Railway Connectors Market by Application (Diesel Multiple Units (DMUs), Electric Multiple Units (EMUs), Light Rails/Trams, Subways/Metros, Passenger Coaches), Platform, Component, Connector Type, and Region - Global Forecast to 2023

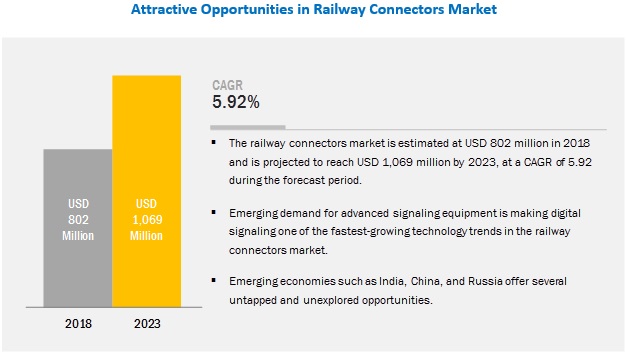

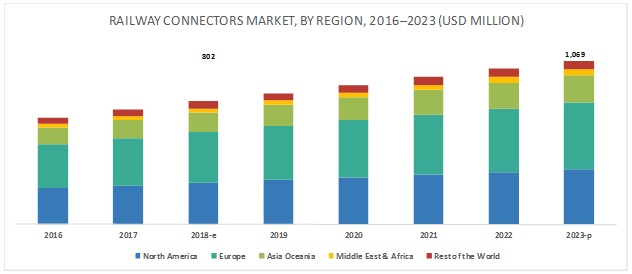

[140 Pages Pages] The railway connectors market is expected to grow from USD 802 million in 2018 to USD 1,069 million by 2023, at a Compound Annual Growth Rate (CAGR) of 5.92% during the forecast period. The study involved four major activities to estimate the current market size for railway connectors. Exhaustive secondary research was done to collect information on the market, peer markets, and the parent market. The next step was to validate these findings, assumptions, and market size with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

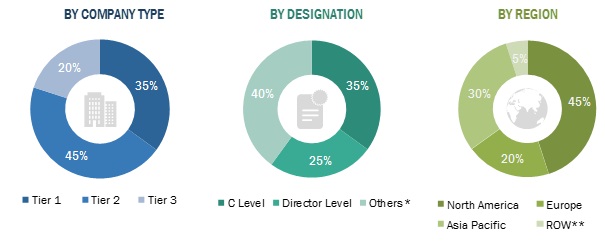

The railway connectors market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of components, platforms, and applications. The supply side is characterized by advancements in technologies and diverse application industries. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the railway connectors market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides, in the component, and platform.

Report Objectives

- To define, segment, and project the global market size for railway connectors

- To understand the structure of the railway connectors market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to North America, Asia Oceania, Europe, Middle East & Africa, and RoW (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments such as expansions & investments, new product launches, mergers & acquisitions, joint ventures, and agreements in the railway connectors market

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Platform, Connector Type, Component, Application, and Region |

|

Geographies covered |

North America, Asia Oceania, Europe, Middle East & Africa, and RoW |

|

Companies covered |

TE Connectivity (Switzerland), Amphenol Corporation (US), Molex Incorporated (US), ITT (US), Smiths Interconnect (US), Fischer Connectors (Switzerland), Esterline Technologies (US), Schaltbau (Germany), and Sichuan Yonggui Science and Technology (China). Total 15 major players covered. |

This research report categorizes the railway connectors market based on component, platform, application, connector type, and region.

