Rapid Prototyping Materials Market by Type (Polymers, Metals, Ceramics), Form (Filament, Powder, Ink), Function (Conceptual, Functional Prototype), End User (Aerospace & Defense, Manufacturing & Construction, Healthcare) - Global Forecast to 2021

[180 Pages Report] Rapid Prototyping Materials Market size was valued at USD 217.5 Million in 2015 and is projected to reach USD 903.8 Million by 2021, at a CAGR of 26.8% from 2016 to 2021. Increasing demand of rapid prototyping materials from varied end-use industries is expected to drive the growth of the rapid prototyping materials market in the near future. Recent advancements in the field of rapid prototyping such as implementation of 3D printing technology for prototyping as well as manufacturing applications has also contributed to the growth of this market. Moreover, manufacturers are working on cost-effective prototyping materials for niche applications, wherein testing the performance of prototype is not required.

The objective of this study is to define varied segments of the rapid prototyping materials market, which include type, form, function, end user, and region, in addition to analyzing trends in each of these submarkets. The report aims to identify market dynamics such as drivers, restraints, challenges, and opportunities that are currently impacting the growth of the rapid prototyping materials market. The base year considered for this study is 2015 and the forecast period is from 2016 to 2021.

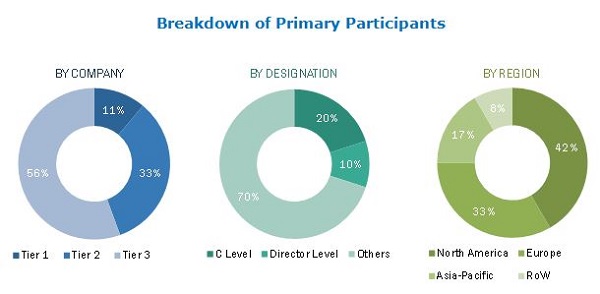

This research study involves data from both secondary and primary sources. Secondary sources include directories and databases, such as Factiva, Bloomberg, Businessweek, and Hoovers, which were referred to collect information for this technical, market oriented, and commercial study of the rapid prototyping materials market. To validate the critical information collected from secondary sources, primary interviews were conducted. The breakdown of primaries conducted is shown in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

Both top-down and bottom-up approaches were utilized to arrive at the market size for the rapid prototyping materials market. Bottom-up approach was used to estimate the market size from the supply side. Subsequently, top-down approach was used to validate the market size obtained from the bottom-up approach. The report is based on certain assumptions.

Market Ecosystem:

The ecosystem of the rapid prototyping materials market comprises raw material suppliers, manufacturers, and distributors. Major activities carried out by raw material suppliers and manufacturers in the rapid prototyping industry include development of new grades or applications, approval of products, and certifications. Some of the raw material suppliers in this market include Evonik AG (Germany), Arkema S.A. (France), and ArcelorMittal (Luxemberg). Manufacturers of rapid prototyping materials include 3D Systems Corporation (U.S.) and Stratasys Ltd. (U.S.), among others.

Target Audience:

The stakeholders for the report include:

- Rapid Prototyping Material Manufacturers, Dealers, and Suppliers

- Government Bodies

- 3D Printing Experts

- End Users of Rapid Prototyping

- Companies Operational in 3D Printing Materials Market

- Defense and Military

- Industry Associations

- Large Infrastructure Companies

- Investment Banks

- Consulting Companies/Consultants in Chemical and Material Sectors

Scope of the Report:

Each segment is described in detail in this report with volume and revenue forecasts.

By Type:

- Polymers

- Metals

- Ceramics

By Form:

- Filament

- Ink

- Powder

By End User:

- Aerospace & Defense

- Healthcare

- Transportation

- Consumer Goods & Electronics

- Manufacturing & Construction

By Function:

- Conceptual Model

- Functional Prototype

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per a company’s specific needs. The following customization options are available for the report:

Company Information:

Detailed analysis and profiling of additional market players (up to five)

The rapid prototyping materials market was valued at USD 217.5 Million in 2015 and is projected to reach USD 903.8 Million by 2021, at a CAGR of 26.8% between 2016 and 2021. Major factors driving the growth of the rapid prototyping materials market include high demand for product modification and development, low cycle time of printing, expected increase in supply capacity with forward integration, and development of application-specific grades.

