANY: BUSINESS OVERVIEW

12.11 LALLEMAND INC

TABLE 222 LALLEMAND INC.: BUSINESS OVERVIEW

12.12 SA LIME & GYPSUM

TABLE 223 SA LIME & GYPSUM: BUSINESS OVERVIEW

12.13 TIMAC AGRO

TABLE 224 TIMAC AGRO: BUSINESS OVERVIEW

12.14 BIOSOIL FARMS

TABLE 225 BIOSOIL FARMS: BUSINESS OVERVIEW

12.15 PROFILE PRODUCTS LLC

12.16 THE FERTRELL COMPANY

TABLE 226 THE FERTRELL COMPANY: BUSINESS OVERVIEW

12.17 HAIFA GROUP

TABLE 227 HAIFA GROUP: BUSINESS OVERVIEW

12.18 SYMBORG

TABLE 228 SYMBORG: BUSINESS OVERVIEW

12.19 SOIL TECHNOLOGIES CORPORATION

12.20 DELBON

TABLE 229 DELBON: BUSINESS OVERVIEW

13 ADJACENT & RELATED MARKETS (Page No. - 215)

13.1 INTRODUCTION

TABLE 230 ADJACENT MARKETS TO SOIL AMENDMENTS

13.2 LIMITATIONS

13.3 BIOFERTILIZERS MARKET

13.3.1 LIMITATIONS

13.3.2 MARKET DEFINITION

13.3.3 MARKET OVERVIEW

13.3.4 BIOFERTILIZERS MARKET, BY TYPE

FIGURE 44 NITROGEN-FIXING BIOFERTILIZERS SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 231 BIOFERTILIZERS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 232 BIOFERTILIZERS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

13.3.5 BIOFERTILIZERS MARKET, BY REGION

TABLE 233 BIOFERTILIZERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

13.4 BIOSTIMULANTS MARKET

13.4.1 LIMITATIONS

13.4.2 MARKET DEFINITION

13.4.3 MARKET OVERVIEW

13.4.4 BIOSTIMULANTS MARKET, BY CROP TYPE

FIGURE 45 FRUITS & VEGETABLES SEGMENT TO DOMINATE THE BIOSTIMULANTS MARKET BY 2026

TABLE 234 BIOSTIMULANTS MARKET SIZE, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 235 BIOSTIMULANTS MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

13.4.5 BIOSTIMULANTS MARKET, BY REGION

TABLE 236 BIOSTIMULANTS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 237 BIOSTIMULANTS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

13.5 SOIL CONDITIONERS MARKET

13.5.1 LIMITATIONS

13.5.2 MARKET DEFINITION

13.5.3 MARKET OVERVIEW

13.5.4 SOIL CONDITIONERS MARKET, BY TYPE

FIGURE 46 SURFACTANTS SEGMENT TO DOMINATE THE SOIL CONDITIONERS MARKET DURING THE FORECAST PERIOD

TABLE 238 SOIL CONDITIONERS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

13.5.5 SOIL CONDITIONERS MARKET, BY REGION

TABLE 239 SOIL CONDITIONERS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

14 APPENDIX (Page No. - 227)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

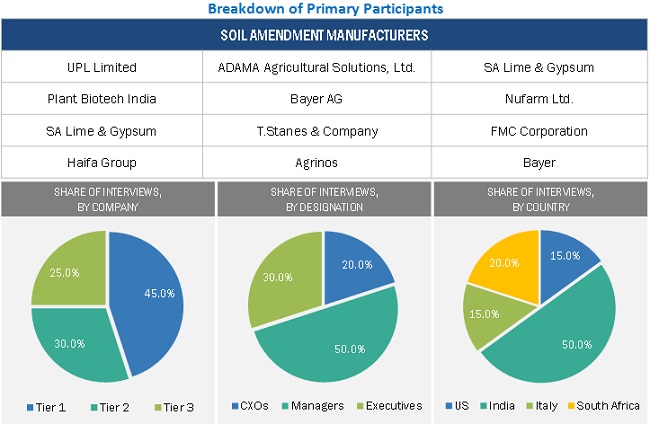

This research study involved the usage of extensive secondary sources, including directories and databases (Hoovers, Forbes, Bloomberg Businessweek, and Factiva), to identify and collect information useful for this technical, market-oriented, and commercial study of the soil amendment market. The primary sources included industry experts from core and related industries and preferred suppliers, dealers, manufacturers, technology developers, alliances, standards & certification organizations from companies, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess prospects. The following figure depicts the market research methodology applied in drafting this report on the soil amendments market

Secondary Research

Various sources have been referred to in the secondary research process to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles from recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases, which have been used to identify & collect information.

Secondary research has been used to obtain key information about the industry’s supply chain, the market’s monetary chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, and geographic markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

Extensive primary research was conducted after acquiring information about the soil amendments market scenario through secondary research. Several primary interviews were conducted with market experts from the demand (farm associations, dealers, and distributors) and supply (manufacturers, formulators, and raw material suppliers) sides across countries of the studied regions. Nearly 20% and 80% of the primary interviews were conducted with the demand and supply sides, respectively. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the soil amendments market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- The grain alcohol market’s value chain and market size, in terms of value and volume, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for key opinions from leaders, such as CEOs, directors, and marketing executives.

- Given below is an illustration of the overall market size estimation process employed for the purpose of this study.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for coconut oil on the basis of product type, source, nature, application and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the coconut oil market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of European market into Italy, Belgium, the Netherlands, Poland, Portugal, and Ukraine

- Further breakdown of the Rest of Asia Pacific market into Indonesia, Malaysia, South Korea, Thailand, and Vietnam.

- Further breakdown of the Rest of South American market into Chile, Colombia, Paraguay, Uruguay, and Peru.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Soil Amendments Market