On the basis of component, the railway connectors market has been segmented as follows:

- Connector Body

- Circular

- Rectangular

- Backshell

- Composite

- Metallic

On the basis of platform, the railway connectors market has been segmented as follows:

- Rolling Stock

- Signaling/Infrastructure

On the basis of application, the railway connectors market has been segmented as follows:

- Diesel Multiple Units (DMUs)

- Electric Multiple Units (EMUs)

- Light Rails/Trams

- Subways/Metros

- Passenger Coaches

On the basis of connector type, the railway connectors market has been segmented as follows:

- Broad Level Connectors/PCB Connectors

- Power Connectors

- RF/HF Coaxial Connectors

- Data Connectors

- Pogo Pin Connectors/Spring Load Connectors

- Modular & Mix Connectors

On the basis of region, the railway connectors market has been segmented as follows:

- North America

- Europe

- Asia Oceania

- Middle East & Africa

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Europe railway connectors products market into Norway and Denmark

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The railway connectors market is expected to grow from USD 802 million in 2018 to USD 1,069 million by 2023, at a Compound Annual Growth Rate (CAGR) of 5.92% during the forecast period. Increased demand for different types of wagons is a major factor driving the growth of the railway connectors market. Wagons are rail vehicles used to carry passengers and freights. These vehicles are not equipped with propulsion systems and hence, are drawn by locomotives. The demand for wagons is continuously growing in countries such as the US, the UK, France, etc., due to increased industrial activities.

By platform, the rolling stock segment is expected to be the largest contributor in the railway connectors market during the forecast period.

Rolling stock refers to powered and unpowered vehicles that move on rails. It also includes wheeled vehicles used by businesses on roadways (such as trams) and other Light Rail Vehicles (LRVs). Moving passengers and freight by rail is far more cost-effective and efficient as compared with other means of transportation. Advancements in technologies such as turbochargers, power electronics, and semiconductors, coupled with significant reduction in vehicle weight, help improve the speed and comfort of transit systems.

Connector body component segment is expected to account for the largest market size during the forecast period.

Connector body is most commonly used type of connector, from traditional industry-standard connectors to innovative new designs, because it has been the standard for a long time. The connector body is used widely in modular machine design, factory automation, robotics, transportation, and power generation. It offers various benefits, such as easy customization with standard modules and space saving. Also called as Radio Frequency (RF) connector, it is an electrical connector designed to work at the radio frequencies in the multi-megahertz range. The connector body is typically used with coaxial cables and is designed to maintain the shielding that the coaxial design offers.

Europe is expected to account for the largest market size during the forecast period.

Europe is the primary revenue generating region in the railway connectors market. Most European vehicles are equipped with high-end technology that includes wireless radio connection, wireless data transmission, eco-friendly cars, and comfort features. However, adoption of high-end technology is lower in the East European countries as compared with the West European countries such as the UK, Germany, France, and Spain. This provides rolling stock OEMs an opportunity to increase their presence in Eastern Europe. France plans to increase the number of rail lines and tramway locomotives.

Key Market Players

Major vendors in the railway connectors market are TE Connectivity (Switzerland), Amphenol Corporation (US), Molex Incorporated (US), ITT (US), Smiths Interconnect (US), Fischer Connectors (Switzerland), Esterline Technologies (US), Schaltbau (Germany), and Sichuan Yonggui Science and Technology (China). TE Connectivity has launched a wide range of advanced products in the past few years to compete strongly in the railway connectors market. For example, in January 2017, it launched an advanced version of ACT composite connectors in the DEUTSCH MIL-DTL-38999 series. In December 2016, Amphenol Corporation introduced a press-fit stacking connector, which is 56-position VPX footprint-compatible connector specifically developed for rugged, high-speed applications. The core competence of the company lies in the connector and sensor technology, and the company plans to continue working strongly on it. The company is strategically developing innovative products for upcoming trends in the end-use market.

Recent Developments

- In September 2018, TE Connectivity launched new 124 position Sliver internal I/O connectors and cable assemblies, which provide a high density solution that enables up to x20 signal transmission lanes, or 40 differential pairs.

- In February 2018, Amphenol Corporation expanded its RJ Field & USB Field range of rugged connectors with two new reduced flange versions of RJF TV6 and USB3F TV for reduced spaces railway applications. The RJ and USB reduced flange receptacles combine space and weight savings with performances equal to standard RJF TV6 and USB3F TV receptacles.