The rapid prototyping materials market has been segmented on the basis of type, form, function, end user, and region. According to end user, the market has been further classified into aerospace & defense, healthcare, automotive, consumer goods & electronics, and manufacturing & construction, among others.

Among all end users, the aerospace & defense segment accounted for the largest share of the rapid prototyping materials market in 2015. This large share is mainly attributed to the latest technological advancements and invention of new materials in rapid prototyping in the aerospace & defense sector. Moreover, in the healthcare sector, metal rapid prototyping is used in several medical products, such as surgical equipment, prosthetics & implants, and tissue engineering products, thereby propelling the applicability of rapid prototyping materials in this sector. However, growing demand for high-quality 3D printing materials that are certified by various governing bodies for medical applications is further driving the market for rapid prototyping materials in the healthcare sector.

Major functions for prototyping include conceptual models and functional prototypes, which either overlap with each other in some case or are mutually exclusive. Conceptual models are used to study the static features of the model or the specimen. For instance, various packaging models can be used to study the aesthetics of products. On the other hand, functional prototypes can be used to study the body components, engine parts, and machine components, among others. Functional prototypes are created to study the dynamics, strength, and hardness of components, which can be tested in virtual operating conditions. With increasing competition among end-use industries, functional prototypes provide a critical solution to test the feasibility of the product.

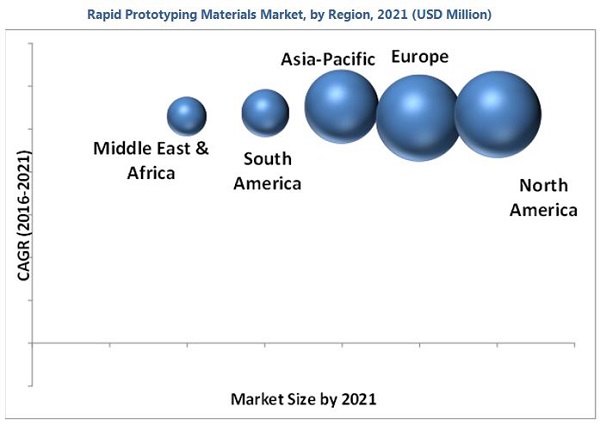

North America is leading the rapid prototyping materials market during the forecast period, owing to the increasing adoption of rapid prototyping materials by varied end-use industries in this region. Moreover, this market in the Asia-Pacific region is expected to grow at the highest CAGR between 2016 and 2021. This growth is mainly attributed to the increasing production activities in the automotive and consumer goods & electronics sectors.

Some of the restraints that impact the growth of the rapid prototyping materials market include synchronization between prototyping and production materials, high material costs, and low acceptance rate of rapid prototyping in emerging economies. However, high R&D investments made by end-use industries is offering lucrative growth opportunities to key players operating in the rapid prototyping materials market.

Leading companies in the rapid prototyping materials market include 3D Systems Corporation (U.S.), Arkema S.A. (France), Stratasys Ltd. (U.S.), Royal DSM N.V. (Netherlands), EOS GmbH Electro Optical Systems (Germany), CRP Group (U.S.), Envisiontec GmbH (Germany), Materialise NV (Belgium), Oxford Performance Materials (U.S.), and Golden Plastics (Hong Kong).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Research Data

2.2.1 Secondary Data

2.2.1.1 Key Data From Secondary Sources

2.2.2 Primary Data

2.2.2.1 Key Data From Primary Sources

2.2.2.2 Key Industry Insights

2.2.2.3 Breakdown of Primaries

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Significant Opportunities for Rapid Prototyping Materials Market

4.2 Rapid Prototyping Materials Market, By Key Regions

4.3 Rapid Prototyping Materials Market: Growth Rate of Key Regions

4.4 Rapid Prototyping Materials Market, By Form and Type

4.5 Rapid Prototyping Materials Market, By Form

4.6 Rapid Prototyping Materials Market: Developing Nations vs Developed Nations

4.7 Rapid Prototyping Materials Market, By End User (Tons)

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 By Type

5.3.2 By Form

5.3.3 By Function

5.3.4 By End User

5.3.5 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 High Demand for Product Modification and Development

5.4.1.2 Expected Increase in Supply Capacity With Forward Integration

5.4.1.3 Low Cycle Time

5.4.1.4 Development of Application Specific Grades

5.4.1.5 Highly Potential Market With Government Support

5.4.2 Restraints

5.4.2.1 Synchronization Between Prototyping and Manufacturing With Respective Methods

5.4.2.2 High Material Cost Due to Low Consumption Volumes

5.4.2.3 Low Acceptance Rate in Developing Economies

5.4.2.4 Certification of Grades With Demand From Critical Industries

5.4.2.5 Monopoly of Few Players With Key Patents for Industrial Grades

5.4.3 Opportunities

5.4.3.1 High R&D Investments By End-Use Industries to Sustain in the Market

5.4.3.2 Shorter Product Life Cycle

5.4.4 Challenges

5.4.4.1 Continuously Evolving Market

6 Industry Trends (Page No. - 49)

6.1 Introduction

6.2 Key Trends

6.2.1 Outsourcing of Prototyping By End-Use Industries

6.3 Value Chain Analysis

6.4 Porter’s Five Forces Analysis

6.4.1 Bargaining Power of Suppliers is Low

6.4.2 Threat of New Entrants is Moderate

6.4.3 Threat of Substitutes is High

6.4.4 Bargaining Power of Buyers is Low

6.4.5 Intensity of Competitive Rivalry is Moderate

7 Rapid Prototyping Material Market, By Type (Page No. - 54)

7.1 Introduction

7.2 Polymers

7.3 Metals

7.4 Ceramics

8 Rapid Prototyping Material Market, By Form (Page No. - 61)

8.1 Introduction

8.2 Filament

8.3 Ink

8.4 Powder

9 Rapid Prototyping Materials Market, By Function (Page No. - 67)

9.1 Introduction

9.2 Conceptual Model

9.3 Functional Prototype

10 Rapid Prototyping Materials Market, By End User (Page No. - 73)

10.1 Introduction

10.2 Aerospace & Defense

10.3 Healthcare

10.4 Transportation

10.5 Consumer Goods & Electronics

10.6 Manufacturing & Construction

10.7 Others

11 Rapid Prototyping Materials Market, By Region (Page No. - 85)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia-Pacific

11.5 South America

11.6 Middle East & Africa

12 Competitive Landscape (Page No. - 108)

12.1 Introduction

12.1.1 New Product Development: the Most Popular Growth Strategy

12.2 Maximum Developments in 2015

12.3 3D Systems Corporation: the Most Active Player

12.4 Competitive Situation & Trends

12.5 New Product Developments/Launches

12.6 Expansions

12.7 Partnerships, Agreements & Collaborations

12.8 Mergers & Acquisitions

13 Company Profiles (Page No. - 119)

(Overview, Financial*, Products & Services, Strategy, and Developments)

13.1 3D Systems Corporation

13.2 Arkema S.A.

13.3 Stratasys, Ltd.

13.4 Royal DSM N.V.

13.5 EOS GmbH Electro Optical Systems

13.6 CRP Group

13.7 Materialise NV

13.8 Oxford Performance Materials

13.9 Golden Plastics

13.10 Renishaw PLC

13.11 Arcam AB

13.12 Höganäs AB

13.13 LPW Technology Ltd.

13.14 GKN PLC

13.15 Sandvik AB

13.16 Carpenter Technology Corporation

13.17 Tethon 3D

13.18 3D Ceram

13.19 Lithoz GmbH

*Details Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 170)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

List of Tables (62 Tables)

Table 1 Rapid Prototyping Material Market, By Type, 2014-2021 (USD Million)

Table 2 Market, By Type, 2014-2021 (Tons)

Table 3 Polymers: Rapid Prototyping Material Market, By Material, 2014-2021 (USD Million)

Table 4 Polymers: Market, By Material, 2014-2021 (Tons)

Table 5 Metals: Rapid Prototyping Materials Market, By Material, 2014-2021 (USD Million)

Table 6 Metals: Market, By Material, 2014-2021 (Tons)

Table 7 Ceramic: Rapid Prototyping Materials Market, By Material, 2014-2021 (USD Million)

Table 8 Ceramics: Market, By Material, 2014-2021 (Tons)

Table 9 Rapid Prototyping Material Market, By Form, 2014-2021 (USD Million)

Table 10 Rapid Prototyping Materials Market, By Form, 2014-2021 (Tons)

Table 11 Filament Rapid Prototyping Material Market, By Type, 2014-2021 (USD Million)