- In January 2017, ITT completed the acquisition of Axtone Railway Components (Axtone). This acquisition is highly complementary to its legacy KONI brand as Axtone produces energy absorption solutions, such as springs, buffers, and coupler components that are critical safety technologies.

Key Questions Addressed by the Report

- What will be the revenue pockets for the railway connectors market in the next five years?

- Who are the leading manufacturers of railway connectors in the global market?

- What are the growth prospects of the railway connectors market?

- What are the major drivers impacting the railway connectors market?

- What are the latest technological trends in this market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in Railway Connectors Market, 2018-2023

4.2 Railway Connectors Market, By Platform

4.3 Railway Connectors Market, By Region

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.3 Drivers

5.3.1 Increased Number of Passengers Opting for Railways as Mode of Transport

5.3.2 Increased Demand for Different Types of Wagons

5.3.3 Adoption of Driverless Trains By Several Countries

5.4 Opportunities

5.4.1 Development of New and Advanced Systems Suitable for Complex Data Communication

5.4.2 Development of Intelligent Rail Systems and Incorporation of Big Data in the Rail Industry

5.5 Challenges

5.5.1 High Overhaul and Maintenance Costs of Rolling Stocks

5.5.2 Increased Complexity in Train Systems Due to Wiring

6 Industry Trends (Page No. - 38)

6.1 Introduction

6.2 Railway Connectors Evolution

6.3 Technology Trends

6.3.1 Digital Technology for Signaling Equipment

6.3.1.1 Wi-Fi Services

6.3.1.2 On-Board Entertainment

6.3.2 Communication/Computer-Based Train Control (CBTC)

6.3.3 Integrated IP Based Passenger Information System for Rolling Stock Application

6.3.4 Rugged Connectors

6.3.5 Automatic/Integrated Train Control (ATC)

6.3.6 High-Voltage Solutions for Railway Technologies

6.4 Regulatory Landscape

6.4.1 Component Design

6.4.2 Railway Operations

6.4.2.1 Durability

6.4.2.2 Reparability

6.4.3 Manufacturing

6.4.3.1 Raw Material

6.4.3.2 Reproducibility

7 Railway Connectors Market, By Connector Type (Page No. - 43)

7.1 Introduction

7.2 Broad Level Connectors/PCB Connectors

7.3 Power Connectors

7.4 RF/HF Coaxial Connectors

7.5 Data Connectors

7.6 Pogo Pin Connectors/Spring Load Connectors

7.7 Modular & Mix Connectors

8 Railway Connectors Market, By Component (Page No. - 46)

8.1 Introduction

8.2 Connectors Body

8.2.1 Circular

8.2.2 Rectangular

8.3 Backshell

8.3.1 Composite

8.3.2 Metallic

9 Railway Connectors Market, By Platform (Page No. - 50)

9.1 Introduction

9.2 Rolling Stock

9.3 Signaling/Infrastructure

10 Railway Connectors Market, By Application (Page No. - 53)

10.1 Introduction

10.2 Diesel Multiple Units (DMUS)

10.3 Electric Multiple Units (EMUS)

10.4 Light Rails/Trams

10.5 Subways/Metros

10.6 Passenger Coaches

11 Regional Analysis (Page No. - 57)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.2 Mexico

11.2.3 Canada

11.3 Europe

11.3.1 Germany

11.3.2 France

11.3.3 UK

11.3.4 Italy

11.3.5 Spain

11.3.6 Switzerland

11.4 Asia Oceania

11.4.1 China

11.4.2 India

11.4.3 Japan

11.4.4 South Korea

11.4.5 Australia

11.5 Middle East & Africa

11.5.1 South Africa

11.5.2 UAE

11.5.3 Egypt

11.5.4 Iran

11.6 Rest of the World

11.6.1 Brazil

11.6.2 Russia

12 Competitive Landscape (Page No. - 107)

12.1 Introduction

12.2 Market Ranking Analysis

12.3 Competitive Scenario

12.3.1 New Product Developments

12.3.2 Acquisitions

13 Company Profiles (Page No. - 111)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Te Connectivity

13.2 Amphenol Corporation

13.3 Molex Incorporated

13.4 ITT

13.5 Smiths Interconnect

13.6 Fischer Connectors

13.7 Esterline Technologies

13.8 Schaltbau

13.9 Sichuan Yonggui Science and Technology

13.10 TT Electronics

13.11 Nexans

13.12 Stäubli Electrical Connectors

13.13 Harting Technology

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 134)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (105 Tables)