Table 12 Filament Rapid Prototyping Material Market, By Type, 2014-2021 (Tons)

Table 13 Ink Rapid Prototyping Material Market, By Type, 2014-2021 (USD Million)

Table 14 Ink Rapid Prototyping Material Market, By Type, 2014-2021 (Tons)

Table 15 Powder Rapid Prototyping Material Market, By Type, 2014-2021 (USD Million)

Table 16 Powder Rapid Prototyping Material Market, By Type, 2014-2021 (Tons)

Table 17 Rapid Prototyping Materials Market, By Function, 2014-2021 (USD Million)

Table 18 Market, By Function, 2014-2021 (Tons)

Table 19 Rapid Prototyping Materials Market in Conceptual Model, By End User, 2014-2021 (USD Million)

Table 20 Market in Conceptual Model, By End User, 2014-2021 (Tons)

Table 21 Rapid Prototyping Materials Market in Functional Prototype, By End User, 2014-2021 (USD Million)

Table 22 Market in Functional Prototype, End User, 2014-2021 (Tons)

Table 23 Rapid Prototyping Materials Market, By End User, 2014-2021 (USD Million)

Table 24 Market, By End User, 2014-2021 (Tons)

Table 25 Rapid Prototyping Materials Market in Aerospace & Defense, By Type, 2014-2021 (USD Million)

Table 26 Market in Aerospace & Defense, By Type, 2014-2021 (Tons)

Table 27 Rapid Prototyping Materials Market in Healthcare, By Type, 2014-2021 (Tons)

Table 28 Market in Healthcare, By Type, 2014-2021 (Tons)

Table 29 Rapid Prototyping Materials Market in Transportation, By Type, 2014-2021 (USD Million)

Table 30 Market in Transportation, By Type, 2014-2021 (Tons)

Table 31 Rapid Prototyping Materials Market in Consumer Goods & Electronics, By Type, 2014-2021 (USD Million)

Table 32 Market in Consumer Goods & Electronics, By Type, 2014-2021 (Tons)

Table 33 Rapid Prototyping Materials Market in Manufacturing & Construction, By Type, 2014-2021 (USD Million)

Table 34 Market in Manufacturing & Construction, By Type, 2014-2021 (Tons)

Table 35 Rapid Prototyping Materials Market in Others, By Type, 2014-2021 (USD Million)

Table 36 Markets in Others, By Type, 2014-2021 (Tons)

Table 37 Rapid Prototyping Materials Market, By Region, 2014-2021 (USD Million)

Table 38 Market, By Region, 2014-2021 (Tons)

Table 39 Rapid Prototyping Materials Market in North America, By End User, 2014-2021 (USD Million)

Table 40 Market in North America, By End User, 2014-2021 (Tons)

Table 41 Rapid Prototyping Materials Market in North America, By Country, 2014-2021 (USD Million)

Table 42 Market in North America, By Country, 2014-2021 (Tons)

Table 43 Rapid Prototyping Materials Market in Europe, By End User, 2014-2021 (USD Million)

Table 44 Market in Europe, By End User, 2014-2021 (Tons)

Table 45 Rapid Prototyping Materials Market in Europe, By Country, 2014-2021 (USD Million)

Table 46 Market in Europe, By Country, 2014-2021 (Tons)

Table 47 Rapid Prototyping Materials Market in Asia-Pacific, By End User, 2014-2021 (USD Million)

Table 48 Market in Asia-Pacific, By End User, 2014-2021 (Tons)

Table 49 Rapid Prototyping Materials Market in Asia-Pacific, By Country, 2014-2021 (USD Million)

Table 50 Market in Asia-Pacific, By Country, 2014-2021 (Tons)

Table 51 Rapid Prototyping Materials Market in South America, By End User, 2014-2021 (USD Million)

Table 52 Market in South America, By End User, 2014-2021 (Tons)

Table 53 Rapid Prototyping Materials Market in South America, By Country, 2014-2021 (USD Million)

Table 54 Market in South America, By Country, 2014-2021 (Tons)

Table 55 Rapid Prototyping Materials Market in Middle East & Africa, By End User, 2014-2021 (USD Million)

Table 56 Market in Middle East & Africa, By End User, 2014-2021 (Tons)

Table 57 Rapid Prototyping Materials Market in Middle East & Africa, By Country, 2014-2021 (USD Million)