Table 1 Railway Connectors Market, By Connector Type, 2016-2023 (USD Million)

Table 2 Railway Connectors Market, By Component, 2016-2023 (USD Million)

Table 3 Connectors Body : Railway Connectors Market, By Type, 2016-2023 (USD Million)

Table 4 Backshell: Railway Connectors Market, By Type, 2016-2023 (USD Million)

Table 5 Railway Connectors Market, By Platform, 2016-2023 (USD Million)

Table 6 Railway Connectors Market, By Application, 2016-2023 (USD Million)

Table 7 Railway Connectors Market Size, By Region, 2018-2023 (USD Million)

Table 8 North America Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 9 North America Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 10 North America Railway Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 11 North America Railway Connectors Body Market Size, By Type, 2016-2023 (USD Million)

Table 12 North America Railway Connectors Backshell Market Size, By Type, 2016-2023 (USD Million)

Table 13 North America Railway Connectors Market Size, By Platform, 2016-2023 (USD Million)

Table 14 North America: Railway Connectors Market Size, By Country, 2016-2023 (USD Million)

Table 15 US Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 16 US Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 17 US Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 18 Mexico Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 19 Mexico Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 20 Mexico Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 21 Canada Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 22 Canada Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 23 Canada Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 24 Europe Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 25 Europe Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 26 Europe Railway Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 27 Europe Railway Connectors Body Market Size, By Type, 2016-2023 (USD Million)

Table 28 Europe Railway Connectors Backshell Market Size, By Type, 2016-2023 (USD Million)

Table 29 Europe Railway Connectors Market Size, By Platform, 2016-2023 (USD Million)

Table 30 Europe Railway Connectors Size, By Country, 2016-2023 (USD Million)

Table 31 Germany Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 32 Germany Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 33 Germany Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 34 France Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 35 France Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 36 France Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 37 UK Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 38 UK Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 39 UK Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 40 Italy Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 41 Italy Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 42 Italy Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 43 Spain Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 44 Spain Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 45 Spain Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 46 Switzerland Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 47 Switzerland Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 48 Switzerland Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 49 Asia Oceania Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 50 Asia Oceania Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 51 Asia Oceania Railway Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 52 Asia Oceania Railway Connectors Body Market Size, By Type, 2016-2023 (USD Million)

Table 53 Asia Oceania Railway Connectors Backshell Market Size, By Type, 2016-2023 (USD Million)

Table 54 Asia Oceania Railway Connectors Market Size, By Platform, 2016-2023 (USD Million)

Table 55 Asia Oceania Railway Connectors Size, By Country, 2016-2023 (USD Million)

Table 56 China Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 57 China Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 58 China Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 59 India Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 60 India Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 61 India Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 62 Japan Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 63 Japan Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 64 Japan Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 65 South Korea Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 66 South Korea Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 67 South Korea Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 68 Australia Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 69 Australia Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 70 Australia Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 71 Middle East & Africa Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 72 Middle East & Africa Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 73 Middle East & Africa Railway Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 74 Middle East & Africa Railway Connectors Body Market Size, By Type, 2016-2023 (USD Million)

Table 75 Middle East & Africa Railway Connectors Backshell Market Size, By Type, 2016-2023 (USD Million)

Table 76 Middle East & Africa Railway Connectors Market Size, By Platform, 2016-2023 (USD Million)

Table 77 Middle East & Africa Railway Connectors Size, By Country, 2016-2023 (USD Million)