Table 58 Market in Middle East & Africa, By Country, 2014-2021 (Tons)

Table 59 New Product Developments/Launches, 2011-2016

Table 60 Expansions, 2011-2016

Table 61 Partnerships, Agreements & Collaborations, 2012-2016

Table 62 Mergers & Acquisitions, 2011-2016

List of Figures (52 Figures)

Figure 1 Rapid Prototyping Materials: Market Segmentation

Figure 2 Research Design

Figure 3 Breakdown of Primary Interviews, By Company Type, Designation, and Region

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation: Top-Down Approach

Figure 6 Rapid Prototyping Materials Market: Data Triangulation

Figure 7 Aerospace & Defense Segment is Expected to Lead the Rapid Prototyping Market Between 2016 and 2021

Figure 8 Rapid Prototyping Materials Market Size, By Type, 2015 (USD Million)

Figure 9 Asia-Pacific is Expected to Register A High Growth Rate Compared to Other Regions Between 2016 and 2021

Figure 10 Aerospace & Defense and Healthcare Industries Expected to Drive the Demand for Rapid Prototyping Materials Between 2016 and 2021

Figure 11 Asia-Pacific Expected to Be A Lucrative Market for Rapid Prototyping Materials

Figure 12 Asia-Pacific is Expected to Grow at the Highest CAGR Between 2016 and 2021

Figure 13 The Polymers Segment Accounted for the Largest Share of the Rapid Prototyping Materials Market in 2015

Figure 14 Filament Segment Expected to Contribute the Maximum Share Between 2015 and 2021

Figure 15 China to Emerge as A Lucrative Market for Rapid Prototyping Materials Between 2015 and 2021

Figure 16 Rapid Prototyping Materials Market has A High Growth Potential in the Conceptual Models Segment Between 2016 and 2021 (Tons)

Figure 17 3D Printing Market Evolution

Figure 18 Rapid Prototyping Materials Market, By Material Type (USD Million), 2016-2021

Figure 19 Rapid Prototyping Materials Market, By Form

Figure 20 Rapid Prototyping Materials Market, By Function

Figure 21 Rapid Prototyping Materials Market, By End User

Figure 22 Rapid Prototyping Materials Market, By Region

Figure 23 Market Dynamics: Rapid Prototyping Materials Market

Figure 24 Raw Material Segment of the Rapid Prototyping Materials Market to Lead the Value Chain

Figure 25 Porter’s Five Forces Analysis (2015)

Figure 26 Rapid Prototyping Material Market, By Type, 2016 & 2021 (Tons)

Figure 27 Rapid Prototyping Materials Market, By Form, 2016 & 2021 (Tons)

Figure 28 Rapid Prototyping Materials Market, By Function, 2016 & 2021 (Tons)

Figure 29 Rapid Prototyping Materials Market, By End User, 2016 & 2021 (Tons)

Figure 30 Rapid Prototyping Materials Market, By Region, 2016 & 2021 (Tons)

Figure 31 New Product Development/Launch: Most Preferred Strategy By Key Companies Over the Last Five Years (2011-2016)

Figure 32 Battle for Market Share: New Product Development Was the Key Strategy, 2011-2016

Figure 33 Rapid Prototyping Material Market, 2015

Figure 34 Global Rapid Prototyping Material Market: Growth Strategies, By Company, 2011–2016

Figure 35 3D Systems: Company Snapshot

Figure 36 SWOT Analysis

Figure 37 Arkema S.A.: Company Snapshot

Figure 38 SWOT Analysis

Figure 39 Stratasys, Ltd.: Company Snapshot

Figure 40 SWOT Analysis

Figure 41 Royal DSM NV: Company Snapshot

Figure 42 SWOT Analysis

Figure 43 SWOT Analysis

Figure 44 Renishaw PLC: Company Snapshot

Figure 45 Arcam AB: Company Snapshot

Figure 46 Höganäs AB: Company Snapshot

Figure 47 GKN PLC: Company Snapshot

Figure 48 SWOT Analysis

Figure 49 Sandvik AB: Company Snapshot

Figure 50 SWOT Analysis

Figure 51 Carpenter Technology Corporation: Company Snapshot

Figure 52 SWOT Analysis

Growth opportunities and latent adjacency in Rapid Prototyping Materials Market