Table 78 South Africa Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 79 South Africa Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 80 South Africa Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 81 UAE Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 82 UAE Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 83 UAE Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 84 Egypt Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 85 Egypt Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 86 Egypt Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 87 Iran Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 88 Iran Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 89 Iran Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 90 Rest of the World Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 91 Rest of the World Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 92 Rest of the World Railway Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 93 Rest of the World Railway Connectors Body Market Size, By Type, 2016-2023 (USD Million)

Table 94 Rest of the World Railway Connectors Backshell Market Size, By Type, 2016-2023 (USD Million)

Table 95 Rest of the World Railway Connectors Market Size, By Platform, 2016-2023 (USD Million)

Table 96 Rest of the World Railway Connectors Size, By Region, 2016-2023 (USD Million)

Table 97 Brazil Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 98 Brazil Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 99 Brazil Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 100 Russia Railway Connectors Market Size, By Application, 2016-2023 (USD Million)

Table 101 Russia Railway Connectors Market Size, By Connector Type, 2016-2023 (USD Million)

Table 102 Russia Connectors Market Size, By Component, 2016-2023 (USD Million)

Table 103 Ranking of Players in the Global Railway Connectors Market

Table 104 New Product Developments, March, 2016–September, 2018

Table 105 Acquistions, January, 2017

List of Figures (32 Figures)

Figure 1 Research Flow

Figure 2 Research Design: Railway Connectors Market

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Electric Multiple Units (EMUS) Segment is Projected to Lead the Railway Connectors Application Market During the Forecast Period

Figure 8 Rolling Stock Platform Segment is Projected to Dominate the Railway Connectors Market During the Forecast Period

Figure 9 Connectors Body Component Segment is Projected to Account for the Highest Share in Railway Connectors Market During the Forecast Period

Figure 10 Europe Projected to Account for the Highest Share in the Railway Connectors Market During the Forecast Period

Figure 11 Emerging Demand of Digital Signaling Equipment for Connectors is the Fastest Growing Trend in Railway Connectors Market

Figure 12 Connectors Body Segment is Projected to Lead Railway Connectors Market During the Forecast Period

Figure 13 Signaling/Infrastructure Segment is Expected the Highest CAGR in 2018-2023 During the Forecast Period

Figure 14 China Estimated to Account for the Largest CAGR in Railway Connectors Market in 2018

Figure 15 Railway Connectors: Market Dynamics

Figure 16 Power Connectors Segment Estimated to Lead the Railway Connectors Market During the Forecast Period

Figure 17 Connectors Body Segment Estimated to Lead the Railway Connectors Market During the Forecast Period

Figure 18 Rolling Stock Segment Estimated to Lead the Railway Connectors Market During the Forecast Period

Figure 19 Electric Multiple Units (EMUS) Segment Estimated to Lead the Railway Connectors Market During the Forecast Period

Figure 20 Europe Estimated to Account for the Largest Share of the Railway Connectors Market in 2018

Figure 21 North America Snapshot: the US to Have the Highest Growth Potential During the Forecast Period

Figure 22 Railway Connectors Market Europe Snapshot

Figure 23 Asia Oceania Railway Connectors Market Snapshot

Figure 24 Middle East & Africa Railway Connectors Market Snapshot

Figure 25 Rest of the World Railway Connectors Market Snapshot

Figure 26 Companies Adopted New Product Developments as A Key Growth Strategy From March 2016 to September 2018

Figure 27 Te Connectivity: Company Snapshot

Figure 28 Amphenol Corporation: Company Snapshot

Figure 29 ITT: Company Snapshot

Figure 30 Esterline Technologies: Company Snapshot

Figure 31 TT Electronics: Company Snapshot

Figure 32 Nexans: Company Snapshot

Growth opportunities and latent adjacency in Railway Connectors Market

Hello, Currently, I am looking for a study on connectors in the railways sector in Europe and the US. My focus is on two segments, Rail Infrastructure/Signaling and Rolling stock. On each segment, I would like to know the market size, trend, connector type and their categories (Circular, rectangular, RF, FO, UIC, and others), and quantities and values. A focus on the major manufacturers in the railway connectors will be appreciate too. I remain available for further information. Regards, Moctar Business Developer, Radiall